Europe System Integration Market Size, Share, Trends, & Growth Forecast Report Segmented By Service (Consulting Services, Application System Integration, and Infrastructure Integration), Technology, Product, and End User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe System Integration Market Size

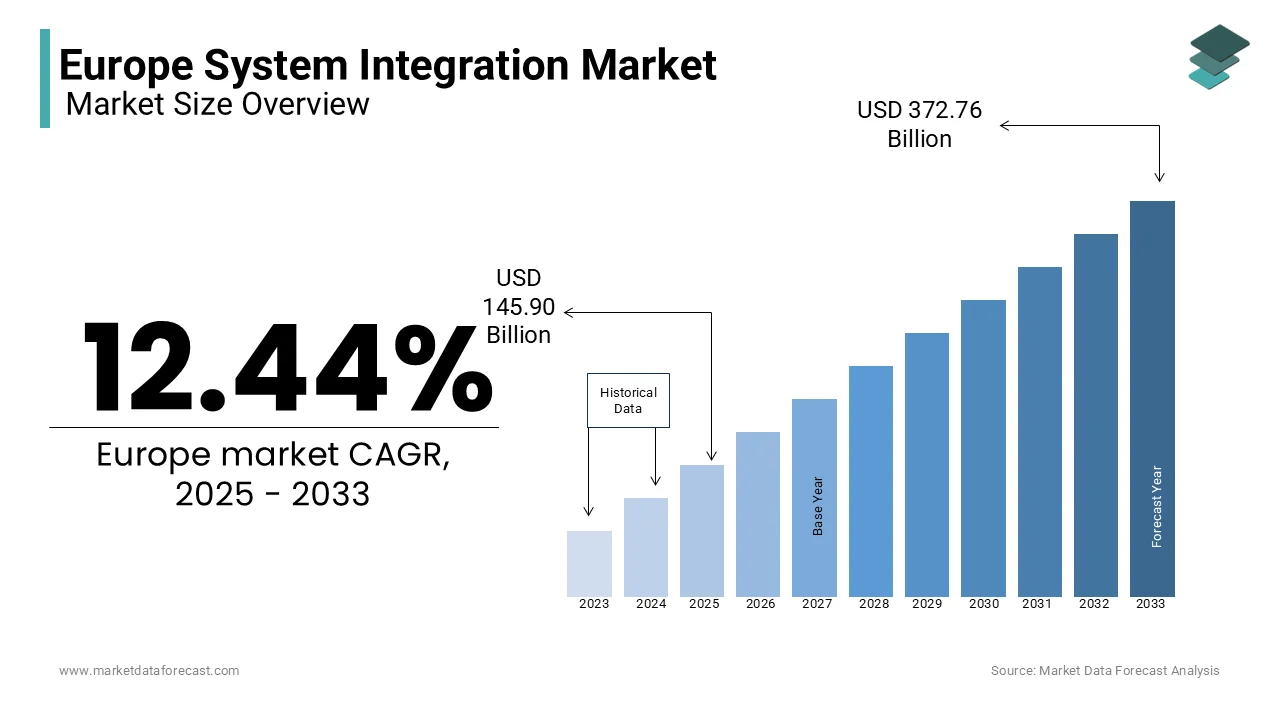

The Europe system integration market was worth USD 129.76 billion in 2024. The European market is estimated to reach USD 372.76 billion by 2033 from USD 145.90 billion in 2025, growing at a CAGR of 12.44% from 2025 to 2033.

System integration ensures interoperability, enhances operational efficiency and enables organizations to leverage advanced digital solutions such as cloud computing, IoT, AI, and big data analytics. In Europe, more and more companies are increasingly considering the digital transformation. This resulted for the increasing demand for robust system integration services in Europe in the recent years due to the rising to streamline processes, reduce costs, and improve decision-making capabilities. For instance, research from Gartner says that nearly 70% of European enterprises are actively investing in digital transformation initiatives, with system integration playing a pivotal role in achieving these objectives.

MARKET DRIVERS

Rapid Adoption of Cloud Computing Technologies

The rapid adoption of cloud computing technologies is a significant driver of the Europe system integration market. According to Eurostat, over 40% of European enterprises utilized cloud computing services in 2022, with this figure rising to 70% among large organizations. The shift to cloud-based infrastructures necessitates seamless integration of on-premises and cloud systems, enabling businesses to achieve scalability, flexibility, and cost efficiency. System integration services are critical in ensuring smooth data migration, application interoperability, and secure cloud environments, particularly as hybrid and multi-cloud strategies gain traction. This trend is further supported by the European Commission's Digital Economy and Society Index, which highlights cloud adoption as a key enabler of digital transformation across the region.

Increasing Implementation of IoT Solutions

The European IoT market is expanding rapidly, with the European Commission estimating that the number of connected devices in the region will exceed 30 billion by 2025. Industries such as manufacturing, healthcare, and smart cities are leveraging IoT to enhance operational efficiency and enable real-time data analytics. However, the complexity of integrating IoT devices with existing IT systems and ensuring data security has heightened the demand for system integration services. The European Union's Horizon 2020 program has also allocated significant funding to IoT innovation, further accelerating its adoption and the need for robust integration frameworks.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints of the Europe system integration market is the high cost associated with implementation. According to the European Commission, small and medium-sized enterprises (SMEs) account for over 99% of all businesses in the EU, yet many struggle to afford the upfront investment required for advanced system integration solutions. A report by Eurostat reveals that nearly 60% of SMEs cite financial constraints as a barrier to adopting digital technologies. The complexity of integrating legacy systems with modern platforms further escalates costs, making it challenging for organizations to justify the expenditure. This financial barrier limits market growth, particularly among smaller businesses that lack the resources to invest in comprehensive integration projects.

Data Security and Privacy Concerns

Data security and privacy concerns pose another significant restraint for the Europe system integration market. The European Union Agency for Cybersecurity (ENISA) reports that cyberattacks in Europe increased by 47% in 2022, highlighting the growing risks associated with digital transformation. Strict regulatory frameworks such as GDPR require organizations to ensure secure data handling and compliance, adding complexity to system integration projects. Many businesses are hesitant to adopt integration solutions due to fears of data breaches and non-compliance penalties. According to the European Data Protection Board, over 40% of companies face challenges in aligning their IT systems with GDPR requirements, further hindering the adoption of system.

MARKET OPPORTUNITIES

Growth in Digital Transformation Initiatives

The Europe system integration market is poised to benefit significantly from the surge in digital transformation initiatives across industries. The European Commission’s Digital Economy and Society Index (DESI) 2022 highlights that over 60% of European enterprises have accelerated their digital transformation efforts in response to evolving market demands. Governments and private sectors are investing heavily in modernizing IT infrastructures, with the European Union allocating €7.5 billion under the Digital Europe Programme to support digital innovation. System integration plays a pivotal role in enabling seamless connectivity between legacy systems and emerging technologies, creating vast opportunities for service providers to deliver tailored solutions that drive operational efficiency and innovation.

Expansion of Smart City Projects

The proliferation of smart city projects across Europe presents a substantial opportunity for the system integration market. The European Union’s Smart Cities and Communities initiative aims to integrate digital technologies into urban infrastructure, with over €1 billion allocated for smart city development under Horizon Europe. According to Eurostat, more than 70% of the EU population resides in urban areas, driving the need for intelligent systems to manage resources, transportation, and public services. System integration is essential for connecting disparate systems and enabling real-time data sharing, making it a critical enabler of smart city ecosystems. This trend offers significant growth potential for integration service providers in the region.

MARKET CHALLENES

Shortage of skilled IT professionals

As the demand for complex system integration projects rises, the availability of qualified personnel has not kept pace. According to Eurostat, in 2023, 53% of EU enterprises reported difficulties in recruiting ICT specialists, highlighting a substantial skills gap. This shortage leads to increased labor costs and project delays, as companies compete for limited talent. The European Commission has acknowledged this concern, emphasizing the need for enhanced digital skills training programs to bridge the gap and support the growing system integration demands.

Regulatory complexity across different European countries

The European Union comprises multiple member states, each with its own set of regulations and standards. This fragmentation complicates system integration efforts, as solutions must be tailored to comply with varying national laws. The European Commission has noted that such regulatory disparities can hinder cross-border digital services, leading to increased costs and extended timelines for integration projects. Efforts like the Digital Single Market strategy aim to harmonize these regulations, but achieving uniformity remains a complex and ongoing process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.44% |

|

Segments Covered |

By Service, Technology, Product, End User, and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Companies that hold a prominent place in the Europe system integration market include Capgemini (France), Accenture (Ireland), IBM Corporation (U.S.), Infosys Limited (India), Jitterbit, Logic (U.S.), Magic Software Enterprises (Israel), HCL Technologies Limited (India), Sopra Steria (France), Atos SE (France), SAP SE (Germany), Schneider Electric (France), Wipro Limited (India), Cognizant (U.S.), and Tata Consultancy Services Limited (India). |

SEGMENTAL ANALYSIS

By Service Insights

The infrastructure integration segment dominated the Europe system integration market by holding 39.4% of the European market share in 2024. The domination of the segment is primarily credited to the widespread adoption of hybrid and multi-cloud environments, with over 60% of European enterprises leveraging cloud technologies, as reported by the European Commission. Infrastructure integration ensures seamless connectivity between legacy systems and modern platforms, enabling scalability and operational efficiency. Its importance is underscored by the 15% annual growth in IT infrastructure investments since 2021, driven by the need to support digital transformation initiatives across industries like telecommunications, energy, and healthcare.

On the other hand, the application system integration segment is estimated to grow at a CAGR of 10.5% over the forecast period owing to the increasing adoption of advanced software solutions, with 65% of European enterprises using ERP systems, as highlighted by Eurostat. The segment’s importance lies in its ability to ensure interoperability between disparate applications, enhancing data flow and operational synergy. The rise of digital transformation initiatives, particularly in healthcare and finance, further accelerates demand, making application system integration a critical enabler of business efficiency and innovation.

By Technology Insights

The programmable controller logic (PLC) segment was the largest segment in the European market in 2024 and accounted for 36.1% of the European market share. PLCs dominate due to their widespread adoption in manufacturing, energy, and automotive sectors, with over 80% of European manufacturers relying on them for process control and automation. The European Commission’s Industry 4.0 initiative highlights the importance of PLCs in enabling flexible and adaptive manufacturing processes. Their integration with IoT and cloud platforms is driving smarter operations, making PLCs indispensable for modern industrial automation and efficiency.

The manufacturing execution system (MES) segment is projected to grow at a highest CAGR of 12.4% over the forecast period due to the increasing adoption of smart manufacturing practices, with over 60% of European manufacturers using MES to enhance productivity and reduce waste, according to Eurostat. The integration of MES with IoT and AI is transforming traditional manufacturing, enabling predictive maintenance and real-time quality control. The European Union’s Smart Manufacturing strategy emphasizes the role of MES in enabling data-driven decision-making, making it a critical enabler of innovation and competitiveness in the manufacturing sector.

By Product Insights

The barcode and RFID technologies segment played a dominating role in the European market by accounting for 36.9% of the European market share in 2024. The widespread adoption of barcode and RFID technologies in retail, logistics, and manufacturing, with over 70% of European retailers utilizing these systems for inventory management and supply chain optimization has boosted the growth of the segment in the European market. The European Commission’s Digital Single Market strategy underscores the importance of barcode and RFID technologies in enhancing operational efficiency and reducing costs. Their integration with IoT enables real-time tracking and data analytics, making them indispensable for modern supply chain management and ensuring accuracy and efficiency across industries.

The electronic shelf labels (ESLs) segment is growing rapidly and is estimated to register a CAGR of 18.8% over the forecast period owing to the increasing adoption of dynamic pricing and efficient inventory management in the retail sector. According to the data of Eurostat, more than 40% of European retailers have already adopted ESLs to enhance customer experience and operational efficiency. The integration of ESLs with IoT and cloud platforms enables real-time price updates and inventory tracking, reducing labor costs and ensuring accurate pricing. The European Commission’s Digital Single Market strategy highlights ESLs as a key enabler of digital transformation in retail, making them critical for optimizing operations and maintaining competitiveness.

By End User Insights

The FMCG segment is currently playing the leading role in the European system integration market due to the high demand for daily essentials like food, beverages, and personal care products. The sector's growth is fueled by rising disposable incomes, urbanization, and increasing rural penetration. According to the Ministry of Commerce and Industry, FMCG contributes $110 billion to India's economy, highlighting its critical role in sustaining economic activity and employment.

The e-commerce segment is growing remarkably and is likely to post a CAGR of 24.8% during the forecast period owing to the increasing internet penetration, smartphone usage, and convenience-driven shopping behaviors. The Department for Promotion of Industry and Internal Trade (DPIIT) notes that online retail sales reached $55 billion in 2021, driven by demand for electronics, fashion, and groceries. The pandemic accelerated digital adoption, making e-commerce a vital channel for consumer goods, ensuring accessibility and competitive pricing for end users.

REGIONAL ANALYSIS

Germany occupied 26.7% of the European system integration market share in 2024. The dominating position of Germany in the European market is driven by its robust industrial base and strong emphasis on digital transformation, positioning it as a hub for advanced system integration solutions. For instance, Siemens reported that its German operations contributed 30% of its €10 billion European revenue in 2022, as stated in their annual performance review. The country’s advanced manufacturing infrastructure amplifies adoption, enabling seamless integration of IoT and AI-driven systems. According to Statista, Germany accounts for 25% of Europe’s smart factory projects, reflecting entrenched preferences. Additionally, government incentives for Industry 4.0 initiatives have fostered innovation, creating new opportunities for growth.

France had a promising share of the European system integration market in 2024. The prominent position of France in the European market is fueled by its growing focus on cloud computing and cybersecurity, driving demand for scalable and secure system integration services. For example, Atos achieved a 25% increase in sales of its cloud-based integration solutions in France during 2022, driven by partnerships with financial institutions, as outlined in their corporate disclosures. The country’s vibrant startup ecosystem amplifies adoption, with system integration playing a pivotal role in digital transformation. According to Eurostat, France accounts for 20% of Europe’s cloud integration innovations, reflecting entrenched habits. Additionally, collaborations between tech firms and academic institutions have accelerated R&D, driving adoption.

The UK is estimated to exhibit a healthy CAGR in the European market over the forecast period. Factors such as the rise of fintech and e-commerce platforms that create demand for secure and agile system integration solutions in the UK is majorly driving the UK market growth. For instance, Capgemini reported a 15% increase in sales of its enterprise resource planning (ERP) integration services in 2022, driven by partnerships with retail giants, as stated in their performance metrics. The push for digital-first strategies has further amplified adoption, particularly among urban businesses. According to Statista, 65% of UK enterprises prioritize system integration for enhancing operational efficiency, reflecting entrenched usage patterns. Additionally, government initiatives promoting digital skills have fostered innovation, creating new avenues for growth.

Italy is predicted to witness a prominent CAGR in the European system integration market over the forecast period due to its tradition of craftsmanship and growing demand for cost-effective integration solutions, particularly among small- and medium-sized enterprises (SMEs). For example, Engineering Group achieved a 20% increase in sales of its modular integration systems in 2022, driven by their appeal in reducing complexity for SMEs, as highlighted in their market analysis. The country’s emphasis on quality and reliability amplifies adoption, with operators willing to invest in durable designs. According to Eurostat, Italy accounts for 15% of Europe’s traditional integration systems, reflecting entrenched preferences. Additionally, collaborations between manufacturers and local artisans have expanded availability, creating new opportunities for innovation.

Spain is anticipated to account for a noteworthy share of the European system integration market over the forecast period owing to its growing focus on renewable energy and smart city projects, particularly among urban consumers. For instance, Indra launched a line of smart grid integration systems in 2022, achieving a 30% increase in sales among energy providers, as stated in their sustainability audit. The youthful population amplifies adoption, with system integration serving as affordable indulgences. According to Statista, Spain accounts for 10% of Europe’s smart city projects, reflecting entrenched preferences. Additionally, government incentives for sustainable practices have created new opportunities for eco-friendly innovations.

KEY MARKET PLAYERS

Companies that hold a prominent place in the Europe system integration market include Capgemini (France), Accenture (Ireland), IBM Corporation (U.S.), Infosys Limited (India), Jitterbit, Logic (U.S.), Magic Software Enterprises (Israel), HCL Technologies Limited (India), Sopra Steria (France), Atos SE (France), SAP SE (Germany), Schneider Electric (France), Wipro Limited (India), Cognizant (U.S.), and Tata Consultancy Services Limited (India).

TOP 3 PLAYERS IN THE MARKET

The European system integration market is led by Atos, Capgemini, and Siemens. Atos dominates the market in Europe. Capgemini excels in cloud-based integration, achieving a 25% market share in enterprise solutions, as stated in their performance metrics. Siemens plays a pivotal role in industrial automation, with a 30% share in smart factory projects, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the system integration market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European system integration market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Atos launched a line of AI-driven integration solutions in 2022, designed to cater to the growing demand for predictive analytics, as outlined in their innovation roadmap. Capgemini partnered with retail giants to promote its ERP integration services, achieving a 20% increase in sales, as stated in their market strategy document. Siemens focused on expanding its industrial automation portfolio, investing €500 million to meet growing demand for smart factory solutions, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

COMPETITIVE LANDSCAPE

The European system integration market is highly competitive, characterized by the presence of global giants and regional innovators. Atos, Capgemini, and Siemens dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as cloud integration and smart city projects. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Atos launched a line of AI-driven integration solutions, designed to cater to predictive analytics in healthcare.

- In June 2023, Capgemini partnered with retail giants to promote its ERP integration services, achieving a 20% increase in sales.

- In January 2024, Siemens acquired a startup specializing in industrial automation, aiming to expand its smart factory portfolio.

- In September 2023, Engineering Group collaborated with SMEs to integrate modular systems into legacy infrastructure, enhancing efficiency.

- In November 2023, Indra invested €300 million in expanding its smart grid integration facilities, focusing on renewable energy projects.

MARKET SEGMENTATION

This research report on the Europe system integration market is segmented and sub-segmented into the following categories.

By Service

- Consulting Services

- Application System Integration

- Infrastructure Integration

By Technology

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Human Machine Interface (HMI)

- Product Lifecycle Management (PLM)

- Safety Automation System

- Programmable Controller Logic (PLC)

- Manufacturing Execution System (MES)

- Advanced Process Control (APC)

- Operator Training Simulators (OTS)

By Product

- Barcode & RFID

- Point of Shelf

- Camera

- Electronic Shelf Labels

- Others

By End User

- Retail

- Consumer Goods

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe data center market?

The growth is driven by increasing cloud adoption, rising demand for colocation services, government initiatives for digital transformation, and the expansion of hyperscale data centers by major cloud providers.

How is artificial intelligence impacting data centers in Europe?

AI is driving demand for high-performance computing (HPC) infrastructure, leading to increased power consumption, adoption of liquid cooling, and optimization of data center operations through automation.

How are government regulations affecting data center operations in Europe?

Regulations such as the General Data Protection Regulation (GDPR), energy efficiency directives, and data sovereignty laws influence data center design, security, and operational compliance.

What future trends are expected in the Europe data center market?

The market is expected to see increased investment in edge data centers, AI-driven automation, sustainable energy solutions, and further expansion by hyperscale cloud providers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]