Europe Swine Feed Market Size, Share, Trends & Growth Forecast Report Segmented By Ingredients, Supplements, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Swine Feed Market Size

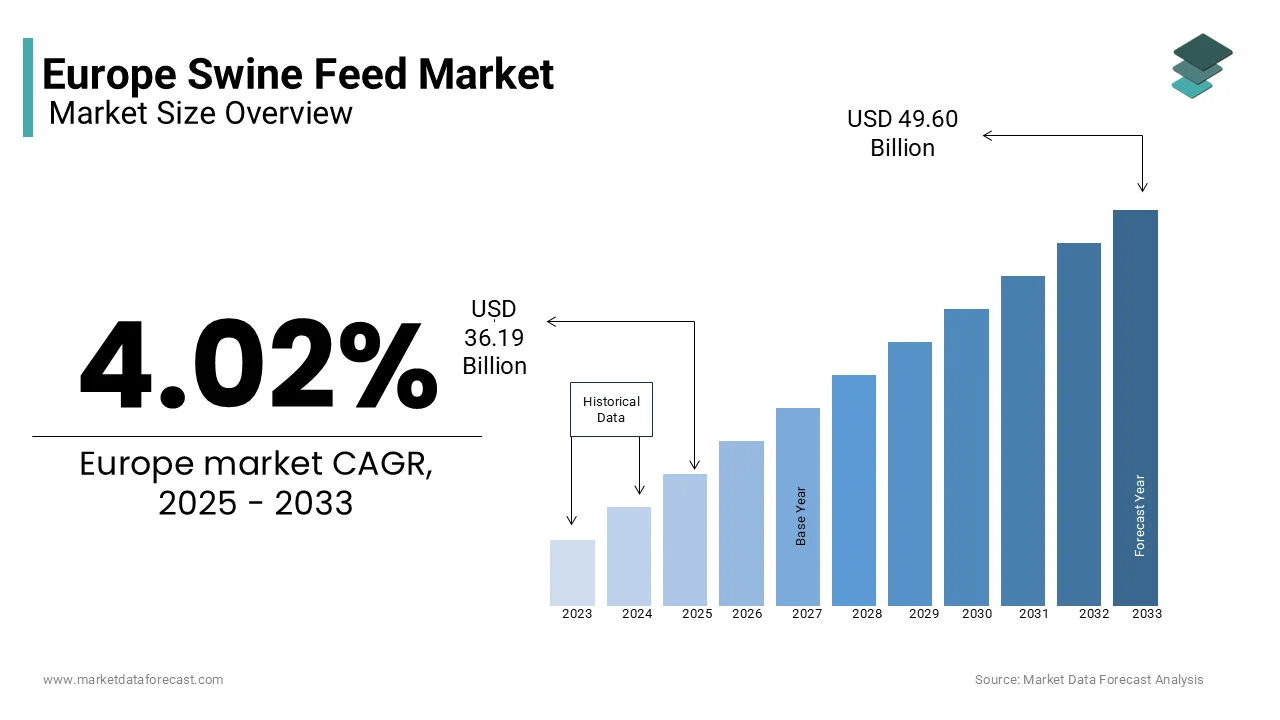

The Europe swine feed market size was valued at USD 34.79 billion in 2024 and is anticipated to reach USD 36.19 billion in 2025 from USD 49.60 billion by 2033, growing at a CAGR of 4.02% during the forecast period from 2025 to 2033.

Swine feed is formulated to optimize growth, health, and productivity in pigs, encompasses a diverse array of ingredients ranging from cereals and oilseed meals to specialized supplements such as vitamins and amino acids. According to Eurostat, pork production accounts for approximately 35% of Europe’s total meat output, with Germany, Spain, and France leading the charge. This underscores the critical role of swine feed in sustaining livestock health and ensuring efficient resource utilization.

As per the European Commission’s Directorate-General for Agriculture and Rural Development, over 60% of European pig farms have adopted precision feeding techniques, integrating nutritional science with advanced farming practices to minimize waste and enhance sustainability. The growing emphasis on reducing the environmental footprint of livestock farming has further propelled innovation in feed formulations, aligning with the EU’s Farm to Fork Strategy goals. For instance, the use of alternative protein sources like insect meal and algae has gained traction, as highlighted by Wageningen University, which reports a 20% increase in their adoption since 2019. With stringent regulations on antibiotic usage and a rising focus on animal welfare, the swine feed market is evolving into a highly specialized and dynamic sector, poised to address both economic and ecological challenges.

MARKET DRIVERS

Rising Demand for High-Quality Pork Products in Europe

The rising demand from consumers for high-quality pork products is majorly driving the European swine feed market growth. According to the European Consumer Organisation (BEUC), over 80% of European consumers prioritize meat sourced from farms adhering to strict quality and welfare standards, creating a ripple effect on feed requirements. This trend is particularly evident in countries like Denmark and the Netherlands, where premium pork brands dominate the market.

For instance, a study by the Danish Ministry of Food, Agriculture and Fisheries highlights that farms using nutritionally optimized swine feed reported a 15% improvement in meat quality and a 10% reduction in fat content, directly aligning with consumer preferences for leaner cuts. Additionally, the French National Institute for Agricultural Research notes that the integration of amino acids and enzymes in feed formulations has increased feed efficiency by up to 25%, enabling farmers to meet stringent quality benchmarks. By ensuring consistent nutrient delivery and enhancing pig health, swine feed not only meets consumer expectations but also enhances farm profitability, making it indispensable in modern pig farming.

Stringent Regulations on Antibiotic Usage

The implementation of stringent regulations aimed at reducing antibiotic usage in livestock farming that is prompting the development of alternative feed solutions is another major factor propelling the European swine feed market growth. According to the European Medicines Agency, antibiotic sales for veterinary use in Europe declined by 34% between 2011 and 2020, driven by policies such as the EU’s Veterinary Medicinal Products Regulation. This regulatory push has catalyzed the adoption of feed additives like acidifiers, probiotics, and prebiotics, which promote gut health and reduce disease incidence.

For example, a report by the German Federal Ministry of Food and Agriculture reveals that the inclusion of acidifiers in swine feed has led to a 20% reduction in post-weaning diarrhea cases, significantly lowering veterinary costs. Similarly, the Spanish Ministry of Agriculture highlights that farms transitioning to antibiotic-free feed formulations witnessed a 12% improvement in piglet survival rates. These advancements not only align with consumer demand for antibiotic-free meat but also position swine feed as a pivotal tool in achieving sustainable and ethical livestock practices across Europe.

MARKET RESTRAINTS

Fluctuating Prices of Key Ingredients

The volatility in prices of key ingredients such as cereals, soybean meal, and oils that form the backbone of feed formulations is primarily inhibiting the growth of the European swine feed market. According to the European Federation of Feed Manufacturers, fluctuations in global commodity markets have caused feed ingredient prices to surge by up to 40% in 2022 alone, severely impacting profit margins for pig farmers. This issue is exacerbated by geopolitical tensions and climate-related disruptions, which have disrupted supply chains and reduced crop yields.

For instance, a study by the Italian Ministry of Agriculture highlights that drought conditions in Southern Europe led to a 15% decline in maize production, a staple ingredient in swine feed, forcing manufacturers to seek costlier alternatives. Additionally, the reliance on imported soybean meal, which accounts for over 70% of Europe’s protein feedstock, as reported by the French Customs Authority, further compounds price instability. Without stable and affordable access to raw materials, the swine feed market faces significant hurdles in maintaining affordability and scalability, deterring smaller farms from adopting advanced formulations.

Limited Awareness of Advanced Feed Solutions

Limited awareness among European farmers, particularly in rural areas, regarding the benefits and applications of advanced feed solutions such as enzyme-enhanced formulations and alternative protein sources is also hampering the expansion of the Europe swine feed market. According to the Czech Ministry of Agriculture, over 60% of small-scale pig farmers lack access to technical training programs or extension services that could educate them about the latest advancements in swine nutrition.

This knowledge gap is compounded by generational disparities, as highlighted by the Swedish Board of Agriculture, which reports that farmers aged 55 and above are 40% less likely to adopt new feed technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper application of feed additives, such as amino acids and antioxidants, can reduce their efficacy by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many farmers remain hesitant to invest in advanced feed solutions, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption of Alternative Protein Sources

The rising adoption of alternative protein sources, such as insect meal, algae, and single-cell proteins that offer sustainable and cost-effective substitutes for traditional feed ingredients is a promising opportunity for the European swine feed market. According to the European Biotechnology Industry Association, investments in insect farming surged by 50% in 2022, with companies like Protix and Ÿnsect leading the charge in producing high-protein feed components. For instance, a study by Wageningen University demonstrates that incorporating insect meal into swine feed formulations can improve weight gain by 10% while reducing feed conversion ratios by 15%. This innovation is further supported by the European Commission’s Horizon Europe program, which has allocated €500 million for research into sustainable protein sources. Additionally, the French National Institute for Agricultural Research highlights that algae-based feeds not only enhance pig health but also reduce greenhouse gas emissions by up to 20%, aligning with the EU’s Green Deal objectives. By fostering scalability and affordability, these alternative proteins are poised to revolutionize the swine feed market, unlocking immense growth potential.

Expansion into Precision Feeding Technologies

The expansion of precision feeding technologies that leverage data analytics, IoT, and AI to optimize feed formulations and delivery systems is another notable opportunity for the European market. According to the German Federal Ministry of Food and Agriculture, over 70% of large-scale pig farms in Europe have integrated precision feeding tools, resulting in a 25% reduction in feed wastage and a 15% improvement in growth rates. This trend is further bolstered by advancements in real-time monitoring systems, as highlighted by the Dutch Ministry of Agriculture, which reports a 30% annual increase in the adoption of automated feeding equipment. Additionally, the integration of machine learning algorithms enables predictive modeling, allowing farmers to anticipate nutritional needs and adjust feed compositions dynamically. A study by the University of Reading demonstrates that precision feeding technologies can reduce production costs by up to 10%, making them an attractive option for cost-conscious farmers. By bridging the gap between technology and agriculture, precision feeding is set to transform the swine feed market, driving efficiency and sustainability.

MARKET CHALLENGES

Environmental Concerns and Sustainability Pressures

The mounting pressure to address environmental concerns associated with feed production, particularly its contribution to greenhouse gas emissions and resource depletion, is one of the significant challenges to the European market. According to the European Environment Agency, livestock feed production accounts for approximately 15% of Europe’s agricultural carbon footprint, primarily due to deforestation linked to soybean cultivation and energy-intensive processing methods. This issue is further compounded by water scarcity challenges, as highlighted by the Spanish Ministry of Agriculture, which reports that feed production consumes over 30% of the agricultural water supply in arid regions. Additionally, the absence of standardized metrics for measuring the environmental impact of feed formulations undermines efforts to develop sustainable alternatives. A study by the University of Copenhagen notes that only 40% of feed manufacturers currently adhere to eco-friendly practices, leaving ample room for improvement. Without addressing these sustainability gaps, the market risks alienating environmentally conscious consumers and policymakers.

Resistance to Technological Adoption Among Small-Scale Farmers

The resistance to technological adoption among small-scale pig farmers that constitute a significant portion of Europe’s agricultural workforce is further challenging the growth of the European market. According to the Romanian Ministry of Agriculture, over 65% of small farms in Eastern Europe rely on traditional feeding practices, citing high costs and complexity as major barriers to adopting advanced technologies. This reluctance is exacerbated by limited access to financing options and technical support, as noted by the Bulgarian Agricultural Fund, which reports that only 20% of surveyed farmers have received subsidies for upgrading their feeding systems. Furthermore, a study by the University of Seville highlights that the perceived risk of investing in unproven technologies often outweighs the potential benefits, deterring adoption. While larger farms can absorb these costs through economies of scale, smaller operations struggle to justify the expenditure, especially when immediate returns are uncertain. Bridging this adoption gap requires targeted interventions and accessible solutions tailored to the unique needs of small-scale farmers.

SEGMENTAL ANALYSIS

Europe Swine Feed Market By Ingredients

The cereals segment had 45.7% of the European market share in 2024. The domination of the cereals segment in the European market is attributed to cereals' affordability, widespread availability, and high energy content that are critical for supporting the rapid growth and reproduction cycles of swine. Wheat, barley, and corn are the most commonly used cereals in swine diets, providing essential carbohydrates that fuel metabolic processes. According to Eurostat, cereal production in Europe reached 304 million metric tons in 2022, ensuring a steady supply for livestock feed manufacturers. The European Feed Manufacturers' Federation highlights that cereals account for approximately 60% of the total energy intake in swine diets, making them indispensable for maintaining optimal body condition and productivity. Additionally, advancements in milling technologies have improved the digestibility of cereals, further enhancing their appeal. For instance, a study by Wageningen University demonstrates that finely ground cereals increase nutrient absorption by up to 15%. Beyond nutrition, cereals also play a vital role in cost management, as they are often cheaper than alternative ingredients like oils or supplements. With Europe's focus on sustainable agriculture, locally sourced cereals reduce reliance on imported feed components, aligning with the EU’s Farm to Fork Strategy.

The amino acids segment is predicted to witness an exponential CAGR of 8.2% over the forecast period owing to the rising adoption of precision feeding practices aimed at optimizing animal health and minimizing environmental impact. Lysine and methionine, two key amino acids, are widely used to balance protein levels in swine diets, reducing the need for excessive soybean meal inclusion. A report by the International Journal of Agricultural Sustainability states that supplementing diets with synthetic amino acids can lower nitrogen excretion by 20%, addressing regulatory pressures to curb agricultural pollution. Furthermore, rising consumer demand for antibiotic-free pork has accelerated the use of amino acids as natural growth promoters. For example, Evonik Industries notes that lysine supplementation improves feed conversion ratios by up to 10%, enhancing profitability for farmers. The push for sustainable and efficient farming practices, coupled with innovations in biotechnology, positions amino acids as a transformative ingredient in the swine feed industry. By 2030, this segment is expected to capture 15% of the total ingredient market, reshaping traditional feeding strategies.

Europe Swine Feed Market By Supplements

The vitamins segment held the leading share of 29.9% of the European market in 2024. The key role that vitamins play in supporting immune function, growth, and overall health in swine is majorly driving the domination of vitamins segment in the European market. Vitamin E, for instance, is widely recognized for its antioxidant properties, which protect cells from oxidative stress and improve meat quality. A study published by the University of Copenhagen reveals that vitamin E supplementation reduces drip loss in pork by 12%, enhancing shelf life and consumer appeal. Similarly, B-complex vitamins are essential for energy metabolism and nervous system development, making them indispensable during early growth stages. The European Food Safety Authority mandates specific vitamin levels in animal feed to ensure compliance with nutritional standards, further solidifying their importance. Moreover, the growing trend toward fortified animal feed has boosted vitamin sales; Statista reports that the global animal feed vitamin market grew by 25% between 2020 and 2022. As Europe prioritizes high-quality pork production, vitamins remain a cornerstone of modern swine nutrition, bridging gaps in dietary requirements and promoting sustainable livestock practices.

The enzymes segment is another promising segment and is predicted to showcase a CAGR of 12.2% over the forecast period. The ability of enzymes to enhance nutrient digestibility and reduce feed costs to align with the EU’s sustainability goals is primarily driving the expansion of the enzymes segment in the European market. Phytase, a widely used enzyme, breaks down phytic acid in plant-based feeds, unlocking phosphorus and other minerals that would otherwise go unused. A case study by the French National Institute for Agricultural Research shows that phytase supplementation increases phosphorus utilization by 35%, significantly lowering dependency on inorganic phosphate sources. Additionally, enzymes like xylanase and protease improve fiber breakdown and protein efficiency, respectively, enabling farmers to incorporate more cost-effective ingredients into feed formulations. The European Commission’s Green Deal emphasizes reducing agricultural waste, and enzymes play a pivotal role in achieving this objective by minimizing undigested nutrients in manure. Companies like DSM and Novozymes have invested heavily in enzyme research, launching innovative products tailored for European markets. With the global enzyme market projected to reach $2 billion by 2027, this segment is poised to revolutionize swine feed formulations, offering both economic and environmental benefits.

COUNTRY ANALYSIS

Top 5 Leading Countries in the European Swine Feed Market

Germany was the top performing regional market for swine feed in Europe in 2024 and occupied 25.7% of the European market share. The leading position of Germany in the European market is driven by the robust pig farming sector of Germany. According to the Fraunhofer Institute, German farmers spend approximately €1.5 billion annually on advanced feed formulations, reflecting their commitment to innovation. A report by the German Agricultural Society highlights that over 70% of pig farms in the country have adopted precision feeding systems, ensuring compliance with sustainability regulations. Additionally, Germany’s strategic location facilitates distribution across Europe, enhancing its market dominance.

Spain accounted for the second largest share of the European swine feed market in 2024. The growth of Spanish swine feed market is attributed to the extensive pig farming sector of Spain that spanned over 95,000 farms. According to Eurostat, Spain’s pork production grew by 12% in 2021, which is driving demand for advanced formulations. Government initiatives, such as subsidies for sustainable feed production to promote eco-friendly practices is further propelling the Spanish market growth. A study by the Spanish Federation of Pig Farmers reveals that farms using optimized feed formulations reported a 15% increase in productivity, underscoring their economic benefits. The advanced agricultural infrastructure and strong export capabilities in Spain are further aiding the swine feed market in Spain.

France is predicted to account for a prominent share of the European swine feed market over the forecast period owing to its focus on high-quality pork production. According to Coldiretti, France’s largest farmers’ association, over 60% of pig farms utilize nutritionally balanced feed formulations, ensuring premium meat quality. The Mediterranean climate and rich biodiversity of France make it ideal for feed ingredient cultivation. A report by the University of Bordeaux highlights that French farms treated with advanced feed solutions achieved a 20% improvement in growth rates and a 10% reduction in mortality rates. Additionally, the participation of France in EU-funded sustainability projects has accelerated the French market growth.

Denmark is a prominent market for swine feed in Europe. The reputation of Denmark for producing high-quality pork products is primarily driving the Denmark market growth. According to the Danish Agriculture and Food Council, over 90% of pig farms in the country have adopted feed formulations enriched with amino acids and enzymes, ensuring compliance with welfare regulations. The focus of Denmark on sustainability, where feed innovations play a critical role. A study by the University of Copenhagen demonstrates that Danish farms using precision feeding technologies reduced greenhouse gas emissions by 25%, addressing environmental concerns. Furthermore, Denmark’s strategic investments in research and development enhance feed formulation advancements, solidifying its market standing.

The Netherlands is anticipated to play a notable role in the European swine feed market over the forecast period due to its expertise in precision agriculture and livestock management. According to Wageningen University, Dutch farms utilizing advanced feed formulations achieved a 30% reduction in feed wastage, aligning with sustainability goals. The advanced logistics network that enable efficient distribution in Netherlands is favouring the market growth in this country. A report by the Netherlands Enterprise Agency highlights that feed exports grew by 18% in 2022, underscoring its global influence. Additionally, the Netherlands’ focus on circular agriculture ensures continued market growth.

KEY MARKET PLAYERS

CHR Hansen Holdings A/S (Denmark), Novus International Inc. (U.S), Lallemand Inc (Canada), BASF (Badishce Anilin und Soda Fabrik) (Germany), Royal DSM N.V. (The Netherlands), ADM (Archer Daniels Midland Company) (U.S), Alltech Inc. (U.S), Charoen Popkhand Foods (Thailand), Cargill Inc. (U.S) and ABF Plc (Associated British Food) (U.K) are some of the important companies in the swine feed market.

Top of Form

MARKET SEGMENTATION

This research report on the Europe swine feed market is segmented and sub-segmented into the following categories.

By Ingredients

- Cereals

- Cereal By-Products

- Oilseed Meal

- Oils

- Molasses

- Supplements

- Others

By Supplements

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Enzymes

- Acidifiers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]