Europe Swimming Pool Treatment Chemicals Market Research Report - Segmented Based on Product (Bleaching Powder, Liquid Chlorine, Trichlor, Trichloroisocyanuric Acid, Others), Application, and By Country (Spain, Italy, France, The UK, Germany, and the Rest of Europe) - Industry Analysis on Size, Share, Trends, & Growth Forecast (2025 to 2033)

Europe Swimming Pool Treatment Chemicals Market Size

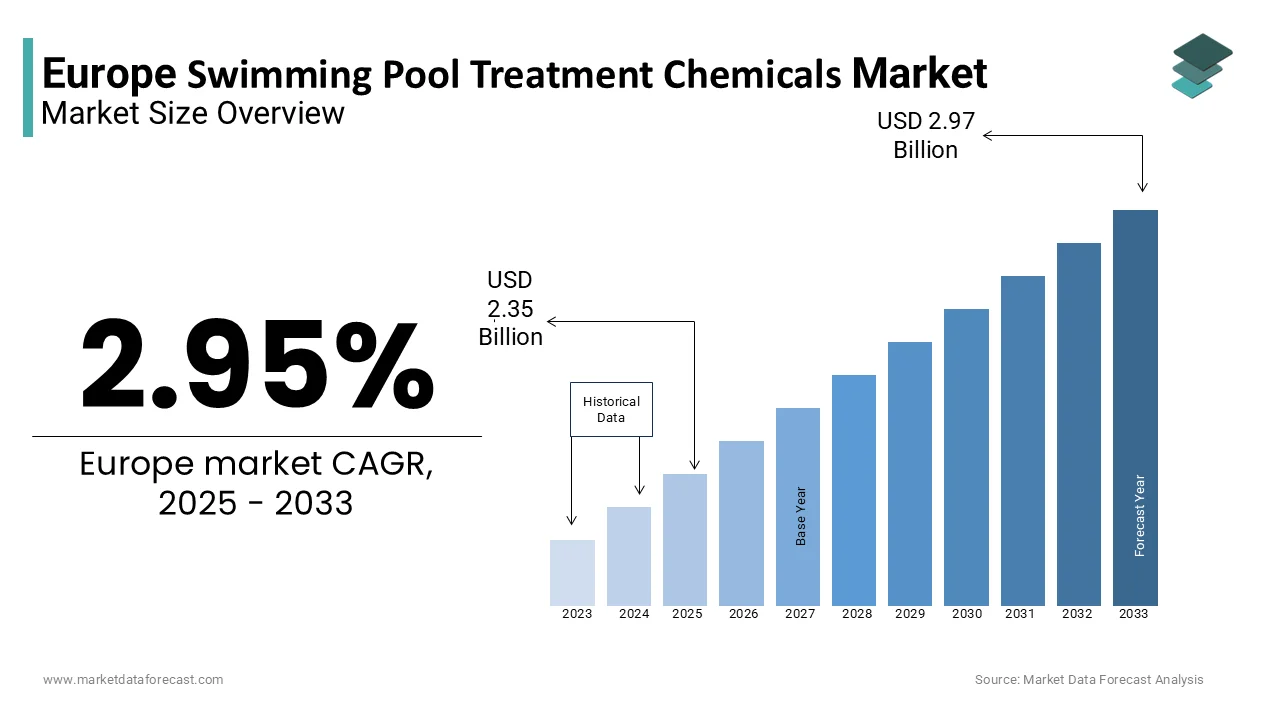

The Europe Swimming Pool Treatment Chemicals Market size was valued at USD 2.28 billion in 2024, and the Europe market size is expected to reach USD 2.97 billion by 2033 from USD 2.35 billion in 2025, growing at a compound annual growth rate (CAGR) of 2.95% during the forecast period.

The Europe swimming pool treatment chemicals market experienced steady growth in the last few years and is predicted to showcase prominent growth over the forecast period due to the increasing pool installations, growing awareness of water hygiene and the rising demand for residential pools, particularly in Southern Europe, where warm climates encourage outdoor lifestyles. Spain leads the regional market, accounting for nearly 20% of Europe’s total chemical sales, as per the Spanish Pool Association. As per Eurostat, over 60% of European consumers prioritize chlorine-free alternatives like saltwater systems and enzyme-based treatments, driving innovation in formulations. Additionally, stringent regulations regarding water safety and environmental protection have further propelled demand for advanced chemical products, ensuring sustained growth in both residential and commercial segments.

MARKET DRIVERS

Rising Demand for Water Hygiene Solutions in Europe

The increasing demand for effective water hygiene solutions is one of the most significant drivers propelling the Europe swimming pool treatment chemicals market forward. According to Nielsen, over 70% of European pool owners view water sanitation as a top priority, creating a lucrative market for chemical manufacturers. For instance, in France, sales of chlorine-based products surged by 25% in 2022, as per the French Environmental Health Authority. This trend is further amplified by the growing awareness of waterborne diseases and regulatory mandates for maintaining safe pH levels. According to the European Centre for Disease Prevention and Control, proper chemical treatment reduces microbial contamination by 99%, encouraging investments in high-quality products. Additionally, advancements in slow-release chlorine tablets have addressed previous concerns about frequent dosing, enhancing convenience.

Expansion of Residential Pools

The surging popularity of residential pools that fuels demand for treatment chemicals is further boosting the growth of the European market. According to a study by Deloitte, the residential pool segment grew by 30% in 2022, with markets like Italy and Spain leading the charge, as per the Italian Construction Federation. The emphasis on home improvement and backyard entertainment has further amplified this trend. As per Eurostat, over 50% of European homeowners now prioritize outdoor amenities, creating a niche for specialized chemical solutions. Additionally, the availability of compact and modular pools has broadened their appeal, ensuring sustained demand.

MARKET RESTRAINTS

High Costs of Eco-Friendly Alternatives

One of the primary restraints hindering the Europe swimming pool treatment chemicals market is the high cost associated with eco-friendly alternatives. According to the European Environment Agency, chlorine-free treatments like saltwater systems and enzyme-based solutions are 30% more expensive than traditional chlorine-based products. For instance, in Germany, over 40% of pool owners cited affordability as the main barrier to adopting sustainable options, as per the German Consumer Protection Agency. While affluent households can absorb these costs, middle-income families often struggle to justify the investment, limiting market accessibility. Furthermore, recurring expenses for refills and maintenance add to the financial strain, posing a significant challenge for broader adoption of eco-friendly solutions.

Stringent Environmental Regulations

The stringent environmental regulations governing chemical usage that impacts product development and marketing strategies is further hindering the growth of the swimming pool treatment chemicals market in Europe. According to the European Chemicals Agency, over 30% of traditional pool chemicals face restrictions due to concerns about toxicity and environmental impact. For example, in Sweden, bans on certain algaecides led to a 15% decline in chemical sales in 2022, as per the Swedish Environmental Protection Agency. This issue is exacerbated by growing consumer skepticism about chemical safety. As per the World Wildlife Fund, only 20% of consumers trust conventional pool chemicals, driving demand for safer alternatives. These challenges not only increase operational risks but also limit opportunities for innovation, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Adoption of Smart Chemical Monitoring Systems

The integration of smart chemical monitoring systems is a notable opportunity for the Europe swimming pool treatment chemicals market. According to a study by Bain & Company, over 60% of European consumers are willing to invest in IoT-enabled devices that automate chemical dosing and water quality management. For instance, in the UK, companies like Zodiac introduced smart sensors that boosted sales by 20%, as per the British Pool Association. The growing emphasis on convenience and precision are fuelling this trend in the European market. As per Eurostat, smart systems reduce chemical wastage by 25% while improving water safety, aligning with consumer values. Additionally, certifications like CE marking have enhanced brand credibility, attracting premium buyers. These innovations highlight the immense potential of smart technologies to reshape the market landscape.

Growth of Chlorine-Free Solutions

The rapid adoption of chlorine-free solutions, driven by health-conscious and environmentally aware consumers is a promising opportunity in the European market. According to Statista, the chlorine-free segment grew by 40% in 2022, with markets like Italy and Spain leading the charge, as per the Italian Renewable Energy Federation. The emphasis on sustainability and skin sensitivity has further amplified this trend. As per McKinsey & Company, over 50% of millennials and Gen Z consumers prioritize natural and non-toxic products, creating a niche for innovative formulations. Additionally, advancements in saltwater and enzyme-based systems have improved effectiveness, addressing previous concerns about performance.

MARKET CHALLENGES

Intense Competition and Price Wars

One of the major challenges facing the Europe swimming pool treatment chemicals market is the intense competition among established brands and private labels, which complicates efforts to build brand loyalty. According to Kantar Worldpanel, private label chemicals account for over 25% of total sales in Europe, with major retailers like Lidl and Aldi offering affordable alternatives to branded products. For instance, in France, private labels captured 30% of the chlorine tablet market share in 2022, as per the French Retail Federation. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. As per Nielsen, over 60% of consumers switch between brands based on discounts and promotions, underscoring the challenge of retaining customer loyalty. Additionally, the lack of innovation in traditional categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

The volatility of raw material prices, which impacts production costs and pricing strategies is another major challenge to the expansion of the European swimming pool treatment chemicals market. According to the International Chemical Council, the price of chlorine and other key ingredients fluctuated by up to 15% over the past year due to supply chain disruptions. For example, in Italy, shortages of raw materials caused logistical challenges, leading to a 10% increase in chemical production costs, as per the Italian Chemical Manufacturers Association. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. These challenges not only strain profitability but also hinder long-term planning and investment in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.95% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

BEHQ S.L.U., PROXIM sro, Leisurechem, Ecolab, BASF SE, Ercros S.A are, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The chlorine-based products segment captured 45.5% of the Europe swimming pool treatment chemicals market share in 2024. The dominating position of chlorine-based segment in the European market is driven by their effectiveness in killing bacteria and algae, appealing to pool owners seeking reliable solutions. For instance, in Spain, chlorine tablets accounted for over 60% of all chemical sales, as per the Spanish Pool Association. The growing preference for cost-effective and widely available options is also contributing to the expansion of the chlorine-based products segment in the European market. According to Eurostat, chlorine-based products reduce microbial contamination by 99%, ensuring compliance with water safety regulations. Additionally, advancements in slow-release formulations have addressed previous concerns about frequent dosing, enhancing convenience.

The enzyme-based solutions segment is on the rise and is projected to witness a CAGR of 8.8% over the forecast period owing to their eco-friendly and skin-safe properties, appealing to health-conscious consumers. For example, in Germany, enzyme-based products gained immense popularity, with sales surging by 40% in 2022, as per the German Environmental Health Authority. The growing emphasis on sustainability and skin sensitivity are fuelling the growth rate of the enzyme-based solutions segment in the European market. According to Statista, over 50% of millennials and Gen Z consumers prioritize natural and non-toxic products, creating a niche for innovative solutions. Additionally, advancements in multi-enzyme formulations have improved effectiveness, addressing previous concerns about performance. These innovations highlight the transformative potential of enzyme-based solutions to address evolving consumer preferences.

By Application Insights

The residential pools held the leading share of 63.9% of the Europe swimming pool treatment chemicals market share in 2024. The dominating position of residential pools segment in the European market is attributed to the widespread adoption of pools in private homes, particularly among affluent households with disposable incomes. For instance, in France, over 80% of chemical sales are attributed to residential pool owners, as per the French Pool Builders Association. The rising trend of home improvement and backyard enhancements is also boosting the expansion of the residential pools segment in the global market. According to Statista, residential pool chemical sales increased by 20% in 2022, reflecting heightened consumer interest in creating personalized leisure spaces. Additionally, the availability of financing options has made pool ownership more accessible, ensuring sustained demand. These attributes ensure that residential pools remain the primary driver of the market.

The commercial pools segment is anticipated to register a promising CAGR in the European market over the forecast period due to the increasing demand for recreational and fitness facilities in hotels, gyms, and resorts. For example, in the Netherlands, luxury hotels reported a 35% increase in demand for premium chemical solutions, as per the Dutch Hospitality Association. The rising emphasis on experiential tourism and wellness is also accelerating the growth of the commercial segment in the European market. According to McKinsey & Company, over 60% of travelers prioritize hotels with premium amenities, creating a niche for specialized venues. Additionally, the integration of smart chemical monitoring systems has enhanced operational efficiency, addressing previous concerns about maintenance costs.

REGIONAL ANALYSIS

Germany stands as the largest contributor to European swimming pool treatment chemicals market and had the major share of the European market in 2024. The dominating position of Germany in the European market is primarily attributed to its robust industrial base and a strong emphasis on water quality standards, which are among the strictest in Europe. According to the German Federal Environment Agency, over 1.5 million private pools exist in the country, supported by a culture of meticulous maintenance and adherence to environmental regulations. The demand for eco-friendly chemicals, such as enzyme-based cleaners and chlorine alternatives, is rising, with annual sales exceeding €300 million in 2023. Germany’s temperate climate also encourages indoor pool installations, driving year-round chemical usage. Additionally, government incentives promoting energy-efficient filtration systems have indirectly boosted the demand for compatible treatment solutions. Urbanization and the growing popularity of wellness centers further amplify consumption. With a focus on sustainability and innovation, Germany not only leads the regional market but also sets benchmarks for product development and regulatory compliance.

France is another promising regional segment for swimming pool treatment chemicals in Europe and is anticipated to account for a substantial share of the regional market over the forecast period. Renowned for its Mediterranean lifestyle and warm climate, France boasts over 3 million residential pools, according to the French National Institute of Statistics. This vast installed base drives consistent demand for treatment chemicals, particularly during peak summer months. The French market is characterized by a preference for premium products, such as stabilized chlorine and pH balancers, with annual expenditures exceeding €400 million. Rising awareness of waterborne diseases has spurred investments in advanced sanitizers and algaecides, ensuring compliance with EU health standards. Furthermore, the country’s thriving tourism industry, particularly along the French Riviera, supports commercial pool installations, creating additional demand. Government initiatives promoting sustainable water management have also encouraged the adoption of biodegradable chemicals. France’s blend of residential and commercial applications positions it as a pivotal player in shaping regional trends.

Italy is estimated to register a prominent CAGR in the European swimming pool treatment chemicals market over the forecast period. The sunny climate and affluent coastal regions of Italy, such as Tuscany and Sicily, make private pools a staple in Italian households, which is majorly driving the Italian market growth. As per the Italian Association of Pool Manufacturers, there are over 1.2 million residential pools in Italy, with annual chemical sales surpassing €250 million. Italians prioritize eco-friendly solutions, leading to increased adoption of saltwater systems and non-chlorine oxidizers. Economic recovery post-pandemic has revitalized the construction sector, boosting new pool installations and subsequent chemical demand. Additionally, Italy’s stringent environmental policies, enforced by the Ministry of Ecological Transition, have accelerated the shift toward green products. The rise of agriturismo (farm-stay tourism) has also driven demand for commercial pool facilities, particularly in rural areas. By balancing tradition with innovation, Italy continues to play a vital role in the European market.

The UK is showing steady growth despite its cooler climate. Urbanization and the proliferation of indoor pools have been key drivers, with London and Manchester leading the trend. According to the British Swimming Pool Federation, there are over 700,000 pools in the UK, supported by a growing appetite for home customization and wellness amenities. The market is valued at £150 million annually, with a notable shift toward smart pool technologies that integrate automated chemical dispensers. Concerns about water hygiene, exacerbated by public health awareness campaigns, have fueled demand for advanced sanitizers like bromine tablets and UV stabilizers. Moreover, the UK’s commitment to Net Zero targets has encouraged the use of sustainable chemicals, aligning with broader environmental goals. Commercial sectors, including hotels and leisure centers, also contribute significantly. The UK’s innovative approach ensures its continued relevance in the regional market.

Spain is predicted to exhibit a notable CAGR in the European swimming pool treatment chemicals market over the forecast period. Blessed with a warm Mediterranean climate, Spain has over 1.3 million residential pools, as reported by the Spanish Pool Association. Coastal regions like Costa del Sol and Balearic Islands drive significant demand for treatment chemicals, particularly during the extended summer season. The market is valued at €200 million annually, with a preference for cost-effective yet high-performance products like liquid chlorine and shock treatments. Rising tourism, which attracts over 80 million visitors annually, has bolstered commercial pool installations in resorts and hotels, amplifying chemical consumption. Water scarcity concerns have also pushed manufacturers to innovate, introducing concentrated formulas that reduce water wastage. Additionally, government subsidies for renewable energy systems have indirectly promoted energy-efficient pool maintenance practices. Spain’s unique blend of residential and hospitality-driven demand makes it a dynamic contributor to the European market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BEHQ S.L.U., PROXIM sro, Leisurechem, Ecolab, BASF SE, Ercros S.A are some of the notable companies in the Europe Swimming Pool Treatment Chemicals market.

The Europe swimming pool treatment chemicals market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 25% of the share, fostering a highly dynamic environment. Key players like Lonza Group and Chemours dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like Blue Science are pioneering enzyme-based treatments, challenging incumbents in the eco-friendly segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

TOP PLAYERS IN THE MARKET

Lonza Group, headquartered in Switzerland, holds a substantial presence in Europe, offering iconic brands like Baquacil and HTH. Chemours, based in the US, specializes in chlorine-based solutions, with a growing footprint in markets like Germany and Italy. Meanwhile, AkzoNobel, a Dutch firm, is renowned for its eco-friendly and enzyme-based solutions, widely adopted by environmentally conscious consumers. According to Nielsen, AkzoNobel’s products account for 10% of the chlorine-free market share in Europe, highlighting its leadership in sustainable innovations. These players collectively drive innovation and set benchmarks for quality and sustainability in the Europe swimming pool treatment chemicals market.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the Europe swimming pool treatment chemicals market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, Lonza Group announced a commitment to achieving carbon neutrality across its production facilities by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, Chemours launched a line of slow-release chlorine tablets designed to reduce chemical wastage and improve user convenience. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the European Investment Bank, AkzoNobel has invested heavily in enzyme-based formulations to cater to health-conscious buyers seeking non-toxic alternatives. These strategies reflect a commitment to innovation and market leadership.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Lonza Group acquired a French startup specializing in enzyme-based pool treatments. This acquisition aimed to expand its portfolio of eco-friendly products and cater to health-conscious buyers.

- In May 2024, Chemours partnered with a German e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, AkzoNobel introduced a line of biodegradable algaecides targeting environmentally conscious consumers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, Blue Science secured USD 50 million in funding from European investors to scale its sustainable chemical initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, Lonza launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the Europe home appliances market is segmented and sub-segmented into the following categories.

By Product

- Bleaching Powder

- Liquid Chlorine

- Trichlor

- Trichloroisocyanuric Acid

- Others

By Application

- Residential Pool

- Commercial Pool

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Mention some key players in Europe's Swimming Pool Treatment Chemicals Market?

BEHQ S.L.U., PROXIM SRO, Leisurechem, Ecolab, BASF SE, Ercros S.A.

Mention any of the Europe Swimming Pool Treatment Chemicals Market Primary Drivers?

Awareness, health concerns, rise in urbanization, and effectiveness of the chemical in creating resistance to bacteria in the pool are leading factors for the market growth.

Which region holds the largest market share?

France in Europe Swimming Pool Treatment Chemicals Market holds the largest market share.

What is the growth rate of the Europe Swimming Pool Treatment Chemicals Market?

The growth rate of the Europe Swimming Pool Treatment Chemicals Market is at a CAGR of around 2.9 %.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]