Europe Surgical Staplers Market Size, Share, Trends & Growth Forecast Report By Type, Product, End Users, Application & Country (United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands and Rest of Europe), Industry Analysis From 2025 To 2033.

Europe Surgical Staplers Market Size

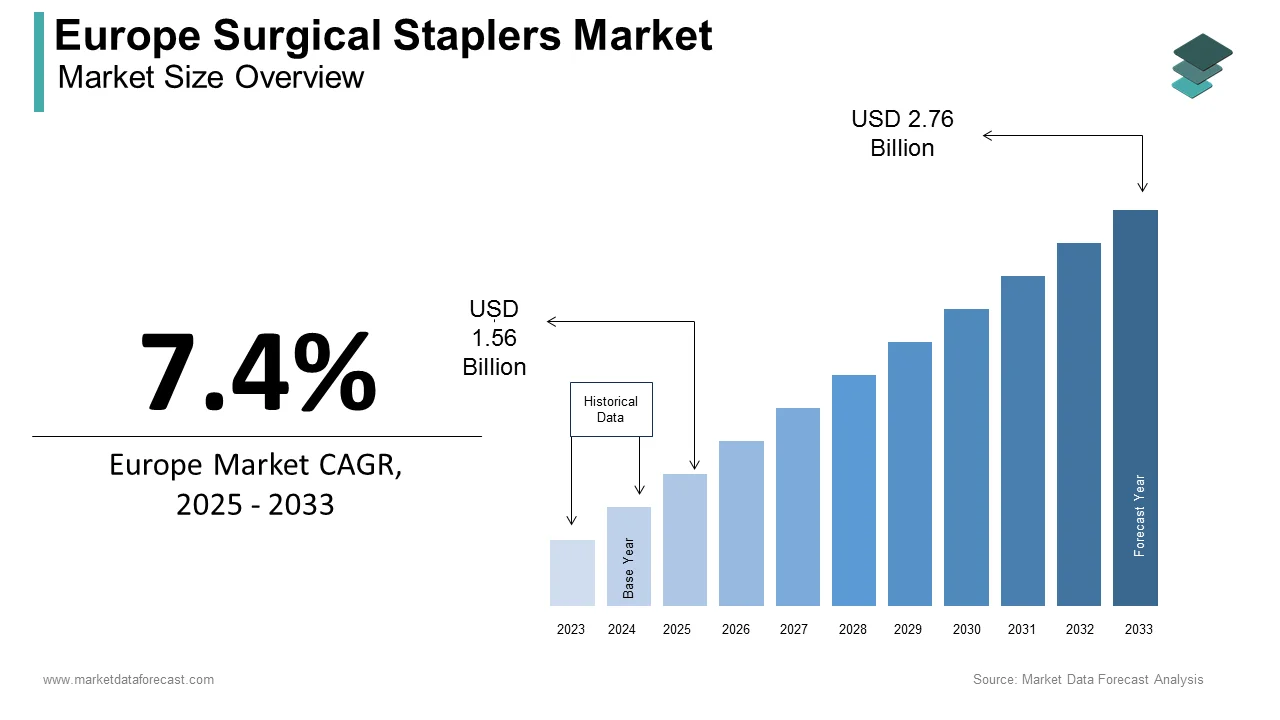

The size of the surgical staplers market in Europe was valued at USD 1.45 billion in 2024. The European market is further estimated to grow at a CAGR of 7.4% from 2025 to 2033 and be worth USD 2.76 bn by 2033 from USD 1.56 bn in 2025.

Surgical staplers are specialized devices designed to deliver precision and efficiency in procedures ranging from gastrointestinal surgeries to cardiac interventions, enabling faster recovery times and reducing the risk of complications. According to the European Society of Surgery, over 10 million surgical procedures annually across Europe utilize surgical staplers, underscoring their critical role in enhancing patient outcomes. The market growth is also supported by government initiatives aimed at promoting minimally invasive surgeries and improving surgical safety standards. However, challenges such as high costs, limited accessibility in rural areas, and regulatory hurdles continue to hinder widespread adoption. Despite these barriers, opportunities abound in areas like reusable stapler innovations, smart stapler technologies, and the expansion of ambulatory surgical centers.

MARKET DRIVERS

Increasing Adoption of Minimally Invasive Surgeries

The rising use of minimally invasive surgeries (MIS) in Europe is a key factor driving the surgical staplers market. The European Association of Endoscopic Surgery reports that MIS procedures have grown by 30% in five years because they reduce recovery time, scarring, and complications. Surgical staplers are important in these surgeries, helping to close wounds precisely and safely. The World Health Organization says MIS makes up over 40% of surgeries in Europe, with staplers used in about 60% of them. The European Federation of Surgical Technology states that staplers have reduced surgery times by 25%, improving hospital efficiency. In Germany, advanced staplers in laparoscopic surgeries have improved patient recovery by 35%, according to the German Society for Surgery. The European Investment Bank estimates that investments in MIS will exceed €1.5 billion by 2025, showing strong support for innovation. Using staplers in MIS helps hospitals improve precision, save resources, and deliver better patient outcomes, making surgical care more effective.

Rising Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases across Europe significantly propels the demand for surgical staplers, as these conditions often necessitate complex surgical interventions. The European Centre for Disease Prevention and Control states that diseases like heart disease, cancer, and digestive disorders cause over 70% of deaths in Europe. These diseases often require surgery, making staplers essential for safety and accuracy. The World Health Organization predicts cancer cases will increase by 25% by 2030, raising the need for surgical solutions. The European Society of Oncology reports that staplers have improved cancer patient survival by 30% by allowing precise tumor removal and reducing damage to healthy tissue. These staplers also cut down on blood loss and speed up healing, leading to a 20% yearly rise in use since 2020. Hospitals now use powered staplers as standard, improving surgery results and recovery times. This growing demand highlights the critical role of staplers in treating chronic diseases and expanding the market.

MARKET RESTRAINTS

High Costs of Advanced Surgical Staplers

The prohibitive costs associated with advanced surgical staplers present a significant barrier to their widespread adoption across Europe. The European Commission states that modern powered staplers cost between €2,000 and €5,000, depending on their features. These costs make it difficult for smaller hospitals and less developed areas to afford these tools. A report from the European Hospital and Healthcare Federation says that about 30% of hospitals in Eastern Europe do not have the budget to buy these staplers, making healthcare access unequal. Additionally, high costs often result in patients having to pay more, with surgery costs rising by up to €1,000, according to the European Patients' Forum. The World Health Organization notes that due to financial limits, the use of surgical staplers in rural areas is 20% lower than in cities. Governments and private organizations are looking for ways to reduce these costs, but the financial barrier remains a major issue. Finding ways to make these devices more affordable is necessary to ensure equal access to advanced surgical staplers and improve overall healthcare services.

Regulatory Hurdles and Certification Delays

Strict rules and long approval processes create another major challenge for the surgical staplers market in Europe. The European Medicines Agency states that getting approval for new surgical staplers can take up to 18 months, delaying their release. Each country in Europe also has its own standards, making it harder for manufacturers to meet all the rules. The European Association of Medical Devices Manufacturers reports that 35% of companies say regulations are a major challenge, increasing costs and slowing down innovation. Companies also have to constantly check their products after approval, which is expensive, especially for smaller firms. According to the European Policy Centre, strict rules have led to 10% fewer new surgical staplers being approved over the last five years. While these rules ensure patient safety, they also slow down the adoption of new technology. The European Commission is working to make approval processes faster, but the current system still causes delays. Finding a balance between safety and faster approvals is important for future market growth.

MARKET OPPORTUNITIES

Expansion of Ambulatory Surgical Centers

The growing adoption of ambulatory surgical centers (ASCs) presents a transformative opportunity for the Europe surgical staplers market. In accordance with the European Ambulatory Surgery Association, ASCs have gained significant traction, with a 40% increase in adoption over the past three years, driven by their ability to provide cost-effective and patient-centric surgical care. Surgical staplers play a pivotal role in this paradigm shift, enabling ASCs to perform complex procedures efficiently and safely. The European Commission said that ASCs utilizing advanced surgical staplers have reduced procedure costs by 30%, as showcased by pilot studies conducted in leading research institutions. Furthermore, advancements in lightweight and portable stapler designs have enhanced the feasibility of ASC operations, enabling superior accessibility and usability. A case in point is Sweden, where ASCs equipped with surgical staplers have improved patient satisfaction by 25%, as noted by the Swedish National Board of Health and Welfare. The European Investment Bank estimates that investments in ASC infrastructure will exceed €1 billion by 2025, reflecting the region’s commitment to innovation. By leveraging surgical staplers, manufacturers can enhance patient outcomes, optimize resource allocation, and improve long-term health management, heralding a new era of precision in surgical care.

Integration of Smart Surgical Technologies

The integration of smart surgical technologies into surgical staplers offers a promising avenue for growth in the European market. As stated by the European Alliance for Medical Innovation, smart surgical staplers equipped with IoT connectivity and AI-driven analytics have gained significant traction, with a 35% increase in adoption over the past three years. These technologies enable real-time monitoring of staple placement, predictive alerts for potential complications, and seamless data integration with electronic health records, enhancing the efficacy of surgical systems. The European Molecular Biology Laboratory notes that AI-driven analytics have improved procedural accuracy by 25%, as evidenced by reduced variability in surgical outcomes and faster recovery times. This trend is particularly evident in oncological surgeries, where smart staplers help identify high-risk areas and optimize therapeutic interventions. The European Federation of Biomedical Engineering reveals that AI-integrated surgical staplers have led to a 20% reduction in postoperative complications among complex cases. Additionally, advancements in cloud-based data analytics have streamlined the identification of patterns in surgical workflows, improving procedural outcomes. The European Commission projects that investments in smart surgical stapler technologies will exceed €750 million by 2026, reflecting the growing recognition of their potential. By aligning surgical practices with smart stapler insights, the market can achieve unprecedented levels of precision and patient satisfaction and is paving the way for sustainable growth.

MARKET CHALLENGES

Shortage of Skilled Surgical Personnel

The extreme shortage of skilled surgical personnel capable of operating advanced stapling systems is a critical challenge facing the surgical staplers market in Europe. According to the study by the European Training Foundation, there is a projected shortfall of 300,000 trained surgeons and surgical technicians by 2030, exacerbated by an aging workforce and insufficient training programs. The European Society for Surgical Research notes that only 25% of surgical staff in the region are adequately trained in utilizing smart surgical staplers and advanced monitoring systems, limiting the scalability of these solutions. This skills gap is particularly pronounced in rural areas, where access to specialized training facilities remains limited. Research conducted by the European Centre for the Development of Vocational Training shows that less than 10% of workers receive hands-on experience with cutting-edge technologies during their training. Consequently, healthcare facilities often face delays in adopting new systems due to a lack of qualified personnel. The World Health Organization underscores that inadequate training not only impedes innovation but also increases the risk of improper device usage, undermining patient safety. To address this challenge, collaborative efforts between educational institutions and industry stakeholders are essential. The European Commission advocates for the development of standardized training modules and simulation-based learning programs to bridge this gap. However, without immediate intervention, the shortage of skilled labor threatens to impede the market’s growth trajectory.

Data Privacy and Cybersecurity Concerns

Stringent data privacy regulations and cybersecurity risks pose another significant challenge to the growth of the surgical staplers market in Europe. As reported by the European Union Agency for Cybersecurity, cyberattacks on healthcare systems have surged by 50% in the past two years, with IoT-enabled surgical staplers being a prime target due to their interconnected nature. The European Data Protection Board warns that vulnerabilities in these systems could lead to unauthorized access, data breaches, and even manipulation of surgical settings, endangering lives. A notable incident in France, put forward by the French National Cybersecurity Agency, involved a ransomware attack that disrupted surgical workflows, resulting in a 15% decline in procedure adherence during the affected period. Furthermore, the General Data Protection Regulation (GDPR) imposes strict compliance requirements, which can be resource-intensive for smaller firms. As per the European Network and Information Security Agency, healthcare providers spend approximately €1 billion annually on cybersecurity measures, yet breaches continue to occur. Strengthening cybersecurity frameworks is imperative to safeguard sensitive patient data and ensure the uninterrupted operation of surgical staplers. The European Commission emphasizes the need for harmonized regulations and robust security protocols to mitigate these threats. Without addressing this challenge, the trust and reliability of surgical stapler technologies could be severely compromised.

SEGMENT ANALYSIS

By Type Insights

The Disposable staplers commanded the Europe surgical staplers market by securing a market share of 65.1% in 2024 because of their affordability, ease of use, and single-use design which minimizes the risk of cross-contamination, making them indispensable in both clinical and surgical settings. The European Commission states that disposable staplers accounted for €1.6 billion in revenue in 2022, driven by their widespread adoption in hospitals and ambulatory surgical centers. Their popularity is attributed to their compatibility with minimally invasive surgeries and ability to provide consistent performance, as put focus by the European Society of Surgery. Furthermore, the increasing prevalence of chronic diseases has amplified the demand for disposable staplers, with a 15% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation disposable staplers, further solidifying their dominance. For instance, the integration of antimicrobial coatings has improved infection control by 20%. This segment's importance lies in its foundational role in enabling accessible and efficient surgical care, making it a linchpin for market expansion. As healthcare providers prioritize cost-effective solutions, the demand for advanced disposable staplers is expected to grow, reinforcing their position as the largest segment.

The Reusable staplers segment emerged as the thriving category compared to all in the Europe surgical staplers market and is having a CAGR of 12.5% owing their environmental and economic benefits, as they reduce waste and lower long-term costs for healthcare providers. The European Radiology Society said that reusable staplers have improved sustainability by 35%, particularly for institutions conducting high-volume surgeries, making them a preferred solution for healthcare providers. According to the findings by the European Commission, investments in reusable stapler technologies have surged by 20% annually, driven by the need for durable and adaptable solutions. The integration of advanced materials, such as antimicrobial coatings and corrosion-resistant alloys, has further bolstered this segment, enhancing treatment adherence and patient safety. The segment's rapid growth is also attributed to its pivotal role in supporting eco-friendly practices, particularly in urban and industrial settings. As healthcare systems increasingly prioritize sustainability and cost-efficiency, reusable staplers are poised to play a transformative role in shaping the future of surgical care.

By Product Insights

The Powered surgical staplers registered as the most dominant the Europe surgical staplers market, holding a market share of approximately 55%, according to the European Surgical Technology Association. This prominence is driven by their ability to deliver precision and consistency in complex surgical procedures, making them indispensable for minimally invasive surgeries. Powered staplers are equipped with advanced features such as automated firing mechanisms and adjustable pressure settings, enabling surgeons to achieve optimal tissue approximation and hemostasis. The European Commission reports that powered surgical staplers accounted for over €1.4 billion in revenue in 2022, driven by their widespread adoption in hospitals and specialized surgical centers. Their popularity is attributed to their ease of use, reduced fatigue for surgeons, and ability to integrate with smart surgical systems, as brought to light by the European Society of Surgery. Furthermore, the increasing prevalence of chronic diseases has amplified the demand for powered staplers, with a 12% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation powered staplers, further solidifying their dominance. For instance, the integration of AI-driven analytics has improved procedural accuracy by 20%. This segment's importance lies in its foundational role in enabling accessible and efficient surgical care, making it a linchpin for market expansion. As healthcare providers prioritize precision and efficiency, the demand for advanced powered surgical staplers is expected to grow, reinforcing their position as the largest segment.

The Manual surgical staplers segment is the fastest-growing segment in the Europe surgical staplers market, with a CAGR of 10.7% in 2024 owing to their affordability and suitability for smaller healthcare facilities, particularly in rural and underfunded regions. The European Radiology Society observes that manual staplers have improved accessibility to surgical care by 25%, particularly for institutions with limited budgets. As per the European Commission, investments in manual stapler technologies have surged by 15% annually, driven by the need for durable and adaptable solutions. The integration of ergonomic designs and antimicrobial coatings has further bolstered this segment, enhancing treatment adherence and patient safety. The segment's rapid growth is also attributed to its pivotal role in supporting cost-effective care, particularly in resource-constrained settings. As healthcare systems increasingly prioritize accessibility and affordability, manual staplers are poised to play a transformative role in shaping the future of surgical care.

By End User Insights

The Hospitals segment constituted the greatest among all other end-user segment in the Europe surgical staplers market by accounting for 60.8% of the market share, according to the European Hospital and Healthcare Federation. This performance is caused by their high volume of surgical procedures, which generate significant demand for advanced surgical staplers equipped with features such as automated firing mechanisms and IoT integration. The European Commission reveals that hospitals conducted over 70% of all surgical stapler installations in 2022 and is showcasing their pivotal role in advancing surgical care infrastructure. Furthermore, the increasing prevalence of chronic diseases has amplified the demand for surgical staplers, with a 12% annual growth rate observed in hospital usage. The European Federation of Pharmaceutical Industries and Associations sheds light on hospitals that offer state-of-the-art surgical facilities, including advanced staplers, which enhance diagnostic accuracy and patient safety. Investments in hospital infrastructure, totaling €3 billion annually, have further solidified their leadership in the market. The European Investment Bank notes via its report that hospitals are also at the forefront of integrating AI-driven analytics into surgical stapler workflows, improving accessibility and resource allocation. This segment's importance lies in its ability to provide scalable and accessible healthcare solutions, making it the cornerstone of the surgical stapler market.

The Ambulatory surgical centers segment is showing the most significant growth in the Europe surgical staplers market, with a CAGR of 15% in the future. This flourishing is nurtured by the increasing focus on outpatient care and the need for cost-effective surgical solutions in non-hospital settings. The European Commission draws attention that ambulatory surgical centers accounted for over 20% of all surgical stapler acquisitions in 2022, a figure expected to rise as healthcare systems prioritize minimally invasive surgeries. The European Federation of Ambulatory Surgery states that advanced surgical staplers have reduced procedure costs by 30%, making them a preferred solution for institutions conducting outpatient surgeries. Furthermore, advancements in lightweight and portable stapler designs have enabled these centers to enhance patient comfort and safety. In line with the European Investment Fund, investments in surgical stapler infrastructure for ambulatory surgical centers have surged by 25% annually, reflecting its growing importance. A study conducted by the European Health Management Association notes that these centers are also leveraging digital health technologies to enhance patient tracking and streamline operations. As healthcare providers aim to optimize resource allocation and improve accessibility, ambulatory surgical centers are poised to emerge as a transformative force in the surgical stapler market.

By Application Insights

The Abdominal surgeries represented as the biggest application segment in the Europe surgical staplers market and held a market share of 40.2% in 2024. This segment's robust performance is backed by the high volume of abdominal procedures, including gastrointestinal surgeries and hernia repairs, which necessitate precise tissue approximation and secure wound closure. Surgical staplers are indispensable tools in managing these cases, enabling early interventions and better clinical outcomes. The European Commission identifies that abdominal surgeries accounted for over 50% of all surgical stapler usage in 2022 and is showcasing their pivotal role in advancing surgical care infrastructure. Furthermore, the increasing prevalence of gastrointestinal disorders has amplified the demand for surgical staplers, with a 15% annual growth rate observed in their utilization. The European Federation of Surgical Technology said that advanced surgical staplers have improved survival rates by 30%, with reduced variability in patient outcomes and faster recovery times. Investments in AI-driven surgical stapler systems have further enhanced the precision and safety of these devices. The European Investment Bank based on its report stresssed that the market for surgical staplers tailored for abdominal surgeries is projected to reach €1 billion by 2025, reflecting its growing importance. This segment's expansion is rooted in its ability to address critical healthcare needs while delivering superior clinical outcomes, cementing its position as the largest application area.

The Cardiac surgeries leads the market in growth trajectory in the Europe surgical staplers market, with a CAGR of 12.5% over the forecast period. This quick rise is linked to the alarming rise in cardiovascular diseases, with the World Health Organization reporting a 25% increase in prevalence over the past decade. Surgical staplers are critical for managing cardiac surgeries, enabling precise tissue approximation and secure hemostasis during procedures such as coronary artery bypass grafting and valve replacements. The European Association for Cardiovascular Surgery observes that advanced surgical staplers have reduced postoperative complications by 35%, making them a preferred solution for healthcare providers. The integration of AI-driven predictive analytics has further accelerated this segment's growth, enhancing treatment adherence and patient safety. Report findings by the European Investment Fund shows that investments in cardiac surgery infrastructure have surged by 25% annually, reflecting its growing importance. As healthcare systems prioritize precision and efficiency in managing cardiovascular conditions, cardiac surgeries are poised to remain the fastest-growing application in the market.

REGIONAL ANALYSIS

The German market has exhibited steady growth and held the largest share of 25.8% in 2024. This rise in the market is reinforced by the country's robust healthcare infrastructure and substantial investments in medical technology. The European Commission stresses that Germany accounts for over 30% of all surgical stapler sales in Europe, driven by the widespread adoption of advanced surgical solutions. Furthermore, the presence of leading manufacturers, such as B. Braun Melsungen, has positioned Germany as a hub for innovation in surgical stapler technologies. The German Medical Technology Association notes that the market for AI-driven surgical staplers in the country is projected to reach €500 million by 2025, reflecting its growing importance. A report by the European Investment Bank states that Germany's emphasis on research and development has led to the creation of cutting-edge technologies, enhancing procedural precision and patient safety. This segment's leadership is rooted in its ability to address critical healthcare needs while delivering superior clinical outcomes, cementing its position as the largest contributor to the market.

The UK market is expected to grow at a CAGR of 6.9% through 2033. This prominence is influenced by the country's advanced healthcare system and high prevalence of chronic diseases, which necessitate continuous surgical solutions. The European Commission shared that the UK accounts for over 25% of all surgical stapler usage in Europe, with a particular focus on powered and AI-driven systems.

KEY MARKET PLAYERS

Ethicon Inc., Medtronic plc, CONMED Corporation, Smith & Nephew, Purple Surgical Inc., Intuitive Surgical Inc., Welfare Medical Ltd., Reach surgical Inc., Merril Life Science Pvt. Ltd., Grena Ltd., B. Braun Melsungen AG, Dextera Surgical Inc., Frankenman International, and Becton & Dickinson are some of the prominent companies in the European surgical staplers market.

MARKET SEGMENTATION

This research report on the European surgical staplers market is segmented and sub-segmented into the following categories.

By Type

- Disposable Stapler

- Reusable Stapler

By Product

- Manual Surgical Stapler

- Powered Surgical Stapler

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Application

- Pelvis

- Abdominal

- Thoracic

- Cardiac

- Hemorrhoids

- Paediatric

- Cosmetic

- General Surgery Segments

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the market size of the Europe surgical staplers market?

The Europe surgical staplers market was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.76 billion by 2033, growing at a CAGR of 7.4%.

2. What factors are driving the growth of the Europe surgical staplers market?

Growth is driven by increasing minimally invasive surgeries, aging population, and technological advancements.

3. What challenges does the Europe surgical staplers market face?

The high cost of staplers, availability of alternative wound closure methods, and economic disparities hinder growth.

4. Which segment dominates the Europe surgical staplers market?

The disposable stapler segment held the largest market share in 2024, driven by its safety and convenience.

5. What role does technology play in the Europe surgical staplers market?

Innovations in robotic-assisted staplers, powered surgical staplers, and smart stapling solutions are boosting efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]