Europe Supervisory Control and Data Acquisition (SCADA) Market Size, Share, Trends, & Growth Forecast Report Segmented By Offering (Hardware, Software, and Services), Component, and End User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Supervisory Control and Data Acquisition (SCADA) Market Size

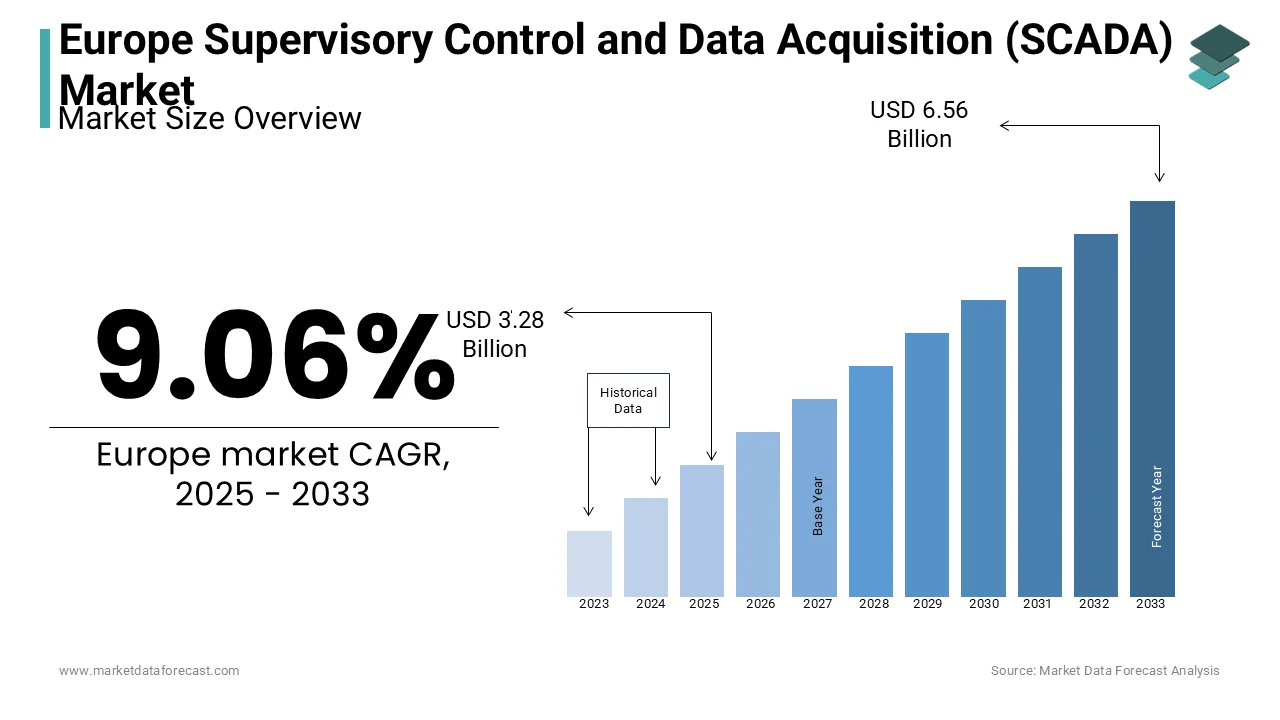

The Europe supervisory control and data acquisition (SCADA) market was valued at USD 3.0 billion in 2024. The European market is projected to reach USD 6.56 billion by 2033 from USD 3.28 billion in 2025, rising at a CAGR of 9.06% from 2025 to 2033.

Supervisory Control and Data Acquisition (SCADA) refers to the systems and technologies designed to monitor, control, and optimize industrial processes in real-time. The growing need for automation in industrial processes is a primary driver of the SCADA market in Europe. According to the European Commission, automation levels in manufacturing increased by 15% over the foreseen period. This has fuelled the emphasis of Europe on adopting advanced technologies. SCADA systems play a critical role in achieving this automation by providing seamless integration with industrial equipment, ensuring process optimization and regulatory compliance. Additionally, the focus of Europe on renewable energy and smart grid implementation further supports the regional market growth. According to the International Energy Agency (IEA), Europe added over 50 GW of renewable energy capacity in 2024 and this is requiring SCADA systems to manage and monitor these complex, distributed energy systems effectively. The adoption of Industry 4.0 technologies, such as the Industrial Internet of Things (IIoT) and advanced analytics are further promoting the importance of SCADA in driving innovation and sustainability across the industrial landscape of Europe.

MARKET DRIVERS

Increasing Adoption of Renewable Energy and Smart Grids

The shift towards renewable energy sources and smart grid implementation is a key driver of the Europe SCADA market. SCADA systems are essential for monitoring and managing the integration of distributed energy resources, ensuring grid stability and efficiency. According to the International Energy Agency, Europe added over 50 GW of renewable energy capacity in 2024, accounting for a significant share of global installations. Countries like Germany, Spain, and the United Kingdom are at the forefront, relying on SCADA solutions to optimize operations across wind, solar, and hydroelectric power plants. This demand is further supported by EU targets to achieve net-zero emissions by 2050, emphasizing the critical role of SCADA in renewable energy management.

Industrial Automation and Industry 4.0 Initiatives

The rise of industrial automation and Industry 4.0 initiatives is another major driver of the SCADA market in Europe. The European Commission highlights that manufacturing automation levels increased by 15% in 2024, reflecting the growing adoption of advanced technologies. SCADA systems are integral to Industry 4.0, enabling real-time data collection, predictive maintenance, and operational control in sectors such as manufacturing, oil and gas, and water treatment. These systems help companies improve efficiency, reduce downtime, and ensure compliance with strict regulations, making SCADA a cornerstone of Europe’s industrial digitalization efforts.

MARKET RESTRAINTS

High Initial Investment and Implementation Costs

The significant upfront costs associated with SCADA systems are a major restraint in the Europe SCADA market. Deploying SCADA solutions requires investment in advanced hardware, software, and network infrastructure, along with ongoing maintenance and training expenses. The European Investment Bank highlights that small and medium-sized enterprises (SMEs), which make up over 99% of businesses in the EU, often struggle to allocate the necessary capital for such projects. For instance, the implementation of SCADA systems in large-scale renewable energy facilities or manufacturing plants can cost several million euros, creating financial barriers for many organizations.

Cybersecurity Risks in Connected Systems

The increasing interconnectivity of SCADA systems with industrial IoT networks introduces heightened cybersecurity risks, posing a challenge for the market. The European Union Agency for Cybersecurity (ENISA) reported a 50% increase in cyberattacks targeting critical infrastructure in 2024, with SCADA systems being a primary target due to their vulnerability to breaches. A successful cyberattack on SCADA-controlled systems can lead to operational disruptions, financial losses, and safety hazards. The need for robust cybersecurity measures, which often require additional investment and expertise, adds complexity to the deployment of SCADA systems and can deter adoption, particularly among cost-sensitive organizations.

MARKET OPPORTUNITIES

Integration of Industrial IoT (IIoT) in SCADA Systems

The increasing adoption of Industrial IoT presents a significant opportunity for the Europe SCADA market. IIoT enhances SCADA systems by enabling real-time data acquisition, advanced analytics, and remote monitoring capabilities across industrial operations. According to the European Commission, the adoption of IoT solutions in industrial processes grew by 30% between 2024 to 2033, with applications in manufacturing, energy, and transportation. This integration allows for predictive maintenance, operational optimization, and improved decision-making. For example, in the energy sector, SCADA systems integrated with IIoT sensors can efficiently manage distributed renewable energy assets, driving operational efficiency and sustainability.

Expansion of Smart Cities Initiatives

The rise of smart city projects across Europe offers a lucrative opportunity for the SCADA market. SCADA systems are pivotal in managing critical urban infrastructure, such as water distribution, energy grids, and public transportation networks. The European Innovation Partnership on Smart Cities and Communities reports that EU funding for smart city initiatives exceeded €1 billion in 2024, reflecting the region's commitment to urban digital transformation. These projects require robust SCADA solutions to monitor and optimize infrastructure performance, enhance resource efficiency, and ensure public safety. The increasing number of smart city developments provides a growing demand for innovative SCADA technologies tailored to urban needs.

MARKET CHALLENGES

Integration Challenges with Legacy Systems

A major challenge in the Europe SCADA market is the integration of SCADA solutions with existing legacy systems. Many industries, particularly in energy and manufacturing, operate with outdated infrastructure that lacks compatibility with modern SCADA technologies. The European Commission highlights that 42% of industrial equipment in Europe is over 20 years old, complicating efforts to implement advanced automation systems. These compatibility issues require extensive customization and retrofitting, increasing deployment costs and timelines. Such challenges discourage some organizations, particularly small and medium-sized enterprises (SMEs), from adopting SCADA systems.

Shortage of Skilled Professionals

The Europe SCADA market faces a significant challenge due to the shortage of skilled professionals required to design, implement, and maintain these complex systems. According to the European Skills Index by Cedefop, there is a substantial gap in digital and technical skills across the EU, particularly in areas like industrial automation and cybersecurity. This shortage affects the ability of businesses to deploy and optimize SCADA solutions effectively. Furthermore, training costs for existing staff to handle SCADA systems add to operational expenses, creating an additional barrier for organizations looking to adopt these technologies. This skills gap remains a critical constraint for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.06% |

|

Segments Covered |

By Offering, Component, End User and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Siemens AG, Schneider Electric SE, ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Honeywell International Inc., General Electric Company, and Mitsubishi Electric Corporation |

SEGMENTAL ANALYSIS

By Offering Insights

The software segment dominated the European SCADA market by holding a 44.3% share in 2023. The leading position of the software segment in the European SCADA segment is attributed to the growing demand for real-time data analytics and process optimization, particularly in manufacturing and energy sectors. Additionally, innovations like cloud-based platforms enhance scalability, addressing urban real estate constraints.

The services segment is anticipated to witness a CAGR of 9.12% over the forecast period in the European SCADA market. The growing need for system integration and maintenance, particularly in industries like oil and gas and power, is mainly driving the expansion of the services segment in the European market. Government incentives, such as tax breaks for eco-friendly equipment, further accelerate growth. Technological advancements, including IoT-enabled monitoring systems, enhance reliability and efficiency.

By Component Insights

The human machine interface (HMI) segment was at the forefront of the European SCADA market by accounting for 36.1% of the European market share in 2024. The growing demand for intuitive visualization tools that enable operators to monitor and control processes efficiently is mainly driving the expansion of the HMI segment in the European market. Germany is a major player in Europe’s industrial automation sector and likely a significant hub for SCADA (Supervisory Control and Data Acquisition) systems due to its strong manufacturing base. Besides, innovations like touch-screen interfaces enhance usability, resolving diverse operator needs. These factors collectively sustain the segment’s place in the market, despite the growing demand for communication systems.

The communication systems segment is growing rapidly and is likely to register a CAGR of 10.4% over the forecast period. The rising demand for seamless data exchange, particularly in IoT-enabled SCADA systems, is propelling the expansion of the communication systems segment in the European market. Government initiatives, such as subsidies for virtual collaboration tools, further accelerate growth. These factors position communication systems as a key growth driver, outpacing traditional components in the coming years.

By End User Insights

The power segment was the top performer of the European SCADA market and held 25.8% of the European market share in 2024. The leading position of the power segment in the European market is attributed to the increasing dependency of the power industry on real-time monitoring systems to manage energy grids. These solutions improve energy efficiency, ensuring optimal resource allocation. Additionally, innovations like cloud-based platforms enhance scalability, addressing regulatory compliance requirements.

The pharmaceuticals segment is estimated to witness a prominent CAGR of 12.7% over the forecast period. The rising need for precise process control, particularly in vaccine and biologics production, is fueling the growth of the pharmaceuticals segment in the European market.

REGIONAL ANALYSIS

Germany led the European SCADA market by commanding a 25.5% share of the European market in 2024 owing to their robust manufacturing base and advanced logistics networks. The GDP per capita of Germany is expected to continue to grow and is enabling higher investments in automation. Also, Germany’s strategic location facilitates cross-border trade, with a significant portion of shipments originating or transiting through the country.

The UK is another key regional segment for SCADA in Europe. The advanced infrastructure of the UK and focus on modernizing water, energy, and transportation systems are driving the UK SCADA market growth. The UK Department for Business, Energy, and Industrial Strategy emphasizes the deployment of SCADA in its smart grid and energy transition projects, ensuring real-time monitoring and reduced downtime. The UK’s commitment to net-zero targets further drives demand for SCADA in renewable energy.

France is anticipated to exhibit the highest CAGR of 9.3% over the forecast period. Urbanization and the rise of e-commerce platforms drive demand for advanced warehousing solutions. Paris alone accounts for a major portion of France’s market activities, supported by government subsidies for eco-friendly equipment.

KEY MARKET PLAYERS

Siemens AG, Schneider Electric SE, ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Honeywell International Inc., General Electric Company, and Mitsubishi Electric Corporation are some of the players contributing significantly to the advancement of the European SCADA market.

Top 3 Players in the Europe SCADA Market

Siemens AG is a global leader in SCADA solutions. Its innovative product portfolio includes cloud-based platforms and IoT-enabled systems tailored for industries like automotive, energy, and pharmaceuticals. The company’s focus on sustainability aligns with EU Green Deal objectives, as evidenced by its development of energy-efficient solutions. Additionally, Siemens invests heavily in R&D, allocating billions annually to enhance its digital capabilities, positioning it as a pioneer in smart infrastructure.

Schneider Electric specializes in energy management and automation. Its EcoStruxure platform integrates AI and machine learning to optimize energy consumption, achieving a great reduction in operational costs for clients like TotalEnergies. The company emphasizes sustainability, offering IoT-enabled systems that comply with stringent EU regulations. Schneider also collaborates with governments, securing subsidies for digital transformation initiatives, further solidifying its leadership in the market.

ABB excels in industrial automation. Its Ability platform leverages AI-driven analytics to enhance predictive maintenance. ABB’s SCADA systems are integral to sectors like oil and gas, power, and pharmaceuticals, with companies like BP relying on its solutions for seamless operations. The company’s strategic acquisitions have expanded its capabilities in intelligent automation. ABB’s commitment to innovation ensures its position as a key player in Europe’s evolving industrial landscape.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players employ diverse strategies to maintain their competitive edge in the European SCADA market. Digital transformation is a top priority, with companies investing heavily in IoT, AI, and cloud-based technologies. For instance, Siemens partnered with Microsoft to integrate Azure Cloud into its SCADA platforms, enabling real-time data analytics and remote monitoring. Similarly, Schneider Electric launched EcoStruxure, an AI-driven solution that optimizes energy efficiency for clients in the power sector.

Sustainability initiatives are another critical focus area. Companies like ABB and Schneider Electric are transitioning to eco-friendly solutions, aligning with the EU Green Deal’s emission reduction targets. Governments incentivize these efforts through subsidies; for example, France offers €50 million annually for integrating SCADA into renewable energy projects.

Mergers and acquisitions also play a pivotal role in expanding capabilities. ABB’s acquisition of a niche AI provider strengthened its predictive maintenance offerings, while Siemens acquired a cloud-based analytics firm to enhance its digital portfolio. These strategies ensure scalability and adaptability in a rapidly evolving market.

COMPETITION OVERVIEW

The European SCADA market is highly competitive, with established players vying for dominance through innovation, specialization, and sustainability. Siemens AG leads the market with its comprehensive product portfolio, catering to diverse industries such as automotive, energy, and pharmaceuticals. Its cloud-based platforms and IoT-enabled systems set a benchmark for operational efficiency, ensuring compliance with stringent EU regulations. Schneider Electric differentiates itself through its focus on energy management and sustainability. The company’s EcoStruxure platform leverages AI and machine learning to optimize energy consumption, making it a preferred choice for renewable energy projects. Its partnerships with governments and adherence to EU Green Deal objectives further enhance its reputation. ABB excels in industrial automation, leveraging AI-driven analytics to deliver predictive maintenance solutions. Its strategic acquisitions and emphasis on intelligent automation position it as a leader in sectors like oil and gas and pharmaceuticals. Smaller players compete by offering niche solutions tailored to specific applications, such as communication systems or HMIs. Price wars and technological advancements further intensify rivalry, driving differentiation and ensuring a vibrant competitive landscape. Regulatory compliance and cybersecurity remain key battlegrounds, shaping the future of the market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Siemens launched a cloud-based SCADA platform, enhancing real-time monitoring capabilities for energy grids across Europe. This initiative aims to reduce operational costs by 25% and strengthen its leadership in smart infrastructure solutions.

- In June 2023, Schneider Electric introduced EcoStruxure, an AI-driven energy management system, achieving a 30% reduction in energy consumption for clients in France and Spain. This move positions the company as a leader in sustainable SCADA solutions.

- In March 2023, ABB acquired a niche AI provider for €1 billion, strengthening its predictive maintenance capabilities and expanding its footprint in the pharmaceutical sector.

- In July 2023, Honeywell partnered with Microsoft to develop IoT-enabled SCADA systems, improving data exchange and operational efficiency for clients in the oil and gas industry.

- In February 2024, Rockwell Automation expanded its SCADA offerings in Spain, increasing adoption rates by 15%. This expansion focuses on providing scalable solutions for renewable energy projects, aligning with regional sustainability goals.

MARKET SEGMENTATION

This research report on the Europe supervisory control and data acquisition (SCADA) market is segmented and sub-segmented into the following categories.

By Offering

- Hardware

- Software

- Services

By Component

- Human Machine Interface (HMI)

- Remote Terminal Unit (RTU)

- Programmable Logic Controller (PLC)

- Communication System

- Others

By End User

- Automotive

- Semiconductor & Electronics

- Oil and Gas

- Pharmaceutical

- Food & Beverage

- Chemical

- Power

- Telecommunication

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe SCADA market?

The growth of the Europe SCADA market is driven by increasing automation in industries, rising demand for real-time data monitoring, and advancements in IoT and cloud computing technologies.

How is cloud-based SCADA transforming the market in Europe?

Cloud-based SCADA is reducing infrastructure costs, enabling remote access to real-time data, and improving system scalability and flexibility.

How is government regulation affecting the SCADA market in Europe?

Government regulations are driving the adoption of secure and efficient SCADA systems, particularly in critical infrastructure sectors like energy and water management.

What future trends are expected in the Europe SCADA market?

Future trends include increased integration of AI and machine learning, wider adoption of 5G for faster data transmission, and greater emphasis on cybersecurity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]