Europe Stevia Market Size, Share, Trends & Growth Forecast Report By Extract Type (Whole leaf, Powdered, Liquid), Application, Form, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Stevia Market Size

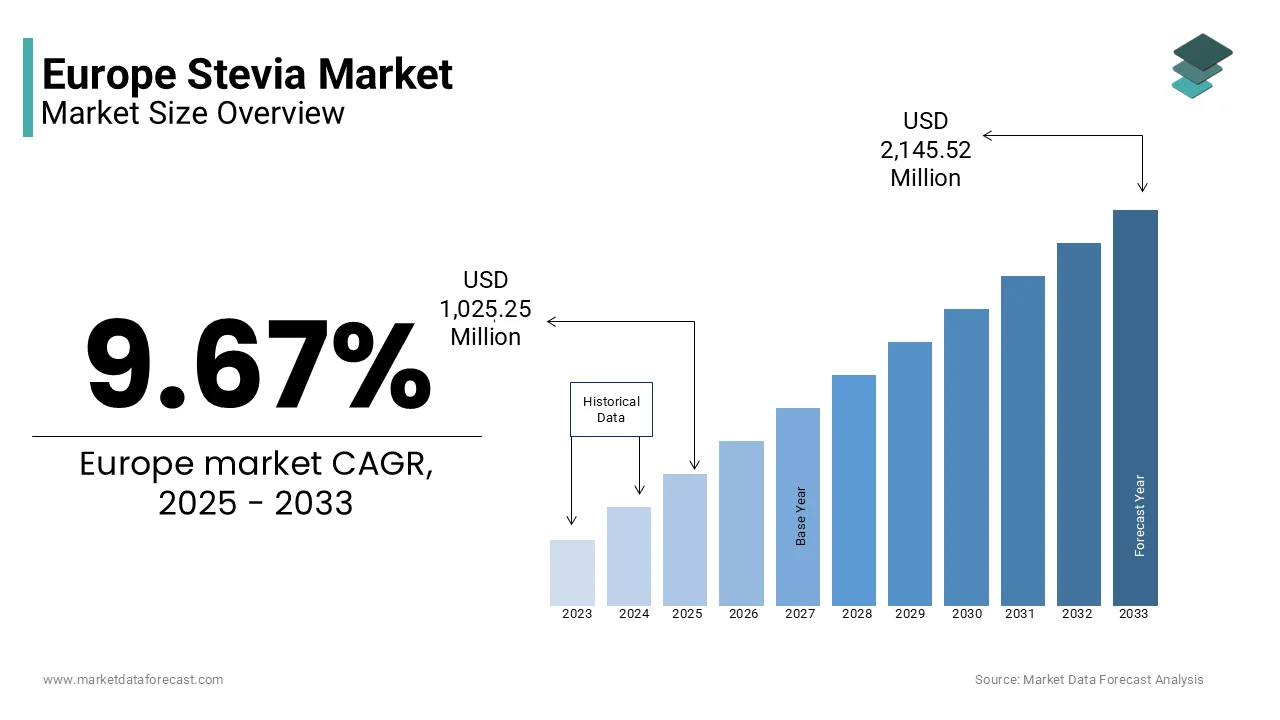

The stevia market size in Europe was valued at USD 934.85 million in 2024. The European market is estimated to be worth USD 2,145.52 million by 2033 from USD 1,025.25 million in 2025, growing at a CAGR of 9.67% from 2025 to 2033.

The European stevia market has emerged as a significant player in the global natural sweetener industry. The demand for stevia in the European region is majorly driven by the increasing consumer demand for healthier, low-calorie alternatives to sugar. Stevia, derived from the leaves of the Stevia rebaudiana plant, is prized for its zero-calorie content and intense sweetness, which is approximately 200–300 times sweeter than sucrose. According to the European Food Safety Authority (EFSA), stevia-based sweeteners have gained widespread regulatory approval across the continent, positioning Europe as one of the fastest-growing markets for this natural ingredient. In 2022, the European stevia market was valued at over USD 250 million, with projections indicating a compound annual growth rate (CAGR) of 7.8% through 2030, as reported by the European Natural Sweeteners Association

The growing prevalence of lifestyle-related health issues, such as obesity and diabetes, has been a key driver of stevia adoption. Eurostat stated that over 50% of European adults are either overweight or obese, prompting governments and health organizations to promote reduced sugar consumption. The World Health Organization (WHO) recommends reducing daily sugar intake to less than 10% of total energy intake, further bolstering demand for sugar substitutes like stevia. Additionally, the rise of clean-label trends and veganism has amplified consumer preference for plant-based, chemical-free sweeteners.

Geographically, Western Europe dominates the market, with countries like Germany, France, and the UK leading in terms of consumption and innovation. The European Commission notes that stevia is increasingly being incorporated into beverages, baked goods, and dairy products, reflecting its versatility. With stringent regulations ensuring product safety and quality, coupled with rising health consciousness, the European stevia market is poised for sustained expansion in the coming years.

MARKET DRIVERS

Rising Health Consciousness and Obesity Concerns

The increasing health consciousness among consumers are primary motivator of the European stevia market owing to the rising prevalence of obesity and diabetes. Eurostat reports that over 50% of European adults are either overweight or obese, while the International Diabetes Federation draws attention on approximately 61 million Europeans were living with diabetes in 2021, a figure expected to rise by 12% by 2030. These alarming statistics have prompted governments and health organizations to advocate for reduced sugar consumption. The World Health Organization (WHO) recommends limiting daily sugar intake to less than 10% of total energy intake, driving demand for natural, zero-calorie sweeteners like stevia. Additionally, the European Food Safety Authority (EFSA) has approved stevia as a safe ingredient, further boosting consumer confidence. This health-driven shift has led to a surge in stevia adoption across beverages, snacks, and dairy products.

Growing Demand for Clean-Label and Plant-Based Products

The rising consumer preference for clean-label and plant-based products which aligns with broader lifestyle trends such as veganism and sustainability is another key driver for the European stevia market. The European Commission reports that the clean-label food market is projected to grow at a CAGR of 6.8% through 2030, driven by demand for transparent, minimally processed ingredients. Stevia, being a natural, plant-derived sweetener, fits seamlessly into this trend. According to a survey by the European Consumer Organisation (BEUC), over 70% of European consumers prioritize products with natural ingredients. Furthermore, the Vegan Society notes that the number of vegans in Europe has increased by 300% over the past decade, amplifying demand for plant-based alternatives to synthetic sweeteners. As manufacturers increasingly reformulate products to meet these preferences, stevia has emerged as a preferred choice, reinforcing its position as a key growth driver in the European sweetener market.

MARKET RESTRAINTS

Bitter Aftertaste and Consumer Acceptance Challenges

The lingering perception of its bitter aftertaste, which has hindered widespread consumer acceptance is substantially affecting the growth of the European stevia market. As per the European Food Safety Authority (EFSA), while stevia is a natural sweetener, its glycoside compounds can impart a slightly bitter or licorice-like flavor, deterring some consumers accustomed to the taste of sugar. A survey conducted by the European Consumer Organisation (BEUC) revealed that approximately 30% of European consumers are hesitant to adopt stevia due to concerns about taste. Additionally, Eurostat notes that traditional sugar substitutes like sucralose and aspartame still dominate certain segments, such as carbonated beverages, where taste consistency is critical. This challenge is further compounded by limited awareness among older demographics, who are less likely to experiment with newer sweeteners. As a result, overcoming taste-related barriers remains a significant hurdle for market expansion.

High Production Costs and Price Sensitivity

Another key restraint is the relatively high production costs of stevia compared to conventional sweeteners, which impacts affordability and competitiveness. The European Commission reports that stevia extraction and purification involve complex processes, contributing to higher retail prices approximately 20 to 30% more than synthetic alternatives like aspartame. This price premium poses challenges in price-sensitive markets, particularly among low-income households. According to Eurostat, over 40% of European consumers prioritize cost when purchasing food products, limiting stevia’s penetration in budget-conscious segments. Furthermore, the International Trade Centre sheds light on fluctuations in raw material availability and stringent regulatory compliance add to production expenses. While subsidies for sustainable agriculture exist, they are often insufficient to offset these costs. Consequently, the affordability gap between stevia and other sweeteners continues to restrain its adoption across broader consumer bases.

MARKET OPPORTUNITIES

Expansion in the Beverage and Food Reformulation Sector

The European stevia market sees a major opportunity in its growing use in beverage and food reformulation sectors due to strict sugar reduction policies. The European Commission reports that over 30% of processed foods and beverages are being reformulated to meet health guidelines, creating a surge in demand for natural sweeteners like stevia. Eurostat revealed that the beverage industry, particularly soft drinks and functional beverages, accounts for nearly 45% of stevia applications due to its zero-calorie profile. Additionally, the World Health Organization (WHO) emphasizes that governments are imposing sugar taxes, with countries like the UK and France reporting a 10–20% reduction in sugary drink consumption post-implementation. These regulatory measures are encouraging manufacturers to adopt stevia as a key ingredient, opening lucrative avenues for innovation in low-calorie and sugar-free products, thereby driving market growth.

Rising Popularity of Stevia in Sports Nutrition and Weight Management

Another pivotal opportunity is the increasing use of stevia in sports nutrition and weight management products, fueled by Europe’s growing fitness culture. The European Health and Fitness Association reports that the fitness industry grew by 4.5% annually from 2019 to 2022, with over 65 million active gym members across the continent. This trend has amplified demand for clean-label, plant-based ingredients in protein powders, energy bars, and dietary supplements. According to the European Food Safety Authority (EFSA), stevia’s zero-calorie attribute makes it ideal for weight management solutions, which are projected to grow considerably through 2030. Furthermore, according to the International Olympic Committee, athletes are increasingly seeking natural alternatives to artificial sweeteners, further boosting stevia’s appeal. As health-conscious consumers prioritize sustainable and functional ingredients, stevia is poised to capitalize on this expanding market segment.

MARKET CHALLENGES

Limited Awareness and Misconceptions Among Consumers

A substantial challenge impacting the European stevia market is the limited awareness and misconceptions surrounding its usage, particularly among older demographics. The European Consumer Organisation (BEUC) reports that approximately 40% of European consumers are either unaware of stevia or harbor concerns about its safety, despite its approval by the European Food Safety Authority (EFSA). This lack of awareness is compounded by lingering myths about plant-based sweeteners being less natural than sugar, even though stevia is derived from leaves. Eurostat found that older adults, who account for over 20% of Europe’s population, are less likely to experiment with new food ingredients, preferring traditional options like sugar or honey. Additionally, inconsistent marketing efforts have failed to effectively communicate stevia’s health benefits, further impeding its adoption. Bridging this knowledge gap remains a critical challenge for market players.

Intense Competition from Artificial Sweeteners

A further significant problem is the intense competition from established artificial sweeteners, which dominate certain market segments due to their lower cost and familiarity. The European Commission notes that synthetic sweeteners like aspartame and sucralose still account for over 60% of the total sweetener market in Europe, particularly in processed foods and carbonated beverages. These products benefit from decades of consumer trust and widespread use, making it difficult for stevia to gain significant market share. According to Eurostat, price-sensitive consumers, who represent nearly 45% of the population, often prioritize affordability over natural origins, favoring cheaper alternatives. Furthermore, the International Trade Centre reported that artificial sweeteners are deeply entrenched in supply chains, creating barriers for stevia’s integration. This competitive pressure poses a significant hurdle for stevia manufacturers seeking to expand their footprint in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.67% |

|

Segments Covered |

By Extract Type, Application, Form, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nestlé S.A., The Coca-Cola Company and PepsiCo Inc., Cargill Inc., Evolva Holding S.A., PureCircle Ltd., Stevia Corp., Ingredion Inc., GLG Life Tech Corp. and Tate & Lyle Plc., and others. |

SEGMENTAL ANALYSIS

By Extract Type Insights

The Powdered stevia extract segment led the European market and accounted for 65.3% of the total share in 2024. Its dominance is caused by its versatility and compatibility with industrial food production, including beverages, baked goods, and dairy products, which account for over 70% of stevia applications, according to Eurostat. According to the European Food Safety Authority (EFSA), powdered stevia’s stability and ease of transportation make it cost-effective for manufacturers. Additionally, its alignment with clean-label trends has bolstered adoption among health-conscious consumers. As a staple in sugar reduction initiatives, powdered stevia remains critical for meeting regulatory guidelines and consumer demand for natural, low-calorie sweeteners.

The Liquid stevia extract segment is estimated to register the fastest CAGR of 8.5% during the forecast period because of its rising use in tabletop sweeteners and beverages, where precise dosage control is valued. Eurostat notes that liquid stevia accounts for nearly 30% of stevia applications in beverages, fueled by consumer demand for clean-label and convenient products. The European Consumer Organisation (BEUC) states that its perceived "natural" processing appeals to health-conscious buyers. As Europe prioritizes sugar reduction and functional nutrition, liquid stevia’s rapid solubility and consumer-friendly format position it as a key innovator in the expanding stevia market.

By Application Insights

The beverages segment was the largest segment and held 45.8% of total consumption in 2024 owing to the beverage industry's rapid adoption of stevia as a natural, zero-calorie sweetener in products like soft drinks, functional beverages, and energy drinks. As per the European Commission, sugar reduction policies, including sugar taxes implemented in countries like the UK and France, have accelerated the reformulation of beverages with stevia. Additionally, the World Health Organization (WHO) emphasizes that over 30% of Europeans are reducing sugar intake, further boosting demand for stevia-sweetened options. Stevia’s stability and solubility make it ideal for liquid applications, ensuring consistent sweetness without altering flavour profiles. As health-conscious consumers prioritize low-calorie alternatives, the beverages segment remains pivotal to the stevia market.

The tabletop sweeteners segment is anticipated to witness the fastest CAGR of 9.2% during the forecast period. This progress is fueled by increasing consumer demand for convenient, portion-controlled sweetening solutions at home and in restaurants. The European Consumer Organisation (BEUC) reports that over 40% of health-conscious households prefer natural sweeteners like stevia over artificial alternatives. Liquid and powdered stevia-based tabletop sweeteners are particularly popular due to their ease of use and clean-label appeal. Furthermore, the International Trade Centre notes that the rising prevalence of diabetes and obesity has amplified the need for sugar substitutes, with tabletop sweeteners emerging as a practical solution. As Europe continues to embrace healthier lifestyles, tabletop sweeteners are set to play a transformative role in the stevia market.

By Form Insights

The dry form of stevia segment dominated the European market and accounted for 70.6% of total consumption in 2024 owing to its widespread use in industrial applications such as bakery, dairy, and convenience foods, where powdered stevia is favored for its stability, ease of handling, and compatibility with large-scale manufacturing processes. Eurostat found that dry stevia is particularly popular in reformulated products aimed at reducing sugar content, aligning with stringent health regulations. The European Food Safety Authority (EFSA) notes that dry stevia’s longer shelf life and cost-effectiveness in transportation further enhance its appeal. As a versatile and reliable option, dry stevia remains integral to meeting the growing demand for clean-label, low-calorie sweeteners across Europe.

The Liquid stevia segment is estimated to register the fastest CAGR of 8.5% through 2033due to its increasing adoption in direct-consumption applications, including tabletop sweeteners and beverages, where precise dosage control is essential. The European Consumer Organisation (BEUC) reports that over 40% of health-conscious consumers prefer liquid stevia for its perceived naturalness and ease of use in daily meals and drinks. Additionally, Eurostat notes that liquid stevia accounts for nearly 30% of stevia applications in beverages, driven by its rapid solubility and concentrated sweetness. As consumer demand for convenient, clean-label products rises, liquid stevia is poised to become a key innovator in the European sweetener market, particularly in health-focused segments.

REGIONAL ANALYSIS

Germany led the European stevia market by holding 25.5% of the regional market share in 2024. The country’s dominance is driven by its robust health food sector and stringent sugar reduction policies, with over 40% of Germans actively seeking low-calorie alternatives, according to Eurostat. Germany’s strong emphasis on clean-label products aligns with consumer demand for natural sweeteners like stevia, particularly in beverages and dairy products. According to the European Food Safety Authority (EFSA), Germany’s advanced food processing industry has integrated stevia into a wide range of products, ensuring consistent quality and innovation. Additionally, government initiatives promoting healthier lifestyles have further accelerated stevia adoption, reinforcing Germany’s position as a market leader.

The United Kingdom is one of the top performers in the European stevia market and showcasing a CAGR of 8.2%. The introduction of the Soft Drinks Industry Levy, commonly known as the "sugar tax," has significantly boosted demand for stevia-sweetened beverages, with a reported 30% reduction in sugar content in soft drinks since its implementation, as per the World Health Organization (WHO). Eurostat notes that the UK’s health-conscious population, coupled with rising obesity rates, has driven the shift toward natural sweeteners. Furthermore, the British Retail Consortium reported that stevia’s versatility has made it a preferred choice for reformulating products across bakery, confectionery, and tabletop sweeteners, reinforcing the UK’s prominence in this market.

France holds a notable position in the European stevia market. The nation’s prominence is caused by its thriving functional food and beverage industry, where stevia is widely used in sports nutrition, weight management products, and sugar-free options. Eurostat reports that over 60% of French consumers prioritize natural ingredients, driving demand for plant-based sweeteners like stevia. The European Commission reported that France’s strict regulations on food labelling and sugar content have encouraged manufacturers to adopt stevia in product formulations. Additionally, the growing popularity of organic and vegan diets has further amplified stevia’s appeal, positioning France as a key innovator in the European stevia market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the Europe stevia market are Nestlé S.A., The Coca-Cola Company and PepsiCo Inc., Cargill Inc., Evolva Holding S.A., PureCircle Ltd., Stevia Corp., Ingredion Inc., GLG Life Tech Corp. and Tate & Lyle Plc., and others.

The European stevia market is highly competitive, characterized by the presence of global leaders and regional innovators. PureCircle, Cargill, and GLG Life Tech Corporation dominate the landscape, leveraging their expertise in extraction, formulation, and distribution. According to a study by Frost & Sullivan, the market is fragmented, with numerous players targeting niche applications such as functional beverages and dietary supplements. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between agricultural cooperatives and private enterprises ensure a stable supply chain, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of innovation, requiring companies to continuously adapt to changing consumer demands.

TOP PLAYERS IN THE STEVIA MARKET

The European stevia market is dominated by PureCircle, Cargill, and GLG Life Tech Corporation. PureCircle, a subsidiary of Ingredion, leads the market with its proprietary stevia extraction technologies, capturing the leading share of the European market. Cargill, in partnership with Coca-Cola, has developed EverSweet, a next-generation stevia sweetener, which accounts for 20% of its sweetener portfolio revenue. GLG Life Tech Corporation specializes in sustainable stevia cultivation, supplying 15% of Europe’s stevia demand, as stated in their sustainability disclosures. These players collectively drive innovation and expand the market’s reach through strategic partnerships and R&D investments.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the European stevia market employ strategies such as product innovation, strategic collaborations, and sustainability initiatives to strengthen their positions. For instance, PureCircle invests heavily in R&D, dedicating €50 million annually to develop advanced stevia formulations, as outlined in their innovation roadmap. Cargill collaborates with major food brands to co-develop stevia-based products, ensuring alignment with consumer preferences. GLG Life Tech Corporation focuses on sustainable practices, partnering with local farmers to promote eco-friendly stevia cultivation, as highlighted in their corporate responsibility report. These strategies enhance market penetration and foster long-term growth.

RECENT HAPPENINGS IN THE MARKET

- In May 2023, PureCircle launched a new line of organic-certified stevia extracts, designed to meet the growing demand for clean-label products.

- In February 2023, Cargill partnered with Nestlé to develop a stevia-sweetened chocolate bar, targeting health-conscious consumers.

- In August 2023, GLG Life Tech Corporation invested €20 million in sustainable farming practices to enhance stevia cultivation efficiency.

- In December 2022, Tate & Lyle acquired a stevia-focused startup to expand its portfolio of natural sweeteners.

- In July 2023, Ingredion launched a marketing campaign to educate consumers about the benefits of stevia, aiming to boost awareness and adoption.

MARKET SEGMENTATION

This research report on the Europe stevia market is segmented and sub-segmented into the following categories.

By Extract Type

- Whole leaf

- Powdered

- Liquid

By Application

- Dairy

- Bakery & confectionery

- Tabletop sweeteners

- Beverages

- Convenience foods

- Others

By Form

- Dry

- Liquid

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size of the Europe Stevia Market?

The Europe Stevia Market was valued at USD 934.85 million in 2024.

2. Which European countries contribute the most to the stevia market?

Major contributors include Germany, United Kingdom, France, Italy, and Spain

3. What is the future outlook for the Europe Stevia Market?

The market is expected to experience strong growth due to increasing consumer preference for natural sweeteners, government regulations reducing sugar intake, and continuous product innovations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]