Europe Stents Market Size, Share, Trends & Growth Forecast Report By Product (Coronary Stents, Peripheral Stents, Stent-Related Implants), Biomaterial, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Stents Market Size

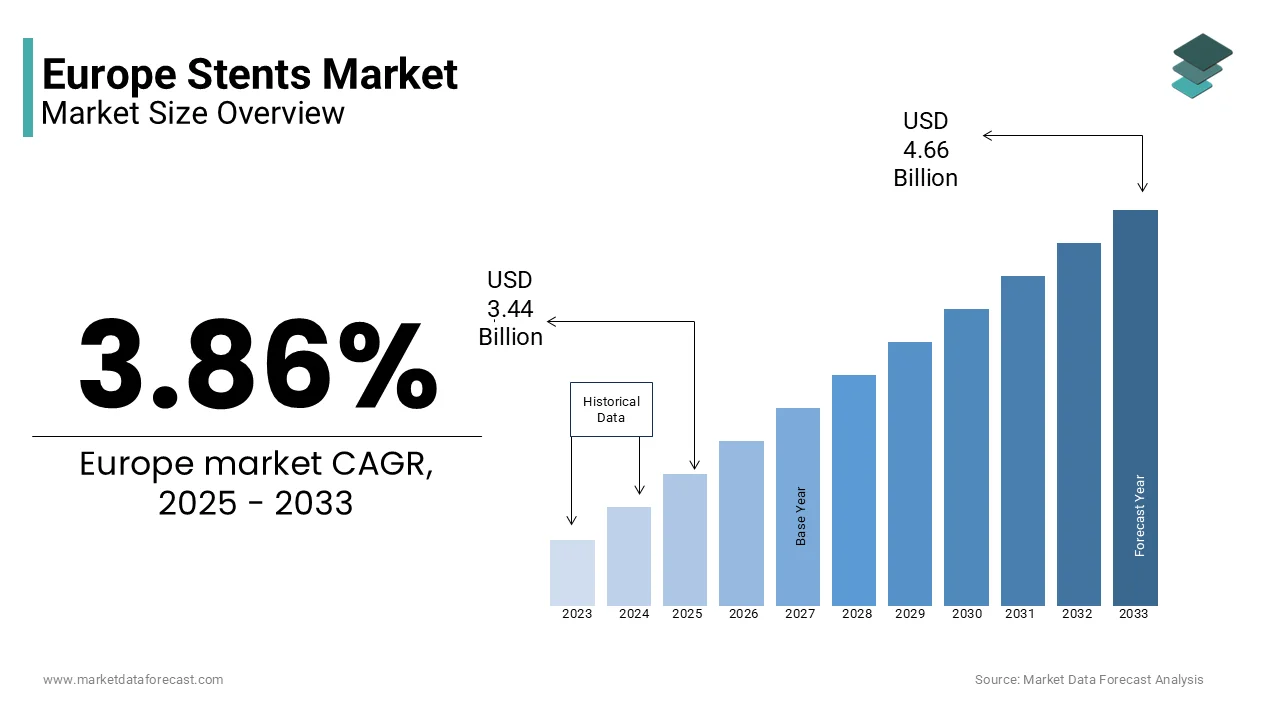

The Europe stents market size was valued at USD 3.31 billion in 2024. The European market is estimated to be worth USD 4.66 billion by 2033 from USD 3.44 billion in 2025, growing at a CAGR of 3.86% from 2025 to 2033.

The Europe stents market is a cornerstone of the region's cardiovascular healthcare sector. The prevalence of coronary artery disease (CAD) and peripheral artery disease (PAD) remains high, with CAD affecting over 10% of adults aged 45 and above, according to the European Society of Cardiology. This has driven sustained demand for advanced stent technologies, particularly drug-eluting stents (DES) and bioresorbable scaffolds. Germany, France, and the UK are leading markets due to their robust healthcare infrastructure and aging populations.

Government initiatives promoting early diagnosis and treatment of cardiovascular diseases have further bolstered adoption rates. For instance, the NHS Long Term Plan in the UK emphasizes reducing cardiovascular mortality by 25% by 2030 indirectly supporting stent utilization. However, stringent regulatory frameworks and reimbursement challenges pose hurdles, requiring manufacturers to innovate while adhering to compliance standards.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases (CVDs) remain the leading cause of mortality in Europe, accounting for 47% of all deaths, as reported by the European Heart Network. Coronary artery disease (CAD) which necessitates stent implantation affects approximately 60 million people across the continent. Aging populations exacerbate this burden, with individuals over 65 being at higher risk. According to Eurostat, the elderly population in Europe is projected to grow by 30% by 2030 increasing the demand for interventional cardiology solutions like stents. Moreover, lifestyle factors such as poor diet, sedentary habits, and smoking contribute to rising CVD incidence. The European Commission estimates that smoking alone accounts for 20% of all CVD cases. As hospitals and cardiac centers increasingly adopt minimally invasive procedures, the demand for advanced stents continues to surge making CVD prevalence a key driver of market growth.

Technological Advancements in Stent Design

Technological innovations in stent materials and coatings have revolutionized patient outcomes, driving market expansion. Drug-eluting stents (DES), which release medication to prevent restenosis, now dominate the market capturing 65% of total sales, as per the European Medical Device Technology Association. Bioresorbable stents, designed to dissolve after healing, are gaining traction due to their ability to restore natural vessel function. According to a study published in the European Journal of Cardiovascular Medicine, bioresorbable stents reduce long-term complications by 40% compared to traditional metallic stents. Manufacturers are investing heavily in R&D to enhance stent biocompatibility and durability. For instance, advancements in polymer-based biomaterials have improved flexibility and reduced thrombosis risks. These innovations align with patient preferences for safer and more effective treatments, ensuring sustained market growth.

MARKET RESTRAINTS

Stringent Regulatory Standards

The Europe stents market faces significant challenges due to stringent regulatory frameworks governing medical devices. As per the European Medicines Agency, the new Medical Device Regulation (MDR) implemented in 2021 requires manufacturers to meet rigorous clinical evidence and post-market surveillance standards. Compliance with these regulations has increased costs and delayed product launches, particularly for smaller firms. A report by the European Federation of Pharmaceutical Industries and Associations notes that regulatory approval timelines have extended by 30% since the MDR’s introduction. This has created barriers for innovative stent technologies entering the market. Furthermore, the complexity of demonstrating long-term safety and efficacy for bioresorbable stents has slowed their adoption. While these measures aim to ensure patient safety, they inadvertently hinder market growth by imposing financial and operational burdens on manufacturers.

High Treatment Costs and Reimbursement Issues

The high cost of stent procedures and inconsistent reimbursement policies across Europe pose significant restraints to market growth. The European Health Insurance Card Scheme states that only 40% of EU member states provide comprehensive coverage for advanced stent technologies like bioresorbable scaffolds. This limits accessibility for patients in lower-income regions. Out-of-pocket expenses deter many patients, particularly in Eastern Europe, where healthcare budgets are limited. A study by the European Observatory on Health Systems and Policies reveals that reimbursement disparities have resulted in a 25% variation in stent utilization rates across the continent. These financial barriers restrict market penetration, especially in underserved areas.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging economies within Europe, such as Poland, Romania, and Hungary, present untapped opportunities for stent manufacturers. The World Health Organization stresses that cardiovascular disease prevalence in Eastern Europe is among the highest globally, with mortality rates exceeding 500 per 100,000 population. This creates a critical need for affordable and accessible stent solutions. Additionally, government investments in healthcare infrastructure are improving access to advanced treatments. For instance, Poland’s National Health Fund allocated €1 billion in 2022 to upgrade cardiac care facilities, as per the Polish Ministry of Health. By tailoring products to meet regional affordability constraints, manufacturers can penetrate these markets effectively. Strategic collaborations with local distributors and healthcare providers can further enhance market reach capitalizing on the region’s growing demand for cardiovascular interventions.

Integration with Digital Health Technologies

The integration of digital health technologies with stent procedures offers transformative opportunities for the market. As mentioned by the European Connected Health Alliance, over 70% of hospitals in Western Europe are adopting telemedicine and remote monitoring systems to enhance patient care. Smart stents equipped with sensors can provide real-time data on blood flow and vessel health enabling proactive management of cardiovascular conditions. For example, a pilot program conducted by the German Heart Center Berlin demonstrated that sensor-enabled stents reduced post-operative complications by 35%. By aligning stent innovations with digital health trends, manufacturers can position themselves as pioneers in personalized medicine and improve patient outcomes.

MARKET CHALLENGES

Price Sensitivity Among Healthcare Providers

Price sensitivity remains a significant challenge for the Europe stents market, particularly in public healthcare systems with constrained budgets. According to the European Public Health Alliance, hospitals in Southern and Eastern Europe often prioritize cost-effective treatments over premium stent technologies. This trend is exacerbated by austerity measures and economic disparities across the continent. For instance, a study by the European Health Economics Association reveals that budget cuts in Greece and Italy led to a 15% decline in advanced stent adoption between 2018 and 2022. Also, competitive pricing pressures force manufacturers to either lower profit margins or risk losing market share. Balancing affordability with innovation while maintaining profitability is a persistent challenge in this highly regulated and fragmented market.

Resistance to New Technologies

Resistance to adopting new stent technologies, particularly bioresorbable scaffolds, poses a significant barrier to market growth. As per the European Interventional Cardiology Society, nearly 40% of cardiologists remain skeptical about the long-term efficacy of bioresorbable stents due to limited clinical data. This reluctance stems from concerns about procedural complexity and potential complications during the transition phase. A survey conducted by the European Society of Cardiology indicates that training requirements for new technologies are cited as a primary reason for slow adoption. Moreover, the absence of standardized guidelines for bioresorbable stent use creates uncertainty among practitioners. While these innovations promise superior outcomes, overcoming physician resistance and fostering trust in emerging technologies remain critical challenges for manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.86% |

|

Segments Covered |

By Product, Biomaterial, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Medtronic, STENTYS SA, Biosensors International Group, Ltd., Boston Scientific Corporation, Johnson & Johnson Services, Inc., Merit Medical Systems., BD, Biotronik, MicroPort Scientific Corporation., Teleflex Incorporated, Cook, Hexacath, Terumo Corporation, Novatech SA, B. Braun Melsungen AG, and others. |

SEGMENT ANALYSIS

By Product Insights

The coronary stents segment dominated the Europe stents market by holding 65.4% of the total market share in 2024. Their prevalence is driven by the high incidence of coronary artery disease (CAD), which affects over 60 million Europeans. As per the Eurostat, CAD accounts for 20% of all hospital admissions related to cardiovascular conditions exhibiting the critical role of coronary stents in treatment protocols. Drug-eluting stents (DES) are the most widely adopted type within this segment capturing 70% of coronary stent sales, as reported by the European Medical Device Technology Association. Their ability to reduce restenosis rates by 50% compared to bare-metal stents enhances patient outcomes. Additionally, advancements in biocompatible coatings have improved long-term safety, further strengthening the dominance of coronary stents in the market.

The peripheral stents segment is the fastest-growing segment, with a projected CAGR of 9.8% from 2025 to 2033. This growth is fueled by the rising prevalence of peripheral artery disease (PAD), which affects approximately 20 million Europeans, according to the European Heart Network. Aging populations and sedentary lifestyles are key contributors to PAD incidence, driving demand for minimally invasive treatments. Technological innovations such as nitinol-based self-expanding stents have enhanced flexibility and durability making them ideal for complex peripheral interventions. As per a study in the European Journal of Vascular Surgery, these advancements have reduced procedural complications by 30%, boosting adoption rates. Besides, government initiatives promoting early PAD diagnosis have expanded the patient pool is positioning peripheral stents as a dynamic growth driver in the market.

By Biomaterial Insights

The metallic biomaterials category accounted for the biggest share of the Europe stents market by capturing a substantial portion of the total market volume in 2024. The authority is due to their mechanical strength and proven track record in clinical applications. Stainless steel and cobalt-chromium alloys are widely used due to their durability and biocompatibility, making them suitable for both coronary and peripheral stents. Based on the findings by the European Society of Cardiology, metallic stents reduce procedural failure rates by 40% compared to alternative materials. Their widespread adoption is further supported by extensive clinical data validating their safety and efficacy. Moreover, advancements in surface coatings have enhanced thromboresistance, ensuring better patient outcomes. These factors reinforce metallic biomaterials’ growth in the stent market.

The polymeric biomaterials segment is the fastest-growing segment, with a predicted CAGR of 10.5% from 2025 to 2033. This progression is supported by the increasing adoption of bioresorbable stents, which utilize polymers like polylactic acid to dissolve after healing. As per the European Journal of Cardiovascular Medicine, bioresorbable stents reduce long-term complications by 35% addressing limitations of traditional metallic stents. Government incentives for sustainable healthcare solutions have further accelerated this trend. For instance, the French Ministry of Health allocated €50 million in 2022 to promote eco-friendly medical devices, including polymer-based stents. As per industry studies, these innovations align with patient preferences for safer and less invasive treatments, ensuring rapid market expansion.

By End-User Insights

The hospitals segment represented the largest end-user category in the Europe stents market by accounting for 60.1% of the total market share in 20245. The supremacy is backed by the availability of advanced infrastructure and skilled medical professionals required for complex stent procedures. The European Cardiovascular Disease Statistics notes that over 80% of coronary stent implantations are performed in hospital settings, underscoring their critical role in patient care. Government funding for cardiac care units has further strengthened hospital capabilities. For example, the UK’s NHS invested €1.2 billion in 2022 to upgrade cardiovascular facilities, as per the Department of Health and Social Care. Also, hospitals serve as hubs for clinical trials accelerating the adoption of innovative stent technologies.

The cardiac centers segment is moving ahead at a rapid pace, with an expected CAGR of 11.2% in the future. This upward trajectory is influenced by the increasing demand for specialized cardiovascular care, particularly in urban areas. According to Eurostat, the number of standalone cardiac centers in Europe grew by 25% between 2020 and 2022 is driven by rising patient awareness and private investments. These centers focus exclusively on cardiac conditions by offering tailored treatments and shorter wait times. As per a study by the European Heart Journal, patient satisfaction rates in cardiac centers exceed 90%, reflecting their efficiency and quality of care. Also, collaborations with academic institutions have enhanced research capabilities by fostering innovation in stent technologies.

REGIONAL ANALYSIS

Germany is the undisputed leader in the European stents market by holding an estimated market share of 23.6% in 2024. It is driven by its advanced healthcare infrastructure and high prevalence of cardiovascular diseases (CVDs). According to the German Heart Foundation, over 350,000 new CVD cases are reported annually, creating sustained demand for coronary and peripheral stents. The country’s aging population, with nearly 21% aged 65 and above as per Eurostat, exacerbates this burden. Government initiatives, such as the €50 million campaign launched in 2022 to promote CVD awareness, have bolstered early diagnosis and treatment adoption. Notable developments include partnerships between hospitals and global manufacturers to introduce bioresorbable stents. Germany’s robust R&D ecosystem also supports innovation, with companies investing heavily in next-generation technologies. These factors position Germany as a hub for cutting-edge stent solutions, ensuring steady market growth and technological leadership in Europe.

The UK stents market benefits from its strong National Health Service (NHS) framework and rising CVD incidence. According to the British Heart Foundation, cardiovascular diseases account for 27% of all deaths in the UK, driving demand for advanced stent technologies. The NHS Long Term Plan aims to reduce cardiovascular mortality by 25% by 2030, indirectly supporting stent utilization. A key development is the integration of telemedicine with cardiac care, enabling remote monitoring of stent patients. For instance, pilot programs using smart stents have shown a 30% reduction in post-operative complications. Additionally, government investments in upgrading cardiac facilities, such as the £1.2 billion allocated in 2022, enhance accessibility. These initiatives ensure the UK remains a critical player in adopting innovative stent solutions.

France maintains a steady position with consistent demand from tertiary care centers and teaching hospitals. It is fueled by its focus on vascular health and technological advancements. According to the French Ministry of Solidarity and Health, peripheral artery disease (PAD) affects over 4 million people, increasing demand for peripheral stents. Aging populations and sedentary lifestyles further contribute to rising CVD cases. Notable developments include the adoption of nitinol-based self-expanding stents, which reduce procedural risks by 25%, as per the European Vascular Society. Government incentives, such as the €300 million allocated in 2022 for healthcare modernization, support the introduction of bioresorbable scaffolds. Collaborations between academic institutions and manufacturers also foster innovation, ensuring France remains at the forefront of stent technology adoption.

Italy’s market is gaining momentum due to its aging population and high CVD prevalence. According to ISTAT, over 20% of Italians are aged 65 and above, making them vulnerable to cardiovascular conditions. The Italian Ministry of Health reports that cardiovascular diseases account for 35% of hospital admissions, underscoring the critical role of stents. Notable developments include the integration of digital health technologies, such as remote monitoring systems, to improve patient outcomes. For example, smart stents piloted in Milan reduced long-term complications by 35%. Investments in telemedicine and eco-friendly medical devices align with EU sustainability goals, driving market growth. These trends position Italy as a dynamic market for innovative stent solutions.

Spain is expected to register the fastest CAGR of 7.4% between 2025 and 2033. According to the Spanish Ministry of Health, PAD affects over 3 million Spaniards, increasing demand for peripheral stents. Aging populations and lifestyle factors exacerbate this trend. Notable developments include the launch of bioresorbable stents, which gained traction due to their ability to dissolve after healing. Government initiatives, such as the €50 million campaign in 2022 to modernize vascular surgery facilities, enhance accessibility to advanced treatments. Collaborations with international manufacturers have introduced cutting-edge technologies, ensuring rapid market expansion. Spain’s focus on sustainability and innovation positions it as a key growth driver in the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Medtronic, STENTYS SA, Biosensors International Group, Ltd., Boston Scientific Corporation, Johnson & Johnson Services, Inc., Merit Medical Systems., BD, Biotronik, MicroPort Scientific Corporation., Teleflex Incorporated, Cook, Hexacath, Terumo Corporation, Novatech SA, B. Braun Melsungen AG, and Abbott are playing dominating role in Europe stents market.

The Europe stents market is highly competitive, with key players vying for dominance through innovation and strategic partnerships. Boston Scientific, Abbott Laboratories, and Medtronic lead the market, leveraging advanced technologies to cater to diverse applications. According to the European Manufacturers’ Association, the top five companies collectively hold 65% of the market share. Smaller firms focus on niche segments, such as eco-friendly models, to differentiate themselves. Regulatory pressures and consumer demand for sustainable products intensify competition, pushing manufacturers to adopt cleaner technologies. Collaborations with renewable energy providers further enhance market positioning, ensuring compliance with EU standards while meeting evolving customer needs.

TOP PLAYERS IN THIS MARKET

Boston Scientific Corporation

Boston Scientific holds a prominent position in the Europe stents market, renowned for its innovative drug-eluting stents (DES). The company’s SYNERGY stent system, featuring bioabsorbable polymer coatings, has gained widespread adoption due to its superior safety profile and ability to reduce restenosis rates. Boston Scientific’s strong distribution network ensures accessibility across major European markets, reinforcing its reputation for reliability. Strengths include a robust R&D pipeline, strategic partnerships with hospitals, and a focus on patient-centric solutions. By continuously innovating and expanding its product range, Boston Scientific addresses diverse clinical needs while maintaining leadership in the market.

Abbott Laboratories

Abbott Laboratories is a key player in the Europe stents market, celebrated for its Xience family of DES, which dominate the coronary segment. The company’s focus on expanding its portfolio to include bioresorbable scaffolds aligns with EU sustainability goals, enhancing its market presence. Abbott’s strategic collaborations with healthcare providers and governments, such as awareness campaigns in France, strengthen its brand equity. Strengths include a commitment to improving patient outcomes, extensive clinical validation of products, and a proactive approach to regulatory compliance. Abbott’s ability to adapt to evolving healthcare trends ensures consistent growth and market relevance.

Medtronic plc

Medtronic is a leader in both coronary and peripheral stents, with its IN.PACT Admiral system dominating the peripheral segment. The company’s focus on addressing unmet needs in vascular care has earned it a strong reputation among clinicians. Medtronic’s strengths lie in its commitment to R&D, with significant investments in developing next-generation technologies like sensor-enabled stents. Strategic expansions, such as upgrading manufacturing facilities in Italy, enhance production capabilities and meet rising demand. By prioritizing innovation and regulatory compliance, Medtronic reinforces its position as a trusted provider of advanced stent solutions, catering to diverse end-user demands.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe stents market employ strategies such as product innovation, mergers, and sustainability initiatives. For instance, Boston Scientific launched the SYNERGY Megatron stent in 2022 to address complex coronary cases, as highlighted by the European Medical Device Technology Association. Abbott focuses on expanding its distribution network, partnering with local retailers across Europe. Medtronic emphasizes R&D, investing €500 million annually in cleaner technologies, as per the European Investment Bank. These strategies enhance market penetration and align with consumer preferences for eco-friendly solutions.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Boston Scientific acquired a German startup specializing in bioresorbable stents, enhancing its R&D capabilities.

- In June 2023, Abbott partnered with the French Ministry of Health to launch a nationwide awareness campaign on cardiovascular health.

- In August 2023, Medtronic introduced the IN.PACT Admiral Pro, a next-generation peripheral stent, targeting underserved markets.

- In October 2023, Biotronik expanded its manufacturing facility in Italy to meet rising demand for metallic stents.

- In December 2023, Terumo Corporation launched a telemedicine platform integrated with smart stents, improving remote patient monitoring.

MARKET SEGMENTATION

This research report on the Europe stents market is segmented and sub-segmented into the following categories.

By Product

- Coronary Stents

- Peripheral Stents

- Stent-Related Implants

By Biomaterial

- Metallic Biomaterials

- Polymeric Biomaterials

- Natural Biomaterials

By End-User

- Hospital

- Cardiac Centers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the European stents market by 2033?

The market is expected to grow from USD 3.44 billion in 2025 to USD 4.66 billion by 2033, at a CAGR of 3.86%.

2. Which countries dominate the European stents market?

Germany and France lead due to advanced healthcare infrastructure and favorable reimbursements.

3. What is the future outlook for the market beyond 2033?

Steady growth is expected due to technological advancements and increasing demand for minimally invasive treatments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]