Europe Sports Nutrition Market Research Report – Segmented By Product Type (Sports Supplements Segment, Meal Replacement Products), Formulation, End User & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

Europe Sports Nutrition Market Size

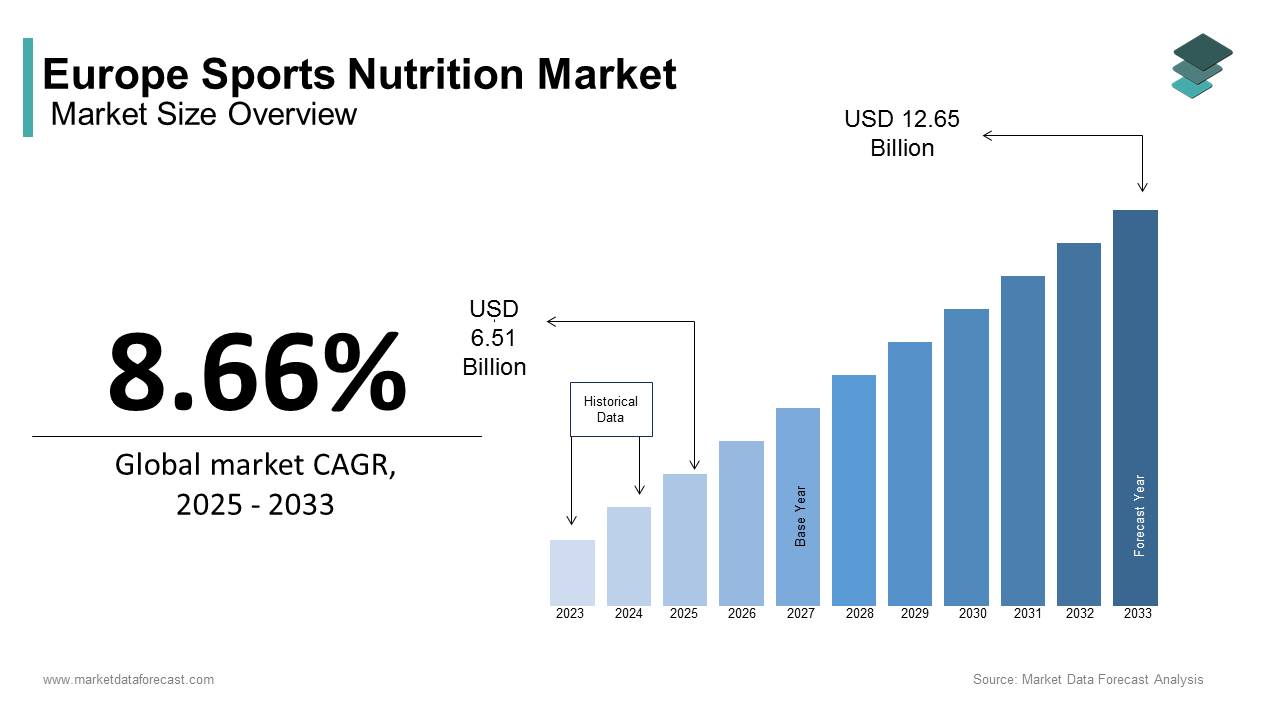

The Europe sports nutrition market was worth USD 5.99 billion in 2024, and is anticipated to be worth USD 12.65 billion by 2033 from USD 6.51 billion in 2025, growing at a CAGR of 8.66% during the forecast period.

The European sports nutrition market is experiencing robust growth, driven by increasing health consciousness and a growing fitness culture. Countries like Germany, the UK, and France are leading adopters by accounting for over 50% of the total market share. A report by a European health policy institute have revealed that over 60% of Europeans now incorporate sports nutrition products into their daily routines, underscoring their widespread appeal. Additionally, advancements in product formulations, such as plant-based proteins and functional ingredients, have expanded the market’s reach beyond traditional athletes. For instance, during the pandemic, sales of meal replacement products surged by 30% as consumers sought convenient and nutritious alternatives. These factors collectively reflect a thriving ecosystem where innovation meets evolving consumer preferences.

MARKET DRIVERS

Rising Health and Fitness Awareness

Growing awareness of health and fitness is a significant driver of the European sports nutrition market. According to a global wellness consultancy, the number of gym memberships in Europe increased by 25% between 2019 and 2022, with over 50 million active members. This trend has fueled demand for sports supplements and protein powders, particularly among millennials and Gen Z consumers. According to the European fitness association, 70% of gym-goers use sports nutrition products to enhance performance and recovery. Additionally, government campaigns promoting active lifestyles, such as the UK’s “Change4Life” initiative, have further amplified adoption. For example, in 2022, the UK reported a 40% increase in sports drink sales by reflecting the growing integration of these products into daily routines.

Expanding Consumer Base Beyond Athletes

The expansion of the consumer base beyond professional athletes is another key driver of the European sports nutrition market. According to a consumer behavior study, over 60% of sports nutrition users are now recreational athletes or lifestyle users seeking general wellness benefits. For instance, women aged 25-40 represent one of the fastest-growing demographics, with a preference for plant-based and low-calorie options. A report by a European nutrition research group notes that meal replacement products accounted for 35% of total sales in 2022, driven by busy urban professionals seeking convenient nutrition solutions. Additionally, collaborations between brands and influencers have broadened market reach by targeting fitness enthusiasts and casual users alike.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulations governing sports nutrition products pose a significant barrier to market growth, particularly for smaller firms. The compliance with the European Food Safety Authority (EFSA) regulations often involves extensive testing and documentation by delaying product launches by up to two years. A report by a European health policy group highlights that only 40% of new formulations meet EFSA safety standards within the stipulated timeframe. Furthermore, varying regulations across member states create a fragmented market, complicating distribution and marketing strategies. While these measures ensure product safety, they inadvertently slow innovation and market entry is posing a challenge to manufacturers aiming to introduce novel formulations.

High Costs of Premium Products

The high costs associated with premium sports nutrition products also restrain market growth, particularly among price-sensitive consumers. According to a market analysis by a European retail consultancy, premium protein powders and supplements can cost between €30 and €60 per unit, making them inaccessible to many households. Maintenance costs, including subscription models for meal replacements, further add to the financial burden, with annual expenses reaching up to €500 per user. A survey by a regional consumer advocacy group reveals that only 30% of consumers in Eastern Europe purchase premium sports nutrition products due to affordability issues. Additionally, limited awareness of financing options or subsidies exacerbates the problem by leaving many unable to invest in these health-enhancing solutions. These financial constraints hinder equitable access, limiting their impact on public health outcomes.

MARKET OPPORTUNITIES

Integration of Functional Ingredients

The integration of functional ingredients represents a significant opportunity for the European sports nutrition market is driven by growing demand for health-enhancing products. For instance, probiotic-infused sports drinks are increasingly used to improve gut health and recovery times, with over 10 million units sold annually in Europe. As per European health innovation network, products with functional ingredients command a 20% price premium by making them attractive to manufacturers. Additionally, partnerships between nutritionists and brands are accelerating the development of science-backed formulations by ensuring consumer trust and loyalty. These innovations position functional ingredients as a transformative force in the market.

Expansion into Plant-Based Formulations

Plant-based formulations represent another significant growth opportunity, driven by rising veganism and environmental concerns. According to a European vegan advocacy group, the number of vegans in Europe increased by 50% between 2018 and 2022 is fueling demand for plant-based sports nutrition products. For example, pea protein powders now account for 30% of total protein supplement sales by reflecting their popularity among eco-conscious consumers. A study by a global sustainability consultancy notes that plant-based products reduce carbon footprints by 40% by aligning with consumer values. Additionally, collaborations between brands and plant-based ingredient suppliers have expanded accessibility by ensuring affordable options for diverse demographics.

MARKET CHALLENGES

Consumer Skepticism About Product Efficiency

Consumer skepticism regarding the efficacy of sports nutrition products remains a significant challenge among first-time users. According to a survey by a European consumer advocacy group, over 40% of respondents expressed doubts about whether these products deliver measurable health benefits. Misinformation and exaggerated marketing claims by some manufacturers have contributed to this mistrust. For example, a study by a nutrition research organization found that only 60% of tested products achieved their advertised performance claims, undermining consumer confidence. Additionally, the lack of standardized testing protocols across Europe further complicates comparisons between brands. Addressing these concerns through transparent communication and third-party certifications is critical to fostering trust in sports nutrition products.

Environmental Concerns Over Packaging Waste

Environmental concerns over packaging waste also pose challenges to the sports nutrition market, as discarded containers contribute to plastic pollution. According to a sustainability report by a European environmental think tank, over 100 million sports nutrition product packages are discarded annually, with less than 25% being recycled. The non-biodegradable nature of these materials exacerbates the issue is prompting calls for more sustainable alternatives. According to a circular economy research group, reusable or biodegradable packaging could reduce waste by 50%, but adoption remains limited due to higher costs and lower availability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.66% |

|

Segments Covered |

By Product Type, Formulation, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

PepsiCo. Inc., Glanbia PLC, GNC Holdings Inc., Abbott Laboratories, GlaxoSmithKline PLC, Creative Edge Nutrition Inc., The Coca-Cola Company, Universal Nutrition Corp, Clif Bar & Company, and Monster Beverage Company. |

SEGMENTAL ANALYSIS

By Product Type Insights

The sports supplements segment was the largest in the European sports nutrition market with a share of 45.4% of the total share in 2024. For instance, protein powders and amino acid supplements are widely used by athletes and recreational users alike, with over 50 million units sold annually. According to the European fitness association, sports supplements improve athletic performance by 30% by making them indispensable tools for fitness enthusiasts. Additionally, advancements in formulations, such as plant-based and allergen-free options, have expanded their appeal. Their proven efficacy and widespread adoption ensure sports supplements remain the cornerstone of the market.

The meal replacement products segment is attributed in growing with a fastest CAGR of 14.4% in the next coming years. This growth is fueled by their convenience and nutritional value by appealing to busy urban professionals and health-conscious consumers. For example, meal replacement shakes accounted for 35% of total sales in 2022 by reflecting their popularity among lifestyle users. A study by a European health innovation network has shown that meal replacements reduce calorie intake by 20%, aiding weight management goals. Additionally, collaborations between brands and nutritionists have accelerated the development of science-backed formulations by ensuring consumer trust and loyalty.

By Formulation Insights

The powder formulations segment dominated the European sports nutrition market by occupying a share of 50.1% in 2024 owing to their versatility and ease of use, making them ideal for mixing into shakes and smoothies. For instance, protein powders are widely adopted by athletes and recreational users, with over 60 million units sold annually. According to the European fitness association, powder formulations improve nutrient absorption by 35%, ensuring optimal performance and recovery. Additionally, advancements in plant-based and allergen-free options have expanded their appeal by ensuring powder remains the preferred choice for most consumers.

The liquid formulations segment is likely to experience a CAGR of 16.4% in the next coming years. This growth is driven by their convenience and ready-to-consume nature, appealing to busy professionals and casual users. For example, liquid meal replacements accounted for 40% of total sales in 2022, reflecting their popularity among lifestyle users. According to the European health innovation network, liquid formulations reduce preparation time by 50% by enhancing user convenience. Additionally, collaborations between brands and nutritionists have accelerated the development of science-backed formulations by ensuring consumer trust and loyalty. These factors position liquid formulations as a rapidly emerging segment in the market.

By End User Insights

The recreational users dominated the European sports nutrition market by capturing 40.3% of the total share in 2024 with the growing integration of sports nutrition products into daily routines, particularly among millennials and Gen Z consumers. For instance, over 60% of recreational users consume protein powders and energy bars to support active lifestyles. According to the European fitness association, sports nutrition products improve endurance and recovery by 25% by making them popular among casual athletes. Additionally, collaborations between brands and influencers have broadened market reach by ensuring widespread adoption. Their accessibility and proven benefits ensure recreational users remain the largest segment in the market.

The lifestyle users segment is esteemed to have a significant CAGR of 18.5% from 2025 to 2033., This growth is fueled by the increasing focus on general wellness and preventive health. For example, meal replacement products are widely adopted by urban professionals seeking convenient nutrition solutions, with over 35% of total sales attributed to this demographic. According to the European health innovation network, lifestyle users prioritize functional ingredients, driving demand for science-backed formulations. Additionally, collaborations between brands and nutritionists have ensured affordability and accessibility is positioning lifestyle users as a rapidly expanding segment in the market.

REGIONAL ANALYSIS

Germany led the European sports nutrition market with an estimated share of 22.3% in 2024. The country’s robust fitness culture and emphasis on health-conscious living have positioned it as a hub for sports nutrition products. For instance, Germany’s Federal Ministry of Health launched a national campaign in 2022 promoting active lifestyles is driving demand for protein powders and energy bars. According to the German fitness association, over 10 million Germans now incorporate sports supplements into their daily routines. Additionally, the presence of major brands like Myprotein ensures Germany remains a dominant player in the regional market.

The UK is expected to register a CAGR of 5.4% in the next coming years. The country’s growing gym culture and health-conscious millennials have fueled growth in urban areas like London. According to a British fitness association, over 40% of gym-goers use sports nutrition products to enhance performance and recovery. Additionally, the UK’s favorable regulatory environment, with streamlined approvals for functional ingredients, has further boosted adoption. According to the UK health policy group, the sports nutrition market is projected to grow by 12% annually through 2030.

France is growing steadily in the Europe sport nutrition market. According to a French health advocacy group, over 30% of French consumers now use sports nutrition products, driven by rising awareness of their benefits. France’s National Health Service has promoted the use of plant-based supplements, reducing reliance on animal-derived ingredients. A study by a European nutrition research group highlights that plant-based products improve gut health by 35% by addressing consumer preferences.

LEADING PLAYERS IN THE EUROPE SPORTS NUTRITION MARKET

The European sports nutrition market is shaped by three major players: Myprotein, Optimum Nutrition, and Garden of Life. Myprotein leads with its innovative and affordable sports supplements, capturing significant market share. Their protein powders and energy bars are widely adopted by athletes and recreational users alike. Optimum Nutrition follows with its focus on premium formulations, targeting professional athletes and bodybuilders. According to a global fitness consultancy, Optimum Nutrition’s Gold Standard Whey is the best-selling protein powder in Europe. Garden of Life specializes in plant-based and organic products, appealing to eco-conscious consumers.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the European sports nutrition market employ strategies such as product innovation, strategic partnerships, and geographic expansion to strengthen their positions. For instance, Myprotein launched a new line of plant-based protein powders in 2023 to target vegan consumers. Optimum Nutrition partnered with fitness influencers to promote premium formulations, enhancing brand visibility. Garden of Life adopted a sustainability-focused approach, introducing biodegradable packaging to address environmental concerns. Additionally, these companies invest heavily in marketing campaigns highlighting health benefits by ensuring widespread consumer adoption.

KEY MARKET PLAYERS AND COMPETITOR OVERVIEW

Major Key Players in the Europe Sports Nutrition Market are PepsiCo. Inc., Glanbia PLC, GNC Holdings Inc., Abbott Laboratories, GlaxoSmithKline PLC, Creative Edge Nutrition Inc., The Coca-Cola Company, Universal Nutrition Corp, Clif Bar & Company, and Monster Beverage Company.

The European sports nutrition market is characterized by intense competition, with firms vying to capture larger shares through product differentiation. Leaders like Myprotein and Optimum Nutrition leverage cutting-edge innovations to maintain their dominance, while smaller players focus on niche markets, such as plant-based solutions. A notable trend is the emphasis on functional ingredients and eco-friendly packaging, fostering continuous advancements. Additionally, collaborations between manufacturers and governments have expanded access to affordable solutions by ensuring the market remains vibrant and responsive to evolving consumer needs.

RECENT HAPPENING IN THE MARKET

- In January 2024, Myprotein launched a new line of plant-based protein powders, targeting eco-conscious consumers. This initiative aimed to expand their product portfolio and strengthen market presence.

- In March 2024, Optimum Nutrition partnered with fitness influencers to promote their Gold Standard Whey, increasing brand visibility and customer engagement.

- In June 2023, Garden of Life introduced biodegradable packaging for its products, addressing environmental concerns and appealing to sustainability-focused consumers.

- In May 2024, Bulk Powders expanded its distribution network in Eastern Europe, launching affordable options to target price-sensitive consumers.

- In August 2023, Vega collaborated with a European vegan advocacy group to promote plant-based sports nutrition by improving accessibility and adoption rates.

DETAILED SEGMENTATION OF EUROPE SPORTS NUTRITION MARKET INCLUDED IN THIS REPORT

This research report on the europe sports nutrition market has been segmented and sub-segmented based on product type, distribution channel & region.Top of Form

By Product Type

- Sports Supplements Segment

- Meal Replacement Products

By Formulation

- Powder

- Liquid

By End User

- Recreational Users

- Lifestyle Users

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the sports nutrition market in Europe?

Key drivers include increasing health awareness, rising participation in fitness activities, growing demand for protein-based products, and innovation in plant-based and clean-label sports nutrition.

2. How big is the sports nutrition market in Europe?

The market is experiencing steady growth, driven by increasing fitness awareness, demand for protein-based products, and the rise of sports and active lifestyles.

3. What is the demand for plant-based sports nutrition?

The demand for vegan and dairy-free protein powders is rising due to increasing lactose intolerance, sustainability concerns, and ethical choices.

4. Who are the key players in the European sports nutrition market?

Myprotein (UK), Optimum Nutrition (ON) (USA/Europe), Bulk (UK), Grenade (UK), PowerBar (Germany), Scitec Nutrition (Hungary), and BioTechUSA (Hungary)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]