Europe Sports Medicine Market Research Report – Segmented By Product ( Reconstruction and Repair, Support and Recovery, Accessories), By Application & By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

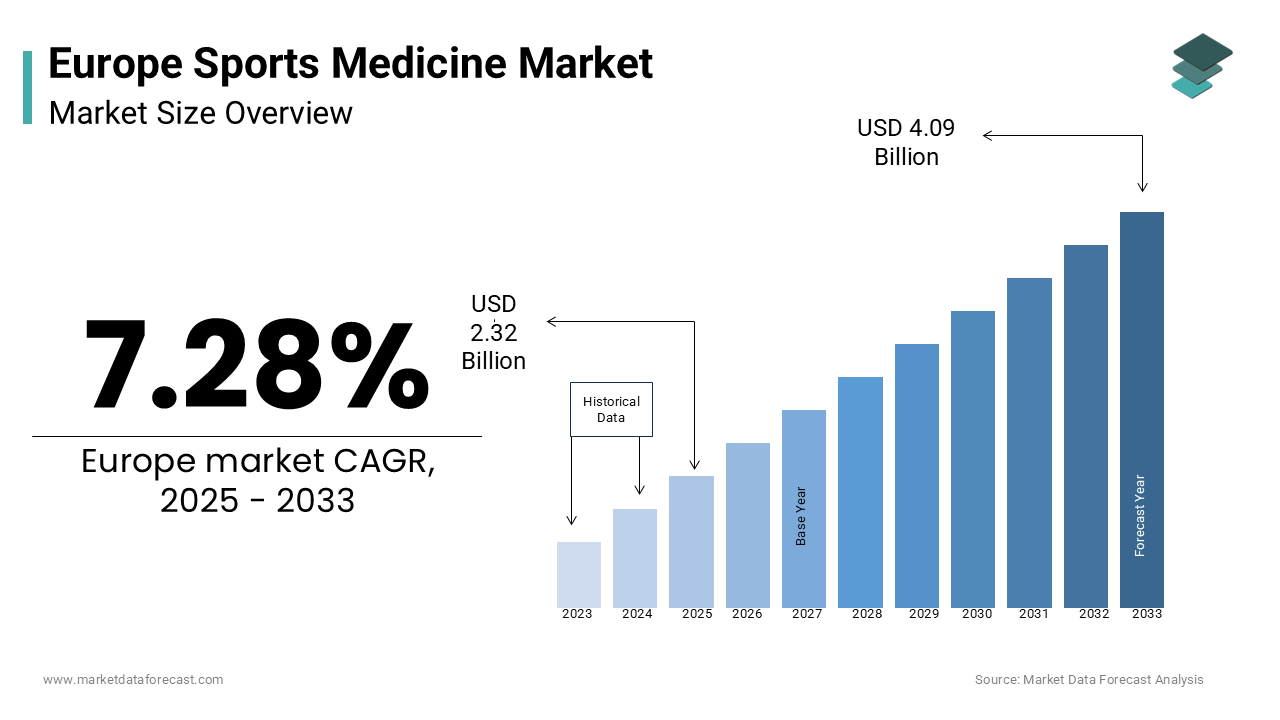

Europe Sports Medicine Market Size

The europe sports medicine market size was valued at USD 2.16 billion in 2024. The size of the europe market was worth USD 2.32 billion in 2025 and is estimated to be growing at a CAGR of 7.28% to reach USD 4.09 billion by 2033.

The market is showcasing the evident potential in the mentioned forecasting period. Sports Medicine is a universal requirement spanning from low, medium, to high-income range countries.

The growth of the Europe sports medicine market is emerging with a rising participation in sports and fitness activities alongside advancements in medical technologies. According to Eurostat, over 40% of Europeans engage in regular physical activity, with participation rates highest among urban populations. This trend has led to an increase in sports-related injuries is prompting a surge in demand for specialized medical products and services. The European Federation of Sports Medicine Societies states that approximately 15 million sports injuries are reported annually, with knee and shoulder injuries being the most prevalent. As per the European Commission, investments in healthcare infrastructure have grown by 20% since 2020 by enabling better access to diagnostic tools and treatments. Additionally, the rise of professional sports leagues and events has fueled demand for advanced rehabilitation equipment and support systems.

MARKET DRIVERS

Rising Incidence of Sports Injuries

The rising incidence of sports injuries is a primary driver propelling the Europe sports medicine market forward. According to the European Injury Database, sports-related injuries account for 30% of all emergency room visits, with knee and ankle injuries being the most common. In 2022, the European Sports Safety Network reported a 15% increase in sports injuries among amateur athletes, that is attributed to increased participation in recreational sports post-pandemic. Professional athletes in football and basketball, also contribute significantly to this trend, with an estimated 2 million injuries annually. As per the World Health Organization, governments across Europe are investing in injury prevention programs by allocating €500 million to promote safe sports practices. These initiatives not only raise awareness but also drive demand for advanced diagnostic and treatment solutions by ensuring sustained market growth.

Technological Advancements in Medical Devices

Technological advancements in medical devices are another significant driver shaping the Europe sports medicine market. According to the European Medical Device Regulation Authority, innovations such as arthroscopic surgical tools and wearable recovery devices have improved treatment outcomes by 25%. In 2022, the European Healthcare Technology Association, AI-powered diagnostic systems reduced injury assessment times by 40% by enhancing patient care. Additionally, the development of biocompatible materials for implants and braces has expanded their applicability in sports medicine.

MARKET RESTRAINTS

High Costs of Advanced Treatments

High costs associated with advanced sports medicine treatments pose a significant restraint on the market. According to the European Healthcare Economics Association, procedures such as arthroscopic surgery and custom orthotics can cost up to €10,000 per patient by making them inaccessible to low-income groups. In 2022, the European Patients’ Forum reported that 30% of patients delayed treatment due to financial constraints in Eastern Europe. Additionally, as per the European Commission, private health insurance coverage for sports injuries remains limited.

Limited Awareness in Rural Areas

Limited awareness of sports medicine services in rural areas is another major restraint impacting market growth. According to Eurostat, rural populations in Europe account for 25% of the total population but have access to only 10% of specialized sports medicine facilities. The European Rural Health Alliance notes that awareness campaigns about injury prevention and rehabilitation are often concentrated in urban centers by leaving rural communities underserved. Additionally, as per the European Sports Medicine Federation, the lack of trained professionals in these regions has resulted in a 20% higher rate of untreated injuries.

MARKET OPPORTUNITIES

Expansion of Telemedicine Services

The expansion of telemedicine services presents a significant opportunity for the Europe sports medicine market. According to the European Telemedicine Association, remote consultations for sports injuries grew by 60% during the pandemic, driven by convenience and accessibility. Platforms offering virtual physiotherapy sessions and personalized recovery plans have gained traction, particularly in urban areas where time constraints are prevalent. According to the European Commission, telemedicine reduces travel costs by 30% by making it an attractive for patients in remote regions. Additionally, wearable devices integrated with telehealth platforms enable real-time monitoring of recovery progress, enhancing patient engagement. These innovations position telemedicine as a key driver of future growth in the sports medicine sector.

Growing Demand for Preventive Care Solutions

The growing demand for preventive care solutions offers immense potential for the Europe sports medicine market. According to the European Public Health Association, preventive measures such as customized training programs and ergonomic equipment have reduced sports injuries by 25% in professional settings. As per the European Sports Medicine Congress, companies specializing in injury prevention tools received €300 million in funding is reflecting investor confidence. Additionally, educational initiatives targeting schools and amateur sports clubs have raised awareness about safe practices, driving demand for preventive products.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Issues

Regulatory hurdles and compliance issues pose significant challenges to the Europe sports medicine market. According to the European Medical Device Regulation Authority, stringent testing and certification processes can delay product launches by up to 18 months is impacting innovation timelines. In 2022, the European Healthcare Compliance Association reported that 20% of new devices failed to meet regulatory standards is resulting in costly redesigns. Additionally, as per the European Commission, varying regulations across member states create inconsistencies in market access, complicating distribution strategies. These challenges not only escalate operational costs but also slow down the adoption of groundbreaking technologies, hindering market expansion.

Shortage of Skilled Professionals

The shortage of skilled professionals in sports medicine is another pressing challenge. According to the European Centre for the Development of Vocational Training, the demand for specialized physiotherapists and sports physicians exceeds supply by 40%. This gap is particularly pronounced in emerging fields such as biomechanics and sports psychology, which require advanced expertise. As per the European Federation of Sports Medicine Societies, aging healthcare professionals and limited training programs have exacerbated the issue, with 25% of practitioners nearing retirement. The lack of technical proficiency not only hampers service delivery but also limits the adoption of innovative techniques, posing barriers to market growth.

SEGMENTAL ANALYSIS

By Product Insights

The reconstruction and repair segment was the largest by holding 45.5% of the Europe sports medicine market share in 2024. This segment’s growth is ascribed with the high prevalence of ligament and tendon injuries among athletes. According to the European Sports Medicine Federation, ACL reconstruction surgeries alone account for 30% of procedures that was driven by advancements in arthroscopic tools. As per the European Commission, government subsidies for orthopedic research have accelerated innovation in biocompatible implants is enhancing recovery outcomes.

The accessories segment is anticipated to register a fastest CAGR of 9.5% during the forecast period. This growth is fueled by rising demand for wearable recovery devices and ergonomic braces, particularly among amateur athletes. According to the International Society for Sports Medicine, sales of smart compression garments increased by 40% in 2022 owing to the ability to monitor muscle activity. Additionally, innovations in lightweight materials have expanded their appeal is positioning accessories as a key driver of future expansion.

By Application Insights

The knee injuries segment was the largest by occupying 35.4% of the Europe sports medicine market share in 2024. Their prevalence is attributed to high-impact sports like football and skiing, which account for 40% of all cases. According to the European Federation of Orthopedics, advancements in MRI diagnostics have improved injury detection by enhancing treatment precision. Additionally, the European Commission notes that public health campaigns promoting safe sports practices have reduced recurrence rates by 20%.

The Foot and ankle injuries segment is likely to exhibit a CAGR of 10.2% during the forecast period. The growth of the segment is driven by increasing participation in running and endurance sports, which account for 30% of cases. According to the International Society for Sports Medicine, innovations in custom orthotics and shock-absorbing footwear have accelerated adoption. Additionally, awareness campaigns targeting amateur runners have expanded the segment’s reach, ensuring rapid growth.

REGIONAL ANALYSIS

Germany was the largest contributor for the Europe sports medicine market with an estimated share of 25.3% in 2024 with the robust healthcare infrastructure and high sports participation rates, with over 27 million registered athletes. Additionally, partnerships between universities and hospitals have enhanced treatment quality is ensuring sustained growth.

Sweden sports medicine market is likely to register a CAGR of 12.4% in the next coming years. Its growth is driven by high adoption rates of preventive care and government incentives for sports safety.

Other regions, including France and Spain, are expected to grow steadily, driven by urbanization and health trends. According to Eurostat, these markets will likely see a 5% annual increase in sports medicine services owing to the rising disposable incomes.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Some of the companies playing a leading role in the European Sports Medicine Market profiled in this report are Smith & Nephew PLC., Arthrex, Inc., Össur hf, Stryker Corporation, Conmed Corporation, Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., Tornier, Inc., Skins International Trading AG, Wright Medical Technology, Inc., DePuy Mitek, Inc., 3M Company Ace Brand, OttoBock Healthcare GmbH and DJO Global, Inc.

The Europe sports medicine market is characterized by intense competition, driven by global leaders and regional innovators striving to deliver high-quality, innovative solutions. Companies differentiate themselves through their focus on cutting-edge technologies, sustainability, and customer-centric approaches. Prominent players like Smith & Nephew, Arthrex, and Stryker Corporation have established themselves as pioneers in areas such as arthroscopic tools, biologics, and imaging systems, leveraging their R&D capabilities to introduce groundbreaking products. Smaller regional players contribute to the competitive landscape by addressing niche segments, such as preventive care and custom orthotics, often through collaborations with local healthcare providers. The emphasis on education and training programs further enhances brand loyalty, as companies equip healthcare professionals with the skills needed to utilize advanced tools effectively. Additionally, adherence to stringent EU regulations ensures that all participants maintain high standards of quality and safety, fostering trust among consumers.

Top Players in the Europe Sports Medicine Market

1. Smith & Nephew

Smith & Nephew holds a prominent position in the Europe sports medicine market, recognized for its cutting-edge orthopedic solutions and commitment to innovation. The company specializes in arthroscopic tools, implants, and surgical instruments designed for treating sports-related injuries. Its strengths lie in its robust R&D capabilities, which enable the development of advanced products tailored to the needs of athletes and healthcare providers. Smith & Nephew has also established strategic partnerships with professional sports organizations and medical institutions, enhancing its reputation as a trusted provider of sports medicine solutions.

2. Arthrex

Arthrex is a key player in the Europe sports medicine market, renowned for its innovative surgical instruments and biologics. The company’s strength lies in its ability to bridge the gap between surgeons and cutting-edge technology, offering solutions that improve patient outcomes. Arthrex emphasizes education and training, hosting workshops and seminars to equip healthcare professionals with the skills needed to utilize its products effectively. This commitment to knowledge-sharing has earned it a loyal customer base and strengthened its market position.

3. Stryker Corporation

Stryker Corporation is a global leader in the sports medicine sector, known for its comprehensive portfolio of reconstructive devices, imaging systems, and diagnostic tools. The company’s strength lies in its adaptability to emerging trends, such as AI-driven diagnostics and personalized treatment solutions. Stryker’s emphasis on engineering excellence ensures that its products are not only innovative but also highly reliable, catering to the demands of professional athletes and healthcare providers alike.

Key Strategies Used by Market Participants

Key players in the Europe sports medicine market employ a variety of strategies to enhance their positions and stay ahead of competitors. A major focus is on product diversification, with companies expanding their portfolios to include preventive care solutions, wearables, and ergonomic accessories. For instance, investments in wearable recovery devices and smart braces have enabled companies to cater to the growing demand for at-home rehabilitation tools. Partnerships with sports federations, universities, and research institutions are another critical strategy is fostering innovation and ensuring alignment with regulatory standards. Digital transformation plays a pivotal role, with companies leveraging AI, telemedicine, and IoT-enabled devices to improve diagnostic accuracy and patient engagement. These strategies collectively drive competitiveness and ensure long-term growth in a rapidly evolving market.

RECENT MARKET DEVELOPMENTS

- In April 2024, Smith & Nephew launched a new line of AI-powered arthroscopic tools designed to enhance surgical precision. This move aims to improve recovery outcomes and strengthen market presence.

- In June 2023, Arthrex partnered with a German sports federation to develop injury prevention programs by aligning with Europe’s focus on safe sports practices.

- In January 2023, Stryker Corporation introduced a range of biocompatible implants by targeting professional athletes and expanding its product portfolio.

- In September 2022, DJO Global acquired a Swedish startup specializing in wearable recovery devices is expanding its digital health capabilities.

- In March 2022, Bauerfeind invested €50 million in a new R&D facility in Poland to accelerate innovation in sports braces and supports.

MARKET SEGMENTATION

This research report on the European sports medicine market has been segmented and sub-segmented into the following categories.

By Product

- Reconstruction and Repair

- Implants

- Prosthetics

- Arthroscopy Devices

- Fracture and Ligament Repair Products

- Orthobiologics

- Support and Recovery

- Braces and Support

- Thermal Therapy Products

- Topical Pain Relief Products

- Compression Clothing

- Monitoring Devices

- Other Body Support and Recovery Products

- Accessories

By Application

- Head Injuries

- Shoulder Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Hip and Groin Injuries

- Knee Injuries

- Foot and Ankle Injuries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]