Europe Sports And Energy Drinks Market Size, Share, Trends & Growth Forecast Report By Product Type (Sports Drinks, Energy Drinks), Packaging Type, Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Sports and Energy Drinks Market Size

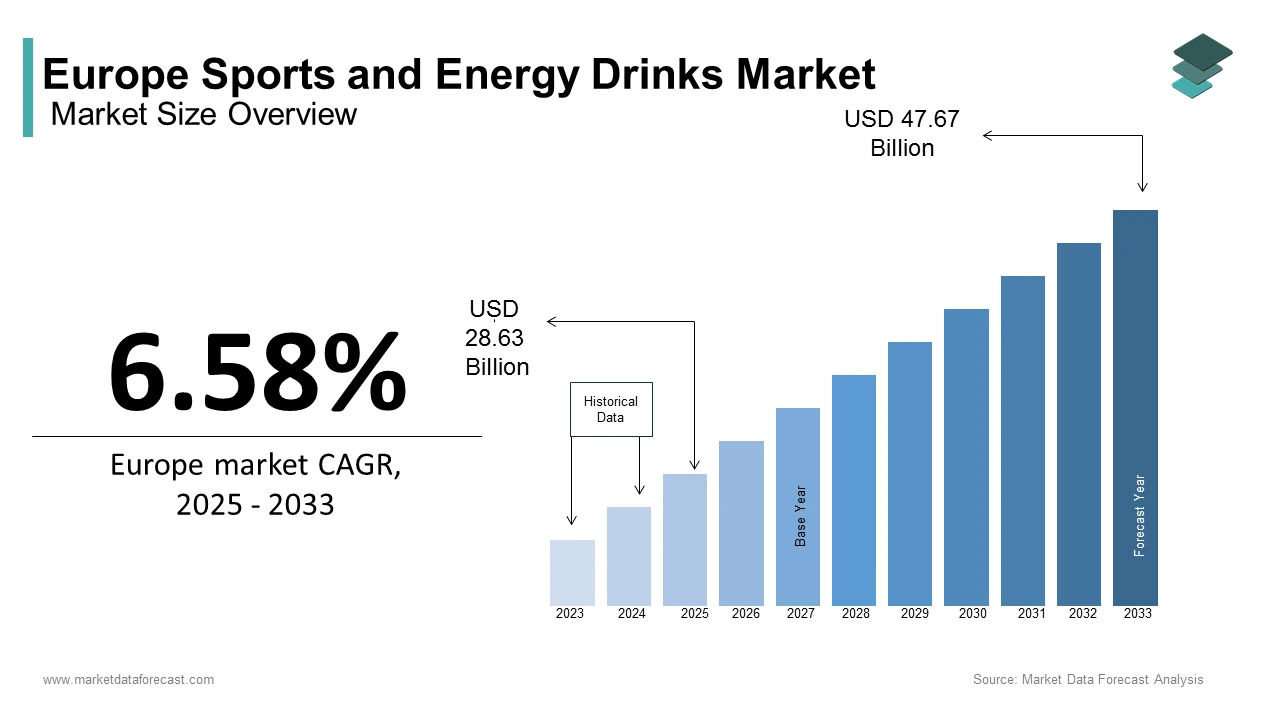

The Europe sports and energy drinks market size was calculated to be USD 26.86 billion in 2024 and is anticipated to be worth USD 47.67 billion by 2033 from USD 28.63 billion in 2025, growing at a CAGR of 6.58% during the forecast period.

Sports drinks are formulated to replenish electrolytes and provide hydration during physical activity, while energy drinks are designed to deliver a quick boost of energy through caffeine, taurine, and other stimulants. In Europe, the demand for sports and energy drinks is growing significantly owing to the increasing health consciousness, urbanization, and the rising popularity of fitness and wellness trends. Over the forecast period, the rising participation in sports and fitness activities, youthful demographic in Europe and a growing interest in active lifestyles is anticipated to promote the demand for sports and energy drinks in Europe. According to the European Health and Fitness Association, over 50 million Europeans are members of fitness clubs, which is indicating a strong cultural shift toward health and wellness. This trend has significantly impacted the sports drinks segment, with sales reaching €6.8 billion in 2022. Additionally, the energy drinks segment has gained traction among young adults and students, particularly in urban areas. For instance, Statista reports that energy drink consumption in Germany increased by 12% in 2022 alone. Furthermore, the rise of e-sports and gaming culture has created new avenues for energy drink brands to engage with consumers.

MARKET DRIVERS

Increasing Participation in Fitness and Sports Activities

The growing emphasis on fitness and sports activities has emerged as a key driver for the sports and energy drinks market. Over 50 million Europeans are actively engaged in fitness-related activities, with gym memberships increasing by 8% annually since 2019. This surge in physical activity has directly influenced the demand for sports drinks, which are designed to replenish electrolytes and provide hydration. A study by the German Nutrition Society reveals that sports drink sales in fitness centers alone reached €2.5 billion in 2022. Countries like the UK and France have witnessed a 15% increase in sports drink consumption, driven by heightened awareness of their benefits during workouts. This driver underscores the importance of aligning product offerings with the needs of health-conscious consumers who prioritize performance and recovery.

Rising Popularity of E-Sports and Gaming Culture

According to Newzoo, the rapid growth of e-sports and gaming culture has created a fertile ground for energy drink manufacturers to expand their consumer base. The European e-sports market was valued at €1.2 billion in 2022, with over 100 million gamers actively participating in competitive gaming events. Energy drinks, marketed as performance enhancers, have become a staple in this community, with brands sponsoring tournaments and collaborating with influencers. According to a report by the Swedish Gaming Federation, energy drink sales among gamers increased by 20% in 2022. This trend is particularly prominent in countries like Sweden and Denmark, where e-sports viewership exceeds 5 million annually. This driver emphasizes the role of energy drinks in catering to the unique needs of gamers seeking sustained focus and alertness during extended gaming sessions.

MARKET RESTRAINTS

Health Concerns and Regulatory Scrutiny

Health concerns associated with excessive consumption of energy drinks have emerged as a significant restraint for the market. High caffeine content and added sugars in energy drinks have been linked to adverse health effects, including heart palpitations and sleep disturbances. A study by the British Medical Journal reveals that over 30% of European consumers have expressed concerns about the safety of energy drinks, leading to a decline in consumption among certain demographics. Regulatory bodies in countries like France and Italy have imposed restrictions on the sale of energy drinks to minors, further impacting market growth. For instance, France reported a 10% drop in energy drink sales following the implementation of stricter labeling requirements. This restraint underscores the need for manufacturers to reformulate products and adopt transparent marketing practices to regain consumer trust.

High Price Sensitivity Among Consumers

Price sensitivity remains a significant challenge for the sports and energy drinks market, particularly in economically disadvantaged regions. Rising production costs, driven by inflation and supply chain disruptions, have led to increased retail prices, deterring budget-conscious consumers. NielsenIQ data indicates that the average price of sports and energy drinks rose by 8% in 2022, resulting in a 5% decline in sales volume in Eastern European markets like Turkey and Russia. This restraint is particularly evident in rural areas, where disposable incomes remain constrained. For instance, the Czech Republic reported a slower uptake of premium-priced sports drinks, despite their popularity in urban centers. This challenge highlights the importance of affordability and value-for-money propositions in maintaining market share.

MARKET OPPORTUNITIES

Expansion into Functional Beverages

The expansion of sports and energy drinks into the functional beverage category presents a significant opportunity for market growth. Functional beverages, enriched with vitamins, minerals, and plant-based ingredients, are gaining popularity among health-conscious consumers. A study by the French National Institute of Health reveals that functional sports drinks accounted for 25% of new product launches in 2022, with a particular focus on immune-boosting formulations. This trend is particularly prominent in urban areas, where millennials seek convenient and nutritious options. For instance, Switzerland reported a 30% increase in sales of vitamin-infused sports drinks during the same period. This opportunity underscores the potential for manufacturers to innovate and diversify their product portfolios to meet evolving consumer needs.

Growth of the Organic Segment

The organic segment of the sports and energy drinks market offers immense growth potential, driven by rising consumer demand for sustainably sourced and chemical-free products. A report by the Italian Ministry of Agriculture highlights that organic sports drink sales increased by 18% in 2022, with Germany and France leading the charge. Consumers are willing to pay a premium for organic-certified products, reflecting their commitment to environmental sustainability. For instance, Italy witnessed a 25% surge in organic energy drink imports during the holiday season. This opportunity emphasizes the importance of aligning production practices with eco-friendly standards to capitalize on the growing organic trend.

MARKET CHALLENGES

Intense Competition from Alternative Beverages

The sports and energy drinks market faces stiff competition from alternative beverages such as coconut water, kombucha, and plant-based drinks. These substitutes are gaining popularity due to their perceived health benefits and natural ingredients. A study by the British Nutrition Foundation reveals that alternative beverages accounted for 30% of new product launches in the functional drinks segment in 2022. This competition has fragmented the market, making it challenging for traditional sports and energy drink manufacturers to maintain their share. For instance, the Netherlands reported a 12% decline in energy drink sales in favor of kombucha-based products. This challenge underscores the need for differentiation through branding, quality, and innovation to sustain competitive advantage.

Regulatory and Certification Hurdles

Stringent regulatory requirements and certification processes pose significant hurdles for sports and energy drink manufacturers. Compliance with labeling, allergen declarations, and nutritional standards has become increasingly complex, particularly for small-scale producers. A report by the Italian Ministry of Health highlights that non-compliance can result in fines and reputational damage, deterring new entrants. Additionally, the introduction of sugar taxes in countries like the UK and France has impacted consumer perceptions of high-sugar energy drinks. This challenge emphasizes the importance of navigating regulatory frameworks effectively while maintaining transparency and trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.58% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Red Bull GmbH, Monster Beverage Corporation, PepsiCo Inc., The Coca-Cola Company, A.G. Barr p.l.c., Hell Energy Drink, Lucozade Ribena Suntory Limited, Coca-Cola Europacific Partners, and Boost Drinks Limited |

SEGMENTAL ANALYSIS

By Product Type Insights

The energy drinks segment led the market by holding 61.2% of the European market share in 2024. The dominating position of energy drinks segment in the European market is attributed to their widespread appeal among young adults and gamers, as well as their association with performance enhancement. The UK and Germany are the largest contributors to this segment, with combined sales exceeding €7.5 billion. A report by the European Beverage Association highlights that energy drinks are particularly popular in urban areas, representing 50% of their total usage.

However, the sports drinks segment is predicted to be the fastest growing segment for the forecast period with a CAGR of 5.5%. Factors such as the increasing participation in fitness activities and the rising popularity of functional formulations are fuelling the expansion of the sports drink segment in the European market. A study by the Swedish National Institute of Health reveals that sports drink sales in Scandinavia grew by 25% in 2022.

By Type Insights

The non-organic sports and energy drinks segment had 75.8% of the European market share in 2024. The lead of the segment in the European market is driven by their affordability and widespread availability. A report by the French Ministry of Agriculture highlights that conventional products are predominantly used in mass-market applications, such as convenience stores and vending machines. The ability of non-organic sports and energy drinks to meet the demands of cost-sensitive consumers while maintaining consistent quality is expected to continue to drive the demand for these drinks.

The organic sports and energy drinks segment is on the rise and is predicted to witness a CAGR of CAGR of 8.2% over the forecast period due to the factors such as the increasing consumer awareness of sustainable farming practices and the health benefits of organic products. A study by the German Organic Food Association reveals that organic sports drink sales in Germany increased by 35% in 2022. The potential of organic sports and energy drinks to redefine market dynamics and attract premium-paying consumers is likely to boost the expansion of the segment in the European market over the forecast period.

By Packaging Type Insights

The bottles segment held the largest share of 55.7% of the European market share in 2024. The dominating position of bottles segment in the European market is attributed to their convenience, recyclability, and suitability for both sports and energy drinks. A report by the European Packaging Federation highlights that PET bottles are particularly popular in the sports drinks segment, representing 60% of its total usage. The ability of bottles to cater to environmentally conscious consumers while maintaining product freshness is expected to boost the growth of the bottles segment in the market over the forecast period.

The cans segment is growing rapidly and is likely to register the fastest CAGR of 6.8% over the forecast period owing to their lightweight design, portability, and suitability for energy drinks. A study by the Swedish Recycling Association reveals that canned energy drink sales in Scandinavia grew by 30% in 2022.

By Distribution Channel Insights

The hypermarkets and supermarkets segment accounted for 45.8% of the European sports and energy drinks market share in 2024 due to their widespread presence and ability to offer a diverse product range. According to a report by the European Retail Federation, supermarket chains like Aldi and Lidl have expanded their sports and energy drink offerings, capitalizing on consumer trust and convenience.

The on-trade segment is anticipated to register the highest CAGR of 7.2% over the forecast period. Factors such as the increasing popularity of sports and energy drinks in cafes, gyms, and entertainment venues is boosting the segmental expansion in the European market. According to a study by the Dutch Hospitality Association, on-trade sales of energy drinks in the Netherlands grew by 25% in 2022.

KEY MARKET PLAYERS

Major Players of the Europe Sports and Energy Drinks Market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo Inc., The Coca-Cola Company, A.G. Barr p.l.c., Hell Energy Drink, Lucozade Ribena Suntory Limited, Coca-Cola Europacific Partners, and Boost Drinks Limited

REGIONAL ANALYSIS

Germany dominated the sports and energy drinks market in Europe in 2024 by occupying a share of 26.4% of the European market. The dominance of Germany in the European market is attributed to a strong tradition of fitness culture and high per capita consumption, which exceeds 15 liters annually. According to the German Health Association, sports drinks are a staple in both household kitchens and fitness centers.

The UK played a promising role in the European market in 2024. The sports and energy drinks market growth in the UK is driven by urbanization and a preference for health-conscious products. As per a report by the British Retail Consortium, London alone accounts for 30% of national sales.

France is predicted to register a prominent CAGR over the forecast period owing to its strong emphasis on organic and gourmet offerings. French consumers spend an average of €20 annually on sports and energy drinks, reflecting their affinity for high-quality products.

Italy is anticipated to account for a notable share of the European market over the forecast period due to its focus on traditional recipes and regional specialties. Italian consumers prioritize quality and authenticity, making it a key market for sports and energy drink brands.

Sweden is anticipated to register a healthy CAGR in the European market over the forecast period. Sweden is popular for its high adoption of functional beverages. Swedish consumers exhibit a strong preference for organic sports drinks, which is propelling the sports and energy drinks market in this country.

DETAILED SEGMENTATION OF EUROPE SPORTS AND ENERGY DRINKS MARKET INCLUDED IN THIS REPORT

This research report on the Europe sports and energy drinks market has been segmented and sub-segmented based on product type, packaging, distribution channel, & region.

By Product Type

- Sports Drinks

- Organic Sports Drinks

- Non-Organic Sports Drinks

- Energy Drinks

- Organic Energy Drinks

- Non-Organic Energy Drinks

By Packaging Type

- Cans

- Bottles

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the key consumers of sports and energy drinks in Europe?

Key consumers include athletes, fitness enthusiasts, students, working professionals, and individuals seeking quick energy boosts.

2. What are the major factors driving the growth of the Europe sports and energy drinks market?

Increasing health consciousness, rising demand for functional beverages, growing sports participation, and aggressive marketing strategies by key brands.

3. Which distribution channels are most commonly used for sports and energy drinks in Europe?

Supermarkets & hypermarkets, convenience stores, online retail, and vending machines are the primary distribution channels.

4. How is the demand for organic sports and energy drinks evolving in Europe?

The demand is increasing due to rising consumer awareness of health benefits, sustainable farming practices, and a preference for clean-label products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]