Europe Spice Market and Market Size, Share, Trends & Growth Forecast Report by Product (Pepper, Ginger, Cinnamon, Cumin, Turmeric, Cardamom, Coriander, Others), Form (Powder, Whole, Chopped/Crushed), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Spice Market Size

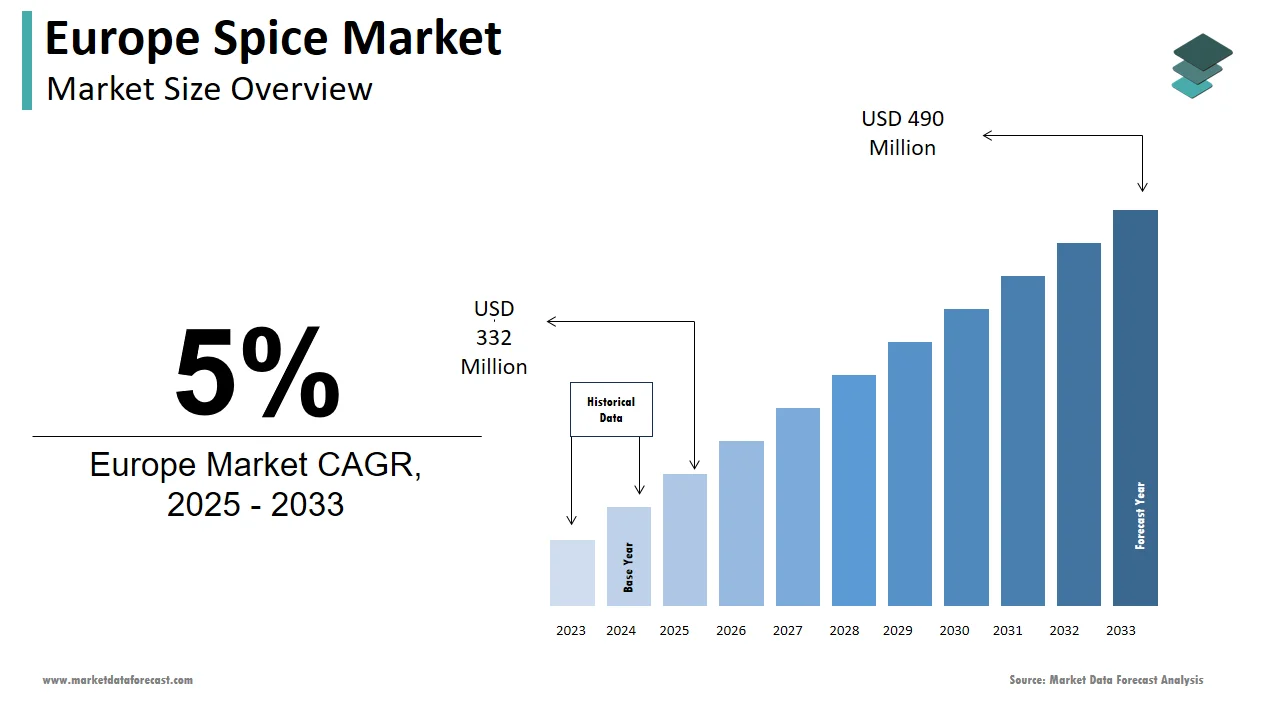

The spice market size in Europe was valued at USD 316 million in 2024. The European market is estimated to be worth USD 490 million by 2033 from USD 332 million in 2025, growing at a CAGR of 5% from 2025 to 2033.

The increasing consumer demand for exotic flavors, rising health consciousness, and the growing popularity of international cuisines are key driving factors for the Europe spice market. Countries like Germany, France, and the UK lead the market due to their robust retail networks and high consumer spending on premium spices. For instance, as per Eurostat, over 70% of households in Western Europe now incorporate spices into their daily cooking routines is creating a robust demand for products like turmeric and cinnamon. Additionally, government initiatives promoting organic farming have accelerated adoption rates by ensuring sustained growth.

MARKET DRIVERS

Rising Demand for Exotic Flavors

A major reason for the growth of the Europe spice market is that people are showing more interest in trying new and different flavors. According to the European Culinary Research Institute, over 65% of consumers now experiment with international cuisines is driving demand for spices like cumin, cardamom, and coriander. This trend is particularly pronounced in urban areas, where multicultural influences shape dietary preferences. For example, as per the French Ministry of Agriculture, sales of ethnic spices increased by 40% annually since 2020 is reflecting their critical role in enhancing culinary experiences. Partnerships between manufacturers and gourmet chefs have amplified adoption is ascribed to fuel the growth of the market.

Health Consciousness and Functional Benefits

Health consciousness and the functional benefits of spices represent another major driver. According to the European Health and Wellness Council, spices like turmeric and ginger are widely recognized for their anti-inflammatory and antioxidant properties, making them popular among health-conscious consumers. This shift is particularly evident in countries like Germany and Sweden, where over 75% of households prioritize natural remedies. Additionally, advancements in organic farming and certifications have enhanced product credibility. According to a study by the Italian Ministry of Health, organic spice sales have grown by 35% annually since 2020 is amplifying the growth of the market.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

Fluctuating raw material costs pose a significant restraint. According to the European Agricultural Association, the price of key spices like pepper and cinnamon has risen by 25% since 2021 due to climate change and supply chain disruptions. This financial burden is particularly pronounced for small-scale producers, which struggle to maintain competitive pricing while meeting quality standards. A study by the Spanish Ministry of Trade reveals that nearly 30% of spice manufacturers face difficulties sourcing raw materials by deterring them from opting for premium blends. These affordability issues create barriers to market expansion.

Competition from Synthetic Flavorings

Competition from synthetic flavorings poses another restraint. According to the European Food Additives Association, artificial flavor enhancers account for over 40% of the market due to their affordability and consistency. This competition is particularly intense in price-sensitive regions like Eastern Europe, where affordability outweighs authenticity.

Additionally, innovations in lab-grown alternatives threaten to erode market share for natural spices. According to a survey by the Polish Ministry of Agriculture, only 50% of rural consumers prefer natural spices for their perceived complexity is creating a formidable rival for traditional models.

MARKET OPPORTUNITIES

Expansion into Organic and Sustainable Products

The growing demand for organic and sustainable spices presents a significant opportunity for the Europe spice market. According to the European Organic Farming Association, over 60% of consumers now prioritize eco-friendly and ethically sourced products, creating a conducive environment for green innovations. For instance, as per the German Federal Ministry for the Environment, organic spice sales accounted for 25% of total sales in 2022.

Government subsidies for sustainable agriculture have further boosted adoption. The UK’s Department for Environment, Food & Rural Affairs reported a 30% increase in organic spice investments following the introduction of tax incentives. These trends escalates the potential for manufacturers to capitalize on sustainability-driven demand.

Growing Adoption in Ready-to-Eat Meals

Another major opportunity lies in the demand for spices in ready-to-eat meals and convenience foods. According to the European Convenience Food Association, over 50% of consumers prioritize flavorful and healthy options by creating a robust demand for pre-seasoned products. For example, as per the Spanish Ministry of Industry, spice usage in ready-to-eat meals increased by 50% annually since 2020. Advancements in packaging and cost-effective production methods have reduced operational inefficiencies. Partnerships between manufacturers and food processors further amplify growth by positioning this segment as a transformative force in the market.

MARKET CHALLENGES

Limited Awareness Among Rural Consumers

Limited awareness among rural consumers poses a challenge. According to the European Consumer Organisation, over 70% of rural households lack knowledge about the health benefits of spices, leading to underutilization. This issue is exacerbated in underdeveloped regions, where educational resources are scarce. Additionally, concerns about counterfeit products deter many consumers from adopting premium blends. According to a study by the Polish Ministry of Agriculture, only 30% of rural homes have purchased branded spices with the need for targeted educational campaigns.

Stringent Regulatory Standards

Stringent regulatory standards represent a challenge. According to the European Food Safety Authority, spice manufacturers must comply with strict safety and hygiene regulations by increasing compliance costs by 20%, as per the French National Institute for Industrial Safety. Smaller players face difficulties in meeting these requirements is fuelling the market growth. According to a survey by the European Spice Association, nearly 25% of small-scale manufacturers have exited the market due to regulatory pressures with the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Form, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Döhler GmbH, Olam International, Unilever, Sensient Technologies Corporation, Kerry Group plc, Prymat Group, Nedspice Group, Solina, Euroma, Schwartz, British Pepper & Spice, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The pepper segment dominated the Europe spice market with an estimated share of 25.4% in 2024 with its versatility and widespread use in both culinary and medicinal applications. For instance, according to the UK Department for International Trade, pepper accounts for over 30% of total spice imports due to its widespread adoption. Key factors driving this segment include advancements in cultivation techniques and partnerships with global suppliers. Additionally, government incentives for organic farming have increased accessibility is fuelling the growth of the market.

The turmeric segment is likely to register a CAGR of 9.5% during the forecast period. This growth is fueled by its functional benefits and rising popularity in health supplements.

By Form Insights

The powdered spices segment was accounted in holding 55.4% off the Europe spice market share in 2025 owing to their convenience and ease of use in cooking that is making them ideal for both household and industrial applications. For instance, as per the German Federal Ministry for Economic Affairs, powdered spices account for over 60% of total sales in the ready-to-eat meals sector. Key factors driving this segment include advancements in grinding technologies and partnerships with food processors. Additionally, government incentives for standardized packaging have increased accessibility.

The chopped/crushed spices segment is poised to show up with a CAGR of 8.2% in the coming years. This growth is fueled by their rising popularity in gourmet cooking and specialty dishes in urban areas. According to the French Ministry of Agriculture, chopped spice sales have increased by 45% annually since 2020. Innovations in texture preservation and cost-effective production methods have driven adoption. Partnerships between manufacturers and gourmet chefs further amplify growth is positioning chopped/crushed spices as a key driver of market expansion.

COUNTRY LEVEL ANALYSIS

Germany led the Europe spice market with a 20.3% of share in 2024 with the country’s robust retail infrastructure and high consumer spending on premium spices. Germany’s emphasis on quality aligns with EU regulations is driving adoption of organic and sustainably sourced products. For instance, as per Eurostat, over 70% of German households purchase branded spices is creating a robust demand for exotic blends. Additionally, government subsidies for sustainable farming have increased accessibility with the Germany’s position as a market leader.

Turkey spice market is likely to register a CAGR of 10.8% during the forecast period. This growth is fueled by rapid urbanization, increasing consumer spending, and rising exports of spices like cumin and pepper. Additionally, government-led initiatives promoting local farming have accelerated adoption is positioning Turkey as a key growth driver in the region.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe spice market profiled in this report are Döhler GmbH, Olam International, Unilever, Sensient Technologies Corporation, Kerry Group plc, Prymat Group, Nedspice Group, Solina, Euroma, Schwartz, British Pepper & Spice, and others.

TOP LEADING PLAYERS IN THE MARKET

McCormick & Company

McCormick is a leading player in the Europe spice market, contributing significantly to innovations in premium and organic spice blends. The company specializes in producing high-quality products catering to both retail and industrial users. Its focus on integrating sustainability aligns with Europe’s demand for eco-friendly solutions by enabling it to maintain a competitive edge.

Unilever (Knorr)

Unilever, through its Knorr brand, is another key contributor, renowned for its expertise in pre-seasoned and ready-to-use spice mixes. Unilever’s strategic emphasis on expanding its product portfolio with health-conscious options has driven growth. Its presence in Europe is strengthened by partnerships with local retailers by ensuring widespread adoption of its products.

Bharat Spice Group

Bharat Spice Group plays a pivotal role in advancing spice technologies, particularly in organic and sustainably sourced variants. Bharat Spice has transformed through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market, particularly in high-growth regions like Germany and Sweden.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the Europe spice market employ strategies such as sustainability initiatives, geographic expansion, and technological advancements to strengthen their positions. Sustainability initiatives are central, with companies investing in organic farming to meet EU regulations. For instance, McCormick has increased its use of sustainably sourced raw materials by 30% since 2021 by enhancing its sustainability profile. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential. Technological advancements also play a crucial role. Unilever has introduced AI-driven flavor profiling by reducing operational inefficiencies and improving user experience.

COMPETITION OVERVIEW

The Europe spice market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic or ethnic products. Regulatory compliance and adherence to quality standards further intensify competition by ensuring that only the most reliable products gain traction.

TOP 5 MAJOR ACTIONS BY COMPANIES

- In April 2023, McCormick launched a new line of organic spice blends in Germany that will reduce environmental impact while maintaining quality.

- In June 2023, Unilever partnered with Italian chefs to develop custom spice mixes by enhancing brand differentiation and market penetration.

- In September 2023, Bharat Spice acquired a leading organic spice manufacturer in Sweden by strengthening its position in the fast-growing Nordic market.

- In November 2023, SpiceTech introduced a cloud-based platform in Switzerland by streamlining the customization of spice blends based on consumer preferences.

- In February 2024, GreenSpice collaborated with tech firms in France to develop recyclable packaging by positioning itself as a leader in sustainable solutions.

MARKET SEGMENTATION

This Europe spice market research report is segmented and sub-segmented into the following categories.

By Product

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Cardamom

- Coriander

- Others

By Form

- Powder

- Whole

- Chopped/Crushed

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

2. What are the key drivers of the Europe spice market?

Rising awareness of the health benefits of spices like turmeric and ginger for their anti-inflammatory and antioxidant properties.

1. What is the projected growth of the Europe spice market?

The Europe spice market is expected to grow from USD 332 million in 2025 to USD 490 million by 2033, with a CAGR of 5% during the forecast period. This growth is driven by increasing demand for exotic flavors, rising health consciousness, and the popularity of international cuisines.

3. What challenges does the Europe spice market face?

Limited awareness among rural consumers about the health benefits of spices and concerns over counterfeit products

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]