Europe Smart Meters Market Size, Share, Trends & Growth Forecast Report By Type (Electric Smart Meters, Water Smart Meters),Component, Technology, Communication Technology, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Smart Meters Market Size

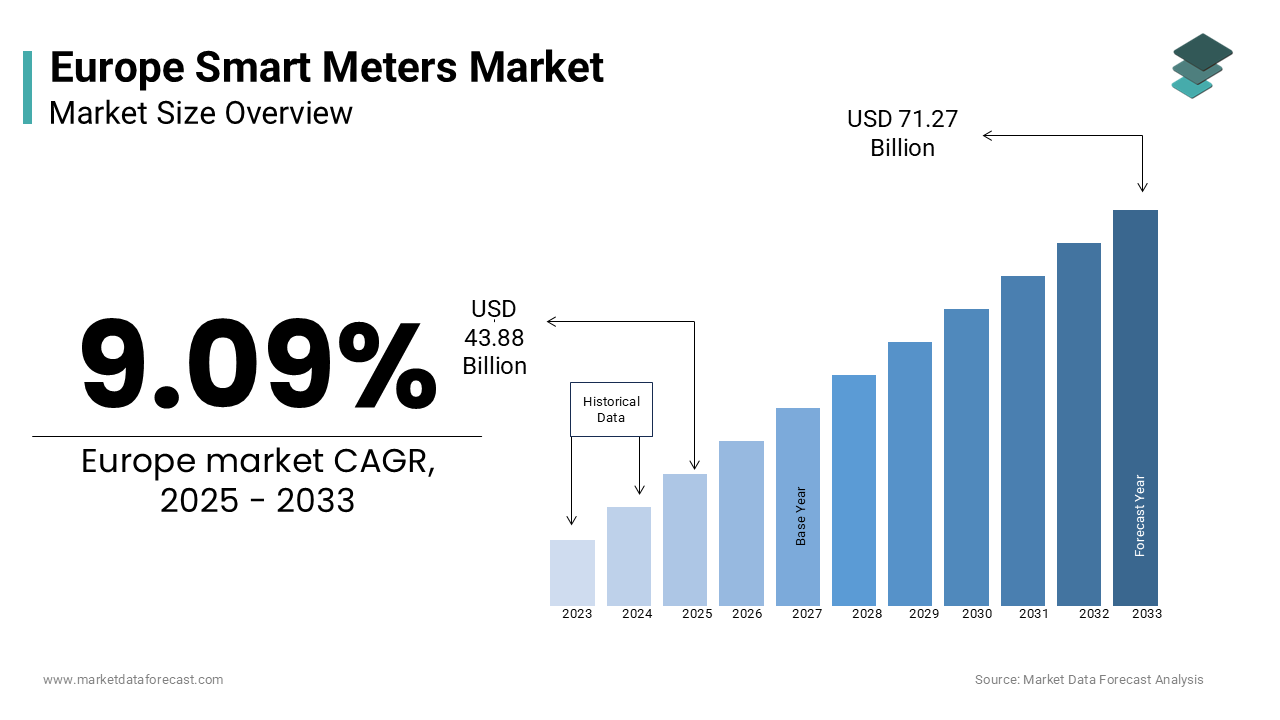

The europe smart meters market was worth USD 7.58 billion in 2024. The europe market is estimated to grow at a CAGR of 9.09% from 2025 to 2033 and be valued at USD 16.59 billion by the end of 2033 from USD 87.27 billion in 2025.

The Europe smart meters market has established a robust presence and is driven by regulatory mandates, technological advancements, and the growing emphasis on energy efficiency. According to the European Commission, over 70% of EU households are expected to be equipped with smart meters by 2025, reflecting the region's commitment to modernizing its energy infrastructure. Also, the market is further bolstered by initiatives like the European Green Deal, which aims to achieve carbon neutrality by 2050. Germany, France, and the UK collectively account for nearly 60% of the total market revenue, supported by their well-developed smart grid ecosystems and high adoption rates of advanced metering technologies. Additionally, rising consumer awareness about energy conservation and real-time monitoring has created a favorable environment for sustained growth in the smart meters market.

MARKET DRIVERS

Regulatory Mandates and Government Initiatives

Government regulations and mandates play a pivotal role in driving the adoption of smart meters across Europe. As per the European Union’s Energy Efficiency Directive, member states are required to roll out smart metering systems to at least 80% of households by 2030. This directive has accelerated investments in smart grid infrastructure, particularly in countries like Italy and Spain, where utility companies have already deployed millions of units. For instance, Enel, Italy’s largest utility provider, has installed over 32 million smart meters as part of its national rollout program, as per the Italian Energy Authority. These regulatory frameworks not only ensure widespread adoption but also create a predictable demand pipeline is encouraging manufacturers to innovate and scale production.

Rising Demand for Energy Efficiency and Conservation

The increasing focus on energy efficiency and conservation is another key driver of the Europe smart meters market. Based on the European Environment Agency, residential energy consumption accounts for approximately 25% of total energy use in Europe is showcasing the need for smarter energy management solutions. Smart meters enable real-time monitoring and data analytics, empowering consumers to optimize their energy usage and reduce costs. For example, British Gas reported a 15% reduction in household energy consumption among users who actively engaged with their smart meter data, as noted by the UK Energy Savings Trust. Additionally, utilities benefit from improved load balancing and reduced operational inefficiencies, further amplifying demand for smart metering systems.

MARKET RESTRAINTS

High Initial Deployment Costs

One of the primary restraints in the Europe smart meters market is the high initial deployment cost, which poses challenges for utility providers and governments. This financial burden is particularly significant for smaller utilities operating in rural or economically disadvantaged areas. Also, the lack of standardized reimbursement policies across EU member states often excludes subsidies for large-scale deployments, further limiting market penetration. While larger utilities can absorb these costs, smaller players struggle to justify the investment, creating disparities in access to advanced metering technologies.

Data Privacy and Cybersecurity Concerns

Data privacy and cybersecurity concerns present another significant challenge for the smart meters market. As per the European Data Protection Board, smart meters collect vast amounts of sensitive consumer data, raising concerns about unauthorized access and misuse. For instance, a 2022 study by the European Cybersecurity Organization revealed that over 30% of smart meter installations were vulnerable to cyberattacks, potentially compromising user privacy and grid security. These risks deter some consumers and utilities from adopting smart metering systems, particularly in regions with weak regulatory frameworks for data protection. Addressing these concerns requires significant investments in encryption technologies and compliance measures, which further increases operational costs.

MARKET OPPORTUNITIES

Integration with IoT and Smart Grid Technologies

The integration of smart meters with IoT-enabled devices and smart grid technologies presents a transformative opportunity for the Europe smart meters market. The European Smart Grid Task Force states that over 40% of smart meter deployments in 2022 included IoT functionalities, enabling real-time data exchange and predictive maintenance. Such as, Siemens’ smart metering solutions integrate with cloud-based platforms to provide utilities with actionable insights into energy consumption patterns, as stated by the German Federal Network Agency. Also, the rise of home automation systems has created opportunities for interoperable smart meters that enhance user convenience and energy efficiency. These advancements align with Europe’s digital transformation goals, ensuring steady market growth.

Expansion into Emerging Markets

Emerging markets in Eastern Europe, such as Poland, Romania, and Hungary, offer significant growth opportunities for the smart meters industry. Based on the European Bank for Reconstruction and Development, these countries are investing heavily in modernizing their energy infrastructure to meet EU standards. Such as, Poland’s National Energy Conservation Agency plans to install over 8 million smart meters by 2025, driven by EU funding and local government initiatives. Apart from these, the growing adoption of renewable energy sources, such as solar and wind, has increased demand for advanced metering systems capable of integrating distributed energy resources. By establishing localized service hubs and partnerships with regional utilities, companies can effectively tap into these burgeoning markets.

MARKET CHALLENGES

Limited Consumer Awareness and Engagement

Despite widespread deployment, limited consumer awareness and engagement remain significant challenges for the Europe smart meters market. Many households fail to fully utilize the capabilities of smart meters due to a lack of understanding or perceived complexity, as brought to light in a survey conducted by the European Consumer Organization. This reluctance to engage with smart meter data hampers efforts to achieve energy savings and reduces the overall impact of metering systems. Additionally, the absence of standardized guidelines for educating consumers complicates decision-making for utilities. Without adequate outreach programs and hands-on demonstrations, the full potential of smart meters cannot be realized, posing a barrier to widespread adoption.

Supply Chain Disruptions and Component Shortages

The Europe smart meters market is vulnerable to supply chain disruptions, exacerbated by geopolitical tensions and economic uncertainties. For instance, the ongoing semiconductor shortage has impacted the production of communication modules used in smart meters, according to a report by the European Semiconductor Industry Association. Furthermore, fluctuations in raw material prices, particularly for metals like copper and aluminum, have increased manufacturing costs. These challenges are compounded by logistical bottlenecks, which delay product deliveries and disrupt installation schedules. Such disruptions not only affect manufacturers but also strain utility providers who rely on timely access to critical components.

SEGMENTAL ANALYSIS

By Type Insights

The electric smart meters segment became the most dominant category of the Europe smart meters market by holding 65.2% of the total share in 2024. The dominance is influenced by their critical role in enabling real-time energy monitoring and billing accuracy. For instance, electric smart meters are extensively used in residential applications, where they provide detailed insights into consumption patterns and facilitate dynamic pricing models. As per the UK Office of Gas and Electricity Markets, over 15 million electric smart meters were installed in the UK alone by 2022, underscoring their widespread adoption. Also, advancements in communication technologies, such as cellular and PLC, have enhanced their functionality, solidifying their prime position.

The water smart meters segment is the fastest-growing segment, with a projected CAGR of 12.5%. The progress is fueled by increasing water scarcity concerns and the need for efficient resource management. For example, water smart meters enable utilities to detect leaks and monitor consumption in real-time, reducing wastage and operational costs. According to a study by the European Environmental Agency, over 20% of water losses in urban areas are attributed to undetected leaks, creating a strong case for smart meter adoption. Further, government incentives promoting sustainable water management have accelerated deployment is ensuring sustained growth in this segment.

By Component Insights

The Hardware segment prevailed in the Europe smart meters market by accounting for a substantial share in 2024. Its dominance is driven by the physical components required for metering systems, such as sensors, communication modules, and display units. For instance, hardware components are essential for enabling real-time data collection and transmission, making them indispensable in all types of smart meters. The European Technology Platform for SmartGrids states that over 90% of smart meter installations include hardware upgrades to support advanced functionalities. In addition, advancements in miniaturization and energy-efficient designs have further amplified demand is strengthening its main position

The software segment is the rapidly advancing in the market, with a calculated CAGR of 14.2% and is fueled by the increasing adoption of cloud-based platforms and data analytics tools for energy management. For example, software solutions enable utilities to analyze consumption patterns, predict demand, and optimize grid operations. Based on a study by the European Smart Grid Task Force, over 50% of smart meter deployments in 2022 included integrated software platforms are spotlighting its rapid adoption. Besides, government initiatives promoting digital transformation have accelerated software adoption, particularly in rural areas where access to advanced metering systems is limited.

By Technology Insights

The AMI segment commanded the Europe smart meters market by contributing a major portion of the total share in 2024. The performance is driven by its ability to provide two-way communication between utilities and consumers, enabling real-time data exchange and remote control. For instance, AMI systems are widely used in commercial and industrial applications, where they facilitate dynamic pricing and load balancing. According to the French Energy Regulatory Commission, over 80% of smart meter installations in France utilize AMI technology, underscoring its widespread adoption. Additionally, advancements in IoT and cloud computing have enhanced its functionality, further amplifying demand.

AMR is the quickest segment, with a calculated CAGR of 10.8%. The progress is fueled by its cost-effectiveness and ease of deployment and is making it suitable for small-scale applications. For example, AMR systems are increasingly being adopted in rural areas, where they enable utilities to monitor consumption without requiring extensive infrastructure upgrades. Findings by the European Rural Energy Network indicates that over 30% of rural households in Eastern Europe utilize AMR technology is showcasing its rapid adoption. Also, government incentives promoting energy efficiency have accelerated deployment is ensuring sustained growth in this segment.

By Communication Technology Insights

The PLC segment secured the top spot in the Europe smart meters market by accounting for 55.1% of the total share in 2024 owing to its ability to leverage existing power lines for data transmission, reducing infrastructure costs. Such as, PLC systems are widely used in residential applications, where they enable seamless integration with existing electrical grids. The German Federal Network Agency states over 60% of smart meter installations in Germany utilize PLC technology is showcasing its widespread adoption. Also, advancements in signal processing and noise reduction have enhanced its reliability, further amplifying demand.

Cellular communication technology is the fastest-growing segment, with a projected CAGR of 15.3% which is due to its scalability and compatibility with IoT-enabled devices. This is making it suitable for diverse applications. For example, cellular systems are increasingly being adopted in urban areas, where they enable high-speed data transmission and real-time monitoring. According to a study by the European Smart Grid Task Force, over 40% of new smart meter deployments in 2022 utilized cellular technology is emphasizing its rapid adoption. Besides these, government initiatives promoting 5G integration have accelerated deployment is ensuring sustained growth in this segment.

By End User Insights

The residential applications segment was the most popular end-user segment and held a 61.4% of the total share in 2024. The position in the market is caused by government mandates and consumer demand for energy-efficient solutions. For instance, residential smart meters enable households to monitor and optimize their energy usage, reducing costs and environmental impact. According to the UK Energy Savings Trust, over 70% of households equipped with smart meters reported a reduction in energy consumption, underscoring their widespread adoption. Additionally, advancements in user-friendly interfaces have enhanced consumer engagement, further amplifying demand.

The industrial applications are the swiftest one to expand with a projected CAGR of 13.7% because of the increasing adoption of renewable energy sources and the need for precise energy management. Like, industrial smart meters enable real-time monitoring of energy flows and predictive maintenance, reducing operational inefficiencies. Based on a study by the European Manufacturing Association, over 30% of large-scale industrial facilities utilize smart metering systems are focusing their rapid adoption. Also, government incentives promoting sustainable practices have accelerated deployment, ensuring sustained growth in this segment.

REGIONAL ANALYSIS

Germany held the largest market share and accounted for 27.3% of the European smart meters market in 2024. This performance is caused by its robust regulatory framework and strong emphasis on energy efficiency. According to the German Federal Network Agency, over 10 million smart meters were installed by 2022 is driven by the country’s commitment to achieving carbon neutrality by 2045. Germany’s well-developed smart grid infrastructure and high adoption rates of renewable energy sources further amplify demand. For instance, Siemens’ smart metering solutions are widely used in residential and industrial applications, enabling real-time monitoring and load balancing. Additionally, government incentives promoting digital transformation have accelerated deployment, ensuring sustained growth.

The UK is the fastest-growing smart meters market in Europe, with a projected CAGR of 10.9% from 2025 to 2033. The country’s progress is due to its ambitious rollout program, which aims to equip every household with a smart meter by 2025. As per the UK Office of Gas and Electricity Markets, over 15 million smart meters were operational by 2022 exhibiting the program’s success. The UK’s focus on dynamic pricing models and consumer engagement has further amplified adoption. For example, British Gas reported a 15% reduction in household energy consumption among users who actively engaged with their smart meter data, as noted by the Energy Savings Trust. These factors solidify the UK’s position as a key player in the regional market.

France is expected to maintain a steady CAGR in the Europe smart meters market which is driven by its large-scale AMI (Advanced Metering Infrastructure) deployment initiatives. As per the French Energy Regulatory Commission, over 35 million Linky smart meters were installed by 2022 is covering nearly 95% of households. France’s emphasis on reducing energy losses and improving grid efficiency has propelled demand for advanced metering systems. Such as, Enedis, the country’s primary utility provider, leverages smart meters to enable real-time data exchange and predictive maintenance, reducing operational inefficiencies. Also, government policies promoting sustainable energy practices have accelerated adoption, ensuring steady market growth.

Italy’s market is growing at a moderate pace and is bolstered by its early adoption of smart metering technologies and extensive infrastructure upgrades. According to the Italian Energy Authority, over 32 million smart meters were deployed by 2022 is making Italy one of the pioneers in Europe. The country’s aging electrical grid and high energy losses necessitate advanced solutions for efficient resource management. For example, Enel’s Telegestore project enabled remote monitoring and control, reducing energy theft and operational costs. Besides these, Italy’s focus on integrating renewable energy sources has increased demand for interoperable smart meters, propelling market expansion.

Spain’s growth is expected to stabilize. It is supported by its rapid modernization of energy infrastructure. According to Red Eléctrica de España, over 10 million smart meters were installed by 2022, driven by EU mandates and local government initiatives. Spain’s emphasis on reducing carbon emissions and promoting energy efficiency has further amplified demand. For instance, Endesa utilizes smart meters to enable dynamic pricing and real-time monitoring, enhancing consumer engagement. Additionally, government subsidies for renewable energy projects have created opportunities for advanced metering systems, ensuring sustained growth.

KEY MARKET PLAYERS AND COMPETITIVE ANALYSIS

Kamstrup A/S, Aclara Technologies, Honeywell International Inc., Landis+Gyr, Siemens AG, Sagemcom, Itron Inc., Schneider Electric are some of the key market players in the Europe smart meters market.

The Europe smart meters market is highly competitive, driven by government mandates for energy efficiency, increasing adoption of renewable energy, and the need for real-time energy monitoring. Key players include global technology giants like Siemens, Schneider Electric, and Landis+Gyr, alongside regional manufacturers such as Itron and Kamstrup. The market benefits from supportive EU policies, including the rollout of smart metering systems to achieve energy conservation targets. Companies are investing in advanced technologies like IoT, AI, and cloud-based platforms to enhance data analytics and grid management capabilities. Strategic partnerships with utility providers and governments are common to ensure large-scale deployments. Additionally, SMEs are entering the market with cost-effective and innovative solutions, intensifying competition. The competitive landscape is shaped by innovation, regulatory compliance, and efforts to address cybersecurity concerns. Overall, the focus remains on improving energy efficiency, reducing operational costs, and enabling smarter energy consumption through cutting-edge smart metering solutions.

Top Players in the Europe Smart Meters Market

Landis+Gyr

Landis+Gyr is a global leader in the smart meters market, renowned for its innovative solutions tailored to diverse applications. The company’s Gridstream Connect platform integrates IoT-enabled devices and cloud-based analytics, enabling utilities to optimize energy distribution and reduce operational costs. Landis+Gyr’s strategic partnerships with European utility providers have strengthened its presence across the continent. Its commitment to sustainability ensures high customer retention, making it a preferred choice for industries seeking reliable and scalable solutions.

Itron Inc.

Itron is a key player in the Europe smart meters market, offering a wide range of products designed for energy and water management. The company’s expertise lies in developing IoT-enabled systems that integrate with smart grid technologies, enabling utilities to optimize operations and reduce costs. Itron’s acquisition of smaller firms specializing in data analytics has enhanced its product offerings, allowing it to cater to evolving customer demands. By leveraging its global network, Itron continues to expand its footprint in emerging markets across Europe, addressing unmet needs effectively.

Schneider Electric

Schneider Electric is a prominent name in the smart meters market, known for its precision-engineered solutions designed for industrial and commercial applications. The company’s EcoStruxure platform integrates hardware and software components, providing actionable insights into energy consumption patterns. Schneider Electric’s collaborations with local distributors and contractors have enabled it to establish a strong presence in Eastern Europe. Its reputation for affordability and performance ensures steady growth, making it a trusted partner for industries requiring advanced metering systems.

Top Strategies Used by Key Players in the Europe Smart Meters Market

Product Innovation and Technological Advancements

Leading companies in the European smart meters market are prioritizing product innovation by integrating AI-driven analytics, real-time data processing, and IoT connectivity into their smart metering solutions. These advanced features enable remote monitoring, predictive maintenance, and automated demand response, helping both consumers and utility providers optimize energy consumption. Additionally, the development of next-generation smart meters with improved cybersecurity protocols and enhanced interoperability ensures compliance with evolving EU regulations. By focusing on technological advancements, companies aim to address critical industry challenges, such as grid stability, energy theft prevention, and seamless integration with renewable energy sources.

Strategic Collaborations and Partnerships

Key industry players are forming strategic alliances with utility companies, government agencies, and technology firms to accelerate the adoption of smart metering solutions. These partnerships help in co-developing advanced metering infrastructure (AMI), securing large-scale deployment contracts, and integrating smart meters with evolving energy management systems. For instance, collaborations with grid operators and energy regulators facilitate smoother policy implementation, while partnerships with AI and data analytics firms improve meter intelligence and predictive capabilities. By working closely with stakeholders across the value chain, companies ensure efficient rollouts, compliance with regional energy mandates, and enhanced customer engagement.

Expansion into Emerging Markets

With Western Europe nearing saturation in smart meter adoption, companies are increasingly focusing on emerging markets in Eastern Europe, such as Poland, Romania, and the Baltic states, where smart grid modernization efforts are gaining momentum. Expanding into these regions involves setting up localized manufacturing facilities, strengthening distribution networks, and establishing dedicated service hubs to ensure timely installation, maintenance, and customer support. Additionally, governments in these countries are introducing funding programs and regulatory incentives to accelerate smart meter deployment, making them attractive markets for expansion. By investing in regional infrastructure, workforce training, and localized solutions, smart meter providers can establish a strong foothold in high-growth markets while contributing to Europe's broader energy transition goals.

REGIONAL ANALYSIS

- In January 2023, Siemens partnered with a German utility company to deploy smart meters across residential areas. This initiative aimed to enhance energy monitoring and reduce carbon emissions.

- In March 2023, Schneider Electric acquired a French startup specializing in IoT-enabled energy management solutions. This acquisition was designed to integrate advanced analytics into its smart meter portfolio.

- In May 2023, Landis+Gyr launched a next-generation smart meter with enhanced cybersecurity features. This move aimed to address growing concerns about data protection in energy systems.

- In August 2023, Itron signed a contract with a UK utility provider to supply 1 million smart meters. This partnership sought to support the UK’s national smart meter rollout program.

- In November 2023, Kamstrup expanded its production facility in Denmark to meet rising demand for smart water and electricity meters. This expansion aimed to strengthen its leadership in the European market.

MARKET SEGMENTATION

This research report on the europe smart meters market is segmented and sub-segmented based on categories.

By Type

- Electric Smart Meters

- Water Smart Meters

By Component

- Hardware

- Software

By Technology

- AMI (Advanced Metering Infrastructure)

- AMR (Automated Meter Reading)

By Communication Technology

- PLC (Power Line Communication)

- Cellular

By End User

- Residential

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the smart meters market in Europe?

Key drivers include the shift towards smart grids, government mandates for energy efficiency, and increased adoption of renewable energy sources. Regulatory frameworks across the EU are pushing for real-time consumption data and reduced energy waste.

What are the emerging trends in the smart meters market?

Trends include integration with home automation, use of AI and machine learning for energy analytics, and deployment of 5G for faster data communication. There's also growing interest in prepaid and multi-utility smart metering.

What is the future outlook for the Europe Smart Meters Market?

The market is expected to grow rapidly with full-scale rollouts, policy support for decarbonization, and expansion of smart city infrastructure. By 2030, most European households are projected to have connected smart metering systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]