Europe Smart Lighting Market Size, Share, Trends, & Growth Forecast Report Segmented By Offering (Hardware, Software, and Services), Communication Technology, Application Type, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Smart Lighting Market Size

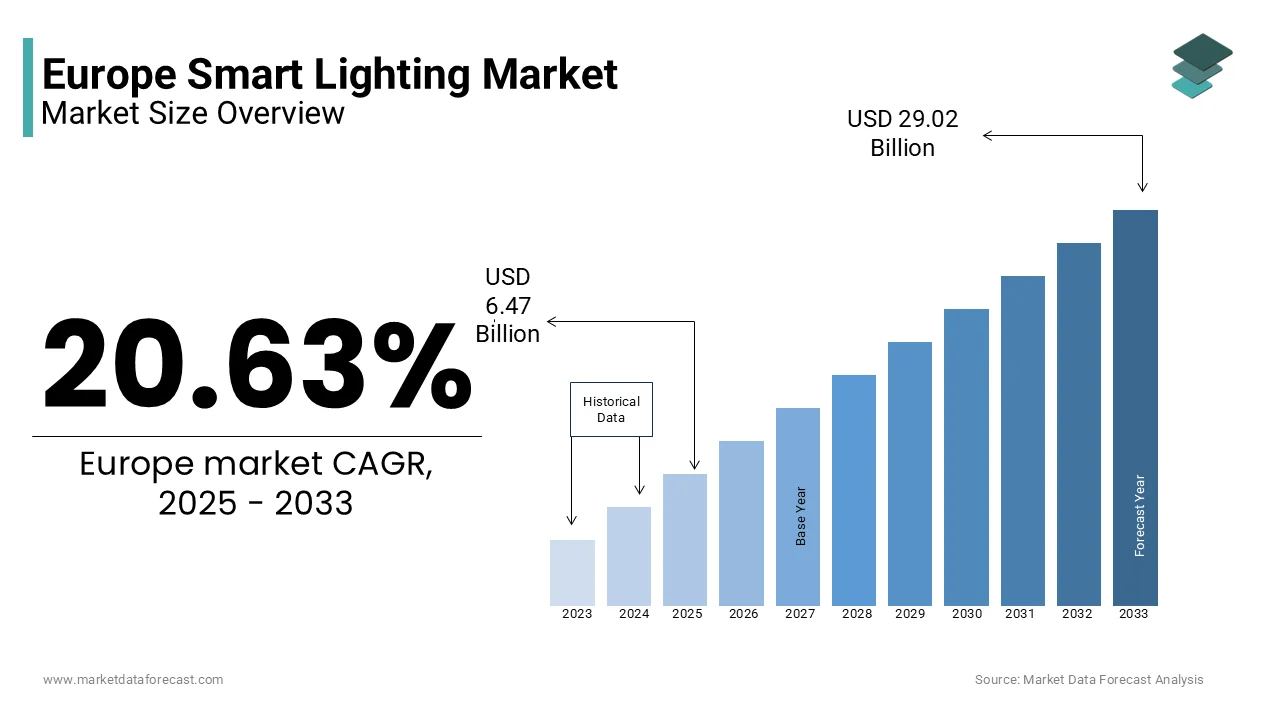

The Europe smart lighting market was valued at USD 5.37 billion in 2024. The European market is estimated to reach USD 29.02 billion by 2033 from USD 6.47 billion by 2025, rising at a CAGR of 20.63% from 2025 to 2033.

Smart lighting systems integrate intelligent controls and connectivity features and enable users to remotely manage lighting settings, optimize energy consumption, and enhance the overall ambiance of residential, commercial, and industrial spaces.

The demand for smart lighting solutions in Europe has been growing significantly from the last few years due to the rising demand for energy-efficient lighting solutions and the proliferation of smart home systems across Europe. Government initiatives, such as the European Green Deal and the Energy Performance of Buildings Directive (EPBD), have established stringent regulations aimed at reducing carbon emissions and energy consumption. These policies have spurred the adoption of smart lighting technologies that offer features like automated dimming, motion detection, and daylight harvesting, thereby optimizing energy usage in various settings. The increasing popularity of smart home systems further propels the market, with consumers seeking integrated solutions that enhance convenience, security, and lifestyle. Smart lighting systems, compatible with voice assistants like Alexa and Google Assistant, seamlessly integrate into this ecosystem, enabling remote and automatic control. Countries such as Germany, the United Kingdom, and France are leading in the adoption of these technologies, driven by innovation in IoT, improved internet access, and rising disposable incomes. Businesses are also leveraging smart lighting technology to optimize operations and enhance user experiences, contributing to the market's expansion.

MARKET DRIVERS

Stringent Energy Efficiency Regulations

The implementation of strict energy efficiency regulations by European governments is a key driver of the smart lighting market. The European Union's Eco-design Directive mandates minimum energy performance standards for lighting products, compelling manufacturers to develop energy-efficient solutions. Additionally, the Energy Performance of Buildings Directive (EPBD) requires EU member states to regulate energy-efficient lighting in new buildings and renovation projects, further accelerating the adoption of smart lighting systems in both residential and commercial sectors. These policies align with the EU’s sustainability goals of reducing carbon emissions and energy consumption. According to the European Environment Agency, primary energy consumption by end-users in the EU declined by 3.8% in 2023 compared to 2022, indicating steady progress toward energy efficiency targets.

Rising Adoption of Smart Home Systems

The growing popularity of smart home automation is another major factor driving the European smart lighting market. Consumers increasingly seek integrated home solutions that enhance convenience, security, and energy efficiency. Smart lighting systems, often compatible with voice assistants like Amazon Alexa and Google Assistant, enable seamless remote control and automation, making them a key component of modern smart homes. Countries such as Germany, the UK, and France are leading in smart home adoption, driven by advancements in IoT technology, improved internet access, and rising disposable incomes. In June 2023, Philips introduced a new range of LED lights designed for outdoor applications, reflecting the market’s response to the growing demand for smart home-integrated lighting solutions.

MARKET RESTRAINTS

High Installation and Maintenance Costs

The substantial initial investment required for smart lighting systems serves as a significant barrier to their widespread adoption in Europe. The installation of these systems often necessitates specialized equipment and professional expertise, leading to elevated costs. The need for qualified engineers to implement both wireless and wired solutions contributes to these heightened expenses. Additionally, ongoing maintenance demands further financial outlays, which can deter consumers and businesses from transitioning to smart lighting solutions. This financial burden is particularly prohibitive in emerging economies and rural areas, where budget constraints and limited access to technical expertise impede the deployment of advanced lighting technologies.

Security and Privacy Concerns

The integration of smart lighting systems into the Internet of Things (IoT) framework raises significant security and privacy issues. These systems are susceptible to cyber-attacks, potentially compromising user data and overall system integrity. The vulnerabilities in smart lighting infrastructure can be exploited by hackers, leading to unauthorized data access and control over lighting systems. Such security breaches not only undermine consumer confidence but also pose substantial risks to privacy, particularly in residential settings. Consequently, apprehensions regarding data security and privacy act as considerable deterrents to the adoption of smart lighting technologies across Europe.

MARKET OPPORTUNITIES

Expansion of Smart City Initiatives

The proliferation of smart city projects across Europe presents a significant opportunity for the smart lighting market. These initiatives aim to enhance urban living through the integration of advanced technologies, with smart lighting systems playing a pivotal role in improving energy efficiency and public safety. According to the European Commission, approximately 75% of Europe's population resides in urban areas, contributing significantly to the EU's energy consumption and greenhouse gas emissions. To address these challenges, countries such as Germany, France, Denmark, and Spain are implementing energy-efficient lighting systems to increase illumination quality while lowering total operational costs, thereby increasing demand for intelligent lighting products and services.

Technological Advancements and Innovation

Continuous technological advancements in lighting solutions offer substantial growth prospects for the European smart lighting market. The development of innovative products, such as dedicated LED luminaires and LED replacement smart bulbs, is emerging as a significant growth area in the lighting industry. Established manufacturers are expanding their product portfolios to enter the market, contributing to the growth of smart lighting solutions. The European Union's Eco-design Directive sets mandatory requirements for energy-related products, including lighting products, aiming to improve the environmental performance of products placed on the European market. This directive establishes minimum energy efficiency and performance standards for lighting products, including smart lighting solutions.

MARKET CHALLENGES

Interoperability and Standardization Issues

The European smart lighting market faces challenges related to interoperability and the lack of standardized protocols among various manufacturers. This fragmentation can lead to compatibility issues, hindering seamless integration of smart lighting systems with other smart home or building automation technologies. The diversity in communication standards and proprietary technologies complicates the deployment and scalability of smart lighting solutions across different platforms. This lack of uniformity can deter consumers and businesses from adopting smart lighting systems, as they may face difficulties in ensuring that products from different vendors work harmoniously together.

Limited Consumer Awareness and Education

Another significant challenge is the limited awareness and understanding among consumers regarding the benefits and functionalities of smart lighting systems. Many potential users remain uninformed about how these technologies can lead to energy savings, enhanced convenience, and improved environmental sustainability. The European Union has recognized this gap and, through initiatives like the European Green Deal, aims to promote energy-efficient technologies, including smart lighting. However, despite these efforts, a considerable portion of the population has yet to fully grasp the advantages of smart lighting, which hampers market growth. Educational campaigns and increased marketing efforts are essential to bridge this knowledge gap and encourage broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.63% |

|

Segments Covered |

By Offering, Communication Technology, Application Type, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Philips Lighting (The Netherlands), Hafele Group (Germany), Acuity Brands (USA), OSRAM (Germany), Cree (USA), Hubbell (USA), Zumtobel Group (Austria), Honeywell (USA), Legrand (France), Eaton (Ireland), Lutron Electronics (USA), and General Electric (USA). |

SEGMENTAL ANALYSIS

By Offering Insights

The hardware segment held the leading share of 69.5% in the European market in 2024. This dominance of hardware segment is due to the increasing adoption of energy-efficient lighting solutions and the integration of advanced sensor-based and wireless technologies in lighting systems. Hardware components form the foundation of smart lighting infrastructures, making them a crucial investment for smart cities, commercial spaces, and residential projects. Additionally, government regulations promoting LED adoption have further driven market growth.

The software segment is estimated to grow at the fastest CAGR of 22.1% over the forecast period. The rising demand for intelligent lighting control systems that enable automation, energy optimization, and remote management is fueling this growth. The integration of IoT and AI-based analytics in lighting systems enhances energy efficiency and improves user experience across residential, commercial, and industrial applications. As smart lighting solutions become more interconnected, the need for robust software platforms continues to expand.

By Communication Technology Insights

The wired technology segment captured 60.9% of the European market share in 2024 due to the established infrastructure in commercial and industrial sectors, where wired systems are preferred for their reliability and consistent performance. Wired connections offer stable communication and are less susceptible to interference, making them ideal for large-scale installations that require robust and secure networks. The preference for wired technology in these applications underscores its importance in delivering dependable smart lighting solutions across Europe.

Conversely, the wireless technology segment is anticipated to grow at the fastest CAGR 25.9% over the forecast period. This rapid growth is driven by the increasing demand for flexible and scalable lighting solutions in residential and small to medium-sized commercial applications. Wireless systems offer ease of installation, cost-effectiveness, and the ability to integrate with smart home ecosystems, making them attractive to consumers seeking convenient and adaptable lighting options. The advancement of wireless communication protocols and the growing adoption of Internet of Things (IoT) devices further contribute to the accelerated expansion of wireless smart lighting solutions in Europe.

By Application Type Insights

The indoor segment had the largest share of the European market in 2024. This dominance is driven by the widespread adoption of smart lighting solutions in office buildings, retail spaces, and industrial facilities, aiming to enhance energy efficiency and reduce operational costs. The European Union's stringent energy efficiency regulations, such as the Energy Performance of Buildings Directive (EPBD), mandate improved energy performance in commercial buildings, further propelling the adoption of smart lighting systems. These systems offer advanced features like automated controls and energy monitoring, aligning with the EU's sustainability goals.

The outdoor segment is estimated to progress at the highest CAGR of 20.8% from 2025 to 2033. This rapid expansion is attributed to increasing investments in smart city initiatives across Europe, focusing on enhancing public safety and energy efficiency. Smart lighting systems in public areas, such as parks and squares, offer benefits like adaptive lighting and energy savings. The European Commission's emphasis on sustainable urban development supports this trend, encouraging municipalities to implement intelligent lighting solutions in public spaces.

REGIONAL ANALYSIS

Germany occupied for the largest share of the European smart lighting market in 2024 due to its strong emphasis on energy efficiency and sustainability. The country has implemented strict regulations under the Energy Performance of Buildings Directive (EPBD), driving widespread adoption of smart lighting in residential and commercial sectors. Smart city initiatives and government incentives for energy-efficient solutions further accelerate market growth. With a well-developed infrastructure and continuous investments in digital transformation, Germany remains at the forefront of smart lighting advancements in Europe.

The United Kingdom is a leading player in the European smart lighting market, driven by the increasing demand for smart home automation and energy-efficient solutions. Government incentives and strict regulations aimed at reducing carbon emissions have propelled the adoption of smart lighting in both commercial and residential sectors. The UK’s tech-savvy population and growing awareness of sustainability benefits have contributed to the expansion of smart lighting solutions. The integration of IoT-enabled lighting systems is further boosting market growth in smart cities and modern urban infrastructure.

France is a key contributor to the European smart lighting market, emphasizing sustainability and energy conservation. The Energy Transition for Green Growth Act has encouraged the widespread adoption of smart lighting solutions to reduce energy consumption in residential, commercial, and public sectors. Smart lighting plays a crucial role in the development of smart cities across France, with investments in advanced adaptive street lighting and connected lighting systems. Consumers are increasingly adopting automated lighting solutions to improve convenience, security, and efficiency, strengthening France’s position in the European market.

KEY MARKET PLAYERS

The major players in the Europe smart lighting market include Philips Lighting (The Netherlands), Hafele Group (Germany), Acuity Brands (USA), OSRAM (Germany), Cree (USA), Hubbell (USA), Zumtobel Group (Austria), Honeywell (USA), Legrand (France), Eaton (Ireland), Lutron Electronics (USA), and General Electric (USA).

TOP 3 PLAYERS IN THE MARKET

The European smart lighting market is led by Signify (Philips Lighting), Osram, and Lutron Electronics. Signify dominates the European smart lighting market. Osram excels in IoT-enabled lighting systems, achieving a 25% market share in smart city projects, as stated in their performance metrics. Lutron specializes in customizable and energy-efficient solutions, contributing significantly to the smart home segment. These players collectively drive innovation and shape the future of the smart lighting market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European smart lighting market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Signify launched a line of AI-driven smart lighting systems in 2022, designed to cater to the growing demand for personalized lighting experiences, as outlined in their innovation roadmap. Osram partnered with urban planners to promote its IoT-enabled lighting solutions, achieving a 20% increase in sales, as stated in their market strategy document. Lutron focused on expanding its customizable portfolio, investing €400 million to meet growing demand for energy-efficient solutions, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

COMPETITIVE LANDSCAPE

The European smart lighting market is highly competitive, characterized by the presence of global giants and regional innovators. Signify, Osram, and Lutron dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as smart homes and smart cities. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Signify launched a line of AI-driven smart lighting systems, designed to cater to personalized lighting trends in smart homes.

- In June 2023, Osram partnered with urban planners to promote its IoT-enabled lighting solutions, achieving a 20% increase in sales.

- In January 2024, Lutron acquired a startup specializing in energy-efficient lighting controls, aiming to expand its sustainable portfolio.

- In September 2023, iGuzzini collaborated with luxury real estate developers to integrate designer smart lighting into high-end projects, enhancing efficiency.

- In November 2023, Philips Lighting invested €300 million in expanding its solar-powered smart lighting facilities, focusing on renewable energy integration.

MARKET SEGMENTATION

This research report on the Europe smart lighting market is segmented and sub-segmented into the following categories.

By Offering

- Hardware

- Lights and Luminaires

- Lighting Controls

- Software

- Services

- Design and Engineering

- Installation

- Post-Installation

By Communication Technology

- Wired Technology

- Wireless Technology

By Application Type

- Indoor Application

-

- Residential

- Commercial

- Industrial

- Outdoor Application

-

- Highways and Roadways

- Architectural

- Public Places

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe smart lighting market?

The growth is primarily driven by increasing smart city initiatives, advancements in IoT technology, rising demand for energy-efficient lighting solutions, and government regulations promoting LED adoption.

What are the key applications of smart lighting in Europe?

Smart lighting is widely used in commercial buildings, residential homes, street lighting, industrial facilities, and public infrastructure to enhance energy efficiency and automation.

What are the most popular technologies used in smart lighting systems?

What are the most popular technologies used in smart lighting systems?

What is the future outlook for the Europe smart lighting market?

The market is expected to grow due to ongoing technological advancements, increasing adoption of AI and IoT, and the expansion of smart city projects across the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]