Europe Small Off Road Engines Market Size, Share, Trends & Growth Forecast Report – Segmented By Engine Displacement, No. of Cylinders, Drive Shaft Orientation, End Use, Distribution Channel, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Small Off-Road Engines Market Size

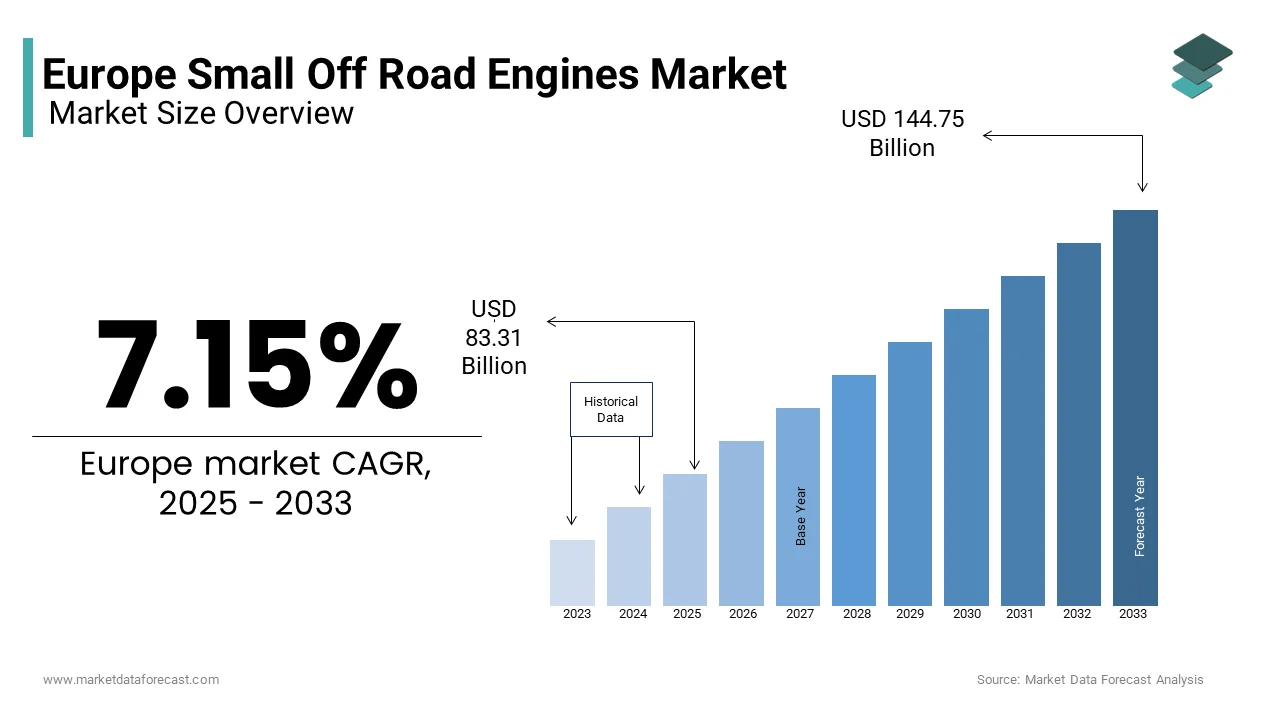

The Europe small off-road engines market size was valued at USD 77.75 billion in 2024 and is anticipated to reach USD 83.31 billion in 2025 from USD 144.75 billion by 2033, growing at a CAGR of 7.15% during the forecast period from 2025 to 2033.

These engines are defined as those with displacements below 25 cubic centimeters for handheld devices and up to 420 cubic centimeters for non-handheld equipment are integral to powering tools like lawnmowers, chainsaws, leaf blowers, generators, and compact tractors. The European SORE market has experienced steady growth due to increasing urbanization, rising demand for landscaping services, and the growing emphasis on sustainable agricultural practices.

The heightened focus on environmental regulations aimed at reducing emissions from combustion engines. The European Union’s stringent emission norms have pushed manufacturers to innovate by leading to the development of cleaner, fuel-efficient engines. The battery-powered electric alternatives are gaining traction in residential applications which is driven by consumer preference for quieter and eco-friendly solutions. Challenges persist including supply chain disruptions caused by geopolitical tensions and fluctuating raw material costs. The Europe small off-road engines market is poised for transformation by offering both opportunities and hurdles for stakeholders.

Market Drivers

Increasing Demand for Landscaping and Gardening Equipment

The rising demand for landscaping and gardening equipment stands as a pivotal driver of the Europe small off-road engines market. Urbanization has been a key contributor to this trend. As per Eurostat, over 75% of Europe’s population now resides in urban areas. This demographic shift has led to a heightened focus on maintaining outdoor spaces is boosting the sales of equipment such as lawnmowers, leaf blowers, and trimmers. Additionally, dual-income households increasingly outsourcing gardening services have further propelled demand. Government initiatives like the EU Green Cities program, which promotes sustainable urban greening projects, have also played a crucial role in driving this market segment.

Stringent Emission Regulations Driving Technological Advancements

Stringent emission regulations are another key factor that is driving the Europe small off-road engines market. According to the European Environment Agency, non-road mobile machinery contributes approximately 15% of total nitrogen oxide (NOx) emissions in the EU. According to the International Energy Agency, the low-emission small engines in Europe was increased by 20% between 2020 and 2023, which is driven by subsidies and incentives for eco-friendly machinery. For instance, countries like Germany and France offer tax benefits for adopting electric-powered equipment by accelerating the transition toward hybrid and electric variants. These regulatory frameworks not only ensure compliance with environmental goals but also foster technological advancements.

Supply Chain Disruptions and Rising Raw Material Costs

The ongoing challenge of supply chain disruptions and escalating raw material costs are restraining the growth rate of the Europe small off-road engines market. According to the European Commission’s Directorate-General, the manufacturing sector faced a 15% increase in raw material prices between 2021 and 2023 driven by geopolitical tensions and global trade uncertainties. Critical materials such as steel, aluminum, and copper, essential for engine production, have been particularly affected. According to the International Labour Organization, disruptions in semiconductor supply chains have delayed the production of advanced electronic components used in modern SORE systems. These challenges have led to increased production costs, with manufacturers passing some of the burden to consumers through higher prices. Smaller firms with limited financial resilience are struggling to compete that is also degrading the growth rate of the market's growth.

Environmental Concerns and Shift Toward Electric Alternatives

Another restraint is the growing environmental scrutiny on traditional combustion-based small off-road engines, which has accelerated the shift toward electric alternatives. According to the European Environment Agency, non-road machinery accounts for nearly 10% of particulate matter emissions in urban areas is prompting stricter regulations and consumer skepticism about fossil-fuel-powered equipment. According to the European Automobile Manufacturers' Association, the electric-powered gardening and landscaping tools sales grew by 25% from 2020 to 2023 with pressuring traditional engine makers to invest heavily in R&D for alternative technologies. However, the high upfront costs of electric engines and limited charging infrastructure in rural areas remain barriers. This shift has created uncertainty for stakeholders reliant on conventional engine sales that further restraining market expansion.

Growing Demand for Battery-Powered and Hybrid Engines

A significant opportunity in the Europe small off-road engines market lies in the increasing adoption of battery-powered and hybrid engines that is driven by the region's focus on sustainability. According to the European Environment Agency, electric-powered machinery could reduce carbon emissions from non-road equipment by up to 30% by 2030 with the EU’s Green Deal objectives. According to the European Investment Bank, investments in green technologies have surged by 40% since 2020, with manufacturers ramping up production of low-emission engines. The market’s growth is attributed to fueled by government subsidies and consumer demand for quieter and eco-friendly solutions.

Expansion of Aftermarket Services and Replacement Demand

The robust growth of aftermarket services and replacement demand in developing countries is esteemed to show case huge opportunities for the small off-road engines market. As per Eurostat, nearly 60% of the total revenue in this sector comes from aftermarket activities, including repairs, spare parts, and maintenance services. With the average lifespan of small off-road engines ranging between 5 to 10 years, the European Machinery Association estimates that replacement demand will account for approximately €3 billion annually by 2025. Additionally, the rise in DIY gardening and home improvement projects, particularly during post-pandemic recovery, has further boosted aftermarket sales. Governments across Europe are also encouraging local service providers to adopt digital tools for predictive maintenance, enhancing efficiency. This growing emphasis on after-sales support offers manufacturers and service providers a lucrative avenue to strengthen customer loyalty and expand their revenue streams.

High Initial Costs of Transitioning to Electric Engines

High initial cost associated with transitioning to electric and hybrid technologies is likely to be a challenging factor for the market growth rate. According to the European Investment Bank, developing advanced battery-powered engines requires significant capital investment, with R&D costs increasing by nearly 25% for manufacturers over the past three years. According to Eurostat, small and medium-sized enterprises (SMEs), which dominate this sector, often lack the financial resources to adopt these innovations by leaving them at a competitive disadvantage. According to the International Energy Agency, while electric engines are gaining traction, their upfront costs are approximately 40% higher than traditional combustion engines by deterring price-sensitive consumers. This financial barrier slows the pace of adoption in rural areas where affordability remains a key concern is hindering the widespread implementation of cleaner technologies.

Limited Charging Infrastructure for Electric Equipment

The inadequate charging infrastructure for electric-powered small off-road engines in rural and semi-urban regions is limiting the growth rate of the market. According to the European Automobile Manufacturers' Association, only 30% of rural households have access to reliable charging facilities is limiting the practicality of battery-operated machinery. According to the European Network of Transmission System Operators for Electricity, the current grid capacity in many regions is insufficient to support large-scale adoption of electric equipment during peak usage periods. This lack of infrastructure creates hesitation among consumers and businesses to invest in electric alternatives, despite their environmental benefits. The European Environment Agency warns that without substantial investments in expanding charging networks, the transition to low-emission engines could face delays, stalling progress toward the EU’s sustainability goals and constraining market growth for electric SORE solutions.

SEGMENTAL ANALYSIS

By Engine Displacement

The up to 100cc segment dominated the market and held 45% of Europe small off-road engines market share in 2024 due to its widespread use in handheld equipment like chainsaws and leaf blowers, which are essential for residential gardening and light commercial tasks. According to Eurostat, over 60% of households in urban areas invest in such tools. Its affordability and ease of maintenance make it highly accessible, particularly for DIY enthusiasts. The segment's importance lies in its ability to cater to the growing urban population, with urbanization rates exceeding 75% in Europe.

The 100-500cc segment is expected to witness a CAGR of 6.2% from2025 to 2033. This growth is fueled by increasing demand for versatile machinery like lawnmowers and compact tractors, which serve both landscaping professionals and agricultural applications. According to the European Environment Agency, stricter emission norms have pushed manufacturers to innovate within this range by making it more fuel-efficient and eco-friendlier. Additionally, the rise in sustainable farming practices has boosted its adoption, with agricultural activities contributing around 20% to the EU’s GDP. This segment’s rapid expansion is due to its pivotal role in balancing industrial productivity with environmental sustainability by positioning it as a key driver of future market dynamics.

By No. of Cylinders

The single-cylinder engine segment led the market by capturing 70% of the total Europe small off road engines market in 2024. This segment leads due to its affordability, simplicity, and suitability for lightweight applications like chainsaws, leaf blowers, and trimmers, which are widely used in residential gardening. According to the European Garden Machinery Association, over 80% of gardening tools sold annually feature single-cylinder engines is driven by their low maintenance costs and ease of use. Its importance lies in catering to urban households where space optimization and budget-friendly solutions are prioritized.

The double-cylinder engine segment is projected to register a CAGR of 5.8% from 2025 to 2033. This growth is fueled by increasing demand for medium-duty equipment such as lawnmowers, compact tractors, and generators, which require higher power output and fuel efficiency. Stricter emission regulations under the EU’s Stage V norms have encouraged manufacturers to innovate within this segment by enhancing performance while reducing environmental impact. According to the International Labour Organization, double-cylinder engines are pivotal in sustainable farming practices, with agriculture contributing around 20% to the EU’s GDP. Their ability to balance power, efficiency, and eco-friendliness makes them indispensable for professional landscapers and farmers by ensuring robust future growth.

By Drive Shaft Orientation

The horizontal shaft engine segment dominated the market and held 60% of the total Europe small off-road engines market in 2024 with its widespread use in popular equipment like lawnmowers, generators, and pressure washers, which are essential for residential and light commercial applications. According to the European Garden Machinery Association, over 70% of gardening tools sold annually feature horizontal shaft engines, driven by their affordability, ease of maintenance, and versatility. Its importance lies in catering to urban households and landscapers in densely populated areas where compact and efficient machinery is prioritized. This segment remains integral to meeting the growing demand for accessible and reliable equipment with urbanization rates exceeding 75% in Europe.

The vertical shaft engine segment is anticipated to witness the fastest CAGR of 5.2% during the forecast period. This growth is fueled by increasing demand for heavy-duty machinery in agriculture and construction, where vertical shaft engines provide superior torque and stability. According to the European Environment Agency, stricter emission regulations have pushed manufacturers to innovate within this segment by enhancing efficiency and reducing environmental impact. Additionally, the rise in sustainable farming practices has boosted adoption, with agriculture contributing around 20% to the EU’s GDP. Vertical shaft engines are critical for professional users requiring robust performance by making this segment vital for addressing industrial needs and ensuring long-term market expansion in key sectors.

By End Use

The gardening/landscaping segment was the largest segment and held 30% of the Europe small off-road engines market share in 2024 with the increasing demand for lawn care equipment like lawnmowers, trimmers, and leaf blowers in urban areas. According to the Eurostat, over 60% of European households engage in gardening activities with urbanization rates exceeding 75% by boosting demand for efficient tools. Its importance lies in supporting both professional landscapers and DIY enthusiasts, while aligning with the EU’s Green Cities initiative to promote sustainable urban spaces. This segment remains pivotal for driving market growth and consumer engagement with growing emphasis on well-maintained outdoor environments.

The agriculture segment is projected to experience the fastest CAGR of 4.8% from 2025 to 2033. This growth is fueled by the rising adoption of compact tractors and tillers, essential for sustainable farming practices. Stricter emission regulations under the EU’s Stage V norms have encouraged manufacturers to innovate by creating cleaner and more efficient engines. Additionally, government subsidies for eco-friendly machinery have accelerated adoption. The agriculture segment plays a critical role in driving technological advancements and long-term sustainability in the Europe small off road engines market.

By Distribution Channel

The OEM segment dominated the market and held 65% of Europe small off-road engines market share in 2024 owing to the steady demand for new machinery equipped with advanced engines in agriculture, landscaping, and construction industries. The European Environment Agency notes that stricter emission regulations under Stage V norms have pushed manufacturers to integrate cleaner and more efficient engines into new equipment, further boosting OEM sales. Additionally, government initiatives promoting sustainable practices have increased investments in modern machinery. Its importance lies in driving innovation and ensuring compliance with environmental standards by making it a cornerstone of the SORE market's growth trajectory.

The Aftermarket segment is expected to witness a CAGR of 5.1% from 2025 to 2033. This growth is fueled by the increasing demand for replacement parts, repairs, and maintenance services in rural areas where older machinery remains in use. According to the European Machinery Association, over 40% of small off-road engines require servicing or replacement within five years, driving aftermarket activities. Additionally, the rise in DIY gardening projects and home improvement trends has boosted demand for affordable spare parts. The aftermarket segment plays a critical role in sustaining long-term customer relationships and expanding revenue streams for manufacturers and service providers.

COUNTRY LEVEL ANALYSIS

Germany led the Europe small off road engines market with 25% of share in 2024. The growth is driven by the country’s robust manufacturing base and strong emphasis on sustainability in agriculture and landscaping sectors. According to the European Environment Agency, Germany accounts for over 20% of the EU’s agricultural output is creating significant demand for advanced machinery equipped with fuel-efficient engines. Additionally, government incentives for eco-friendly equipment have accelerated adoption. Germany’s well-established aftermarket network further strengthens its position is ensuring steady revenue from repairs and spare parts. With urbanization and green initiatives shaping consumer preferences, Germany remains pivotal in driving innovation and growth within the Europe small off road engines market.

France is likely to exhibit a CAGR of 18.5% of the market during the forecast period with thriving gardening and landscaping industries, supported by urbanization rates exceeding 80%. France’s focus on sustainable urban planning has increased demand for low-emission engines used in residential and commercial applications. According to the International Labour Organization, France’s agricultural sector, which contributes 15% to its GDP, also drives demand for compact tractors and tillers. Government subsidies for eco-friendly machinery and investments in smart farming technologies further bolster growth. France’s strategic emphasis on sustainability and modernization ensures its prominence in the SORE market.

Italy’s dominance is fueled by its strong gardening culture and widespread use of lawn care equipment in both urban and rural areas. According to the European Garden Machinery Association, Italy ranks among the top three countries in Europe for gardening tool sales which is driven by its aesthetic focus on outdoor spaces. Additionally, Italy’s agricultural sector which contributes 10% to its GDP that supports demand for efficient machinery like compact tractors. The Italian government’s push for renewable energy and emission reductions has encouraged manufacturers to innovate by enhancing market growth.

KEY MARKET PLAYERS

Briggs & Stratton, Chongqing Fuchai Industry Group, Chongqing Zongshen Power Machinery Co., Ltd., Greaves Cotton Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Liquid Combustion Technology, LLC, Loncin Motor Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Motorenfabrik Hatz GmbH & Co. KG, Yamaha Motor Co., Ltd., Yanmar Co., Ltd. These are the market players that dominate the European small off-road engines market.

MARKET SEGMENTATION

This research report on the Europe small off road engines market is segmented and sub-segmented into the following categories.

By Engine Displacement

- Upto 100cc

- 100-500cc

- 500cc to 800cc

By No. of Cylinders

- Single

- Double

- Multi

By Drive Shaft Orientation

- Horizontal

- Vertical

By End Use

- Agriculture

- Domestic

- Gardening/ Landscaping

- Residential

- Commercial

- Industrial

- Automotive

- Construction

By Distribution Channel

- OEM

- Aftermarket

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

The current market size of the Europe small off road engines market?

The current market size of Europe's small off-road engines market was valued at USD 83.81 Bn by 2025

Why is the demand for the 100cc to 500cc Europe small off road engines rising?

The up-to-100cc segment dominated the market and held 45% of Europe's small off-road engines market share in 2024, and The 100-500cc segment is expected to witness a CAGR of 6.2% from 2025 to 2033.

Who are the market players in this Europe small off road engines rising?

Briggs & Stratton, Chongqing Fuchai Industry Group, Chongqing Zongshen Power Machinery Co., Ltd., Greaves Cotton Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Liquid Combustion Technology, LLC, Loncin Motor Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Motorenfabrik Hatz GmbH & Co. KG, Yamaha Motor Co., Ltd., Yanmar Co., Ltd.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]