Europe Shrimp Market Size, Share, Trends & Growth Forecast Report By Species (L. Vannamei, P. Monodon, P. Chinensis, Others), Source (Wild, Aquaculture), Form (Green/Head-off, Peeled, Cooked, Others), Distribution Channel (B2B, B2C), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Shrimp Market and Market Size

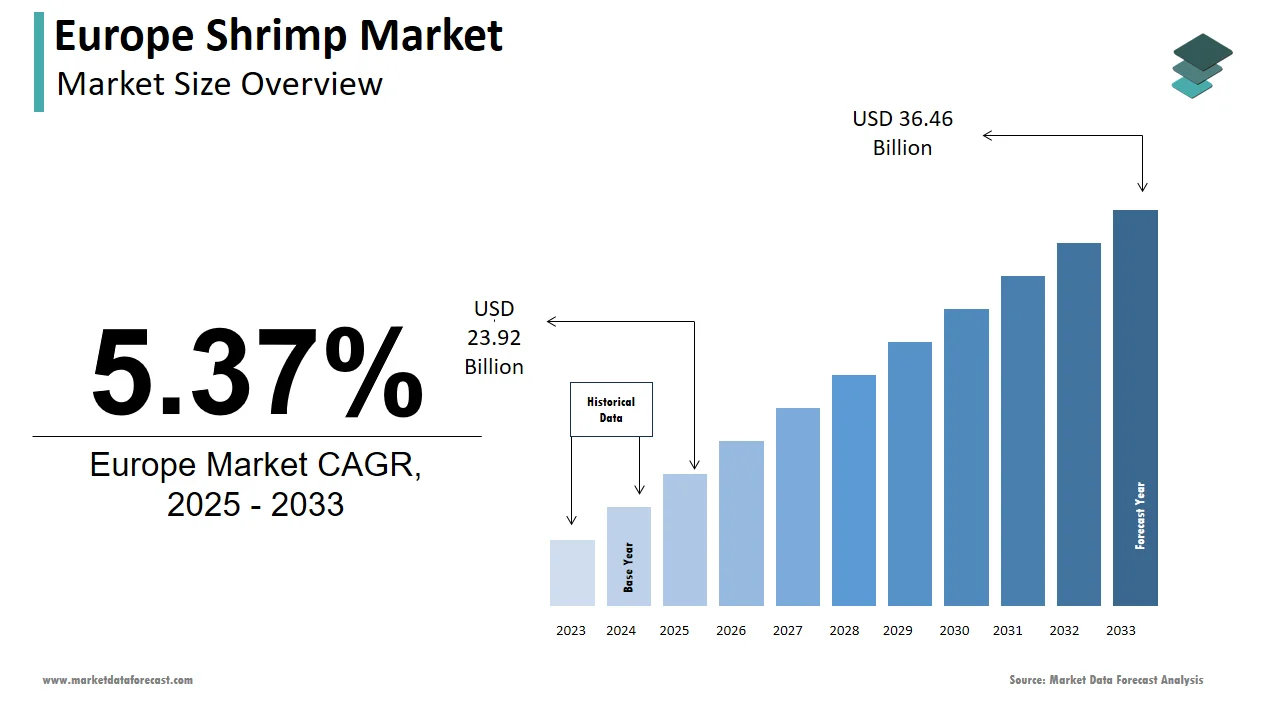

The shrimp market size in Europe was valued at USD 22.7 billion in 2024. The European market is estimated to be worth USD 36.46 billion by 2033 from USD 23.92 billion in 2025, growing at a CAGR of 5.37% from 2025 to 2033.

The Europe shrimp market is a dynamic and rapidly evolving sector, driven by consumer preferences for seafood as a healthy protein source. According to the Food and Agriculture Organization (FAO), Europe ranks among the top regions globally in terms of shrimp imports, accounting for approximately 25% of global shrimp consumption. Countries like Spain, France, and the UK are major contributors, collectively representing more than 60% of regional consumption. As per Eurostat, shrimp imports into Europe grew by 10% in 2022 is reflecting the region’s reliance on external suppliers, particularly from Asia and Latin America. Sustainability concerns have also gained prominence, with consumers increasingly favoring shrimp sourced from certified aquaculture practices. The European Union’s stringent regulations on seafood safety and traceability further shape market dynamics. Additionally, innovations in packaging and frozen shrimp products have expanded accessibility is making shrimp a staple in European households.

MARKET DRIVERS

Rising Health Consciousness

The growing awareness of health benefits associated with seafood consumption is a primary driver of the Europe shrimp market. As per the European Commission, seafood consumption has increased by 15% over the past decade, with shrimp being one of the most preferred choices due to its high protein and low-fat content. Shrimp is also rich in omega-3 fatty acids, which are linked to cardiovascular health, making it a popular option among health-conscious consumers. A study by the Marine Stewardship Council revealed that over 70% of European consumers prioritize seafood with health claims, driving demand for premium shrimp products. Furthermore, the rise of fitness trends and dietary shifts towards lean proteins has amplified shrimp’s appeal. Retailers and restaurants are capitalizing on this trend by offering innovative shrimp-based dishes, such as salads and grilled options, catering to evolving consumer preferences.

Expansion of the Foodservice Sector

The robust growth of the foodservice industry in Europe significantly contributes to the shrimp market’s expansion. Shrimp is a versatile ingredient widely used in cuisines such as Mediterranean, Asian, and American, making it a staple in restaurants and cafes. The proliferation of fast-casual dining chains and delivery platforms has further boosted demand, as shrimp-based meals are often featured in menus for their appeal to diverse palates. Also, tourism in coastal regions like Spain and Italy has bolstered shrimp consumption, creating a lucrative market for suppliers.

MARKET RESTRAINTS

Environmental Concerns

Environmental concerns pose a significant challenge to the Europe shrimp market, particularly regarding unsustainable aquaculture practices. The World Wildlife Fund (WWF) stresses that shrimp farming is responsible for 30% of mangrove deforestation in tropical regions are leading to habitat loss and biodiversity decline. These environmental issues have raised consumer awareness and prompted calls for sustainable sourcing. A survey by Globescan revealed that 65% of European consumers are willing to pay a premium for sustainably sourced shrimp, yet certification adoption remains limited. The lack of transparency in supply chains further complicates efforts to ensure eco-friendly practices. Moreover, regulatory pressures from the European Union, such as the EU Action Plan for Deforestation-Free Supply Chains, have increased compliance costs for importers, creating financial barriers for smaller players in the market.

Price Volatility

Price volatility is another critical restraint affecting the Europe shrimp market, driven by fluctuating global supply and demand dynamics. According to the FAO, shrimp prices can vary by up to 20% annually due to factors such as disease outbreaks in aquaculture farms and geopolitical tensions. For instance, the 2022 surge in global inflation led to a 15% increase in shrimp prices are impacting affordability for European consumers. Retailers and foodservice operators face challenges in maintaining stable pricing, which affects profit margins and consumer loyalty. Also, dependence on imports from countries like India and Ecuador exposes the market to currency fluctuations and trade restrictions. This unpredictability creates uncertainty for stakeholders, deterring long-term investments and strategic planning in the shrimp sector.

MARKET OPPORTUNITIES

Adoption of E-commerce Platforms

The rapid adoption of e-commerce platforms presents a significant opportunity for the Europe shrimp market, driven by the convenience and accessibility they offer. As stated by the McKinsey & Company, online grocery sales in Europe grew by 35% in 2022, with frozen and fresh seafood witnessing a notable uptick in demand. Shrimp, being a versatile and easy-to-store product, is well-suited for online retail. Companies like HelloFresh and Amazon Fresh have capitalized on this trend by offering pre-packaged shrimp kits and meal solutions tailored to busy urban consumers. A study revealed that 45% of European shoppers prefer purchasing seafood online due to competitive pricing and home delivery options. Innovations in cold chain logistics and vacuum-sealed packaging further enhance the feasibility of online shrimp sales are creating new revenue streams for suppliers and retailers.

Sustainable Aquaculture Practices

Sustainable aquaculture practices offer a promising avenue for growth in the Europe shrimp market, aligning with the region’s commitment to environmental conservation. According to the Aquaculture Stewardship Council, certified sustainable shrimp production has increased by 25% annually since 2020, driven by consumer demand for eco-friendly products. Initiatives such as recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA) are gaining traction is enabling efficient resource use and waste reduction. A report by Rabobank suggests that Europe’s domestic shrimp production could grow by 10% annually if sustainable practices are adopted on a larger scale. Governments and private investors are increasingly funding research and development in this area is fostering innovation and reducing reliance on imports. By embracing sustainability, the market can address environmental concerns while meeting consumer expectations.

MARKET CHALLENGES

Disease Outbreaks in Aquaculture

Disease outbreaks in aquaculture farms remain a persistent challenge for the Europe shrimp market, threatening supply stability and profitability. The FAO indicated that diseases such as Early Mortality Syndrome (EMS) have caused losses exceeding $1 billion annually in global shrimp production. While Europe primarily relies on imports, these outbreaks indirectly impact the market by disrupting supply chains and increasing prices. Findings by the European Food Safety Authority notes that shrimp imported from affected regions often face stricter inspections, delaying shipments and raising operational costs. Also, the lack of effective vaccines and biosecurity measures exacerbates the vulnerability of shrimp farms. Resolving these challenges requires collaboration between governments, producers, and researchers to develop resilient farming practices and safeguard the market’s future.

Consumer Mistrust in Imported Products

Consumer mistrust in imported shrimp products poses another significant challenge, stemming from concerns about quality and ethical sourcing. According to a survey by Ethical Consumer, 60% of European consumers express skepticism about the origins of imported seafood, citing issues such as chemical residues and unethical labor practices. This mistrust is fueled by media coverage of scandals involving mislabeling and contamination. A report by Greenpeace emphasizes that inadequate enforcement of EU import regulations allows substandard products to enter the market, undermining consumer confidence. To combat this, companies must invest in transparent supply chains and third-party certifications, which can be costly and time-consuming. Building trust through clear communication and accountability is essential to overcoming this challenge and ensuring long-term market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Species, Source, Form, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

Thai Union Group PCL, Clearwater Seafoods, Avanti Feeds Limited, High Liner Foods, Surapon Foods Public Company Limited, Mazzetta Company, LLC, Aqua Star, Nordic Seafood A/S, The Waterbase Limited, Wild Ocean Direct, and others. |

SEGMENTAL ANALYSIS

By Species Insights

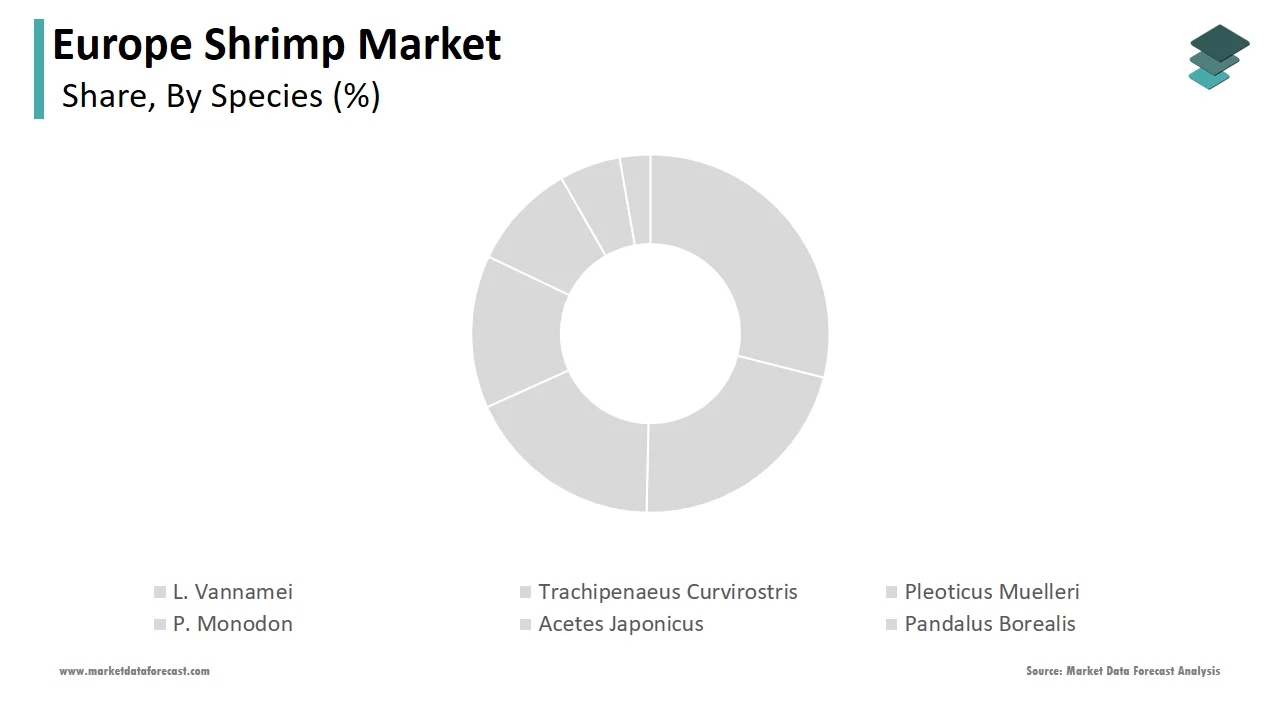

L. Vannamei was the most dominant segment of the Europe shrimp market by capturing 62.8% of the total share in 2024. Its widespread adoption is driven by the adaptability to intensive farming methods and consistent supply. As per the Rabobank, global production of L. Vannamei exceeded 5 million tons in 2022, with Europe importing over 1 million tons. The species’ mild flavor and firm texture make it ideal for diverse culinary applications, from salads to pasta dishes. Besides these, advancements in selective breeding have enhanced its growth rates and disease resistance, reducing production costs. The EU’s focus on promoting sustainable aquaculture has further bolstered its dominance, as L. Vannamei farms increasingly adopt eco-friendly practices.

Pandalus Borealis is the fastest-growing segment, with a CAGR of 8.5%. The growth is influenced by its status as a wild-caught, premium product, appealing to affluent consumers seeking authenticity. The cold waters of the North Atlantic, where Pandalus Borealis thrives, ensure superior quality and taste. A report by SeafoodSource stresses that demand for wild-caught shrimp has surged by 20% in gourmet restaurants are driving its popularity. Also, certifications from organizations like the Marine Stewardship Council have enhanced its credibility, attracting environmentally conscious buyers. The species’ unique flavor profile and versatility in high-end cuisine further contribute to its rapid market expansion.

By Source Insights

The Wild-caught shrimp segment commanded the largest share of the Europe shrimp market and accounted for 53.5% of the total volume in 2024. The position in the market is due to its reputation for superior taste and texture, particularly among premium consumers. According to a report by the Marine Stewardship Council, wild-caught shrimp from regions like the North Atlantic and Mediterranean are highly sought after in fine dining establishments. The EU’s stringent regulations on seafood safety ensure that wild-caught shrimp meets high-quality standards, enhancing consumer confidence. Apart from these, certifications emphasizing sustainable fishing practices have strengthened its appeal is aligning with Europe’s growing demand for responsibly sourced seafood.

Aquaculture is rapidly growing category, with a CAGR of 9.2%. The progress is supported by technological advancements and the increasing adoption of sustainable farming practices. Innovations such as recirculating aquaculture systems (RAS) enable year-round production, reducing dependency on seasonal wild catches. A study by the FAO states that aquaculture now accounts for over 50% of global shrimp production, with Europe emerging as a key importer. The affordability and consistency of farmed shrimp make it an attractive option for mass-market retailers and foodservice operators. Moreover, investments in eco-friendly aquaculture are addressing environmental concerns, propelling its rapid adoption.

By Form Insights

The Peeled shrimp segment held the maximum share of 41.1% of the Europe shrimp market in 2024. The popularity is attributed to its convenience and versatility in cooking is making it a favorite among home cooks and professional chefs alike. Based on a study by SeafoodSource, peeled shrimp is extensively used in ready-to-cook meals and restaurant dishes are catering to the growing demand for quick and easy meal solutions. The availability of vacuum-sealed packaging has further enhanced its shelf life, boosting retail sales. Additionally, peeled shrimp is often marketed as a premium product, commanding higher prices and contributing significantly to overall market revenue.

The cooked shrimp is witnessing the quickest upward trajectory in the market with a CAGR of 10.5%. The development is influenced by the rising popularity of ready-to-eat meals and convenience foods. Cooked shrimp is widely used in salads, sandwiches, and appetizers, appealing to busy urban consumers. Innovations in freezing and preservation technologies have ensured consistent quality, making cooked shrimp a reliable choice for retailers. Furthermore, its alignment with health-conscious trends has propelled its adoption across Europe.

By Distribution Channel Insights

The B2B segment is the most used channel in the Europe shrimp market and possessed 66.8% of total sale in 2024. The growth of this segment is driven by the extensive use of shrimp in the foodservice industry, including restaurants, hotels, and catering services. According to Eurostat, the European hospitality sector consumes over 1.5 million tons of shrimp annually, underscoring its reliance on bulk procurement. The B2B channel benefits from economies of scale, enabling suppliers to offer competitive pricing and secure long-term contracts. Besides these, partnerships with distributors and wholesalers ensure efficient supply chain management is meeting the demands of large-scale operations.

The B2C segment is seeing the highest acceleration by having a CAGR of 11.2% owing to the increasing penetration of e-commerce platforms and direct-to-consumer sales models. A report by McKinsey emphasizes that online grocery shopping has surged by 30% in Europe, with frozen and fresh shrimp gaining traction among home cooks. Innovations in packaging and delivery logistics have enhanced the feasibility of B2C sales, catering to urban consumers seeking convenience. Also, marketing campaigns emphasizing health benefits and sustainability have attracted environmentally conscious buyers, further accelerating the segment’s expansion.

COUNTRY LEVEL ANALYSIS

Spain remained a cornerstone of the Europe shrimp market by commanding 33.7% of regional consumption in 2024. Its strategic position as a gateway to seafood imports from Latin America and Asia has cemented its position in the market. According to Eurostat, Spain imported over 300,000 tons of shrimp in 2022 and is driven by its thriving hospitality sector and coastal tourism. The country’s Mediterranean diet, which emphasizes seafood, further fuels demand. Retailers like Mercadona have expanded their frozen shrimp offerings, capitalizing on consumer preferences for convenience. Also, Spain’s focus on sustainable sourcing aligns with EU regulations, ensuring compliance and enhancing market credibility.

France is a significant consumer of shrimp, particularly in the premium and organic segments. The French appetite for gourmet cuisine, particularly dishes featuring shrimp, drives consistent demand. Moreover, shrimp sales in France grew by 12% in 2022, with hypermarkets like Carrefour leading the distribution. The rise of meal kits and ready-to-eat options has further boosted shrimp’s popularity. France’s stringent food safety standards ensure high-quality imports, while domestic initiatives to promote local aquaculture are gaining traction. Collaborations between French chefs and seafood suppliers have also elevated shrimp’s status in fine dining.

The UK shrimp market is experiencing steady growth which is supported by its robust retail and foodservice sectors. Data revealed that shrimp imports into the UK increased by 10% post-Brexit as retailers adapted to new trade dynamics. Major supermarkets like Tesco and Sainsbury’s have introduced premium shrimp products, targeting health-conscious consumers. Urbanization and the growing trend of home cooking have amplified demand. Additionally, certifications such as the Marine Stewardship Council label have bolstered consumer trust, ensuring steady growth in the market.

Germany has one of the most structured and regulated seafood markets in Europe. It is driven by its large population and strong purchasing power. According to the German Seafood Association, shrimp is among the top three seafood items consumed in the country. The rise of vegan and pescatarian diets has further fueled its popularity. Retail chains like Aldi and Lidl offer competitively priced shrimp products, catering to diverse consumer segments. Germany’s emphasis on sustainability has encouraged the adoption of eco-friendly packaging, aligning with EU environmental goals.

Italy is the rapidly advancing country in the European shrimp market, with an estimated CAGR of 6.4% from 2025 to 2033. As per the Coldiretti, shrimp is a staple in Italian seafood dishes, with demand growing by 8% annually. The country’s tourism industry, particularly in coastal regions like Venice and Sicily, drives shrimp consumption in restaurants. Italian consumers prioritize quality and traceability is prompting retailers to source shrimp from certified suppliers. Innovations in frozen shrimp products have expanded accessibility, making it a household favourite.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe shrimp market profiled in this report are Thai Union Group PCL, Clearwater Seafoods, Avanti Feeds Limited, High Liner Foods, Surapon Foods Public Company Limited, Mazzetta Company, LLC, Aqua Star, Nordic Seafood A/S, The Waterbase Limited, Wild Ocean Direct, and others.

TOP LEADING PLAYERS IN THE MARKET

Royal Greenland

Royal Greenland is a prominent player in the Europe shrimp market, renowned for its wild-caught shrimp sourced from the North Atlantic. The company’s commitment to sustainability and traceability has earned it a loyal customer base. Royal Greenland’s Pandalus Borealis shrimp is highly regarded for its superior taste and texture, making it a preferred choice for gourmet restaurants. Its investments in advanced freezing technologies ensure product quality, reinforcing its reputation as a premium supplier in the global seafood industry.

Thai Union Group

Thai Union Group is a key contributor to the Europe shrimp market, leveraging its expertise in aquaculture to supply high-quality farmed shrimp. The company’s focus on innovation and sustainability has enabled it to meet stringent EU regulations. Thai Union’s L. Vannamei shrimp is widely distributed across Europe, catering to both retail and foodservice sectors. Its partnerships with European distributors have strengthened its market presence, ensuring consistent supply and competitive pricing.

Nueva Pescanova Group

Nueva Pescanova Group is a major player in the Europe shrimp market, offering a diverse range of shrimp products tailored to consumer preferences. The company’s vertically integrated operations ensure efficient production and distribution. Nueva Pescanova’s commitment to eco-friendly practices aligns with EU sustainability goals, enhancing its brand appeal. Its innovative product lines, including cooked and breaded shrimp, cater to evolving market demands are reinforcing its position in the global seafood sector.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Sustainability Certifications

To align with growing consumer demand for eco-friendly seafood, key players in the European shrimp market are actively pursuing sustainability certifications such as the Marine Stewardship Council (MSC), Aquaculture Stewardship Council (ASC), and GlobalG.A.P. These certifications ensure that shrimp are sourced through responsible fishing or aquaculture practices, minimizing environmental impact and ensuring long-term resource sustainability. Certified products are increasingly preferred by supermarkets, restaurants, and eco-conscious consumers, boosting brand credibility and expanding market reach. Additionally, compliance with European Union (EU) sustainability regulations provides exporters with a competitive advantage in securing retail partnerships and premium pricing. As sustainability concerns continue to shape consumer purchasing decisions, obtaining these certifications is not just a strategic move but a necessity for long-term success in the industry.

Product Diversification

To cater to evolving consumer preferences and enhance profitability, shrimp producers and suppliers are focusing on product diversification. The introduction of value-added shrimp products, such as pre-cooked, marinated, seasoned, breaded, and organic shrimp, has significantly increased market appeal among urban consumers, health-conscious buyers, and convenience-seeking households. Retailers and foodservice providers are capitalizing on this trend by offering ready-to-cook and ready-to-eat shrimp meals, making seafood consumption more accessible and hassle-free. Additionally, premium product segments including wild-caught, organic, and antibiotic-free shrimp are gaining traction as consumers prioritize quality and transparency in their food choices. Expanding product lines not only differentiates brands in a competitive market but also enhances profitability by creating new revenue streams.

Supply Chain Optimization

Ensuring consistent shrimp quality, availability, and cost-efficiency requires robust supply chain management. Leading shrimp suppliers in Europe are strengthening direct partnerships with aquaculture farms and global seafood exporters to maintain stable supply chains amid fluctuating global shrimp production. Investments in cold chain infrastructure, advanced freezing technologies, and real-time logistics tracking are improving product shelf life and reducing wastage, ensuring fresh and high-quality shrimp reach end consumers. Additionally, companies are adopting blockchain technology for supply chain transparency, allowing buyers to verify sourcing details and ethical practices. By streamlining distribution networks, reducing lead times, and securing long-term supplier agreements, shrimp companies can mitigate risks associated with price volatility, regulatory barriers, and seasonal fluctuations, ultimately enhancing market stability and competitiveness.

COMPETITION OVERVIEW

The Europe shrimp market is highly competitive, driven by growing consumer demand for seafood, rising health consciousness, and increasing imports from key shrimp-producing countries like Ecuador, India, and Vietnam. Key players include seafood processors, distributors, and retailers such as Pescanova, Thai Union Group, and Royal Greenland. The market benefits from advancements in cold chain logistics, ensuring fresh and frozen shrimp reach consumers efficiently. Sustainability certifications, such as those from the Marine Stewardship Council (MSC), play a crucial role in shaping consumer preferences and competitive dynamics. Companies are also focusing on product diversification, offering value-added shrimp products like ready-to-cook meals to cater to convenience-driven lifestyles. Competition is intensified by price fluctuations due to supply chain disruptions and import tariffs. Additionally, local producers face challenges from imported shrimp, which often offer lower prices. Overall, innovation, sustainability, and strategic supply chain management are central to maintaining a competitive edge in this market.

MAJOR ACTIONS TAKEN BY COMPANIES

- In February 2023, Pescanova launched a line of sustainably sourced shrimp products certified by the Marine Stewardship Council. This initiative aimed to attract eco-conscious consumers and strengthen its market position.

- In April 2023, Thai Union Group expanded its distribution network in Eastern Europe by partnering with local retailers. This move was designed to increase market penetration and accessibility.

- In June 2023, Royal Greenland introduced a new range of ready-to-cook shrimp meals tailored for European consumers. This launch aimed to capitalize on the growing demand for convenience foods.

- In August 2023, Seafresh Investments acquired a Dutch cold chain logistics company to enhance its shrimp distribution capabilities. This acquisition aimed to improve supply chain efficiency and reduce delivery times.

- In November 2023, Clearwater Seafoods collaborated with a UK-based restaurant chain to supply premium shrimp for their seafood dishes. This partnership sought to boost brand visibility and drive sales in the foodservice sector.

MARKET SEGMENTATION

This Europe shrimp market research report is segmented and sub-segmented into the following categories.

By Species

- L. Vannamei

- Trachipenaeus Curvirostris

- Pleoticus Muelleri

- P. Monodon

- Acetes Japonicus

- Pandalus Borealis

- P. Chinensis

- Others

By Source

- Wild

- Aquaculture

By Form

- Green/ Head-off

- Green/ Head-on

- Peeled

- Cooked

- Breaded

- Others

By Distribution Channel

- B2B

- B2C

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is fueling the Europe shrimp market growth?

Rising seafood consumption and increasing demand for protein-rich diets are fueling the Europe shrimp market.

2. Which segment leads the Europe shrimp market?

The frozen shrimp segment accounts for the major share in the Europe shrimp market.

3. What is a key trend in the Europe shrimp market?

Growing popularity of organic and sustainably farmed shrimp is a key trend in the Europe shrimp market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]