Europe Self-Storage Market Size, Share, Trends & Growth Forecast Report By Unit Size (Small, Medium, Large), Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Self-storage Market Size

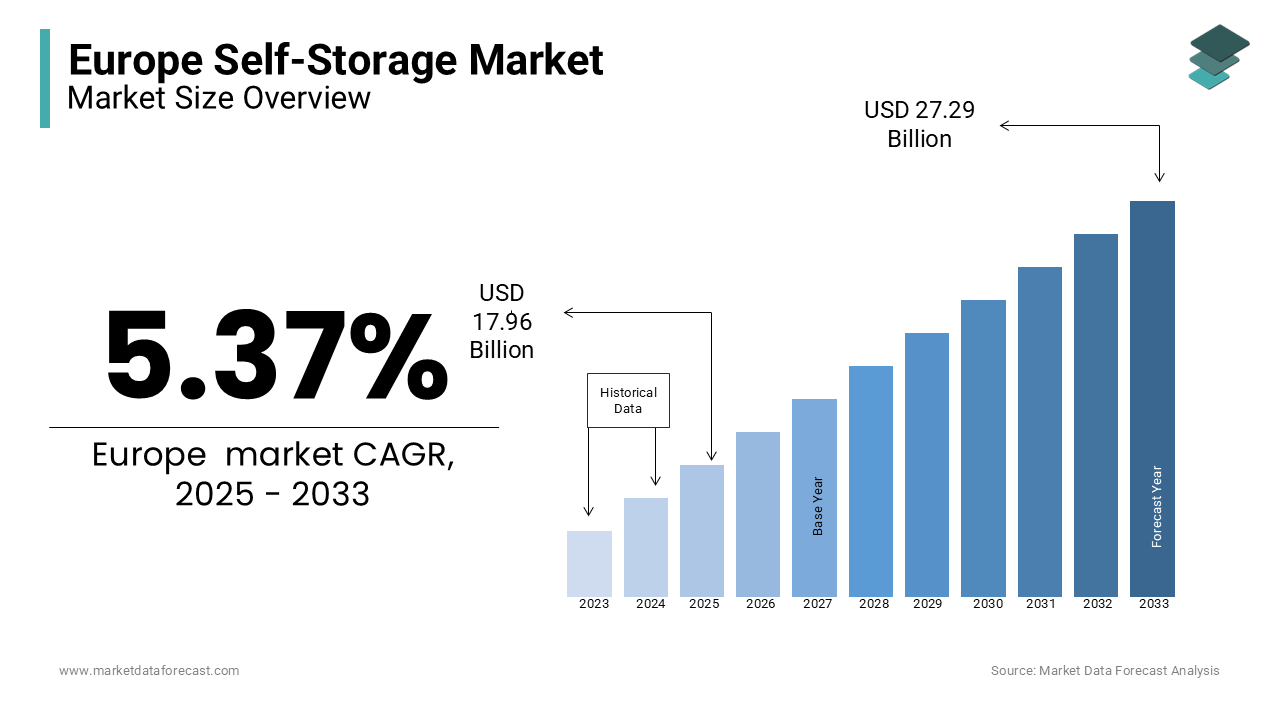

The Self-storage market size in Europe was valued at USD 17.04 billion in 2024. The European market is estimated to be worth USD 27.29 billion by 2033 from USD 17.96 billion in 2025, growing at a CAGR of 5.37% from 2025 to 2033.

Self-storage refers to the rental of storage spaces in the form of units or lockers to individuals or businesses seeking secure, flexible, and cost-effective solutions for storing personal belongings, inventory, or documents. The self-storage market has gained significant traction across Europe due to the increasing demand for additional space in densely populated urban areas, where residential and commercial spaces are often limited. According to the Federation of European Self Storage Associations (FEDESSA), the European self-storage market has experienced steady growth, with over 3,500 facilities operating across the region as of 2023. The United Kingdom remains the largest market, accounting for nearly 40% of the total facilities, followed by France and Germany. The rising urbanization, smaller living spaces, and the increasing popularity of e-commerce that has led to higher demand for storage solutions among small businesses are likely to drive demand for self-storage services in Europe in the coming years. Additionally, the COVID-19 pandemic accelerated the adoption of self-storage services, as individuals sought space for home office equipment and businesses required inventory storage due to supply chain disruptions.

MARKET DRIVERS

Urbanization and Limited Living Space in Europe

Urbanization is a significant driver of the Europe self-storage market, with over 75% of the European population living in urban areas, as reported by the European Commission. The trend toward smaller residential spaces in cities has created a growing need for additional storage solutions. For instance, in the UK, the average home size has decreased by 4% over the past decade, according to the Office for National Statistics. This has led to increased demand for self-storage units, particularly in metropolitan areas like London, Paris, and Berlin, where space constraints are most pronounced.

E-commerce Growth and Business Demand

The rapid expansion of e-commerce has fueled demand for self-storage among small and medium-sized enterprises (SMEs). Eurostat data shows that e-commerce sales in the EU grew by 13% in 2022, reaching €718 billion. Many SMEs rely on self-storage facilities to manage inventory, store equipment, and handle seasonal fluctuations. For example, in Germany, over 30% of self-storage users are businesses, according to the Federation of European Self-Storage Associations (FEDESSA). This trend underscores the critical role of self-storage in supporting the logistics and operational needs of the growing e-commerce sector.

MARKET RESTRAINTS

High Real Estate Costs

The Europe self-storage market faces significant challenges due to the high cost of real estate, particularly in urban areas. According to Eurostat, property prices in the EU increased by 6.1% in 2022, with cities like London, Paris, and Amsterdam experiencing even higher rates. These rising costs make it difficult for self-storage operators to acquire and maintain facilities in prime locations, limiting their ability to expand. For instance, in the UK, the average cost of commercial property in London reached £75 per square foot in 2023, as reported by the UK Office for National Statistics, creating a barrier for new entrants and smaller operators.

Regulatory and Zoning Challenges

Stringent zoning laws and regulatory hurdles pose another major restraint for the self-storage market in Europe. The European Environment Agency highlights that urban planning regulations in many EU countries restrict the development of self-storage facilities in residential or central business districts. For example, in France, local authorities often impose strict limits on the size and location of such facilities to preserve urban aesthetics. These regulatory constraints delay project approvals and increase operational costs, hindering market growth and accessibility for consumers.

MARKET OPPORTUNITIES

Technological Advancements and Digital Transformation

The integration of advanced technologies presents a significant opportunity for the Europe self-storage market. According to the European Commission, 65% of European businesses are investing in digital transformation, including automation and IoT solutions. Self-storage operators can leverage technologies like smart access systems, automated inventory management, and online booking platforms to enhance customer experience and operational efficiency. For instance, in the UK, over 40% of self-storage facilities now offer digital access controls, as reported by the Federation of European Self Storage Associations (FEDESSA). This shift not only attracts tech-savvy consumers but also reduces operational costs, driving market growth.

Expansion into Untapped Markets

There is substantial potential for growth in underserved regions across Europe. Eurostat data reveals that Eastern European countries like Poland and Hungary have seen a 20% increase in disposable income over the past five years, creating demand for self-storage services. Additionally, rural areas in Western Europe, where self-storage penetration remains low, offer untapped opportunities. For example, in Germany, only 15% of self-storage facilities are located outside major cities, according to the German Federal Statistical Office. Expanding into these regions can help operators capture new customer segments and diversify their revenue streams.

MARKET CHALLENGES

Economic Uncertainty and Consumer Spending Constraints

Economic volatility and rising inflation are significant challenges for the Europe self-storage market. According to Eurostat, the annual inflation rate in the Euro area reached 5.2% in 2023, impacting consumer spending power. This has led to reduced demand for non-essential services, including self-storage, as households prioritize essential expenses. For instance, in the UK, the Office for National Statistics reported a 3% decline in discretionary spending in 2023, affecting industries reliant on consumer flexibility. Economic uncertainty also discourages long-term commitments to storage rentals, posing a challenge for market stability and growth.

Environmental and Sustainability Pressures

The self-storage industry faces increasing scrutiny regarding its environmental impact. The European Environment Agency highlights that construction and operation of storage facilities contribute to carbon emissions and land use concerns. Many European countries are implementing stricter sustainability regulations, such as the EU’s Green Deal, which mandates energy-efficient building standards. For example, in the Netherlands, the government requires new commercial buildings to meet nearly zero-energy standards, increasing operational costs for self-storage providers. Balancing profitability with sustainability remains a critical challenge for the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.37% |

|

Segments Covered |

By Unit Size, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

W. P. Carey, SM Prime Holdings, Extra Space Storage Inc, CubeSmart, Smartstop Self Storage REIT Inc Ordinary Shares - Class A, Safestore Holdings PLC Ordinary Shares, Public Storage, Shurgard Self Storage Ltd, Big Yellow Group PLC, and others |

SEGMENTAL ANALYSIS

By Unit Size Insights

The medium-sized segment led the market and accounted for 46.8% of the European market share in 2024. Medium-sized self-storage units that range between 25 and 100 square feet dominate the European self-storage market. According to the Federation of European Self Storage Associations, these units are the most versatile, catering to households, businesses, and individuals with mid-term storage needs. Their popularity stems from their balance of space and affordability, making them ideal for relocations, inventory storage, and larger personal items. In countries like Germany and the UK, medium units are in high demand due to urbanization and the growing need for flexible storage solutions. Their widespread use underscores their importance in meeting diverse customer requirements.

However, the small segment is anticipated to witness the fastest CAGR of 10.87% in the European market over the forecast period. The small self-storage units that are typically under 25 square feet have gained traction in the recent years. The growing urbanization, rising demand from students, and the need for temporary storage in densely populated cities like Paris and London are propelling the growth of the small segment in the European market. Small units are cost-effective and convenient, appealing to individuals with limited storage needs. The European Environment Agency highlights that over 75% of the EU population lives in urban areas, further fueling demand. Their rapid growth reflects the importance of compact, affordable storage solutions in modern urban living. Source: Federation of European Self Storage Associations and Cushman & Wakefield.

By Application Insights

The personal use segment dominated the market by accounting for 69.4% of the European market share in 2024. The domination of the personal use segment is primarily driven by urbanization and shrinking living spaces. Eurostat reports that over 75% of Europe’s population resides in urban areas, where space constraints are prevalent. Personal storage is essential for individuals managing life transitions, such as relocation, downsizing, or temporary housing needs. Its affordability and flexibility make it a vital solution for urban dwellers, particularly in cities like London and Paris, where space optimization is critical for daily living.

The business use segment is predicted to grow at a CAGR of 8.2% over the forecast period owing to the rise of e-commerce and SMEs. Eurostat data shows that e-commerce sales in the EU grew by 13% in 2022, creating demand for storage solutions among online retailers. Additionally, startups and freelancers increasingly rely on self-storage to reduce operational costs. In Germany, 25% of self-storage facilities are used by businesses, according to the German Federal Statistical Office. The segment’s importance lies in providing cost-effective, flexible storage options that support business scalability and operational efficiency.

REGIONAL ANALYSIS

The UK is the undisputed leader in the European self-storage market, holding the largest market share. Its dominance is attributed to high urbanization rates, a mature self-storage industry, and increasing demand for flexible storage solutions. The market has seen a compound annual growth rate (CAGR) of around 7% over the past five years, as reported by Cushman & Wakefield. Major cities like London, Manchester, and Birmingham have witnessed significant growth in self-storage facilities, driven by the need for space optimization among both individuals and businesses. The UK’s well-established self-storage culture and the presence of leading operators like Big Yellow and Safestore further solidify its leading position.

France is another promising market for self-storage services in Europe. The rising consumer awareness and the expansion of self-storage operators in urban areas are propelling the French self-storage services market growth. Paris, Lyon, and Marseille are key cities driving demand, as residents and businesses seek additional space for storage. The Federation of European Self Storage Associations highlights that France has seen increasing adoption of self-storage services due to changing lifestyles and smaller living spaces in urban centers. The market’s growth is also supported by the entry of international self-storage brands and the development of modern, customer-friendly facilities.

Germany holds a considerable share of the European market and the growth of the German market is majorly credited to its strong economy and growing awareness of self-storage solutions. Cities like Berlin, Frankfurt, and Munich are major contributors to the market’s expansion. The country’s high population density and the increasing need for storage among businesses and individuals have propelled demand. According to industry reports, Germany’s self-storage market has shown consistent growth, supported by the presence of both local and international operators. The market benefits from a well-developed infrastructure and a culture of efficiency, making self-storage a popular choice for space management.

KEY MARKET PLAYERS

W. P. Carey, SM Prime Holdings, Extra Space Storage Inc, CubeSmart, Smartstop Self Storage REIT Inc Ordinary Shares - Class A, Safestore Holdings PLC Ordinary Shares, Public Storage, Shurgard Self Storage Ltd, Big Yellow Group PLC are the key players in the Europe self-storage market

MARKET SEGMENTATION

This research report on the Europe self-storage market is segmented and sub-segmented into the following categories.

By Unit Size

- Small

- Medium

- Large

By Application

- Personal

- Business

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate of the European self-storage market?

The Europe self-storage market is expected to grow at a compound annual growth rate (CAGR) of 5.37% from 2025 to 2033, increasing from a valuation of USD 17.96 billion in 2025 to USD 27.29 billion by 2033

2. Which countries are leading the self-storage market in Europe?

The United Kingdom is the largest market, accounting for nearly 40% of total facilities, followed by significant markets in France and Germany. These countries have seen substantial demand due to urbanization and limited residential space

3. What factors are driving demand for self-storage services in Europe?

Key drivers include rising urbanization, shrinking living spaces, and the growth of e-commerce, which has increased the need for storage solutions among small and medium-sized enterprises (SMEs) that require inventory management

4. What challenges does the European self-storage market face?

The market faces challenges such as high real estate costs in urban areas, stringent zoning laws, and regulatory hurdles that restrict the development of new facilities. Additionally, economic volatility and rising inflation may impact consumer spending on non-essential services like self-storage

5. What opportunities exist for growth in the European self-storage market?

There is significant potential for expansion in underserved regions, particularly in Eastern Europe and rural areas of Western Europe where self-storage penetration remains low. The integration of advanced technologies, such as smart access systems and online booking platforms, also presents opportunities for enhancing customer experience and operational efficiency

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]