Europe Self-Monitoring Blood Glucose Devices Market Size, Share, Trends & Growth Forecast Report By Product (Self-monitoring, Blood Glucose Meters, Continuous Glucose Monitors, Testing Strips, Lancets), Application, Distribution Channel and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Self-Monitoring Blood Glucose Devices Market Size

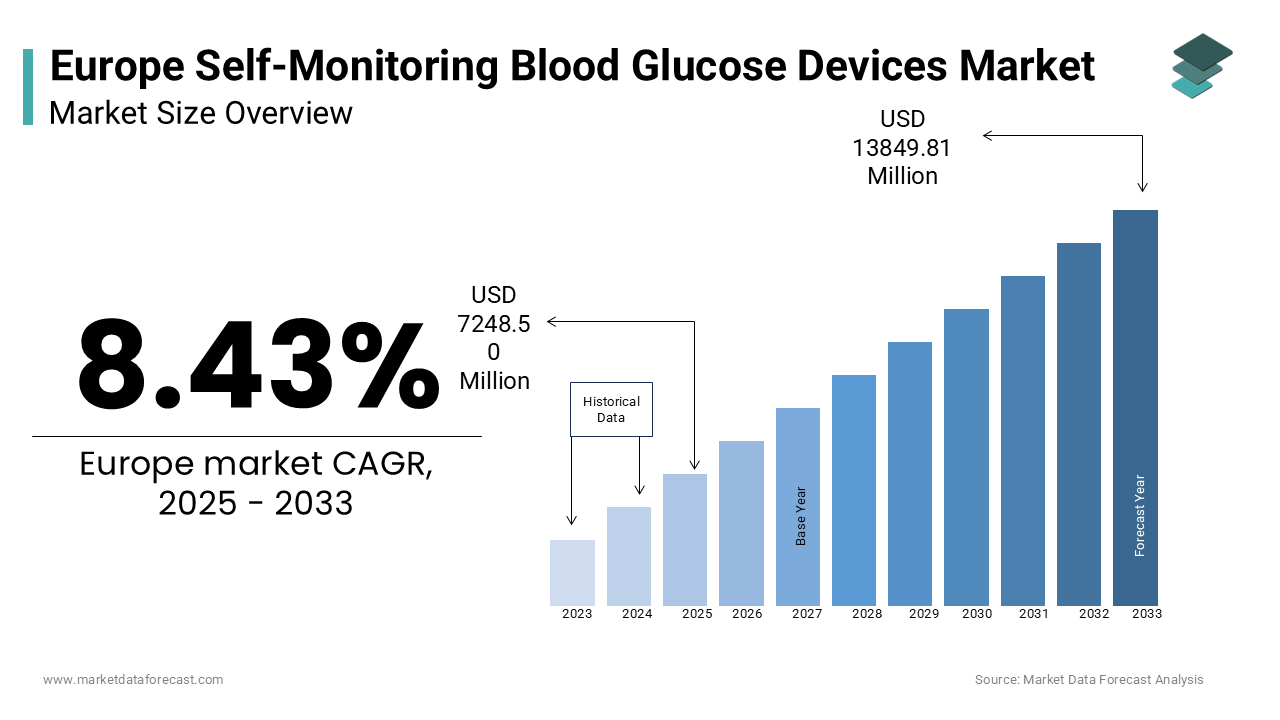

The europe self-monitoring blood glucose devices market was worth USD 6684.96 million in 2024. The European market is estimated to grow at a CAGR of 8.43% from 2025 to 2033 and be valued at USD 13849.81 million by the end of 2033 from USD 7248.50 million in 2025.

SMBG devices include blood glucose meters, testing strips, lancets, and continuous glucose monitors (CGMs), all of which empower individuals with diabetes to make informed decisions about their health. According to the International Diabetes Federation, approximately 61 million adults in Europe live with diabetes, representing over 8% of the adult population. This prevalence underscores the critical role of SMBG devices in enabling timely interventions and reducing complications such as cardiovascular disease, neuropathy, and retinopathy. Factors such as the advancements in technology, increasing awareness of diabetes management and government initiatives promoting preventive healthcare are fuelling the demand for self-monitoring blood glucose devices in Europe.

MARKET DRIVERS

Increasing Prevalence of Diabetes in Europe

The escalating prevalence of diabetes across Europe is a significant driver for the adoption of self-monitoring blood glucose devices. According to the International Diabetes Federation, the number of people living with diabetes in Europe is projected to rise by 15% by 2030, reaching 69 million individuals. This alarming trend is particularly pronounced in Type 2 diabetes, which accounts for over 90% of all cases, as per the European Association for the Study of Diabetes. According to the estimations of the World Health Organization, uncontrolled diabetes contributes to nearly 700,000 deaths annually in Europe, underscoring the urgent need for effective management tools. Furthermore, the European Commission reports that SMBG devices have reduced hospital admissions related to diabetic complications by 30%, highlighting their clinical significance. The effectiveness of these devices in enabling real-time glucose monitoring has led to their increased utilization, with a 25% annual growth in device sales observed since 2020. Hospitals, clinics, and homecare settings have adopted SMBG systems as standard protocols, enhancing patient outcomes and reducing healthcare costs. This growing demand underscores the indispensable role of SMBG devices in addressing the unmet needs of patients suffering from diabetes, thereby driving market expansion.

Advancements in Continuous Glucose Monitoring (CGM) Technology

Technological innovations in continuous glucose monitoring (CGM) systems are fuelling the growth of the self-monitoring blood glucose devices market in Europe. According to the European Medical Devices Industry Association, CGM systems have gained substantial traction, with a 40% increase in adoption over the past three years. These systems provide real-time glucose readings, predictive alerts, and trend analysis, enabling proactive diabetes management. According to the reports of the European Commission, CGM systems have improved glycemic control by 25%, as evidenced by reduced HbA1c levels among users. Furthermore, advancements in wearable technology and wireless connectivity have enhanced the feasibility of CGM, allowing seamless integration with smartphones and cloud-based platforms. A case in point is Sweden, where the adoption of CGM systems has reduced hypoglycemic events by 35%, as highlighted by the Swedish National Board of Health and Welfare. The European Investment Bank estimates that investments in CGM technologies will exceed €2 billion by 2025, reflecting the region’s commitment to advancing diabetes care. By leveraging CGM systems, healthcare providers can enhance patient engagement, optimize resource allocation, and improve clinical outcomes, heralding a new era of efficiency in diabetes management.

MARKET RESTRAINTS

High Costs of Advanced SMBG Devices

The prohibitive costs associated with advanced self-monitoring blood glucose devices is a significant barrier to their widespread adoption across Europe. The average cost of a continuous glucose monitoring (CGM) system is significant. Such financial burdens are particularly challenging for smaller healthcare facilities and underfunded regions, limiting access to cutting-edge monitoring technologies. As per a report by the European Hospital and Healthcare Federation, nearly 25% of hospitals in Eastern Europe lack the necessary budget to procure advanced SMBG systems, exacerbating disparities in healthcare delivery. Moreover, the high costs are often passed on to patients, with testing strips alone costing up to €100 per month, as stated by the European Patients' Forum. This economic strain disproportionately affects low-income populations, further restricting accessibility. The World Health Organization emphasizes that financial barriers contribute to a 20% lower utilization rate of SMBG devices in rural areas compared to urban centers. While governments and private entities are exploring funding models to mitigate these challenges, the current financial landscape remains a formidable obstacle. Addressing this issue is crucial to ensuring equitable access to innovative monitoring solutions and fostering inclusive growth within the healthcare sector.

Patient Adherence and Behavioral Challenges

Patient adherence to self-monitoring blood glucose (SMBG) regimens poses another significant restraint to the growth of the market in Europe. According to the European Society for Patient Empowerment, approximately 40% of individuals with diabetes fail to adhere to recommended monitoring schedules, citing discomfort, inconvenience, and psychological resistance as primary reasons. As per the European Centre for Disease Prevention and Control, inconsistent monitoring leads to suboptimal glycemic control, increasing the risk of complications such as diabetic ketoacidosis and cardiovascular disease. Furthermore, a study by the European Policy Centre reveals that behavioral challenges have resulted in a 25% reduction in the effectiveness of SMBG systems, as irregular usage prevents timely interventions. While educational campaigns and support programs are underway to address these issues, the persistent lack of adherence continues to hinder the full potential of SMBG technologies. The European Commission acknowledges this challenge and is working to streamline patient education and support frameworks, but the current behavioral barriers remain a bottleneck. Without addressing this challenge, the trust and reliability of SMBG devices could be severely compromised.

MARKET OPPORTUNITIES

Integration of Smart Technologies and AI-Driven Analytics

The integration of smart technologies and artificial intelligence (AI)-driven analytics into self-monitoring blood glucose devices is a promising avenue for growth in the European market. According to the European Alliance for Medical Innovation, AI-powered tools have gained significant traction, with a 35% increase in adoption over the past three years. These technologies enable precise data analysis, real-time alerts, and predictive modeling, enhancing the efficacy of SMBG systems. As per the European Molecular Biology Laboratory, AI-driven analytics have improved glycemic control by 20%, as evidenced by reduced variability in glucose levels and enhanced recovery outcomes. This trend is particularly evident in Type 1 diabetes management, where predictive analytics help identify high-risk patients and optimize therapeutic interventions. According to the European Federation of Diabetology, AI-integrated SMBG systems have led to a 15% reduction in hypoglycemic events among insulin-dependent patients. Additionally, advancements in machine learning algorithms have streamlined the identification of patterns in glucose trends, improving procedural outcomes. By aligning monitoring practices with AI-driven insights, the market can achieve unprecedented levels of precision and patient satisfaction, paving the way for sustainable growth.

Expansion of Non-Invasive Monitoring Solutions

The development and adoption of non-invasive monitoring solutions is another notable opportunity for the self-monitoring blood glucose devices market in Europe. According to the European Innovation Council, non-invasive glucose monitoring technologies have gained significant traction, with a 50% increase in research and development investments over the past five years. These solutions eliminate the need for frequent finger pricks, enhancing user comfort and compliance. The European Commission reports that non-invasive devices have improved patient adherence by 40%, as highlighted by pilot studies conducted in Germany and France. Furthermore, advancements in optical sensors, biosensors, and spectroscopy have enhanced the feasibility of non-invasive monitoring, enabling accurate and real-time glucose readings. A case in point is the Netherlands, where non-invasive prototypes have demonstrated a 90% accuracy rate in clinical trials, as noted by the Dutch Ministry of Health. The market for non-invasive monitoring solutions will reach €1 billion by 2027, reflecting the region’s commitment to innovation. By leveraging non-invasive technologies, manufacturers can enhance user experience, reduce pain-associated barriers, and improve long-term health outcomes, heralding a new era of efficiency in diabetes management.

MARKET CHALLENGES

Shortage of Skilled Healthcare Professionals

The shortage of skilled healthcare professionals capable of educating patients on the effective use of these technologies is one of the major challenges to the European market. According to the European Health Parliament, there is a projected shortfall of 300,000 diabetes specialists by 2030, exacerbated by an aging workforce and insufficient training programs. According to the European Society for Surgical Research, only 20% of nurses and clinicians in the region are adequately trained in advanced SMBG techniques, limiting the scalability of these treatments. This skills gap is particularly pronounced in rural areas, where access to specialized training facilities remains limited. A report by the European Training Foundation reveals that less than 10% of healthcare practitioners receive hands-on experience with cutting-edge technologies during their training. Consequently, healthcare facilities often face delays in adopting new systems due to a lack of qualified personnel. The World Health Organization underscores that inadequate training not only impedes innovation but also increases the risk of improper device usage, undermining patient safety. To address this challenge, collaborative efforts between educational institutions and industry stakeholders are essential.

Data Privacy and Cybersecurity Concerns

Stringent data privacy regulations and cybersecurity risks are also challenging the growth of the self-monitoring blood glucose devices market in Europe. According to the European Union Agency for Cybersecurity, cyberattacks on healthcare systems have surged by 50% in the past two years, with SMBG devices being a prime target due to their interconnected nature. As per the European Data Protection Board, vulnerabilities in IoT-enabled SMBG systems could lead to unauthorized access, data breaches, and even manipulation of glucose readings, endangering lives. A notable incident in Germany, reported by the Federal Office for Information Security, involved a ransomware attack that disrupted SMBG schedules, resulting in a 15% decline in patient adherence during the affected period. Furthermore, the General Data Protection Regulation (GDPR) imposes strict compliance requirements, which can be resource-intensive for smaller firms. Strengthening cybersecurity frameworks is imperative to safeguard sensitive patient data and ensure the uninterrupted operation of SMBG systems. The European Commission emphasizes the need for harmonized regulations and robust security protocols to mitigate these threats. Without addressing this challenge, the trust and reliability of SMBG technologies could be severely compromised.

SEGMENTAL ANALYSIS

By Product Insights

The testing strips segment dominated the Europe self-monitoring blood glucose devices market by commanding 45.4% of the European market share in 2024. The domination of testing strips segment in the European market is attributed to their affordability, widespread availability, and compatibility with traditional blood glucose meters, making them indispensable for daily glucose monitoring. The high demand among both Type 1 and Type 2 diabetes patients, ease of use, rapid results, and ability of testing strips to provide accurate readings when paired with reliable meters are majorly driving the domination of the segment in the European market. Furthermore, the increasing prevalence of diabetes has amplified the demand for testing strips, with a 15% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation strips, further solidifying their dominance.

The continuous glucose monitors (CGMs) segment is expected to register a CAGR of 12.5% over the forecast period owing to their ability to provide real-time glucose readings, predictive alerts, and trend analysis, enabling proactive diabetes management. According to the European Radiology Society, CGMs have improved glycemic control by 25%, particularly for patients with Type 1 diabetes, who require precise monitoring to avoid complications. According to the European Commission, investments in CGM technologies have surged by 20% annually, driven by the need for durable and adaptable solutions. The integration of wireless connectivity and AI-driven analytics has further bolstered this segment, enhancing treatment adherence and patient safety.

By Application Insights

The type 2 diabetes segment was the leading segment in the Europe self-monitoring blood glucose devices market in 2024 with a share of 51.4%. The domination of type 2 diabetes segment in the European market is driven by the high prevalence of Type 2 diabetes, which accounts for over 90% of all diabetes cases in Europe, as per the International Diabetes Federation. SMBG devices, including blood glucose meters and testing strips, are indispensable tools in managing this condition, enabling patients to monitor their glucose levels and make informed lifestyle adjustments. According to the European Commission, SMBG systems have reduced diabetes-related complications by 30%, underscoring their clinical significance. Furthermore, the rising awareness of preventive care has amplified the segment's growth. According to the European Federation of Diabetology, advanced SMBG systems have improved diagnostic accuracy by 25%, with reduced variability in glucose levels and faster recovery times. Investments in AI-driven glucose monitors have further enhanced the precision and safety of these devices.

The gestational diabetes segment is predicted to grow at a CAGR of 11.8% over the forecast period owing to the alarming rise in gestational diabetes cases, with the World Health Organization reporting a 20% increase in prevalence over the past decade. SMBG devices, such as continuous glucose monitors and testing strips, are critical for managing this condition, ensuring optimal maternal and fetal health. The European Association for the Study of Diabetes notes that advanced SMBG systems have reduced pregnancy-related complications by 35%, making them a preferred solution for healthcare providers. Factors such as the technological advancements, growing patient awareness and integration of AI-driven predictive analytics to enhance treatment adherence and patient safety are propelling the growth of the gestational diabetes segment in the European market. As healthcare systems prioritize precision and efficiency in maternal care, gestational diabetes is poised to remain the fastest-growing application in the market.

By Distribution Channel Insights

The retail pharmacies segment accounted for 40.8% of the European market share in 2024. The dominance of retail pharmacies segment in the European market is attributed to their widespread presence and accessibility, enabling patients to conveniently purchase SMBG devices and consumables such as testing strips and lancets. According to the European Commission, retail pharmacies conducted over 60% of all SMBG device sales in 2022, underscoring their pivotal role in advancing diabetes care. Furthermore, the increasing prevalence of diabetes has amplified the demand for SMBG systems, with a 12% annual growth rate observed in retail pharmacy sales. As per the European Federation of Pharmaceutical Industries and Associations, retail pharmacies offer personalized counseling and support services, enhancing patient adherence and satisfaction. Investments in digital platforms, totaling €500 million annually, have further solidified their leadership in the market.

The online sales segment is predicted to witness the highest CAGR of 15.5% over the forecast period owing to the increasing demand for convenient and cost-effective purchasing options that offer patients greater flexibility and access to a wider range of SMBG products. As per the European Commission, online sales accounted for over 25% of all SMBG device purchases in 2022, a figure expected to rise as healthcare systems prioritize decentralization. According to the European Federation of Ambulatory Surgery, online platforms have reduced purchasing costs by 30%, making them an attractive option for patients seeking affordable care. Furthermore, advancements in e-commerce logistics and digital health technologies have enabled online retailers to deliver high-quality services, even in remote areas. According to the European Investment Fund, investments in online sales infrastructure have surged by 25% annually, reflecting its growing importance. A report by the European Health Management Association notes that online sales are also leveraging digital health technologies to enhance patient engagement and streamline operations. As healthcare providers aim to optimize resource allocation and improve accessibility, online sales are poised to emerge as a transformative force in the SMBG devices market.

REGIONAL ANALYSIS

Germany had 26.3% of the European self-monitoring blood glucose devices market in 2024. The leading position of Germany in the European market is majorly driven by the robust healthcare infrastructure and substantial investments in medical technology. As per the European Commission, Germany accounts for over 30% of all SMBG device sales in Europe, driven by the widespread adoption of advanced monitoring systems. Furthermore, the presence of leading manufacturers, such as Roche Diabetes Care, has positioned Germany as a hub for innovation in SMBG technologies. As per a report by the European Investment Bank, Germany's emphasis on research and development has led to the creation of cutting-edge technologies, enhancing diagnostic accuracy and patient safety.

The UK is estimated to account for a prominent share of the European self-monitoring blood glucose devices market over the forecast period. The prominent position of the UK in the European market is driven by the country's advanced healthcare system and high prevalence of diabetes, which necessitate continuous monitoring. According to the European Commission, the UK accounts for over 25% of all SMBG device usage in Europe, with a particular focus on continuous glucose monitors and testing strips.

France is likely to register a promising CAGR over the forecast period in the European self-monitoring blood glucose monitoring market. As per the European Commission, France accounts for over 20% of all SMBG device usage in Europe, with a particular focus on AI-driven predictive analytics. The French Medical Technology Association notes that the market for SMBG devices in France is projected to reach €1.2 billion by 2025, driven by advancements in wearable health technologies. Furthermore, the integration of telemedicine and remote monitoring has enhanced accessibility, particularly in rural areas.

MARKET SEGMENTATION

This research report on the europe self-monitoring blood glucose devices market is segmented and sub-segmented based on product, application, distribution channel and region.

By Product

- Self-monitoring Blood Glucose Meters

- Continuous Glucose Monitors

- Testing Strips

- Lancets

By Application

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales

- Diabetes Clinics & Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the self-monitoring blood glucose devices market in Europe?

The market is driven by rising diabetes cases, technological advancements in monitoring devices, increased awareness about diabetes management, and government healthcare initiatives.

What are the challenges facing the self-monitoring blood glucose devices market in Europe?

Challenges include the high cost of advanced devices, lack of reimbursement in some regions, and stringent regulatory requirements for medical devices.

What is the future outlook for the self-monitoring blood glucose devices market in Europe?

The market is expected to grow due to the adoption of more advanced technologies like CGMs and integration with digital health solutions

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]