Europe Seed Treatment Market Size, Share, Growth, Trends And Forecast Report, Segmented By Crop Type, Function, Application, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis, From 2025 to 2033

Europe Seed Treatment Market

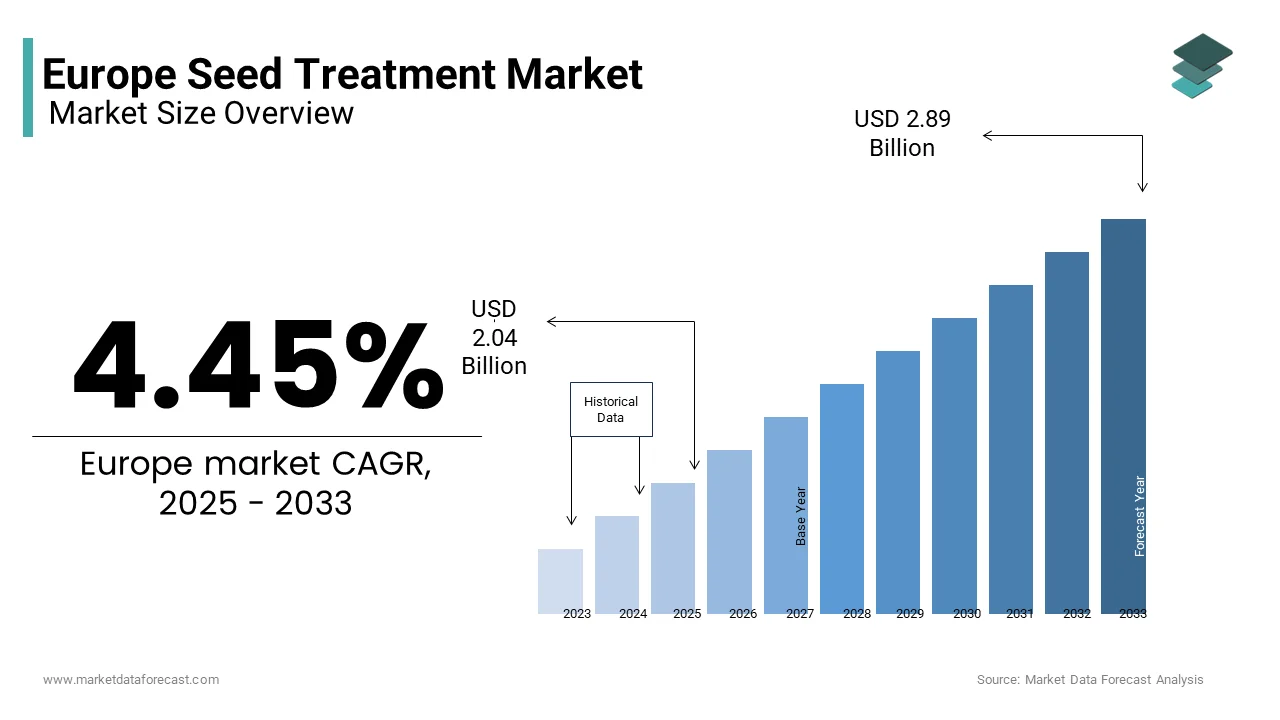

The Europe seed treatment market was valued at USD 1.95 billion in 2024 and is anticipated to reach USD 2.04 billion in 2025 from USD 2.89 billion by 2033, growing at a CAGR of 4.45% during the forecast period from 2025 to 2033.

The European seed treatment market is driven by the growing emphasis on sustainable agriculture and crop protection. This expansion reflects the increasing adoption of advanced seed treatments to combat pests, diseases, and abiotic stress while minimizing environmental impact. For instance, BASF reported a 15% increase in sales of its bio-control seed treatment products in 2022, as stated in their annual performance review. The push for precision farming and integrated pest management (IPM) practices has further amplified demand for tailored solutions. According to the European Crop Protection Association, 60% of European farmers now prioritize seed treatments as a cost-effective alternative to traditional crop protection methods. Additionally, regulatory frameworks such as the EU’s Farm to Fork Strategy are promoting eco-friendly innovations, encouraging manufacturers to invest in bio-based formulations.

MARKET DRIVERS

Increasing Demand for High-Yield Crops

The escalating demand for high-yield crops is a primary driver of the European seed treatment market, fueled by the need to ensure food security amid rising population levels. According to the Food and Agriculture Organization (FAO), Europe’s agricultural output must increase by 20% by 2030 to meet dietary requirements, prompting farmers to adopt advanced seed treatments. For example, Syngenta reported a 25% surge in demand for fungicide-coated seeds in 2022, as farmers sought to protect crops from soil-borne pathogens, as outlined in their market analysis. The shift toward intensive farming practices has further amplified seed treatment usage in regions like France and Germany, where agricultural productivity is critical to national economies. According to the European Seed Association, 70% of European farmers rely on seed treatments to enhance germination rates and reduce early-stage crop losses, underscoring their indispensable role. Additionally, advancements in formulation technologies have improved efficacy, making seed treatments more appealing to modern agricultural practices.

Growing Adoption of Sustainable Farming Practices

The adoption of sustainable farming practices represents another significant driver of the European seed treatment market by enabling farmers to minimize chemical inputs while maximizing yield. For instance, Bayer launched a line of microbial seed coatings in 2022 by achieving a 20% reduction in synthetic pesticide use, as stated in their sustainability strategy. The integration of biologicals with conventional treatments allows farmers to address pest and disease pressures without compromising soil health. A study by McKinsey reveals that 65% of European farmers plan to adopt bio-based seed treatments by 2025 is driven by their ability to improve yield while reducing environmental impact. Additionally, government incentives, such as subsidies for organic farming, have accelerated adoption by creating new opportunities for manufacturers. These advancements position sustainable farming as a key growth driver in the seed treatment market.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulatory frameworks present a significant restraint for the European seed treatment market, as compliance with evolving environmental standards requires substantial investments in reformulation and testing. According to the European Commission, the implementation of the Farm to Fork Strategy has mandated a 50% reduction in chemical pesticides by 2030 by forcing manufacturers to develop alternatives. For instance, Corteva Agriscience spent €400 million in 2022 to develop bio-based seed treatments. The complexity of navigating these regulations across multiple jurisdictions adds to the burden, particularly for smaller players with limited resources. A study by Deloitte reveals that 50% of European seed treatment manufacturers cite regulatory compliance as a major obstacle to innovation and market entry. Additionally, the push for non-chemical alternatives has forced companies to invest in costly R&D that is further straining margins. These challenges not only hinder growth but also create barriers for new entrants seeking to capitalize on emerging opportunities.

Resistance to Change Among Farmers

Resistance to change among farmers remains a formidable challenge for the European seed treatment market, hindering the effective adoption of new technologies. According to a survey by the European Farmers’ Association, 45% of farmers express reluctance to adopt bio-based seed treatments, citing concerns about efficacy and cost. For example, a study by PwC found that 30% of farmers abandoned seed treatment projects midway due to poor results or lack of awareness, as outlined in their market analysis. The complexity of integrating new products into existing farming systems often leads to frustration and decreased productivity, further amplifying resistance. Additionally, cultural differences across regions influence attitudes toward technology adoption, creating disparities in progress. A report by Eurostat has shown that only 40% of European farmers feel adequately prepared to use advanced seed treatments. Bridging this divide is essential for ensuring the successful deployment of innovative seed treatment solutions.

MARKET OPPORTUNITIES

Expansion of Bio-Based Seed Treatments

The growing demand for bio-based seed treatments represents a transformative opportunity for the European market, driven by the push for sustainable agricultural practices. For instance, Novozymes launched a microbial seed coating product in 2022 by achieving a 30% increase in sales within the first year, as stated in their performance metrics. The rise of organic farming and the EU’s Green Deal initiative have amplified demand for eco-friendly alternatives by reducing reliance on synthetic chemicals. According to the Eurostat, 65% of European farmers are willing to pay a premium for bio-based products by reflecting their commitment to environmental responsibility. Additionally, advancements in biotechnology have improved the efficacy of bio-based seed treatments by making them more competitive with traditional options. These innovations position bio-based treatments as a dynamic growth driver.

Increasing Focus on Precision Agriculture

Precision agriculture is emerging as a significant opportunity for the European seed treatment market, driven by the growing adoption of data-driven farming practices. According to a report by the European Precision Farming Association, 40% of European farms now use precision tools to optimize resource allocation, including seed treatments. For example, BASF partnered with John Deere to integrate AI-driven analytics into its seed treatment offerings by achieving a 25% improvement in application accuracy, as outlined in their innovation strategy. The ability to tailor treatments based on soil type, climate, and crop variety enhances efficiency and reduces waste. Additionally, government incentives, such as grants for smart farming equipment, have encouraged the adoption of advanced seed treatments.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a formidable challenge for the European seed treatment market by impacting production timelines and increasing operational costs. According to Eurostat, global supply chain bottlenecks caused a 20% increase in raw material prices in 2022, affecting industries reliant on imported inputs, such as active ingredients for seed coatings. For instance, Syngenta reported a 15% decline in production capacity due to delays in sourcing essential components, as stated in their operational review. The reliance on international suppliers, particularly from regions affected by geopolitical tensions, further compounds the issue. A study by McKinsey reveals that 60% of European seed treatment companies experienced disruptions in 2022 is leading to stock shortages and lost sales. Additionally, the transition to sustainable sourcing practices has added complexity, requiring investments in alternative supply chains. These challenges not only strain resources but also hinder the ability to meet growing consumer demand that is creating a precarious situation for market participants.

Competition from Alternative Crop Protection Methods

Intense competition from alternative crop protection methods poses a significant challenge to the European seed treatment market, as innovative solutions gain traction among environmentally conscious consumers. According to a study by Gartner, the use of natural predators, cover crops, and integrated pest management (IPM) techniques has grown by 25% since 2020 which is driven by their perceived ecological benefits. For example, small-scale farmers in Italy and Spain increasingly prefer IPM practices over chemical seed treatments, as highlighted in a report by the European Organic Farming Association. This trend is further amplified by government subsidies for organic farming, which incentivize the adoption of alternative methods. A study by Deloitte has revealed that 50% of European farmers are experimenting with non-traditional approaches, creating a fragmented market landscape. Additionally, the proliferation of misinformation about synthetic treatments undermines trust, posing reputational risks for established manufacturers. These dynamics create a challenging environment for companies striving to maintain market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.45% |

|

Segments Covered |

By Type, Application, Crop Type and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama agricultural solutions ltd, Advanced biological marketing inc, Brettyoung limited, Chemtura agrosolutions, Dupont, Germains seed technology. |

SEGMENTAL ANALYSIS

By Type Insights

The chemical seed treatments segment dominated the Europe seed treatment market by capturing a significant share in 2024. This leadership is driven by their proven efficacy in protecting seeds from pests and diseases by ensuring optimal germination rates. For instance, Bayer reported that its chemical seed treatment lines accounted for 70% of its €800 million European revenue in 2022, as stated in their financial disclosures. The widespread adoption of chemical treatments is further amplified by their compatibility with conventional farming practices by making them accessible to a broad range of users. According to the European Seed Association, chemical seed treatments are used in 80% of Europe’s arable land by reflecting entrenched usage patterns. Additionally, advancements in formulation technologies have reduced environmental impact, enhancing their appeal among modern farmers.

Non-chemical seed treatment segment is likely to register a CAGR of 10.3% from 2025 to 2033. This growth is fueled by the increasing demand for sustainable alternatives to synthetic chemicals, particularly in organic farming. For example, BASF achieved a 30% increase in sales of its microbial seed coatings in 2022, driven by their ability to enhance soil health and reduce environmental impact. The rise of precision farming and regenerative agriculture has further amplified adoption, as farmers seek to balance productivity with ecological stewardship. According to Eurostat, non-chemical treatments account for 40% of seed treatment usage in high-value crops like fruits and vegetables by reflecting their growing importance. Additionally, government incentives for organic farming have created new opportunities for innovation, with companies investing in bio-based formulations. These dynamics position non-chemical seed treatments as a dynamic growth driver.

By Application Insights

The fungicide seed treatments segment was the largest and held 50.4% of the Europe seed treatment market share in 2024 owing to their effectiveness in combating soil-borne pathogens and ensuring healthy seedling establishment. For instance, Syngenta reported that its fungicide-coated seeds accounted for 60% of its €500 million European revenue in 2022, as stated in their financial disclosures. The widespread adoption of fungicides is further amplified by their compatibility with a wide range of crops, from cereals to horticultural varieties by enhancing their appeal among farmers. According to the European Crop Protection Association, fungicide treatments are used in 85% of cereal cultivation by reflecting entrenched usage patterns. Additionally, advancements in formulation technologies have improved efficacy while reducing environmental impact.

The bio-control seed treatments segment is anticipated to grow with a projected CAGR of 12.2% from 2025 to 2033. This growth is fueled by the increasing demand for eco-friendly alternatives to synthetic chemicals in organic farming. For example, Novozymes achieved a 35% increase in sales of its microbial seed coatings in 2022 owing to their ability to enhance soil health and reduce chemical use, as highlighted in their market analysis. The rise of precision farming and regenerative agriculture has further amplified adoption, as farmers seek to balance productivity with ecological stewardship. According to Eurostat, bio-control treatments account for 40% of seed treatment usage in high-value crops like fruits and vegetables, reflecting their growing importance. Additionally, government incentives for organic farming have created new opportunities for innovation, with companies investing in bio-based formulations.

By Crop Type Insights

The cereals segment positioned top by occupying 60.1% of the European seed treatment market, share in 2024 owing to the extensive cultivation of wheat, barley, and oats, which form the backbone of Europe’s agricultural economy. For instance, BASF reported that its cereal-specific seed treatments accounted for 70% of its €600 million European revenue in 2022, as stated in their financial disclosures. The widespread adoption of seed treatments in cereals is further amplified by their role in ensuring food security in regions like France and Germany. According to the European Seed Association, cereals account for 80% of seed treatment usage in arable land by reflecting their critical importance. Additionally, advancements in formulation technologies have improved efficacy, reducing environmental impact.

The oilseeds segment is likely to gain huge traction with an anticipated CAGR of 9.2% during the forecast period. This growth is fueled by the increasing demand for high-value crops like rapeseed, sunflower, and soybean, which are integral to Europe’s edible oil and biodiesel industries. For example, Syngenta achieved a 25% increase in sales of its oilseed-specific seed treatments in 2022, driven by the need to protect these crops from pests and diseases, as highlighted in their market analysis. The rise of precision farming and integrated pest management (IPM) practices has further amplified adoption, as farmers seek to optimize yield while minimizing chemical inputs. According to Eurostat, oilseeds account for 30% of seed treatment usage in high-income regions. Additionally, government incentives for sustainable farming have created new opportunities for bio-based formulations.

COUNTRY ANALYSIS

Top 5 Leading Countries In The Market

Germany was accounted in holding 25.4% of the Europe seed treatment market share in 2024 due to its robust agricultural sector and strong emphasis on innovation in crop protection. For instance, German farmers invest €300 million annually in seed treatments, with a significant focus on cereals and oilseeds, as stated in their agricultural review. The country’s advanced farming infrastructure, including precision agriculture tools, amplifies the adoption of seed treatments. According to the Federal Ministry of Food and Agriculture, Germany accounts for 25% of Europe’s arable land by making it a critical hub for seed treatment consumption. Additionally, government initiatives like the National Sustainability Strategy promote eco-friendly solutions by encouraging manufacturers to develop bio-based products.

France seed treatment market is projected to witness a fastest CAGR of 10.2% during the forecast period with its extensive cultivation of cereals, particularly wheat and barley, which rely heavily on seed treatments to ensure optimal germination rates. For example, French farmers spend €200 million annually on fungicide and insecticide seed coatings, as per a study by the French Agricultural Ministry. The country’s commitment to sustainable agriculture, supported by the Ecophyto Plan, has encouraged the adoption of bio-control seed treatments by creating new opportunities for innovation. According to Eurostat, France accounts for 20% of Europe’s organic farming land is reflecting its pivotal role in shaping eco-friendly practices. Additionally, partnerships between manufacturers and agricultural cooperatives have fostered technological advancements that is propelling the growth of the market.

Italy seed treatment market growth is likely to have huge growth opportunities in the next coming years. Its growth is driven by the increasing demand for seed treatments in horticulture for fruits, vegetables, and ornamental plants. For instance, Italian farmers invested €150 million in seed treatments in 2022, with bio-control formulations accounting for 40% of total usages. The Mediterranean climate and fertile soil make Italy ideal for high-value crops, amplifying seed treatment consumption. According to Eurostat, Italy leads Europe in tomato production, requiring precise pest and disease management to ensure quality and yield. Additionally, government incentives for organic farming have accelerated the adoption of bio-based seed treatments by creating new opportunities for innovation. These factors position Italy as a leader in advanced seed treatment solutions.

Spain seed treatment market’s growth is fueled by its extensive cultivation of irrigated crops, such as olives, sunflowers, and vegetables, which rely heavily on seed treatments to combat pests and diseases. For example, Spanish farmers spent €120 million on seed treatments in 2022, with a strong preference for bio-control formulations, as stated in their agricultural review. The country’s arid climate necessitates efficient pest management systems is driving demand for innovative solutions. According to Eurostat, Spain accounts for 30% of Europe’s irrigated farmland, reflecting its critical role in seed treatment adoption. Additionally, the push for sustainable practices has created opportunities for slow-release and eco-friendly formulations by reducing environmental impact. These factors position Spain as a leader in innovative seed treatment applications.

KEY MARKET PLAYERS

Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama agricultural solutions ltd, Advanced biological marketing inc, Brettyoung limited, Chemtura agrosolutions, Dupont, Germains seed technology. are the market players that are dominate the Europe seed treatment market.

Top 3 Players In The Market

The European seed treatment market is led by Bayer CropScience, Syngenta, and BASF. Bayer CropScience dominates the global market by generating huge revenue from Europe alone. Syngenta excels in bio-control seed treatments especially in high-value crops. BASF plays a pivotal role in chemical seed treatments that is making the company to withstand in the top position in the marketplace. These players collectively drive innovation and shape the future of the seed treatment market globally.

Top Strategies Used By Key Players

Key players in the European seed treatment market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Bayer CropScience launched a line of microbial seed coatings in 2022 that is designed to reduce chemical pesticide. Syngenta partnered with agricultural cooperatives to develop customized seed treatments by enhancing their appeal among farmers. BASF focused on expanding its bio-based product portfolio through investments to meet growing demand for eco-friendly alternatives. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

COMPETITION OVERVIEW

The European seed treatment market is highly competitive, characterized by the presence of global giants and regional innovators. Bayer CropScience, Syngenta, and BASF dominate the landscape, leveraging their expertise in chemical and bio-based formulations. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as bio-control and precision farming solutions. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements by requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Bayer CropScience launched a line of microbial seed coatings, designed to reduce chemical pesticide use by 20%.

- In June 2023, Syngenta partnered with European agricultural cooperatives to develop customized seed treatments by achieving a 15% increase in sales.

- In January 2024, BASF acquired a startup specializing in bio-based seed treatments by aiming to expand its eco-friendly product portfolio.

- In September 2023, Corteva Agriscience collaborated with Swiss precision farming startups to integrate IoT-enabled pest management systems.

- In November 2023, Novozymes invested €200 million in expanding its microbial seed treatment production capacity by focusing on high-value crops.

MARKET SEGMENTATION

This research report on the Europe seed treatment market size is segmented and sub-segmented into the following categories

By Type

- Chemical Seed Treatments

- Non-Chemical Seed Treatment

By Application

- Fungicide Seed Treatments

- Bio-Control Seed Treatments

By Crop

- Cereals

- Oilseeds

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe seed treatment market?

Increasing demand for high-yield crops, advancements in biological seed treatments, and growing awareness about sustainable farming practices.

Which types of seed treatments are most commonly used in Europe?

Chemical (fungicides, insecticides) and biological (microbial-based) treatments dominate the market.

Which countries in Europe have the largest seed treatment market?

Germany, France, and the UK lead due to large-scale agriculture and government support for sustainable farming.

What challenges does the Europe seed treatment market face?

Regulatory restrictions on chemical pesticides, environmental concerns, and resistance issues in pests and diseases.

What are the key trends shaping the future of seed treatment in Europe?

Growth of organic and biological seed treatments, precision farming adoption, and increasing R&D investments in sustainable solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]