Europe SD-WAN (Software-Defined Wide Area Network) Market Size, Share, Trends, & Growth Forecast Report Segmented By Component Insights (Solution and Services), Deployment, Organization Size, and End-user Size, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe SD-WAN (Software-Defined Wide Area Network) Market Size

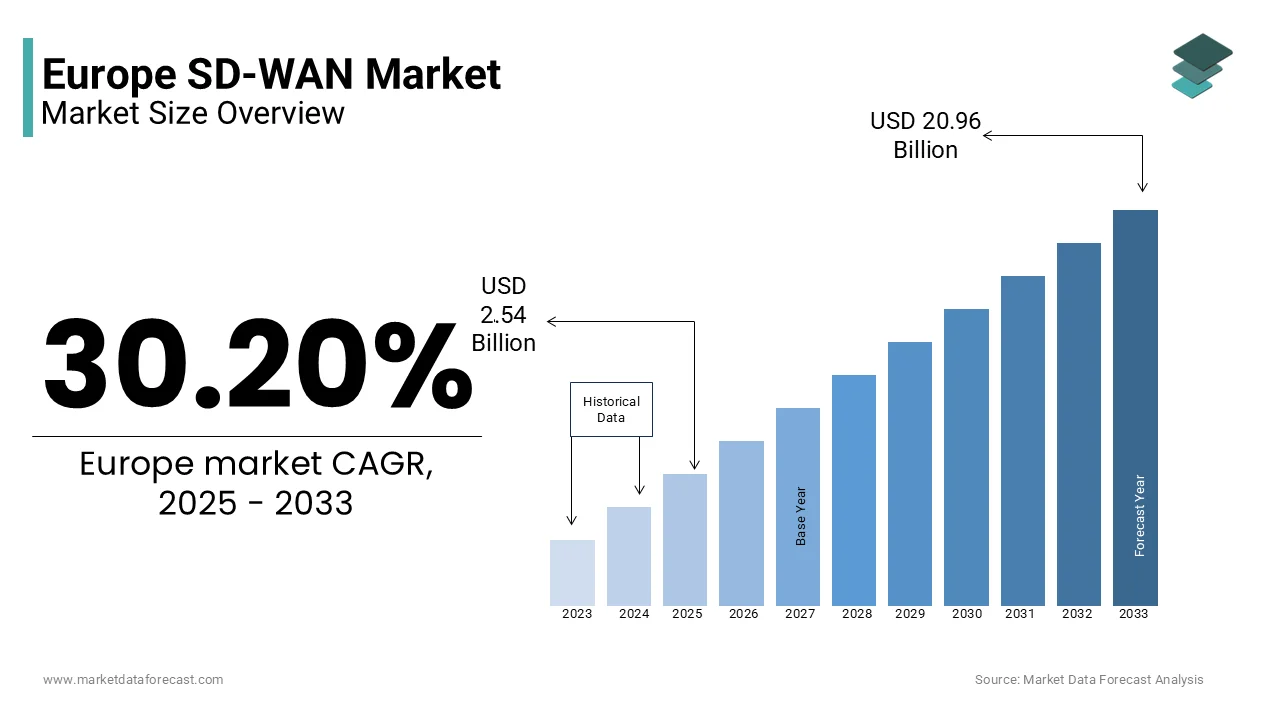

The Europe software-defined wide area network market was worth USD 1.95 billion in 2024. The European market is projected to reach USD 20.96 billion by 2033 from USD 2.54 billion in 2025, growing at a CAGR of 30.20% from 2025 to 2033.

The Europe SD-WAN market has been growing significantly over the last few years due to the increasing demand for efficient, scalable, and secure network solutions across various industries. SD-WAN technology enables organizations to optimize their network performance by leveraging software-defined networking principles to manage and direct traffic across multiple connections, including MPLS, broadband, and LTE. This flexibility is particularly valuable in Europe as businesses are increasingly adopting cloud-based applications and digital transformation initiatives, which is needing robust and agile network infrastructures.

The rising adoption of hybrid work models, the proliferation of IoT devices, and the need for enhanced cybersecurity measures are anticipated to continue to fuel the demand for SD-WAN services in the Europe over the forecast period. Furthermore, the emphasis of the European Union on digital sovereignty and data privacy regulations, such as GDPR, has prompted organizations to invest in SD-WAN solutions that ensure compliance and secure data transmission. As per a study by Gartner, over 60% of European enterprises are expected to deploy SD-WAN by 2025, up from approximately 35% in 2022. Industries such as healthcare, retail, and finance are leading the adoption of the SD-WAN due to the increasing need for seamless connectivity and improved user experiences. The UK, Germany, and France are among the largest markets for SD-WAN in Europe.

MARKET DRIVERS

Adoption of Cloud-Based Services in Europe

The rapid adoption of cloud-based services is a primary driver of the Europe SD-WAN market. According to Eurostat, over 60% of European enterprises utilized cloud computing services in 2022, a significant increase from 41% in 2018. This surge is attributed to the growing reliance on SaaS applications and hybrid cloud environments, which require agile and secure network solutions. SD-WAN enables seamless connectivity to cloud platforms, reducing latency and improving application performance. The European Commission’s Digital Economy and Society Index (DESI) 2023 report highlights that cloud adoption is highest in countries like Finland, Sweden, and Denmark, further accelerating SD-WAN deployment across the region.

Increasing Need for Robust Cybersecurity Measures

The rising demand for robust cybersecurity measures is another critical factor driving the Europe SD-WAN market. The European Union Agency for Cybersecurity (ENISA) reported a 47% rise in cyberattacks across Europe in 2022, prompting organizations to prioritize secure networking solutions. SD-WAN integrates advanced security features such as encryption, firewalls, and threat detection, ensuring compliance with stringent regulations like GDPR. A report by the European Cybersecurity Organization (ECSO) states that 70% of European businesses plan to enhance their network security infrastructure by 2025, with SD-WAN being a key component. This trend underscores the technology’s role in addressing evolving cyber threats.

MARKET RESTRAINTS

High Initial Deployment Costs

One of the major restraints of the Europe SD-WAN market is the high initial deployment costs. According to a report by the European Investment Bank, small and medium-sized enterprises (SMEs) in Europe face significant financial barriers when adopting advanced technologies like SD-WAN, with 45% citing cost as a primary concern. The upfront investment required for hardware, software, and skilled personnel can be prohibitive, particularly for smaller organizations. The European Commission’s 2023 SME Performance Review highlights that only 30% of SMEs in the EU have adopted advanced digital technologies, largely due to budgetary constraints. This financial challenge limits the widespread adoption of SD-WAN, especially among cost-sensitive businesses.

Lack of Skilled Workforce

Another significant restraint is the lack of a skilled workforce capable of managing and implementing SD-WAN solutions. The European Centre for the Development of Vocational Training (Cedefop) reports that 40% of European companies face difficulties in finding IT professionals with expertise in software-defined networking and cybersecurity. This skills gap is particularly pronounced in Eastern and Southern Europe, where digital literacy rates are lower compared to Northern and Western regions. The European Commission’s Digital Economy and Society Index (DESI) 2023 further emphasizes that 55% of enterprises struggle to recruit qualified personnel for advanced IT roles. This shortage hampers the effective deployment and management of SD-WAN solutions, slowing market growth.

MARKET OPPORTUNITIES

Expansion of 5G Networks

The rollout of 5G networks across Europe presents a significant opportunity for the SD-WAN market. According to the European Commission’s 5G Observatory, 5G coverage in the EU reached 66% of populated areas by the end of 2023, with countries like Germany, France, and Italy leading the deployment. SD-WAN can leverage 5G’s high-speed, low-latency capabilities to enhance network performance, particularly for bandwidth-intensive applications such as IoT and real-time analytics. The European Telecommunications Network Operators’ Association (ETNO) estimates that 5G-enabled SD-WAN solutions could generate €10 billion in revenue by 2027, driven by increased demand from industries like manufacturing, healthcare, and transportation.

Growing Emphasis on Digital Transformation

The growing emphasis on digital transformation across European industries offers a substantial opportunity for the SD-WAN market. The European Commission’s Digital Economy and Society Index (DESI) 2023 reveals that 75% of European enterprises have accelerated their digital transformation initiatives post-pandemic, with a focus on cloud adoption and remote work infrastructure. SD-WAN plays a critical role in enabling these transformations by providing scalable, secure, and cost-effective network solutions. A report by the European Investment Bank indicates that digital transformation investments in the EU are expected to grow by 20% annually, reaching €150 billion by 2025. This trend positions SD-WAN as a key enabler of future-ready business operations.

MARKET CHALLENGES

Regulatory Complexity and Compliance

One of the major challenges facing the Europe SD-WAN market is the complexity of regulatory compliance. The European Union’s stringent data protection regulations, such as GDPR, require businesses to ensure secure data transmission and storage, which can be difficult to achieve with SD-WAN implementations. According to the European Data Protection Board, over 40% of European companies reported challenges in aligning their network infrastructure with GDPR requirements in 2023. Additionally, varying national regulations across EU member states further complicate compliance efforts. The European Commission’s 2023 Digital Single Market Report highlights that 35% of enterprises face delays in SD-WAN deployment due to regulatory hurdles, slowing market growth and increasing operational costs.

Integration with Legacy Systems

Another significant challenge is the integration of SD-WAN with existing legacy systems. Many European enterprises, particularly in sectors like manufacturing and utilities, still rely on outdated network infrastructures. The European Investment Bank’s 2023 report states that 50% of industrial companies in the EU use legacy systems that are incompatible with modern SD-WAN solutions. This incompatibility often requires costly and time-consuming upgrades, deterring adoption. The European Commission’s Digital Economy and Society Index (DESI) 2023 further notes that 60% of businesses cite technical challenges in integrating SD-WAN with legacy systems as a barrier to adoption, limiting the technology’s potential to transform network operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

30.20% |

|

Segments Covered |

By Component, Deployment, Organization Size, End-user Size, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Cisco Systems, Inc., Oracle Corporation, Hewlett Packard Enterprise Company., Nokia Corporation, VMware, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Fortinet, Inc., Citrix Systems, Inc., Ciena Corporation, Epsilon Telecommunications, Telefonaktiebolaget LM Ericsson, BT, NEC Corporation, and Tata Communications are some of the major players in the European software-defined wide area network market. |

SEGMENTAL ANALYSIS

By Component Insights

The software segment dominated the market by accounting for 55.6% of the European market share in 2024. The domination of the software segment in the European market is majorly attributed to the critical role SD-WAN software plays in automating network management, optimizing traffic routing, and enhancing application performance. The increasing adoption of cloud-based applications and hybrid work models has further fueled demand. The European Investment Bank reports that 70% of European enterprises prioritize software investments to improve network agility and reduce operational costs, underscoring its importance in enabling digital transformation and ensuring seamless connectivity.

The managed services segment is growing significantly and is estimated to witness the highest CAGR of 25.8% over the forecast period. The rising complexity of network management and the need for 24/7 monitoring and support are boosting the growth of the software segment in the European market. For instance, as per the European Commission’s 2023 Digital Single Market Report, 45% of enterprises prefer managed services to reduce operational burdens and ensure optimal performance. Additionally, the increasing adoption of SD-WAN by SMEs, which often lack in-house expertise, is driving demand. Managed services are crucial for enabling businesses to focus on core operations while ensuring reliable and secure network performance.

By Deployment Insights

The cloud deployment was the largest segment in the Europe SD-WAN market and occupied 65.9% of the European market share in 2024. The domination of the cloud segment is driven by the growing adoption of cloud-based applications and hybrid work models, which require scalable and flexible network solutions. The European Investment Bank reports that 70% of enterprises prioritize cloud-based SD-WAN for its cost-efficiency and ease of management. Additionally, the shift toward digital transformation and the need for remote network management have further solidified its importance, making it a cornerstone of modern enterprise networking strategies.

Again, the cloud deployment segment is also anticipated to be the fastest-growing segment and register a CAGR of 30.8% during the forecast period due to the increasing demand for scalable, secure, and cost-effective network solutions that support cloud-first strategies. The European Commission’s 2023 Digital Single Market Report notes that 60% of European businesses are accelerating their cloud adoption to enhance operational agility. Furthermore, the rise of hybrid work environments and the proliferation of IoT devices are driving the need for cloud-based SD-WAN, making it a critical enabler of future-ready business operations.

By Organization Size Insights

The large enterprises segment dominated the market in Europe by capturing 71.8% of the European market share in 2024. The dominance of large enterprises segment is majorly attributed to their complex networking needs, multi-location operations, and significant IT budgets. The European Commission’s Digital Economy and Society Index (DESI) 2023 highlights that 75% of large enterprises have integrated SD-WAN into their digital transformation strategies, particularly in sectors like finance, healthcare, and manufacturing. SD-WAN enables these organizations to optimize application performance, enhance cybersecurity, and streamline network management, making it a critical component of their IT infrastructure.

The SME segment is the fastest-growing in the Europe SD-WAN market and is predicted to grow at a CAGR of 35.8% over the forecast period. The increasing need for cost-effective, scalable, and agile networking solutions that support cloud adoption and remote work is driving the growth of the SME segment in the European market. The European Investment Bank notes that 40% of SMEs are investing in SD-WAN to improve connectivity and reduce operational costs. Additionally, the rise of digital transformation initiatives among SMEs, particularly in retail and professional services, is accelerating adoption. SD-WAN’s ability to provide enterprise-grade networking at a lower cost is making it increasingly vital for SMEs to remain competitive.

By End-user Size Insights

The IT & telecom segment captured 25.9% of the European market share in 2024. The growing need of IT and telecom for high-performance and low-latency networks to support cloud-based applications, data centers, and communication services is one of the major factors propelling the growth of the IT and telecom segment. The European Telecommunications Network Operators’ Association (ETNO) highlights that 70% of IT & telecom companies have adopted SD-WAN to enhance network agility and reduce operational costs. SD-WAN is critical for enabling seamless connectivity and supporting the sector’s rapid digital transformation, making it a cornerstone of modern IT infrastructure.

The healthcare segment is projected to register at a CAGR of 40.9% over the forecast period. The growing adoption of telemedicine, electronic health records, and IoT-enabled medical devices, which require secure and reliable connectivity is driving the growth of the healthcare segment in the European market. The European Commission’s 2023 Digital Single Market Report notes that 55% of healthcare providers have deployed SD-WAN to ensure compliance with data protection regulations like GDPR and to enhance patient care. SD-WAN’s ability to provide robust security and seamless connectivity is making it indispensable for modern healthcare operations.

REGIONAL ANALYSIS

The UK is the leading market for SD-WAN in Europe and 30.9% of the European market share in 2024. The UK’s dominance is driven by its advanced digital infrastructure, high cloud adoption rates, and strong emphasis on cybersecurity. The country’s thriving financial services sector, which accounts for 40% of SD-WAN deployments, relies heavily on secure and agile networking solutions. The UK government’s push for digital transformation, as highlighted in its 2023 National Cyber Strategy, further accelerates SD-WAN adoption. The market is projected to grow at a CAGR of 32% over the next five years, solidifying its leading position.

Germany is the second-largest SD-WAN market in Europe. The country’s leadership is attributed to its robust manufacturing sector, which contributes 35% of SD-WAN deployments, and its focus on Industry 4.0 initiatives. Germany’s strong regulatory framework, including GDPR compliance, drives demand for secure and reliable networking solutions. The European Investment Bank notes that 60% of German enterprises have integrated SD-WAN into their digital transformation strategies. With a projected CAGR of 30%, Germany remains a key driver of SD-WAN growth in Europe.

France is a prominent regional segment in the European SD-WAN market. The thriving retail and healthcare sectors of France that represent 30% of SD-WAN adoption is driving the French market growth. The national cloud strategy of France, "Cloud de Confiance," and its focus on digital sovereignty further boost SD-WAN deployment. The European Union Agency for Cybersecurity (ENISA) highlights that 50% of French businesses prioritize SD-WAN for its ability to enhance data security and compliance. With a projected CAGR of 28%, France is a significant contributor to the growth of the Europe SD-WAN market.

KEY MARKET PLAYERS

Cisco Systems, Inc., Oracle Corporation, Hewlett Packard Enterprise Company., Nokia Corporation, VMware, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Fortinet, Inc., Citrix Systems, Inc., Ciena Corporation, Epsilon Telecommunications, Telefonaktiebolaget LM Ericsson, BT, NEC Corporation, and Tata Communications are some of the major players in the European software-defined wide area network market.

MARKET SEGMENTATION

This research report on the Europe software-defined wide area network market is segmented and sub-segmented into the following categories.

By Component

- Solution

- Software

- Hardware

- Services

- Managed Services

- Professional Services

By Deployment

- Cloud

- On-premise

By Organization Size

- SMEs

- Large Enterprises

By End-user Size

- Service Providers

- Verticals

- IT & Telecom

- BFSI

- Manufacturing

- Retail

- Healthcare

- Government

- Transport & Logistics

- Energy & Utilities

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe SD-WAN market?

The increasing adoption of cloud-based applications, the need for cost-effective network management, and rising demand for secure and scalable connectivity solutions are driving the growth of the SD-WAN market in Europe.

How does SD-WAN improve network performance for enterprises?

SD-WAN optimizes network traffic by dynamically selecting the best path for data transmission, reducing latency, enhancing bandwidth efficiency, and improving overall application performance.

What security features does SD-WAN offer to European enterprises?

SD-WAN includes integrated security features such as end-to-end encryption, firewall capabilities, threat detection, and segmentation to protect enterprise networks from cyber threats.

How is the regulatory landscape affecting the SD-WAN market in Europe?

Compliance with data protection laws such as GDPR and sector-specific regulations is influencing SD-WAN adoption, driving the demand for solutions with enhanced security and data privacy capabilities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]