Europe Scintillator Market Size, Share, Trends & Growth Forecast Report by Composition of Material (In-Organic Scintillators, Organic Scintillators), End Product (Personal or Pocket Size Instruments, Hand-Held Instruments, Fixed, Installed, and Automatic Instruments), Application (Healthcare, Nuclear Power Plants, Manufacturing Industries, Homeland Security and Defense), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Scintillator Market Size

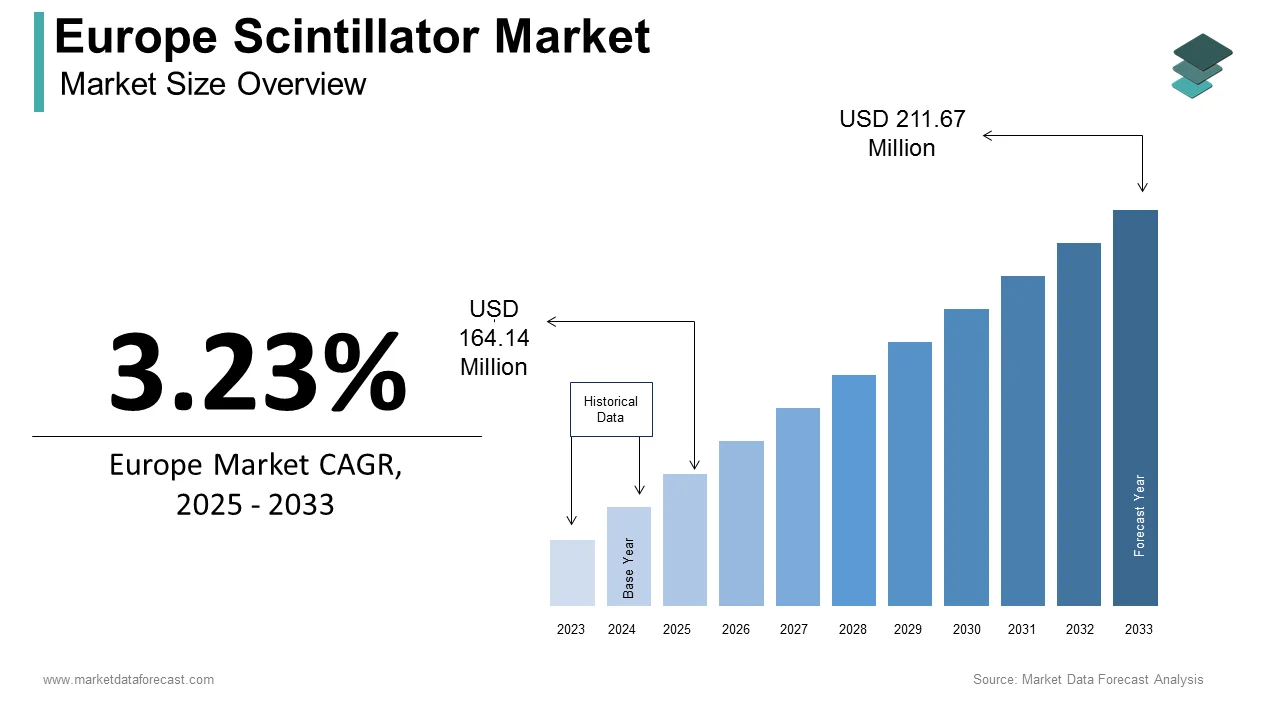

The scintillator market size in Europe was valued at USD 159 million in 2024. The European market is estimated to be worth USD 211.67 million by 2033 from USD 164.14 million in 2025, growing at a CAGR of 3.23% from 2025 to 2033.

Scintillators are widely employed across various sectors, including healthcare, nuclear power plants, manufacturing, homeland security, and defense. These materials are essential for applications such as medical imaging, nuclear reactor monitoring, and radiation detection in security systems. The market is driven by advancements in technology, increasing demand for accurate radiation detection, and the growing emphasis on nuclear safety and healthcare diagnostics. Europe accounted for a significant share of the global scintillators market in 2024 due to its robust healthcare infrastructure and stringent nuclear safety regulations. The focus of European region on renewable energy and nuclear power further amplifies the demand for scintillators. Additionally, the rise in cancer diagnostics and treatment procedures has spurred the adoption of scintillators in medical imaging devices such as PET and SPECT scanners. The market is also influenced by the increasing need for homeland security and defense applications, particularly in light of rising geopolitical tensions. As Europe continues to prioritize safety and technological innovation, the scintillator market is poised for steady growth, supported by ongoing research and development activities aimed at enhancing material efficiency and performance.

MARKET DRIVERS

Increasing Demand in Healthcare Applications in Europe

The healthcare sector is a primary driver of the Europe scintillator market, fueled by the rising prevalence of cancer and cardiovascular diseases. Scintillators are integral to medical imaging technologies such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT), which are essential for early disease detection and treatment planning. According to the World Health Organization, cancer is the second leading cause of death in Europe, accounting for approximately 20% of all fatalities. This has led to a surge in demand for advanced diagnostic tools, with the growing demand for the medical imaging in Europe. The integration of scintillators in these devices ensures high-resolution imaging, enabling accurate diagnosis and improved patient outcomes. Furthermore, government initiatives and funding for healthcare infrastructure development across Europe are bolstering market growth. For instance, the European Union’s Horizon Europe program has allocated significant resources to advance medical technologies, including radiation detection systems. This trend underscores the critical role of scintillators in modern healthcare and their contribution to the market’s expansion.

Growing Emphasis on Nuclear Safety and Security

The Europe scintillator market is also driven by the increasing focus on nuclear safety and security, particularly in the context of energy production and defense. Scintillators are widely used in nuclear power plants to monitor radiation levels and ensure operational safety. According to the International Atomic Energy Agency, Europe is home to over 180 nuclear reactors, accounting for nearly 30% of the global total. The region’s commitment to nuclear energy as a low-carbon power source has intensified the need for reliable radiation detection systems. Additionally, the escalating threat of nuclear terrorism and the proliferation of radioactive materials have heightened the demand for scintillators in homeland security applications. A report by the European Commission highlights that investments in nuclear safety technologies are expected to increase by 7% annually over the next decade. This trend is further supported by stringent regulatory frameworks, such as the Euratom Treaty, which mandates rigorous radiation monitoring and safety standards. The combination of these factors underscores the pivotal role of scintillators in ensuring nuclear safety and security, driving their adoption across Europe.

MARKET RESTRAINTS

High Cost of Advanced Scintillator Materials

The high cost associated with advanced scintillator materials, such as lutetium oxyorthosilicate (LSO) and lanthanum bromide (LaBr3) is one of the major restraints of the European scintillator market. These materials offer superior performance in terms of light yield and energy resolution but are expensive to produce due to the scarcity of raw materials and complex manufacturing processes. According to a report by Statista, the price of rare earth elements, which are essential for producing high-performance scintillators, has increased by over 15% in the past five years. This cost factor limits their adoption, particularly in cost-sensitive industries such as manufacturing and small-scale healthcare facilities. Additionally, the high initial investment required for scintillator-based systems poses a challenge for end-users, especially in developing regions of Europe. While these materials are indispensable for applications requiring high precision, their prohibitive cost remains a barrier to widespread adoption, thereby restraining market growth.

Regulatory and Environmental Challenges

The regulatory and environmental challenges are hindering the growth of the Europe scintillator market. The production and disposal of scintillator materials often involve hazardous substances, which are subject to stringent environmental regulations. For instance, the European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) framework imposes strict guidelines on the use of toxic materials, including certain scintillator compounds. Compliance with these regulations increases production costs and operational complexities for manufacturers. Moreover, the disposal of scintillator waste requires specialized facilities to prevent environmental contamination, adding to the overall cost. A study by the European Environment Agency indicates that the cost of managing hazardous waste in Europe has risen by 10% annually over the past decade. These regulatory and environmental challenges not only increase the financial burden on manufacturers but also slow down the pace of innovation and market expansion.

MARKET OPPORTUNITIES

Advancements in Scintillator Technology

The significant advancements in scintillator technology, particularly the development of hybrid and nanocomposite materials is one of the major opportunities for the European scintillator market. These innovations offer enhanced performance characteristics, such as higher light yield, faster response times, and improved energy resolution, making them ideal for next-generation applications. The integration of nanotechnology in scintillator production has opened new avenues for applications in high-energy physics and space exploration. For instance, the European Space Agency has invested heavily in scintillator-based detectors for satellite missions, aiming to improve radiation monitoring in space. These technological advancements not only expand the scope of scintillator applications but also create lucrative opportunities for market players to differentiate their offerings and capture a larger share of the market.

Expansion of Nuclear Power Infrastructure

The expansion of nuclear power infrastructure in Europe presents a significant opportunity for the scintillator market. With the European Union’s commitment to achieving carbon neutrality by 2050, nuclear energy is being increasingly recognized as a key component of the region’s energy transition strategy. According to the World Nuclear Association, Europe plans to construct 15 new nuclear reactors by 2035, with investments exceeding EUR 500 billion. This expansion will drive the demand for scintillators, which are essential for radiation monitoring and safety in nuclear power plants. Additionally, the decommissioning of aging reactors and the need for advanced radiation detection systems in waste management further amplify the market potential. The combination of these factors creates a robust growth opportunity for scintillator manufacturers, particularly those offering innovative and cost-effective solutions.

MARKET CHALLENGES

Supply Chain Disruptions

The Europe scintillator market faces significant challenges due to supply chain disruptions, particularly in the procurement of rare earth elements and other critical raw materials. According to a report by the European Commission, over 80% of the global supply of rare earth elements is controlled by a single country, making the market vulnerable to geopolitical tensions and trade restrictions. The COVID-19 pandemic further exacerbated these issues, causing delays in material shipments and increasing production costs. A study by Deloitte highlights that supply chain disruptions have led to a 20% increase in lead times for scintillator manufacturers in Europe. These challenges not only affect production schedules but also result in higher prices for end-users, thereby limiting market growth.

Competition from Alternative Technologies

The Europe scintillator market is increasingly facing competition from alternative radiation detection technologies, such as semiconductor-based detectors. These alternatives offer advantages such as compact size, lower power consumption, and ease of integration, making them attractive for certain applications. While scintillators remain indispensable for high-precision applications, the growing adoption of alternative technologies in industries such as manufacturing and security could limit their market share. This competitive landscape necessitates continuous innovation and cost optimization by scintillator manufacturers to maintain their relevance in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Composition of Material, End Product, Application and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Scintacor Ltd., Hamamatsu Photonics K.K, Proterial, Ltd. (formerly Hitachi Metals), Applied Scintillation Technologies Ltd., Mirion Technologies, Inc., Saint-Gobain Ceramics & Plastics, Inc., and Others. |

SEGMENTAL ANALYSIS

By Composition of Material Insights

The inorganic scintillators segment dominated the Europe scintillator market by holding 68.7% of the European market share in 2024. These materials, such as sodium iodide (NaI) and cesium iodide (CsI), are widely used due to their high density, excellent light yield, and superior energy resolution. Their dominance is particularly evident in medical imaging and nuclear power applications, where precision and reliability are paramount. For instance, sodium iodide scintillators are extensively used in gamma cameras for cancer diagnostics, while cesium iodide is preferred for high-energy physics experiments. The growing demand for accurate radiation detection in healthcare and energy sectors underscores the importance of inorganic scintillators, driving their market leadership.

The organic scintillators segment is estimated to progress at a CAGR of 7.74% over the forecast period in the European scintillator market. These materials, such as anthracene and stilbene, are gaining traction due to their flexibility, low cost, and ease of fabrication. Organic scintillators are particularly suited for applications requiring large-area detection, such as homeland security and environmental monitoring. Their ability to detect low-energy radiation and compatibility with plastic substrates make them ideal for portable and handheld devices. The increasing focus on nuclear safety and the rising threat of radioactive contamination are key factors driving the growth of this segment.

By End Product Insights

The fixed, installed, and automatic instruments segment held 51.7% of the European market share in 2024. These instruments are widely used in nuclear power plants, healthcare facilities, and industrial settings for continuous radiation monitoring. Their dominance is attributed to their high accuracy, reliability, and ability to operate in harsh environments. For instance, automatic scintillator-based detectors are essential for real-time radiation monitoring in nuclear reactors, ensuring operational safety and compliance with regulatory standards. The growing emphasis on nuclear safety and the expansion of healthcare infrastructure are key drivers of this segment.

The hand-held instruments segment is anticipated to witness a promising CAGR in the European market over the forecast period. These portable devices are increasingly used in homeland security, environmental monitoring, and emergency response applications. Their compact size, ease of use, and ability to provide real-time radiation detection make them indispensable for field operations. The rising threat of nuclear terrorism and the need for rapid response in emergency situations are key factors driving the growth of this segment.

By Application Insights

The healthcare segment dominated the Europe scintillator market by occupying 40.8% of the European market share in 2024. Scintillators are integral to medical imaging technologies such as PET and SPECT scanners, which are essential for cancer diagnostics and treatment planning. The growing prevalence of chronic diseases and the increasing demand for early diagnosis are key drivers of this segment. For instance, the European Cancer Information System reports that over 3.7 million new cancer cases were diagnosed in Europe in 2022, highlighting the critical role of scintillators in healthcare.

The homeland security and defense segment is projected to grow at a CAGR of 9.5% over the forecast period. Scintillators are widely used in radiation detection systems for border security, nuclear threat detection, and emergency response. The escalating threat of nuclear terrorism and the increasing focus on national security are key factors driving the growth of this segment.

REGIONAL ANALYSIS

Germany accounted for the major share of the Europe scintillator market in 2024. The robust healthcare infrastructure, advanced nuclear power plants, and strong emphasis on research and development are key factors driving the domination of Germany in the European market. Germany is home to over 30 nuclear research facilities and is a global leader in medical imaging technologies, underscoring the importance of scintillators in the country.

France holds a significant share of the Europe scintillator market, driven by its extensive nuclear power infrastructure and advanced healthcare system. According to the World Nuclear Association, France operates 56 nuclear reactors, accounting for over 70% of its electricity generation. This reliance on nuclear energy creates a strong demand for scintillators in radiation monitoring and safety applications.

The United Kingdom is a key player in the Europe scintillator market, with a focus on healthcare and homeland security applications. The country’s National Health Service (NHS) is one of the largest healthcare systems in the world, driving the demand for medical imaging technologies. Additionally, the UK’s stringent nuclear safety regulations and investments in national security further bolster the market.

Italy is a growing market for scintillators, driven by its expanding healthcare sector and increasing focus on renewable energy. The country’s investments in nuclear research and development, coupled with its commitment to environmental sustainability, create opportunities for scintillator applications in radiation monitoring and safety.

Spain is an emerging market for scintillators, with a focus on healthcare and industrial applications. The country’s growing emphasis on nuclear safety and the increasing prevalence of chronic diseases are key factors driving the demand for scintillators. Additionally, Spain’s investments in renewable energy and environmental monitoring further contribute to market growth.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe scintillator market profiled in this report are Scintacor Ltd., Hamamatsu Photonics K.K, Proterial, Ltd. (formerly Hitachi Metals), Applied Scintillation Technologies Ltd., Mirion Technologies, Inc., Saint-Gobain Ceramics & Plastics, Inc., and Others.

MARKET SEGMENTATION

This Europe scintillator market research report is segmented and sub-segmented into the following categories.

By Composition of Material

-

In-Organic Scintillators

-

Alkali Halides

-

Oxide Based Scintillators

-

Others

-

-

Organic Scintillators

-

Single Crystal

-

Liquid Scintillators

-

Plastic Scintillators

-

By End Product

-

Personal or Pocket Size Instruments

-

Hand-Held Instruments

-

Fixed, Installed, and Automatic Instruments

By Application

-

Healthcare

-

Nuclear Power Plants

-

Manufacturing Industries

-

Homeland Security and Defense

-

Others

By Country

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Frequently Asked Questions

1. What is the current market size of the Europe Scintillator Market?

The Europe Scintillator Market was valued at USD 159 million in 2024 and is expected to reach USD 211.67 million by 2033, growing at a CAGR of 3.23% from 2025 to 2033.

2. Which factors are driving the Europe Scintillator Market?

The Europe Scintillator Market is driven by increasing demand in healthcare applications, rising emphasis on nuclear safety, and growing use in homeland security and defense.

3. What are the key applications of scintillators in the Europe Scintillator Market?

Scintillators in the Europe Scintillator Market are used in medical imaging (PET, SPECT scanners), radiation detection in nuclear power plants, security screening, and industrial applications.

4. What challenges does the Europe Scintillator Market face?

The Europe Scintillator Market faces challenges like high costs of advanced scintillator materials, strict environmental regulations, and supply chain disruptions affecting rare earth materials.

5. What opportunities exist in the Europe Scintillator Market?

The Europe Scintillator Market has opportunities in technological advancements in scintillator materials, expansion of nuclear power infrastructure, and increasing investment in healthcare imaging technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]