Europe Sandblasting Media Market Research Report – Segmented By Product Type ( aluminum oxide segment, silicon carbide segment ) Application Type (automotive application segment, construction application segment ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Sandblasting Media Market Size

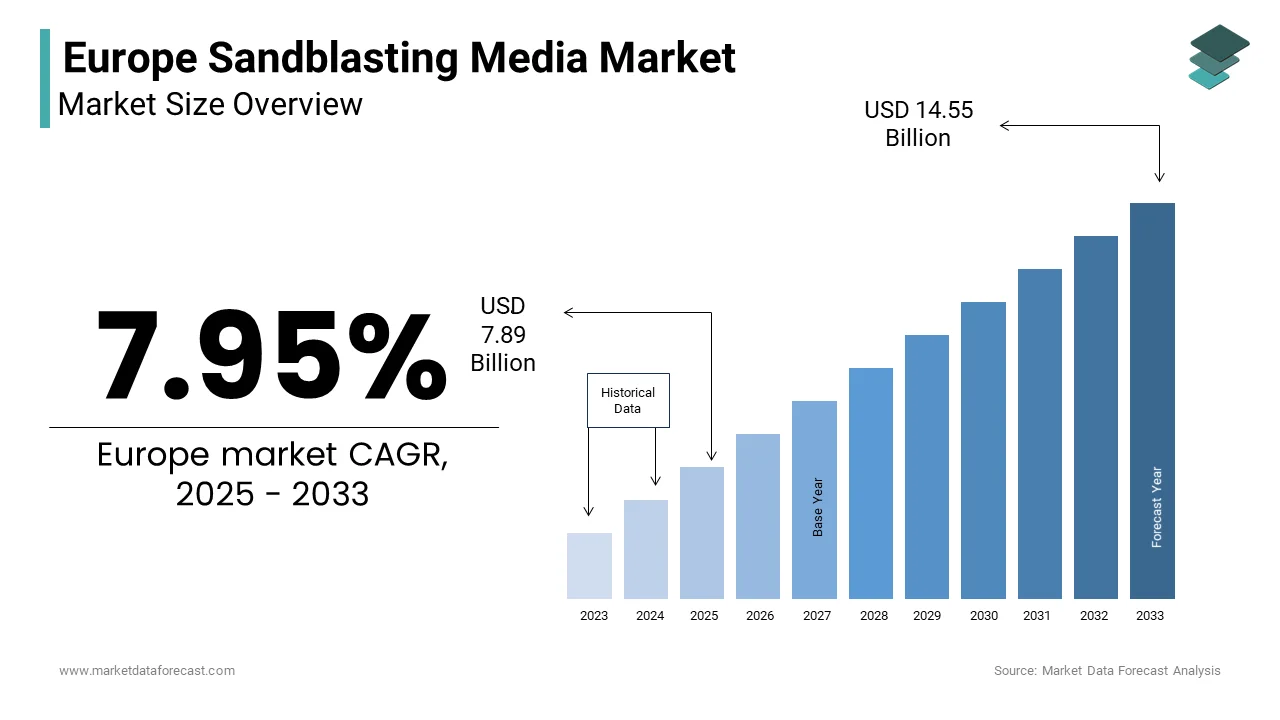

The europe sandblasting media market Size was valued at USD 7.31 billion in 2024. The europe sandblasting media market size is expected to have 7.95 % CAGR from 2025 to 2033 and be worth USD 14.55 billion by 2033 from USD 7.89 billion in 2025.

Sandblasting, also known as abrasive blasting, involves propelling abrasive media at high velocity to clean, smooth, or shape surfaces. Commonly used media include aluminum oxide, silicon carbide, steel grit, and sodium bicarbonate, each selected based on the specific requirements of the application. The market is characterized by increasing demand from various sectors, including automotive, aerospace, construction, and metalworking, where surface preparation is critical for ensuring product quality and longevity. The growing emphasis on efficiency and precision in manufacturing processes is also propelling the demand for high-quality sandblasting media. As industries continue to evolve and innovate, the demand for effective and sustainable sandblasting solutions is anticipated to rise by positioning this market for significant expansion in the coming years.

MARKET DRIVERS

Rising Demand from the Automotive Industry

The rising demand from the automotive industry serves as a primary driver for the Europe Sandblasting Media Market. The need for effective surface preparation techniques has become increasingly critical as the automotive sector continues to grow. Sandblasting is widely used in automotive manufacturing for processes such as paint removal, surface cleaning, and preparation of metal components. According to the European Automobile Manufacturers Association, the automotive industry in Europe produced approximately 15 million vehicles in 2022 by reflecting a robust market that directly correlates with the demand for sandblasting media.

The ongoing trend towards electric vehicles (EVs), which require specialized surface treatments to enhance performance and durability. The rising production of vehicles and the need for efficient surface preparation solutions is prompting the growth of the market. The demand for these products is expected to remain strong as manufacturers continue to innovate and develop advanced sandblasting media tailored for automotive applications.

Growth in Construction Activities

The growth in construction activities across Europe serves as another significant driver for the Europe Sandblasting Media Market. The demand for sandblasting media is surging as urbanization accelerates and infrastructure development projects increase. Sandblasting is extensively used in construction for surface preparation, cleaning, and finishing of materials such as concrete, metal, and wood. According to Eurostat, construction output in the EU increased by approximately 3.5% in 2022 with a robust recovery from the impacts of the COVID-19 pandemic and a growing trend towards infrastructure development.

The increasing investments in residential and commercial construction, where high-quality surface preparation is essential for ensuring durability and aesthetics. The demand for sandblasting media in construction applications is projected to grow with the rising number of construction projects and the need for effective surface treatment solutions. The demand for innovative sandblasting media is expected to rise by positioning this market for significant growth.

MARKET RESTRAINTS

Environmental Regulations

One of the primary restraints affecting the Europe Sandblasting Media Market is the increasing stringency of environmental regulations governing the use of abrasive materials. The sandblasting process can generate dust and particulate matter, which can pose health risks to workers and environmental concerns if not managed properly. Regulatory bodies in Europe have implemented stringent guidelines aimed at minimizing the environmental impact of sandblasting operations. According to the European Chemicals Agency, compliance with regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) can be complex and burdensome for sandblasting media manufacturers.

These regulatory challenges can hinder the growth of the sandblasting media market, as manufacturers may face delays in product approvals and increased costs associated with compliance. Additionally, the growing emphasis on sustainability and the shift towards eco-friendly practices may further limit the market potential for traditional sandblasting media. Stakeholders must stay informed about regulatory changes and invest in compliance strategies that ensure their products meet the necessary standards while fostering innovation.

Price Volatility of Raw Materials

Another significant restraint in the Europe Sandblasting Media Market is the price volatility of raw materials used in the production of abrasive media. The prices of key materials, such as aluminum oxide, silicon carbide, and steel grit, have been subject to fluctuations due to global supply chain disruptions, geopolitical tensions, and changes in demand.

These price fluctuations can pose challenges for manufacturers, as they may struggle to maintain consistent production costs and pricing strategies. Increased raw material costs can lead to higher prices for sandblasting media, potentially affecting consumer demand. Additionally, manufacturers may be forced to explore alternative sourcing options or invest in more expensive raw materials, which can further strain their profit margins. Companies must develop robust supply chain strategies, including diversifying suppliers and investing in inventory management systems to ensure stability in production costs.

MARKET OPPORTUNITIES

Expansion of Eco-Friendly Abrasives

The expansion of eco-friendly abrasives presents a significant opportunity for the Europe Sandblasting Media Market. There is a growing demand for sustainable alternatives to traditional sandblasting media as environmental concerns become more pronounced. Eco-friendly abrasives, such as recycled glass, walnut shells, and baking soda, are gaining traction due to their lower environmental impact and potential for recyclability. Manufacturers that focus on developing and marketing eco-friendly sandblasting media can capitalize on this growing consumer demand. The demand for sustainable sandblasting solutions is expected to rise as industries increasingly prioritize environmental responsibility and compliance with stringent regulations. The companies that innovate in this space can position themselves as leaders in the sustainable materials sector.

Technological Advancements in Sandblasting Equipment

Technological advancements in sandblasting equipment present another major opportunity for the Europe Sandblasting Media Market. Innovations in equipment design, such as automated sandblasting systems and advanced dust collection technologies are enhancing the efficiency and safety of sandblasting operations. These advancements enable manufacturers to improve productivity while minimizing health risks associated with dust exposure.

The demand for innovative equipment is anticipated to rise as manufacturers invest in research and development to create cutting-edge sandblasting technologies. Companies that focus on leveraging these technological advancements to improve their product offerings can capture a significant share of the growing market by positioning themselves for long-term success in the competitive sandblasting media landscape.

MARKET CHALLENGES

Supply Chain Disruptions

One of the major challenges facing the Europe Sandblasting Media Market is the vulnerability of supply chains. The production of sandblasting media relies on a complex network of suppliers for various raw materials, including aluminum oxide, silicon carbide, and other abrasives. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have escalated the fragility of supply chains that is leading to delays and increased costs.

These disruptions can hinder manufacturers' ability to meet production schedules and fulfill customer orders, ultimately impacting revenue and market share. Additionally, fluctuations in the availability and cost of raw materials can further complicate the supply chain, as manufacturers may struggle to source the necessary components for their sandblasting media production. The companies must develop robust supply chain strategies, including diversifying suppliers and investing in inventory management systems to ensure continuity in production.

Competition from Alternative Surface Preparation Methods

The competition from alternative surface preparation methods presents a significant challenge for the Europe Sandblasting Media Market. Various methods such as water jet cutting, laser cleaning, and chemical stripping are emerging as viable alternatives to traditional sandblasting as industries seek to innovate and improve efficiency. These alternatives may offer unique advantages, such as reduced environmental impact, lower labor costs, and enhanced precision.

This competitive landscape can make it difficult for sandblasting media manufacturers to maintain market share, particularly as companies seek innovative solutions to improve their processes. To address this challenge, manufacturers must focus on differentiating their products by emphasizing the unique benefits of sandblasting media, such as their effectiveness in achieving desired surface finishes and their versatility across various applications. Additionally, investing in research and development to enhance the performance of sandblasting media can help manufacturers stay competitive in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.95 % |

|

Segments Covered |

By Product Type, Application Type and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Saber Autonomous Solutions, Harsco Metals & Minerals, Prince Minerals, GMA Garnet Pty |

SEGMENT ANALYSIS

By Product Type Insights

The aluminum oxide segment was the largest and by occupying 40.3% of the Europe sandblasting media market share in 2024. This dominance is primarily due to the widespread use of aluminum oxide as an abrasive material in various applications, including metal finishing, surface preparation, and cleaning. Aluminum oxide is favored for its durability, hardness, and ability to produce a smooth surface finish by making it an ideal choice for manufacturers seeking effective sandblasting solutions.

The growth of the market is driven by the rising production of metal components and the need for effective surface treatment solutions.

The silicon carbide segment is the fastest-growing category within the Europe Sandblasting Media Market, with a projected CAGR of 6.5% from 2023 to 2028. This growth can be attributed to the increasing demand for silicon carbide as an abrasive material in various applications in the automotive and aerospace industries. Silicon carbide is known for its exceptional hardness and thermal conductivity by making it suitable for demanding surface preparation tasks.

The significance of this segment lies in its ability to cater to the growing consumer preference for high-performance abrasives that enhance efficiency and productivity. The demand for silicon carbide in sandblasting applications is expected to rise as industries continue to invest in advanced manufacturing processes. Companies that focus on developing innovative silicon carbide solutions tailored for specific applications can capitalize on this growing market opportunity by positioning themselves for success in the competitive sandblasting media landscape.

By Application Type Insights

The automotive application segment dominated the Europe Sandblasting Media Market with a significant share of 35.3% in 2024. This dominance is primarily due to the extensive use of sandblasting media in automotive manufacturing for processes such as paint removal, surface cleaning, and preparation of metal components. Sandblasting is essential in achieving the desired surface finish and ensuring the quality of automotive parts. The segment’s growth is driven by the rising number of automotive manufacturing projects and the need for effective surface preparation solutions. Manufacturers continue to innovate and develop advanced sandblasting media for automotive applications that is expected to remain a key driver of growth in the sandblasting media market.

The construction application segment is anticipated to witness a CAGR of 6.3% from 2025 to 2033. This growth can be attributed to the increasing demand for sandblasting media in construction applications, where it is used for surface preparation, cleaning, and finishing of materials such as concrete and metal. Sandblasting is essential in ensuring the durability and aesthetics of construction projects. The significance of this segment lies in its ability to cater to the growing demand for effective surface treatment solutions in the construction industry. The demand for sandblasting media in construction applications is expected to increase as urbanization and infrastructure development continue to rise. Companies that focus on developing innovative sandblasting solutions tailored for the construction sector can capitalize on this growing market opportunity by positioning themselves for success in the competitive sandblasting media landscape.

Country Level Analysis

Germany was the dominant contributor in the Europe Sandblasting Media Market by holding a share of 25.4% in 2024. This dominance is largely due to its robust industrial sector, which includes significant applications of sandblasting media in automotive, aerospace, and construction industries. The country is known for its high-quality manufacturing standards and strong emphasis on innovation, driving the demand for effective sandblasting solutions. The market growth in this country is also driven by increasing investments in manufacturing and infrastructure development. The presence of major manufacturers and suppliers in Germany further bolsters the market's growth, as these companies seek to enhance performance and sustainability through effective sandblasting media solutions.

France sandblasting media market is ascribed to exhibit a CAGR of 3.8% during the forecast period. The French industrial sector is characterized by a diverse range of applications for sandblasting media in automotive and construction. The country has a well-developed infrastructure for sandblasting media production by supporting the growth of the market.

The rising trend of sustainable practices and the increasing demand for effective sandblasting solutions are prompting the growth of the market in this country. The French government has also been proactive in promoting environmental initiatives, which further supports the growth of the sandblasting media market. The demand for sandblasting media is anticipated to rise by positioning France as a key player in the European sandblasting media landscape.

The United Kingdom is another significant player in the Europe Sandblasting Media Market. The UK market is characterized by a growing demand for high-quality sandblasting media with a strong focus on industrial applications. British manufacturers are increasingly investing in advanced sandblasting technologies to meet the evolving needs of various industries. The rise of construction activities and the increasing popularity of effective sandblasting solutions are significantly to fuel the market’s growth in UK. This country’s diverse industrial landscape, combined with a growing awareness of the benefits of sandblasting media, positions it as a vital market within the European sandblasting media sector.

Italy sandblasting media market growth is attributed to grow steadily during the forecast period. The Italian industrial sector is known for its strong presence of manufacturers producing specialized sandblasting media. Italian consumers and industries are increasingly investing in sandblasting solutions to enhance their operational efficiency. The increasing trend of sustainable practices and the rising demand for effective sandblasting solutions. Are ascribed to bolster the growth of the market. The combination of a rich industrial heritage and a growing emphasis on sustainability positions Italy as a key market in the European sandblasting media landscape.

The Spanish market is characterized by an increasing demand for high-quality sandblasting solutions with a growing interest in sandblasting media across various applications, including automotive and construction. The rise of construction activities and the increasing demand for effective sandblasting solutions are likely to fuel the growth of the market in this country. The combination of a strong industrial culture and a growing awareness of the benefits of high-quality sandblasting media positions Spain as an important player in the European sandblasting media market.

KEY MARKET PLAYERS

Key players operating in the Europe Sandblasting Media Market profiled in this report are Saber Autonomous Solutions, Harsco Metals & Minerals, Prince Minerals, GMA Garnet Pty, MHG Strahlanlagen, Naxos Diskus Schleifmittelwerke, Ensio Resources, Opta Minerals and GMA Garnet group.

MARKET SEGMENTATION

This research report on the Europe Sandblasting Media Market has been segmented and sub-segmented into the following categories.

By Product Type

- aluminum oxide segment

- silicon carbide segment

By Application Type

- automotive application segment

- construction application segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

Which industries are the primary consumers of sandblasting media in Europe?

Key industries include automotive, marine, aerospace, construction, and metalworking.

How do environmental regulations impact the sandblasting media market in Europe?

Stringent environmental regulations promote the use of eco-friendly and recyclable blasting materials.

What technological advancements are influencing the sandblasting media market?

The adoption of robotic and automated sandblasting systems is enhancing efficiency and precision.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]