Europe Retail Analytics Market Size, Share, Trends, & Growth Forecast Report By Mode of Deployment (On-Premise and Cloud), Type, Module Type, Business Type, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Retail Analytics Market Size

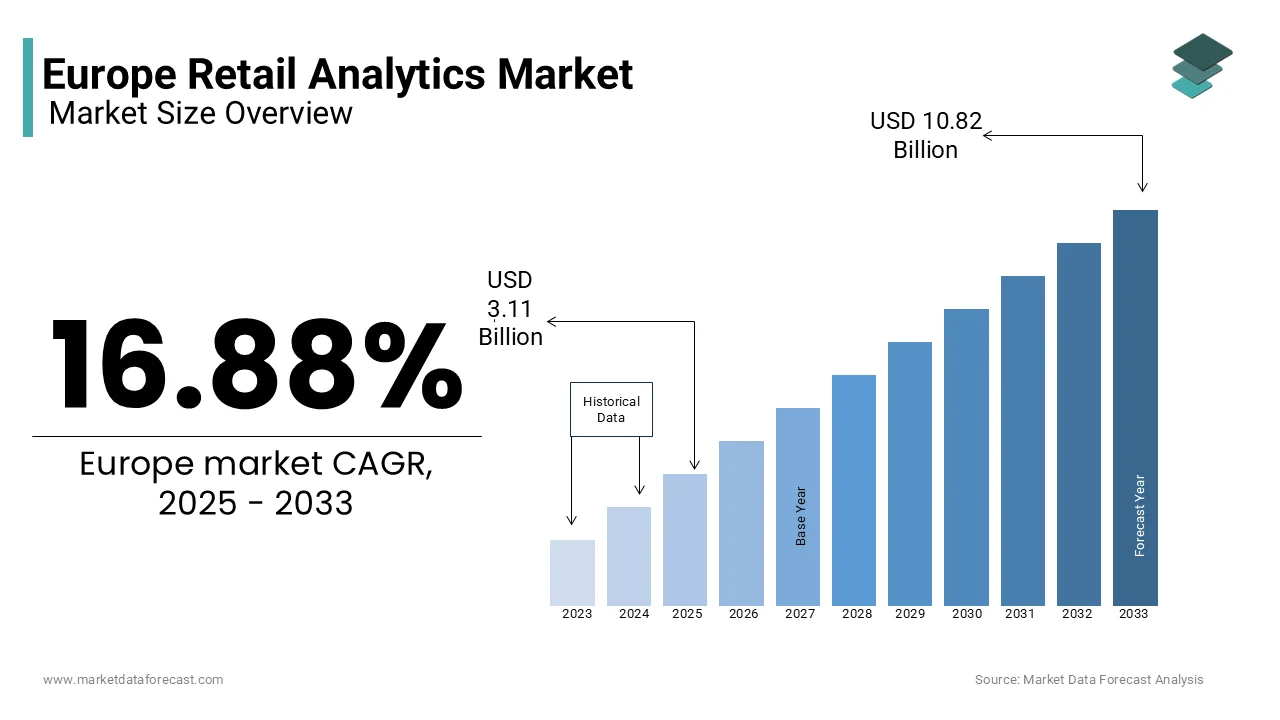

The Europe retail analytics market was worth USD 2.66 billion in 2024. The Europe market is projected to reach USD 10.82 billion in 2033 from USD 3.11 billion in 2025, rising at a CAGR of 16.88% from 2025 to 2033.

Retail analytics involves the use of advanced data analysis techniques, artificial intelligence (AI), machine learning (ML), and big data platforms to extract actionable insights from vast amounts of structured and unstructured retail data. These insights enable retailers to optimize inventory management, personalize marketing strategies, improve supply chain operations, and enhance overall profitability. As consumer behavior becomes increasingly digital and omnichannel, retailers are leveraging analytics to gain a competitive edge in a highly fragmented market.

In 2024, the Europe retail analytics market has experienced substantial growth and is expected to have promising growth over the forecast period. In this regional market, the United Kingdom, Germany, and France are at the forefront and playing a dominating role. As per a report by Eurostat, nearly 70% of European retailers now utilize some form of analytics to track customer preferences and predict purchasing trends. Furthermore, the rise of e-commerce, accelerated by the COVID-19 pandemic, has underscored the importance of real-time data analytics in managing online sales and inventory levels. The European Retail Forum emphasizes that retailers investing in predictive analytics have reported a 20% increase in customer retention rates. Collectively, these factors position the Europe retail analytics market as a cornerstone of modern retail innovation and transformation.

MARKET DRIVERS

Rising Adoption of Omnichannel Retailing Strategies in Europe

The growing adoption of omnichannel retailing is a key driver of the Europe retail analytics market, as retailers strive to deliver seamless shopping experiences across online and offline platforms. Eurostat reports that over 65% of European consumers now engage in omnichannel shopping behaviors, such as buying online and returning in-store, necessitating advanced analytics to track customer journeys. The European Retail Forum highlights that retailers leveraging analytics for inventory synchronization across channels have achieved up to a 25% reduction in stockouts. Furthermore, Research and Markets notes that the demand for real-time data integration has surged, with predictive analytics tools expected to grow at a CAGR of 16% through 2030. This trend is further amplified by the rise of mobile commerce, which accounts for 40% of e-commerce sales in Europe. Retailers are increasingly investing in analytics to optimize pricing strategies and personalize promotions, driving the regional market expansion.

Increasing Focus on Personalized Customer Experiences

The emphasis on personalized customer experiences is another major driver propelling the Europe retail analytics market forward. According to a study by the European Consumer Centre (ECC), 78% of shoppers are more likely to purchase from retailers offering personalized recommendations, underscoring the value of data-driven insights. The European Data Protection Supervisor (EDPS) notes that retailers using AI-powered analytics have improved customer retention rates by up to 30%. Additionally, Eurostat reports that personalized marketing campaigns account for 20% of total retail revenue in Europe, highlighting their financial impact. Retailers are deploying machine learning algorithms to analyze browsing patterns, purchase histories, and demographic data, enabling hyper-personalized product suggestions. This focus on personalization not only enhances customer satisfaction but also aligns with stringent GDPR compliance requirements, ensuring ethical data usage while fostering trust and loyalty among consumers.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

One significant restraint in the Europe retail analytics market is the high cost of implementing advanced analytics solutions, which often poses a barrier for small and medium-sized enterprises (SMEs). According to the European Investment Bank (EIB), over 50% of SME retailers cite budget limitations as a major challenge in adopting data-driven technologies. According to Eurostat, the initial investment required for AI-powered analytics platforms can exceed €100,000, making it unaffordable for many smaller players. Additionally, the European Retail Forum notes that ongoing expenses related to data storage, software updates, and skilled personnel further strain financial resources. This financial burden is particularly pronounced in Eastern Europe, where technological adoption lags behind Western counterparts. As a result, many retailers delay or avoid investing in analytics, hindering market growth and creating disparities in technological advancement across the region.

Data Privacy Concerns and Regulatory Compliance Challenges

Data privacy concerns and stringent regulatory requirements is another major restraint for the Europe retail analytics market. According to the European Data Protection Supervisor (EDPS), 60% of retailers face challenges in ensuring compliance with the General Data Protection Regulation (GDPR), which imposes strict rules on data collection and usage. Non-compliance can result in fines of up to €20 million or 4% of annual global turnover, as noted by the European Commission. Furthermore, Eurostat reveals that 45% of consumers express reluctance to share personal data due to privacy fears, limiting the availability of valuable insights. Retailers must invest heavily in secure data management systems, which adds to operational costs. These regulatory hurdles not only increase complexity but also slow down the adoption of innovative analytics solutions, restraining market expansion.

MARKET OPPORTUNITIES

Expansion of AI and Machine Learning Technologies

The integration of artificial intelligence (AI) and machine learning (ML) is a significant opportunity for the Europe retail analytics market, enabling retailers to unlock deeper insights and enhance operational efficiency. According to Eurostat, the adoption of AI-driven analytics is projected to grow by 20% annually, with over 40% of European retailers planning to invest in these technologies by 2025. The European Commission highlights that AI-powered tools can reduce supply chain inefficiencies by up to 30%, while improving demand forecasting accuracy by 25%. Additionally, AI-based personalization engines are expected to generate €15 billion in incremental revenue for European retailers by 2030. These technologies enable real-time decision-making, automate repetitive tasks, and optimize inventory management, making them indispensable for staying competitive in an increasingly digital marketplace.

Growing Demand for Real-Time Analytics in E-Commerce

The rising demand for real-time analytics in e-commerce offers another major opportunity for the Europe retail analytics market, driven by the rapid growth of online shopping. According to Eurostat, e-commerce sales in Europe grew by 18% in 2022, accounting for 22% of total retail revenue. The European Retail Forum emphasizes that real-time analytics helps retailers monitor website traffic, track customer behavior, and adjust pricing dynamically, leading to a 20% increase in conversion rates. Furthermore, the European Central Bank (ECB) notes that real-time fraud detection systems powered by analytics have reduced online payment fraud by 35%, enhancing consumer trust. As retailers strive to meet evolving customer expectations for instant gratification and seamless experiences, investments in real-time analytics platforms are set to surge, creating a lucrative growth avenue for the market.

MARKET CHALLENGES

Limited Availability of Skilled Workforce

The limited availability of skilled professionals capable of managing advanced analytics tools and interpreting complex data is one of the major challenges to the European market. According to Eurostat, over 40% of European retailers face difficulties in recruiting data scientists and analytics experts, hindering their ability to fully leverage these technologies. The European Centre for the Development of Vocational Training (Cedefop) highlights that only 15% of the current workforce in the retail sector possesses advanced digital skills, creating a substantial skill gap. Furthermore, the European Commission notes that the demand for data analytics expertise is expected to grow by 25% annually, outpacing the supply of qualified candidates. This shortage not only delays the implementation of analytics solutions but also increases operational costs as companies invest in extensive training programs or outsource expertise, limiting market growth.

Fragmentation of Data Sources and Integration Issues

The fragmentation of data sources and the difficulty in integrating disparate systems that complicates the adoption of retail analytics is further challenging the growth of the European market. According to the European Data Protection Supervisor (EDPS), 55% of retailers struggle to consolidate data from multiple channels, such as online platforms, point-of-sale systems, and customer relationship management (CRM) tools. As per the Eurostat, inefficient data integration can lead to a 30% loss in potential insights, undermining decision-making processes. Additionally, the European Retail Forum notes that legacy systems, still prevalent in 60% of traditional retailers, are often incompatible with modern analytics platforms, requiring costly upgrades. These integration challenges not only increase complexity but also slow down the adoption of analytics, particularly among smaller retailers with limited technical resources, posing a barrier to market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.88% |

|

Segments Covered |

By Mode of Deployment, Type, Module Type, Business Type, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

SAP SE, Oracle Corporation, Qlik Technologies, IBM Corporation, and RetailNext, Inc. |

SEGMENTAL ANALYSIS

By Mode of Deployment Insights

The cloud deployment segment accounted for 60.1% of the European market share in 2024. The leading position of the cloud deployment segment in the European market is driven by the scalability, flexibility, and cost-effectiveness it offers, enabling real-time data processing and seamless integration across channels. According to the European Commission, cloud solutions reduce operational costs by up to 30%, which is making them ideal for SMEs and e-commerce players. With e-commerce accounting for 22% of retail revenue in Europe, retailers rely on cloud analytics for dynamic pricing, inventory management, and customer personalization. The advancements in cloud security have further accelerated adoption, solidifying its importance in driving innovation and efficiency.

By Type Insights

The solutions segment dominated the market by holding 65.6% of the European market share in 2024. The domination of solutions segment in the European market is driven by the widespread adoption of analytics platforms, visualization tools, and data management systems, which are critical for deriving actionable insights. According to the European Commission, analytics tools account for 40% of this segment, with AI-powered solutions growing at a CAGR of 15.8%. These tools enable retailers to predict consumer trends, optimize pricing, and manage inventory effectively. Research and Markets notes a 20% annual growth in data visualization tools, as they simplify complex data interpretation. The importance of solutions lies in empowering retailers with data-driven decision-making capabilities, enhancing competitiveness and operational efficiency.

The services segment is anticipated to witness the fastest CAGR of 14.2% over the forecast period due to factors such as the rising complexity of integrating analytics tools with legacy systems, particularly among SMEs. According to the European Retail Forum, more than 50% of retailers rely on consulting and support services for seamless implementation and GDPR compliance. As per the Eurostat, consulting services are expected to grow by 18% annually, as retailers seek expertise to navigate technological advancements. The increasing demand for integration and ongoing support underscores the segment's importance in ensuring successful adoption and sustainability of analytics solutions, making it a key driver of market expansion.

By Module Type Insights

The marketing module segment occupied 26.6% of the European market share in 2024. The growing demand for personalized marketing strategies and dynamic pricing models is one of the major factors driving the growth of the marketing module segment in the European market. According to the European Retail Forum, retailers using analytics for loyalty programs and segment analysis have achieved a 30% increase in customer retention rates. Additionally, the dynamic pricing tools are growing at a CAGR of 16%, enabling retailers to adjust prices in real-time based on demand and competition. By leveraging consumer insights, this module enhances customer engagement, drives revenue growth, and fosters brand loyalty, making it indispensable in today’s competitive retail landscape.

The supply chain management module is anticipated to witness a CAGR of 17.7% over the forecast period owing to the rising complexity of global supply chains and the need for real-time inventory optimization. As per the European Commission, predictive analytics has reduced stockouts by 30% and excess inventory by 25%, improving operational efficiency. Furthermore, AI-driven demand forecasting tools are gaining traction, enabling retailers to anticipate trends and optimize vendor relationships. As retailers prioritize cost reduction and seamless logistics, this module’s ability to streamline operations and enhance supply chain visibility positions it as a critical driver of innovation and market expansion.

By Business Type Insights

The large-scale organizations segment occupied 60.9% of the European market share in 2024. The dominating position of the large-scale organizations segment is attributed to their extensive financial resources and advanced IT infrastructure, enabling them to adopt sophisticated analytics tools like AI-driven forecasting and real-time supply chain optimization. The European Retail Forum highlights that these organizations have reduced operational costs by 25% through analytics. Research and Markets notes that investments in IoT and big data platforms by large enterprises are growing at a CAGR of 18%, driving innovation. Their ability to scale analytics across multiple channels ensures market leadership, making them pivotal in shaping the industry’s technological evolution and setting benchmarks for smaller players.

The SME segment is anticipated to register a CAGR of 16.5% in the European retail analytics market over the forecast period owing to the rapid adoption of cost-effective, cloud-based analytics solutions, which have reduced implementation costs by 35%, as reported by Eurostat. The European Commission states that SMEs leveraging analytics have achieved a 20% increase in revenue growth by enhancing customer engagement and operational efficiency. Cloud platforms have made advanced tools accessible, enabling SMEs to compete with larger players. As SMEs increasingly prioritize data-driven decision-making, their focus on affordability and scalability underscores their importance in democratizing access to retail analytics and driving widespread market expansion.

REGIONAL ANALYSIS

Germany held 25.8% of the Europe retail analytics market share in 2024. Factors such as the robust retail sector, advanced technological infrastructure, and high adoption rates of AI-driven analytics tools are majorly boosting the growth of Germany in the European market. According to the Federal Ministry for Economic Affairs and Climate Action, German retailers are leveraging analytics to optimize supply chains and enhance customer experiences, particularly in e-commerce, which accounts for 22% of total retail sales. Additionally, Germany’s strong emphasis on GDPR compliance has spurred investments in secure analytics platforms. The country’s strategic location within Europe also facilitates cross-border trade, further boosting demand for data-driven insights. These factors position Germany as a key innovator and trendsetter in the retail analytics landscape.

The UK accounted for the second largest share of the European retail analytics market in 2024 and is expected to grow at a healthy CAGR over the forecast period owing to its highly digitalized retail sector, where over 70% of consumers engage in online shopping, driving demand for real-time analytics. The British Retail Consortium emphasizes that retailers are adopting predictive analytics to improve inventory management and personalize marketing strategies. Furthermore, post-Brexit supply chain challenges have accelerated the adoption of analytics to ensure operational efficiency. The UK’s focus on innovation, coupled with government initiatives promoting digital transformation, reinforces its position as a leader in retail analytics adoption and implementation.

France holds a notable position in the European retail analytics market. The prominence of France in the European market is fueled by its thriving luxury goods and fashion industries, which rely heavily on analytics for customer segmentation and personalized marketing. The European Retail Forum notes that French retailers are investing in cloud-based analytics solutions to streamline omnichannel operations, with e-commerce growing at 18% annually. Additionally, the French government’s push for sustainable retail practices has encouraged the use of analytics to optimize energy consumption and reduce waste. These initiatives, combined with a tech-savvy consumer base, make France a significant contributor to the growth and evolution of the retail analytics market in Europe.

KEY MARKET PLAYERS

The major players in the Europe retail analytics market include SAP SE, Oracle Corporation, Qlik Technologies, IBM Corporation, and RetailNext, Inc.

MARKET SEGMENTATION

This research report on the Europe retail analytics market is segmented and sub-segmented into the following categories.

By Mode of Deployment

- On-Premise

- Cloud

By Type

- Solutions

- Analytics

- Visualization Tools

- Data Management

- others

- Services

- Integration,

- Support & Consulting

By Module Type

- Strategy & Planning (Macro Trends, KPI, Value Analysis)

- Marketing (Pricing, Loyalty and Segment Analysis)

- Financial Management (Accounts Management)

- Store Operations (Fraud Detection, Workforce Analytics)

- Merchandising (Assortment Optimization, Shopper Path Analytics)

- Supply Chain Management (Inventory, Vendor and Supply-Demand Modelling)

- Other Module Types

By Business Type

- Small & Medium Enterprises

- Large-scale organizations

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe retail analytics market?

The growth of the Europe retail analytics market is driven by increasing adoption of AI and machine learning, the rising need for personalized customer experiences, and the expansion of e-commerce.

What are the key applications of retail analytics in Europe?

Retail analytics is used for customer behavior analysis, inventory management, demand forecasting, fraud detection, and optimizing pricing strategies.

What role does AI play in the Europe retail analytics market?

AI helps retailers analyze large datasets, automate decision-making, improve demand forecasting, and enhance chatbot-based customer support.

What is the future outlook for the Europe retail analytics market?

The market is expected to grow steadily due to increasing investments in AI-driven analytics, higher adoption of omnichannel retailing, and advancements in real-time data processing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]