Europe Residential Boiler Market Research Report – Segmented By Technology ( condensing boilers, electric boilers ) Fuel ( natural gas boilers, electric boilers) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Residential Boiler Market Size

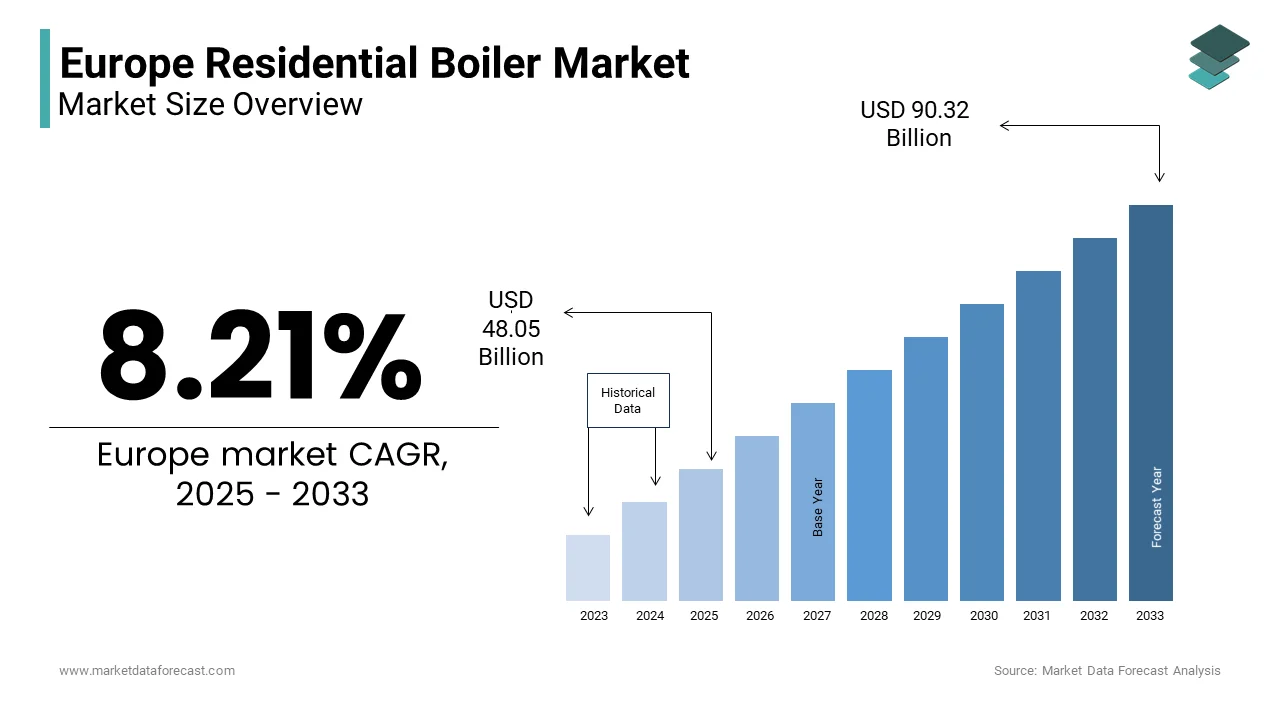

The Europe Residential Boiler Market Size was valued at USD 44.4 billion in 2024. The Europe Residential Boiler Market size is expected to have 8.21 % CAGR from 2025 to 2033 and be worth USD 90.32 billion by 2033 from USD 48.05 billion in 2025.

The Europe residential boiler market is driven by stringent energy efficiency regulations and the push for sustainable heating solutions under the European Green Deal. Natural gas remains the primary fuel source with an extensive pipeline network. However, the transition to low-carbon alternatives, such as electric heat pumps that poses challenges to traditional boiler technologies.

MARKET DRIVERS

Stringent Energy Efficiency Regulations

The energy efficiency mandates are a key driver of the Europe residential boiler market. The European Union’s Ecodesign Directive requires all new boilers to meet minimum efficiency standards, pushing manufacturers to innovate. According to the International Energy Agency (IEA), condensing boilers of new installations due to their compliance with these regulations. Governments across Europe offer subsidies for replacing old, inefficient boilers, further boosting demand. The regulatory frameworks will continue to shape market dynamics by ensuring sustained growth.

Urbanization and Retrofitting Demand

Urbanization is another significant driver, with cities accounting for over 75% of Europe’s population, as per Eurostat. Aging housing stock in urban areas creates a strong retrofitting demand for modern boilers. The European Commission estimates that 70% of residential buildings in Europe are over 30 years old by requiring upgrades to meet current energy standards. Condensing boilers, particularly gas-powered models, are favored for their cost-effectiveness and ease of installation in existing homes. Additionally, rising energy costs have prompted homeowners to invest in efficient heating systems.

MARKET RESTRAINTS

High Initial Costs of Advanced Boilers

One major restraint is the high upfront cost of advanced residential boilers, particularly condensing and hybrid models. According to the European Heating Industry Association, the average price of a condensing boiler ranges from €2,000 to €5,000, depending on capacity and features. This cost is prohibitive for many households, especially in economically disadvantaged regions. While long-term savings on energy bills are evident, the initial investment remains a barrier for adoption. The lack of accessible financing options exacerbates this issue is limiting market penetration. As Europe grapples with economic uncertainties, addressing cost barriers will be crucial for sustained market growth.

Competition from Electric Heat Pumps

The growing popularity of electric heat pumps poses a significant challenge to the residential boiler market. Heat pumps are increasingly viewed as a sustainable alternative in regions transitioning away from fossil fuels. The European Commission’s Renovation Wave initiative promotes heat pumps as part of its strategy to reduce building emissions by 60% by 2030. This shift threatens traditional boiler technologies, especially oil-fired models, which face declining demand. As per Eurostat, oil boiler sales dropped by 18% in 2022 alone. While boilers remain dominant, competition from heat pumps is reshaping market dynamics and forcing manufacturers to adapt.

MARKET OPPORTUNITIES

Transition to Hydrogen-Compatible Boilers

The transition to hydrogen-compatible boilers presents a significant opportunity for the Europe residential boiler market. The European Hydrogen Strategy aims to produce 10 million tonnes of renewable hydrogen annually by 2030 by creating a viable pathway for hydrogen-based heating. According to the European Gas Research Group, hydrogen-ready boilers can reduce carbon emissions by up to 80% compared to conventional models. Countries like the UK and Germany are investing heavily in hydrogen infrastructure, with pilot projects underway. As per a study by the International Renewable Energy Agency, hydrogen-compatible boilers could capture 30% of the market by 2035. Manufacturers that innovate in this space stand to gain a competitive edge by aligning with Europe’s decarbonization goals while addressing consumer demand for sustainable solutions.

Expansion into Eastern Europe

Emerging markets in Eastern Europe offer untapped potential for residential boiler manufacturers. Countries like Poland and Romania are experiencing rapid urbanization and rising disposable incomes is driving demand for modern heating solutions. According to Eurostat, Poland added over 1 million new households between 2018 and 2022 by creating a parallel need for efficient boilers. The European Bank for Reconstruction and Development notes that Eastern Europe’s heating infrastructure is outdated, with 60% of boilers over 15 years old. This presents a lucrative opportunity for retrofitting and replacement projects. Additionally, government initiatives to phase out coal heating in favor of gas and electric systems further bolster market prospects.

MARKET CHALLENGES

Regulatory Uncertainty and Policy Shifts

Regulatory uncertainty poses a significant challenge to the Europe residential boiler market. While energy efficiency mandates drive innovation, frequent policy shifts create unpredictability for manufacturers and consumers alike. For instance, the UK’s decision to ban gas boiler installations in new homes by 2025 has disrupted traditional market dynamics, as noted by the UK Department for Business, Energy & Industrial Strategy. Similarly, France’s push for carbon-neutral heating by 2050 has led to fluctuating subsidies and incentives by complicating long-term planning. According to the European Environmental Bureau, inconsistent policies across member states hinder market stability. Manufacturers must navigate these complexities while balancing compliance costs and consumer expectations is making it difficult to maintain consistent growth trajectories.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge with exacerbated by global events and geopolitical tensions. The European Heating Industry Association reports that supply chain bottlenecks caused a 20% increase in raw material costs in 2022 by impacting production timelines and profitability. Components like steel and copper are essential for boiler manufacturing, have seen price volatility. Additionally, labor shortages in key manufacturing hubs like Germany and Italy have slowed production rates. Eurostat data indicates that 30% of boiler manufacturers faced delays exceeding six months due to supply chain issues. These disruptions not only affect operational efficiency but also erode consumer trust, as delivery timelines extend. Addressing these challenges requires strategic investments in supply chain resilience and diversification.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.21 % |

|

Segments Covered |

By Technology, Fuel and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

BDR Thermea Group,Hoval,VIESSMANN,Immergas S.p.A,Bradford White Corporation,Bosch Industriekessel |

SEGMENT ANALYSIS

By Technology Insights

The condensing boilers segment dominated the Europe residential boiler market by accounting for 62.3% in 2024 owing to their superior efficiency, achieving up to 98% thermal efficiency, and compliance with stringent emissions standards. Natural gas boilers are favored for their cost-effectiveness and widespread availability, supported by an extensive pipeline network. According to the International Energy Agency, gas boilers reduce carbon emissions by 25% compared to non-condensing models by making them a preferred choice for retrofitting projects.

The electric boilers segment is likely to register a CAGR of 12.3% during the forecast period. This growth is fueled by the transition to renewable energy sources and the push for decarbonization. Electric boilers are particularly advantageous in regions phasing out fossil fuels, such as Scandinavia and parts of Western Europe. According to Eurostat, renewable electricity accounted for 38% of Europe’s energy mix in 2022 by enhancing the viability of electric boilers. Additionally, advancements in smart grid technology enable real-time energy optimization by reducing operational costs.

By Fuel Insights

The natural gas boilers segment held 55.4% of the Europe residential boiler market share in 2024 owing to the widespread availability of natural gas infrastructure across Europe in countries like Germany, Italy, and the UK. The European Heating Industry Association notes that natural gas boilers are favored for their cost-effectiveness and high efficiency, with condensing models achieving up to 98% thermal efficiency. Additionally, natural gas remains a cleaner alternative to oil and coal by aligning with Europe’s decarbonization goals. Government subsidies for replacing old boilers with energy-efficient gas models further bolster demand.

The electric boilers segment is projected to exhibit a CAGR of 15.4% from 2025 to 2033. This growth is fueled by the increasing adoption of renewable electricity and the push for zero-carbon heating solutions. According to the International Renewable Energy Agency, renewable electricity accounted for 40% of Europe’s energy mix in 2022 by enhancing the feasibility of electric boilers. These systems are particularly popular in urban areas and regions transitioning away from fossil fuels. Additionally, advancements in smart technology enable real-time energy management thereby reducing operational costs. The segment’s rapid expansion is further supported by government initiatives promoting electrification by making electric boilers a key driver of sustainable heating innovation.

COUNTRY LEVEL ANALYSIS

Germany dominated the Europe residential boiler market with 25.5% of the total share in 2024. The growth of the market is driven by stringent energy efficiency regulations, such as the Building Energy Act, which mandates high-efficiency heating systems. According to the German Heating Industry Association, over 70% of new installations in 2022 were condensing boilers with the country’s commitment to sustainability. Germany’s extensive natural gas infrastructure further supports market growth, ensuring widespread adoption of gas-powered boilers.

Spain is projected to exhibit a CAGR of 10.5% from 2025 to 2033. This growth is fueled by urbanization trends and the push for energy-efficient heating solutions. The Spanish government’s Renovation Plan to upgrade aging housing stock by creating significant opportunities for modern boilers. According to Eurostat, electric boilers are gaining traction due to Spain’s increasing reliance on renewable electricity, which accounted for 45% of its energy mix in 2022. The transition to low-carbon heating systems is combined with favorable policies, positions Spain as a key growth driver in the region.

The UK, France, and Italy are expected to grow steadily, supported by aging housing stock and favorable policies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Residential Boiler Market are BDR Thermea Group,Hoval,VIESSMANN,Immergas S.p.A,Bradford White Corporation,Bosch Industriekessel,A. O. Smith,FERROLI, ACV,NTI Boilers,Atlantic,Ariston Holding N.V,Fonderie Sime S.p.A,Carrier,Vaillant Group,Lennox International Inc.

The Europe residential boiler market is characterized by intense competition, with leading players vying for dominance through innovation and strategic positioning. Smaller firms focus on niche segments, such as electric boilers or smart heating systems, to differentiate themselves. The fragmented nature of the market fosters collaboration, with firms partnering to integrate complementary technologies. Regulatory pressures and the shift toward decarbonization drive continuous improvement, benefiting consumers through cost-effective and eco-friendly products. However, the rise of electric heat pumps poses a challenge is forcing traditional boiler manufacturers to adapt or risk losing market share.

Top strategies used by the key market participants

Key players in the Europe residential boiler market employ diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies investing heavily in R&D to develop hydrogen-compatible and AI-enabled boilers. For instance, Bosch Thermotechnology focuses on hydrogen-ready systems to align with decarbonization goals. Strategic partnerships are another critical approach with Vaillant Group collaborates with energy providers like E.ON to promote energy-efficient heating solutions. Geographic expansion into emerging markets, such as Eastern Europe, is also prevalent, with Viessmann Group targeting untapped regions through localized marketing and distribution networks. These strategies ensure sustained growth and alignment with evolving consumer preferences and regulatory frameworks.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Bosch launched a hydrogen-ready boiler, enhancing its sustainability portfolio.

- In June 2023, Vaillant partnered with E.ON to promote energy-efficient heating solutions across Europe.

- In August 2023, Viessmann acquired GreenHeat Technologies by expanding its R&D capabilities for low-carbon systems.

- In October 2023, Ideal Boilers introduced AI-enabled systems by optimizing energy usage and operational efficiency.

- In December 2023, Baxi invested €50 million in hydrogen boiler development by aligning with EU decarbonization targets.

MARKET SEGMENTATION

This research report on the europe residential boiler market has been segmented and sub-segmented into the following categories.

By Technology

- condensing boilers

- electric boilers

By Fuel

- natural gas boilers

- electric boilers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the future trends in the European residential boiler market?

Transition toward hydrogen-ready and hybrid boilers , Expansion of smart home-compatible systems ,Increased focus on sustainability and circular economy principles

What types of residential boilers are most commonly used in Europe?

Gas-fired boilers , Electric boilers, Oil-fired boilers,Biomass boilers,Condensing boilers

What is the current size of the Europe residential boiler market?

The market size varies annually, but as of the most recent data, it is valued in the multi-billion euro range and is expected to grow steadily due to energy efficiency trends and heating demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]