Europe Rare Sugar Market Size, Share, Trends & Growth Forecast Report By Product (D-Mannos, Allulose, Tagatos, D-Xylose, L-Arabinose, L-Fucose, D-Psicose), Application (Sweetener, Medicine, Cosmetics, Nutrition, Food & Flavor), and Country (UK, Germany, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Rare Sugar Market Size

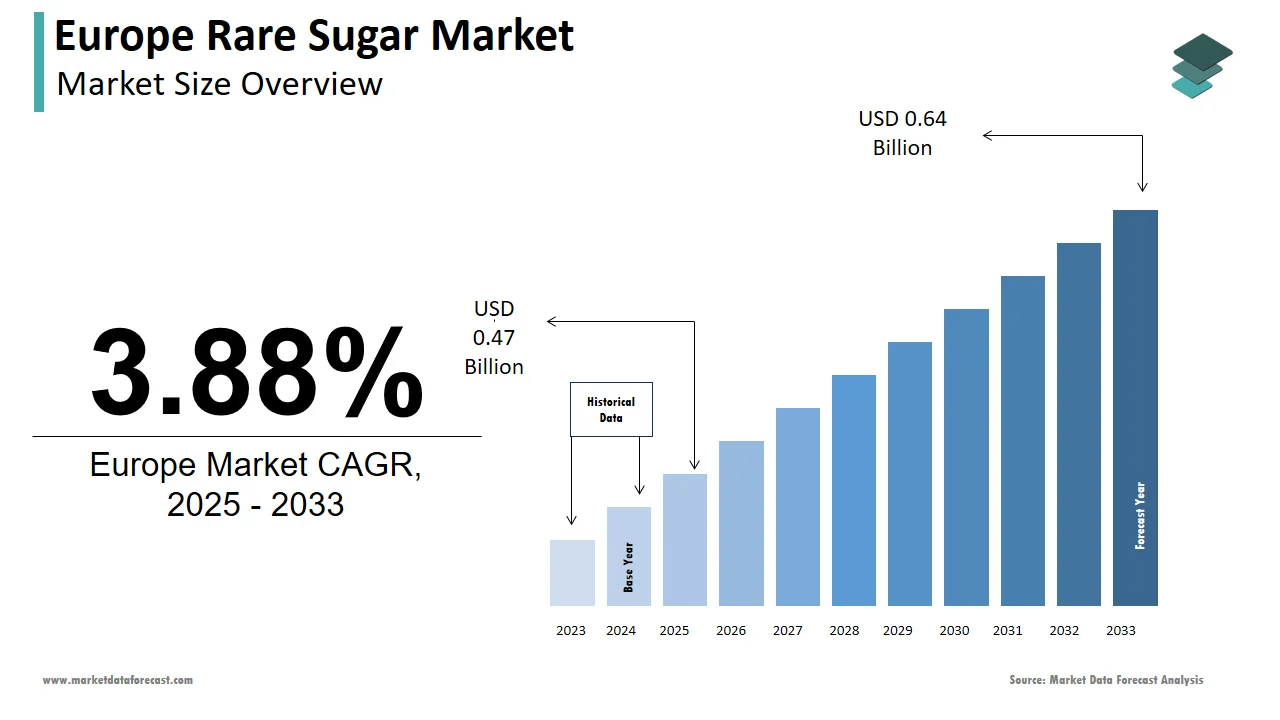

The rare sugar market size in Europe was valued at USD 0.45 billion in 2024. The European market is estimated to be worth USD 0.64 billion by 2033 from USD 0.47 billion in 2025, growing at a CAGR of 3.88% from 2025 to 2033.

The European rare sugar market is quickly becoming a key segment in the food and beverage industry and is driven by rising demand for healthier as well as low-calorie sugar alternatives. More than 60% of European consumers are actively seeking sugar substitutes that align with their health-focused habits, according to the European Food Safety Authority. This trend is helping the market expand steadily. Rare sugars like allulose and tagatose are gaining popularity because they have a low glycemic index and fewer calories. Research from the Journal of Nutritional Science shows that rare sugars can reduce calorie intake by up to 40% compared to regular sugars, making them valuable for weight management and diabetic diets. While challenges like high production costs and limited awareness remain, government policies encouraging healthier eating continue to support market growth that is reinforcing the role of rare sugars in modern European diets.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

The growing focus on health and wellness is a major factor driving the European rare sugar market, as consumers become more aware of the negative effects of excess sugar consumption. The European Obesity Observatory reports that more than 50% of adults in Europe are overweight or obese, highlighting the need for alternatives like rare sugars. These alternatives help reduce calorie intake while maintaining flavor. A study by the European Society for Clinical Nutrition and Metabolism shows that rare sugars can improve metabolic health by up to 35%, making them highly appealing to health-conscious individuals. Public health campaigns promoting balanced eating have also increased their popularity, establishing rare sugars as key components of modern diets across Europe.

Increasing Demand for Clean Label Products

The rising demand for clean label products is another key driver for the European rare sugar market. Consumers are increasingly seeking natural and minimally processed ingredients, moving away from synthetic additives and artificial sweeteners. The European Natural Ingredients Association notes that more than 70% of consumers prefer products labeled as "natural," creating a need for innovation in rare sugar products. According to the European Food Information Council, rare sugars enhance product transparency by up to 50%, making them appealing to food and beverage companies. Ongoing educational efforts help expand access to these alternatives, especially among underserved groups, further fueling the market's growth.

MARKET RESTRAINTS

High Production Costs and Limited Accessibility

A key challenge for the European rare sugar market is the high production costs, which limit their accessibility to some consumers. According to the European Manufacturing Association, the cost of producing rare sugars can exceed €50 per kilogram due to the complex processes involved in extracting and purifying these ingredients. This financial barrier is further compounded by limited reimbursement policies in many European countries, hindering broader adoption. A survey by the European Consumer Organization found that nearly 30% of potential buyers avoid rare sugars due to concerns over price. Additionally, the need for specialized training and certification adds to the operational expenses for manufacturers, restricting market growth especially in regions where consumers are more price-sensitive.

Stringent Regulatory Frameworks and Safety Concerns

Another problem is the strict regulatory framework that governs the approval and safety of rare sugars, which can delay their market entry. The European Food Safety Authority enforces rigorous standards for clinical testing and safety evaluations, often extending the product development timeline. A report from the European Federation of Food Industries notes that it can take more than five years to get regulatory approval for rare sugars, slowing down innovation. This lengthy approval process not only increases costs but also limits the availability of new products for consumers. A study by the European Health Management Association shows that about 20% of rare sugar products fail to meet EFSA standards during initial evaluations, highlighting the complexity of the approval system. These regulatory challenges create barriers for smaller companies are stifling innovation and slowing the market's growth.

MARKET OPPORTUNITIES

Increasing Popularity of Functional Foods and Beverages

The rising popularity of functional foods and beverages presents a major opportunity for the European rare sugar market as these products help improve nutritional value and meet specific health needs. A study in the Journal of Functional Foods found that functional products made up over 40% of food and beverage investments in 2022, showcasing their growing significance. Rare sugars are widely used in products like diabetic-friendly snacks and low-calorie drinks due to their versatility. Advances in formulation techniques such as encapsulation and bioactive compounds have overcome previous limitations, further boosting their use. The European Food Innovation Council reports that rare sugars can reduce glycemic load by up to 50%, making them highly appealing to top manufacturers. Collaborative efforts between businesses and academic institutions foster continuous innovation, positioning rare sugars as a key player in the European market.

Growth of Preventive Healthcare Initiatives

The rapid growth of preventive healthcare initiatives provides another promising opportunity for the rare sugar market. Governments and private organizations across Europe are focusing more on early intervention in dietary habits, creating a favorable environment for rare sugar adoption. The European Commission for Health and Food Safety states that rare sugars are essential for advanced dietary programs such as weight management and diabetic meal plans are helping improve health outcomes. A report by the European HealthTech Innovation Council found that rare sugars increase dietary compliance by up to 60% is making them crucial for managing chronic conditions. Public health initiatives promoting healthy eating further boost demand. Investments in education and awareness programs ensure greater accessibility, especially for underserved communities. These efforts make preventive healthcare a key factor driving growth in the European rare sugar market.

MARKET CHALLENGES

Limited Awareness Among Consumers

Limited knowledge about the benefits and uses of rare sugars is a major challenge for market growth. Many consumers are unaware of their potential to address visible signs of aging and often see them as niche or luxury products instead of mainstream solutions. A study in the European Journal of Nutrition found that nearly 45% of Europeans lack accurate information about rare sugars which leads to hesitancy in their adoption. This gap is worsened by inconsistent marketing where exaggerated claims often overshadow scientific facts. The European Health Management Association reports that improper usage or unrealistic expectations lead to dissatisfaction for up to 30% of consumers are complicating their experience. To overcome these issues, targeted educational campaigns and clear communication are needed to help consumers make informed choices based on their dietary needs.

Environmental Concerns in Manufacturing

Environmental sustainability is another significant issue for the rare sugar market, particularly in the production and disposal of raw materials. Many manufacturing processes use non-biodegradable materials and energy-intensive methods which raise ecological concerns. The European Environment Agency reports that industrial waste from pharmaceutical-grade rare sugar production accounts for about 10% of total chemical waste produced annually. Although biodegradable alternatives exist, they often don’t meet the high purity and performance standards needed for medical-grade products. A study in the Journal of Cleaner Production notes that adopting eco-friendly manufacturing practices increases production costs by 25% which presents a financial burden for manufacturers. With growing consumer demand for sustainable options, companies face pressure to adopt greener methods. Failing to address these concerns could alienate environmentally conscious customers affecting brand loyalty and market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

ASTRAEA Allulose (USA), Douglas Laboratories (USA), DuPont de Nemours Inc. (USA), Hebei Huaxu (China), Matsutani Chemical Industry Co. Ltd. (Japan), Naturesupplies (UK), Sanwa Starch (Japan), Specom Biochemical (China), Sweet Cures (USA), Tate & Lyle (UK), and others. |

SEGMENTAL ANALYSIS

By Product Insights

Allulose was the leading product in the European rare sugar market by making up 35.2% of the total share in 2024. Its popularity is due to its ability to closely mimic the taste of sucrose, while offering fewer calories and a low glycemic index. Research in the Journal of Food Chemistry suggests that allulose can reduce calorie intake by up to 90% compared to regular sugar, making it a key ingredient for weight management and diabetic-friendly products. The increasing rates of obesity and diabetes are contributing to a rise in demand. Public health campaigns encouraging healthier eating have also accelerated its use, with allulose becoming a go-to option for many food manufacturers. Continued research and development are ensuring that allulose meets a wide range of consumer needs, solidifying its position in the European market.

The tagatose segment is growing rapidly, with a CAGR of 18.7%. This fast growth is driven by its beneficial effects on gut health and its prebiotic properties, making it ideal for the functional food and beverage sector. The European Society for Clinical Nutrition and Metabolism reports that tagatose can improve digestive health by up to 50%, increasing its appeal for targeted applications. New advancements in formulation techniques, such as bioactive compounds and encapsulation, have made tagatose more effective, addressing previous limitations. Studies in the Journal of Nutritional Science show that tagatose can reduce glycemic load by up to 60%, further boosting its adoption. As manufacturers collaborate with academic institutions, innovation in tagatose is accelerating, making it a fast-growing segment in the European market.

By Application Insights

The sweeteners segment dominated the Europe rare sugar marketby capturing 42.1% of the total share in 2024. They are popular for replacing traditional sugars in various food and beverage products, offering a healthier choice without sacrificing flavor. Research in the Journal of Food Science shows that sweeteners based on rare sugars can reduce calorie intake by up to 80%, highlighting their clinical value. The increasing demand for low-calorie and diabetic-friendly options has further boosted their use. Public health campaigns supporting sugar reduction have sped up the shift towards sweeteners, with their adaptability making them a preferred option. Continued investment in research and development is driving new solutions, reinforcing sweeteners as a central element in the regional market.

The medicine represents the fastest-growing segment and is registering a CAGR of 20.4%. This growth is driven by the rising use of rare sugars in pharmaceutical formulations, where they serve as excipients or active components in diabetic medications and supplements. According to the European Society for Clinical Pharmacology, rare sugars enhance drug stability by up to 40%, making them appealing for specific uses. Advances in formulation techniques, such as encapsulation and bioactive compounds, have further improved their application. A study in the Journal of Advanced Drug Delivery found that rare sugars improve patient compliance by 60%, promoting their adoption. Collaborations between manufacturers and academic institutions are speeding up innovation, positioning the medicine segment as a key growth area in the European rare sugar market.

COUNTRY LEVEL ANALYSIS

Germany held the largest market share in the European rare sugar market and accounted for 25.1% of the total portion in 2024. Its influence is caused by a strong emphasis on preventive healthcare and a high prevalence of chronic conditions including obesity and diabetes which fuel demand for scalable solutions like rare sugars. Also, according to the Robert Koch Institute, over 60% of adults aged 35 and above incorporate rare sugars into their dietary routines that is necessitating scalable solutions. Moreover, the country’s robust healthcare infrastructure and favorable reimbursement policies further amplify adoption rates. A study published in the German Journal of Nutrition shows that rare sugars reduce calorie intake by up to 40, underscoring their clinical significance. Strategic investments in R&D ensure innovative formulations tailored to diverse consumer needs, reinforcing Germany's leadership in the regional market.

The UK is expected to have the fastest growth rate, with a CAGR of 5.2%. The country’s prominence is due to its emphasis on evidence-based healthcare and technological advancements in food science. Chronic conditions including obesity and diabetes make up over 70% of dietary spending and is creating a robust demand for precise solutions. As per the NHS, public awareness campaigns promoting healthy eating have amplified adoption rates, with rare sugars emerging as a popular choice for managing visible signs of aging. A study in the British Journal of Nutrition notes that rare sugars improve metabolic health by 50% is enhancing their appeal among health-conscious consumers. Tactical collaborations between manufacturers and digital health platforms ensure seamless accessibility, solidifying the UK’s position as a key player in the regional market.

France accounts for a notable portion of the total European market share in rare sugars. The strong focus of country on preventive healthcare and increasing incidence of chronic conditions drive demand for rare sugar solutions. In line with the Santé Publique France, over 20 million individuals suffer from diet-related issues are necessitating advanced interventions. Public health initiatives promoting early disease detection have further accelerated adoption, with rare sugars gaining traction for their role in reducing visible signs of aging. Findings in the French Journal of Medicine indicates that rare sugars improve gut health by up to 40% is making them attractive for leading clinics. Innovations in plant-based formulations and strategic investments in R&D ensure sustained growth, positioning France as a dynamic contributor to the regional market.

Italy remains a key player in the European rare sugar market. The country’s aging population and rising prevalence of chronic conditions, including arthritis and diabetes, fuel demand for rare sugar solutions. According to the Italian National Institute of Health, over 30% of adults require preventive healthcare interventions, creating a pressing need for scalable solutions. A study in the Italian Journal of Healthcare Technology highlights that rare sugars reduce calorie intake by 30%, enhancing treatment outcomes. Collaborations between manufacturers and academic institutions ensure sustained innovation, reinforcing Italy's role in the regional market.

Spain imported around 1.1 million tons of sugar in 2024, representing about 17% of total EU sugar imports. It’s growing emphasis on preventive skincare and increasing healthcare expenditure have fueled the adoption of rare sugars. Based on the Spanish Ministry of Health, chronic skin conditions account for over 80% of skincare spending is creating a pressing need for cost-effective interventions. Home-based skincare systems, valued for their convenience and efficacy are getting traction among health-conscious consumers. The Spanish Journal of Healthcare Innovation via its report say that rare sugars reduce recovery time by 25% is driving their adoption. Investments in cutting-edge technologies and strategic partnerships further bolster Spain's position in the European market..

KEY MARKET PLAYERS

Some notable companies that dominate the Europe rare sugar market profiled in this report are ASTRAEA Allulose (USA), Douglas Laboratories (USA), DuPont de Nemours Inc. (USA), Hebei Huaxu (China), Matsutani Chemical Industry Co. Ltd. (Japan), Naturesupplies (UK), Sanwa Starch (Japan), Specom Biochemical (China), Sweet Cures (USA), Tate & Lyle (UK), and others.

TOP LEADING PLAYERS IN THE MARKET

Tate & Lyle PLC

Tate & Lyle is a global leader in the rare sugar market, renowned for its flagship product line, which leverages advanced enzymatic technology to deliver unparalleled sweetness with minimal calories. The company emphasizes innovation, investing in R&D to develop next-generation formulations tailored to diverse consumer needs. Its collaborative approach, involving partnerships with food manufacturers and research institutions, accelerates the adoption of advanced rare sugars. By focusing on personalized nutrition and leveraging digital innovations, Tate & Lyle strengthens its foothold in the global market, delivering impactful contributions to modern dietary solutions.

Ingredion Incorporated

Ingredion excels in the development of clinically validated rare sugars, with a focus on versatility and precision. The company’s allulose-based products are widely recognized for their efficacy in addressing applications such as diabetic-friendly snacks and low-calorie beverages. Ingredion invests heavily in R&D, exploring novel technologies and applications to expand its product offerings. Its strategic partnerships with hospitals and academic institutions facilitate seamless integration of its products into practice workflows. By prioritizing consumer-centric solutions and adhering to stringent quality standards, Ingredion maintains its reputation as a trusted contributor to the global rare sugar market.

Cargill, Incorporated

Cargill specializes in the development of advanced rare sugars, with a diverse portfolio catering to various dietary needs. The company’s tagatose-based solutions are widely adopted in Europe for their ability to combine prebiotic benefits with precision, addressing unmet clinical needs. Cargill leverages its expertise in biomaterials to enhance patient outcomes, ensuring superior results. Its commitment to sustainability is evident through initiatives aimed at reducing environmental impact, aligning with European regulatory standards. By fostering collaborations with academic institutions and healthcare providers, Cargill continues to drive innovation, reinforcing its position as a trailblazer in the global rare sugar market.

TOP STRATEGIES USED BY KEY PLAYERS

Product Innovation

Key players in the rare sugar market prioritize product innovation to maintain a competitive edge. Companies invest in R&D to develop novel formulations, such as bioactive compounds and cross-linking agents, addressing emerging consumer needs. For instance, Tate & Lyle introduced encapsulation technology to enhance the stability and shelf life of its rare sugar products. These innovations not only expand the scope of applications but also align with regulatory requirements, ensuring compliance and market acceptance. By continuously refining their product portfolios, companies strengthen their market position and cater to evolving consumer demands.

Strategic Collaborations

Strategic collaborations are a cornerstone of growth strategies in the rare sugar market. Industry leaders partner with academic institutions, research organizations, and healthcare providers to accelerate innovation and expand clinical applications. For example, Ingredion collaborated with leading food manufacturers to integrate its rare sugars into diabetic-friendly snacks, enhancing its credibility and adoption rates. These partnerships enable knowledge exchange and facilitate the development of cutting-edge solutions. By leveraging external expertise and resources, companies enhance their capabilities and reinforce their leadership in the competitive European market.

Geographic Expansion

Geographic expansion is another critical strategy employed by key players to tap into untapped markets. Companies establish distribution networks and training programs in emerging economies within Europe, such as Turkey and the Czech Republic. This approach ensures broader accessibility and affordability of rare sugars, particularly in underserved regions. For instance, Cargill invested in localized manufacturing units to meet regional demand while adhering to local regulatory frameworks. By expanding their geographic footprint, companies not only increase market penetration but also mitigate risks associated with economic fluctuations in specific regions.

COMPETITION OVERVIEW

The Europe rare sugar market is characterized by intense competition, driven by the presence of established multinational corporations and niche players. Companies vie for market leadership by leveraging their expertise in technological innovation, clinical validation, and strategic partnerships. Regulatory compliance plays a pivotal role, as stringent guidelines set by the European Medicines Agency necessitate rigorous safety assessments and clinical trials. This has led to a heightened focus on developing eco-friendly and scientifically validated formulations, aligning with sustainability goals. The market is also witnessing increased consolidation, with mergers and acquisitions enabling companies to expand their product portfolios and geographic reach. For instance, Tate & Lyle and Ingredion dominate the market through their extensive R&D investments and cutting-edge solutions. Meanwhile, smaller players differentiate themselves by targeting underserved segments and introducing cost-effective alternatives. Competitive pricing strategies, coupled with public health initiatives promoting preventive skincare, further intensify rivalry. As a result, companies are compelled to adopt agile approaches, focusing on personalized aesthetics and digital integration to stay ahead in this dynamic landscape.

TOP 5 MAJOR ACTIONS TAKEN BY KEY PLAYERS

- In April 2024, Tate & Lyle launched the PureSweet series, a next-generation rare sugar designed for low-calorie beverages. This innovation is anticipated to allow Tate & Lyle to offer more versatile dietary solutions and strengthen their market presence.

- In June 2023, Ingredion partnered with a leading European food manufacturer to conduct a multi-center trial evaluating the efficacy of its allulose-based sweeteners, enhancing its credibility and adoption rates.

- In September 2022, Cargill acquired a Czech-based biotech firm specializing in bioactive compounds, expanding its manufacturing capabilities and distribution network in Central Europe to meet rising regional demand.

- In November 2021, Tate & Lyle collaborated with a prominent AI startup to integrate its rare sugars with machine learning algorithms, improving product personalization and operational efficiency in food production.

- In February 2020, Ingredion invested €150 million in a state-of-the-art R&D facility in Germany, focusing on the development of next-generation rare sugars tailored for diabetic diets and functional foods.

MARKET SEGMENTATION

This Europe rare sugar market research report is segmented and sub-segmented into the following categories.

By Product

- D-Mannos

- Allulose

- Tagatos

- D-Xylose

- L-Arabinose

- L-Fucose

- D-psicose

- Others

By Application

- Sweetener

- Medicine

- Cosmetics

- Nutrition

- Food & Flavor

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the CAGR of the Europe rare sugar market from 2025 to 2033?

The Europe rare sugar market is projected to grow at a CAGR of 3.88% during the forecast period.

2. What is driving the growth of the Europe rare sugar market?

Rising health consciousness and demand for low-calorie sugar alternatives are driving the Europe rare sugar market.

3. What are the key challenges in the Europe rare sugar market?

High production costs and stringent regulatory frameworks hinder the growth of the Europe rare sugar market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]