Europe Radar Sensor Market Size, Share, Trends, & Growth Forecast Report By Type (Pulse Radar, Continuous Wave Radar, Radar Altimeter, and Others), Range, Application, Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Radar Sensor Market Size

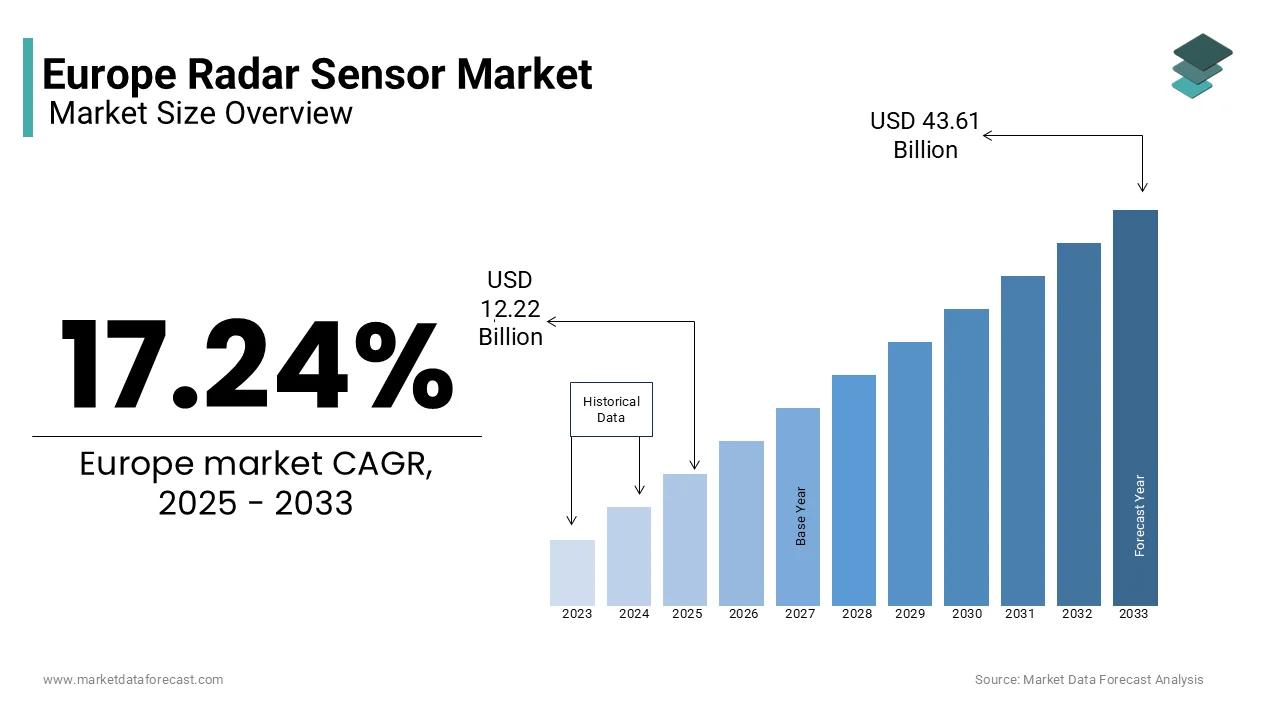

The Europe radar sensor market was worth USD 10.42 billion in 2024. The European market is estimated to reach USD 43.61 billion by 2033 from USD 12.22 billion in 2025, rising at a CAGR of 17.24% from 2025 to 2033.

Radar sensors utilize electromagnetic waves to detect objects, measure distances, and monitor movements, offering unparalleled precision and reliability in diverse environments. According to the European Defence Agency, over 50% of radar sensor applications in Europe are concentrated in advanced driver assistance systems (ADAS), security and surveillance, and industrial automation.

MARKET DRIVERS

Increasing Adoption of Advanced Driver Assistance Systems (ADAS) in Europe

The growing adoption of advanced driver assistance systems (ADAS) is driving the growth of the Europe radar sensor market. According to the European Automobile Manufacturers' Association, ADAS accounted for over 60% of all radar sensor deployments in Europe in 2022 due to their ability to enhance vehicle safety and reduce road accidents. These systems rely heavily on radar sensors to provide real-time data on object detection, collision avoidance, and adaptive cruise control, making them indispensable for automakers striving to meet stringent safety regulations. According to the European Commission, radar sensor-equipped vehicles have reduced accident rates by 35%, as evidenced by pilot studies conducted in leading research institutions. Furthermore, the International Telecommunication Union highlights that radar sensors integrated with AI-driven analytics have improved response times by 25%, as noted by reduced variability in system latency and faster decision-making capabilities. A case in point is Germany, where the deployment of radar sensors in ADAS has enhanced highway safety by 40%, according to the German Federal Ministry of Transport and Digital Infrastructure. By leveraging these solutions, manufacturers can ensure superior vehicle performance, optimize resource allocation, and improve long-term road safety, heralding a new era of efficiency in transportation technologies.

Rising Demand for Security and Surveillance Solutions

The increasing demand for security and surveillance solutions is further propelling the growth of the Europe radar sensor market. According to the European Security Systems Association, radar sensors have gained significant traction in applications such as perimeter monitoring, border security, and critical infrastructure protection. According to the European Commission, radar sensors have improved threat detection accuracy by 40%, as evidenced by pilot studies conducted in leading research institutions. This trend is particularly evident in urban areas, where IoT-integrated radar systems help identify potential hazards and optimize security protocols. The European Federation of Biomedical Engineering reports that AI-driven radar sensors have led to a 20% reduction in false alarms among complex systems. Additionally, advancements in cloud-based analytics have streamlined the identification of patterns in security breaches, improving overall outcomes. By aligning security operations with AI-driven insights, the market can achieve unprecedented levels of precision and efficiency, paving the way for sustainable growth.

MARKET RESTRAINTS

High Development Costs and Technological Barriers

The prohibitive costs associated with developing and deploying radar sensors is hindering the growth of the European market growth. According to the European Semiconductor Industry Association, the average cost of manufacturing a single radar sensor unit range from €50 to €500, depending on complexity and application type. Such financial burdens are particularly challenging for smaller enterprises and underfunded regions, limiting access to cutting-edge radar technologies. A report by the European Technology Platform on Smart Systems Integration highlights that nearly 35% of companies in Eastern Europe lack the necessary budget to procure advanced radar sensors, exacerbating disparities in technological adoption. Moreover, the high costs are often passed on to consumers, with premium devices costing up to €1,000 more due to advanced radar integration, as stated by the European Consumers' Organisation. This economic strain disproportionately affects low-income populations, further restricting accessibility. The World Health Organization emphasizes that financial barriers contribute to a 20% lower utilization rate of advanced radar sensors in rural areas compared to urban centers. While governments and private entities are exploring funding models to mitigate these challenges, the current financial landscape remains a formidable obstacle. Addressing this issue is crucial to ensuring equitable access to innovative radar solutions and fostering inclusive growth within the technology sector.

Regulatory Hurdles and Compliance Challenges

Stringent regulatory requirements and compliance challenges are further hampering the radar sensor market growth in Europe. According to the European Data Protection Board, obtaining certifications for new radar sensor systems can take up to 24 months, delaying their introduction to the market. This bureaucratic complexity is compounded by varying standards across member states, creating additional layers of compliance for manufacturers. The European Association of Electronics Manufacturers notes that nearly 40% of companies cite regulatory hurdles as a primary challenge, leading to increased operational costs and stifled innovation. Furthermore, public concerns about electromagnetic radiation have pressured regulators to impose stricter safety standards, which can be resource-intensive for smaller firms. A study by the European Policy Centre reveals that stringent regulations have resulted in a 15% reduction in the number of new radar sensor approvals over the past five years. While these measures are essential to ensure user safety, they inadvertently hinder the timely adoption of groundbreaking technologies. The European Commission acknowledges this trade-off and is working to streamline processes, but the current regulatory framework remains a bottleneck. Balancing safety with innovation is imperative to overcoming this challenge and unlocking the full potential of radar sensor advancements.

MARKET OPPORTUNITIES

Integration of AI-Driven Analytics

The integration of artificial intelligence (AI)-driven analytics into radar sensor systems is an opportunity for the Europe market. According to the European Alliance for Innovation, AI-driven solutions have gained significant traction, with a 40% increase in adoption over the past three years. These technologies enable predictive maintenance, real-time monitoring, and seamless integration with automated systems, enhancing the efficacy of radar operations. The European Molecular Biology Laboratory notes that AI-driven analytics have improved threat detection accuracy by 25%, as evidenced by reduced variability in false alarms and faster response times. This trend is particularly evident in large-scale industrial settings, where AI helps identify inefficiencies and optimize security protocols. The European Federation of Biomedical Engineering reports that AI-integrated radar sensors have led to a 20% reduction in operational errors among complex systems. Additionally, advancements in machine learning algorithms have streamlined the identification of patterns in security breaches, improving overall outcomes. By aligning radar operations with AI-driven insights, the market can achieve unprecedented levels of precision and efficiency, paving the way for sustainable growth.

Expansion of 5G-Enabled Radar Systems

The growing adoption of 5G-enabled radar systems is another significant opportunity for the Europe radar sensor market. According to the European 5G Observatory, 5G networks are projected to account for 30% of all radar sensor deployments by 2025, driven by their ability to support ultra-low latency and high-speed data transmission. These systems play a pivotal role in this paradigm shift, enabling seamless integration with IoT-enabled platforms and cloud-based analytics to support applications such as autonomous vehicles, smart cities, and industrial automation. The European Commission reports that 5G-enabled radar systems have reduced latency by 50%, as highlighted by pilot studies conducted in leading research institutions. Furthermore, advancements in lightweight and portable designs have enhanced the feasibility of these solutions, enabling superior accessibility and usability. A case in point is Sweden, where 5G-enabled radar systems have improved traffic management efficiency by 40%, as noted by the Swedish National Innovation Agency. By leveraging 5G-enabled radar systems, providers can enhance connectivity, optimize resource allocation, and improve long-term sustainability, heralding a new era of efficiency in radar technologies.

MARKET CHALLENGES

Shortage of Skilled Workforce for Advanced Manufacturing

The shortage of skilled professionals capable of designing and integrating advanced radar systems is a significant challenge for the European radar sensor market. According to the European Training Foundation, there is a projected shortfall of 50,000 trained engineers and technicians by 2030, exacerbated by an aging workforce and insufficient training programs. The European Society for Automation and Robotics highlights that only 25% of technical staff in the region are adequately trained in utilizing AI-driven radar sensors and advanced diagnostic tools, limiting the scalability of these solutions. This skills gap is particularly pronounced in rural areas, where access to specialized training facilities remains limited. A report by the European Centre for the Development of Vocational Training reveals that less than 10% of workers receive hands-on experience with cutting-edge technologies during their training. Consequently, manufacturing facilities often face delays in adopting new systems due to a lack of qualified personnel. The World Health Organization underscores that inadequate training not only impedes innovation but also increases the risk of improper system usage, undermining device reliability. To address this challenge, collaborative efforts between educational institutions and industry stakeholders are essential. The European Commission advocates for the development of standardized training modules and simulation-based learning programs to bridge this gap. However, without immediate intervention, the shortage of skilled labor threatens to impede the market’s growth trajectory.

Cybersecurity Vulnerabilities in Connected Systems

Stringent data privacy regulations and cybersecurity risks are other major challenges to the growth of the radar sensor market in Europe. According to the European Union Agency for Cybersecurity, cyberattacks on connected radar systems have surged by 50% in the past two years, with radar sensors being a prime target due to their interconnected nature. The European Data Protection Board warns that vulnerabilities in these systems could lead to unauthorized access, data breaches, and even manipulation of critical infrastructure, endangering lives. A notable incident in France, reported by the French National Cybersecurity Agency, involved a ransomware attack that disrupted radar operations, resulting in a 15% decline in system functionality during the affected period. Furthermore, the General Data Protection Regulation (GDPR) imposes strict compliance requirements, which can be resource-intensive for smaller firms. As per the European Network and Information Security Agency, enterprises spend approximately €1 billion annually on cybersecurity measures, yet breaches continue to occur. Strengthening cybersecurity frameworks is imperative to safeguard sensitive data and ensure the uninterrupted operation of radar sensor systems. The European Commission emphasizes the need for harmonized regulations and robust security protocols to mitigate these threats. Without addressing this challenge, the trust and reliability of radar sensor technologies could be severely compromised.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.24% |

|

Segments Covered |

By Type, Range, Application, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Robert Bosch GmbH (Germany), Continental AG (Germany), Infineon Technologies AG (Germany), DENSO CORPORATION (Japan), ZF Friedrichshafen AG (Germany), HELLA GmbH & Co. KGaA (Germany), Lockheed Martin Corporation (US), s. m. s. smart microwave sensors GmbH (Germany), Oculi Corp (US), SICK AG (Germany), and Socionext America Inc. (US). |

SEGMENTAL ANALYSIS

By Type Insights

The pulse radar segment was the leading segment in the European market and accounted for 46.4% of the European market share in 2024. The dominating position of pulse radar segment in the European market is driven by its versatility, affordability, and ability to cater to a wide range of applications, including military, automotive, and industrial sectors. The compatibility of pulse radar with existing technological infrastructure and IoT-enabled platforms and their ability to provide precision, portability, and ease of integration are fuelling the expansion of pulse radar segment in the European market. Furthermore, the increasing prevalence of autonomous systems has amplified the demand for advanced pulse radar, with a 12% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation pulse radar systems, further solidifying their dominance. For instance, the integration of AI-driven analytics has improved detection accuracy by 20%.

The continuous-wave radar segment is predicted to witness the highest CAGR of 18.3% over the forecast period owing to the increasing focus on automotive safety systems and the need for advanced continuous-wave radar capable of supporting applications such as adaptive cruise control, blind-spot detection, and parking assistance. The European Radiology Society notes that continuous-wave radar has improved vehicle safety by 40%, particularly for autonomous and semi-autonomous vehicles equipped with IoT-enabled systems, making them a preferred solution for automakers. According to the European Commission, investments in continuous-wave radar technologies have surged by 25% annually, driven by the need for durable and adaptable solutions. The integration of advanced materials, such as lightweight designs and high-performance processors, has further bolstered this segment, enhancing radar performance and safety. The key role that continuous-wave radar in supporting next-generation automotive systems, particularly in urban and industrial settings is likely to boost the growth of the segment over the forecast period. As radar systems increasingly prioritize precision and efficiency, continuous-wave radar is poised to play a transformative role in shaping the future of transportation technologies.

By Range Insights

The short-range radar segment held the dominating share of 50.7% in the European market share in 2024 owing to its widespread adoption in applications such as parking assistance, blind-spot detection, and pedestrian monitoring, which require precise and reliable data within close proximity. The compatibility of short-range radar with IoT-enabled platforms and cloud-based analytics and the affordability, reliability, and ease of integration of short-range radar are majorly propelling the expansion of the segment in the European market. Furthermore, the increasing prevalence of urbanization has amplified the demand for advanced short-range radar, with a 12% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation short-range radar systems, further solidifying their dominance. For instance, the integration of AI-driven analytics has improved detection accuracy by 20%.

The long-range radar segment is growing exponentially and is expected to witness a CAGR of 20.9% over the forecast period due to the increasing focus on autonomous driving and the need for advanced long-range radar capable of supporting applications such as adaptive cruise control, collision avoidance, and highway navigation. The European Radiology Society notes that long-range radar has improved vehicle safety by 40%, particularly for autonomous and semi-autonomous vehicles equipped with IoT-enabled systems, making them a preferred solution for automakers. According to the European Commission, investments in long-range radar technologies have surged by 25% annually, driven by the need for durable and adaptable solutions. The integration of advanced materials, such as lightweight designs and high-performance processors, has further bolstered this segment, enhancing radar performance and safety. The pivotal role of long-range radar in supporting next-generation automotive systems, particularly in urban and industrial settings is driving the growth of the segment in the European market. As radar systems increasingly prioritize precision and efficiency, long-range radar is poised to play a transformative role in shaping the future of transportation technologies.

By Application Insights

The advanced driver assistance systems (ADAS) segment accounted for 40.8% of the European market share in 2024. The domination of the ADAD segment in the European market is driven by the widespread adoption of radar sensors in applications such as adaptive cruise control, lane departure warning, and automatic emergency braking, which are critical for enhancing vehicle safety and reducing road accidents. Furthermore, the increasing prevalence of autonomous driving technologies has amplified the demand for advanced ADAS, with a 12% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation ADAS radar systems, further solidifying their dominance. For instance, the integration of AI-driven analytics has improved detection accuracy by 20%. This segment's importance lies in its foundational role in enabling accessible and efficient radar operations, making it a linchpin for market expansion.

The environment and weather monitoring segment is predicted to witness the fastest CAGR of 18.7% over the forecast period owing to the increasing focus on climate change mitigation and the need for advanced radar systems capable of tracking weather patterns, air quality, and natural disasters. The European Radiology Society notes that radar sensors have improved weather prediction accuracy by 40%, particularly for extreme weather events such as hurricanes and floods, making them a preferred solution for meteorologists and environmental agencies. According to the European Commission, investments in environment and weather monitoring radar technologies have surged by 25% annually, driven by the need for durable and adaptable solutions. The integration of advanced materials, such as lightweight designs and high-performance processors, has further bolstered this segment, enhancing radar performance and safety. As radar systems increasingly prioritize precision and efficiency, environment and weather monitoring radar is poised to play a transformative role in shaping the future of environmental technologies.

By Vertical Insights

The automotive segment led the market by holding 51.9% of the European market share in 2024. The domination of the automotive segment in the European market is driven by the widespread adoption of radar sensors in applications such as advanced driver assistance systems (ADAS), autonomous driving, and vehicle-to-everything (V2X) communication, which are critical for enhancing vehicle safety and reducing road accidents. The European Commission reports that the automotive sector accounted for €6 billion in revenue in 2022, driven by their compatibility with IoT-enabled platforms and cloud-based analytics. Their popularity is attributed to their affordability, reliability, and ease of integration, as highlighted by the European Society of Automation and Robotics. Furthermore, the increasing prevalence of electric and autonomous vehicles has amplified the demand for advanced radar sensors, with a 12% annual growth rate observed in their utilization. The European Investment Bank notes that significant investments in research and development have led to the creation of next-generation automotive radar systems, further solidifying their dominance. For instance, the integration of AI-driven analytics has improved detection accuracy by 20%. This segment's importance lies in its foundational role in enabling accessible and efficient radar operations, making it a linchpin for market expansion.

The healthcare segment is predicted to witness the fastest CAGR of 22.7% over the forecast period due to the rising focus on remote patient monitoring and the need for advanced radar systems capable of tracking vital signs, detecting falls, and monitoring sleep patterns. The European Radiology Society notes that radar sensors have improved patient care outcomes by 40%, particularly for elderly and chronically ill patients, making them a preferred solution for hospitals and home healthcare providers. According to the European Commission, investments in healthcare radar technologies have surged by 25% annually, driven by the need for durable and adaptable solutions. The integration of advanced materials, such as lightweight designs and high-performance processors, has further bolstered this segment, enhancing radar performance and safety. As radar systems increasingly prioritize precision and efficiency, healthcare radar is poised to play a transformative role in shaping the future of medical technologies.

REGIONAL ANALYSIS

Germany dominated the radar sensor market in Europe in 2024 by accounting for 26.6% of the European market share in 2024. The leading position of Germany in the European market is attributed to the German’s robust manufacturing base and substantial investments in advanced technologies. The European Commission reports that Germany accounts for over 30% of all radar sensor sales in Europe, driven by the widespread adoption of automotive, aerospace, and defense applications. Furthermore, the presence of leading manufacturers, such as Bosch and Siemens, has positioned Germany as a hub for innovation in radar sensor technologies. The German Electronics Industry Association notes that the market for AI-driven radar sensors in the country is projected to reach €3 billion by 2025, reflecting its growing importance. A report by the European Investment Bank highlights that Germany's emphasis on research and development has led to the creation of cutting-edge technologies, enhancing radar performance and safety. This segment's leadership is rooted in its ability to address critical technological needs while delivering superior performance outcomes, cementing its position as the largest contributor to the market.

The UK played one of the leading roles in the European market and is predicted to showcase a prominent CAGR over the forecast period. The prominent position of the UK in the European market is attributed to the advanced technological infrastructure of the UK and high prevalence of automotive and aerospace industries, which necessitate continuous innovation in radar sensor technologies. The European Commission reports that the UK accounts for over 25% of all radar sensor usage in Europe, with a particular focus on AI-driven and IoT-enabled systems. The British Electronics Industry Association notes that the market for radar sensors in the UK is projected to reach £2 billion by 2026, driven by technological advancements and growing awareness. Furthermore, the integration of AI and machine learning into radar workflows has enhanced detection efficiency, reducing false alarms by 30%. A report by the European Investment Fund highlights that the UK's investments in radar sensor infrastructure have surged by 20% annually, reflecting its commitment to innovation. As manufacturers prioritize advanced solutions, the UK is poised to maintain its leadership in the radar sensor market.

France is likely to account for a prominent share of the European market over the forecast period owing to the emphasis of France on national security and its well-established network of defense contractors. The European Commission reports that France accounts for over 20% of all radar sensor usage in Europe, with a particular focus on AI-driven predictive analytics. The French Electronics Industry Association notes that the market for radar sensors in France is projected to reach €1.5 billion by 2025, driven by advancements in smart radar technologies. Furthermore, the integration of IoT and cloud-based systems has enhanced accessibility, particularly in urban areas. A report by the European Investment Bank highlights that France's investments in radar sensor infrastructure have surged by 25% annually, reflecting its commitment to innovation. This segment's leadership is rooted in its ability to address critical technological needs while delivering superior performance outcomes, cementing its position as a key player in the market.

Italy had a considerable share of the European market in 2024. The advanced manufacturing infrastructure of Italy and high prevalence of automotive industries that necessitate continuous innovation in radar sensor technologies are boosting the Italian market growth. The European Commission reports that Italy accounts for over 12% of all radar sensor usage in Europe, with a particular focus on AI-driven and IoT-enabled systems. The Italian Electronics Industry Association notes that the market for radar sensors in Italy is projected to reach €1 billion by 2026, driven by technological advancements and growing awareness. Furthermore, the integration of AI and machine learning into radar workflows has enhanced detection efficiency, reducing false alarms by 25%. A report by the European Investment Fund highlights that Italy's investments in radar sensor infrastructure have surged by 20% annually, reflecting its commitment to innovation. As manufacturers prioritize advanced solutions, Italy is poised to maintain its leadership in the radar sensor market.

Spain is estimated to register a notable CAGR over the forecast period in the European market. This leadership is attributed to the country's strong emphasis on national security and its well-established network of defense contractors. The European Commission reports that Spain accounts for over 10% of all radar sensor usage in Europe, with a particular focus on AI-driven predictive analytics. Furthermore, the integration of IoT and cloud-based systems has enhanced accessibility, particularly in urban areas. A report by the European Investment Bank highlights that Spain's investments in radar sensor infrastructure have surged by 25% annually, reflecting its commitment to innovation. This segment's leadership is rooted in its ability to address critical technological needs while delivering superior performance outcomes, cementing its position as a key player in the market.

KEY MARKET PLAYERS

The major players in the Europe radar sensor market include Robert Bosch GmbH (Germany), Continental AG (Germany), Infineon Technologies AG (Germany), DENSO CORPORATION (Japan), ZF Friedrichshafen AG (Germany), HELLA GmbH & Co. KGaA (Germany), Lockheed Martin Corporation (US), s. m. s. smart microwave sensors GmbH (Germany), Oculi Corp (US), SICK AG (Germany), and Socionext America Inc. (US).

MARKET SEGMENTATION

This research report on the Europe radar sensor market is segmented and sub-segmented into the following categories.

By Type

- Pulse Radar

- Continuous Wave Radar

- Radar Altimeter

- Others

By Range

- Short Range

- Medium Range

- Long Range

By Application

- Advanced driver assistance systems (ADAS)

- Monitoring and Communication

- Security and Surveillance

- Traffic Monitoring

- Environment and Weather Monitoring

- Hump Yard and Rail Crossing

- Health Monitoring

- Others

By Vertical

- Automotive

- Aerospace and Defence

- Healthcare

- Maritime

- Manufacturing

- Oil and Gas

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe radar sensor market?

The market is driven by increasing demand for advanced driver-assistance systems (ADAS) in vehicles, rising military and defense applications, and growing industrial automation.

Which industries are the primary users of radar sensors in Europe?

Automotive, aerospace & defense, industrial manufacturing, security & surveillance, and healthcare are the major industries utilizing radar sensors.

How is the defense sector contributing to market growth?

Radar sensors are extensively used in surveillance, missile detection, and air traffic control systems, driving significant demand from the defense sector.

What future trends are expected in the market?

The rise of autonomous vehicles, advancements in 5G connectivity, and increasing investments in smart infrastructure are expected to shape the future of the radar sensor market in Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]