Europe PV Inverter Market Size, Share, Trends, & Growth Forecast Report By Product (String, Micro, Central, Hybrid, and Others), Phase, Connectivity, Output Power, Output Rating, End-user Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe PV Inverter Market Size

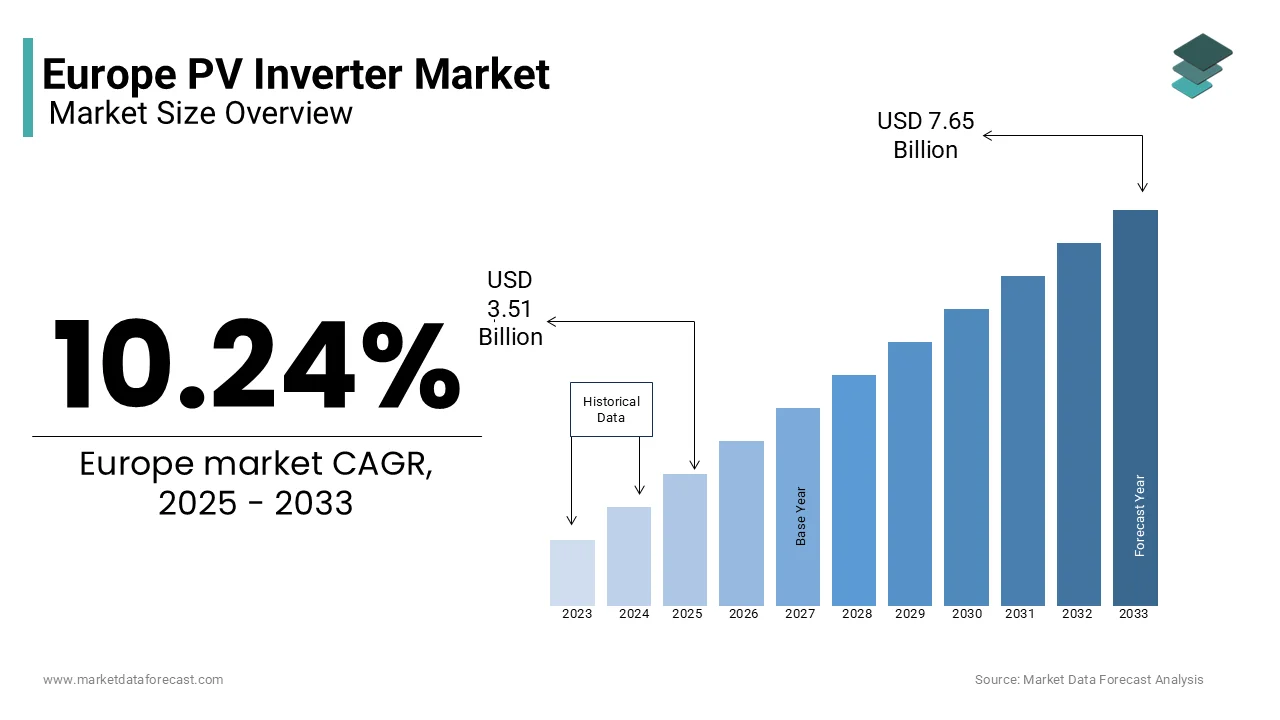

The Europe PV inverter market was worth USD 3.18 billion in 2024. The European market is projected to reach USD 7.65 billion by 2033 from USD 3.51 billion in 2025, rising at a CAGR of 10.24% from 2025 to 2033.

Photovoltaic (PV) inverters are playing an indispensable role in converting direct current (DC) generated by solar panels into alternating current (AC) for use in homes, businesses, and utilities. As per the European Photovoltaic Industry Association, the market has experienced exponential growth due to the increasing adoption of solar energy systems as a sustainable alternative to fossil fuels. PV inverters are not only essential for energy conversion but also enable grid integration, energy storage compatibility, and system monitoring, making them pivotal in advancing Europe’s clean energy transition.

According to Eurostat, solar energy accounted for 14% of the EU’s total electricity generation in 2022, with PV inverters being a cornerstone of this achievement. Germany, Spain, and Italy emerged as key contributors. According to the estimations of the International Renewable Energy Agency (IRENA), Europe installed over 40 gigawatts (GW) of solar capacity in 2022 due to the favorable government policies and declining technology costs. With advancements in hybrid and smart inverters, coupled with the growing emphasis on energy independence, the Europe PV inverter market is poised for sustained expansion. This growth aligns with the European Green Deal, which aims to achieve carbon neutrality by 2050, further solidifying the importance of PV inverters in shaping a sustainable energy future.

MARKET DRIVERS

Government Policies Promoting Solar Energy Adoption

The implementation of robust government policies aimed at accelerating solar energy adoption in Europe is primarily driving the growth of the Europe PV inverter market. According to the European Commission, the EU has set ambitious targets to increase renewable energy’s share in the energy mix to 42.5% by 2030, creating a favorable environment for solar installations and, consequently, PV inverters. Initiatives such as Germany’s Renewable Energy Sources Act (EEG) and Spain’s National Integrated Energy and Climate Plan have incentivized both residential and commercial solar projects, boosting demand for inverters. The German Federal Ministry for Economic Affairs and Energy reports that subsidies for rooftop solar systems increased by 20% in 2022, resulting in a 35% rise in domestic PV installations. Similarly, France’s Multiannual Energy Program allocated €9 billion to solar energy projects, which is driving the deployment of advanced inverters capable of integrating with smart grids. These policy frameworks have not only stimulated market growth but also positioned Europe as a global leader in renewable energy innovation, ensuring long-term sustainability and economic benefits.

Technological Advancements Enhancing Efficiency and Reliability

Technological advancements in PV inverter design and functionality are further boosting the expansion of the Europe PV inverter market. According to the Fraunhofer Institute for Solar Energy Systems, modern inverters now achieve efficiency rates exceeding 98%, significantly improving energy yield and reducing operational costs. Innovations such as hybrid inverters that combine solar power generation with battery storage, have gained traction, particularly in countries like Sweden and Denmark, where energy storage solutions are prioritized. According to the Italian Ministry of Ecological Transition, the adoption of string inverters equipped with artificial intelligence (AI) for predictive maintenance has reduced system downtime by 15%. Furthermore, advancements in microinverters have enabled higher energy output for small-scale installations, making solar energy more accessible to residential users. These technological strides are not only enhancing the performance of solar systems but also attracting significant private sector investment, further bolstering the market’s growth trajectory.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

The prevalence of supply chain disruptions and shortages of critical components, such as semiconductors and capacitors are one of the major restraints to the European PV inverter market. According to the European Semiconductor Industry Association, global semiconductor shortages caused a 10% delay in PV inverter production schedules across Europe in 2022. This issue was exacerbated by geopolitical tensions and logistical bottlenecks, leading to increased lead times and elevated costs for manufacturers. According to the French Ministry of Economy and Finance, the average price of inverters rose by 12% during the first half of 2022, which is impacting project economics and delaying installations. Additionally, reliance on imports from Asia for key components has exposed the market to vulnerabilities, particularly during periods of heightened global uncertainty. Addressing these supply chain challenges through localized manufacturing and strategic stockpiling is essential to ensure the resilience and competitiveness of the Europe PV inverter market.

High Initial Costs and Financial Barriers

High initial cost associated with PV inverters that poses a financial barrier for end-users, particularly in emerging markets is further hindering the growth of the European market. According to the UK Department for Business, Energy & Industrial Strategy, the upfront cost of installing a residential solar system, including inverters, ranges between €8,000 and €15,000, deterring potential adopters despite long-term savings. According to the Spanish Institute for Energy Diversification and Saving, limited access to affordable financing options remains a key obstacle, particularly in rural areas where awareness of solar energy benefits is low. Moreover, the absence of standardized subsidy programs across Europe has created disparities in adoption rates, with Eastern European countries lagging behind their Western counterparts. Bridging these financial gaps through innovative financing models and targeted government support is crucial to overcoming cost-related barriers and fostering widespread adoption.

MARKET OPPORTUNITIES

Integration with Smart Grids and IoT Technologies

The integration with smart grids and Internet of Things (IoT) technologies to enable enhanced energy management and grid stability is a lucrative opportunity for the European market. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), smart grid investments in Europe are projected to exceed €100 billion by 2030, creating a conducive environment for advanced inverter deployment. According to the Swedish Energy Agency, smart inverters equipped with IoT capabilities can optimize energy distribution, reduce peak load pressures, and facilitate real-time monitoring. For instance, hybrid inverters with AI-driven analytics have demonstrated a 25% improvement in energy efficiency in pilot projects across Scandinavia. This synergy not only enhances the reliability of solar systems but also positions inverters as integral components of Europe’s digital energy infrastructure. By capitalizing on this opportunity, manufacturers can unlock new revenue streams while contributing to a smarter and more sustainable energy ecosystem.

Expansion into Emerging Markets and Applications

The expansion of PV inverters into emerging markets and applications, such as agrivoltaics and electric vehicle (EV) charging stations is another significant opportunity for the European market. According to the European Agricultural Machinery Association, agrivoltaic systems, which combine solar panels with agricultural activities, are gaining popularity, particularly in Southern Europe. These systems require specialized inverters capable of handling fluctuating loads, presenting a lucrative growth avenue. As per the Dutch Ministry of Infrastructure and Water Management, the integration of PV inverters with EV charging stations is expected to grow at a healthy CAGR over the forecast period and this trend is driven by the increasing adoption of EVs and the need for decentralized energy solutions. By diversifying into these untapped sectors, the Europe PV inverter market can address evolving consumer demands while reinforcing its leadership in clean energy innovation.

MARKET CHALLENGES

Regulatory Uncertainty and Policy Fragmentation

The regulatory uncertainty and policy fragmentation across member states that hinder harmonized market development is a pressing challenge to the European market. According to the European Policy Centre, inconsistent national policies regarding solar energy incentives and grid connection standards create barriers to cross-border collaboration and market integration. As per the Danish Energy Agency, this lack of alignment has resulted in fragmented solar infrastructure, with only 60% of planned projects reaching completion. Additionally, frequent changes in subsidy schemes and tax regulations complicate compliance for manufacturers and installers, undermining investor confidence. Overcoming these challenges requires greater coordination among EU member states and the establishment of unified frameworks to facilitate seamless market growth and innovation.

Environmental Concerns and Recycling Challenges

The environmental impact of PV inverters, particularly concerning electronic waste (e-waste) and recycling is further challenging the expansion of the European market. According to the European Environmental Bureau, e-waste from solar energy systems, including inverters, is projected to reach 78 million metric tons globally by 2030. This issue is compounded by the lack of standardized recycling processes for inverters, which contain hazardous materials such as lead and cadmium. As per the Czech Ministry of Environment, less than 30% of inverters are currently recycled in Europe, posing significant environmental risks. Furthermore, the absence of extended producer responsibility (EPR) policies in several countries exacerbates the problem, leaving manufacturers unaccountable for end-of-life disposal. Addressing these concerns through innovative recycling technologies and stringent regulatory measures is imperative to ensure the sustainability of the Europe PV inverter market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.24% |

|

Segments Covered |

By Product, Phase, Connectivity, Output Power, Output Rating, End-user Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Solar Edge Technologies, Siemens Energy, Fimer Group, SMA Solar Technology AG, Delta Electronics, Inc., Sun Power Corporation, Omron Corporation, Eaton Corporation, Emerson Electric Co., and Power Electronics S.L. |

SEGMENTAL ANALYSIS

By Product Types Insights

The string inverters segment occupied 56.7% of the Europe PV inverter market share in 2024. The domination of the string inverters segment in the European market is attributed to their cost-effectiveness, ease of installation, and suitability for small to medium-sized solar installations. As per the German Federal Ministry for Economic Affairs and Energy, string inverters achieved an average efficiency of 97%, which is making them ideal for residential and commercial applications. Additionally, advancements in multi-string technology have expanded their applicability, with over 2 million units installed across Europe in 2022. Their versatility and proven performance underscore their critical role in driving market growth.

The hybrid inverters segment is anticipated to progress at a CAGR of 22.9% over the forecast period owing to their ability to integrate solar power generation with battery storage, addressing the growing demand for energy independence. According to the Italian National Agency for New Technologies, hybrid inverters are increasingly adopted in regions with unstable grids, such as Southern Europe, where they provide uninterrupted power supply. Their compatibility with smart home systems further amplifies their appeal, positioning them as a key driver of innovation in the Europe PV inverter market.

By Phase Insights

The single-phase inverters segment captured 45.5% of the Europe PV inverter market share in 2024. The dominating position of single-phase segment in the European market is driven by their suitability for residential applications, where simplicity and affordability are prioritized. According to the UK Department for Business, Energy & Industrial Strategy, single-phase inverters are compatible with most rooftop solar systems, with over 1.5 million units installed in 2022. Their widespread adoption underscores their importance in democratizing access to solar energy across Europe.

By Connectivity Insights

The battery backup segment is predicted to register the fastest CAGR of 25.8% over the forecast period owing to the increasing demand for energy storage solutions, particularly in regions prone to grid instability. According to the Dutch Ministry of Infrastructure and Water Management, battery backup systems equipped with advanced inverters can store excess energy for later use, reducing reliance on traditional grids. This trend reflects Europe’s commitment to enhancing energy security and sustainability.

By Output Power Insights

The inverters with an output power range of 5-30 kW dominated the market by capturing 40.9% of the European market share in 2024. The promising position of the segment in the European market is driven by their suitability for commercial and small industrial applications. As per the French Ministry of Ecological Transition, these inverters achieved an average efficiency of 96%, making them ideal for businesses seeking reliable energy solutions. Their scalability and cost-effectiveness further reinforce their leadership position.

The above 100 kW inverters segment is anticipated to witness a promising CAGR of 28.8% over the forecast period owing to the increasing adoption of utility-scale solar projects, particularly in Northern Europe. As per the Italian Ministry of Ecological Transition, large-scale inverters are essential for optimizing energy yield in megawatt-level installations, underscoring their importance in advancing Europe’s renewable energy goals.

By Output Rating Insights

The inverters with an output rating of 330-415V segment captured 51.8% of the European market share in 2024. The dominating position of the segment in the European market is attributed to their compatibility with standard household appliances and grid requirements. According to the German Federal Ministry for Economic Affairs and Energy, these inverters are widely used in residential and commercial installations, with over 3 million units deployed in 2022. Their reliability and efficiency make them a preferred choice for end-users.

The more than 600V inverters segment is projected to showcase the fastest CAGR of 30.7% over the forecast period owing to their application in utility-scale projects, where high voltage is essential for efficient energy transmission. According to the Italian National Agency for New Technologies, these inverters are critical for reducing energy losses in large-scale installations, positioning them as a key enabler of Europe’s clean energy transition.

By End-User Industry Insights

The residential segment dominated the market by holding 45.9% of the European market share in 2024. The government incentives and the growing awareness of energy independence are primarily boosting the expansion of the residential segment in the European market. As per the UK Department for Business, Energy & Industrial Strategy, residential installations increased by 25% in 2022, underscoring the sector’s importance in driving market growth. The affordability and accessibility of inverters for households further amplify their adoption.

The utility segment is anticipated to witness the highest CAGR of 35.5% over the forecast period due to the increasing deployment of utility-scale solar farms, particularly in Southern Europe. According to the Dutch Ministry of Infrastructure and Water Management, utility-scale projects require advanced inverters capable of handling high capacities, making them indispensable for achieving Europe’s renewable energy targets.

REGIONAL ANALYSIS

Germany led the PV inverter market in Europe by holding 25.9% of the European market share in 2024. The dominating position of Germany in the European market is driven by robust solar policies and a thriving manufacturing base. According to the German Photovoltaic Industry Association, Gemany installed over 7 GW of solar capacity in 2022, reinforcing its leadership in renewable energy innovation.

Spain was the second largest regional market for PV inverters in Europe. The abundant sunlight and supportive policies have fueled solar adoption, which is driving demand for PV inverters in Spain. As per the Spanish Ministry for the Ecological Transition, Spain aims to install 30 GW of solar capacity by 2030, underscoring its commitment to advancing the market.

Italy accounts for a notable share of the European market. Factors such as the favorable incentives and a strong focus on residential solar installations are driving the Italian market growth. According to the Italian National Agency for New Technologies, Italy installed over 2 GW of solar capacity in 2022, highlighting its growing influence in the regional market.

France is anticipated to register a healthy CAGR in the European PV inverter market over the forecast period owing to the emphasis of France on renewable energy integration and industrial decarbonization has spurred inverter adoption. According to the French National Hydrogen Council, France plans to deploy 10 GW of solar capacity by 2025, reinforcing its leadership in sustainable energy solutions.

The UK is predicted to occupy a notable share of the European PV inverter market over the forecast period owing to the ambitious solar targets and strong private sector participation. As per the UK Hydrogen and Fuel Cell Association, the UK aims to achieve net-zero emissions by 2050, positioning it as a key contributor to Europe’s renewable energy landscape.

KEY MARKET PLAYERS

The major players in the Europe PV inverter market include Solar Edge Technologies, Siemens Energy, Fimer Group, SMA Solar Technology AG, Delta Electronics, Inc., Sun Power Corporation, Omron Corporation, Eaton Corporation, Emerson Electric Co., and Power Electronics S.L.

MARKET SEGMENTATION

This research report on the Europe market is segmented and sub-segmented into the following categories.

By Product

- String

- Micro

- Central

- Hybrid

- Others

By Phase

- Single Phase

- Two-Phase

- Three Phase

By Connectivity

- Standalone

- On-grid

- Battery Backup

By Output Power

- Up to 1 kW

- 1-5kW

- 5-30kW

- 30-70kW

- 70-100kW

- Above 100kW

By Output Rating

- Up to 250V

- 250-330V

- 330-415V

- 415-600V

- More than 600V

By End-user Industry

- Residential

- Commercial

- Industrial

- Utility

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe PV inverter market?

The growth of the Europe PV inverter market is driven by increasing solar energy installations, government incentives for renewable energy, and advancements in inverter technology improving efficiency and grid integration.

What types of PV inverters are most commonly used in Europe?

String inverters and central inverters are the most commonly used in Europe, with microinverters gaining popularity in residential and small-scale commercial installations.

How does the rise of electric vehicles impact the PV inverter market?

The rise of electric vehicles is increasing the demand for bidirectional inverters and vehicle-to-grid (V2G) technology, enabling better energy management and grid support.

What future trends are expected in the Europe PV inverter market?

Future trends include the growth of AI-driven energy management, increased adoption of grid-forming inverters, and further integration of PV inverters with smart grids and energy storage solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com