Europe Pumps Market Size, Share, Trends & Growth Forecast Report By Type (Centrifugal Pumps, Positive Displacement Pumps), End User, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Pumps Market Size

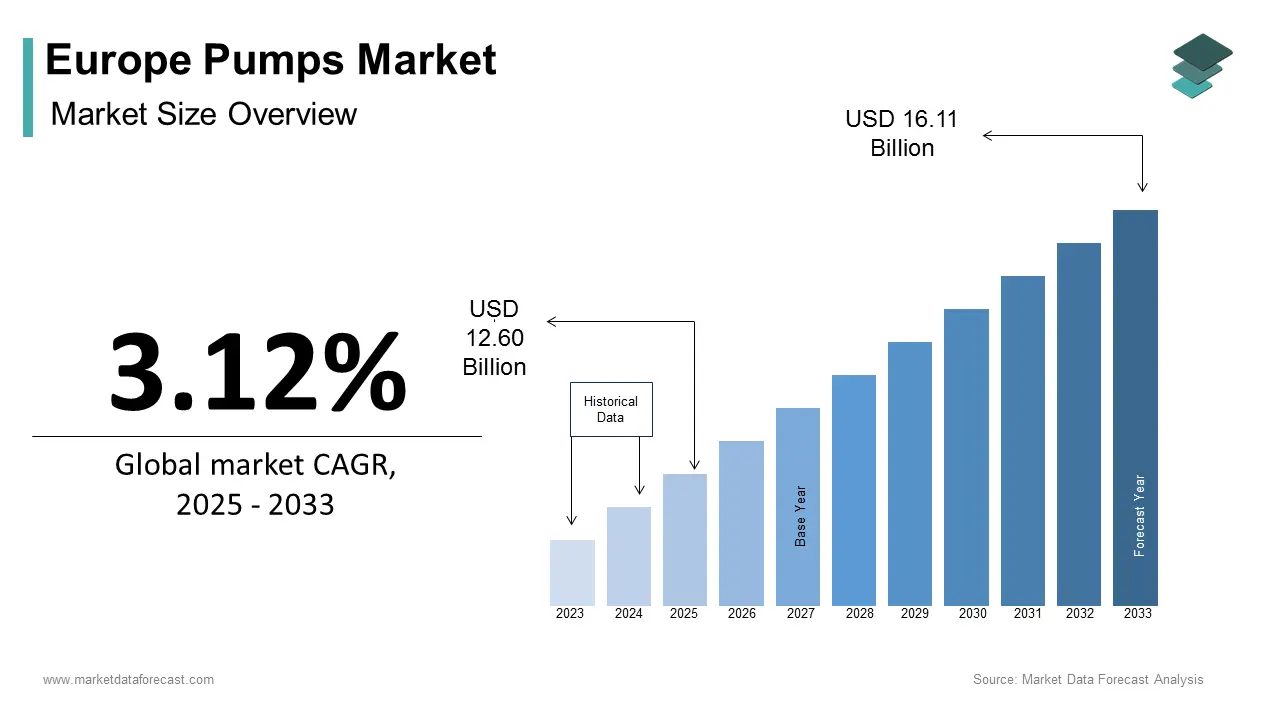

The Europe pumps market size was calculated to be USD 12.22 billion in 2024 and is anticipated to be worth USD 16.11 billion by 2033 from USD 12.60 billion in 2025, growing at a CAGR of 3.12% during the forecast period.

The European pumps market has established a robust presence across the continent, driven by industrialization, urbanization, and stringent environmental regulations. These factors have positioned the region as a leader in adopting advanced water management and industrial solutions. According to the European Environment Agency, over 70% of urban wastewater is treated efficiently, underscoring the critical role of pumps in supporting water infrastructure systems, including wastewater treatment.

The industrial sector further amplifies demand for high-performance pumps, accounting for nearly 25% of Europe's GDP, as reported by Eurostat. Industrial-grade pumps are essential for maintaining operational efficiency across manufacturing, energy, and processing industries. Additionally, renewable energy initiatives, particularly in solar and wind power plants, have created a growing need for specialized pumping solutions. This trend aligns with Europe's broader commitment to sustainability and energy efficiency.

Germany, France, and the UK collectively dominate the market, holding approximately 45% of the regional share. These countries benefit from advanced technological capabilities and strong policy frameworks that support innovation and adoption of energy-efficient solutions. Notably, investments in energy-efficient pump technologies surged by 15% in 2022, according to the International Energy Agency, reflecting a decisive shift toward sustainable practices.

MARKET DRIVERS

Industrial Expansion and Automation

Industrial expansion remains a cornerstone driver for the European pumps market, propelled by advancements in automation and smart manufacturing initiatives. The European Commission states that the adoption of Industry 4.0 technologies increased by 20% in 2022, creating heightened demand for precision-engineered pumps. Key industries such as oil and gas, chemical processing, and food and beverage rely heavily on advanced pumping systems to ensure seamless operations. For instance, the International Energy Agency reports that the oil and gas sector alone accounts for 30% of total pump demand in Europe. The emergence of modular and IoT-enabled pumps has significantly improved operational efficiency, reducing downtime by an estimated 25%, as noted by the European Federation of Chemical Engineering. With investments in industrial automation projected to reach €150 billion by 2025, the pump industry is poised for sustained growth. This trend exhibits how industrial expansion and technological integration are driving the market forward.

Stringent Environmental Regulations

Environmental regulations are another significant driver shaping the European pumps market. The European Green Deal mandates industries to adopt energy-efficient solutions, including high-efficiency pumps, to reduce carbon footprints. In line with the European Environment Agency, energy-efficient pumps can save up to 20% of electricity costs annually. In 2022, the EU introduced stricter guidelines for water and wastewater management requiring municipalities to upgrade their infrastructure. This has led to a surge in demand for centrifugal and submersible pumps. To add to this, the Confederation of European Wastewater Associations reports that over €50 billion was allocated for wastewater treatment projects between 2021 and 2023. These regulatory frameworks not only drive innovation but also create lucrative opportunities for pump manufacturers to align with sustainability goals.

MARKET RESTRAINTS

High Initial Investment Costs

A primary restraint affecting the European pumps market is the high initial investment required for advanced pump systems. This financial barrier often deters small and medium-sized enterprises (SMEs) from adopting cutting-edge technologies, limiting market penetration. As indicated by the European Federation of Pump Manufacturers, maintenance costs for high-end pumps can account for 15% to 20% of total expenditure over their lifecycle. While these systems offer long-term savings, the upfront investment remains a significant hurdle, particularly in regions with constrained budgets. Economic uncertainties, such as inflation and fluctuating energy prices, further exacerbate this issue, impacting purchasing decisions across industries.

Complex Regulatory Compliance

Another restraint is the complexity associated with adhering to stringent regulatory standards. The European Commission directs compliance with multiple directives, such as the Eco-Design Directive and REACH regulations, which govern energy efficiency and chemical safety. Non-compliance can result in penalties exceeding €500,000, as reported by the European Court of Auditors. Furthermore, certifying pumps for specific applications, such as hazardous environments, involves rigorous testing and documentation, increasing lead times by up to 30%. According to the European Association of Pump Manufacturers, nearly 25% of companies face delays in product launches due to compliance issues. So, these challenges not only escalate operational costs but also pose barriers to innovation, hindering the market’s overall growth trajectory.

MARKET OPPORTUNITIES

Renewable Energy Integration

The integration of pumps in renewable energy systems presents a significant opportunity for the European pumps market. The data published by the European Wind Energy Association reveal that offshore wind farms require specialized pumps for cooling and hydraulic systems, driving demand for high-performance models. By 2025, investments in renewable energy infrastructure are projected to surpass €300 billion, as stated by the European Investment Bank. The International Renewable Energy Agency notes that Europe accounts for 40% of global renewable energy capacity, making it a fertile ground for pump manufacturers. The shift toward decarbonization and net-zero goals further amplifies this opportunity, positioning the pump industry as a key enabler of sustainable energy solutions.

Smart City Development Initiatives

Smart city initiatives across Europe are creating unprecedented opportunities for the pumps market. According to Eurostat, over 75% of Europe’s population resides in urban areas, necessitating efficient water management and infrastructure systems. Smart cities leverage IoT-enabled pumps for real-time monitoring and predictive maintenance, reducing operational costs by 20%, as per the European Smart Cities Observatory. In 2022, the European Commission allocated €10 billion for smart city projects, focusing on water distribution and wastewater treatment. In conjunction with, the Confederation of European Water Services reports that the adoption of smart pumps in urban areas has increased water conservation by 15%. With smart city investments expected to double by 2026, the demand for innovative pump solutions is set to soar, offering lucrative prospects for manufacturers.

MARKET CHALLENGES

Fluctuating Raw Material Prices

Fluctuating raw material prices pose a significant challenge to the European pumps market. According to the European Metal Trade Association, the cost of stainless steel which is a key component in pump manufacturing and surged by 25% in 2022 due to supply chain disruptions. Similarly, copper prices increased by 15%, impacting production costs for electric motor components. The European Federation of Pump Manufacturers reports that raw materials account for approximately 40% of total manufacturing expenses, making price volatility a critical concern. These fluctuations not only affect profit margins but also lead to delayed project timelines, as manufacturers struggle to absorb additional costs. Geopolitical tensions, particularly in Eastern Europe, have exacerbated supply chain bottlenecks, further complicating raw material procurement. Addressing this challenge requires strategic sourcing and risk mitigation measures to ensure market stability.

Skilled Labor Shortage

Another pressing challenge is the shortage of skilled labor required for pump installation, maintenance, and innovation. The European Centre for the Development of Vocational Training stressed that the demand for skilled technicians in the industrial sector outstrips supply by 30%. This gap is particularly pronounced in advanced pump technologies, where expertise in IoT and automation is essential. A study by the European Federation of Engineers reveals that over 50% of companies reported difficulties in recruiting qualified personnel in 2022. The lack of technical proficiency not only hampers operational efficiency but also slows down the adoption of new technologies. On top of that, the aging workforce in Europe exacerbates the issue, with 25% of experienced engineers nearing retirement, as brought to attention by the European Commission. Addressing this challenge requires targeted training programs and partnerships with educational institutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.12% |

|

Segments Covered |

By Type, End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Husqvarna Group, Robert Bosch GmbH, STIGA S.p.A., Zucchetti Centro Sistemi S.p.A., AL-KO Kober SE, Deere & Company, Honda Motor Co., Ltd., WORX (Positec Tool Corporation), LG Electronics, MTD Products Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The centrifugal pumps segment dominated the Europe pumps market and held a share of 55.1% in 2024. This widespread adoption is credited to their versatility and ability to handle large volumes of fluids efficiently. Also, major industries such as water and wastewater, oil and gas, and agriculture have relied heavily on centrifugal pumps for their operations. According to Eurostat, the water and wastewater segment alone consumes 30% of centrifugal pumps in Europe. As well as, advancements in design, like multi-stage and submersible variants, have enhanced their performance which is driving their dominance. The European Environment Agency notes that centrifugal pumps contribute to 20% energy savings in water management systems, making them indispensable for sustainable practices. Investments in infrastructure projects, e.g. the EU’s €750 billion recovery fund, further bolster demand, strengthening centrifugal pumps’ leading position in the market.

Positive displacement pumps are the fastest-growing segment, with a CAGR of 6.5%, as per the International Fluid Power Society. The growth is propelled by their precision in handling viscous fluids and high-pressure applications, making them ideal for the chemical and pharmaceutical industries. As per the European Chemical Industry Council, the demand for positive displacement pumps in these sectors increased by 25% in 2022. Additionally, advancements in diaphragm and rotary lobe pump technologies have expanded their applicability in food processing and biotechnology. The European Federation of Pharmaceutical Industries emphasizes that 40% of pharmaceutical production lines now utilize positive displacement pumps. Furthermore, the push for customization and compact designs has fueled their adoption in niche applications, ensuring rapid market expansion. These factors underscore their potential to outpace other segments in the coming years.

By End Use Insights

The water and wastewater segment led the Europe pumps market. It accounted for 38.2% of the total share in 2024. This command over the market is due to stringent environmental regulations mandating efficient water management systems. According to the European Environment Agency, over 90% of urban wastewater is treated using advanced pump technologies, showcasing their critical role. Additionally, the EU’s Green Deal allocates €150 billion for water infrastructure projects, further boosting demand. The European Confederation of Water Services notes that energy-efficient pumps reduce operational costs by 25%, driving their adoption. With urbanization rates increasing by 2% annually, as stated by Eurostat, the need for reliable water distribution systems ensures this segment’s continued position. Therefore, these factors collectively reinforce its position as the largest end-use segment.

The infrastructure application (HDD) segment is the quickest expanding category, with a CAGR of 7.2%. This progress is influencef by rising investments in underground infrastructure, such as pipelines and utility networks. According to the European Investment Bank, over €200 billion was allocated for infrastructure development in 2022. HDD pumps are essential for trenchless construction, minimizing surface disruption and reducing costs by 30%, as highlighted by the International Society for Trenchless Technology. Additionally, urban expansion projects in major cities like Paris and Berlin have increased demand for HDD solutions. The European Commission emphasizes that sustainable infrastructure development aligns with green goals, further propelling this segment’s rapid expansion. These dynamics show its potential to emerge as a key growth driver.

REGIONAL ANALYSIS

Germany was the largest European pumps market, hold a share of 28.7% in 2024. The supremacy of this country is driven by a strong industrial base, including automotive, chemical, and manufacturing sectors, which rely heavily on advanced pumping systems. Moreover, according to the German Engineering Federation, the pump exports of Germany exceeded €10 billion in 2022, showcased their global significance. Additionally, commitment of nation towards renewable energy, with investments reaching €100 billion, has spurred demand for specialized pumps in wind and solar applications. Apart from these, the Federal Environment Agency stressed that energy-efficient pumps contribute to 20% reductions in industrial emissions and aligns with national sustainability goals. As a result, these factors are likely to strengthen the position of Germany as the largest contributor to the regional market.

Sweden is believed to be the fastest-growing market, with a CAGR of 8.5%. This growth is fueled by the focus on green technologies and smart city initiatives by the country. To add to this, the Swedish Energy Agency noted that investments in renewable energy infrastructure increased by 40% in 2022, driving demand for advanced pump solutions. Besides, the smart city projects of Stockholm emphasize water management and energy efficiency which is creating opportunities for innovative pumps. Also, as per the Swedish Environmental Protection Agency, these pumps lower water wastage by 15%, enhancing their adoption. Therefore, with sustainability at the core of national policies, Sweden’s rapid growth shows its potential to emerge as a key market leader.

Other regions, including France, Italy, and Spain, are expected to witness steady growth, supported by urbanization and industrialization. In addition, according to Eurostat, urban populations in these countries are increasing by 3% annually and that is boosting consumption for water and wastewater pumps. On top of that, renewable energy projects, such as Spain’s €20 billion solar initiative, are creating new avenues. So, these regions are likely to contribute significantly to market expansion in the coming years.

LEADING PLAYERS IN THE EUROPE PUMPS MARKET

Grundfos

Grundfos is a globally recognized leader in the pumps market, distinguished by its innovative solutions and steadfast commitment to sustainability. The company specializes in energy-efficient pumps designed for water management and industrial applications. A key strength of Grundfos lies in its robust research and development (R&D) division, which focuses on integrating IoT-enabled and smart pump technologies. Additionally, the company has pioneered digital solutions such as remote monitoring, significantly enhancing operational efficiency. Grundfos further strengthens its market position through strategic collaborations with governments and industries to meet energy-saving objectives.

Sulzer

Sulzer is renowned for delivering high-performance pumps tailored to diverse sectors, including oil and gas, mining, and water treatment. The company excels in providing customizable solutions that cater to niche applications. Its commitment to sustainability is evident in the development of eco-friendly products, such as low-emission pumps. Leveraging its global expertise and localized service networks, Sulzer effectively addresses the unique needs of European markets, ensuring reliable and efficient pump systems.

KSB SE & Co. KGaA

KSB is a prominent player in the pumps market, offering a comprehensive portfolio of centrifugal and positive displacement pumps. The company is widely acknowledged for its engineering excellence and adaptability to emerging trends, including Industry 4.0. KSB’s emphasis on quality and reliability has earned it a strong reputation in critical industries such as power generation and chemical processing. Furthermore, its proactive approach to innovation ensures alignment with evolving market demands, positioning KSB as a trusted partner for industrial clients.

TOP STRATEGIES EMPLOYED BY KEY MARKET PARTICIPANTS

Mergers and Acquisitions

Mergers and acquisitions serve as a critical growth strategy, enabling companies to expand their geographic footprint and diversify their product portfolios. For example, acquiring smaller firms specializing in smart technologies allows key players to bolster their technological capabilities and integrate advanced features such as IoT-enabled solutions. This approach not only enhances operational efficiency but also strengthens market presence.

Strategic Partnerships

Strategic partnerships with government bodies and industry stakeholders play a pivotal role in facilitating participation in large-scale infrastructure projects. These collaborations provide access to funding, resources, and expertise, enabling companies to deliver innovative solutions that align with regional development goals. Such alliances are particularly valuable in addressing complex challenges related to water management and energy conservation.

Product Innovation

Product innovation remains a cornerstone of competitive differentiation in the pumps market. Companies focus on developing energy-efficient solutions and integrating IoT technologies to meet the growing demand for sustainable and intelligent systems. By prioritizing innovation, market participants ensure compliance with stringent environmental regulations while catering to the needs of modern industries.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major key market players of the Europe pumps market include Husqvarna Group, Robert Bosch GmbH, STIGA S.p.A., Zucchetti Centro Sistemi S.p.A., AL-KO Kober SE, Deere & Company, Honda Motor Co., Ltd., WORX (Positec Tool Corporation), LG Electronics, MTD Products Inc.

The Europe pumps market is highly competitive, characterized by the presence of global leaders and regional players. Companies differentiate themselves through innovation, sustainability, and customer-centric solutions. Intense rivalry exists in segments like centrifugal and positive displacement pumps, where technological advancements dictate market share. Strategic collaborations and adherence to regulatory standards further intensify competition, fostering a dynamic and evolving landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Grundfos launched a new line of IoT-enabled pumps designed to optimize water management systems. This move aims to enhance operational efficiency and reduce energy consumption.

- In June 2023, Sulzer partnered with a German renewable energy firm to develop specialized pumps for offshore wind farms, aligning with Europe’s green energy goals.

- In January 2023, KSB introduced a range of energy-efficient pumps for wastewater treatment, targeting municipal projects across Europe.

- In September 2022, Xylem acquired a Dutch startup specializing in smart water technologies, expanding its digital capabilities.

- In March 2022, Wilo Group invested €50 million in a new R&D facility in Poland to accelerate innovation in industrial pump solutions.

MARKET SEGMENTATION

This research report on the Europe pumps market has been segmented and sub-segmented based on type, end use, and region. Top of Form

By Type

- Centrifugal Pumps

- Positive Displacement Pumps

By End Use

- Water & Wastewater

- Infrastructure Application (HDD)

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the pumps market in Europe?

Key drivers include increasing investments in infrastructure, water and wastewater treatment projects, growing demand from the oil & gas and energy sectors, and technological advancements in pump efficiency and automation.

2. Who are the major end-users of pumps in Europe?

Primary end-users include the oil & gas industry, water and wastewater treatment facilities, power generation plants, chemical manufacturers, and the construction sector.

3. Which types of pumps are most commonly used in Europe?

The most commonly used pumps include centrifugal pumps, positive displacement pumps, submersible pumps, and diaphragm pumps.

4. How is technology impacting the pumps market in Europe?

Innovations such as smart pumps, IoT integration, remote monitoring, and energy-efficient motors are improving performance and reducing operational costs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]