Europe Prothrombin Complex Concentrate (PCC) Market Size, Share, Trends & Growth Forecast Report By Distribution Channel (Compound Pharmacies, Retail Pharmacies, Hospital Pharmacies) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Prothrombin Complex Concentrate (PCC) Market Size

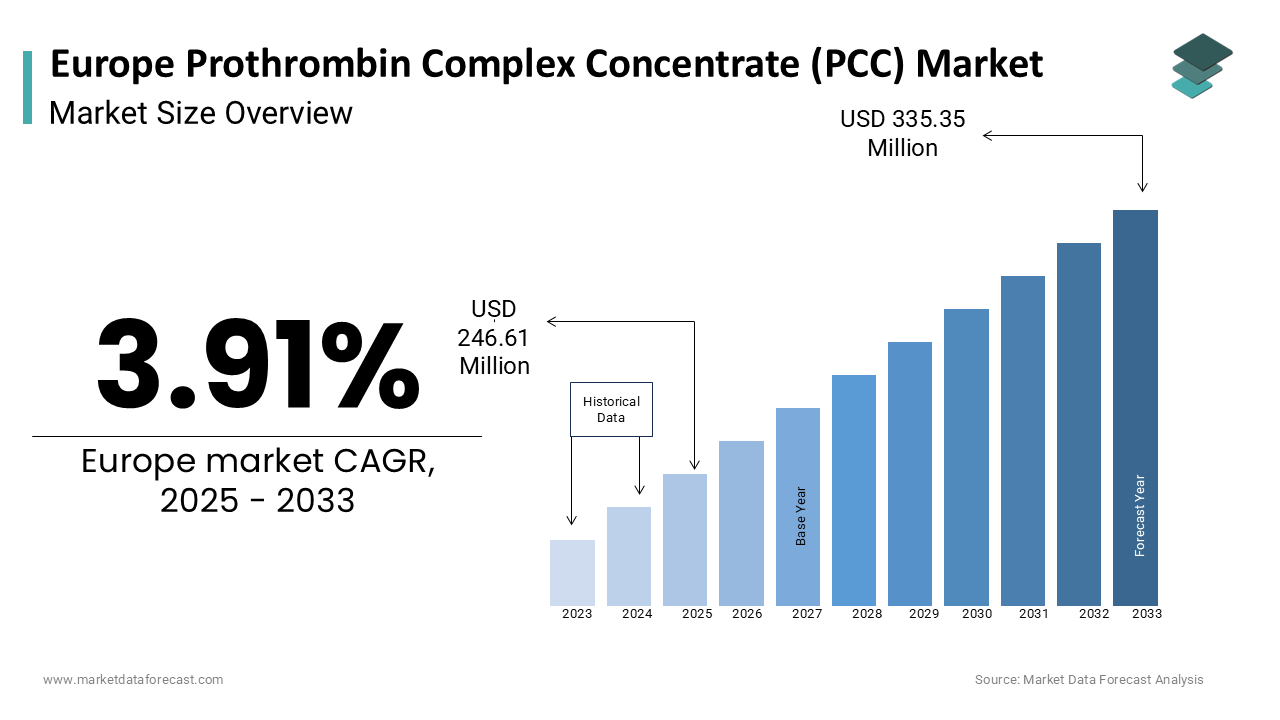

The europe prothrombin complex concentrate (PCC) market was worth USD 237.32 million in 2024. The European market is estimated to grow at a CAGR of 3.91% from 2025 to 2033 and be valued at USD 246.61 million by the end of 2033 from USD 335.15 million in 2025.

The European prothrombin complex concentrate (PCC) market reflects a dynamic and evolving landscape was driven by an aging population and increasing prevalence of bleeding disorders. As per data from the European Hematology Association, hemophilia and other coagulation disorders remain significant health concerns in Europe is necessitating advanced therapeutic options like PCCs. According to a study published in the Journal of Thrombosis and Haemostasis, the demand for PCCs has surged due to their efficacy in managing acute bleeding episodes and reversing anticoagulant effects, particularly in patients on vitamin K antagonists. The region’s robust healthcare infrastructure further supports the adoption of these concentrates, with Germany, France, and the UK leading in terms of market penetration.

As per insights shared by the World Federation of Hemophilia, Europe accounts for approximately 30% of the global PCC consumption due to its prominence in this therapeutic domain. Additionally, regulatory frameworks established by the European Medicines Agency ensure high safety and quality standards by fostering trust among healthcare providers. Despite these favorable conditions, pricing pressures and the availability of alternative therapies like recombinant factor concentrates pose challenges. Market players are addressing these hurdles through strategic partnerships and innovations by ensuring sustained growth in the region.

MARKET DRIVERS

Rising Incidence of Coagulation Disorders and Geriatric Population

The increasing prevalence of coagulation disorders, coupled with Europe's aging population, serves as a significant driver for the prothrombin complex concentrate (PCC) market. According to the European Hematology Association, approximately 1 in 10,000 individuals in Europe are diagnosed with hemophilia, while acquired coagulation disorders like vitamin K antagonist-induced bleeding are also on the rise. This growing patient pool directly amplifies the demand for PCCs, which are critical in managing acute bleeding episodes. Elderly patients often use anticoagulants such as warfarin, making them frequent candidates for PCC interventions. According to the Journal of Thrombosis Research, nearly 30% of elderly patients on anticoagulants require emergency reversal agents annually. This trend is expected to persist by driving sustained demand for PCCs with life expectancy increasing across the continent. PCCs emerge as a cornerstone therapy by underpinning their expanding role in Europe’s therapeutic landscape as healthcare providers focus on reducing mortality rates associated with bleeding complications.

Advancements in Anticoagulant Therapies and Regulatory Support

The proliferation of direct oral anticoagulants (DOACs) across Europe has inadvertently bolstered the demand for prothrombin complex concentrates. According to the British Journal of Clinical Pharmacology, DOAC usage has grown by over 50% in the past five years due to their efficacy and convenience compared to traditional anticoagulants. However, this surge necessitates effective reversal agents like PCCs for cases of severe bleeding or emergency surgeries. A study published in the European Heart Journal estimates that around 15% of DOAC users encounter situations requiring rapid anticoagulant reversal, creating a niche yet critical market for PCCs. Additionally, stringent regulatory frameworks established by the European Medicines Agency ensure the availability of high-quality PCC formulations, enhancing physician confidence in their use. These regulations mandate rigorous clinical trials and post-market surveillance, which not only assure safety but also drive innovation in product development. The market is further propelled by collaborations between pharmaceutical companies and research institutions are fostering improvements in PCC formulations.

MARKET RESTRAINTS

High Cost and Reimbursement Challenges

The high cost of prothrombin complex concentrates (PCCs) poses a significant restraint to their widespread adoption in Europe. According to the European Health Economics Association, PCC therapies can cost between €2,000 and €5,000 per treatment episode is depending on the severity of the condition and dosage requirements. This financial burden is exacerbated by inconsistent reimbursement policies across European countries, with nations like Greece and Poland offering limited coverage compared to Germany or France. According to a report by the International Society on Thrombosis and Haemostasis, nearly 20% of patients requiring PCCs face delays or abandon treatment due to cost-related barriers. Furthermore, budget constraints in public healthcare systems often lead to prioritization of alternative, less expensive therapies, such as fresh frozen plasma, despite their inferior efficacy. The fragmented nature of reimbursement frameworks also complicates market penetration for manufacturers, limiting their ability to scale operations. While some countries have introduced reforms to address these gaps, disparities persist, particularly in Eastern Europe.

Emergence of Competitive Therapies and Shifting Treatment Paradigms

The emergence of alternative therapies, such as recombinant factor concentrates and novel reversal agents, presents another major restraint for the PCC market in Europe. According to a study published in the British Journal of Haematology, recombinant factor IX and VIIa therapies are increasingly preferred in specific clinical scenarios due to their targeted mechanisms and reduced risk of pathogen transmission. These alternatives account for approximately 35% of the total hemostatic therapy market in Europe, as per the European Medicines Agency. Additionally, the introduction of idarucizumab, a reversal agent specifically designed for dabigatran, has shifted treatment paradigms, reducing reliance on PCCs for certain anticoagulant reversals. Moreover, ongoing research into gene therapies for hemophilia and other bleeding disorders threatens to disrupt traditional treatment models altogether. Such advancements, while beneficial for patients, intensify competitive pressures on PCC manufacturers.

MARKET OPPORTUNITIES

Expansion of Indications and Clinical Applications

The prothrombin complex concentrate (PCC) market in Europe is poised to benefit significantly from the expansion of its clinical applications beyond traditional uses. According to a study published in the Journal of Thrombosis and Haemostasis, PCCs are increasingly being explored for off-label uses, such as trauma-induced coagulopathy and perioperative bleeding management, which collectively account for over 20% of critical care cases in Europe annually. The European Society of Anaesthesiology estimates that trauma-related bleeding affects approximately 500,000 patients each year, creating a substantial unmet need for rapid-acting hemostatic agents like PCCs. Moreover, ongoing clinical trials are investigating the efficacy of PCCs in reversing novel oral anticoagulants in broader patient populations, with preliminary results showing a success rate of over 85% in achieving hemostasis. As per the European Journal of Emergency Medicine, the inclusion of PCCs in updated treatment guidelines for trauma and surgery could expand their usage by 15-20% over the next five years. This diversification of indications not only enhances the therapeutic value of PCCs but also opens new revenue streams for manufacturers by positioning them to capitalize on underserved segments within the healthcare system.

Strategic Collaborations and Technological Advancements

Strategic collaborations and advancements in biotechnology present another pivotal opportunity for the European PCC market. According to the European Biopharmaceutical Enterprises Association, partnerships between pharmaceutical companies and research institutions have led to the development of next-generation PCC formulations with improved stability, reduced immunogenicity, and extended shelf life. These innovations address key limitations of current products, enhancing their appeal to healthcare providers. Furthermore, as per data shared by the European Pharmaceutical Market Research Association, the adoption of advanced manufacturing technologies has reduced production costs by up to 25% by enabling manufacturers to offer competitive pricing while maintaining profitability. Additionally, geographic expansion into emerging markets within Eastern Europe, where underserved populations face significant barriers to accessing hemostatic therapies, offers untapped potential. The European Health Management Association projects that increasing healthcare expenditure in these regions could boost demand for PCCs by 30% over the next decade.

MARKET CHALLENGES

Stringent Regulatory Standards and Approval Delays

The prothrombin complex concentrate (PCC) market in Europe faces significant hurdles due to stringent regulatory standards imposed by the European Medicines Agency (EMA). According to the European Federation of Pharmaceutical Industries and Associations, securing EMA approval for new PCC formulations can take up to 18 months, with additional delays caused by post-approval surveillance requirements. These rigorous processes are essential to ensure safety but often slow down product launches, limiting market access for innovative therapies. Furthermore, as per a study published in Clinical Therapeutics, nearly 25% of PCC-related clinical trials in Europe face interruptions or terminations due to non-compliance with evolving regulatory guidelines. This creates a bottleneck for manufacturers striving to introduce advanced formulations that address unmet medical needs. Additionally, disparities in national regulatory frameworks across EU member states further complicate market entry. For instance, while Germany adopts new therapies relatively quickly, countries like Romania and Bulgaria experience prolonged delays due to bureaucratic inefficiencies. The cumulative effect of these challenges not only stifles innovation but also increases operational costs is making it harder for smaller companies to compete effectively in the European PCC market.

Limited Awareness and Training Among Healthcare Providers

Another critical challenge is the limited awareness and training among healthcare providers regarding the optimal use of PCCs. According to the European Hematology Association, approximately 40% of emergency care physicians in Europe lack comprehensive knowledge about PCC dosing protocols and indications, leading to suboptimal utilization in critical scenarios. A survey conducted by the European Society of Anaesthesiology revealed that less than 60% of hospitals in rural areas have established guidelines for PCC administration is resulting in inconsistent treatment practices. This gap in expertise is particularly concerning given the complexity of managing acute bleeding episodes and anticoagulant reversals. Moreover, as per data shared by the Journal of Critical Care Medicine, underutilization of PCCs due to insufficient training contributes to a 10-15% increase in adverse patient outcomes annually. Bridging this knowledge gap requires extensive educational campaigns and hands-on training programs, which are resource-intensive and time-consuming.

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The hospital pharmacies segment dominated the European prothrombin complex concentrate (PCC) market by accounting for 55.5% of the total share in 2024. The segment’s growth is driven by the centralized nature of critical care delivery in Europe, where hospitals serve as the primary hubs for managing life-threatening bleeding episodes and anticoagulant reversals. According to a study published in the European Journal of Hospital Pharmacy, over 70% of PCC administrations occur within hospital settings due to their availability of specialized medical staff and advanced infrastructure.

One key factor fueling this segment's dominance is the rising incidence of trauma and emergency surgeries. The European Society of Anaesthesiology estimates that trauma-related bleeding accounts for nearly 30% of emergency room cases annually, with hospitals being the sole point of intervention. Additionally, the increasing prevalence of chronic conditions requiring anticoagulant therapies, such as atrial fibrillation, further amplifies hospital pharmacy demand. According to a report by the European Heart Rhythm Association, over 12 million Europeans are on long-term anticoagulants, necessitating rapid reversal agents like PCCs during emergencies. Hospitals also benefit from bulk purchasing agreements, which reduce costs and ensure consistent supply. These factors collectively reinforce the stronghold of hospital pharmacies in the PCC distribution landscape.

The Compound pharmacies segment is likely to register a CAGR of 8.5% during the forecast period. This rapid expansion is fueled by the growing demand for personalized medicine and tailored therapeutic solutions. Unlike retail or hospital pharmacies, compound pharmacies specialize in customizing medications to meet individual patient needs, a feature particularly advantageous for patients requiring precise dosages of PCCs.

A significant driver of this growth is the increasing prevalence of rare coagulation disorders, which often demand bespoke treatment formulations. As per data shared by the European Organisation for Rare Diseases, there are over 6,000 diagnosed cases of rare bleeding disorders annually in Europe, many of which require customized PCC regimens. Furthermore, advancements in compounding technologies have improved formulation accuracy and safety which is enhancing patient trust. The Journal of Personalized Medicine reports that adoption rates of compounded therapies have risen by 40% in the past five years by reflecting heightened awareness among healthcare providers. Additionally, favorable regulatory frameworks in countries like Germany and France support innovation in compounding practices that is accelerating segment growth.

REGIONAL ANALYSIS

Germany was the largest contributor to the European prothrombin complex concentrate (PCC) market with a share of 22.3% in 2024. The country’s robust healthcare infrastructure and high prevalence of bleeding disordersares ascribed to fuel the growth of the market. As per the German Society for Hematology and Medical Oncology, Germany records over 8,000 new cases of hemophilia annually, driving demand for advanced therapies like PCCs. Additionally, Germany’s aging population, with over 21% aged above 65 as per Eurostat, further amplifies the need for anticoagulant reversal agents in managing age-related conditions. The presence of stringent regulatory frameworks ensures that German patients have access to high-quality PCC formulations, fostering trust among healthcare providers. Furthermore, government initiatives such as the National Health Insurance Act ensure widespread reimbursement for critical therapies, reducing financial barriers for patients. These factors collectively reinforce Germany’s dominance in the European PCC market.

The France PCC market is expected to hold a significant CAGR of 15.4% during the forecast period. According to the French Society of Hematology, France accounts for nearly 7,000 hemophilia patients, with a growing reliance on PCCs for acute bleeding episodes. Moreover, France’s universal healthcare system ensures equitable access to advanced therapies, with over 95% of the population covered under public insurance schemes. A study published in the European Journal of Internal Medicine notes that France has witnessed a 25% increase in PCC usage over the past five years, driven by rising awareness of their efficacy in trauma and surgery. Additionally, the French government’s investment in rare disease research has spurred advancements in personalized treatments, further boosting PCC adoption.

The United Kingdom is likely to have the significant growth opportunities in the next coming years. The UK’s market status is bolstered by its leading role in clinical trials and medical innovation. According to the National Institute for Health and Care Excellence (NICE), the UK conducts over 30% of Europe’s hematology-related clinical trials, many of which focus on optimizing PCC use in diverse patient populations. Furthermore, the UK’s aging demographic, with 18% of the population aged 65 or older as per the Office for National Statistics, drives demand for anticoagulant reversal therapies. The NHS plays a pivotal role in ensuring affordability and accessibility, with policies mandating coverage for life-saving treatments. According to a report by the British Journal of Haematology, PCC utilization in trauma care has risen by 30% since 2018, underscoring their growing importance.

The Italian PCC market is likely to gain traction over the growth rate in coming years. Italy’s market growth is fueled by its high burden of coagulation disorders and increasing geriatric population. Data from the Italian Society of Hematology reveals that Italy reports over 6,000 hemophilia cases, necessitating effective hemostatic interventions. Furthermore, Italy’s elderly population, which constitutes 23% of the total population as per ISTAT, significantly drives demand for PCCs in managing age-related complications. The Italian government’s focus on enhancing healthcare accessibility has also played a crucial role, with regional health authorities ensuring widespread availability of PCCs.

Spain is to grow steadily throughout the forecast period. Spain’s market status is shaped by its expanding elderly population and rising incidence of chronic diseases. According to the Spanish National Institute of Statistics, over 19% of Spaniards are aged 65 or older, creating a heightened demand for therapies addressing bleeding complications. Additionally, Spain’s proactive approach to integrating advanced hemostatic agents into national treatment protocols has accelerated PCC adoption. According to a report by the European Journal of Emergency Medicine, PCC utilization in trauma care has increased by 28% in Spain over the past four years. Furthermore, collaborative efforts between pharmaceutical companies and Spanish research institutions have led to improved formulations, enhancing their appeal to clinicians.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The European PCC market is characterized by intense competition among key players striving to address the growing demand for effective bleeding disorder treatments and anticoagulation reversal therapies. Prominent companies, such as CSL Behring, Grifols, and Octapharma, dominate the market with their robust product portfolios and strong distribution networks. The competitive landscape is shaped by factors such as stringent regulatory requirements, technological advancements, and increasing patient awareness. Companies focus on innovation, geographic expansion, and strategic collaborations to maintain their position in the marketplace. The market also witnesses competition from biosimilars and generic manufacturers, which intensifies pricing pressures. Additionally, partnerships with healthcare providers and participation in medical conferences further boost brand visibility and credibility. The competitive dynamics are expected to evolve as emerging players enter the market is driving innovation and expanding treatment accessibility across Europe.

Top Players in the Europe Prothrombin Complex Concentrate (PCC) Market

Key players in the Europe Prothrombin Complex Concentrate (PCC) market include CSL Behring, Grifols, Octapharma, Kedrion, Takeda, Sanquin, Novo Nordisk, Baxter International, China Biologic Products, and Biotest AG.

CSL Behring is a leading player in the European prothrombin complex concentrate (PCC) market, renowned for its innovative therapeutic solutions. The company’s flagship PCC product, Beriplex®, is widely used across Europe for rapid reversal of anticoagulant effects and management of bleeding disorders. CSL Behring’s strong distribution network and partnerships with healthcare providers ensure widespread accessibility. According to the European Medicines Agency, Beriplex® accounts for a significant portion of PCC prescriptions in emergency care settings. The company’s commitment to research and development has led to advancements in formulation stability and efficacy.

Grifols holds a prominent position in the European PCC market, driven by its expertise in plasma-derived therapies. Its key product, Octaplex®, is widely regarded for its safety and reliability in treating acute bleeding episodes. Grifols leverages its vertically integrated business model, controlling the entire production process from plasma collection to manufacturing, ensuring consistent quality. The company’s focus on sustainability and innovation has enabled it to meet growing demand while maintaining compliance with stringent regulatory standards.

Kedrion Biopharma is a key contributor to the European PCC market, offering high-quality plasma-derived products like Kedrion PCC. The company’s growth is fueled by its strategic focus on expanding access to life-saving therapies in underserved regions. According to the International Society on Thrombosis and Haemostasis, Kedrion has increased its production capacity by 30% over the past five years, addressing rising demand. Kedrion’s emphasis on affordability and patient-centric solutions has strengthened its reputation among healthcare providers. The company actively participates in global initiatives to combat rare bleeding disorders, enhancing its visibility in international markets.

RECENT MARKET DEVELOPMENTS

- In March 2023, CSL Behring launched a next-generation PCC formulation in Europe, offering faster-acting properties to enhance patient outcomes and strengthen its prominent position.

- In June 2022, Grifols announced a strategic partnership with a European research institution to advance clinical trials for a novel PCC variant, aiming to address unmet medical needs.

- In September 2021, Octapharma expanded its manufacturing facility in Austria to increase production capacity, ensuring consistent supply and meeting rising demand in the European market.

- In November 2020, Biotest AG acquired a smaller biotech firm specializing in plasma-derived therapies, enhancing its PCC portfolio and R&D capabilities.

- In January 2019, Sanofi partnered with a regional distributor in Eastern Europe to expand its geographic reach, targeting underserved markets and boosting sales revenue.

MARKET SEGMENTATION

This research report on the prothrombin complex concentrate (PCC) market is segmented and sub-segmented based on categories.

By Distribution Channel

- Compound Pharmacies

- Retail Pharmacies

- Hospital Pharmacies

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the PCC market in Europe?

The market is driven by rising cases of bleeding disorders, increased use of anticoagulants, and a growing elderly population. Additionally, advancements in emergency and surgical care are boosting demand.

What challenges does the PCC market face?

Challenges include high treatment costs, limited awareness in some regions, and stringent regulatory approvals. Supply chain disruptions can also affect product availability.

Who are the major players in the Europe PCC market?

Key players include CSL Behring, Grifols, Octapharma, Kedrion, Takeda, Sanquin, Baxter, Biotest, Novo Nordisk, and China Biologic Products. These companies offer a variety of PCC formulations and related therapies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]