Europe Pressure Transmitter Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By By Type, Application, Fluid Type And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Pressure Transmitter Market Size

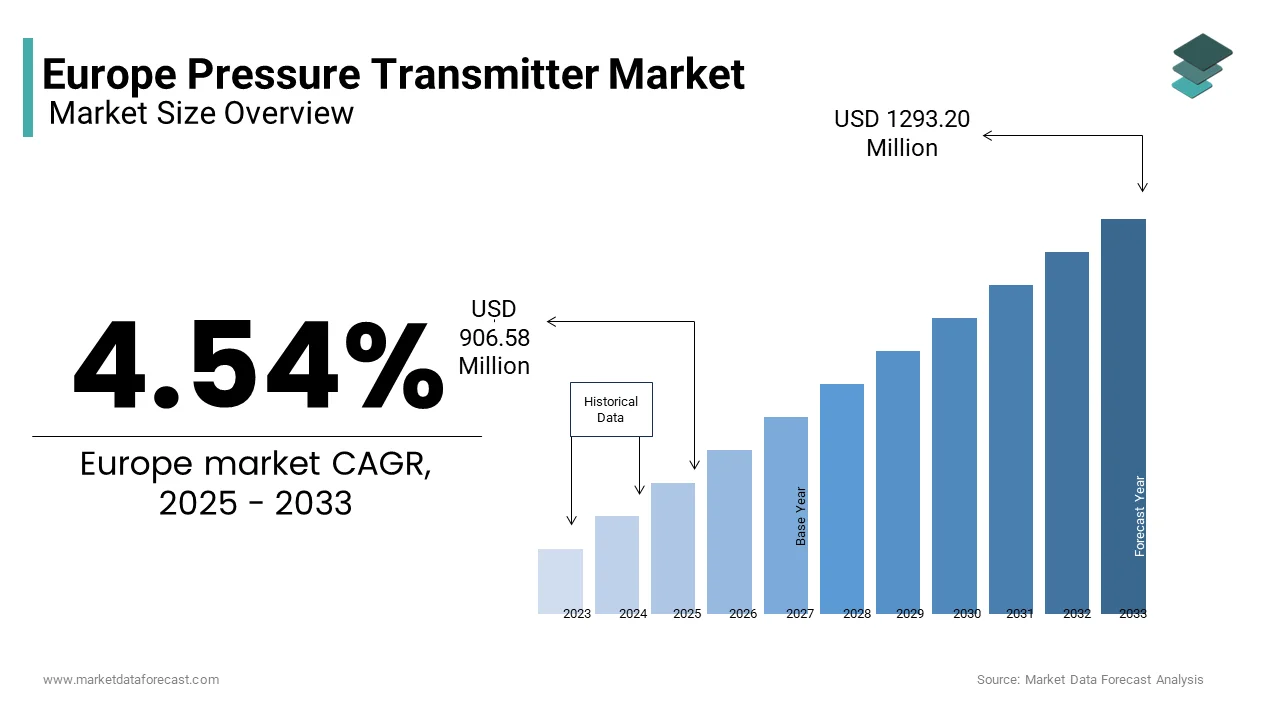

The Europe pressure transmitter market size was valued at USD 867.21 million in 2024 and is anticipated to reach USD 906.58 million in 2025 from USD 1293.20 million by 2033, growing at a CAGR of 4.54% during the forecast period from 2025 to 2033.

The Europe pressure transmitter market is witnessing steady growth with the industrial automation and the increasing adoption of smart technologies across key sectors. One notable trend shaping the market is the integration of IoT-enabled pressure transmitters, which are gaining traction due to their ability to provide real-time monitoring and predictive maintenance solutions. A senior analyst from a European industrial technology consultancy stated that nearly 30% of new installations in 2023 were IoT-compatible devices is signaling a shift toward digitalization. Furthermore, stringent environmental regulations have propelled the use of these devices in emission control systems, particularly in the chemical and energy sectors.

MARKET DRIVERS

Industrial Automation: A Catalyst for Growth

The Europe pressure transmitter market is significantly propelled by the rapid adoption of industrial automation across key sectors. The region’s manufacturing hubs in Germany, have embraced smart technologies to enhance productivity and precision. This surge in automation has created a heightened demand for advanced pressure transmitters, which are critical for applications such as hydraulic systems, pneumatic controls, and robotic assembly lines. According to a study conducted by a leading European technology research group, over 60% of manufacturers in Western Europe are integrating IoT-enabled pressure transmitters into their operations. The need for high-precision pressure transmitters is expected to grow consistently with the European Union setting ambitious targets to automate 75% of its manufacturing sector by 2030.

Stringent Environmental Regulations Driving Demand

Another major driver of the Europe pressure transmitter market is the enforcement of strict environmental regulations aimed at emissions control and energy efficiency. The European Union’s Industrial Emissions Directive (IED) mandates industries to monitor process parameters in real time, creating a significant demand for reliable pressure transmitters. As per data published by the European Environment Agency, industries are increasingly prioritizing compliance with these regulations is leading to widespread adoption of advanced instrumentation systems.

For instance, a survey by a prominent energy consultancy revealed that 40% of European refineries upgraded their monitoring systems in 2022 to align with regulatory standards. Additionally, the growing emphasis on renewable energy projects, such as wind farms and hydrogen production, has further amplified the need for accurate pressure measurement solutions. An energy market expert noted that the European renewable energy sector expanded by 18% in 2022 that will present new opportunities for pressure transmitter manufacturers.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

One of the significant restraints impacting the Europe pressure transmitter market is the high initial cost associated with advanced devices those integrated with IoT and smart technologies. These sophisticated systems often require substantial upfront investment, which can deter small and medium-sized enterprises (SMEs) from adopting them. Moreover, the total cost of ownership extends beyond the purchase price, encompassing installation, calibration, and maintenance expenses. The average cost of implementing IoT-enabled pressure transmitters can be 25-30% higher than traditional models by making it less feasible for industries operating on tight budgets. For instance, in Eastern Europe, where industrial modernization is still in its nascent stages, only 20% of companies have fully transitioned to advanced pressure monitoring solutions, as per a regional economic study. This financial burden limits the widespread adoption of cutting-edge pressure transmitters, thereby constraining market growth in certain segments.

Supply Chain Disruptions and Component Shortages

Another critical restraint affecting the Europe pressure transmitter market is the ongoing issue of supply chain disruptions and semiconductor shortages. The global semiconductor crisis, which intensified during the pandemic, has had a ripple effect on the production of electronic components essential for manufacturing advanced pressure transmitters. According to a logistics expert at a European trade association, the shortage of semiconductors led to a 15% decline in the production capacity of instrumentation manufacturers in 2022.

Additionally, geopolitical tensions and trade restrictions have further exacerbated the availability of critical raw materials like rare earth metals, which are vital for sensor development. A study conducted by a renowned supply chain consultancy revealed that over 60% of European manufacturers faced delays exceeding three months in sourcing key components. These disruptions not only increase production costs but also extend lead times, creating challenges for meeting rising demand. As a result, many companies are forced to rely on older inventory or delay new installations, thereby slowing down market expansion.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Projects

The Europe pressure transmitter market is poised to benefit significantly from the rapid expansion of renewable energy projects in wind, solar, and hydrogen production. According to a senior analyst at a leading European energy research institute, renewable energy capacity in Europe grew by 21% in 2022, with solar and wind accounting for over 70% of new installations. These projects require precise pressure monitoring systems to ensure efficient operation and safety is creating a robust demand for advanced pressure transmitters.

For instance, hydrogen production, which is gaining momentum as part of the EU’s Green Deal, relies heavily on accurate pressure measurement to manage electrolysis processes and storage systems. Additionally, offshore wind farms, which are expected to contribute 20% of Europe’s electricity by 2030 that requires ruggedized pressure transmitters capable of withstanding harsh marine environments.

Digital Transformation and Smart Factory Initiatives

Another major opportunity lies in Europe’s accelerating digital transformation and the adoption of smart factory initiatives. The European manufacturing sector is undergoing a paradigm shift, with industries increasingly integrating IoT, AI, and machine learning into their operations. According to a study by a prominent industrial technology group, over 50% of European manufacturers plan to implement smart factory solutions by 2025, up from just 30% in 2020. Pressure transmitters play a pivotal role in these systems by enabling real-time data collection and process optimization.

A logistics and automation expert stated that IoT-enabled pressure transmitters can improve operational efficiency by up to 40%, making them indispensable for industries aiming to achieve Industry 4.0 standards. Furthermore, the European Commission estimates that investments in smart manufacturing technologies will reach €250 billion by 2025 with the immense potential for growth in this space.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The Europe pressure transmitter market faces significant challenges due to intense competition among manufacturers, leading to price wars that impact profitability. According to a senior analyst at a European industrial consultancy, the market is highly fragmented, with over 50 major players vying for market share, including global giants like Siemens and ABB, as well as regional manufacturers. This competitive landscape has resulted in downward pressure on pricing with average selling prices for standard pressure transmitters have declined by approximately 10-15% over the past three years.

Smaller manufacturers in Eastern Europe, are disproportionately affected, as they often lack the economies of scale to compete effectively. According to a study conducted by a trade association, nearly 25% of small-scale manufacturers reported shrinking profit margins in 2022 due to aggressive pricing strategies by larger competitors. Additionally, the influx of low-cost imports from Asia has further intensified competition, with a logistics expert stating that Asian imports now account for 20% of the European market. This price-driven competition not only hampers innovation but also creates sustainability challenges for smaller players striving to maintain quality standards.

Complexity of Customization and Integration

Another pressing challenge for the Europe pressure transmitter market is the growing demand for customized solutions tailored to specific industrial applications. The need for specialized pressure transmitters increases as industries adopt more complex systems, such as smart factories and renewable energy projects. However, customization poses significant hurdles for manufacturers. According to a senior consultant at an industrial technology firm is developing bespoke solutions can extend production timelines by up to 40%, while increasing costs by 25-30%.

Moreover, integrating these devices into existing systems often requires extensive compatibility testing and software adjustments, which can delay project implementation. Many European manufacturers reported difficulties in aligning their products with client-specific requirements in 2022. This complexity is further compounded by the lack of standardized protocols across industries is making it challenging for manufacturers to design universally compatible solutions. As a result, companies face increased operational risks and resource allocation challenges is potentially slowing down market growth in highly specialized segments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.16% |

|

Segments Covered |

By Type, Application, Fluid Type and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), ABB (Switzerland), Endress+Hauser Group Services AG (Switzerland), Honeywell International Inc. (US), Siemens (Germany), Schneider Electric (France), Fuji Electric Co., Ltd. (Japan), Azbil Corporation (Japan), Ashcroft, Inc. (US), Danfoss (Denmark), KROHNE (Germany), Huba Control (Switzerland), WIKA Alexander Wiegand SE & Co. KG (Germany), Dwyer Instruments, LLC (US). |

SEGMENT ANALYSIS

By Types Insights

The ifferential pressure transmitters segment led the Europe pressure transmitter market by accounting for 40.3% of the total share in 2024. This segment’s dominance is driven by its widespread application across key industries such as oil and gas, chemical processing, and water treatment. A senior analyst from the European Process Instrumentation Forum stated that differential pressure transmitters are indispensable for measuring flow rates, liquid levels, and filter performance is making them critical to process optimization. Additionally, the growing emphasis on wastewater management has further boosted adoption with municipal water treatment plants in Western Europe utilize these devices. Furthermore, advancements in sensor technology have enhanced accuracy and reliability is enabling their integration into complex industrial processes.

The multivariable pressure transmitter segment is projected to grow at the highest CAGR of 7.8% from 2025 to 2033. This rapid growth is attributed to the rising adoption of advanced instrumentation in industries undergoing digital transformation. A senior consultant at an industrial automation consultancy explained that multivariable transmitters combine multiple measurements such as pressure, temperature, and flow—into a single device is offering unmatched efficiency and reducing the need for additional equipment.

A key driver of this growth is the increasing focus on smart manufacturing. As per a report by a European technology think tank, over 50% of manufacturers adopting Industry 4.0 principles prefer multivariable solutions due to their ability to integrate seamlessly with IoT platforms. Additionally, the renewable energy sector is emerging as a significant contributor, with an energy market expert noting that wind farms and hydrogen production facilities require compact, multifunctional devices for precise process control. Furthermore, cost savings achieved through reduced installation and maintenance expenses have spurred adoption, particularly in the pharmaceutical and food processing industries.

By Application Insights

The diaphragm pressure transmitters segment was accounted in holding 45.3% of the Europe pressure transmitter market share in 2024. This dominance is primarily driven by their versatility and reliability in a wide range of industrial applications. The diaphragm-based designs are preferred for their robustness and ability to handle corrosive and viscous fluids is making them indispensable in chemical and oil and gas industries. Additionally, advancements in material science have enhanced the durability of diaphragms, with a report that new alloys and coatings have extended their operational lifespan by up to 25%. Furthermore, the growing focus on emissions control has increased demand, as these devices are critical for monitoring processes in refineries and power plants. The European Environment Agency estimates that regulatory compliance will drive a 15% increase in diaphragm transmitter adoption by 2030 by reinforcing their position as the largest segment.

The wireless pressure transmitters segment is anticipated to register a CAGR of 9.2% from 2025 to 2033. This rapid growth is fueled by the increasing adoption of wireless technologies in industrial automation and remote monitoring applications. A senior consultant at a European IoT solutions provider explained that wireless transmitters eliminate the need for extensive wiring by reducing installation costs by up to 30% and enabling real-time data access in hard-to-reach locations. A major driver of this growth is the expansion of smart factories and predictive maintenance systems. As per a study by a technology think tank, over 40% of European manufacturers adopting Industry 4.0 principles prefer wireless solutions due to their seamless integration with cloud platforms. Additionally, the rise of renewable energy projects has further accelerated adoption, with an energy market expert noting that offshore wind farms and remote solar installations rely heavily on wireless transmitters for efficient operation. Top of Form

By Fluid Type Insights

The liquid pressure transmitters segment was accounted in holding a dominant share of the Europe pressure transmitter market in 2024. This segment’s prominence is driven by its widespread application across industries such as water treatment, chemical processing, and food and beverage production. A senior analyst at the European Water Partnership stated that over 70% of municipal water utilities rely on liquid pressure transmitters for monitoring water distribution networks and ensuring consistent flow rates. A key factor behind this dominance is the increasing focus on efficient water management. Europe faces significant water stress, with nearly 20% of its population living in regions with water scarcity. This has led to heightened investments in advanced instrumentation for leak detection and wastewater treatment, where liquid pressure transmitters play a critical role.

The steam pressure transmitters segment is likely to exhibit a CAGR of 8.5% during the forecast period. This rapid growth is fueled by the increasing adoption of steam-based systems in industries such as power generation, pharmaceuticals, and food processing. A senior energy analyst explained that steam remains a critical medium for heat transfer and sterilization processes that is driving demand for accurate pressure monitoring solutions.Additionally, regulatory mandates for emissions control have intensified the need for precise steam pressure measurement in refineries and power plants. A report by an environmental consultancy noted that steam-based systems account for 30% of industrial energy consumption by making them a focal point for modernization efforts. Furthermore, advancements in sensor technology have enhanced the durability and accuracy of steam pressure transmitters by enabling their deployment in high-temperature environments.

COUNTRY ANALYSIS

Germany led the Europe pressure transmitter market with a dominant share of 28.9% in 2024. The country’s dominance is due to its robust manufacturing sector, which accounts for nearly 25% of Europe’s total industrial output. A key factor behind Germany’s dominance is its commitment to Industry 4.0 initiatives. German manufacturers have integrated IoT-enabled devices into their operations that is creating a surge in demand for smart pressure transmitters.

France is estimated to witness a fastest CAGR of 7.6% during the forecast period. The country’s strong emphasis on energy transition and nuclear power has positioned it as a key player in the regional market. France generates over 70% of its electricity from nuclear sources is requiring precise pressure monitoring systems for safety and efficiency, as per an energy market expert.

Another driving factor is the rapid expansion of renewable energy projects. According to a report by the French Renewable Energy Association, wind and solar capacity grew by 22% in 2022 by necessitating advanced pressure transmitters for system integration. Additionally, France’s pharmaceutical and food processing industries, which account for 12% of its industrial revenue, rely on hygienic pressure transmitters for quality control. A study by a European trade association revealed that 45% of French manufacturers adopted predictive maintenance solutions in 2023. These initiatives in France will drive the growth of the market to the next level.

The UK pressure transmitter market growth is augmented to have steady pace throughput the forecast period. The country’s focus on smart manufacturing and infrastructure modernization has created significant opportunities for pressure transmitter manufacturers. The water and wastewater sector is another major contributor to this growth. As per an environmental expert, the UK plans to invest £50 billion in water infrastructure by 2030 that is requiring reliable pressure transmitters for leak detection and flow management. Ad

Italy pressure transmitter market is growing at higher pace from past few years and is to continue the same growth in the foreseen years. The country’s prominence growth is driven by its strong presence in process industries, including chemicals, textiles, and food processing. Renewable energy adoption is another critical growth driver. According to a report by the Italian Renewable Energy Agency, solar and wind installations increased by 25% in 2022. Additionally, Italy’s food and beverage industry, which contributes 8% to its GDP, relies on hygienic transmitters for compliance with EU regulations.

Spain’s rapid adoption of renewable energy and smart city initiatives has positioned it as a key growth for the Europe pressure transmitter market. Smart city projects are also driving demand for pressure transmitters. As per a report by the Spanish Smart Cities Network, over 50 cities are implementing IoT-based infrastructure is requiring advanced monitoring systems for utilities like water and gas. A study by a European consultancy revealed that 35% of Spanish manufacturers adopted IoT-enabled transmitters in 2023.

KEY MARKET PLAYERS

Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), ABB (Switzerland), Endress+Hauser Group Services AG (Switzerland), Honeywell International Inc. (US), Siemens (Germany), Schneider Electric (France), Fuji Electric Co., Ltd. (Japan), Azbil Corporation (Japan), Ashcroft, Inc. (US), Danfoss (Denmark), KROHNE (Germany), Huba Control (Switzerland), WIKA Alexander Wiegand SE & Co. KG (Germany), Dwyer Instruments, LLC (US). are the market players that are dominating the Europe pressure transmitter market.

Top 3 Key Players In This Market

Endress+Hauser

Endress+Hauser is a global leader in process instrumentation, renowned for its innovative pressure transmitter solutions tailored to diverse industrial applications. The company’s strong presence in Europe is driven by its focus on precision engineering and digitalization. Endress+Hauser has pioneered IoT-integrated pressure transmitters, enabling real-time monitoring and predictive maintenance. Their products are widely adopted in chemical, oil and gas, and water treatment industries.

Emerson Electric Co.

Emerson Electric Co. is a key player in the Europe pressure transmitter market, offering cutting-edge solutions like the Rosemount series, known for their reliability and accuracy. Emerson’s expertise lies in providing customized transmitters for challenging environments, such as offshore rigs and refineries. The company emphasizes sustainability, aligning its innovations with Europe’s Green Deal objectives. Emerson’s advanced diagnostics capabilities have set benchmarks in operational efficiency in power generation and renewable energy sectors. On a global scale, Emerson drives industrial automation through its integrated systems, supporting industries in achieving energy efficiency and process optimization.

Siemens AG

Siemens AG stands out as a major contributor to the Europe pressure transmitter market, leveraging its extensive experience in industrial automation and digitalization. Siemens’ SITRANS series is highly regarded for its versatility and seamless integration with smart factory ecosystems. The company plays a pivotal role in Europe’s transition to Industry 4.0, offering IoT-enabled transmitters that enhance productivity and reduce downtime. Siemens also supports renewable energy projects, including hydrogen production and wind farms, with specialized pressure monitoring solutions. Globally, Siemens’ commitment to innovation and sustainability reinforces its prominence in the industrial instrumentation sector.

Overview Of Competition In The Europe Pressure Transmitter Market

The Europe pressure transmitter market is highly competitive, driven by demand across industries such as oil and gas, pharmaceuticals, food and beverage, and water treatment. Key players focus on innovation, strategic partnerships, and geographic expansion to maintain their foothold. The market is characterized by technological advancements like wireless connectivity, IoT integration, and miniaturization, which enhance product capabilities. Companies are also investing heavily in R&D to develop high-accuracy, cost-effective solutions tailored to industry-specific needs. Mergers, acquisitions, and collaborations are common strategies to consolidate market share. Additionally, regulatory compliance with environmental and safety standards plays a critical role in shaping competition. Prominent companies are leveraging digital marketing and customer-centric approaches to strengthen brand loyalty. With rising industrial automation trends and smart factory initiatives, the pressure transmitter market is poised for significant growth. However, intense rivalry among key players, coupled with price sensitivity in certain segments are creating challenges that require innovative strategies to sustain dominance.

RECENT HAPPENINGS IN THIS MARKET

- In January 2023, ABB launched its next-generation wireless pressure transmitters in Europe. These devices incorporated advanced IoT capabilities, enabling real-time monitoring and predictive maintenance for industrial applications.

- In June 2023, Siemens AG acquired a German startup specializing in smart sensor technology. This move aimed to integrate cutting-edge AI-driven analytics into their pressure transmitter portfolio, enhancing operational efficiency for customers.

- In September 2023, Emerson Electric partnered with a leading European water utility company to deploy customized pressure transmitter solutions for wastewater management systems, expanding their footprint in the municipal sector.

- In November 2023, Honeywell International introduced a compact, low-power pressure transmitter series designed for small-scale industrial applications, targeting SMEs in Eastern Europe.

- In February 2024, Endress+Hauser opened a new manufacturing facility in Poland dedicated to producing high-precision pressure transmitters. This initiative strengthened their supply chain resilience and reduced lead times for European clients.

MARKET SEGMENTATION

This research report on the Europe pressure transmitter market is segmented and sub-segmented into the following categories.

By Type

- Absolute Pressure Transmitters

- Gauge Pressure Transmitters

- Differential Pressure Transmitters

- Multivariable Pressure Transmitters

By Application

- Diaphragm Pressure

- Wireless Pressure

By Fluid Type

- Liquid Pressure

- Steam Pressure

- Gas Pressure

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the pressure transmitters market in Europe?

This FAQ addresses the market drivers such as industrial automation, environmental regulations, energy efficiency requirements, and demand in sectors like oil & gas, pharmaceuticals, and food & beverage.

Which end-user industries hold the largest market share for pressure transmitters in Europe, and why?

This explores sector-specific demand, such as how the chemical industry requires precise pressure control or how pharmaceuticals depend on sanitary pressure transmitters for compliance.

How are advancements in digital and smart pressure transmitter technologies impacting the European market?

This question dives into the adoption of IoT-enabled sensors, wireless transmitters, and integration with Industry 4.0 platforms, which are shaping future demand.

Who are the major players in the European pressure transmitter market, and what are their competitive strategies?

This provides insight into key manufacturers (e.g., Siemens, ABB, Endress+Hauser, WIKA), their innovation, pricing strategies, and regional distribution strengths.

What are the key regulatory and environmental considerations influencing pressure transmitter adoption in Europe?

This includes discussion of EU regulations (like RoHS, ATEX, PED), emission control mandates, and how sustainability goals affect product design and deployment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]