Europe Premium Chocolate Market Size, Share, Trends & Growth Forecast Report By Product Type (Dark Premium Chocolate, White/ Milk Premium Chocolates), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Premium Chocolate Market Size

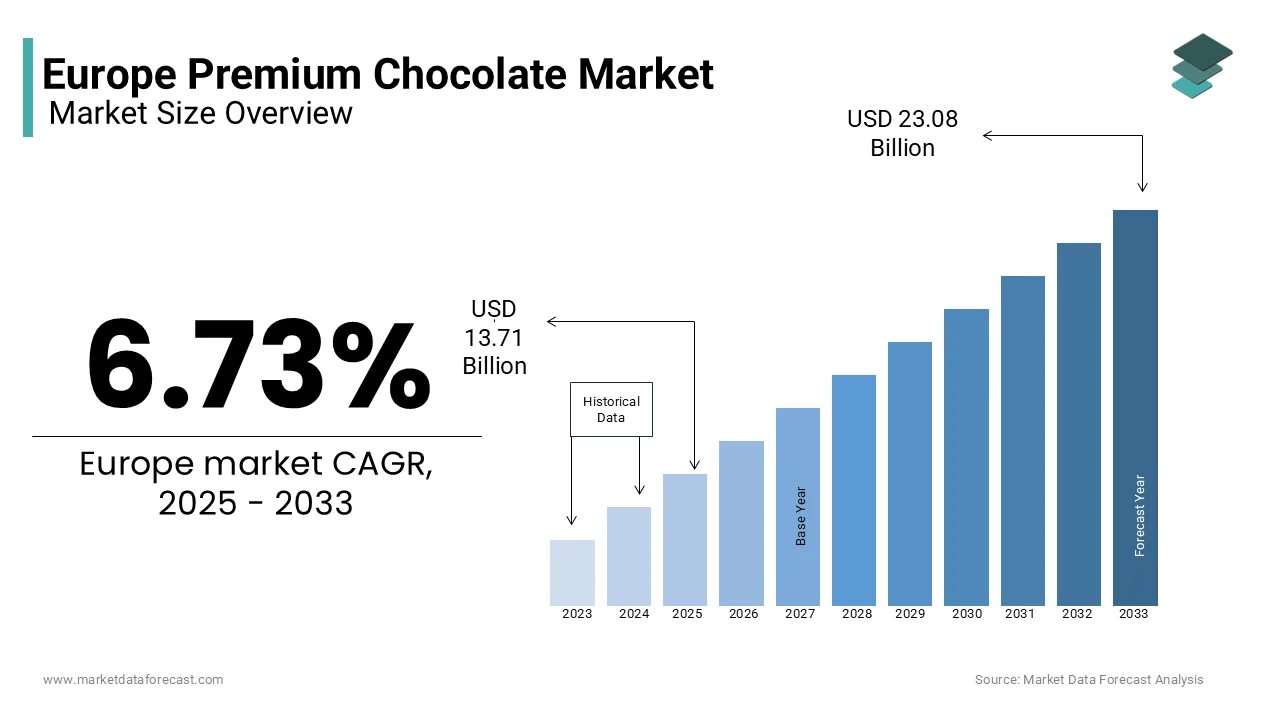

The premium chocolate market size in Europe was valued at USD 12.85 billion in 2024. The European market is estimated to be worth USD 23.08 billion by 2033 from USD 13.71 billion in 2025, growing at a CAGR of 6.73% from 2025 to 2033.

The European premium chocolate market is a niche yet rapidly evolving segment within the European broader confectionery industry and is popular for its high-quality ingredients, artisanal craftsmanship, and unique flavor profiles. Premium chocolate is typically defined as chocolate that contains a higher cocoa content, often exceeding 50%, and is produced using ethically sourced cocoa beans. Factors such as the shifting consumer preferences toward indulgence and health-conscious choices, historical affinity of Europe for chocolate, rising disposable incomes and urbanization and the growing awareness of sustainable and fair-trade practices are contributing to the demand for premium chocolate in the European region.

According to the International Cocoa Organization, over 30% of European consumers actively seek products with certifications such as Fairtrade or Rainforest Alliance, reflecting a heightened focus on ethical consumption. Furthermore, the rise of experiential retail and gourmet chocolate boutiques has contributed to the market's expansion. For instance, Germany, a leading producer and consumer of chocolate in Europe, accounts for nearly 18% of the region's premium chocolate sales. This trend underscores the importance of innovation and branding in capturing consumer loyalty.

MARKET DRIVERS

Growing Demand for Health-Conscious Indulgence

There has been a notable shift in consumer behavior across Europe, with individuals increasingly prioritizing health without compromising on indulgence. This trend has propelled the demand for premium dark chocolate, which is perceived as a healthier alternative due to its high cocoa content and lower sugar levels. Dark chocolate with cocoa content exceeding 70% is particularly sought after, with Statista reporting that sales of such products grew by 12% in 2022 alone. The health benefits associated with dark chocolate, including its rich antioxidant properties and potential cardiovascular advantages, have resonated strongly with European consumers. Notably, countries like Switzerland and France have witnessed a surge in premium dark chocolate consumption, with per capita spending reaching €25 annually. This driver underscores the importance of aligning product offerings with health-conscious trends, as manufacturers capitalize on the growing preference for functional foods.

Rising Influence of Ethical Consumerism

Ethical considerations are becoming a pivotal factor influencing purchasing decisions in the premium chocolate market in Europe. Consumers are increasingly favoring brands that emphasize sustainability, transparency, and fair-trade practices. A survey conducted by the International Trade Centre revealed that over 40% of European consumers are willing to pay a premium for chocolates certified as sustainably sourced. This trend is particularly pronounced in countries like the UK and Germany, where ethical certifications such as Fairtrade and UTZ have gained significant traction. For instance, the Fairtrade Foundation reported a 15% increase in sales of certified premium chocolates in 2022. This driver highlights the critical role of corporate responsibility in shaping brand loyalty and market growth, as companies strive to meet the ethical expectations of discerning consumers

MARKET RESTRAINTS

Economic Uncertainty and Price Sensitivity

Economic volatility and inflationary pressures have emerged as significant restraints for the European premium chocolate market. Rising costs of raw materials, particularly cocoa and sugar have led to increased production expenses that are often passed on to consumers. Inflation rates across the EU averaged 8.4% in 2022, prompting price hikes in premium chocolate products. NielsenIQ data indicates that the average price of premium chocolate bars rose by 10% during the same period, deterring price-sensitive consumers. This restraint is particularly evident in Southern European markets like Spain and Italy, where disposable incomes remain constrained. The economic uncertainty has also led to a decline in impulse purchases, with consumers opting for more affordable alternatives. This trend underscores the challenge of maintaining affordability while preserving the exclusivity and quality that define premium chocolate offerings.

Stringent Regulatory Frameworks

Stringent food safety regulations pose another significant restraint for the premium chocolate market in Europe. Compliance with labeling requirements, allergen declarations, and nutritional standards has become increasingly complex, particularly for smaller artisanal producers. According to a report by the European Food Safety Authority, non-compliance with these regulations can result in hefty fines and reputational damage. Additionally, the ban on certain additives and preservatives has forced manufacturers to reformulate their products, often at a higher cost. For instance, the introduction of the Nutri-Score labeling system in France and Belgium has impacted consumer perceptions of premium chocolates, particularly those with high sugar content. This restraint emphasizes the need for manufacturers to navigate regulatory challenges effectively while maintaining product integrity and consumer trust.

MARKET OPPORTUNITIES

Expansion of Online Retail Channels

The proliferation of online retail platforms presents a lucrative opportunity for the European premium chocolate market. E-commerce sales in Europe grew by 13% in 2022, with gourmet and artisanal products witnessing a significant uptick in demand. Amazon and local platforms like Zalando have become key distribution channels, enabling brands to reach a wider audience. A study by McKinsey & Company revealed that 65% of European consumers prefer purchasing premium chocolates online due to convenience and access to exclusive offerings. This trend is particularly prominent in urban areas, where digital adoption is highest. For instance, the UK reported a 20% increase in online sales of premium chocolates during the holiday season. This opportunity highlights the potential for brands to leverage digital marketing strategies and personalized customer experiences to drive growth in the online segment.

Innovation in Flavor Profiles and Packaging

Innovation in flavor profiles and packaging design offers a promising avenue for the expansion of the European premium chocolate market. Consumers are increasingly drawn to unique and exotic flavors, such as matcha-infused chocolate or chili-spiced variants, which cater to adventurous palates. Mintel reports that flavored premium chocolates accounted for 25% of new product launches in 2022. Additionally, sustainable and aesthetically appealing packaging has become a key differentiator, with 70% of consumers expressing a preference for eco-friendly materials. Countries like Sweden and Denmark have embraced this trend, with brands incorporating biodegradable wrappers and minimalist designs. This opportunity underscores the importance of creativity and sustainability in capturing consumer interest and fostering brand loyalty.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the premium chocolate market in Europe. The global logistics crisis, exacerbated by geopolitical tensions and climate change, has led to delays in the procurement of cocoa beans and other essential ingredients. A report by the International Cocoa Organization highlights that cocoa prices surged by 15% in 2022 due to reduced harvests in West Africa, a primary sourcing region for European manufacturers. These disruptions have not only increased production costs but also affected product availability, particularly for small-scale producers. For instance, Germany experienced a 10% decline in premium chocolate imports during the first half of 2022. This challenge underscores the need for robust supply chain management and diversification of sourcing strategies to mitigate risks.

Intense Market Competition

The European premium chocolate market faces intense competition from both established players and emerging artisanal brands. The entry of private-label products from major retailers like Carrefour and Tesco has intensified price wars, squeezing profit margins for traditional manufacturers. A study by Deloitte reveals that private-label chocolates now account for 20% of total sales in the premium segment. Additionally, the proliferation of niche brands offering innovative products has fragmented the market, making it challenging for companies to maintain market share. This challenge highlights the importance of differentiation through branding, quality, and customer engagement to sustain competitive advantage in an increasingly crowded marketplace.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.73% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nestlé S.A., Neuhaus (United Belgian Chocolate Makers), Pierre Marcolini Group, Pladis Global (Yildiz Holding), Mondelez International Inc, Mars Incorporated, Ferrero International S.A, Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, and Cemoi Group, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The dark segment led the market in Europe in 2024 and accounted for 45.3% of the European market share due to its perceived health benefits and growing consumer awareness of its antioxidant properties. The UK and Germany are the largest contributors to this segment, with combined sales exceeding €1.2 billion. According to a report by the European Cocoa Association, dark chocolate with cocoa content above 70% is particularly popular among health-conscious millennials, who represent 35% of the consumer base.

The white and milk premium chocolate segment is projected to register the highest CAGR of 5.8% over the forecast period. Innovations in flavor infusion and texture enhancement, such as caramelized milk chocolate is primarily driving the growth of the white and milk premium chocolate segment in the European market. According to a study by the International Dairy Federation, milk chocolate remains a favorite among younger demographics, particularly in France and Italy, where per capita consumption exceeds 8 kg annually.

By Distribution Channel Insights

The hypermarkets and supermarkets segment had 50.9% of the European premium chocolate market share in 2024. The dominance of hypermarkets and supermarkets segment is primarily due to their widespread presence and ability to offer a diverse product range. A report by the European Retail Federation highlights that supermarket chains like Aldi and Lidl have expanded their premium chocolate offerings, capitalizing on consumer trust and convenience. This segment's importance lies in its accessibility and ability to drive volume sales, making it a critical channel for manufacturers.

The online retail segment is estimated to promising CAGR of 12.3% over the forecast period owing to the increasing penetration of e-commerce platforms and consumer preference for home delivery. A study by McKinsey & Company reveals that online sales of premium chocolates in the UK grew by 25% in 2022.

REGIONAL ANALYSIS

Germany accounted for the leading share of 20.9% in the European premium chocolate market in 2024. The leading position of Germany in the European market is primarily attributed to a strong tradition of chocolate manufacturing and high per capita consumption, which exceeds 11 kg annually. According to the German Confectionery Association, Germany is home to renowned brands like Ritter Sport, which is further strengthening the position of Germany in the European market.

Switzerland is a notable player in the European premium chocolate market. According to Swiss Chocolate Manufacturers, Switzerland is famous for its high-quality cocoa processing and iconic brands like Lindt. Swiss consumers exhibit a strong preference for dark chocolate, which is propelling the premium chocolate market growth in Switzerland.

The UK is another key reginal player in the European premium chocolate market. The growth of the UK premium chocolate market is driven by urbanization and a preference for artisanal products.

France is estimated to hold a prominent share of the European market over the forecast period. The strong emphasis on luxury and gourmet offerings are boosting the French premium chocolate market expansion.

The focus of Italy on traditional recipes and regional specialties are driving the Italian premium chocolate market growth. Italian consumers prioritize quality and authenticity, making it a key market for premium chocolate brands.

KEY MARKET PLAYERS

The major key players in Europe Premium Chocolate market are Nestlé S.A., Neuhaus (United Belgian Chocolate Makers), Pierre Marcolini Group, Pladis Global (Yildiz Holding), Mondelez International Inc, Mars Incorporated, Ferrero International S.A, Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Cemoi Group, and others.

MARKET SEGMENTATION

This research report on the Europe premium chocolate market is segmented and sub-segmented into the following categories.

By Product Type

- Dark Premium Chocolate

- White/ Milk Premium Chocolates

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the premium chocolate market in Europe in 2024?

The premium chocolate market in Europe was valued at USD 12.85 billion in 2024.

2. What factors are driving the growth of the premium chocolate market in Europe?

Key drivers include rising health consciousness, demand for high-quality ingredients, luxury gifting trends, and increasing preference for sustainable and ethically sourced products

3. Which regions or countries are leading the demand for premium chocolate in Europe?

Countries like the UK, Switzerland, Germany, and France are significant contributors due to their strong presence of premium chocolate manufacturers and high consumer demand for luxury goods

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]