Europe Precision Medicine Market Research Report – Segmented By Technology (Big Data Analytics, Bioinformatics, Gene Sequencing, Drug Discovery, Companion Diagnostics, Others), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

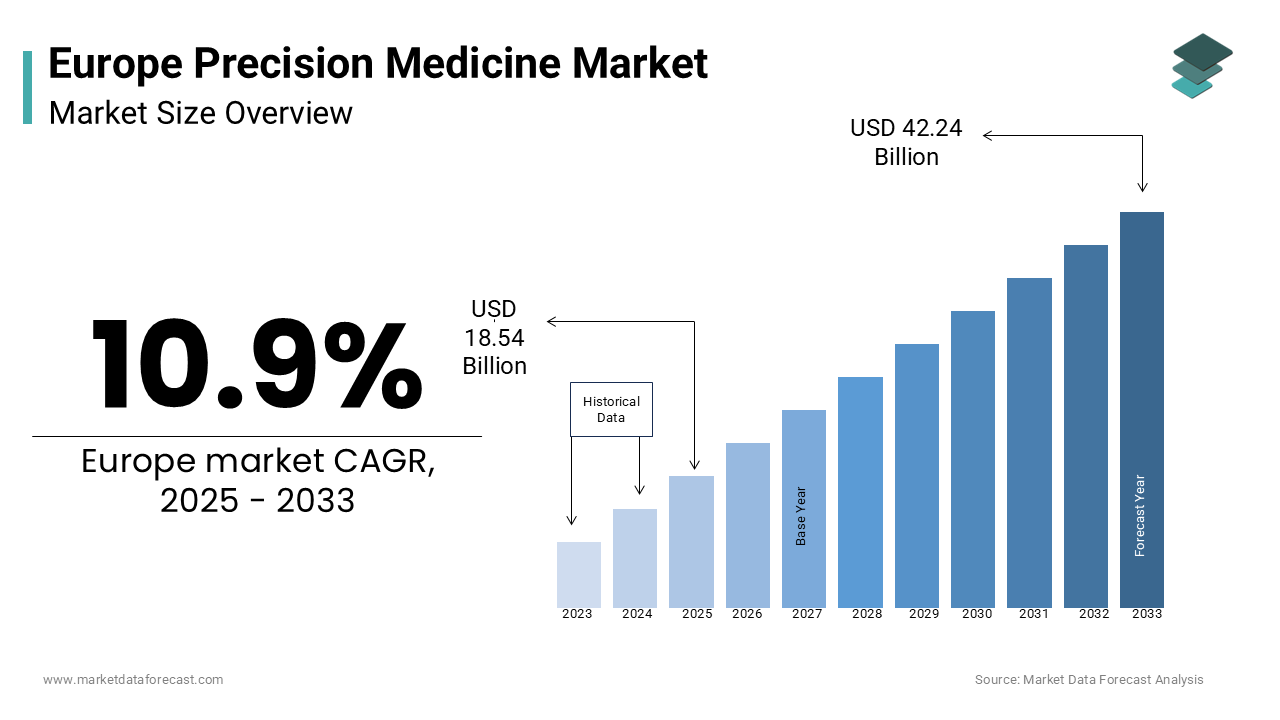

Europe Precision Medicine Market Size

The European precision medicine market size was valued at USD 16.72 billion in 2024. The European precision medicine market size is estimated to be worth USD 42.24 billion by 2033 from USD 18.54 billion in 2025, growing at a CAGR of 10.9% from 2025 to 2033.

The Europe precision medicine market is a rapidly evolving segment within healthcare, driven by advancements in genomics, data analytics, and personalized treatment approaches. This growth is fueled by an increasing prevalence of chronic diseases, with cancer alone accounting for over 4 million new cases annually in Europe, as per the European Cancer Organisation.

Countries like Germany, the UK, and France are at the forefront of adopting precision medicine due to their robust R&D infrastructure and high healthcare spending. For instance, Germany’s Federal Ministry of Health allocated over €5 billion in 2022 for genomic research and personalized therapies. Additionally, the implementation of the General Data Protection Regulation (GDPR) ensures ethical use of patient data.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

Chronic diseases such as cancer, cardiovascular disorders, and autoimmune conditions are key drivers of the precision medicine market in Europe. According to the World Health Organization, chronic diseases account for 77% of all deaths in Europe by creating a pressing demand for personalized treatments. Precision medicine offers targeted therapies that improve patient outcomes, with oncology applications achieving success rates of up to 85%, as reported by the European Society for Medical Oncology.

For example, breast cancer patients treated with personalized therapies experience a 30% higher survival rate compared to traditional methods, according to the NHS England. This efficacy drives widespread adoption, particularly in countries with advanced healthcare systems. Additionally, government initiatives like the UK’s "100,000 Genomes Project" have accelerated the integration of precision medicine into clinical practice.

Advancements in Genomic Technologies

Technological advancements in genomic sequencing are transforming the precision medicine landscape. According to Illumina, Inc., the cost of whole-genome sequencing has dropped from 10,000in2011tolessthan600 in 2023 by making it more accessible for widespread use. These advancements enable researchers to identify genetic mutations linked to diseases is facilitating the development of tailored therapies. According to the European Bioinformatics Institute, over 20,000 genetic variants associated with diseases have been identified with the growing potential of precision medicine. Furthermore, collaborations between biotech firms and academic institutions have led to breakthroughs in CRISPR gene-editing technologies by enhancing treatment precision.

MARKET RESTRAINTS

High Costs and Limited Reimbursement Policies

One of the primary restraints hindering the Europe precision medicine market is the high cost of personalized treatments and limited reimbursement policies. According to the European Federation of Pharmaceutical Industries and Associations, the average cost of a single precision medicine therapy exceeds €100,000 annually is making it inaccessible for many patients. This financial burden is exacerbated by inconsistent reimbursement frameworks across European countries. For instance, only 40% of EU nations provide full coverage for genetic testing, as per the European Health Insurance Card Association.

Additionally, hospitals face challenges in acquiring advanced genomic tools due to their substantial upfront costs. A survey conducted by MedTech Europe revealed that nearly 25% of healthcare facilities cited budget constraints as a barrier to implementing precision medicine technologies. These affordability issues create disparities in patient access in underdeveloped regions.

Ethical and Privacy Concerns

Ethical concerns surrounding patient data usage represent another significant restraint. According to the European Data Protection Board, over 60% of Europeans express apprehension about how their genetic information is stored and utilized. The sensitive nature of genomic data raises questions about privacy breaches and unauthorized access is deterring both patients and healthcare providers from embracing precision medicine. Furthermore, debates over informed consent and the potential misuse of genetic information complicate regulatory approvals. As per a study published in the European Journal of Human Genetics, nearly 35% of patients hesitate to participate in genomic studies due to these concerns.

MARKET OPPORTUNITIES

Growing Adoption of Big Data Analytics

The integration of big data analytics presents a significant opportunity for the Europe precision medicine market. According to Eurostat, healthcare data generation in Europe is projected to grow by 36% annually is creating vast datasets for analysis. Advanced analytics tools enable researchers to identify patterns and correlations in patient data is facilitating the development of personalized treatments. For instance, AI-driven platforms have reduced diagnostic errors by 20%, as stated by the European Alliance for Personalised Medicine. Moreover, partnerships between tech giants and healthcare providers are accelerating the adoption of big data solutions. For example, IBM Watson Health collaborates with European hospitals to analyze patient records and predict treatment

Expansion into Emerging Markets

Emerging markets in Eastern and Southern Europe offer untapped potential for precision medicine. According to the European Investment Bank, healthcare investments in these regions are expected to increase by 15% annually over the next five years. Countries like Poland and Romania are witnessing rapid urbanization and improved healthcare infrastructure is creating opportunities for precision medicine adoption. Additionally, government-led initiatives, such as Turkey’s National Genome Project, aim to map genetic profiles of its population by fostering the development of localized therapies. As per the Turkish Ministry of Health, these efforts have already led to a 10% rise in precision medicine procedures since 2022.

MARKET CHALLENGES

Limited Awareness Among Healthcare Providers

A significant challenge facing the precision medicine market is the limited awareness and training among healthcare professionals regarding genomic technologies. According to the European Medical Students' Association, less than 40% of practicing physicians in rural areas are adequately trained to interpret genetic test results or recommend personalized therapies. This knowledge gap hinders effective utilization of precision medicine tools, leading to suboptimal patient care.

Moreover, the lack of standardized educational programs exacerbates the issue. A survey by the European Hospital and Healthcare Federation revealed that only 25% of medical schools incorporate genomics into their curriculum. Without proper education and skill development, healthcare providers may hesitate to adopt precision medicine by slowing market growth.

Regulatory Hurdles

Regulatory hurdles pose another challenge, as stringent approval processes delay the commercialization of precision medicine technologies. According to the European Medicines Agency, the average time required for regulatory approval of personalized therapies is three to five years is significantly impacting market entry timelines. Additionally, the implementation of the In Vitro Diagnostic Regulation (IVDR) in 2022 has introduced additional compliance requirements, increasing operational costs for manufacturers. A study by the European Policy Centre found that nearly 30% of small- and medium-sized enterprises struggle to meet IVDR standards is potentially stifling innovation.

SEGMENTAL ANALYSIS

By Technology Insights

The big data analytics segment was the largest and held 35.4% of the Europe precision medicine market share in 2024 with its ability to process vast datasets by enabling precise disease prediction and treatment customization. The adoption of predictive analytics has reduced diagnostic errors by 20% that is ascribed to bolster the growth of the segment. Key factors driving this segment include the exponential growth of healthcare data and advancements in machine learning algorithms. For instance, AI-powered platforms analyze patient records to identify genetic predispositions is improving diagnostic accuracy. Collaborations between tech firms and healthcare providers further amplify adoption thereby ensuring sustained growth.

The gene sequencing segment is likely to register a CAGR of 15.8% during the forecast period. This growth is fueled by declining sequencing costs and rising applications in oncology and rare disease diagnostics. According to Illumina, Inc., over 1 million genomes have been sequenced in Europe since 2020 that is to soely boost the growth of the segment. Advancements in next-generation sequencing (NGS) technologies have reduced turnaround times is making it feasible for widespread clinical use. Government-led initiatives, such as the UK’s "100,000 Genomes Project," further accelerate adoption by positioning gene sequencing as a transformative force in precision medicine.

By Application Insights

The oncology segment dominated the Europe paper towel market with a share of 45.3% in 2024. The growth of the segment is attributed to the increasing incidence of cancer, with over 4 million new cases annually in Europe. Precision medicine enables targeted therapies by achieving success rates of up to 85% in certain cancers. The segment's growth is bolstered by advancements in biomarker research and companion diagnostics. For example, HER2-targeted therapies have improved breast cancer survival rates by 30%. Government funding for cancer research further amplifies adoption is ensuring continued dominance in the market.

The immunology segment is likely to witness a fastest growth with an estimated CAGR of 13.2% in the next coming years. This growth is fueled by the rising prevalence of autoimmune diseases and advancements in immunotherapy. According to the European Federation of Immunological Societies, over 80 autoimmune disorders have been identified is creating a robust demand for personalized treatments.

Breakthroughs in immune profiling technologies have enhanced treatment precision. Additionally, collaborations between biotech firms and academic institutions have led to the development of novel therapies is positioning immunology as a key growth driver.

REGIONAL ANALYSIS

Germany led the Europe precision medicine market with an estimated share of 28.7% in 2024 with the country’s robust healthcare infrastructure, substantial R&D investments, and strong emphasis on personalized therapies. Germany spends over €400 billion annually on healthcare, with significant portions allocated to genomic research and precision medicine initiatives, as per Eurostat. The prevalence of chronic diseases further amplifies demand. According to the Robert Koch Institute, cancer incidence in Germany exceeds 500,000 new cases annually by necessitating advanced diagnostic tools and tailored treatments. Additionally, government-led initiatives like the National Decade Against Cancer prioritize early detection and personalized therapies is driving the adoption of precision medicine technologies. Germany’s dominance is also bolstered by its role as a hub for medical technology innovation, with over 1,500 companies specializing in biotech and genomics, as stated by the German Medical Technology Association.

Turkey paper towel market growth is ascribed to exhibit a fastest CAGR of 14.5% during the forecast period. This growth is fueled by rapid urbanization, increasing healthcare investments, and rising awareness of personalized medicine. The expansion of private healthcare facilities and partnerships with international manufacturers further accelerates growth. According to the Turkish Statistical Institute, over 200 new hospitals have been established in the past five years by enhancing diagnostic capabilities. Additionally, government-led initiatives like the National Genome Project aim to map the genetic profiles of its population is fostering localized therapies and boosting market growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key market participants dominating the European Precision Medicine Market are Pfizer, Roche, Covance, Novartis, Qiagen, Biocrates Life Sciences, Teva Pharmaceutical, Nanostring Technologies, Laboratory Corporation of America Holdings, Tepnel Pharma Services, Intomics, Ferrer InCode, Silicon Biosystems, Eagle Genomics, Medtronic, and Quest Diagnostics.

The Europe precision medicine market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Illumina, Thermo Fisher Scientific, and Roche dominate the landscape through continuous innovation and strategic collaborations. Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable genomic solutions. Regional players differentiate themselves by catering to niche segments, such as rare disease diagnostics or pediatric applications. Regulatory compliance and adherence to quality standards further intensify competition by ensuring that only the most reliable products gain traction. As demand grows, players increasingly invest in expanding their geographic footprint and forming alliances with healthcare providers is fostering a dynamic and evolving competitive environment.

Top Players in the Europe Precision Medicine Market

1. Illumina, Inc.

Illumina, Inc. is a leading player in the precision medicine market, contributing significantly to global innovations in genomic sequencing. The company’s Next-Generation Sequencing (NGS) platforms dominate the European market, enabling researchers to decode genetic information with unparalleled accuracy. Its focus on reducing sequencing costs while enhancing efficiency aligns with Europe’s growing demand for affordable and accessible precision medicine solutions, enabling it to maintain a competitive edge.

2. Thermo Fisher Scientific

Thermo Fisher Scientific is another key contributor, renowned for its comprehensive portfolio of precision medicine tools, including gene sequencing systems and companion diagnostics. Thermo Fisher’s strategic emphasis on R&D has led to breakthroughs in biomarker discovery and immunotherapy development. Its presence in Europe is strengthened by partnerships with academic institutions and healthcare providers by ensuring widespread adoption of its technologies.

3. F. Hoffmann-La Roche AG

F. Hoffmann-La Roche AG specializes in personalized oncology treatments and companion diagnostics, playing a pivotal role in advancing precision medicine. Its HER2-targeted therapies, for instance, have improved breast cancer survival rates by 30%. Roche’s commitment to innovation and collaboration positions it as a major player in the market, particularly in oncology applications.

Top Strategies Used by Key Players in the Europe Precision Medicine Market

Key players in the Europe precision medicine market employ strategies such as product innovation, strategic collaborations, and geographic expansion to strengthen their positions. Product innovation is central, with companies investing heavily in R&D to develop cutting-edge genomic tools. For instance, Illumina introduced AI-integrated sequencing platforms is enhancing diagnostic accuracy and operational efficiency. Strategic partnerships with hospitals and research institutions also play a crucial role. Thermo Fisher collaborates with European healthcare providers to promote biomarker research, increasing adoption rates. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential. Roche leverages mergers and acquisitions to consolidate its market presence is acquiring smaller firms to diversify its product portfolio.

RECENT MARKET DEVELOPMENTS

- In April 2023, Illumina, Inc. launched the NovaSeq X Plus platform in Europe by offering higher throughput and reduced sequencing costs is enabling broader adoption of precision medicine technologies.

- In June 2023, Thermo Fisher Scientific partnered with the European Hospital and Healthcare Federation to advance biomarker research is focusing on oncology and autoimmune diseases.

- In September 2023, F. Hoffmann-La Roche AG acquired a UK-based biotech firm specializing in companion diagnostics is expanding its portfolio of personalized oncology solutions.

- In November 2023, Qiagen N.V. introduced a cloud-based bioinformatics platform in Switzerland is integrating genomic data analysis tools to streamline precision medicine workflows.

- In February 2024, Agilent Technologies collaborated with academic research institutes in Germany to develop next-generation sequencing tools for rare disease diagnostics is positioning itself as a leader in niche applications.

MARKET SEGMENTATION

This research report on the European precision medicine market has been segmented and sub-segmented into the following categories

By Technology

- Big Data Analytics

- Bioinformatics

- Gene Sequencing

- Drug Discover

- Companion Diagnostics

- Others

By Application

- Oncology

- CNS

- Immunology

- Respiratory

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]