Europe Pre-Insulated Pipe Market Size, Share, Trends & Growth Forecast Report By Installation (Below Ground & Above Ground), End-Use Industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Pre-Insulated Pipe Market Size

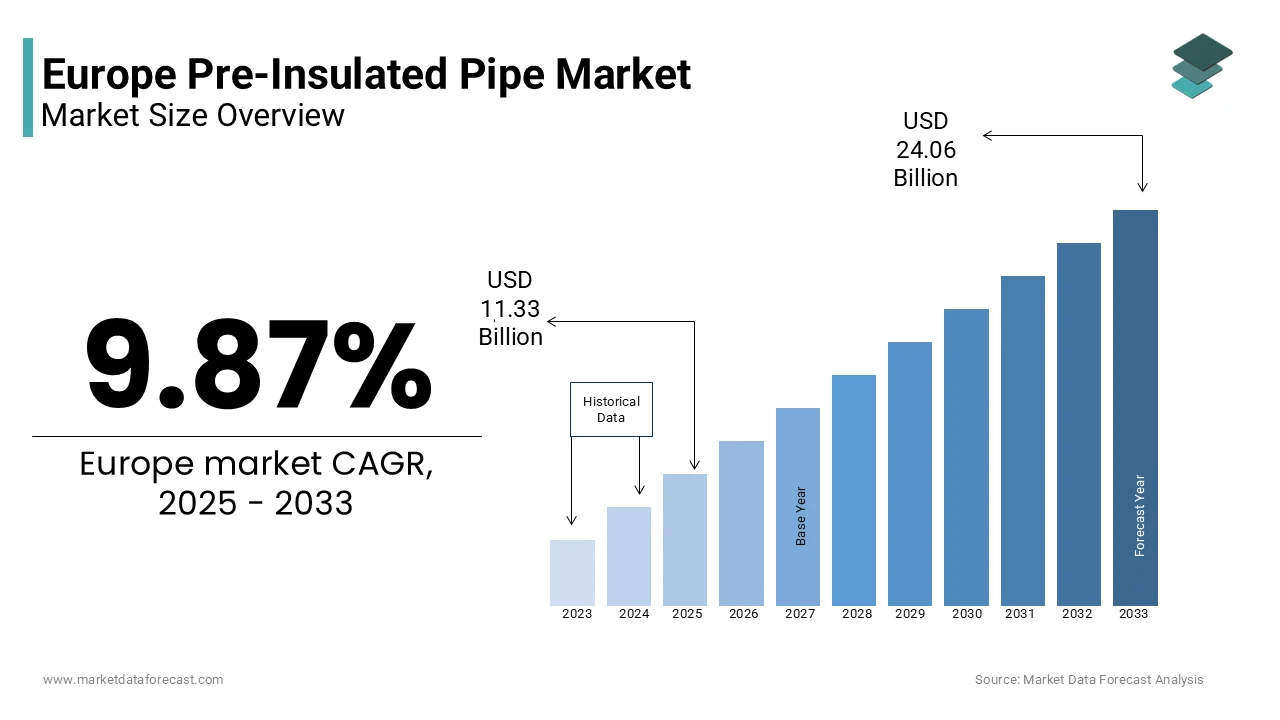

The Europe Pre-Insulated Pipe market size was valued at USD 10.31 billion in 2024. The European market size is estimated to be worth USD 24.06 billion by 2033 from USD 11.33 billion in 2025, growing at a CAGR of 9.87% from 2025 to 2033.

The Europe Pre-Insulated Pipe market has established a robust presence and is driven by its critical role in energy-efficient infrastructure development. Germany leads this expansion, accounting for a major portion of the regional market share. This dominance stems from stringent energy efficiency regulations and substantial investments in renewable energy projects.

District heating systems dominate end-use applications, holding a notable market share in Europe. The adoption of Pre-Insulated Pipes is further propelled by urbanization trends, with cities like Paris and Stockholm integrating advanced heating solutions. Despite challenges such as high initial costs, the market benefits from supportive policies under the European Green Deal, which aims to achieve carbon neutrality by 2050.

MARKET DRIVERS

Growing Demand for Energy Efficiency

Energy efficiency remains a cornerstone of Europe’s sustainability agenda, significantly boosting the demand for pre-insulated pipes. According to the International Energy Agency, buildings account for nearly 40% of the continent’s energy consumption, necessitating efficient thermal distribution systems. Pre-insulated pipes reduce heat loss significantly, making them pivotal for modern district heating networks. In 2022, approximately 60% of new district heating installations incorporated these pipes, reflecting their indispensable role in achieving energy savings. The European Union’s directive on energy performance mandates member states to enhance building efficiency, creating a surge in retrofitting projects. Such initiatives have amplified market growth, with projections indicating a 5% rise in demand annually. The alignment of these pipes with green building certifications, such as BREEAM, further underscores their importance, driving widespread adoption across both public and private sectors.

Expansion of District Heating Infrastructure

The proliferation of district heating infrastructure serves as another major driver for the pre-insulated pipe market. As per the European District Heating Association, district heating supplies about 12% of Europe’s total heating demand, with Scandinavia leading adoption rates high. Investments in this sector are surging; for example, Sweden allocated €1.5 billion in 2023 to expand its district heating network, directly increasing pipe requirements. In addition, pre-insulated pipes are preferred due to their durability and ability to maintain consistent temperatures over long distances. According to a study, these pipes reduce maintenance costs considerably compared to traditional alternatives. Furthermore, urbanization trends are accelerating demand, with cities like Berlin and Helsinki prioritizing centralized heating solutions. The integration of renewable energy sources, such as geothermal and biomass, into district heating systems also amplifies the need for efficient piping, ensuring sustained market momentum.

MARKET RESTRAINTS

High Initial Costs

A significant barrier to the adoption of pre-insulated pipes is their high upfront cost, which often deters smaller municipalities and private developers. According to the European Investment Bank, the installation of pre-insulated pipes can be 30-40% more expensive than conventional alternatives. This financial burden is particularly pronounced in economically challenged regions, such as Southern Europe, where Spain and Italy face budget constraints for large-scale infrastructure projects.

Despite long-term savings in energy efficiency, the initial investment required for materials and skilled labor poses a challenge. This disparity limits market penetration, especially in areas with limited access to funding or subsidies. Although governmental incentives exist, they are often insufficient to offset the financial gap, hindering widespread adoption and slowing market growth.

Stringent Regulatory Compliance

Stringent regulatory standards governing material quality and environmental impact present another restraint for the pre-insulated pipe market. According to the European Committee for Standardization, manufacturers must comply with EN 253 standards, which mandate rigorous testing for thermal conductivity and mechanical strength. While these regulations ensure product reliability, they increase production complexity and costs, ultimately raising prices for end-users.

Additionally, varying national regulations across Europe create compliance challenges for manufacturers. For example, Germany requires adherence to DIN 16893 standards. This fragmentation complicates cross-border trade and increases administrative burdens. A report by the Federation of European Heating Industries highlights that nearly 20% of manufacturers cite regulatory hurdles as a primary obstacle to market expansion. Such barriers not only impede innovation but also slow down the pace of market consolidation and scaling.

MARKET OPPORTUNITIES

Renewable Energy Integration

The integration of renewable energy sources into district heating systems presents a lucrative opportunity for the pre-insulated pipe market. As per the European Renewable Energy Council, the renewable energy sources made up 24.5% of the gross final energy consumption in the EU in 2023 which is a surge from 23% in 2022, with projections indicating a rise to 32% by 2030. This shift necessitates efficient piping systems capable of handling diverse energy sources, such as geothermal and biomass. Pre-insulated pipes, with their superior thermal retention properties, are ideal for this purpose. Countries like Denmark and Sweden are pioneering this trend, investing heavily in hybrid heating systems. For example, Copenhagen’s district heating network utilizes pre-insulated pipes to integrate wind energy-generated heat, reducing emissions.

Smart City Development Initiatives

Europe’s smart city initiatives offer another promising avenue for market growth. According to the European Smart Cities Observatory, numerious cities across the continent are implementing smart infrastructure projects, many of which prioritize energy-efficient heating solutions. Pre-insulated pipes play a crucial role in these developments by enabling seamless integration of IoT-enabled monitoring systems.

For instance, Amsterdam’s smart district heating network uses pre-insulated pipes equipped with sensors to optimize energy flow, reducing operational costs. Similar projects in cities like Barcelona and Vienna highlight the growing synergy between smart technologies and advanced piping systems. By aligning with these initiatives, manufacturers can tap into a rapidly expanding niche, ensuring sustained market relevance and profitability.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the pre-insulated pipe market, exacerbated by geopolitical tensions and logistical bottlenecks. Like, raw material shortages, particularly polyurethane foam and steel, have led to a significant increase in production costs in recent years. These disruptions are particularly acute in Eastern Europe, where reliance on imports from Russia and China has been curtailed due to trade restrictions.

For example, Poland experienced a decline in pre-insulated pipe production in 2022, attributed to delayed shipments of essential materials. Such delays not only inflate costs but also hinder timely project completions, eroding client trust.

Market Competition

Intense competition within the pre-insulated pipe market presents another formidable challenge. A noticeable number companies operate in the region, leading to price wars and margin pressures. Smaller players, lacking economies of scale, struggle to compete with industry giants which control a major portion of the market share.

This competitive landscape is further complicated by the entry of low-cost Asian manufacturers, who undercut prices. For instance, Italian manufacturers reported a decline in domestic sales in 2023 due to imported alternatives. Additionally, rapid technological advancements necessitate continuous innovation, straining R&D budgets for mid-sized firms.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.87% |

|

Segments Covered |

By Installation, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Georg Fischer AG (Switzerland), Kabelwerke Brugg (Switzerland), Polypipe Group PLC (UK), Logstor (Denmark), Uponor (Finland), Watts Water Technologies (US), Perma-Pipe International Holdings (US), Isoplus Fernwaermetechnik GmbH (Germany), and others. |

SEGMENT ANALYSIS

By Installation Insights

The below-ground installation segment had the maximum market share of Europe’s pre-insulated pipe trade by accounting for 65.5% of the total share in 2024. This segment’s prominence is due to its ability to minimize heat loss and protect pipes from external damage. For instance, underground installations considerably reduce thermal losses compared to above-ground systems. Urbanization trends further bolster this dominance, with cities like London and Paris prioritizing underground networks to preserve aesthetics and maximize space utilization. Technological advancements, such as trenchless installation methods, have also enhanced feasibility, reducing deployment costs. These factors collectively ensure below-ground installation remains the preferred choice, sustaining its leadership position.

The above-ground installation segment is the fastest-growing segment, with a calculated CAGR of 6.2% in the coming years. This progress is credited to its cost-effectiveness and ease of maintenance, particularly in rural and industrial settings. Moreover, rising demand for modular heating solutions further accelerates adoption. Additionally, advancements in corrosion-resistant coatings have extended the lifespan of these pipes, addressing previous durability concerns. These innovations, coupled with supportive government policies, position above-ground installation as a dynamic and rapidly expanding segment within the market.

By End-Use Industry Insights

The district heating and cooling segment represented the largest end-use category by capturing 55.2% of the market share in 2024. This dominance of the segment is driven by Europe’s commitment to decarbonization, with district heating systems playing a pivotal role in reducing carbon emissions. For instance, Sweden’s district heating networks prevent approximately 2 million tons of CO2 annually, according to the Swedish Environmental Protection Agency. Apart from these, government incentives further amplify adoption. Germany’s KfW Development Bank offers subsidies covering up to 40% of project costs, encouraging municipalities to invest in district heating infrastructure. Besides, the integration of renewable energy sources can enhance system efficiency, with pre-insulated pipes reducing heat loss notably. These factors ensure district heating remains the cornerstone of the pre-insulated pipe market.

The oil and gas segment is accelerating in the market, with a CAGR of 7.5% during the forecast period. This development of the segment is attributed to the increasing use of pre-insulated pipes for transporting heated crude oil and natural gas. For example, Norway’s offshore oil fields utilize these pipes to maintain optimal temperatures, reducing viscosity and enhancing flow efficiency.

Technological advancements, such as multi-layer insulation, have expanded application scope, enabling operations in extreme conditions. These developments position oil and gas as a high-growth segment, driven by innovation and rising energy demands.

REGIONAL ANALYSIS

Germany was the largest contributor to the Europe pre-insulated pipe market with 28.5% share in 2024. This expansion of the country is due to the country’s unwavering commitment to energy efficiency and sustainable infrastructure development. Germany’s district heating systems are among the most advanced globally, with pre-insulated pipes playing a critical role in minimizing heat loss during energy transmission. The German government has implemented stringent regulations mandating energy-efficient building practices, further propelling demand. For instance, the Energy Efficiency Directive requires all new buildings to achieve near-zero energy consumption by 2025, creating a fertile ground for pre-insulated pipe adoption.

Sweden emerges as the fastest-growing market, with a projected CAGR of 8.3%. This rapid progress is fueled by the nation’s aggressive transition toward renewable energy and its emphasis on smart city development. Sweden’s district heating networks, which already supply a significant portion of the country’s heating needs, are increasingly integrating renewable energy sources such as geothermal and biomass. Pre-insulated pipes are indispensable in these systems, ensuring minimal thermal losses and optimal performance. In 2023, Sweden allocated €1.5 billion to expand and modernize its district heating infrastructure, particularly in urban centers like Stockholm and Gothenburg.

France and Italy are anticipated to experience steady growth which is supported by EU funding and increasing urbanization trends. France’s focus on retrofitting aging infrastructure and Italy’s push for energy-efficient residential heating solutions create significant opportunities for market expansion. Spain, while currently lagging due to economic constraints, holds untapped potential, particularly in regions like Madrid and Barcelona, where smart city projects are gaining traction.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Georg Fischer AG (Switzerland), Kabelwerke Brugg (Switzerland), Polypipe Group PLC (UK), Logstor (Denmark), Uponor (Finland), Watts Water Technologies (US), Perma-Pipe International Holdings (US), and Isoplus Fernwaermetechnik GmbH (Germany) are playing a dominant role in the European pre-insulated pipe market.

The Europe pre-insulated pipe market is characterized by fierce competition, driven by the presence of established players and the entry of new entrants seeking to capitalize on growing demand. As per the European Federation of Insulation Manufacturers, over 50 companies operate in the region, creating a highly fragmented yet dynamic landscape. Market leaders such as Logstor, Uponor, and Brugg Pipe Systems dominate through innovative product offerings and strategic alliances. However, smaller players face significant challenges, including pricing pressures and limited access to advanced technologies. The competitive environment is further intensified by the influx of low-cost Asian manufacturers, who undercut prices. To counter this, European manufacturers are focusing on value-added services, such as IoT integration and predictive maintenance, to differentiate themselves. Additionally, regulatory compliance adds another layer of complexity, as companies must adhere to stringent standards governing material quality and environmental impact. Despite these hurdles, the market remains ripe for consolidation, with mergers and acquisitions likely to reshape the competitive dynamics in the coming years.

TOP PLAYERS IN THIS MARKET

The Europe pre-insulated pipe market is dominated by three key players—Logstor, Uponor, and Brugg Pipe Systems—each contributing significantly to global innovation and sustainability efforts. Logstor leads the pack by leveraging its expertise in renewable energy applications. The company specializes in developing high-performance pre-insulated pipes tailored for district heating systems powered by wind, solar, and geothermal energy. Uponor follows closely with a strong focus on smart city integration. Its Smart Heating Solutions division develops IoT-enabled pipes that allow real-time monitoring of temperature and pressure, enhancing operational efficiency. Uponor’s partnerships with research institutions across Europe have positioned it as a leader in technological innovation. Brugg Pipe Systems distinguishes itself through its corrosion-resistant product line, catering to industrial applications in the oil and gas sector.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe pre-insulated pipe market employ diverse strategies to maintain their competitive edge and expand their footprint. Mergers and acquisitions are a primary tactic, enabling companies to consolidate resources and enhance technological capabilities. Partnerships and collaborations are another critical strategy, exemplified by Uponor’s alliance with a German research institute in June 2023 to develop eco-friendly materials that align with EU sustainability goals. Geographic expansion is also a priority, with Brugg Pipe Systems opening a new production facility in Eastern Europe to tap into emerging markets. Additionally, heavy investments in R&D underscore the industry’s focus on innovation; Finally, differentiation through specialized products, such as Brugg’s corrosion-resistant pipes, ensures sustained market relevance amid intense competition.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Logstor acquired a Danish startup specializing in IoT-enabled pipes, enhancing its ability to offer smart heating solutions.

- In June 2023, Uponor partnered with a German research institute to develop eco-friendly materials, aligning with EU sustainability mandates.

- In March 2023, Brugg Pipe Systems launched a corrosion-resistant product line, targeting the oil and gas sector and expanding its application scope.

- In September 2022, Logstor expanded its production facility in Poland, increasing capacity to meet rising demand in Eastern Europe.

- In January 2022, Uponor invested €50 million in R&D for smart heating solutions, reinforcing its leadership in technological innovation.

MARKET SEGMENTATION

This research report on the Europe pre-insulated pipe market is segmented and sub-segmented into the following categories.

By Installation

- Below Ground

- Above Ground

By End-use Industry

- District Heating & Cooling

- Oil & Gas

- Infrastructure & Utility

- Others

- Food Processing

- Pharmaceuticals

- Wineries

- Chemicals

- Water Treatment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key trends shaping the Europe Pre-Insulated Pipe Market?

Major trends include rising adoption of district heating systems, urbanization in cities like Paris and Stockholm, and alignment with green building standards such as BREEAM.

2. What are the major challenges restraining the growth of the Europe Pre-Insulated Pipe Market?

High initial costs, stringent regulatory compliance, supply chain disruptions, and intense market competition are key challenges affecting market expansion.

3. What opportunities exist for new entrants in the Europe Pre-Insulated Pipe Market?

Emerging opportunities lie in catering to niche requirements across sectors like cooling and industrial applications, as well as focusing on sustainable and energy-efficient solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]