Europe Power Transformer Market Research Report – Segmented By Power Rating (medium power transformers, large power transformers ) Cooling Type , Phase, End User & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Power Transformer Market Size

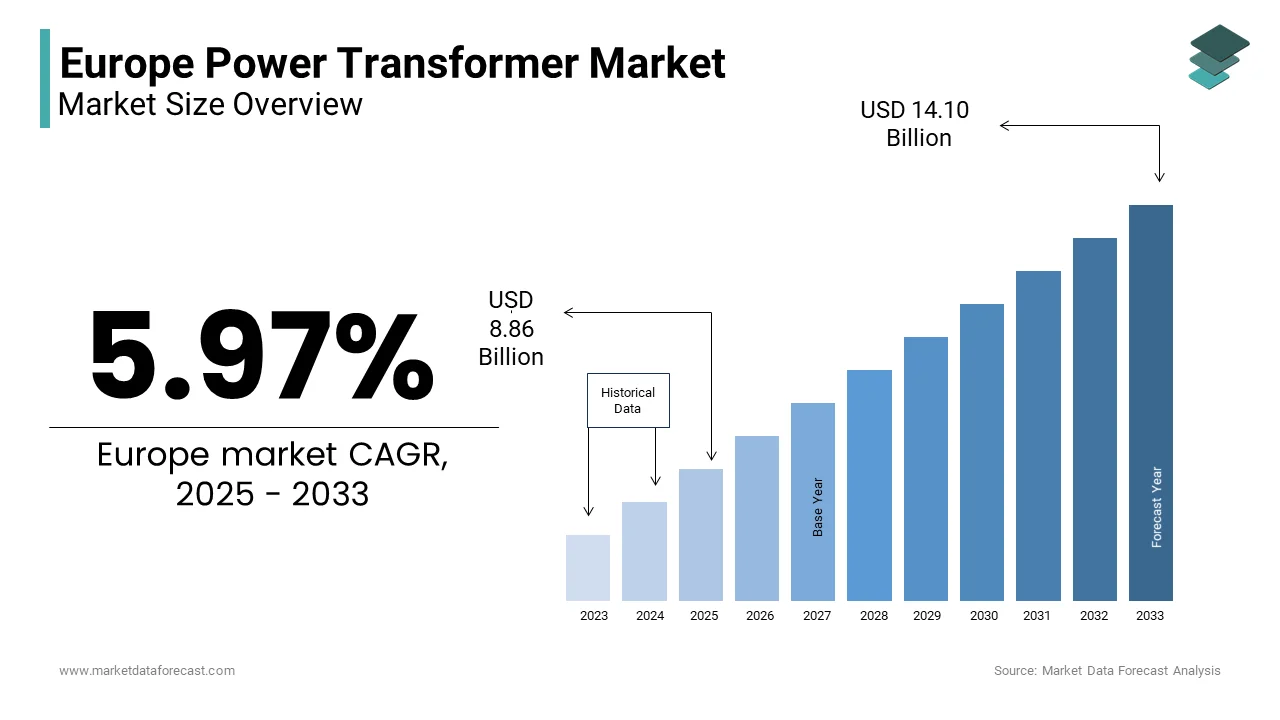

The Europe Power Transformer Market Size was valued at USD 8.36 billion in 2024. The Europe Power Transformer Market size is expected to have 5.97 % CAGR from 2025 to 2033 and be worth USD 14.10 billion by 2033 from USD 8.86 billion in 2025.

The European power transformer market is growth is driven by the region’s energy infrastructure with its transition towards sustainable and resilient power systems. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), transformers account for approximately 30% of the total grid infrastructure investment in Europe due to their role in electricity transmission and distribution. The market is bolstered by the EU’s commitment to achieving carbon neutrality by 2050, which has accelerated investments in renewable energy integration and grid modernization. For instance, as per Eurostat, renewable energy sources contributed 41% of the EU’s electricity generation in 2022. However, aging infrastructure remains a challenge, with over 60% of transformers in Eastern Europe exceeding their operational lifespan, according to the European Distribution System Operators’ Association.

MARKET DRIVERS

Renewable Energy Integration

The rapid integration of renewable energy sources is a key driver of the European power transformer market. As per the International Renewable Energy Agency (IRENA), renewable energy capacity in Europe grew by 15% annually between 2020 and 2022, with solar and wind leading the expansion. Transformers are essential for integrating these decentralized energy sources into the grid by ensuring efficient voltage regulation and power distribution. For example, Spain added 7 GW of renewable capacity in 2022, as stated by the Spanish Ministry of Ecological Transition by creating significant demand for medium and large transformers. Additionally, offshore wind farms, such as those in the UK and Denmark, require specialized transformers to manage high-voltage direct current (HVDC) transmission. These developments not only enhance grid reliability but also position transformers as indispensable components of Europe’s green energy transition.

Grid Modernization Initiatives

Grid modernization initiatives across Europe are another major driver of the power transformer market. Countries like France and Italy are prioritizing digitalization and automation to reduce energy losses and improve efficiency. Italy’s Terna invested €1.5 billion in grid resilience projects by focusing on replacing outdated transformers with energy-efficient models. These initiatives are driven by the need to accommodate growing electricity demand and projected to increase by 8% annually through 2030. The modern transformers play a pivotal role in supporting Europe’s evolving energy landscape by enhancing grid flexibility and reliability.

MARKET RESTRAINTS

High Capital Costs

High capital costs pose a significant restraint to the European power transformer market for small utilities and industrial players. This challenge is acute in Eastern Europe, where economic disparities limit infrastructure investments. For example, Romania’s utility sector allocated only 10% of its annual budget to transformer upgrades in 2022, as stated by the Romanian Energy Regulatory Authority. Additionally, the lead time for manufacturing and installing transformers can extend up to 12 months that is complicating procurement processes.

Aging Infrastructure Challenges

The prevalence of aging infrastructure across Europe is another major restraint for the power transformer market. According to the European Distribution System Operators’ Association, over 60% of transformers in Eastern Europe are more than 30 years old is increasing the risk of failures and inefficiencies. For instance, Poland experienced a 15% rise in transformer-related outages in 2022, as reported by the Polish Energy Regulatory Office. Replacing these outdated systems requires significant investment, which many countries struggle to allocate amidst competing priorities. Furthermore, the lack of standardized replacement frameworks exacerbates the issue is leading to prolonged downtimes and increased operational costs.

MARKET OPPORTUNITIES

Electrification of Transportation

The electrification of transportation presents a significant opportunity for the European power transformer market. According to the European Automobile Manufacturers’ Association (ACEA), electric vehicle (EV) sales in Europe surged by 40% in 2022 by reaching 2.6 million units. This growth necessitates robust charging infrastructure, which relies heavily on transformers to manage increased electricity demand. For example, Norway, a leader in EV adoption, installed over 10,000 public charging stations in 2022, as per the Norwegian Electric Vehicle Association. Similarly, Germany’s government allocated €6 billion for EV charging infrastructure development is creating substantial demand for medium and large transformers. The need for grid reinforcements and specialized transformers will continue to expand by offering lucrative opportunities for manufacturers.

Digitalization and IoT Integration

Digitalization and IoT integration represent another promising opportunity for the power transformer market. The European Smart Grid Task Force estimates that IoT-enabled transformers can reduce energy losses by up to 15% by enhancing grid efficiency. For instance, Italy’s Terna partnered with Siemens in 2022 to deploy IoT-enabled transformers by improving real-time monitoring and predictive maintenance capabilities, as stated by the Italian Ministry of Economic Development. These advancements not only optimize performance but also align with EU regulations promoting energy efficiency. The demand for innovative transformers equipped with IoT functionalities is expected to grow by creating new avenues for market expansion.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a significant challenge for the European power transformer market. According to the European Logistics Association, transformer manufacturers faced an average delay of 20% in raw material deliveries in 2022 due to geopolitical tensions and trade restrictions. For example, Germany’s reliance on imported copper and steel resulted in a 25% increase in production costs, as per the German Mechanical Engineering Industry Association. These disruptions not only escalate expenses but also hinder timely project completions, particularly for large-scale grid modernization initiatives. Additionally, the complexity of sourcing specialized components, such as high-voltage bushings, further compounds the issue.

Regulatory Compliance

Regulatory compliance poses another challenge for the power transformer market in Europe. The European Commission’s stringent environmental and safety standards require manufacturers to invest heavily in R&D to develop eco-friendly and low-loss transformers. For instance, the UK’s Environmental Agency mandates that all transformers meet Eco-design Directive requirements by 2025, as stated by the British Electrical and Allied Manufacturers’ Association. Non-compliance can result in penalties and lost market share, particularly in highly regulated sectors like utilities. Moreover, the fragmented nature of regional regulations across EU member states creates additional complexity by forcing manufacturers to adapt their products to varying specifications. These regulatory hurdles increase operational costs and create barriers for smaller players seeking to enter the market.

REPORT COVERAGE

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.97 % |

|

Segments Covered |

By Power Rating, Cooling Type, Phase, End User and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Hitachi Energy (Japan), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan) |

SEGMENT ANALYSIS

By Power Rating Insights

The medium power transformers segment was the largest by occupying 45.3% of the Europe power transformer market share in 2024. Their versatility makes them ideal for both industrial and utility applications in regions undergoing grid modernization. The need for reliable power distribution in manufacturing facilities is likely to propel the growth of the market. Additionally, their ability to handle moderate loads while maintaining energy efficiency aligns with EU sustainability goals. The segment’s dominance is further supported by its relatively lower cost compared to large transformers by making it accessible for smaller utilities and industries.

The large power transformers segment is likely to exhibit a fastest growth with a CAGR of 9.2% from 2025 to 2033. The growth is fueled by investments in high-voltage transmission networks to integrate renewable energy sources. These transformers are critical for managing long-distance power transmission with minimal losses. Furthermore, technological advancements, such as enhanced cooling systems and digital monitoring that have improved their performance and reliability is driving rapid adoption across utilities and renewable energy projects.

By Cooling Type Insights

The oil-cooled transformers segment was the largest and held 60.1% of the European power transformer market share in 2024 with their superior cooling efficiency and ability to handle high-voltage applications is making them indispensable for utilities and large-scale industrial operations. For instance, Germany’s transmission grid operators rely on oil-cooled transformers for over 70% of their high-voltage substations, according to the German Federal Network Agency. These transformers are particularly favored in regions with aging infrastructure, where reliability and durability are critical. Additionally, advancements in biodegradable oils have addressed environmental concerns is enhancing the growth of the market.

The air-cooled transformers segment is more likely to experience a CAGR of 8.5% during the forecast period. Their growth is driven by increasing demand in urban areas and commercial buildings, where space constraints and noise regulations favor compact, low-maintenance solutions. For example, France’s commercial sector invested €1.2 billion in energy-efficient building upgrades in 2022 by creating significant demand for air-cooled transformers, according to the French National Institute for Industrial Skills. These transformers are also gaining traction in renewable energy projects, such as rooftop solar installations, due to their ease of installation and environmental compatibility. Furthermore, technological innovations, such as improved thermal management systems, have enhanced their performance by making them a preferred choice for modern applications.

By Phase Insights

The three-phase transformers segment was the largest with a dominant share of the Europe power transformer market in 2024. Their widespread use is attributed to their ability to deliver consistent power supply across long distances by making them ideal for utilities and industrial applications. These transformers are also preferred for their energy efficiency and lower operational costs compared to single-phase alternatives. Additionally, their compatibility with renewable energy sources, such as wind farms and solar parks, has further amplified their demand. The segment’s leadership is reinforced by its scalability by catering to both small-scale residential needs and large-scale industrial operations.

The single-phase transformers segment is projected to exhibit a CAGR of 7.8% from 2025 to 2033. Their growth is fueled by increasing electrification in rural and remote areas, where single-phase systems are sufficient for residential and small commercial applications. These transformers are also gaining popularity in the residential sector due to their compact size and ease of installation. Moreover, advancements in smart grid technologies have enabled single-phase transformers to integrate seamlessly with IoT-enabled systems by enhancing their appeal for modern applications.

By End User Insights

The utilities segment was the largest with 40.3% of the Europe power transformer market share in 2024. Their dominance is driven by the need for reliable and efficient power transmission and distribution across Europe’s extensive grid networks. For instance, the UK’s National Grid allocated £5 billion in 2022 for transformer upgrades to support renewable energy integration, as stated by the British Electrical and Allied Manufacturers’ Association. Utilities prioritize large and medium transformers for high-voltage applications by ensuring seamless electricity flow to residential, commercial, and industrial consumers. Additionally, regulatory mandates, such as the EU’s Clean Energy Package, have accelerated investments in transformer modernization to reduce energy losses and enhance grid resilience.

The industrial sector is lucratively to grow with a CAGR of 9.1% in the next coming years. Its growth is fueled by Europe’s industrial resurgence in manufacturing hubs like Germany and France. Industries such as chemicals, automotive, and food & beverage rely heavily on transformers for precise voltage regulation and uninterrupted operations. The segment’s expansion is further propelled by the adoption of Industry 4.0 technologies, which require advanced transformers to support automation and digitalization. The demand for innovative transformer solutions is expected to accelerate as industries increasingly prioritize energy efficiency.

COUNTRY LEVEL ANALYSIS

Germany led the European power transformer market by accounting for 25.8% of share in 2024 with its robust industrial base and commitment to renewable energy integration. For instance, Germany’s Energiewende initiative invested in grid modernization projects in 2022 by creating substantial demand for advanced transformers.

Spain is expected to witness a fastest CAGR of 8.3% owing to the investments in renewable energy and rural electrification. The Spanish Ministry of Ecological Transition reports that renewable energy projects were initiated in 2022 by creating demand for specialized transformers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the European power transformer market are Hitachi Energy (Japan), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hyundai Electric (South Korea), Fuji Electric (Japan), Toshiba corporation (Japan), MGM Transformer Company (California), CG Power and Industrial Solutions (India), Ningbo Ironcube Works International Co., Ltd. (China), Chint Group (China), EFACEC (Portugal), CG power & Industrial Solutions (India), Hyosung Heavy Industries (South Korea), Bharat Heavy Electricals Limited (India), SBG SMIT (Germany), WEG (South Korea), Transformer & Rectifier India Ltd. (India),

The European power transformer market is highly competitive, characterized by the presence of global giants and regional specialists. According to ENTSO-E, the top five players account for 60% of the market, leaving room for smaller firms to innovate and capture niche segments. Price competition is intense in commoditized categories like medium transformers. However, differentiation through technological advancements, such as smart transformers that provides a competitive advantage. Regional players often focus on specific industries, such as renewables or utilities by leveraging their expertise to build loyal customer bases.

Top strategies used by the key market participants

Key players in the European power transformer market employ diverse strategies to maintain their competitive edge. Product innovation is central, with companies like Siemens investing heavily in IoT-enabled and eco-friendly transformers to meet regulatory and customer demands. Strategic acquisitions also play a vital role; for instance, ABB’s acquisition of GE Industrial Solutions expanded its footprint in high-voltage applications. Partnerships with regional utilities and governments ensure widespread adoption, particularly in renewable energy projects. Additionally, sustainability initiatives, such as developing energy-efficient models, align with EU directives by enhancing brand reputation. These strategies collectively enable manufacturers to address evolving market needs while maintaining leadership positions.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Siemens Energy launched its Sensformer® technology, integrating IoT capabilities into transformers to enable real-time monitoring and predictive maintenance. This initiative aims to enhance grid reliability and efficiency by aligning with Europe’s push toward digitalization.

- In May 2023, ABB announced a €200 million investment to expand its manufacturing facility in Sweden, targeting increased production capacity for HVDC transformers to support renewable energy projects. This move amplifies ABB’s commitment to meeting Europe’s growing demand for sustainable energy solutions.

- In July 2023, Schneider Electric partnered with Enedis, France’s largest electricity distributor, to deploy EcoStruxure-enabled transformers for urban electrification projects. This collaboration supports France’s sustainability goals and enhances Schneider’s market presence in the region.

- In September 2023, Hitachi Energy introduced a new line of biodegradable oil transformers designed to reduce environmental impact. This innovation addresses stringent EU regulations and positions Hitachi as a leader in eco-friendly transformer solutions.

- In November 2023, Toshiba Energy Systems collaborated with a German utility to develop specialized transformers for offshore wind farms. This strategic partnership reflects Toshiba’s focus on high-growth renewable energy applications and strengthens its foothold in the European market.

MARKET SEGMENTATION

This research report on the europe golf cart market has been segmented and sub-segmented into the following categories.

By Power Rating

- medium power transformers

- large power transformers

By Cooling Type

- oil-cooled transformers

- air-cooled transformers

By Phase

- three-phase transformers

- single-phase transformers

By End User

- utilities

- industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the key factors driving the growth of the power transformer market in Europe?

Growth is driven by the transition to renewable energy, grid modernization, increasing electricity demand, and the replacement of aging infrastructure.

Which countries in Europe are leading the power transformer market?

Germany, France, the UK, and Italy are major contributors due to strong industrial bases, energy transition policies, and infrastructure investments.

What are the main types of power transformers available in the European market?

Key types include small (up to 60 MVA), medium (61–600 MVA), and large (above 600 MVA) power transformers, categorized by rating and application.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]