Europe POS Terminals Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware, Software, and Services), Type (Fixed Point-of-Sale Terminals and Mobile/Portable Point-of-Sale Terminals), End-user Industries, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe POS Terminals Market Size

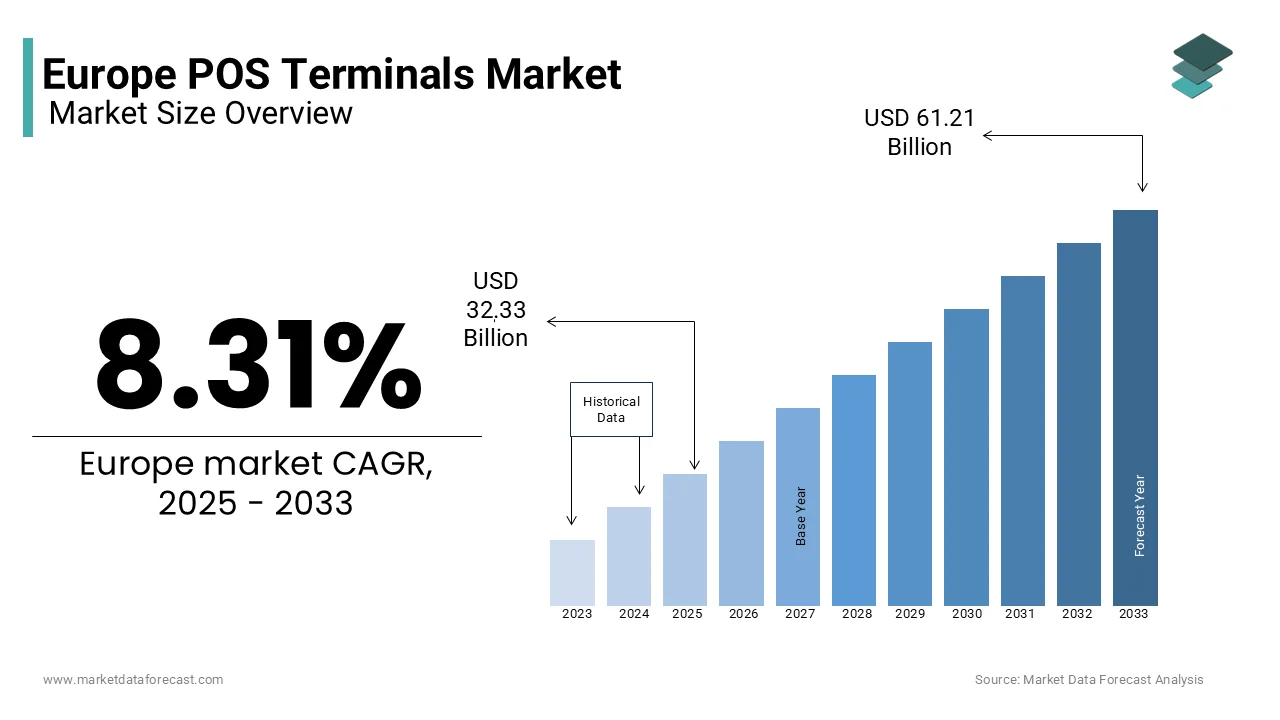

The Europe POS terminals market was worth USD 29.84 billion in 2024. The Europe market is estimated to reach USD 61.21 billion by 2033 from USD 32.33 billion in 2025, rising at a CAGR of 8.31% from 2025 to 2033.

POS terminals, which facilitate electronic transactions between merchants and customers, have become an integral component of retail, hospitality, healthcare, and other service-oriented industries across the continent. These devices encompass traditional card readers, mobile POS systems, and self-service kiosks, offering seamless integration with cloud-based platforms and advanced analytics tools.

The European market is characterized by its diversity, with Western Europe leading in terms of adoption rates due to high internet penetration and robust financial infrastructure. Meanwhile, Eastern Europe is witnessing accelerated growth fueled by government initiatives promoting cashless economies. Contactless payments accounted for over 50% of all transactions in the region during 2022 by playing a pivotal role of NFC-enabled POS systems. Furthermore, the rise of e-commerce and m-commerce has spurred demand for portable and versatile POS solutions by enabling small and medium enterprises to compete effectively. As per the European Central Bank, non-cash payments grew by approximately 13% annually between 2019 and 2022 by reinforcing the indispensability of POS terminals in modern commerce. Regulatory frameworks such as the Revised Payment Services Directive (PSD2) continue to shape the landscape by ensuring secure and transparent operations while fostering innovation within the industry.

MARKET DRIVERS

Widespread Adoption of Cashless Payment Systems

The Europe POS terminals market is significantly driven by the rapid adoption of cashless payment systems, which is supported by government policies and evolving consumer behavior. According to the European Central Bank, non-cash payments in the Eurozone exceeded 90 billion transactions in 2021 by reflecting a substantial increase over the past few years. This growth has been fueled by initiatives aimed at reducing cash dependency, such as Sweden’s ambitious goal to become a completely cashless society by 2030. According to the United Kingdom’s Access to Cash Review, over 80% of its population now regularly uses digital payment methods. The COVID-19 pandemic further accelerated this trend is prompting countries like France and Germany to raise contactless payment limits. According to the European Payments Council, contactless transactions accounted for nearly 75% of all card-based payments in 2022 is compelling merchants to adopt advanced POS systems that support secure and efficient cashless operations.

Technological Innovation Enhancing Customer Experience

The integration of cutting-edge technologies to enhance customer experience and operational efficiency is accelerating the growth rate of the market. According to the Eurostat, businesses leveraging smart POS systems experienced a 20% improvement in operational efficiency between 2019 and 2022. According to the European Commission, small and medium enterprises adopting mobile POS devices saw a 30% increase in sales due to streamlined checkout processes and reduced waiting times. Innovations such as AI, cloud computing, and IoT have enabled personalized services and real-time inventory management by revolutionizing sectors like retail and hospitality. Self-service kiosks in airports and supermarkets are gaining popularity. These advancements not only cater to tech-savvy consumers but also align with sustainability goals by minimizing paper receipts and optimizing resource allocation, thereby fostering long-term market expansion.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints for SMEs

The high initial investment required for advanced systems, which poses a challenge for small and medium enterprises (SMEs) is restraining the growth rate of the Europe POS terminal market. According to the European Investment, over 60% of SMEs in Europe face financial barriers when adopting new technologies, including POS systems. These costs encompass hardware purchases, software licensing, and integration with existing infrastructure, which can be prohibitive for smaller businesses operating on tight budgets. According to the European Commission, nearly 40% of SMEs in rural areas lack access to affordable financing options, further limiting their ability to invest in modern POS solutions. Ongoing subscription fees remain a concern while cloud-based POS systems have reduced some upfront expenses. According to Eurostat, only 25% of micro-enterprises in the EU adopted advanced digital tools in 2022.

Cybersecurity Concerns and Data Privacy Challenges

The growing concern over cybersecurity threats and data privacy issues associated with POS systems is degrading the growth rate of the Europe POS terminals market. The European Union Agency for Cybersecurity (ENISA) reported a 25% increase in cyberattacks targeting payment systems in 2022 by raising fears among businesses and consumers alike. High-profile breaches have highlighted vulnerabilities, particularly in older POS models lacking robust encryption protocols. Furthermore, the General Data Protection Regulation (GDPR) imposes strict penalties for non-compliance by creating additional pressure for businesses to ensure their systems meet stringent security standards. As per the European Central Bank, 35% of merchants delayed upgrading their POS terminals due to concerns about potential data breaches. These challenges are compounded by the rising sophistication of cybercriminals by making it essential for businesses to invest in advanced security measures which further adds to operational costs and acts as a barrier to market expansion.

MARKET OPPORTUNITIES

Expansion of E-Commerce and M-Commerce Platforms

The rapid growth of e-commerce and mobile commerce (m-commerce) presents a significant opportunity for the Europe POS terminals market. According to the Eurostat, online retail sales in the EU grew by 12% annually between 2020 and 2022 which is driven by increased internet penetration and smartphone usage. This trend has led to a surge in demand for portable and versatile POS solutions by enabling businesses to process payments seamlessly across physical and digital channels. According to the European Commission, over 60% of consumers now prefer retailers offering integrated payment options, such as mobile wallets and QR code-based systems. The adoption of cloud-based and mobile POS systems is expected to accelerate is driving market expansion and fostering greater financial inclusion.

Integration of AI and IoT for Smart Retail Solutions

Another major opportunity lies in the integration of artificial intelligence (AI) and the Internet of Things (IoT) into POS terminals by enabling smarter retail operations and personalized customer experiences. According to the European Investment Bank, businesses adopting AI-driven POS systems could achieve up to a 30% increase in operational efficiency by 2025. These technologies allow retailers to analyze purchasing patterns, optimize inventory management, and deliver tailored promotions in real-time. According to the European Commission, over 40% of large retailers in Europe have already implemented IoT-enabled POS devices to enhance store automation and streamline checkout processes. According to the European Payments Council, smart POS terminals equipped with AI capabilities are projected to reduce transaction processing times by 25% by improving overall customer satisfaction. The demand for advanced POS solutions is set to grow by unlocking new avenues for innovation and market development.

MARKET CHALLENGES

Fragmented Regulatory Landscape Across Member States

A significant challenge in the Europe POS terminals market is the fragmented regulatory environment, which varies across member states and complicates compliance for businesses operating in multiple countries. According to the European Central Bank, over 30% of cross-border transactions face delays due to differing national regulations on payment systems and data protection. For instance, while the General Data Protection Regulation (GDPR) provides a unified framework for data privacy, individual countries often impose additional requirements is increasing operational complexity for POS providers. According to the European Commission, small and medium enterprises (SMEs) spend an average of €5,000 annually per country to ensure compliance with local laws. This regulatory fragmentation not only raises costs but also slows down the adoption of innovative POS solutions. According to Eurostat, businesses operating in more than three EU countries report a 15% higher administrative burden, hindering scalability and market integration.

Resistance to Technological Adoption Among Traditional Businesses

The resistance to adopting modern POS technologies among traditional businesses in rural and less-developed regions. According to the Eurostat, nearly 45% of small retailers in Eastern Europe still rely on outdated cash registers or manual payment methods by citing a lack of technical expertise and perceived complexity as primary barriers. According to the European Investment Bank, only 20% of traditional merchants in these regions have transitioned to digital payment systems, despite government incentives. Additionally, the European Payments Council found that over 60% of consumers in rural areas prefer cash transactions that further discouraging businesses from investing in POS terminals. This cultural and behavioral resistance limits market penetration, especially in regions where digital literacy remains low. As a result, bridging the technological gap and fostering awareness about the benefits of modern POS systems remain critical challenges for market players seeking to achieve widespread adoption across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.31% |

|

Segments Covered |

By Component, Type, End-user Industries, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Ingenico Group (Worldline), NEC Corporation, NCR Corporation, Izettle UK (Paypal), and Verifone Inc. |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the market and held 55% of the Europe POS terminals market share in 2024 owing to its essential role of physical devices like card readers and self-service kiosks in facilitating transactions. According to the European Central Bank, contactless hardware systems accounted for over 70% of all payment devices in 2022 is driven by consumer demand for fast and secure payments. This segment's importance lies in its foundational role, as software and services depend on reliable hardware. However, high costs and rapid obsolescence challenge growth.

The software segment is likely to experience a CAGR of 18.1% from 2025 to 2033 with the adoption of cloud-based solutions, with the European Investment Bank reporting a 25% annual rise in businesses integrating AI-driven analytics. Software’s scalability and ability to enhance customer experience make it critical for modern POS systems. This segment’s rapid expansion is due to its transformative role in streamlining operations and boosting profitability across industries.

By Type Insights

Fixed point-of-sale terminal was the largest segment and held 65% of Europe POS terminals market share in 2024. Their dominance is attributed to their widespread use in established retail and hospitality sectors, where reliability and high transaction capacity are critical. According to the European Central Bank, fixed POS systems processed over 70% of all in-store transactions in 2022 by making them indispensable for businesses with permanent locations. These terminals support peripherals like barcode scanners and receipt printers by enhancing operational efficiency.

Mobile/portable POS terminals segment is anticipated to register a CAGR of 6.5% during the forecast period. This rapid growth is fueled by the rise of m-commerce and contactless payments, with the European Investment Bank reporting a 30% annual increase in adoption among SMEs since 2020. Their flexibility allows businesses to process payments anywhere by catering to trends like pop-up stores and food delivery services. According to the European Commission, over 65% of urban retailers now use mobile POS systems which is driven by consumer demand for seamless, on-the-go transactions. This segment’s adaptability and convenience make it pivotal for modernizing payment ecosystems across Europe.

By End-user Industries Insights

Retail segment dominated the market and held 50% of the Europe POS terminals market share in 2024 with the widespread adoption of POS systems for inventory management, contactless payments, and customer analytics. According to the European Commission, over 80% of retail outlets use POS terminals to enhance operational efficiency and deliver seamless omnichannel experiences. According to the Eurostat, 15% annual growth in POS adoption among small retailers from 2020 to 2022 was fueled by the rise of e-commerce and m-commerce. Features like loyalty program integration and real-time data processing make POS systems indispensable for retailer is enabling the companies to stay competitive and meet evolving consumer expectations.

Hospitality segment is estimated to witness a CAGR of 20.2% from 2025 to 2033. This rapid growth is attributed to the increasing demand for contactless dining and tableside payment solutions. According to the European Investment Bank, hospitality businesses adopting advanced POS systems achieved a 25% boost in operational efficiency between 2020 and 2022. Mobile POS devices, now used by over 60% of restaurants by enabling faster transactions and improve customer satisfaction, as per European Payments Council. The segment's focus on enhancing guest experiences and streamlining operations makes it a key driver of innovation in the POS terminals market in urban areas with high footfall and tourism activity.

REGIONAL ANALYSIS

Germany led the Europe POS terminals market with share of 22% in 2024 owing to its robust retail sector and high adoption of cashless payment systems that is driven by government initiatives promoting digitalization. According to the European Central Bank, Germany accounted for over 30% of all contactless transactions in Europe in 2022. Additionally, the country’s strong manufacturing base has spurred demand for advanced POS solutions in industries like automotive retail and hospitality. According to Eurostat, over 70% of German SMEs have adopted mobile POS systems by reflecting their commitment to innovation. The presence of key POS technology providers and a tech-savvy population further escalates the Germany’s position as a market leader.

The United Kingdom is esteemed to have a projected CAGR of 16% during the forecast period due to its highly developed e-commerce ecosystem and widespread adoption of contactless payments, which accounted for 80% of all transactions in 2022, according to the UK Finance organization. Post-Brexit regulatory adjustments have also encouraged businesses to adopt modern POS systems to streamline cross-border transactions. According to the British Retail Consortium, over 65% of retailers have integrated AI-driven POS software to enhance customer experience. The UK’s emphasis on innovation, coupled with its urbanized consumer base that ensures its prominence in driving POS terminal adoption across Europe.

France is likely to exhibit significant growth rate in the coming years with the improving hospitality and tourism sectors, where POS systems are critical for enhancing operational efficiency. According to the Banque de France, contactless payments grew by 40% annually between 2020 and 2022, with Paris being a major hub for POS innovation. Additionally, government incentives promoting cashless economies have accelerated adoption among small merchants, with Eurostat reporting a 25% rise in POS terminal usage in rural areas. France’s focus on integrating IoT-enabled POS devices in retail and healthcare further strengthens its market position by making it a key contributor to the region’s technological advancements.

KEY MARKET PLAYERS

The major players in the Europe pos terminals market include Ingenico Group (Worldline), NEC Corporation, NCR Corporation, Izettle UK (Paypal), and Verifone Inc.

MARKET SEGMENTATION

This research report on the Europe POS Terminals market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Type

- Fixed Point-of-Sale Terminals

- Mobile/Portable Point-of-Sale Terminals

By End-user Industries

- Entertainment

- Hospitality

- Healthcare

- Retail

- Other End-user Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe POS terminals market?

The growth of the Europe POS terminals market is driven by increasing adoption of cashless transactions, rising e-commerce penetration, growing demand for contactless payments, and government initiatives promoting digital payments.

Which industries are the largest adopters of POS terminals in Europe?

The retail and hospitality industries are the largest adopters of POS terminals in Europe, followed by healthcare, transportation, and entertainment sectors.

What trends are shaping the future of POS terminals in Europe?

Key trends shaping the future of POS terminals in Europe include the rise of cloud-based POS systems, integration of AI-driven analytics, biometric authentication, and increased adoption of omnichannel payment solutions.

What role does contactless payment technology play in the European POS market?

Contactless payment technology plays a significant role in the European POS market, as it enhances transaction speed, improves customer convenience, and aligns with consumer preferences for seamless, tap-and-go payments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]