Europe Polyurethane Market Size, Share, Trends & Growth Forecast Report By Type (Rigid Foam, Flexible Foam, Coatings, Adhesives, Sealants, and Elastomers (CASE), Thermoplastic Polyurethane, Other Types), End User Industry, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Polyurethane Market Size

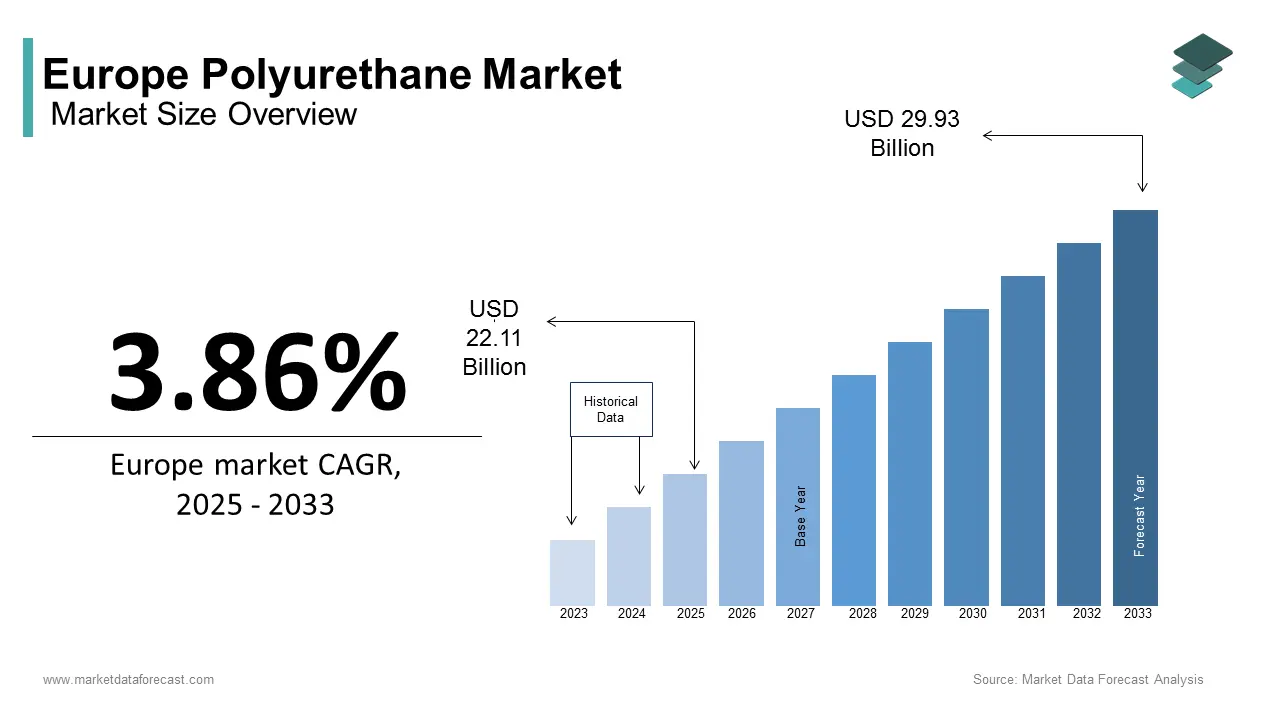

The European polyurethane market size was calculated to be USD 21.29 billion in 2024 and is anticipated to be worth USD 29.93 billion by 2033 from USD 22.11 billion In 2025, growing at a CAGR of 3.86% during the forecast period.

Polyurethane (PU) is a versatile polymer and is widely utilized across diverse sectors such as construction, automotive, furniture, appliances, and packaging due to its durability, thermal insulation properties, and adaptability. The demand for polyurethane has been growing gradually in the European market owing to the increasing demand for energy-efficient materials and lightweight solutions. The European Environment Agency reports that demand for eco-friendly PU products surged by 9% annually between 2020 and 2023, driven by consumer awareness and green procurement policies. Additionally, the rise of energy-efficient building practices has bolstered demand for rigid polyurethane foam in insulation applications. The UK Office for National Statistics notes that the construction sector alone consumes nearly 35% of total polyurethane, underscoring its dominance. Furthermore, advancements in polymer technologies have expanded the scope of polyurethane in automotive lightweighting and smart packaging solutions. As Europe continues to prioritize innovation and circular economy initiatives, the polyurethane market is poised for robust expansion.

MARKET DRIVERS

Increasing Demand for Energy-Efficient Insulation Materials

The growing demand for energy-efficient insulation materials is a major driver of the European polyurethane market. The European Environment Agency highlights that stringent EU regulations, such as the Energy Performance of Buildings Directive (EPBD), have mandated the use of high-performance insulation to reduce carbon emissions. Rigid polyurethane foam, which accounts for nearly 35% of total polyurethane consumption, is widely used in construction for its superior thermal insulation properties. Eurostat reports that the construction sector’s adoption of energy-efficient materials grew by 8% annually between 2020 and 2023, driven by urbanization and retrofitting projects. Additionally, the UK Office for National Statistics notes that investments in sustainable building practices surged by 12% in 2022, further boosting demand for polyurethane-based solutions. As Europe prioritizes decarbonization, rigid polyurethane foam remains indispensable in achieving energy efficiency goals.

Expansion in Automotive Lightweighting Applications

The expansion of automotive lightweighting applications is another key driver propelling the European polyurethane market. The European Automobile Manufacturers’ Association (ACEA) reports that the automotive sector’s shift toward lightweight materials to improve fuel efficiency and reduce carbon emissions has increased demand for flexible polyurethane foams and coatings. These materials are extensively used in seating, interior trims, and under-the-hood components due to their durability and lightweight properties. Eurostat highlights that the use of polyurethane in automotive applications grew by 7% annually from 2021 to 2023, supported by EU Green Deal targets for reducing vehicle emissions. Furthermore, FranceAgriMer notes that electric vehicles (EVs), projected to account for 20% of new car sales by 2025, are driving demand for advanced polyurethane solutions. This trend underscores the material’s critical role in shaping the future of sustainable mobility in Europe.

MARKET RESTRAINTS

Stringent Environmental Regulations on Raw Materials

Stringent environmental regulations targeting raw materials used in polyurethane production pose a significant challenge to the European market. The European Environment Agency highlights that key feedstocks, such as methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), are under scrutiny due to their hazardous nature and potential environmental impact. Eurostat reports that compliance with REACH regulations has increased production costs for manufacturers by up to 20%, particularly for small- and medium-sized enterprises. Additionally, FranceAgriMer notes that restrictions on volatile organic compounds (VOCs) emitted during polyurethane processing have forced companies to invest in cleaner technologies, further raising operational expenses. While these measures aim to reduce environmental harm, they also slow market growth by increasing barriers to entry and complicating supply chains, limiting the industry's ability to meet rising demand efficiently.

Volatility in Crude Oil Prices and Feedstock Costs

The volatility in crude oil prices and feedstock costs is another major restraint affecting the European polyurethane market. According to Eurostat, crude oil, a primary raw material for polyurethane precursors like polyols, experienced price fluctuations of up to 45% in 2022, driven by geopolitical tensions and supply chain disruptions. The European Chemical Industry Council (CEFIC) highlights that raw materials account for approximately 65% of total production costs, making manufacturers vulnerable to price instability. This volatility is exacerbated by Europe’s reliance on imported feedstock, subject to trade restrictions and logistical bottlenecks. The UK Office for National Statistics reports that rising input costs reduced profit margins for 35% of polyurethane producers in 2022, limiting their ability to innovate or expand capacity. These financial pressures hinder market growth and create uncertainties in meeting industrial demand.

MARKET OPPORTUNITIES

Growth in Bio-Based and Recyclable Polyurethane

The increasing focus on bio-based and recyclable polyurethane presents a significant opportunity for the European market. The European Environment Agency reports that demand for sustainable polymers is growing at a CAGR of 10% (2023-2028), driven by EU circular economy initiatives and consumer demand for eco-friendly products. Eurostat highlights that investments in bio-based polyurethane, derived from renewable sources like vegetable oils, surged by 15% in 2022, enabling manufacturers to produce greener alternatives for coatings, adhesives, and foams. Additionally, FranceAgriMer notes that recyclable polyurethane solutions are gaining traction, with their market share projected to reach 20% by 2030. As industries like construction and automotive prioritize sustainability, manufacturers are innovating to meet regulatory mandates and reduce carbon footprints. This shift positions bio-based and recyclable polyurethane as a key growth driver in Europe.

Expansion in Smart Packaging and Electronics

The rising demand for smart packaging and electronics applications offers another promising opportunity for the European polyurethane market. The UK Office for National Statistics reports that the use of polyurethane in protective coatings and encapsulants for electronics grew by 12% annually between 2020 and 2023, driven by advancements in IoT devices and wearable technology. Additionally, the European Plastics Converters Association (EuPC) highlights that polyurethane’s flexibility and durability make it ideal for smart packaging solutions, such as temperature-sensitive films for perishable goods. With Europe’s e-commerce sector projected to grow by 9% annually, as per Eurostat, the demand for innovative packaging materials is set to rise significantly. This trend underscores polyurethane’s critical role in supporting Europe’s technological advancements and sustainable packaging innovations.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity present significant challenges to the European polyurethane market. According to Eurostat, over 70% of key raw materials, such as methylene diphenyl diisocyanate (MDI) and polyols, are imported, making the industry vulnerable to trade restrictions and logistical bottlenecks. The European Chemical Industry Council (CEFIC) reports that supply chain disruptions caused a 30% increase in raw material costs in 2022, driven by geopolitical tensions and post-pandemic recovery efforts. Additionally, the UK Office for National Statistics highlights that delivery delays for critical inputs increased by 20%, straining production schedules. Smaller manufacturers, in particular, struggle to absorb these financial pressures, limiting their ability to compete or innovate. These challenges hinder production efficiency and create uncertainties in meeting rising demand across key sectors like construction and automotive.

Intense Competition from Substitute Materials

Intense competition from substitute materials poses another major challenge to the European polyurethane market. The European Environment Agency notes that alternatives like bioplastics, natural fibers, and polystyrene are gaining traction due to stricter environmental regulations and consumer preferences for sustainable options. FranceAgriMer reports that demand for substitutes in packaging and insulation applications grew by 15% annually between 2020 and 2023, driven by EU policies promoting recyclability and reduced carbon footprints. Additionally, Eurostat highlights that over 25% of traditional polyurethane applications, such as foam insulation and packaging films, face partial replacement by eco-friendly alternatives. While polyurethane remains versatile and cost-effective, its higher environmental impact compared to substitutes limits adoption in certain sectors, forcing manufacturers to invest in innovation and sustainable alternatives, increasing operational costs and slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.86% |

|

Segments Covered |

By Type, End use industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Covestro, BASF, Huntsman Corporation, Dow Inc., Wanhua Chemical Group, Recticel, Vita Group, Armacell. |

SEGMENTAL ANALYSIS

By Type Insights

The rigid foam segment held the major share of 41.4% of the European market share in 2024. The domination of rigid foam segment is majorly driven by widespread applications in thermal insulation for construction and appliances. The European Environment Agency highlights that rigid polyurethane foam is a preferred material for energy-efficient building practices, mandated by EU regulations such as the Energy Performance of Buildings Directive (EPBD). Additionally, the UK Office for National Statistics notes that the construction sector alone consumes nearly 50% of rigid foam, underscoring its critical role in reducing carbon emissions through improved insulation. As Europe prioritizes decarbonization and sustainable infrastructure, rigid foam remains pivotal in driving energy efficiency and supporting green building initiatives.

The thermoplastic polyurethane (TPU) segment is the fastest-growing type in the European polyurethane market and is expected to register a CAGR of 8.5% during the forecast period owing to the increasing demand in high-performance applications such as automotive lightweighting, medical devices, and electronics. FranceAgriMer reports that TPU’s superior flexibility, durability, and resistance to abrasion make it ideal for manufacturing flexible cables, protective coatings, and wearable technology components. Additionally, the European Plastics Converters Association (EuPC) highlights that advancements in polymer technologies have expanded TPU’s use in smart packaging and 3D printing materials. With industries seeking innovative solutions for durable and versatile materials, thermoplastic polyurethane is set to play a transformative role in shaping the future of the polyurethane market.

By End-user Industry Insights

The building and construction segment is the largest end-user segment in the European polyurethane market and held 35.3% of the European market share in 2024. The dominance of building and construction segment is majorly attributed to the widespread use of rigid polyurethane foam for thermal insulation in residential, commercial, and industrial buildings. The European Environment Agency emphasizes that stringent EU regulations, such as the Energy Performance of Buildings Directive (EPBD), have accelerated the adoption of energy-efficient materials to reduce carbon emissions. Additionally, the UK Office for National Statistics notes that retrofitting projects and urbanization trends have further propelled demand for polyurethane-based solutions in construction. With Europe prioritizing sustainable infrastructure and green building practices, this segment remains pivotal in driving market growth.

The electronics and appliances segment is estimated to showcase a CAGR of 9.2% during the forecast period. Factors such as the increasing demand for polyurethane in protective coatings, encapsulants, and insulating foams used in electronic devices, household appliances, and IoT-enabled technologies is propelling the expansion of the electronics and appliances segment in the European market. FranceAgriMer reports that advancements in smart home systems and wearable electronics have significantly boosted the use of thermoplastic polyurethane (TPU) and flexible foams. Additionally, the European Plastics Converters Association (EuPC) highlights that polyurethane’s durability, thermal stability, and electrical insulation properties make it indispensable for high-performance applications. As Europe continues to lead in technological innovation, this segment is set to play a transformative role in shaping the future of the polyurethane market.

REGIONAL ANALYSIS

Germany held 32.9% of the European market share in 2024. The leading role of Germany in the European market is primarily attributed to its robust manufacturing base, particularly in automotive, construction, and appliances, which are intensive users of polyurethane foams and coatings. The Federal Ministry for Economic Affairs and Climate Action highlights Germany’s leadership in adopting energy-efficient building practices, supported by EU regulations like the Energy Performance of Buildings Directive (EPBD). France follows with an 18% share, driven by its strong construction sector and demand for insulation materials, as noted by France AgriMer. The UK secures third place with a 15% share, fuelled by rising investments in sustainable infrastructure and smart packaging solutions, as per the UK Office for National Statistics. These nations lead due to their diversified industrial ecosystems, focus on sustainability, and alignment with EU environmental policies.

France captured a substantial share of the European market in 2024 and is likely to play a major role in the European market over the forecast period. The thriving construction sector of France, where rigid polyurethane foam is extensively used for thermal insulation in residential and commercial buildings is propelling the French market expansion. The adherence of France to EU environmental regulations has accelerated the adoption of energy-efficient materials, meeting consumer demand for sustainable solutions. Additionally, the country’s growing emphasis on retrofitting projects and urbanization trends has increased demand for polyurethane-based solutions. With its reputation for innovation and commitment to green building practices, France continues to be a significant contributor to the growth of the polyurethane market, reinforcing its importance in Europe.

The UK is another regional segment in the European polyurethane market and is expected to account for a notable share of the European market over the forecast period. The growth of the UK market is fueled by rising investments in sustainable infrastructure, smart packaging solutions, and energy-efficient appliances. The surge in retrofitting projects and modern housing developments has bolstered demand for rigid polyurethane foam in insulation applications. Additionally, the UK’s focus on reducing carbon emissions through innovative materials aligns with EU Green Deal targets, driving the adoption of eco-friendly polyurethane solutions. This focus on sustainability and technological advancements underscores the UK’s importance in the European polyurethane landscape.

LEADING PLAYERS IN THE MARKET

The European polyurethane market is led by BASF, Covestro, and Huntsman. BASF dominates the market in Europe. Covestro excels in bio-based polyurethane, achieving a 25% market share in sustainable solutions, as stated in their performance metrics. Huntsman plays a pivotal role in lightweight materials, with a 30% share in automotive applications, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the polyurethane market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European polyurethane market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, BASF launched a line of bio-based polyurethane solutions in 2022, designed to cater to eco-conscious consumers, as outlined in their innovation roadmap. Covestro partnered with automotive manufacturers to promote its lightweight polyurethane foams, achieving a 20% increase in sales, as stated in their market strategy document. Huntsman focused on expanding its sustainable materials portfolio, investing €500 million to meet growing demand for recyclable options, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

The European polyurethane market is highly competitive, characterized by the presence of global giants and regional innovators. BASF, Covestro, and Huntsman dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as bio-based polyurethane and smart coatings. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, BASF launched a line of bio-based polyurethane solutions, designed to cater to eco-conscious consumers.

- In June 2023, Covestro partnered with automotive manufacturers to promote its lightweight polyurethane foams, achieving a 20% increase in sales.

- In January 2024, Huntsman acquired a startup specializing in sustainable materials, aiming to expand its eco-friendly portfolio.

- In September 2023, Dow Chemical collaborated with electronics manufacturers to integrate smart coatings into their products, enhancing efficiency.

- In November 2023, Covestro invested €300 million in expanding its bio-based polyurethane production facilities, focusing on circular economy initiatives.

MARKET SEGMENTATION

This research report on the European Polyurethane market has been segmented and sub-segmented based on type, end-use, and region.

By Type

- Rigid Foam

- Flexible Foam

- Coatings, Adhesives, Sealants, and Elastomers (CASE)

- Thermoplastic Polyurethane

- Other Types

By End-user Industry

- Furniture

- Building and Construction

- Electronics and Appliances

- Automotive

- Footwear

- Packaging

- Other End-user Industries

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors influence polyurethane prices in Europe?

Prices are affected by raw material costs (such as isocyanates and polyols), supply chain disruptions, demand from key industries, and environmental regulations.

2. Which countries are the largest producers of polyurethane in Europe?

Germany, France, Italy, and the Netherlands are major polyurethane producers due to strong industrial and manufacturing bases.

3. How is polyurethane manufactured in Europe?

Polyurethane is produced by reacting polyols with isocyanates, often with catalysts and additives, to create different forms such as foams, coatings, and elastomers.

4. Who regulates the polyurethane market in Europe?

The European Chemicals Agency (ECHA) and the European Commission regulate polyurethane production, safety, and environmental impact.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]