Europe Polypropylene Market Size, Share, Trends & Growth Forecast Report By Polymer Type (Homopolymer, Copolymer), Process, Application, End-use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Polypropylene Market Size

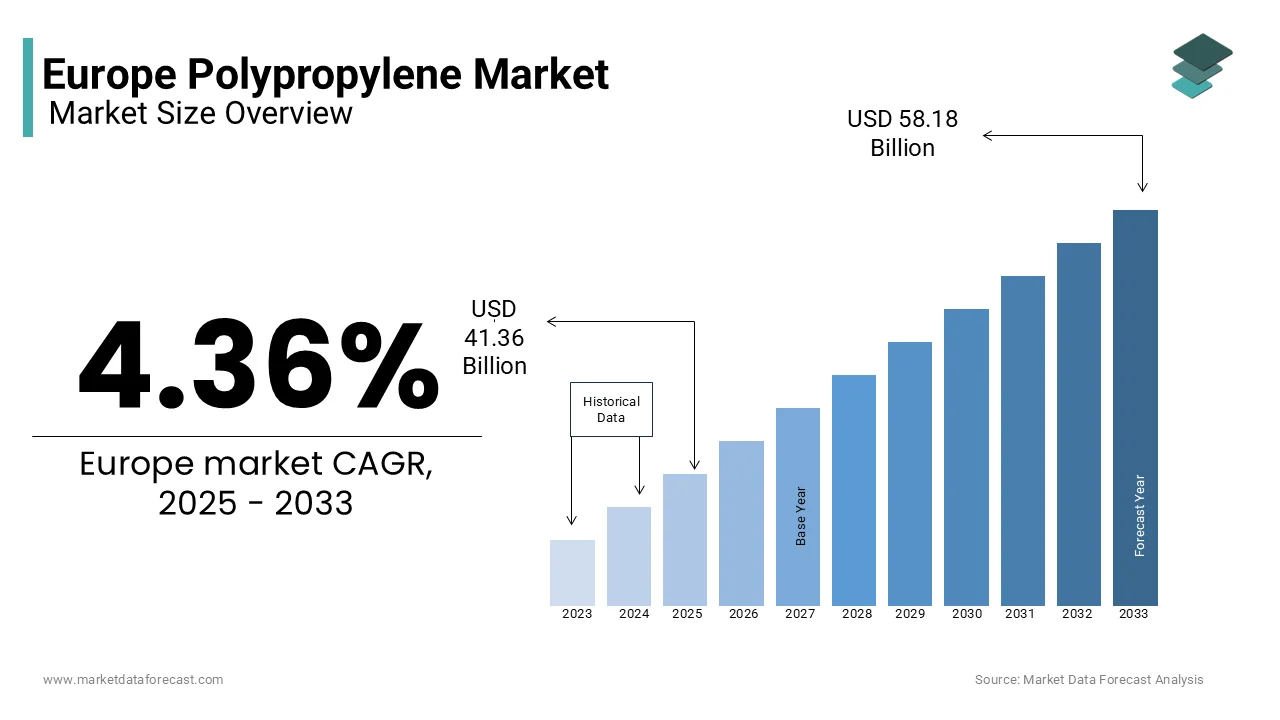

The Polypropylene market size in Europe was valued at USD 39.63 billion in 2024. The European market is estimated to be worth USD 58.18 billion by 2033 from USD 41.36 billion in 2025, growing at a CAGR of 4.36% from 2025 to 2033.

Polypropylene, a thermoplastic polymer, is known for its exceptional qualities, including high tensile strength, chemical resistance, and versatility. These attributes make it a preferred material in packaging, automotive components, textiles, consumer goods, and construction products.

In Europe, polypropylene plays a crucial role in packaging, particularly in food preservation and hygiene, owing to its lightweight and durable nature. Its widespread adoption in the automotive industry stems from its ability to reduce vehicle weight by enhancing fuel efficiency while maintaining strength and reliability. Furthermore, polypropylene is essential in producing medical equipment, such as syringes and surgical masks due to its importance in healthcare.

As sustainability becomes a focal point in Europe, advancements in recycling technologies have gained traction. Polypropylene's recyclability aligns well with the European Union’s environmental directives, which emphasize reducing plastic waste and promoting circular economies. This transition has fostered the exploration of bio-based polypropylene, derived from renewable resources, as a greener alternative. These ongoing efforts leverages the polypropylene's enduring relevance and its potential to support Europe's drive toward sustainability and innovation in various sectors.

MARKET DRIVERS

Growth in the Building and Construction Industry

The building and construction sector in Europe is a significant driver of the polypropylene market due to its extensive use in applications like air and moisture barrier membranes, carpet textiles, industrial adhesives, and piping. Additionally, Italy’s construction industry grew by 8.6% in 2021, driven by a 14% increase in housing redevelopment and a 3.5% rise in new housing construction, according to the National Association of Building Contractors (ANCE). This surge is due to the rising demand for polypropylene-based materials in the construction sector.

Increasing Demand in the Automotive Industry

The growing scale of the automotive sector is another factor that is fuelling the growth rate of the European polypropylene market. Polypropylene is used extensively in automotive components like bumpers, cable insulation, interior wrappings, and wheel covers due to its moldability, tensile strength, and lightweight properties. According to the International Organization of Motor Vehicle Manufacturers (OICA), France's automobile production, including cars and commercial vehicles, reached 1,351,308 units in 2021 by reflecting a 3% increase from 2020.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Pressures

The European polypropylene market faces challenges due to growing environmental concerns and stringent regulations. Although polypropylene is recyclable, its recycling rate remains low, creating environmental strain. According to the European Environment Agency, only 14% of plastic packaging waste in Europe was recycled in 2020, with a significant portion ending up in landfills or as pollutants. The European Union has introduced measures such as the Single-Use Plastics Directive, which bans certain products like plastic cutlery and plates, limiting polypropylene use in specific applications. Furthermore, the European Green Deal aims to achieve a 55% reduction in greenhouse gas emissions by 2030, pressuring manufacturers to adopt more sustainable practices, increasing compliance costs, and impacting market dynamics.

Volatility in Raw Material Prices

The volatility of raw material prices, particularly propylene derived from crude oil, is a major restraint for the polypropylene market in Europe. Price fluctuations directly impact production costs, disrupting supply chains and profit margins. According to the European Commission's Directorate-General for Energy, Brent crude oil prices ranged from $9.12 per barrel in April 2020 to over $70 per barrel in 2021, showcasing significant instability. Geopolitical factors, such as the Russia-Ukraine conflict, have further strained supply chains and escalated raw material prices. Additionally, in 2022, the EU’s increased reliance on imports for feedstocks like naphtha and ethylene exacerbated cost challenges, adding to the financial burden on polypropylene manufacturers and restraining market growth.

MARKET OPPORTUNITIES

Expansion in the Packaging Industry

The use of polypropylene in packaging is creating significant opportunities for the polypropylene market. Polypropylene's lightweight, durable, and chemical-resistant properties make it ideal for packaging applications, particularly in the food and beverage sector. Polypropylene accounting for a substantial share due to its versatility and cost-effectiveness. The increasing demand for convenient and sustainable packaging solutions is expected to drive the adoption of polypropylene in this sector. Additionally, the European Commission's Circular Economy Action Plan aims to make all packaging recyclable by 2030 by encouraging the use of recyclable materials like polypropylene and fostering market growth.

Advancements in Automotive Applications

Polypropylene's lightweight and durable characteristics make it a preferred material for automotive components such as bumpers, interior trims, and under-the-hood parts. This factor is attributed in leveraging the growth rate of the market. In 2021, the European automotive industry produced approximately 16.5 million vehicles, with a significant portion incorporating polypropylene-based components to reduce weight and enhance fuel efficiency. The European Commission's Green Deal aims to reduce carbon emissions from the transport sector, further driving the demand for lightweight materials like polypropylene. This regulatory push, combined with consumer preference for fuel-efficient vehicles, is expected to bolster the use of polypropylene in automotive manufacturing.

MARKET CHALLENGES

Intensifying Global Competition

The increasing global competition is one of the key challenging factor for the Europe polypropylene market. The manufacturing capabilities in regions like China and the United States is causing huge competition between the industries which is also to hamper the growth rate of the market. These regions benefit from lower production costs and greater access to raw materials, which allows them to offer more competitive pricing. This has led to a shift in the market dynamics, with European polypropylene producers struggling to keep pace. As a result, European manufacturers are forced to innovate and improve efficiency to stay relevant. Moreover, the shift in global trade patterns has further intensified competition by making it difficult for Europe to dominate in key sectors.

High Energy Costs

High energy costs represent another significant challenge for the European polypropylene market. Polypropylene production is energy-intensive, and in recent years, energy prices in Europe have seen substantial increases. This puts additional financial pressure on manufacturers, especially when compared to regions where energy costs are lower. The rising energy costs have led to a decline in manufacturing output, as some plants are unable to remain profitable under these conditions. Furthermore, energy price volatility impacts the stability of production by making it harder for companies to plan and budget effectively. This challenge forces European polypropylene producers to seek alternatives or restructure their operations to remain competitive.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Polymer Type, Process, Application, Chemical Structure, End-use and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

ExxonMobil Chemical (U.S.), China National Petroleum Corporation (China), INEOS (United Kingdom), China Petroleum & Chemical Corporation (China), SABIC (Saudi Arabia), Ducor Petrochemicals (Netherlands), Reliance Industries Limited (India), Formosa Plastic Group (Taiwan), Total S.A. (France), BASF SE (Germany), Repsol (Spain), Borouge (UAE), Borealis AG (Austria), MOL Group (Hungary), and others. |

SEGMENTAL ANALYSIS

By Type Insights

The homopolymer segment was the largest and held Europe polypropylene market share of 54.7% in 2024. This is driven by its superior rigidity and thermal resistance by appealing to industries like automotive and packaging. For instance, in Germany, homopolymer accounted for over 70% of all automotive-grade polypropylene sales, as per the German Automotive Federation. A key factor behind the segment’s dominance is the growing preference for cost-effective and widely available options. According to Eurostat, homopolymer reduces manufacturing costs by 15% while maintaining performance standards by ensuring compliance with industry requirements. Additionally, advancements in polymer blends have addressed previous concerns about brittleness by enhancing appeal.

The copolymer segment is projected to witness a significant CAGR of 7.2% from 2025 to 2033. This growth is fueled by its excellent impact resistance and flexibility by appealing to industries like healthcare and electronics. For example, in France, copolymer gained immense popularity, with sales surging by 40% in 2022, as per the French Healthcare Federation. A significant driver of this segment’s rapid expansion is the growing emphasis on specialized applications. Additionally, advancements in multi-component systems have improved effectiveness by addressing previous concerns about performance.

By Process Insights

The injection molding segment dominated the Europe polypropylene market with an estimated share of 43.2% in 2024 owing to its versatility and ability to produce complex shapes with high precision by appealing to industries like automotive and consumer goods. For instance, in Italy, over 80% of polypropylene components are manufactured using injection molding, as per the Italian Manufacturing Association. A key factor behind the segment’s dominance is the growing trend of automation and mass production. Additionally, the availability of advanced machinery has broadened its appeal, ensuring sustained growth. These attributes ensure that injection molding remains the primary driver of the market.

The extrusion segment is esteemed to register a CAGR of 6.3% from 2025 to 2033. This growth is fueled by its suitability for producing films, sheets, and pipes by appealing to industries like packaging and construction. For example, in the UK, extruded polypropylene films gained immense popularity, with sales surging by 35% in 2022, as per the British Packaging Federation. A significant driver of this segment’s rapid expansion is the growing emphasis on lightweight and durable materials. According to McKinsey & Company, extruded polypropylene products reduce material usage by 20% while maintaining performance by creating a niche for innovative solutions. Additionally, advancements in co-extrusion technologies have improved layer adhesion by addressing previous concerns about durability.

By Application Insights

The fiber segment dominated the Europe polypropylene market by capturing 40.3% of share in 2024. This prominence is driven by its widespread use in textiles, carpets, and geotextiles by appealing to industries like construction and fashion. For instance, in Turkey, polypropylene fibers accounted for over 60% of all textile-grade polymer sales, as per the Turkish Textile Manufacturers Association. A key factor behind the segment’s dominance is the growing preference for cost-effective and durable materials. According to Eurostat, polypropylene fibers reduce production costs by 25% while improving tensile strength by ensuring compliance with industry standards. Additionally, advancements in fiber spinning technologies have addressed previous concerns about elasticity.

The film and sheet segment is projected to exhibit a CAGR of 8.3% from 2025 to 2033. This growth is fueled by its extensive use in packaging, agriculture, and industrial applications by appealing to industries seeking lightweight and recyclable solutions. For example, in Spain, polypropylene films gained immense popularity, with sales surging by 40% in 2022, as per the Spanish Packaging Federation. A significant driver of this segment’s rapid expansion is the growing emphasis on sustainable packaging. Additionally, advancements in biaxial orientation have improved mechanical properties, addressing previous concerns about tear resistance.

By Chemical Structure Insights

The isotactic polypropylene dominated the Europe polypropylene market share in 2024. This growth is driven by its high crystallinity and mechanical strength, appealing to industries like automotive and packaging. For instance, in Germany, isotactic polypropylene accounted for over 80% of all injection-molded applications, as per the German Chemical Industry Association.

A key factor behind the segment’s dominance is the growing preference for high-performance materials. According to Eurostat, isotactic polypropylene improves tensile strength by 25% while maintaining thermal stability by ensuring compliance with industry requirements. Additionally, advancements in polymerization techniques have enhanced its processability by addressing previous concerns about brittleness and heat resistance.

The syndiotactic polypropylene segment is inclined to have a fastest CAGR of 9.1% in the enxt coming years. This growth is fueled by its unique properties, such as improved clarity and impact resistance, which make it suitable for specialized applications like medical devices and optical films. For example, in France, syndiotactic polypropylene gained significant traction, with sales surging by 45% in 2022, as per the French Healthcare Federation. A significant driver of this segment’s rapid expansion is the growing emphasis on advanced materials for niche industries. Additionally, advancements in metallocene catalysts have improved polymer consistency, addressing previous concerns about scalability and cost-efficiency.

By End-Use Insights

The packaging segment was the largest and held 35.4% of the Europe polypropylene market share in 2024. This growth is driven by its widespread use in flexible and rigid packaging solutions, appealing to industries like food and beverage, pharmaceuticals, and e-commerce. For instance, in France, polypropylene-based packaging accounted for over 70% of all food-grade polymer sales, as per the French Packaging Federation. A key factor behind the segment’s dominance is the growing emphasis on lightweight and recyclable materials. According to Eurostat, polypropylene reduces packaging weight by 20% while maintaining durability by aligning with consumer preferences for sustainability. Additionally, advancements in transparent and heat-resistant formulations have broadened its appeal, ensuring sustained demand.

The Medical segment is quickly growing with an anticipated CAGR of 8.6% during the forecast period. This growth is fueled by the increasing demand for sterilizable and durable materials in healthcare devices and equipment. For example, in Germany, polypropylene-based medical components gained immense popularity, with sales surging by 40% in 2022, as per the German Healthcare Federation.A significant driver of this segment’s rapid expansion is the growing emphasis on advanced healthcare solutions. Additionally, government funding for healthcare infrastructure has encouraged investments in high-performance materials by addressing previous concerns about cost-efficiency.

REGIONAL ANALYSIS

Germany was the top performer in the Europe polypropylene market with a share of 25.4% in 2024. The country’s robust industrial base and emphasis on technological innovation have positioned it as a leader in the region. For instance, global brands like BASF SE are renowned for their high-performance polypropylene grades by catering to diverse industries such as automotive, packaging, and healthcare. A key factor driving Germany’s success is its proactive adoption of sustainable practices. According to the German Environmental Ministry, over 60% of German manufacturers prioritize bio-based and recyclable polypropylene solutions, encouraging investments in eco-friendly alternatives. Additionally, the rise of digital platforms has enabled German brands to reach a broader audience, further boosting demand.

Italy polypropylene market is likely to grow with a CAGR of 4.5% during the forecast period. The country’s strong emphasis on design and quality has escalated its position as a key player. For instance, Italian brands like Versalis dominate the mid-tier segment by appealing to cost-conscious yet performance-focused consumers. A significant driver of Italy’s dominance is its focus on export-oriented growth and innovation. According to the Italian Manufacturing Association, over 50% of Italian polypropylene production is exported is reflecting its global appeal. Additionally, as per Deloitte, the integration of digital marketing strategies has enhanced brand visibility by encouraging younger demographics to explore advanced polypropylene solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in Europe Polypropylene market are ExxonMobil Chemical (U.S.), China National Petroleum Corporation (China), INEOS (United Kingdom), China Petroleum & Chemical Corporation (China), SABIC (Saudi Arabia), Ducor Petrochemicals (Netherlands), Reliance Industries Limited (India), Formosa Plastic Group (Taiwan), Total S.A. (France), BASF SE (Germany), Repsol (Spain), Borouge (UAE), Borealis AG (Austria), MOL Group (Hungary), and others.

The Europe polypropylene market is characterized by intense competition, with established brands and emerging startups vying for market share. Key players like BASF and LyondellBasell dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like GreenPoly are pioneering bio-based polypropylene solutions, challenging incumbents in the sustainability segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users.

TOP PLAYERS IN THE EUROPE POLYPROPYLENE MARKET

The Europe polypropylene market is led by three key players: BASF SE, LyondellBasell Industries, and SABIC, each contributing significantly to the global market. BASF SE, headquartered in Germany, holds a substantial presence in Europe, offering iconic products like Ultramid and Lupolen.

LyondellBasell, based in the Netherlands, specializes in high-performance polypropylene grades, with a growing footprint in markets like automotive and packaging. Meanwhile, SABIC, a Saudi firm with a strong European presence is renowned for its innovative solutions in film and sheet applications. These players collectively drive innovation and set benchmarks for the Europe polypropylene market.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the Europe polypropylene market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, BASF announced a commitment to achieving carbon neutrality across its production facilities by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, LyondellBasell launched a line of bio-based polypropylene products targeting environmentally conscious buyers. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the European Investment Bank, SABIC has invested heavily in advanced recycling technologies to cater to the growing demand for recyclable materials. These strategies reflect a commitment to innovation and market dominance.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF acquired a Dutch startup specializing in advanced recycling technologies. This acquisition aimed to expand its portfolio of recyclable polypropylene solutions and cater to environmentally conscious buyers.

- In May 2024, LyondellBasell partnered with a German e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, SABIC introduced a line of biodegradable polypropylene products targeting sustainable packaging manufacturers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, GreenPoly secured USD 50 million in funding from European investors to scale its bio-based polypropylene initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, BASF launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the Europe polypropylene market is segmented and sub-segmented into the following categories.

By Polymer Type

- Homopolymer

- Copolymer

By Process

- Injection Molding

- Blow Molding

- Extrusion Molding

- Others

By Application

- Fiber

- Film & Sheet

- Raffia

- Others

By Chemical Structure

- Isotactic

- Syndiotactic

- Atactic

By End-use

- Automotive

- Building & Construction

- Packaging

- Medical

- Electrical & Electronics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the market size of the Europe Polypropylene Market in 2024?

The Europe Polypropylene Market was valued at USD 39.63 billion in 2024.

2. What factors are driving the growth of the Europe Polypropylene Market?

The market growth is driven by factors such as increasing demand from the packaging, automotive, and construction industries, rising adoption of lightweight materials, and advancements in polypropylene manufacturing technologies.

3. What challenges could impact the growth of the market?

Challenges include fluctuations in raw material prices, environmental concerns regarding plastic waste, and stringent government regulations on plastic usage.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]