Europe Polyhydroxyalkanoate (PHA) Market Size, Share, Trends & Growth Forecast Report By Type (Short Chain, Length Medium, Chain Length), Form, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Polyhydroxyalkanoate (PHA) Market Size

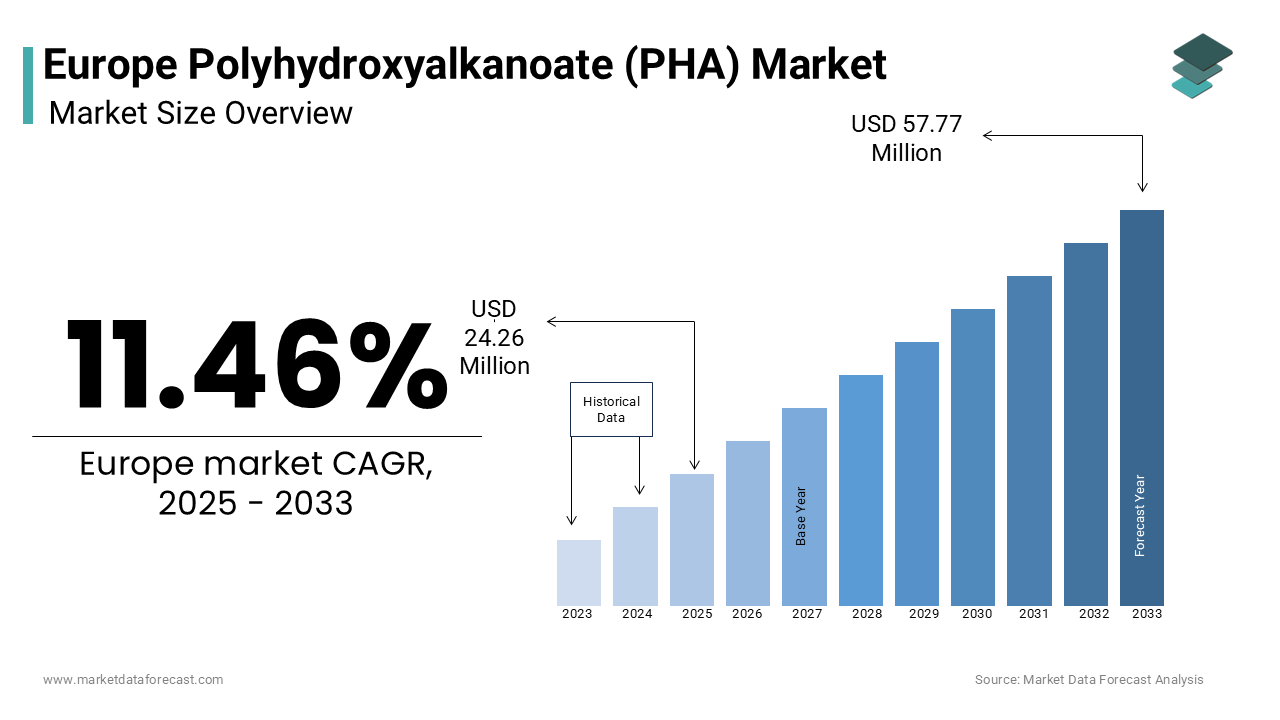

The europe polyhydroxyalkanoate (PHA) market was worth USD 21.76 million in 2024. The European market is estimated to grow at a CAGR of 11.46% from 2025 to 2033 and be valued at USD 57.77 million by the end of 2033 from USD 24.26 million in 2025.

Polyhydroxyalkanoate (PHA) is produced by microbial fermentation of organic materials, making it a sustainable alternative to conventional petroleum-based plastics. The increasing awareness of environmental issues and the detrimental effects of plastic pollution have catalyzed the demand for biodegradable materials is positioning PHA as a viable solution.

The versatility of PHA allows for its application across various industries, including packaging, agriculture, biomedical, and consumer goods. Its biodegradability and compatibility with existing manufacturing processes make it an attractive option for companies seeking to enhance their sustainability profiles. As the European Union implements stricter regulations on plastic waste and promotes the circular economy, the PHA market is poised for significant growth. The future of the European PHA market will be shaped by advancements in production technologies, increasing consumer demand for sustainable products, and the ongoing transition towards a more circular economy.

MARKET DRIVERS

Growing Environmental Awareness and Regulatory Support

The increasing environmental awareness among consumers and businesses is a significant driver of the European PHA market. As concerns about plastic pollution and its impact on ecosystems escalate, there is a growing demand for sustainable alternatives to conventional plastics. According to a survey conducted by the European Commission, approximately 85% of Europeans believe that reducing plastic waste is a priority, leading to a shift in consumer preferences towards biodegradable materials. This heightened awareness has prompted manufacturers to seek eco-friendly solutions, positioning PHA as a viable option. Moreover, regulatory support from the European Union further bolsters the demand for PHA. The EU has implemented various directives aimed at reducing single-use plastics and promoting the use of biodegradable materials. For instance, the Single-Use Plastics Directive aims to ban certain single-use plastic items and encourages the adoption of sustainable alternatives.

Advancements in Production Technologies

Advancements in production technologies for PHA are another key driver propelling the European market. Innovations in microbial fermentation processes and genetic engineering have significantly improved the efficiency and cost-effectiveness of PHA production. As per a report by the European Bioplastics Association, the production capacity of PHA in Europe is expected to increase by over 30% by 2025 which is driven by technological advancements and investments in research and development. These advancements enable manufacturers to produce PHA at a lower cost and with higher yields, making it a more competitive alternative to conventional plastics. Additionally, the development of new PHA formulations with tailored properties allows for a broader range of applications, further enhancing its market potential.

MARKET RESTRAINTS

High Production Costs

Elevated production costs associated with PHA manufacturing is hindering the growth of the European PHA market. Despite advancements in production technologies, the cost of producing PHA remains higher than that of conventional petroleum-based plastics. According to industry estimates, the production cost of PHA can be up to 30% higher than that of traditional plastics, primarily due to the expenses related to raw materials, fermentation processes, and downstream processing. This cost disparity can hinder the widespread adoption of PHA, particularly in price-sensitive markets. Moreover, the limited availability of feedstock for PHA production can further exacerbate cost challenges. While PHA can be produced from various organic materials, the competition for these feedstocks with other industries, such as food and feed, can lead to price fluctuations and supply constraints.

Limited Awareness and Acceptance

Another notable restraint is the limited awareness and acceptance of PHA among consumers and businesses. In spite of the growing interest in sustainable materials, many stakeholders remain unfamiliar with the benefits and applications of PHA. In line with a survey conducted by the European Bioplastics Association, approximately 40% of consumers reported a lack of knowledge about biodegradable plastics, including PHA. This lack of awareness can hinder market growth, as consumers may be hesitant to choose products made from unfamiliar materials. Additionally, businesses may be reluctant to invest in PHA due to concerns about performance, processing compatibility, and regulatory compliance. The transition from conventional plastics to biodegradable alternatives requires significant changes in manufacturing processes and supply chains, which can pose challenges for companies.

MARKET OPPORTUNITIES

Expansion of Biodegradable Packaging Solutions

The expansion of biodegradable packaging solutions presents a significant opportunity for the European PHA market. The consumers increasingly demand sustainable packaging options, manufacturers are seeking alternatives to conventional plastics that contribute to environmental pollution. PHA, with its biodegradable properties and versatility, is well-positioned to meet the rising demand for eco-friendly packaging solutions. Manufacturers can capitalize on this opportunity by developing innovative packaging products that utilize PHA, catering to various industries, including food and beverage, cosmetics, and consumer goods. The ability of PHA to decompose naturally in various environments makes it an attractive option for companies looking to enhance their sustainability profiles.

Growth of the Biomedical Sector

The growth of the biomedical sector offers another promising opportunity for the European PHA market. PHA's biocompatibility and biodegradability make it an ideal material for various medical applications, including drug delivery systems, sutures, and tissue engineering scaffolds. Since the demand for sustainable and biocompatible materials in the biomedical sector continues to rise, manufacturers can leverage this opportunity by developing innovative PHA-based products that meet the specific needs of healthcare applications. The ability of PHA to degrade safely in the body without causing adverse reactions positions it as a valuable alternative to traditional synthetic materials. As the biomedical sector develops towards more sustainable practices, the European PHA market is well-positioned to capitalize on this trend, fostering innovation and expanding market opportunities.

MARKET CHALLENGES

Competition from Conventional Plastics

One of the primary challenges facing the European PHA market is the intense competition from conventional plastics. Apart from the growing awareness of environmental issues, traditional petroleum-based plastics remain dominant in many applications due to their established supply chains, lower costs, and widespread availability. As per a report by PlasticsEurope, the global production of conventional plastics reached 368 million tons in 2020, highlighting the significant market share held by traditional materials. This landscape can pose challenges for PHA manufacturers in terms of market penetration and pricing. Moreover, the performance characteristics of conventional plastics, such as durability and processing ease, often surpass those of PHA, making it difficult for biodegradable alternatives to gain traction in certain applications.

Supply Chain Vulnerabilities

A key issue is the potential for supply chain vulnerabilities which can impact the availability and pricing of raw materials used in PHA production. The COVID-19 pandemic has highlighted vulnerabilities in global supply chains, leading to shortages and delays in the procurement of essential materials. A survey conducted by the European Chemicals Industry Council states nearly 60% of chemical manufacturers reported disruptions in their supply chains due to the pandemic, affecting their ability to meet production demands. Additionally, geopolitical tensions and trade disputes can further exacerbate supply chain challenges, leading to increased costs and uncertainty in the market. Ensuring a reliable supply of raw materials is crucial for the long-term sustainability and competitiveness of the European PHA market.

SEGMENTAL ANALYSIS

By Type Insights

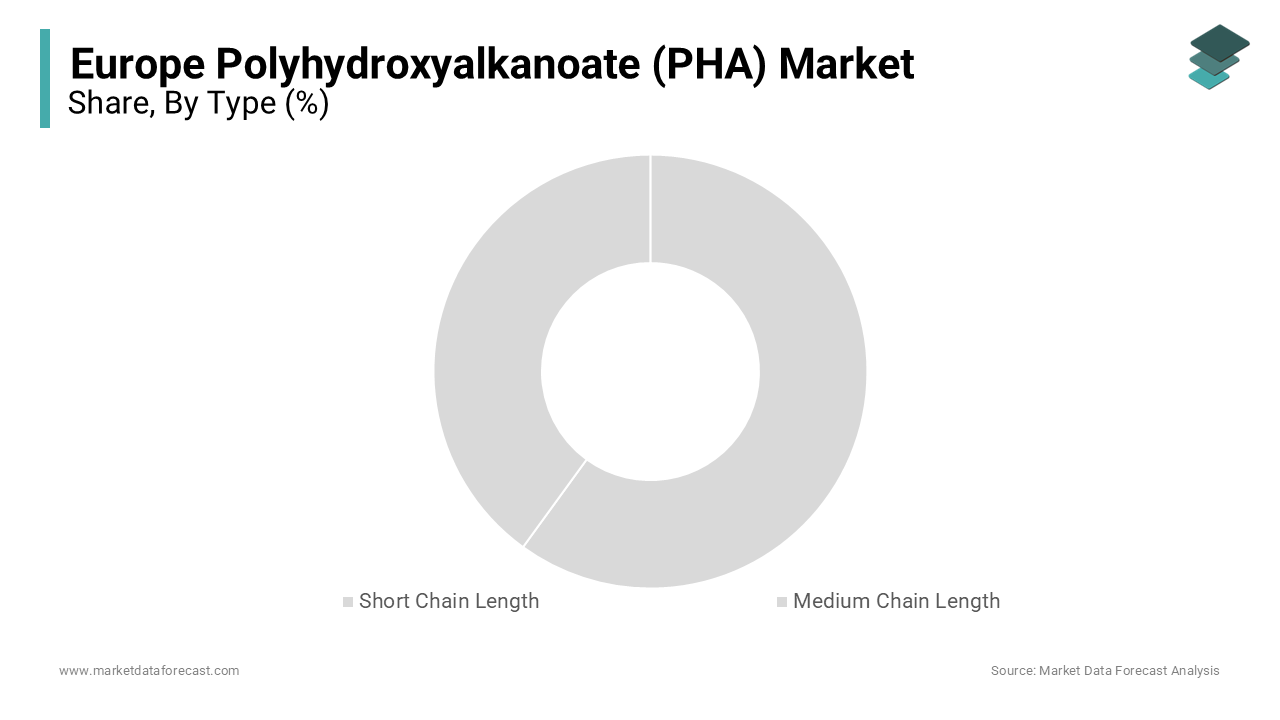

The European PHA market's short chain length PHA segment emerged as the highest contributor and captured 60.2% of the total market share in 2024 owing to the widespread use of short chain length PHAs in various applications, including packaging, agricultural films, and disposable items. The importance is illustrated by its versatility and biodegradability. Short chain length PHAs, such as polyhydroxybutyrate (PHB), are known for their excellent mechanical properties and biodegradability is making them suitable for a wide range of applications. The growing emphasis on sustainability and the circular economy has further bolstered the demand for short chain length PHAs, as they can be easily integrated into existing manufacturing processes.

The medium chain length PHA segment is seen as the fastest-growing category within the European PHA market, with a projected CAGR of 14.3% during the coming years. This can be credited to the increasing recognition of medium chain length PHAs such as polyhydroxyhexanoate (PHH) for their unique properties and potential applications in various industries. The rising trend of incorporating biodegradable materials into medical applications is a key driver of growth in the medium chain length PHA segment. Medium chain length PHAs exhibit enhanced flexibility and elasticity, making them suitable for applications such as drug delivery systems and tissue engineering scaffolds.

By Form Insights

The co-polymerized PHA segment positioned as the dominant one in the European PHA market by taking control of the 55.5% of the total market share in 2024. This place in this market is supported by the versatility and enhanced properties of co-polymerized PHAs, which are utilized in various applications including packaging, agricultural films, and consumer goods. The segment is made relevant by its capability to combine the beneficial properties of different monomers and is resulting in materials with tailored characteristics. Co-polymerized PHAs exhibit improved mechanical properties, flexibility, and processability, making them suitable for a wide range of applications. The growing emphasis on sustainability and the circular economy has further bolstered the demand for co-polymerized PHAs, as they can be easily integrated into existing manufacturing processes.

The linear PHA segment is considered as the swiftest rising category within the European PHA market, with a predicted CAGR of 15.4% over the forecast years. The surging desire or ant for linear PHAs in various applications, particularly in the biomedical and packaging sectors, is influencing this segment to advance. The unique properties of linear PHAs, such as their biodegradability and biocompatibility, make them ideal for applications in the biomedical field, including drug delivery systems and tissue engineering. Since the demand for sustainable and eco-friendly materials continues to rise, the linear PHA segment is well-positioned for robust growth in the European PHA market.

By Application Insights

The packaging and food services segment became the largest application category within the European PHA market by accounting for 40.5% of the total market share in 2024. The reason behind this position is the increasing demand for sustainable packaging solutions in the food and beverage industry. The potential of PHA to decompose naturally in various environments makes it an attractive option for companies looking to enhance their sustainability profiles. The value of the packaging and food services is demonstrated by its critical function in preserving product quality and extending shelf life. PHA is utilized in various applications including food containers, disposable cutlery, and packaging films turning it a staple in the packaging industry. The growing emphasis on reducing plastic waste and promoting eco-friendly alternatives has further bolstered the demand for PHA in this segment. The consumers increasingly prioritize sustainable packaging options, hence, the packaging and food services segment is expected to maintain its leading position in the European PHA market is providing opportunities for innovation and product development.

The biomedical segment is having the fastest-growth rate in the application category within the European PHA market, with an estimated CAGR of 16.8% over the forecast period. This rise can be linked to the increasing recognition of PHA's biocompatibility and biodegradability, making it an ideal material for various medical applications including drug delivery systems, sutures, and tissue engineering scaffolds. The accelerating pattern of incorporating sustainable materials into medical applications is a key driver of growth in the biomedical segment. PHA's unique properties such as its ability to degrade safely in the body without causing adverse reactions position it as a valuable alternative to traditional synthetic materials.

REGIONAL ANALYSIS

Germany commanded the European PHA market and accounted for 25.7% of the total market share in 2024. This dominance can be attributed to the country's robust industrial base and strong demand for biodegradable materials across various sectors, including packaging, automotive, and consumer goods. Moreover, Germany's commitment to sustainability and recycling initiatives further enhances the market for PHA. The country has implemented stringent regulations aimed at reducing plastic waste and promoting the circular economy, which encourages manufacturers to innovate and develop eco-friendly products. The emphasis on high-quality engineering and manufacturing standards in Germany also ensures that PHA products meet rigorous performance and safety requirements, making them highly sought after in various applications.

France is projected to grow at a CAGR of 5.5% from 2025 to 2033 which is propelled by the increasing focus on sustainability and innovation. The French market is characterized by a diverse range of applications for PHA, particularly in the packaging and food services sector. France has implemented various initiatives aimed at reducing plastic waste and encouraging the use of recycled materials in manufacturing. This focus on sustainability aligns with the growing consumer demand for eco-friendly products, further bolstering the market for PHA. Additionally, the beverage industry in France is undergoing a transformation, with manufacturers increasingly adopting lightweight materials to enhance product convenience and reduce environmental impact.

The United Kingdom is another key player in the European PHA market, accounting for approximately 18% of the total market share. The UK market is characterized by a strong demand for biodegradable materials across various industries including food and beverage, personal care, and household products. According to a report by the UK Plastics Industry Federation, the bioplastics business in the UK is projected to reach £500 million by 2025 which is driven by the increasing focus on sustainability and the adoption of innovative packaging solutions. It is committed to reducing plastic waste and promoting recycling initiatives. The UK government has implemented various policies aimed at encouraging the use of recycled materials and reducing single-use plastics, which aligns with the growing consumer demand for sustainable products. This focus on environmental responsibility is expected to drive the demand for PHA that incorporates recycled content, further solidifying the market's growth. Moreover, the beverage sector in the UK is experiencing significant changes, with a rising preference for bottled water and health-oriented drinks. As consumers seek convenient and portable packaging options, the demand for PHA bottles is expected to grow. The UK market is providing opportunities for manufacturers to innovate and develop sustainable packaging solutions.

Italy is also a notable player in the European PHA market. The Italian market is featured by a wide range of applications for PHA, particularly in the packaging and food services sector. The relevance is present in its rich manufacturing heritage and commitment to quality. Italy is home to numerous manufacturers and suppliers of PHA, catering to various industries with high-performance materials. The beverage sector, particularly bottled water and soft drinks, plays a crucial role in driving demand for PHA, as consumers increasingly seek convenient and portable options. Additionally, the growing emphasis on sustainable practices in Italy is expected to further bolster the market for PHA. As consumers increasingly prioritize eco-friendly products, manufacturers are investing in the development of innovative solutions that align with sustainability goals. This focus on environmental responsibility positions Italy as a significant player in the European PHA market.

Spain is comfortably positioned to capitalize on this trend and is reinforcing its status as a significant player in the European PHA market. The Spanish market is viewed as a growing demand for biodegradable materials across various industries, including food and beverage, personal care, and household products. This nation is valued for its commitment to environmental responsibility and the promotion of sustainable practices. Spain has implemented various initiatives aimed at reducing plastic waste and encouraging the use of recycled materials in manufacturing. This focus on sustainability aligns with the growing consumer demand for eco-friendly products, further bolstering the market for PHA. Moreover, the beverage industry in Spain is experiencing significant growth, with a rising preference for bottled water and health-oriented drinks. As consumers seek convenient and portable packaging options, the demand for PHA bottles is expected to grow.

MARKET SEGMENTATION

This research report on the europe polyhydroxyalkanoate (PHA) market is segmented and sub-segmented based on categories.

By Type

- Short Chain Length

- Medium Chain Length

By Form

- Co-Polymerized PHA

- Linear PHA

By Application

- Packaging and Food Services

- Bio-Medical

- Agriculture

- Chemical Additive

- 3D Printing

- Cosmetics

- Wastewater Treatment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the Europe Polyhydroxyalkanoate (PHA) market?

Challenges in the European Polyhydroxyalkanoate (PHA) market include high production costs, limited scale of production, and the need for advancements in PHA production technologies to make it more commercially viable.

What are the growth drivers for the European Polyhydroxyalkanoate (PHA) market?

Growth drivers include increasing environmental concerns, government regulations on plastic waste reduction, rising consumer demand for sustainable products, and advancements in PHA production technologies.

What is the market forecast for Polyhydroxyalkanoate (PHA) in Europe?

The European Polyhydroxyalkanoate (PHA) market is expected to grow significantly due to increasing environmental awareness and regulations on plastic waste, with continued advancements in production processes and technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]