Europe Plastic Compounding Market Size, Share, Trends, & Growth Forecast Report By Product (Polyethylene (PE), Polypropylene (PP), Thermoplastic Vulcanizates (TPV), Thermoplastic Polyolefins (TPO), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), Polyamide (PA), Polycarbonate (PC), Acrylonitrile Butadiene Systems (ABS), and Others), Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Plastic Compounding Market Size

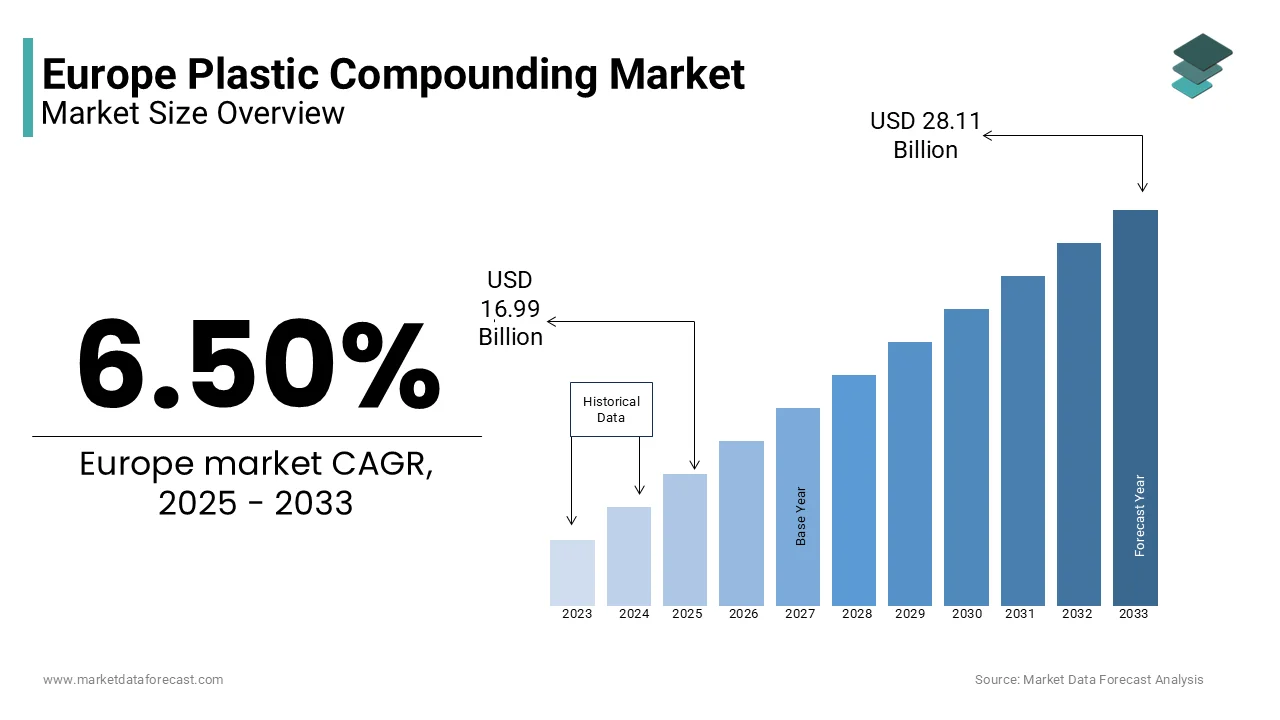

The Europe plastic compounding market was worth USD 15.95 billion in 2024. The European market is projected to reach USD 28.11 billion by 2033 from USD 16.99 billion in 2025, rising at a CAGR of 6.50% from 2025 to 2033.

The European Plastic Compounding is pivotal in enhancing the properties of base polymers, thereby enabling their application across a multitude of industries, including automotive, construction, packaging, and consumer goods. The increasing demand for lightweight, durable, and high-performance materials is driving the growth of this market. The market is characterized by a diverse range of products, including polyethylene, polypropylene, and polyvinyl chloride, each tailored to meet specific performance requirements. The growing emphasis on sustainability and the circular economy is also influencing the market dynamics, as manufacturers seek to incorporate recycled materials and bio-based additives into their formulations. The plastic compounding sector is poised to adapt and innovate by ensuring its relevance in a rapidly evolving landscape.

MARKET DRIVERS

Increasing Demand for Lightweight Materials

The escalating demand for lightweight materials in various industries is a significant driver of the European Plastic Compounding market. The need for lightweight components has become paramount as manufacturers strive to enhance fuel efficiency and reduce emissions in the automotive sector. According to a report by the European Automobile Manufacturers Association, the average weight of vehicles in Europe has decreased by approximately 10% over the past decade, largely due to the adoption of advanced plastic materials. Moreover, the construction industry is also increasingly utilizing lightweight plastic materials for applications such as insulation, roofing, and cladding. The shift towards energy-efficient buildings has further fueled the demand for lightweight solutions that offer superior thermal performance without compromising structural integrity.

Technological Advancements in Compounding Processes

Technological advancements in compounding processes are another key driver propelling the European Plastic Compounding market. Innovations in processing techniques, such as twin-screw extrusion and reactive compounding that have significantly enhanced the efficiency and effectiveness of plastic compounding operations. These advancements enable manufacturers to produce high-quality compounds with tailored properties by catering to the specific needs of various applications. According to a study by the European Plastics Converters Association, the adoption of advanced compounding technologies has led to a 15% increase in production efficiency across the sector.

Furthermore, the integration of automation and digitalization in compounding processes is streamlining operations and reducing production costs. The implementation of Industry 4.0 principles, including real-time monitoring and data analytics, allows manufacturers to optimize their processes and improve product consistency.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Costs

One of the significant restraints affecting the European Plastic Compounding market is the complex regulatory landscape governing the use of plastics and additives. The European Union has implemented stringent regulations aimed at reducing plastic waste and promoting sustainability, such as the Single-Use Plastics Directive and the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation. Compliance with these regulations can be challenging for manufacturers, particularly small and medium-sized enterprises (SMEs) that may lack the resources to navigate the regulatory framework effectively. According to a report by the European Chemicals Agency, the costs associated with compliance can reach up to €1 million per product by posing a financial burden on smaller companies.

Additionally, the evolving nature of regulations, particularly concerning the use of certain additives and materials, can create uncertainty in the market. Manufacturers must continuously adapt to changing requirements, which can lead to delays in product launches and increased operational costs. As a result, the regulatory challenges present a significant restraint on the European Plastic Compounding market by necessitating strategic planning and investment in compliance measures to ensure market access.

Price Volatility of Raw Materials

Another notable restraint is the price volatility of raw materials used in plastic compounding. The primary raw materials, including polymers and additives, are subject to fluctuations in supply and demand, which can significantly impact production costs. According to the PlasticsEurope association, the prices of key polymers have experienced fluctuations of up to 20% in recent years, driven by factors such as geopolitical tensions, supply chain disruptions, and changes in crude oil prices. This volatility can create challenges for manufacturers in maintaining stable pricing for their products by potentially affecting profitability and market competitiveness.

Moreover, the increasing competition for raw materials in the context of sustainability and recycling initiatives can further exacerbate supply chain challenges. The demand for high-quality recycled feedstock is rising by leading to potential shortages and price increases as manufacturers strive to incorporate recycled materials into their formulations. Therefore, navigating the challenges associated with raw material volatility is essential for the European Plastic Compounding market to ensure consistent supply and pricing stability.

MARKET OPPORTUNITIES

Growth of the Electric Vehicle Market

The rapid growth of the electric vehicle (EV) market presents a significant opportunity for the European Plastic Compounding market as governments and consumers increasingly prioritize sustainability and environmental responsibility, the demand for electric vehicles is surging. According to the European Automobile Manufacturers Association, the share of electric vehicles in new car registrations in Europe reached 10% in 2020, and this figure is expected to rise to 30% by 2025. The automotive industry is increasingly turning to advanced plastic compounds to reduce vehicle weight and enhance energy efficiency by making it a key growth area for plastic compounding manufacturers.

Moreover, the unique properties of plastic compounds, such as electrical insulation and resistance to corrosion, make them ideal for various components in electric vehicles, including battery housings, interior parts, and exterior panels. The European Plastic Compounding market is well-positioned to capitalize on this trend by providing innovative solutions that meet the evolving needs of the automotive sector.

Increasing Demand for Sustainable Solutions

The growing emphasis on sustainability and the circular economy offers another promising opportunity for the European Plastic Compounding market. There is a rising demand for sustainable plastic solutions that minimize environmental impact as consumers and businesses alike become more environmentally conscious. Manufacturers are increasingly investing in the development of bio-based plastics and compounds that utilize renewable resources, as well as incorporating recycled materials into their formulations. This shift aligns with the broader trend of reducing plastic waste and promoting recycling initiatives across Europe.

MARKET CHALLENGES

Competition from Alternative Materials

One of the primary challenges facing the European Plastic Compounding market is the intense competition from alternative materials. This competitive landscape can pose challenges for plastic compounding manufacturers in terms of market share and pricing. Moreover, the growing popularity of bioplastics and other sustainable materials can further erode market share for conventional plastic compounds. Manufacturers may face pressure to adapt their product offerings to remain competitive as consumers increasingly prioritize eco-friendly options.

Supply Chain Disruptions

Another significant challenge is the potential for supply chain disruptions, which can impact the availability and pricing of raw materials used in plastic compounding. The COVID-19 pandemic has many vulnerabilities in global supply chains, leading to shortages and delays in the procurement of essential materials. According to a survey conducted by the European Chemicals Industry Council, nearly 60% of chemical manufacturers reported disruptions in their supply chains due to the pandemic, affecting their ability to meet production demands.

Additionally, geopolitical tensions and trade disputes can further exacerbate supply chain challenges, leading to increased costs and uncertainty in the market. They must implement effective supply chain management strategies to mitigate the impact of these disruptions as manufacturers strive to maintain consistent production levels. Ensuring a reliable supply of raw materials is crucial for the long-term sustainability and competitiveness of the European Plastic Compounding market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.50% |

|

Segments Covered |

By Product, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

BASF SE, The Dow Chemical Company, SABIC, LyondellBasell Industries, N.V., Dyneon GmbH, Asahi Kasei Plastics, Covestro (Bayer Material Science), Eurostar Engineering Plastics, Lanxess, Solvay, Avient Corporation, Ensinger, Akkro Plastic, Technocompound, RTP Company, PCW GmbH, RIA-POLYMERS GMBH, Ravago, Washington Penn Plastics Company, Celanese Corporation, and Borealis. |

SEGMENTAL ANALYSIS

By Product Insights

The polyethylene segment was the largest and held 41.1% of the Europe plastic compounding market share in 2024. This dominance can be attributed to the widespread use of polyethylene in various applications, including packaging, automotive, and consumer goods. The growth is driven by the increasing demand for lightweight and durable materials. The versatility of polyethylene, combined with its cost-effectiveness by makes it a preferred choice among manufacturers across multiple sectors. The growing emphasis on sustainable packaging solutions has further bolstered the demand for polyethylene, particularly in the context of recycling initiatives. The polyethylene segment is expected to maintain its leading position in the European Plastic Compounding market by providing opportunities for innovation and product development.

The polypropylene segment is likely to achieve a CAGR of 6.8% during the forecast period. This growth can be attributed to the increasing demand for polypropylene in automotive and construction applications, where its lightweight and high-strength properties are highly valued. The rising trend of lightweighting in the automotive industry is a key driver of growth in the polypropylene segment. The adoption of polypropylene for components such as bumpers, dashboards, and interior trims is on the rise. Additionally, the versatility of polypropylene allows for its use in various applications by including packaging and consumer goods.

By Application Insights

The automotive segment was the largest by capturing 35.3% of the European Plastic Compounding market share in 2024. This dominance is primarily driven by the increasing use of plastic compounds in vehicle manufacturing, where they are valued for their lightweight and durable properties. According to a report by the European Automobile Manufacturers Association, the use of plastics in vehicles has increased by approximately 20% over the past decade by reflecting a growing trend towards lightweighting and fuel efficiency. Plastic compounds are utilized in various applications, including interior components, exterior panels, and under-the-hood parts by contributing to weight reduction and improved fuel economy.

The packaging segment is likely to grow with an anticipated CAGR of 7.5% during the forecast period. This growth can be attributed to the increasing demand for sustainable and innovative packaging solutions across various industries, including food and beverage, cosmetics, and pharmaceuticals. The rising trend of e-commerce and online shopping has further fueled the demand for efficient and protective packaging solutions. Plastic compounds, particularly polyethylene and polypropylene, are widely used in packaging applications due to their lightweight, durability, and versatility. The packaging segment is poised for substantial growth by reinforcing its position as the fastest-growing application within the European Plastic Compounding market.

REGIONAL ANALYSIS

Germany Plastic Compounding market was the largest in holding the share of 25.6% in 2024. This dominance can be attributed to the country's robust industrial base and strong demand for plastic compounds across various sectors, including automotive, construction, and packaging. Moreover, Germany's commitment to sustainability and recycling initiatives further enhances the market for plastic compounding. The country has implemented stringent regulations aimed at reducing plastic waste and promoting the circular economy, which encourages manufacturers to innovate and develop eco-friendly products. The emphasis on high-quality engineering and manufacturing standards in Germany also ensures that plastic compounds meet rigorous performance and safety requirements by making them highly sought after in various applications. The automotive sector, in particular, plays a crucial role in driving demand for plastic compounds in Germany. The need for lightweight and durable materials is paramount with major automotive manufacturers and suppliers located in the country.

The United Kingdom is anticipated to witness a CAGR of 9.7% during the forecast period. The UK market is characterized by a strong demand for plastic compounds across various industries, including automotive, packaging, and consumer goods. The importance of the UK market lies in its commitment to reducing plastic waste and promoting recycling initiatives. The UK government has implemented various policies aimed at encouraging the use of recycled materials and reducing single-use plastics, which aligns with the growing consumer demand for sustainable products. This focus on environmental responsibility is expected to drive the demand for advanced plastic compounds that meet stringent sustainability criteria.

France plastic compounding market is attributed to have steady growth with a diverse range of applications for plastic compounds in the automotive, packaging, and construction sectors. The importance of the French market lies in its commitment to environmental responsibility and the promotion of sustainable practices. France has implemented various initiatives aimed at reducing plastic waste and encouraging the use of recycled materials in manufacturing. This focus on sustainability aligns with the growing consumer demand for eco-friendly products that further bolsters the market for plastic compounding.

KEY MARKET PLAYERS

The major players in the Europe Plastic compounding market include BASF SE, The Dow Chemical Company, SABIC, LyondellBasell Industries, N.V., Dyneon GmbH, Asahi Kasei Plastics, Covestro (Bayer Material Science), Eurostar Engineering Plastics, Lanxess, Solvay, Avient Corporation, Ensinger, Akkro Plastic, Technocompound, RTP Company, PCW GmbH, RIA-POLYMERS GMBH, Ravago, Washington Penn Plastics Company, Celanese Corporation, and Borealis.

MARKET SEGMENTATION

This research report on the Europe Plastic compounding market is segmented and sub-segmented into the following categories.

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Systems (ABS)

- Others

By Application

- Automotive

- Construction

- Electrical & Electronics

- Packaging

- Consumer Goods

- Industrial Machinery

- Medical Devices

- Optical Media

- Appliances

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe plastic compounding market?

The market is growing due to increasing demand in automotive, packaging, construction, and electrical & electronics industries, along with a focus on lightweight and sustainable materials.

Which industries are the primary consumers of plastic compounds in Europe?

Major consumers include the automotive, construction, packaging, electrical & electronics, and healthcare industries.

How is the automotive industry influencing plastic compounding demand?

Automakers are using lightweight plastic compounds to improve fuel efficiency, reduce emissions, and enhance vehicle performance.

What is the future outlook for the Europe plastic compounding market?

The market is expected to grow with advancements in sustainable plastic solutions, increased recycling initiatives, and rising demand from key end-use industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]