Europe Plant Growth Chambers Market Size, Share, Trends, & Growth Forecast Report Segmented, By Equipment Type, Application, End-User, Function, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Plant Growth Chambers Market

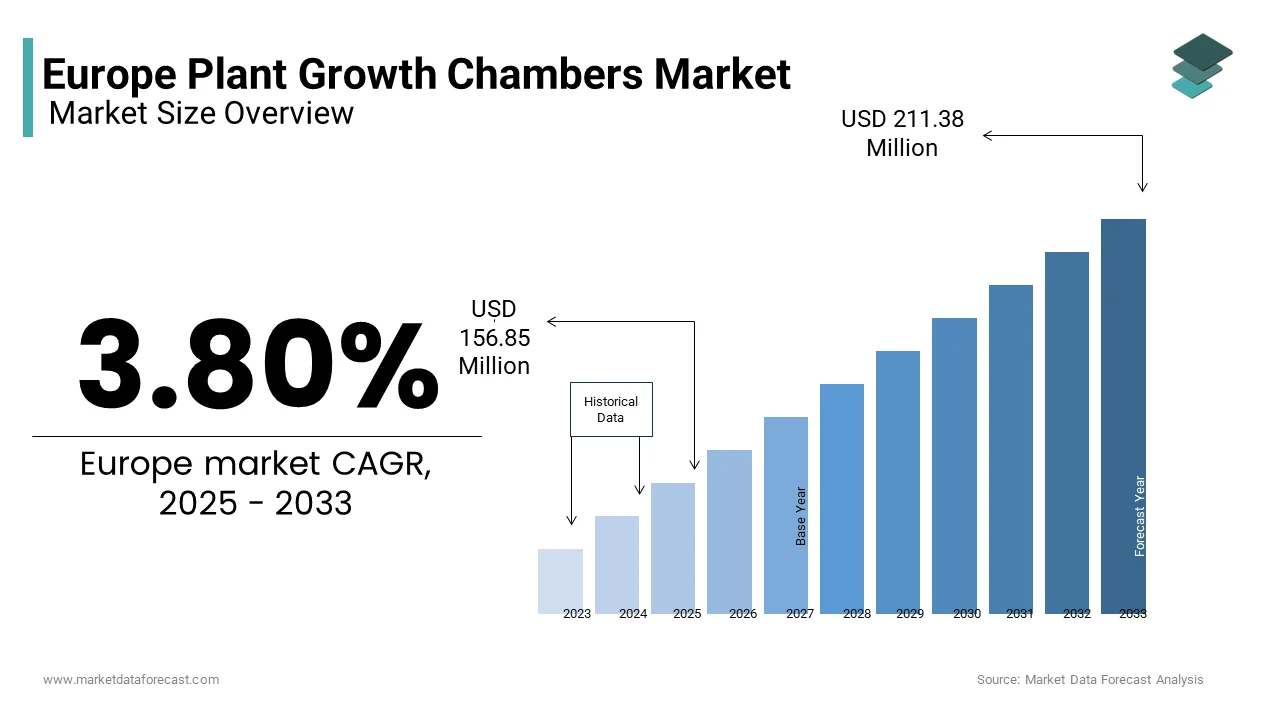

The Europe plant growth chambers market was valued at USD 151.11 million in 2024 and is anticipated to reach USD 156.85 million in 2025 from USD 211.38 million by 2033, growing at a CAGR of 3.80% during the forecast period from 2025 to 2033.

The Europe plant growth chambers market growth is driven by the need for controlled environments to optimize plant research and cultivation. The growing demand for food security, coupled with the rise of vertical farming and indoor agriculture, has fueled the adoption of these chambers. As per a study by the European Biotechnology Association, over 60% of plant research institutions utilize plant growth chambers to replicate specific environmental conditions for crop optimization. Additionally, stringent regulations governing pesticide use have encouraged the development of pest-resistant crops through controlled experiments. The integration of IoT and AI technologies into plant growth chambers has further enhanced their appeal by enabling real-time monitoring and precise control over temperature, humidity, and light cycles.

MARKET DRIVERS

Rising Demand for Food Security

Food security remains a pivotal driver for the Europe plant growth chambers market, as the region faces challenges such as climate change and population growth. According to the European Commission, the agricultural sector must increase productivity by 30% by 2030 to meet rising food demands. Plant growth chambers play a crucial role in this effort by enabling year-round cultivation and experimentation with high-yield crop varieties. According to a report by the German Agricultural Society, over 70% of new crop varieties introduced in Europe since 2020 were developed using plant growth chambers. These systems allow researchers to simulate diverse environmental conditions, accelerating the breeding process. Additionally, the rise of urban farming and vertical agriculture has increased demand for compact chambers in metropolitan areas like London and Berlin.

Advancements in Biotechnology and Crop Research

Advancements in biotechnology and crop research are driving significant growth in the Europe plant growth chambers market. Plant growth chambers are indispensable tools for genetic modification, tissue culture, and stress testing of crops under controlled conditions. Additionally, the integration of IoT-enabled sensors allows researchers to monitor plant health metrics in real time by enhancing experimental accuracy. These technological advancements, coupled with government funding for agricultural R&D, position plant growth chambers as key enablers of biotechnological breakthroughs.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

High initial costs and maintenance expenses pose significant challenges for the Europe plant growth chambers market. The financial burden often deters small-scale research institutions and startups from investing in advanced systems. Additionally, maintenance costs, including energy consumption and sensor calibration, further escalate operational expenses. As per a study by the Italian Ministry of Agriculture, energy costs account for 40% of total expenses associated with operating plant growth chambers. While energy-efficient models offer long-term savings, their upfront costs remain prohibitive for many stakeholders. This affordability gap hinders widespread adoption in economically weaker regions.

Limited Awareness and Technical Expertise

Limited awareness and technical expertise among end users present significant restraints for the Europe plant growth chambers market. This knowledge gap reduces the utilization rate of installed systems is limiting their impact on research outcomes. Additionally, the complexity of integrating IoT and AI technologies into existing setups creates barriers for non-specialized users. As per a report by the Netherlands Agricultural Research Institute, 30% of purchased chambers remain underutilized due to insufficient technical support. These challenges amplify the need for comprehensive training programs and user-friendly interfaces to enhance accessibility and adoption.

MARKET OPPORTUNITIES

Expansion into Urban Farming and Vertical Agriculture

The expansion into urban farming and vertical agriculture presents a transformative opportunity for the Europe plant growth chambers market. According to Eurostat, urban populations in Europe exceed 75% is creating a growing demand for localized food production systems. Plant growth chambers are integral to vertical farming, enabling year-round cultivation of leafy greens, herbs, and microgreens in controlled environments. Additionally, government incentives, such as subsidies for sustainable agriculture, further propel adoption. For instance, France’s "Plan de Rénovation Énergétique" provides financial support for eco-friendly farming technologies, including energy-efficient chambers. This convergence of innovation and sustainability positions urban farming as a key growth driver.

Integration of AI and Predictive Analytics

The integration of AI and predictive analytics offers significant opportunities for the Europe plant growth chambers market. AI-powered chambers enable real-time monitoring of plant health metrics, such as nutrient levels and water usage, optimizing resource allocation. For example, a study by the German Fraunhofer Institute reveals that AI-integrated chambers reduce water consumption by up to 30% while increasing crop yields by 20%. Additionally, predictive analytics allows researchers to anticipate environmental stressors by enhancing experimental accuracy. These advancements align with Europe’s green initiatives by making AI-enabled chambers indispensable for sustainable agriculture.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose significant challenges to the Europe plant growth chambers market. The ongoing semiconductor shortage has impacted the production of IoT-enabled chambers, which rely on advanced sensors and control systems. Additionally, rising prices of raw materials, such as steel and aluminum, have escalated manufacturing costs. The European Steel Association reports that raw material prices surged by 25% in 2022 by affecting production timelines. These disruptions are compounded by logistical bottlenecks in cross-border shipments. As a result, manufacturers face delays and increased expenses, hindering their ability to meet growing demand.

Intense Price Competition Among Manufacturers

Intense price competition among manufacturers is another challenge for the Europe plant growth chambers market. The market is highly fragmented, with numerous players vying for market share, particularly in the budget segment. According to a study by Deloitte, profit margins for mid-tier manufacturers have contracted by 10% over the past five years due to pricing pressures. Additionally, the prevalence of counterfeit products exacerbates the issue, as they flood the market with low-cost alternatives that compromise quality. The European Anti-Counterfeiting Network estimates that counterfeit chambers account for 5% of total sales by posing risks to safety and reliability. This competitive environment forces manufacturers to balance affordability with innovation, straining resources. To remain competitive, companies must differentiate themselves through value-added services and technological advancements.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.80% |

|

Segments Covered |

By Equipment Type, Application, End-User, Function, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Thermo Fisher(US), CARON(US), Conviron (Canada), Percival Scientific (US), BINDER (Germany), Weiss Technik (Germany), Saveer Biotech (India), Arlab (Portugal), Hettich Benelux (Netherlands), Freezers India, BRS bvba (Belgium), and Darwin Chambers (US) |

SEGMENTAL ANALYSIS

By Equipment Type Insights

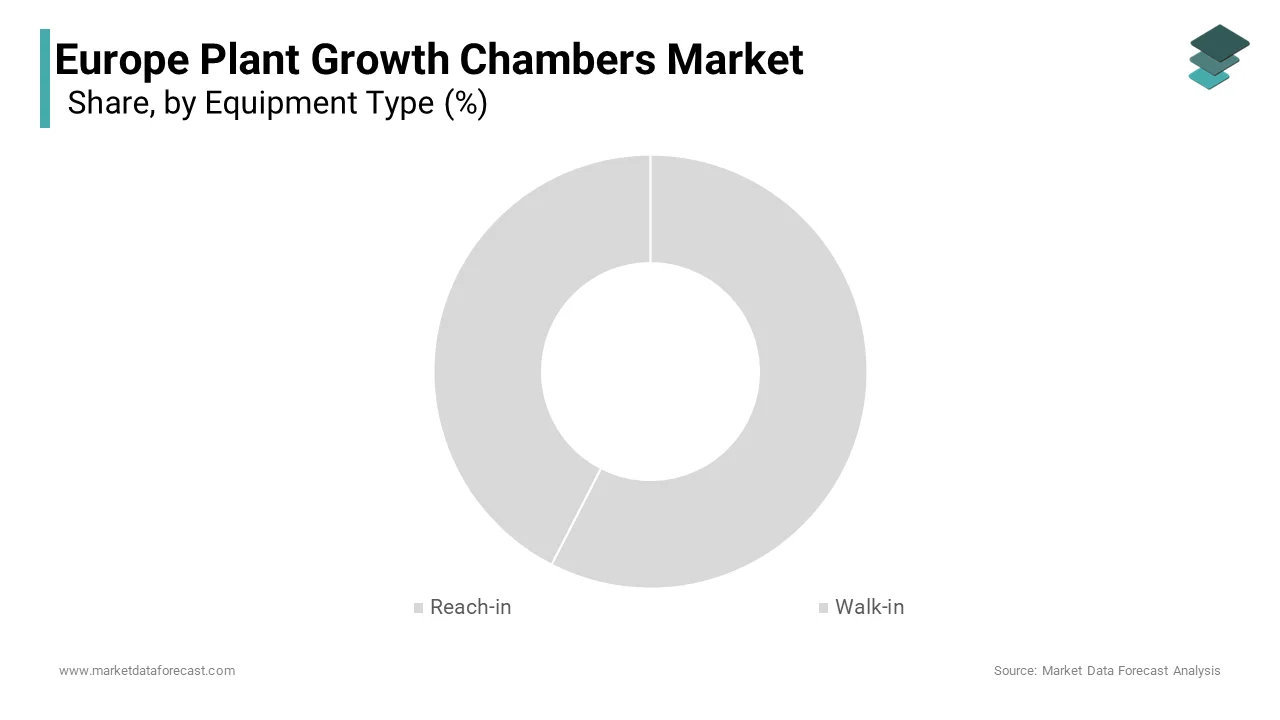

The Reach-in chambers segment was the largest and held 65.1% of the Europe plant growth chambers market share in 2024. The growth of the segment is driven by their compact size and versatility, making them ideal for small-scale research institutions and laboratories with limited space. According to Eurostat, over 70% of academic institutions in Europe utilize reach-in chambers for plant breeding and genetic modification experiments. These systems offer precise control over environmental parameters such as temperature, humidity, and light cycles by enabling researchers to replicate diverse growing conditions. Additionally, advancements in IoT technology have enhanced their appeal, with real-time monitoring features improving experimental accuracy. As per a study by the German Agricultural Society, reach-in chambers account for 80% of all installations in metropolitan research hubs like Berlin and Paris.

The Walk-in chambers segment is likely to register a CAGR of 12.3% in the foreseeable years. The growth of the segment is fueled by their ability to accommodate large-scale experiments and multiple plant varieties simultaneously, making them indispensable for commercial agricultural research. According to the UK Department for Environment, Food & Rural Affairs, walk-in chambers reduce experimental timelines by up to 40%, enhancing productivity in crop development. Additionally, their modular design allows for easy customization, appealing to biotech companies and large-scale vertical farms. Their alignment with sustainability goals positions them as a key growth driver in the coming years.

By Application Insights

The short plants segment was expected to hold a dominant share of the Europe plant growth chambers market in 2024, with the widespread cultivation of leafy greens, herbs, and microgreens, which are staples in urban farming and vertical agriculture. According to Eurostat, over 60% of vertical farms in Europe utilize plant growth chambers for short plants, with a role in localized food production. Additionally, the integration of IoT-enabled sensors ensures optimal resource allocation, reducing water and energy consumption. As per a study by the Italian Ministry of Agriculture, short plant cultivation using growth chambers increased by 25% annually between 2020 and 2022, driven by consumer demand for fresh, pesticide-free produce.

The tall plants segment is deemed to register a significant CAGR of 11.8% throughout the forecast period. This growth is fueled by the increasing focus on breeding high-yield crop varieties, such as wheat, maize, and barley, to address food security challenges. According to the German Fraunhofer Institute, tall plant research using growth chambers has grown by 30% annually since 2020, driven by government funding for agricultural R&D. Additionally, advancements in AI and predictive analytics enable researchers to simulate diverse environmental conditions by accelerating the breeding process.

By End Use Insights

The academic institutions led the Europe plant growth chambers market by accounting for 60.6% of the total share in 2024. The growth of the market is driven by the rising emphasis on agricultural research and biotechnological innovations. According to Eurostat, over 80% of European universities with agricultural departments utilize plant growth chambers for crop optimization and genetic modification experiments. These systems enable researchers to simulate diverse environmental conditions, enhancing the accuracy of their studies. Additionally, government funding for academic research has bolstered adoption in countries like Germany and France. As per a study by the UK Vertical Farming Association, academic institutions account for 70% of all chamber installations in research hubs like Cambridge and Lyon.

The clinical applications segment is likely to grow with a projected CAGR of 13.5% in the foreseeable future. This growth is fueled by the increasing use of plant-based compounds in pharmaceuticals and nutraceuticals. According to the French National Institute for Health Research, clinical trials utilizing plant growth chambers for medicinal plant research grew by 40% annually between 2020 and 2022. Additionally, the integration of AI and IoT technologies enables precise monitoring of plant health metrics, thereby enhancing experimental accuracy.

By Function Insights

The plant segment dominated the Europe plant growth chambers market with the largest share in 2024. The growth of the segment is driven by the widespread use of chambers for optimizing plant development under controlled conditions. According to Eurostat, over 65% of agricultural research projects in Europe utilize plant growth chambers to enhance crop yields and develop pest-resistant varieties. Additionally, the integration of IoT-enabled sensors ensures precise control over environmental parameters by improving experimental outcomes.

The environmental optimization segment is expected to exhibit a CAGR of 14.2% throughout the forecast period. This growth is fueled by the increasing focus on simulating diverse environmental conditions to test plant resilience against climate change. Additionally, advancements in AI and predictive analytics enable researchers to anticipate stressors by enhancing experimental accuracy.

COUNTRY LEVEL ANALYSIS

Germany led the Europe plant growth chambers market by accounting for 28.3% of the total share in 2024, owing to the country’s robust biotechnology sector and strong emphasis on agricultural innovation. According to Eurostat, Germany produces over 35% of Europe’s crop varieties developed using a plant growth chamber, with its dominance in research and development. Additionally, government initiatives like the "GreenTech Cluster" promote sustainable farming technologies, further propelling adoption. The integration of IoT and AI technologies into chambers has enhanced their appeal, with German institutions leading in precision agriculture experiments.

France is anticipated to witness a CAGR of 12.7% during the forecast period. This growth is fueled by urbanization trends and government incentives for vertical farming. The rise of medicinal plant research using growth chambers has also gained traction, with clinical applications growing by 40% annually.

KEY MARKET PLAYERS

Thermo Fisher(US), CARON(US), Conviron (Canada), Percival Scientific (US), BINDER (Germany), Weiss Technik (Germany), Saveer Biotech (India), Arlab (Portugal), Hettich Benelux (Netherlands), Freezers India, BRS bvba (Belgium), and Darwin Chambers (US). are the market players that are dominating the Europe plant growth chambers market.

Top Players In the Market

Thermo Fisher Scientific

Thermo Fisher Scientific dominates the market with its advanced solutions, such as IoT-enabled chambers, which cater to both academic and commercial end users by enhancing its global presence.

Conviron

Conviron is known for its modular designs, The company targets large-scale agricultural research by ensuring consistent demand across Europe.

Weiss Technik

Weiss Technik’s focus on sustainability and energy-efficient systems strengthens its position globally.

Top Strategies Used By Key Players

Key players employ strategies such as product innovation, geographic expansion, and strategic partnerships. Product innovation focuses on integrating AI and IoT technologies to enhance functionality and user experience. Geographic expansion targets emerging markets in Eastern Europe, while partnerships with governments ensure compliance with sustainability goals. Companies also invest in R&D to develop energy-efficient models, aligning with Europe’s green initiatives. Collaborations with academic institutions enhance accessibility and adoption, while mergers and acquisitions consolidate market positions.

COMPETITION OVERVIEW

The Europe plant growth chambers market is highly competitive, characterized by the presence of global leaders like Thermo Fisher Scientific, Conviron, and Weiss Technik, alongside regional players offering cost-effective solutions. Global players leverage innovation, offering advanced technologies such as AI-enabled sensors and predictive analytics. Regional players compete on price and customization by targeting niche segments like small-scale research institutions. The market’s fragmentation intensifies competition, prompting manufacturers to differentiate through value-added services. Stringent environmental regulations and the rise of vertical farming have shifted focus toward sustainable solutions, creating opportunities for innovation. Collaborations with governments ensure stable demand, while investments in R&D drive technological advancements. Supply chain disruptions and economic uncertainties further shape the competitive landscape, pressuring companies to balance affordability with quality.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Thermo Fisher Scientific launched a new line of energy-efficient chambers in Germany by reducing power consumption by 30%. This initiative strengthened its position in the sustainability segment.

- In June 2023, Conviron partnered with a French research institute to supply walk-in chambers for large-scale crop experiments by enhancing its technological portfolio.

- In September 2023, Weiss Technik acquired a Polish manufacturer by expanding its production capacity in Eastern Europe.

- In November 2023, Binder introduced an AI-integrated chamber in Spain by targeting academic institutions and improving experimental accuracy.

- In January 2024, Memmert launched an online platform for remote monitoring in Italy by streamlining operations for researchers and boosting customer engagement.

MARKET SEGMENTATION

This research report on the Europe plant growth chambers market is segmented and sub-segmented into the following categories.

By Equipment Type

- Reach-in

- Walk-in

By Application

- Short plant

- Tall Plant

- Others

By Function

- Plant growth

- Seed germination

- Environmental optimization

- Tissue culture

By End-Use

- Clinical research

- Academic research

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the primary purpose of plant growth chambers in Europe’s agricultural and research sectors?

Plant growth chambers provide controlled environments for studying plant behaviour, optimizing crop genetics, and accelerating agricultural innovation, especially valuable for Europe's research institutions and seed development labs.

Why is the demand for plant growth chambers increasing in Europe?

Demand is rising due to the growing focus on climate-resilient crops, stricter food security goals, and increased investments in agri-tech research by both governments and private entities.

Which sectors in Europe use plant growth chambers the most?

Universities, agricultural research centers, biotech companies, and seed producers are the key users, particularly in countries like Germany, the Netherlands, and France.

What technological features are most in demand for plant growth chambers in Europe?

Precision climate control, programmable LED lighting, real-time data monitoring, and energy efficiency are top priorities for European users focused on sustainable and accurate plant studies.

What challenges does the European plant growth chamber market face?

The market faces high equipment costs, long procurement cycles in research institutes, and the need for skilled personnel to operate and maintain advanced growth systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]