Europe Plant-Based Seafood Market Size, Share, Trends & Growth Forecast Report By Product Type (Fish Alternatives, Crustacean Alternatives, Mollusk Alternatives, Ready-To-Eat Meals & Snacks), Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Plant-Based Seafood Market Size

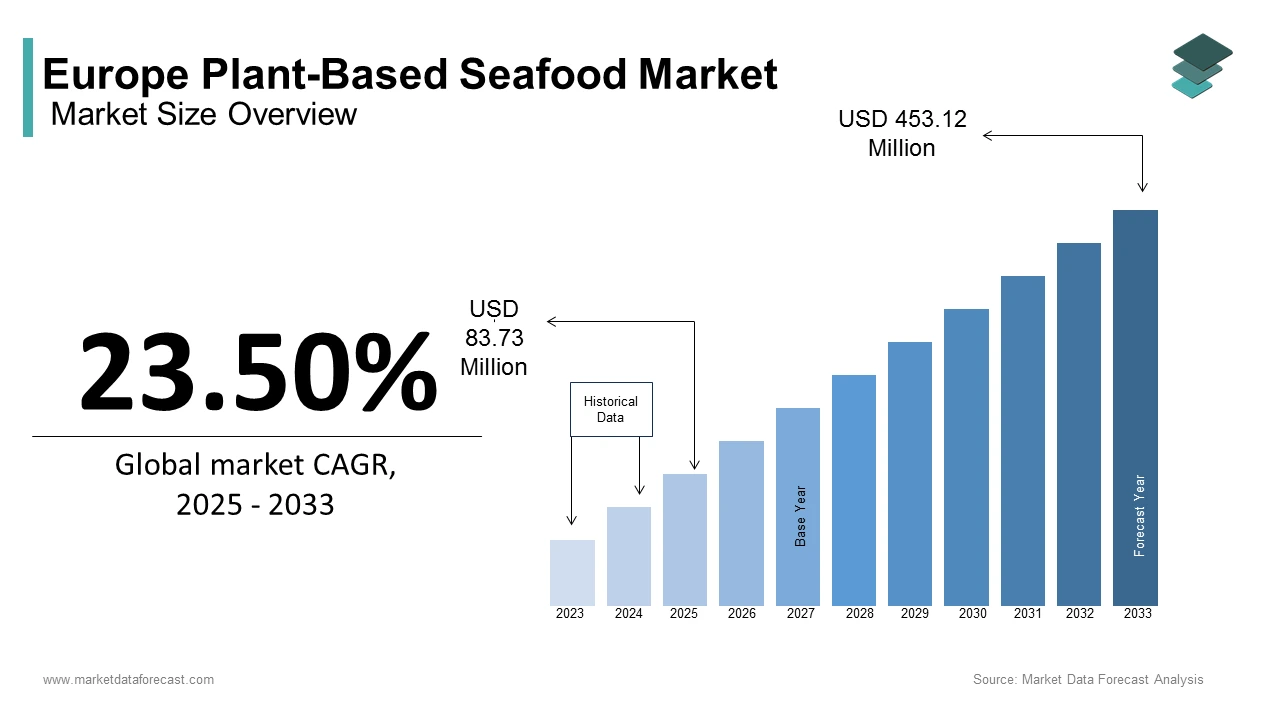

The Europe plant-based seafood market size was calculated to be USD 67.80 million in 2024 and is anticipated to be worth USD 453.12 million by 2033 from USD 83.73 million in 2025, growing at a CAGR of 23.50% during the forecast period.

Plant-based seafood products are crafted from ingredients such as soy, peas, seaweed, and algae that are designed to mimic the taste, texture, and nutritional profile of fish, shrimp, crab, and other marine species. According to the European Food Safety Authority (EFSA), the consumption of plant-based seafood in Europe has grown by over 15% annually since 2020, indicating a shift towards environmentally conscious dietary choices. According to the World Wildlife Fund (WWF), overfishing and marine ecosystem degradation have prompted consumers to seek alternatives that reduce pressure on global fish stocks. Germany leads the region in terms of adoption and accounted for the leading share of the European market in 2024. The rising popularity of veganism and flexitarian diets, coupled with stringent regulations against unsustainable fishing practices are contributing to the increasing demand for plant-based seafood products in Europe.

MARKET DRIVERS

Increasing Awareness of Environmental Sustainability

The growing awareness of environmental sustainability serves as a major driver propelling the Europe plant-based seafood market. According to the World Wildlife Fund (WWF), over 90% of global fish stocks are either fully exploited or overfished, leading to significant ecological imbalances and threatening marine biodiversity. This alarming trend has heightened consumer consciousness regarding the environmental impact of traditional seafood consumption, prompting a shift towards sustainable alternatives. The European Environment Agency reports that plant-based seafood products have witnessed a 30% annual increase in adoption across Europe, particularly in countries like Sweden and Denmark, where eco-friendly initiatives are prioritized. Furthermore, government-led campaigns promoting sustainable diets and reducing carbon footprints have bolstered the demand for plant-based seafood. The United Nations Food and Agriculture Organization (FAO) highlights that replacing conventional seafood with plant-based alternatives can reduce greenhouse gas emissions by up to 50%, underscoring their critical role in addressing climate change and fostering market growth in this region.

Rising Popularity of Vegan and Flexitarian Diets

The increasing popularity of vegan and flexitarian diets has emerged as another significant driver shaping the Europe plant-based seafood market. According to the European Vegetarian Union, over 7% of Europeans identify as vegetarian or vegan, while an additional 30% actively incorporate plant-based meals into their diets. This dietary shift has created a fertile ground for plant-based seafood products, which cater to health-conscious consumers seeking nutritious and cruelty-free alternatives. The German Nutrition Society reports that the demand for plant-based seafood in Germany alone has surged by 25% annually, driven by its inclusion in mainstream restaurants and retail outlets. Additionally, the rise of social media influencers and celebrity endorsements has amplified awareness, particularly among millennials and Gen Z consumers. The European Consumer Organisation notes that nearly 60% of new product launches in the plant-based food sector feature seafood alternatives, underscoring their immense potential to drive innovation and meet evolving consumer preferences.

MARKET RESTRAINTS

High Production Costs and Pricing Challenges

One of the primary restraints impeding the growth of the Europe plant-based seafood market is the high production costs associated with developing and manufacturing these products. According to the European Commission, the production of plant-based seafood involves advanced technologies and specialized ingredients, such as algae extracts and textured proteins, which significantly increase operational expenses. These costs are subsequently passed on to consumers, making plant-based seafood less affordable compared to conventional seafood or other plant-based alternatives. The Organisation for Economic Co-operation and Development (OECD) reports that the average retail price of plant-based seafood is approximately 40% higher than traditional seafood, limiting its accessibility, particularly in low-income households. Additionally, fluctuations in raw material availability, such as agricultural derivatives used in protein extraction, further exacerbate pricing volatility. This economic barrier not only restricts market penetration but also challenges manufacturers in achieving economies of scale, thereby hindering widespread adoption.

Limited Consumer Awareness and Misconceptions

Another significant restraint facing the Europe plant-based seafood market is the limited awareness and misconceptions surrounding its taste, texture, and nutritional value. According to Eurostat, nearly 45% of European consumers remain uncertain about the differences between plant-based seafood and traditional seafood, often perceiving plant-based alternatives as inferior in quality or flavor. The European Consumer Organisation highlights that misinformation campaigns and conflicting scientific studies have created confusion, deterring potential users from adopting these products. For instance, some consumers associate plant-based seafood with artificial additives or poor nutritional profiles, despite evidence suggesting that many formulations are fortified with essential vitamins and omega-3 fatty acids. Furthermore, the lack of standardized labeling practices across the region complicates efforts to educate consumers about the benefits of plant-based seafood. The EFSA notes that only 30% of surveyed individuals actively seek out plant-based seafood, underscoring the need for targeted marketing and educational initiatives to dispel myths and enhance consumer confidence.

MARKET OPPORTUNITIES

Expansion into Retail and Foodservice Channels

The growing integration of plant-based seafood into retail and foodservice channels presents a substantial opportunity for the Europe plant-based seafood market. According to the European Food Safety Authority (EFSA), supermarkets and hypermarkets account for over 50% of plant-based seafood sales, driven by strategic partnerships with manufacturers and the increasing availability of diverse product offerings. As per the UK Department of Health, the inclusion of plant-based seafood in mainstream restaurant menus and fast-food chains has surged by 20% annually, supported by collaborations with major brands like Burger King and McDonald’s. Countries like France and Italy have witnessed a 25% annual increase in the adoption of plant-based seafood in foodservice establishments, driven by their appeal to health-conscious and environmentally aware consumers. Furthermore, innovations in product formulations have improved taste and texture, addressed earlier consumer concerns and enhancing marketability.

Rising Demand for Clean-Label Products

The increasing demand for clean-label products offers another lucrative opportunity for the Europe plant-based seafood market. According to the European Commission, over 70% of European consumers prioritize transparency in food labeling, seeking products free from artificial additives and preservatives. This trend has prompted manufacturers to develop plant-based seafood using natural ingredients, such as seaweed, algae, and pea protein, aligning with clean-label trends. The German Federal Ministry of Food and Agriculture reports that the demand for clean-label plant-based seafood has grown by 18% annually, supported by their use in premium and gourmet applications. Additionally, the rise of health-conscious millennials and Gen Z consumers has further amplified demand for products featuring minimal processing and sustainable sourcing. According to the EFSA, nearly 60% of new product launches in the plant-based food sector now emphasize clean-label claims, underscoring the immense potential for market players to capitalize on this trend and expand their portfolios.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Raw Material Scarcity

A significant challenge confronting the Europe plant-based seafood market is the vulnerability of supply chains and the scarcity of raw materials essential for production. According to the European Commission, disruptions caused by geopolitical tensions, climate change, and logistical bottlenecks have led to shortages of key inputs, such as pea protein and algae extracts. The European Environment Agency reports that extreme weather events, including droughts and floods, have adversely impacted agricultural yields, reducing the availability of raw materials by up to 25% in certain regions. These supply chain constraints have resulted in increased production costs and prolonged lead times, adversely affecting market dynamics. Furthermore, the reliance on imports for certain raw materials exposes manufacturers to currency fluctuations and trade uncertainties. The Organisation for Economic Co-operation and Development (OECD) notes that over 30% of companies in the plant-based seafood industry reported supply chain-related challenges in 2022, underscoring the urgent need for diversification and localization strategies to mitigate risks and ensure business continuity.

Consumer Skepticism and Flavor Limitations

Another pressing challenge facing the Europe plant-based seafood market is consumer skepticism and limitations in replicating the authentic taste and texture of traditional seafood. According to Eurostat, nearly 50% of consumers remain hesitant to adopt plant-based seafood due to concerns about flavor discrepancies and sensory experiences. The European Consumer Organisation highlights that early iterations of plant-based seafood often failed to mimic the delicate textures of fish and shellfish, creating barriers to acceptance. For instance, some consumers perceive plant-based shrimp or crab as lacking the umami flavor profile characteristic of their marine counterparts. Furthermore, the absence of standardized benchmarks for taste and texture across the region complicates efforts to enhance product development and consumer satisfaction. The EFSA notes that only 40% of surveyed individuals express willingness to try plant-based seafood, underscoring the need for continuous innovation and sensory testing to address consumer expectations and build trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.50% |

|

Segments Covered |

By Product Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Nestlé S.A., Mycorena AB, Pronofa ASA, Revo Foods, Good Catch Foods, Ocean Hugger Foods, Sotexpro, Gardein, Impossible Foods Inc., Ahimsa Foods |

SEGMENTAL ANALYSIS

By Product Type Insights

The fish products segment led the Europe plant-based seafood market by occupying a share of 51.8% of the European market share in 2024. The growth of the fish products segment is driven by their versatility and ability to cater to a wide range of culinary applications, including fillets, burgers, and sushi alternatives. According to the German Federal Ministry of Food and Agriculture, plant-based fish products are favored for their high protein content and omega-3 enrichment, making them a popular choice among health-conscious consumers. The EFSA reports that the demand for plant-based fish products has grown by 22% annually, supported by their inclusion in mainstream retail and foodservice channels. Additionally, advancements in formulation technologies have improved taste and texture, addressing earlier consumer concerns and enhancing marketability. Their compatibility with diverse dietary preferences solidifies their dominance in the market, positioning them as a cornerstone of future growth.

The prawn and shrimp products segment is expected to progress at a CAGR of 18.5% over the forecast period owing to their increasing demand for versatile and visually appealing seafood alternatives, particularly in appetizers, salads, and Asian-inspired dishes. According to the EFSA, innovations in texturization and flavoring technologies have enabled manufacturers to replicate the delicate texture and umami taste of shrimp, driving consumer acceptance. The UK Department of Health highlights that the demand for plant-based prawn and shrimp products has surged by 30% annually, supported by their inclusion in premium and gourmet applications. Furthermore, the rise of health-conscious millennials and Gen Z consumers has further propelled adoption, particularly in developed regions like the UK and Germany.

By Distribution Channel Insights

The supermarkets and hypermarkets segment accounted for 46.1% of the European plant-based seafood market in 2024 due to their extensive reach, diverse product offerings, and ability to cater to a broad consumer base. According to the UK Department of Health, retailers benefit from strategic partnerships with manufacturers, enabling them to stock a wide variety of plant-based seafood products, from mainstream brands to niche formulations. The convenience of one-stop shopping and promotional discounts further enhances consumer engagement. The EFSA reports that supermarkets and hypermarkets have witnessed a 22% increase in plant-based seafood sales over the past three years, driven by rising health consciousness and the growing availability of clean-label products. Their established infrastructure and trusted brand presence solidify their position as the leading distribution channel in the market.

The online retailers segment is expected to grow at an exponential CAGR of 25.3% during the forecast period owing to the increasing penetration of e-commerce platforms and shifting consumer preferences towards digital shopping. According to Eurostat, online sales of plant-based seafood products have surged by over 30% annually, driven by the convenience of home delivery and access to detailed product information. The rise of subscription-based models and personalized recommendations has further enhanced customer engagement. The European Consumer Organisation highlights that nearly 50% of millennials prefer purchasing plant-based seafood online due to competitive pricing and exclusive deals. Additionally, the proliferation of mobile apps and social media marketing has expanded the reach of online retailers, positioning them as a key driver of future market growth.

KEY MARKET PLAYERS

Major Players of the Europe Plant-Based Seafood Market include Nestlé S.A., Mycorena AB, Pronofa ASA, Revo Foods, Good Catch Foods, Ocean Hugger Foods, Sotexpro, Gardein, Impossible Foods Inc., and Ahimsa Foods

REGIONAL ANALYSIS

Germany led the plant-based seafood market in Europe by accounting for 25.8% of the European market share in 2024. The growth of Germany in the European market is driven by the country's strong emphasis on sustainability, stringent environmental regulations, and high consumer awareness of plant-based diets. According to Eurostat, Germany accounts for over 30% of Europe's plant-based food consumption, with plant-based seafood playing a pivotal role in clean-label formulations. The German Nutrition Society highlights that the demand for plant-based seafood has surged by 22% annually, supported by government initiatives promoting healthier and more sustainable diets. Additionally, Germany's robust food and beverage industry has amplified demand, creating a fertile ground for market expansion.

The UK is another leading regional market for plant-based seafood in Europe. The stringent regulations of the UK against unsustainable fishing practices and the introduction of campaigns promoting plant-based diets have significantly boosted the adoption of plant-based seafood. Over the forecast period, the UK market for plant-based seafood is projected to expand at a notable CAGR owing to the rising consumer awareness about overfishing and marine conservation. The UK's thriving foodservice sector, particularly in vegan and vegetarian restaurants, further amplifies demand. Additionally, the prevalence of health-conscious millennials has fueled the popularity of plant-based diets, creating a fertile ground for market expansion.

France is likely to hold a substantial share of the Europe plant-based seafood market over the forecast period. The culinary traditions and emphasis of France on gourmet products have driven the integration of plant-based seafood into premium food and beverage offerings. According to the French Ministry of Agriculture, the demand for plant-based seafood has surged by 18% annually, supported by their use in artisanal dishes and fine dining establishments. France's focus on sustainability and organic farming aligns with clean-label trends, further propelling market growth. Additionally, the country's robust export-oriented food industry has increased the adoption of plant-based seafood, enhancing their importance in the regional market.

Italy is anticipated to witness a prominent CAGR in the Europe plant-based seafood market over the forecast period. The rich culinary heritage of Italy and growing health consciousness have driven the adoption of plant-based seafood in traditional recipes and modern formulations. According to the Italian Confederation of Bakeries, the demand for plant-based seafood has grown by 20% annually, supported by their use in pasta dishes, risottos, and Mediterranean cuisine. Italy's strong export-oriented food industry further amplifies demand, as manufacturers seek to meet international clean-label standards. Additionally, the rise of plant-based diets and the popularity of Mediterranean cuisine have positioned plant-based seafood as a key ingredient in innovative product development.

Spain is predicted to register a healthy CAGR in the European market over the forecast period. The warm climate of Spain and agricultural expertise have facilitated the cultivation of raw materials like seaweed and algae, reducing dependency on imports. According to the Spanish Diabetes Federation, the demand for plant-based seafood has increased by 15% annually, driven by rising awareness about sustainable fishing practices and marine conservation. Spain's vibrant tourism industry has also contributed to market growth, as hotels and restaurants adopt high-quality plant-based seafood options. Additionally, the country's growing focus on sustainability and eco-friendly practices aligns with clean-label trends, ensuring sustained demand for plant-based seafood.

DETAILED SEGMENTATION OF EUROPE PLANT-BASED SEAFOOD MARKET INCLUDED IN THIS REPORT

This research report on the Europe plant-based seafood market has been segmented and sub-segmented based on product type, distribution channel & region.

By Product Type

- Fish Alternatives

- Crustacean Alternatives

- Mollusk Alternatives

- Ready-to-Eat Meals & Snacks

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty & Health Food Stores

- Online Retail

- Foodservice

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the plant-based seafood market in Europe?

Increasing consumer demand for sustainable and ethical food options, rising vegan and flexitarian populations, and advancements in plant-based food technology are key drivers.

2. What are the key challenges facing the plant-based seafood industry in Europe?

Challenges include achieving authentic taste and texture, high production costs, regulatory approvals, and consumer skepticism about alternative seafood products.

3. How are consumers responding to plant-based seafood in Europe?

Consumers are increasingly adopting plant-based seafood due to health, environmental, and ethical concerns, but some remain hesitant due to taste and texture differences.

4. Who regulates plant-based seafood products in Europe?

The European Food Safety Authority (EFSA) and national food regulatory bodies oversee the safety and labeling of plant-based seafood products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]