Europe PET Packaging Market Size, Share, Trends & Growth Forecast Report By End User Industry (Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe PET Packaging Market Size

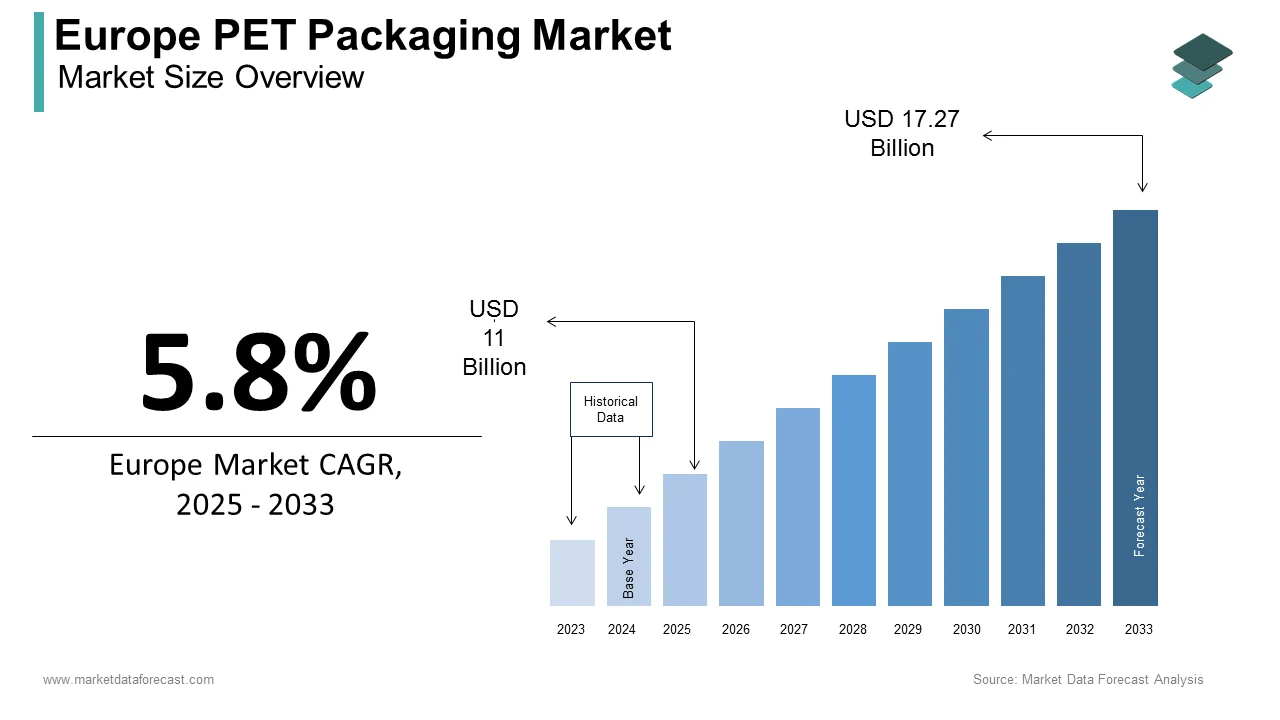

The PET packaging market size in Europe was valued at USD 10.4 billion in 2024. The European market is estimated to be worth USD 17.27 billion by 2033 from USD 11 billion in 2025, growing at a CAGR of 5.8% from 2025 to 2033.

PET is widely utilized in various applications, including beverage bottles, food containers, and packaging for consumer goods. The market has experienced significant growth due to the increasing demand for sustainable packaging solutions, driven by consumer preferences for environmentally friendly products. The versatility of PET is combined with its excellent barrier properties and clarity, makes it a preferred choice for manufacturers across multiple sectors. The growing emphasis on recycling and the circular economy has further bolstered the demand for PET packaging, as it can be easily recycled and reused. The PET packaging sector is poised to adapt and innovate by ensuring its relevance in a rapidly evolving landscape. The market's future will be shaped by advancements in technology, sustainability efforts, and changing consumer preferences.

MARKET DRIVERS

Rising Demand for Sustainable Packaging Solutions

The increasing consumer demand for sustainable packaging solutions is a significant driver of the European PET packaging market. Consumers are actively seeking products that minimize their ecological footprint as environmental awareness grows. According to a survey conducted by the European Commission, approximately 79% of Europeans consider the environmental impact of packaging when making purchasing decisions. This shift in consumer behavior has prompted manufacturers to adopt more sustainable practices by including the use of recyclable materials like PET. Moreover, the European Union's commitment to reducing plastic waste and promoting a circular economy has led to the implementation of various regulations aimed at encouraging recycling and the use of recycled materials. The EU's Plastics Strategy aims to make all plastic packaging recyclable by 2030, further driving the demand for PET packaging. The European PET packaging market is well-positioned for sustained growth as consumers and businesses alike prioritize environmentally responsible packaging.

Growth of the Beverage Industry

The growth of the beverage industry is another key driver propelling the European PET packaging market. PET is widely used in the production of beverage bottles due to its lightweight, shatter-resistant properties, and excellent barrier performance. The increasing consumption of bottled beverages in the context of on-the-go lifestyles has significantly bolstered the demand for PET packaging. Additionally, the trend towards healthier beverage options, such as flavored water and functional drinks that has further fueled the demand for PET bottles. The convenience and portability of PET packaging make it an ideal choice for consumers seeking easy-to-carry options.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Costs

One of the significant restraints affecting the European PET packaging market is the complex regulatory landscape governing the use of plastics and packaging materials. The European Union has implemented stringent regulations aimed at reducing plastic waste and promoting sustainability, such as the Single-Use Plastics Directive and the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation. Compliance with these regulations can be challenging for manufacturers, particularly small and medium-sized enterprises (SMEs) that may lack the resources to navigate the regulatory framework effectively. According to a report by the European Chemicals Agency, the costs associated with compliance can reach up to €1 million per product by posing a financial burden on smaller companies.

Furthermore, the evolving nature of regulations is concerning the use of certain additives and materials can create uncertainty in the market. Manufacturers must continuously adapt to changing requirements, which can lead to delays in product launches and increased operational costs.

Price Volatility of Raw Materials

Another notable restraint is the price volatility of raw materials used in PET packaging production. The primary raw materials for PET, including terephthalic acid and ethylene glycol, are subject to fluctuations in supply and demand, which can significantly impact production costs. According to the PlasticsEurope association, the prices of key raw materials have experienced fluctuations of up to 25% in recent years with the factors such as geopolitical tensions, supply chain disruptions, and changes in crude oil prices. This volatility can create challenges for manufacturers in maintaining stable pricing for their products, potentially affecting profitability and market competitiveness.

Moreover, the increasing competition for raw materials in the context of sustainability and recycling initiatives can further exacerbate supply chain challenges. The demand for high-quality recycled feedstock is rising by leading to potential shortages and price increases. Therefore, navigating the challenges associated with raw material volatility is essential for the European PET packaging market to ensure consistent supply and pricing stability.

MARKET OPPORTUNITIES

Expansion of the Recycling Infrastructure

The expansion of recycling infrastructure presents a significant opportunity for the European PET packaging market. The need for efficient recycling systems has become increasingly important as the demand for sustainable packaging solutions continues to rise. According to a report by the European Commission, the recycling rate for PET bottles in Europe reached 59% in 2020, with a target of 77% by 2025. This growing emphasis on recycling is driving investments in advanced recycling technologies and facilities, which can enhance the quality and availability of recycled PET (rPET). Manufacturers can capitalize on this opportunity by incorporating rPET into their packaging solutions, thereby reducing their reliance on virgin materials and minimizing their environmental impact. The increasing consumer preference for products made from recycled materials further supports this trend, as consumers seek to make more sustainable choices.

Growth of E-commerce and Online Retail

The growth of e-commerce and online retail presents another promising opportunity for the European PET packaging market. The COVID-19 pandemic has accelerated the shift towards online shopping, with consumers increasingly turning to e-commerce platforms for their purchasing needs. This trend has created a heightened demand for efficient and protective packaging solutions that can withstand the rigors of shipping and handling.

PET packaging is known for its lightweight and durable properties and is well-suited for e-commerce applications in the packaging of food, beverages, and consumer goods. The demand for PET packaging is expected to grow as online retailers seek to enhance the customer experience through effective packaging solutions.

MARKET CHALLENGES

Competition from Alternative Packaging Materials

One of the primary challenges facing the European PET packaging market is the intense competition from alternative packaging materials. The materials such as glass, metal, and biodegradable options are gaining traction as viable substitutes as industries seek to reduce their reliance on traditional plastics. Moreover, the growing popularity of bioplastics and other sustainable materials can further erode market share for conventional PET packaging. Manufacturers may face pressure to adapt their product offerings to remain competitive as consumers increasingly prioritize eco-friendly options.

Supply Chain Disruptions

Another significant challenge is the potential for supply chain disruptions, which can impact the availability and pricing of raw materials used in PET packaging. The COVID-19 pandemic has escalated vulnerabilities in global supply chains is leading to shortages and delays in the procurement of essential materials. According to a survey conducted by the European Chemicals Industry Council, nearly 60% of chemical manufacturers reported disruptions in their supply chains due to the pandemic by affecting their ability to meet production demands.

Additionally, geopolitical tensions and trade disputes can further exacerbate supply chain challenges is leading to increased costs and uncertainty in the market. They must implement effective supply chain management strategies to mitigate the impact of these disruptions as manufacturers strive to maintain consistent production levels. Ensuring a reliable supply of raw materials is crucial for the long-term sustainability and competitiveness of the European PET packaging market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By End User Industry and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Equipolymers, Indorama Ventures Public Company Limited, JBF Industries Ltd, NEO GROUP, SIBUR Holding PJSC, and Others. |

SEGMENTAL ANALYSIS

By End User Industry Insights

The packaging segment dominated the market and held 60.4% of the total European PET packaging market share in 2024. This dominance is primarily driven by the widespread use of PET in the food and beverage industry, where it is valued for its lightweight, shatter-resistant properties, and excellent barrier performance. The importance of the packaging segment lies in its critical function in preserving product quality and extending shelf life. PET is commonly used in beverage bottles, food containers, and packaging for consumer goods by making it a staple in the packaging industry. The growing emphasis on sustainability and recycling initiatives has further bolstered the demand for PET packaging, as it can be easily recycled and reused.

The automotive segment is likely to exhibit a CAGR of 6.5% during the forecast period. This growth can be attributed to the increasing use of PET in automotive applications in the production of lightweight components and interior parts. According to a report by the European Automobile Manufacturers Association, the demand for lightweight materials in the automotive industry is expected to rise significantly that is driven by the need for improved fuel efficiency and reduced emissions. The rising trend of lightweighting in the automotive sector is a key driver of growth in the PET segment. The adoption of PET for components such as bumpers, dashboards, and interior trims is on the rise as manufacturers seek to enhance vehicle performance and reduce weight.

REGIONAL ANALYSIS

Germany's PET packaging market was the top performer by holding accounting 25.6% of the share in 2024. This dominance can be attributed to the country's robust industrial base and strong demand for PET packaging across various sectors, including food and beverage, automotive, and consumer goods. Moreover, Germany's commitment to sustainability and recycling initiatives further enhances the market for PET packaging. The country has implemented stringent regulations aimed at reducing plastic waste and promoting the circular economy, which encourages manufacturers to innovate and develop eco-friendly products. The emphasis on high-quality engineering and manufacturing standards in Germany also ensures that PET packaging meets rigorous performance and safety requirements by making it highly sought after in various applications.

France's PET packaging market is ascribed to register a CAGR of 5.5% during the forecast period owing to the increasing focus on sustainability and innovation. The importance of the French market lies in its commitment to environmental responsibility and the promotion of sustainable practices. France has implemented various initiatives aimed at reducing plastic waste and encouraging the use of recycled materials in manufacturing. This focus on sustainability aligns with the growing consumer demand for eco-friendly products that further bolsters the market for PET packaging. Additionally, the beverage industry in France is a transformation with manufacturers increasingly adopting lightweight materials to enhance product convenience and reduce environmental impact.

The United Kingdom PET packaging market is lucratively to grow in the next coming years with the increasing focus on sustainability and the adoption of innovative packaging solutions. The importance of the UK market lies in its commitment to reducing plastic waste and promoting recycling initiatives. The UK government has implemented various policies aimed at encouraging the use of recycled materials and reducing single-use plastics, which aligns with the growing consumer demand for sustainable products. This focus on environmental responsibility is expected to drive the demand for PET packaging that incorporates recycled content. Moreover, the beverage sector in the UK is experiencing significant changes with a rising preference for bottled water and health-oriented drinks.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe PET packaging market profiled in this report are Equipolymers, Indorama Ventures Public Company Limited, JBF Industries Ltd, NEO GROUP, SIBUR Holding PJSC, and Others.

MARKET SEGMENTATION

This Europe PET packaging market research report is segmented and sub-segmented into the following categories.

By End User Industry

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth of the Europe PET Packaging Market?

The Europe PET Packaging Market is projected to grow at a CAGR of 5.8% from 2025 to 2033, driven by increasing demand for sustainable packaging.

2. Which industries drive the Europe PET Packaging Market?

The Europe PET Packaging Market is fueled by industries such as food & beverages, pharmaceuticals, and personal care, due to PET’s durability and recyclability.

3. What challenges does the Europe PET Packaging Market face?

The Europe PET Packaging Market faces challenges like fluctuating raw material prices and strict environmental regulations limiting plastic use.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]