Europe Pet Insurance Market Size, Share, Trends & Growth Forecast Report By Policy Type, Policy and Country (United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 To 2033

Europe Pet Insurance Market Size

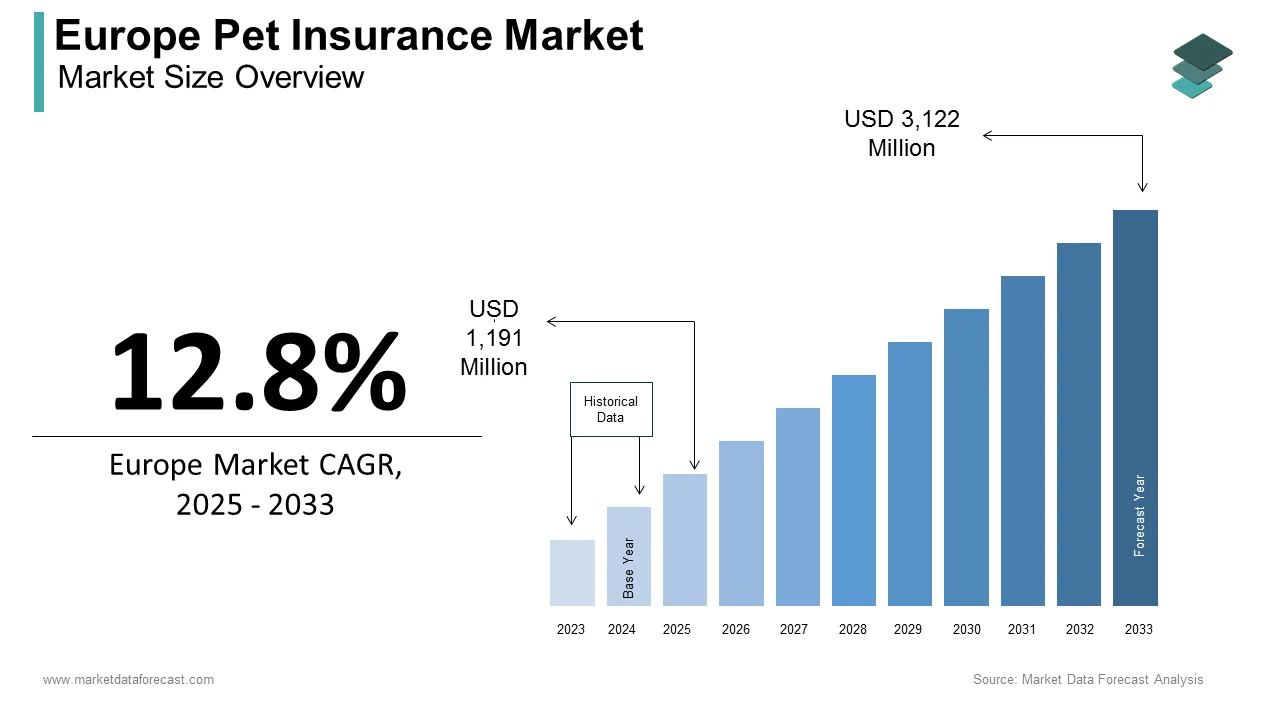

The size of the Europe pet insurance market was worth USD 1,056 million in 2024. The European market is expected to grow at a CAGR of 12.8% from 2025 to 2033 and be worth USD 3,122 million by 2033 from USD 1,191 million in 2025.

Pet insurance refers to insurance policies designed to cover the healthcare expenses of pets, including accidents, illnesses, routine checkups, and preventive care. Pet insurance has gained popularity across Europe as pet ownership rises and pet health becomes a priority. The growing prevalence of chronic diseases among pets, such as arthritis and diabetes, is promoting the need for comprehensive insurance coverage. According to the Federation of Veterinarians of Europe (FVE), veterinary costs in Europe have steadily increased due to advancements in medical treatments and diagnostics. This trend has made pet insurance an essential tool for managing unexpected healthcare costs. Additionally, the rising pet adoption rates, particularly during the COVID-19 pandemic, which saw a significant surge in pet ownership are contributing to the pet insurance market expansion in Europe. According to the reports of the European Pet Food Industry Federation (FEDIAF), nearly 90 million European households owned pets in 2022. This is driving demand for insurance products tailored to their needs in Europe. The United Kingdom, Sweden, and Germany are leading the way in policy adoption in Europe. These countries are characterized by high awareness of pet health and a strong emphasis on preventive care, contributing to the regional market expansion.

MARKET DRIVERS

Rising Veterinary Costs in Europe

The increasing cost of veterinary care is a significant driver of the European pet insurance market. Advanced diagnostic tools, specialized treatments, and surgical procedures have made veterinary care more effective but also more expensive. According to the Federation of Veterinarians of Europe (FVE), veterinary service costs have risen by over 20% in the last five years, particularly for complex treatments like cancer therapy or orthopedic surgeries. These escalating expenses encourage pet owners to invest in insurance policies to manage unexpected costs and provide optimal care for their pets, thereby fueling market growth.

Growing Pet Ownership and Awareness of Pet Health

The rise in pet ownership across Europe, coupled with increased awareness of pet health, is another key driver of the pet insurance market. The European Pet Food Industry Federation (FEDIAF) reports that approximately 90 million households in Europe owned pets in 2022, reflecting a growing attachment to companion animals. Additionally, pet owners are becoming more proactive in seeking preventive care and comprehensive health coverage for their pets. This shift in mindset has led to higher adoption rates of pet insurance policies, particularly in countries with strong cultural emphasis on animal welfare, such as Sweden and the United Kingdom. This trend continues to expand the market.

MARKET RESTRAINTS

High Cost of Premiums

The cost of pet insurance premiums is a significant restraint in the European pet insurance market. Many pet owners, especially those with limited budgets, find comprehensive coverage expensive, which limits policy adoption. According to the Federation of Veterinarians of Europe (FVE), the average annual cost of pet insurance in the region ranges from €250 to €700, depending on the coverage level and the pet's breed or age. This cost barrier is particularly challenging for lower-income households, leading some pet owners to opt out of insurance or choose minimal coverage, thereby slowing market growth.

Limited Awareness in Certain Regions

Uneven awareness about the benefits of pet insurance across Europe acts as another restraint on the market. While countries like the United Kingdom and Sweden have high insurance adoption rates, other regions, such as Southern and Eastern Europe, lag behind. The European Pet Food Industry Federation (FEDIAF) highlights that less than 5% of pet owners in these regions have active insurance policies. This disparity is attributed to a lack of education about insurance products and lower levels of disposable income in these areas. Bridging this awareness gap is crucial for achieving balanced growth across the European market.

MARKET OPPORTUNITIES

Integration of Digital Platforms and Telemedicine

The adoption of digital platforms and telemedicine services offers a significant opportunity for the Europe pet insurance market. Insurers are increasingly integrating mobile apps and online portals to streamline claim processes, provide real-time policy management, and offer telemedicine consultations. The European Commission highlights that digital transformation in the healthcare sector grew by 30% in 2022, driven by consumer demand for convenient and remote services. Pet telemedicine, which allows owners to consult veterinarians virtually, enhances the value of insurance policies by providing accessible and timely care. This technological advancement is particularly appealing to tech-savvy pet owners and is set to attract new customers.

Expansion of Customized and Preventive Care Plans

The growing demand for tailored insurance plans that address specific pet needs presents another opportunity for market growth. Pet owners are increasingly seeking policies that cover preventive care, such as vaccinations, wellness exams, and nutritional counseling, alongside traditional accident and illness coverage. According to the Federation of Veterinarians of Europe (FVE), preventive healthcare visits for pets rose by 15% in 2022, reflecting a proactive approach to pet wellness. Insurers can capitalize on this trend by offering flexible, modular plans that cater to different breeds, life stages, and medical histories, thereby appealing to a broader customer base and driving policy adoption.

MARKET CHALLENGES

Limited Coverage for Older Pets and Pre-Existing Conditions

A significant challenge in the European pet insurance market is the limited coverage offered for older pets and pre-existing conditions. Insurers often exclude coverage for pets above a certain age or charge significantly higher premiums, making it unaffordable for many owners. According to the Federation of Veterinarians of Europe (FVE), approximately 25% of pets in Europe are senior animals, yet many remain uninsured due to these restrictions. Additionally, policies frequently exclude pre-existing conditions, leaving owners unable to claim ongoing treatments. This gap in coverage reduces the appeal of pet insurance and creates dissatisfaction among potential policyholders.

Complexity in Understanding Insurance Policies

The complexity of insurance terms and policy exclusions poses another challenge in the European pet insurance market. Many pet owners find it difficult to navigate coverage details, such as deductibles, co-payments, and waiting periods, leading to confusion and lower adoption rates. A survey by the European Consumer Organisation indicates that 60% of pet owners in Europe feel that insurance policies lack transparency, discouraging them from purchasing coverage. This challenge is further exacerbated by inconsistent terms and varying regulations across countries, which create additional hurdles for consumers and hinder market growth. Simplifying policies and improving transparency are critical to addressing this issue.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Policy, Policy Type, and country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Petfirst Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group, and Others. |

SEGMENTAL ANALYSIS

By Policy Insights

The dog insurance segment led the market in 2024 and is expected to hold the leading position in the European market throughout the forecast period. In Europe, dogs are among the most favored and extensively owned pets. The growing focus of dog owners regarding their pet’s health and well-being and the increasing interest of dog owners to seek financial protection against veterinary expenses are majorly driving the expansion of the dog insurance segment. The availability of advanced veterinary treatments for dogs and the expansion of coverage options to include hereditary and congenital conditions, behavioral therapy and alternative therapies across the European region are boosting the growth of the dog insurance segment in the Europe pet insurance market. France and Sweden are emerging key markets for dog insurance in Europe and are showing double-digit growth rates in policy sales observed annually.

The cat insurance segment was the second largest segment in the European pet insurance market in 2024 and is anticipated to grow at a prominent CAGR during the forecast period. The growth of the cat insurance segment is majorly attributed to the growing adoption of cats as pets and the rising availability of specialized veterinary services for cats. The United Kingdom and Germany are the leading markets for cat insurance in Europe, holding around 50% of the market share.

By Policy Type Insights

The Lifetime cover segment is gaining traction over the market share and is likely to hold the leading share of the European market during the forecast period. The average lifetime cost of raising a dog is more than $27,000, the demand for pet insurance has grown in recent yea due to the high expense of pet ownershiprs. Non-lifetime policies may be preferred by pet owners for affordable options, particularly those opting for coverage for acute or transient medical issues over chronic or long-term illnesses. Therefore, high cost is boosting the demand for the lifetime insurance segment.

REGIONAL ANALYSIS

The UK led the pet insurance market in Europe in 2024. The domination of the UK market is primarily driven by high pet ownership rates and widespread awareness of pet health. According to the Pet Food Manufacturers’ Association, 62% of UK households owned pets in 2022, with over 40% of these owners opting for insurance coverage. The UK's pet market is largely unexplored, with 70% of dogs and more than 80% of cats lacking health insurance. The UK has a high pet ownership rate and a mature insurance industry, which offers high growth potential for the market participants to tap the UK pet insurance market; for instance, according to the statistics of the Pet Food Manufacturers Association (PFMA), an estimated 12 million households in the UK own pets. The UK’s well-established insurance providers offer comprehensive policies covering accidents, illnesses, and preventive care, supported by advanced digital claim processes. This robust ecosystem positions the UK as a leader in the market.

Sweden is a key player in the European pet insurance market. Sweden has one of the highest pet adoption rates globally. The Swedish Insurance Federation reports that over 90% of pet owners in Sweden have insurance, reflecting a strong cultural emphasis on pet welfare. Sweden has a strong culture of pet ownership. Pet owners in Sweden have been prioritizing comprehensive healthcare for their pets, which is resulting in the increasing adoption of pet insurance policies. Agria, which is one of the largest pet insurance companies in Sweden, says an estimated 90% of dogs, 60% of horses, and 50% of cats in Sweden are insured. Comprehensive policy offerings, including routine care and chronic illness coverage, have contributed to this high penetration, making Sweden a benchmark in the sector.

Germany is another major pet insurance market in Europe. The growing pet population and increasing veterinary costs propel the German pet insurance market growth. According to the FEDIAF, Germany had over 34 million pets in 2022 and this is creating substantial demand for insurance. The presence of a large pet population and increasing awareness of the benefits of pet insurance in Germany are majorly propelling the German pet insurance market. An increase in the interest among pet owners in taking insurance coverage for their pets against veterinary expenses has been noticed, and this trend is likely to accelerate during the forecast period and boost the German market growth, for instance, as per the data published by Gesamtverband der Deutschen Versicherungswirtschaft, an expected 20% of dogs and 10% of cats in Germany are insured and this highlights the growing interest of pet owners in opting for pet insurance and the market potential for pet insurance providers in Germany. Additionally, the country’s focus on pet health, supported by a strong network of veterinary clinics, drives the adoption of insurance policies that cater to both routine and emergency care.

KEY MARKET PARTICIPANTS

Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Petfirst Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group are some of the notable companies in the Europe pet insurance market.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, A real-time pet insurance service was announced by the CRIF in the United Kingdom with aggressive prices and faster claim settlements.

MARKET SEGMENTATION

This research report on the Europe pet insurance market has been segmented and sub-segmented into the following categories.

By Policy

- Cat Insurance

- Dog Insurance

- Horse Insurance

- Rabbit Insurance

- Exotic Pet Insurance

- Others

By Policy Type

- Lifetime Cover

- Accidental Cover

- Illness Cover

- Non-lifetime Cover

- Accidental Cover

- Illness Cover

By Region

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]