Europe Pet Food Market Size, Share, Trends, & Growth Forecast - Segmented By Ingredient, Product , Animal Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2024 to 2032)

Europe Pet Food Market Size (2024 to 2032)

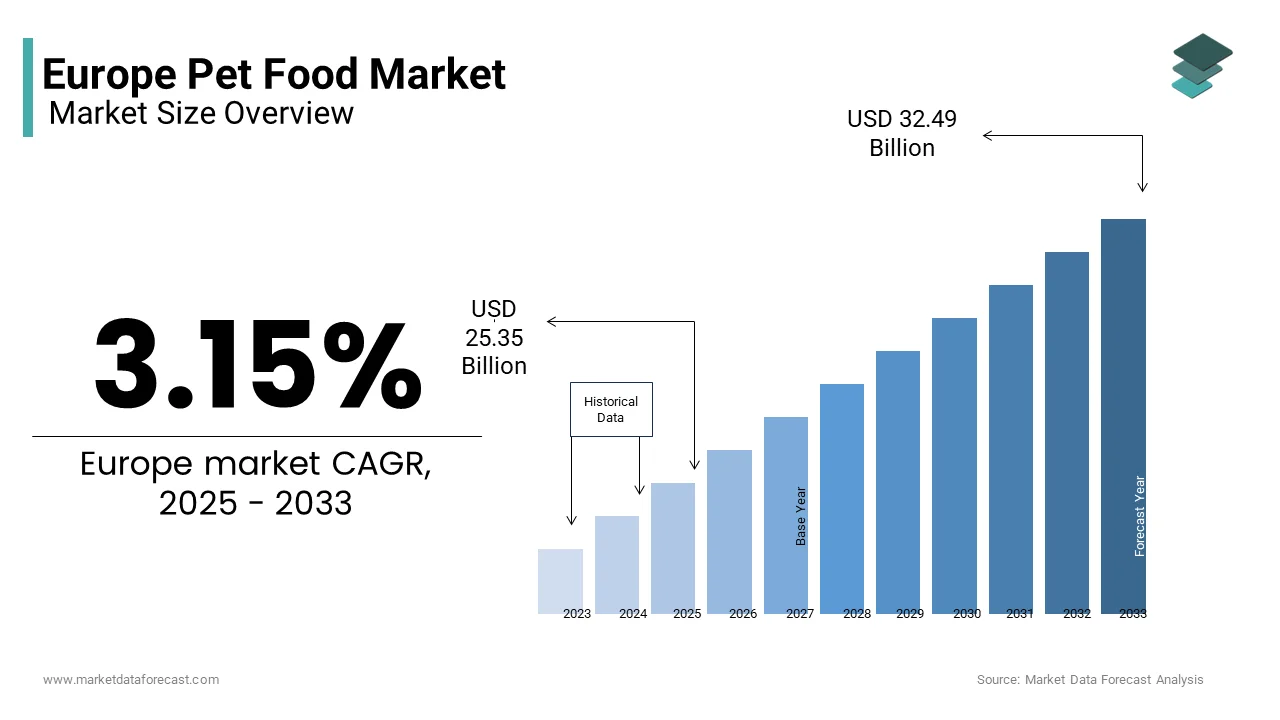

The European pet food market is expected to reach USD 23.83 billion in 2023 and anticipated to reach USD 24.58 billion in 2024, from USD 31.50 billion by 2032 and growing at a CAGR of 3.15% from 2024 to 2032.

MARKET DRIVERS

The increasing adoption of pets in Europe propels the growth of the European pet food market.

Many people are adopting pets for emotional support; older people and low financial status people have low interaction with other people, and living alone at house requires emotional support. The adoption of pets had increased post-pandemic due to increased pet humanization. Pet humanization includes incorporating pets into all human things, such as trips and healthcare with nutrition, driving the growth of Europe's pet food market size. According to the European Pet Food Federation, around 46% of households have at least a single pet. Due to the increased adoption of pets, pet food manufacturers are introducing premium products, which play a pivotal role in market growth. The adoption of urbanization is leading to the desire for pets in large households, which is expected to propel the growth of European pet food market revenue.

Growing awareness of the animal companion is accelerating the growth of the European pet food market.

People are aware that having pets at home helps manage depression and loneliness. Pets like dogs and cats also provide security to their owners and help them take care of the family. Pets keep children secure, which is gaining people's interest. These factors are raising the adoption rate in Europe, which influences the increase in the growth of the European pet food market. The increasing trend toward conventional dog food and fresh, healthy food is expected to create lucrative opportunities for the European pet food market. The ease of availability of pet foods in online retailing is expected to influence the market positively during the forecast period.

The Easter region is experiencing more growth of private-label pet feed brands than its Western counterpart. This can be due to variations in population incomes. The progress of these brands has not only surpassed inflation but also the proportion of the overall market. This pattern in the regional industry is fuelled by the continuous enhancement in food quality and the cumulative development in caloric cover. Coupled with the direct impact of the cost-of-living crisis led by heightening inflation in the previous two years. The European pet food market is propelled by the high adoption rate in the region. It has increased post-pandemic due to increased pet humanization. This includes trips and vacations, taking care of pets, and spending on healthcare like humans. All these are pushing forward the growth of Europe's pet food market size. Moreover, the increased pace of urbanization has also played an important role in boosting its demand because of higher spendable income, etc.

MARKET RESTRAINTS

The stringent government regulations for pet adoption in Europe hinder the growth of the Europe pet food market.

Regulations that are associated with animal neglect and cruelty are hampering the adoption rate, which decreases the growth of the pet food market. According to PETA UK, around a million animals are observed under animal neglect and cruelty. According to a few studies, pets are also the victims in most child abuse cases. Another factor challenging the pet food market is habituating home food to the pets. Most pet owners habituate feeding their pets their food, hindering the pet food market size. The high cost of feed and raw materials is also estimated to impede the market's growth. The stringent regulatory environment has a complicated system for registration and approval, which is created to ensure higher levels of quality, safety, and hygiene. This is a key factor hindering the entry of non-EU producers trying to access the regional industry. Moreover, the strict government regulations for pet adoption related to animal neglect and cruelty are hampering the adoption rate and decreasing the growth of the Europe pet food market. Further, the high feed and raw materials cost is also estimated to impede the market's growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.15% |

|

Segments Covered |

By Product, Ingredients, Animal Type, and Country |

|

Various Analyses Covered |

Regional and country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD and Pet Center |

This European pet food market research report has been segmented and sub-segmented into the following categories.

Europe Pet Food Market By Product

- Dry Pet Food

- Wet Pet Food

- Veterinary Diet

- Treats/Snacks

The dry pet food segment dominated the European pet food revenue with a market share of 25% in 2023. However, frozen and freeze-dried pet food is gaining traction due to its longer shelf-life and is projected to have a significant growth rate in the forecast period. Changing lifestyles are allowing people to prefer frozen food for their pets.

Europe Pet Food Market By Ingredients

- Animal Derivatives

- Plant derivatives

- Insect derivatives

- Cereals & Cereal by-products

- Fruits & Vegetables

- Fats & Oils

- Vitamins & Minerals

- Additives

The animal-derived segment held a significant share in the European pet food market. This segment includes fish, chicken, beef, and pork, which dogs and cats highly prefer. The plant-derived segment is expected to grow significantly in European pet food revenue due to increased pet health awareness among pet owners. The insect-derived segment has also gained traction recently and is estimated to have decent growth over the forecast period.

Europe Pet Food Market By Animal

- Dog

- Cat

- Bird

- Other Animals

The cat segment dominated the European market due to increased cat adoption over dogs in the last decade. According to the European Pet Food Industry Federation, the pet cat population dominated the dog population by over 20 million in Russia, which stood at the top for cat population, followed by Germany and France. The increasing pet humanization is accelerating the pet food market in the European region. With the increase in cats as pets, cat food is becoming more prominent in this region. The current modern lifestyle resembles cats as the most widespread adoption pet.

Europe Pet Food Market By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

European region held the second largest share in the pet food market, with a market share of 27% in 2023. The UK dominated the European pet food market due to its high pet adoption rate, which is expected to maintain its domination in the forecast period. According to UK Pet Food, 62% of households will consist of pets in 2022, which is expected to increase in the upcoming years, positively influencing the European pet food market share. Pet owners in Europe are investing more in premium pet food to provide healthy pets with essential nutrients. The presence of the key market players in this region also influences the market growth.

Germany is witnessing strong growth in the Europe pet market, with overall sales of 7.1 billion euros or 7.54 billion dollars in 2023. All the pet categories in the country saw a surge in their sales due to the rise in demand. Besides this, the stationary specialist and food retailer’s revenue grew by 9.5 percent against last year to 5.616 billion euros in 2023. In addition, the majority of pets in the nation stay in multi-person households. Around 35 percent of two-person families, three individuals or more, and a single person with 36 and 29 percent, respectively.

Italy is one of the largest markets in Europe for pet foods. In 2022, there are more than 65 million pets were taken care of by pet parents in the country and this figure is about 200k greater than that of 2021. So, fish with 29.9 million tops the list of popular pets, followed by birds with 12.9 million then cats with 10.2 million. In addition, out of 10 families, 4 or more have a pet which is on par with the European average.

France's pet food market is expected to grow at an elevated pace during the forecast period. The owners on average spend more than 940 euros annually on their pets. Of which the maximum portion of approximately 630 euros is credited to food and close to 140 and 25 euros for veterinary costs and sitting services. Moreover, in May 2024, Mars announced that it would invest 130 million euros over 8 plants in France.

The United Kingdom is projected to propel further in the future. It is home to over 30 million pets, of which mostly are dogs and cats, with 13.5 and 12.5 million, respectively. Also, about 57 percent of UK families own pets, and this proportion rose by 5 percent in 2022. At that time, 62 percent had animals. Furthermore, there are around 3000 pet stores in the country.

Spain's pet market is anticipated to grow at a steady rate during the forecast period. The change in impression and understanding has expanded the regional pet care industry and raised the demand for superior-quality goods and services particularly for health. Surprisingly, 8 out of 10 people having pets consider them as their other family members.

KEY MARKET PLAYERS

The European pet food market is highly concentrated, with ten major players together accounting for more than 50% of the market share, and the remaining market share is distributed among a large number of small manufacturers. Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD, Pet Center, Incorporated (PCI), Nestle Purina PetCare, Nisshin Saifun Group INC. Natural Dog Food Company, Halo, Purely for Pets, Marukan CO. LTD., Nutrena, and Spectrum Brands, INC. are the major companies in the Europe pet food market.

RECENT HAPPENINGS IN THE EUROPE PET FOOD MARKET

- In April 2023, General Mills announced the procurement of European pet food brand Edgard & Cooper. This purchase suits the company’s Accelerate strategy emphasizing improving their core businesses, global platforms, and domestic brands to advance further in sustainable development and give value to investors. Also, Edgard & Cooper is famous for its organic and eco-friendly method for pet food with projected retail sales of around 100 million euros in 2023 throughout 13 markets.

- In April 2024, Nestle will build a new factory for pet food in Italy. For this, the company will invest 472 million euros or 507.92 million dollars in Mnatua and is planned to open by 2027.

Frequently Asked Questions

What is the current size of the pet food market in Europe?

The European pet food market was valued at USD 23.83 billion in 2023.

Which countries in Europe are the key players in the pet food market?

Germany, the United Kingdom, France, Italy, and Spain are capturing the major share of the Europe pet food market.

What is the impact of the COVID-19 pandemic on the European pet food market?

The impact of the pandemic is severe on pets, as many people thought the spread of the virus increased with the animals during the pandemic. Some people gave up on their pets, and many people considered giving up on their pets to escape from the spread of COVID-19.

What are the key market players involved in European pet food market?

Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD, Pet Center, Incorporated (PCI), Nestle Purina PetCare, Nisshin Saifun Group INC. Natural Dog Food Company, Halo, Purely for Pets, Marukan CO. LTD., Nutrena, and Spectrum Brands, INC. are the major companies in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]