Europe Pet Care Market Size, Share, Trends & Growth Forecast Research Report, Segmented By Product Type, Pet Type, Distribution Channel And By Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Pet Care Market Size

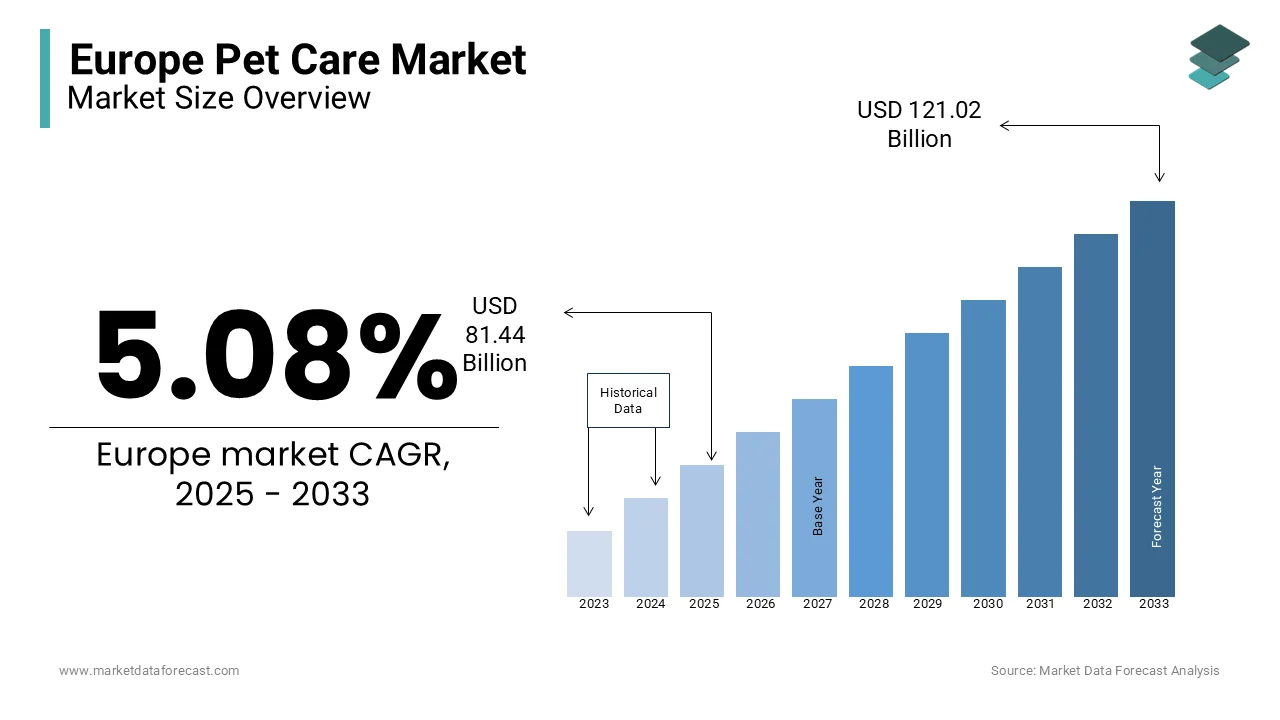

The European pet care market size was valued at USD 77.51 billion in 2024 and is anticipated to reach USD 81.44 billion in 2025 from USD 121.02 billion by 2033, growing at a CAGR of 5.08% from 2025 to 2033.

Pet ownership in Europe is significant. According to the European Pet Food Industry Federation (FEDIAF), an estimated 90 million households owning at least one pet in Europe. Dogs and cats account for the majority, with approximately 89 million cats and 67 million dogs across the region in 2022. Additionally, the growing awareness of pet health has spurred demand for specialized veterinary services, insurance, and advanced pet nutrition products. The European pet care market has also witnessed substantial growth in e-commerce, with more pet owners opting to purchase supplies online for convenience. As per the data of the Eurostat, a 20% rise was noticed in online sales of pet-related products in 2022. Furthermore, innovations in technology, such as smart pet collars and automated feeders are contributing to the pet care market expansion in Europe.

MARKET DRIVERS

Increasing Pet Ownership and Humanization of Pets

The rising pet ownership in Europe, coupled with the growing trend of treating pets as family members, is a key driver of the pet care market. According to the European Pet Food Industry Federation (FEDIAF), there were over 160 million companion animals in Europe in 2022, with a significant increase in pet adoptions during the COVID-19 pandemic. This humanization of pets has fueled demand for premium and customized products, such as organic pet food and high-quality grooming services. Additionally, the focus on pet wellness has led to higher spending on healthcare and enrichment products, reflecting a cultural shift towards prioritizing pets’ overall quality of life.

Advancements in Pet Healthcare and Nutrition

Innovations in pet healthcare and nutrition are driving growth in the Europe pet care market. The European Medicines Agency (EMA) highlights an increasing focus on preventive healthcare for pets, including vaccines, parasite control, and diagnostics. Pet owners are investing in advanced veterinary treatments and nutritional products tailored to specific breeds and life stages. Additionally, the demand for functional foods, such as grain-free and hypoallergenic options, has surged, with sales of specialized pet food increasing by 15% in 2022. These advancements ensure healthier and longer lives for pets, driving sustained market expansion.

MARKET RESTRAINTS

High Cost of Premium Pet Products and Services

The rising cost of premium pet care products and services acts as a significant restraint in the Europe pet care market. The European Pet Food Industry Federation (FEDIAF) notes that organic and specialized pet foods, as well as advanced veterinary treatments, are substantially more expensive than standard options. For example, grain-free or hypoallergenic pet food can cost up to 40% more than conventional varieties. Similarly, access to high-quality veterinary care, including diagnostics and surgical procedures, can be prohibitively expensive for many pet owners. These high costs limit the affordability of premium products and services, particularly for middle- and lower-income households.

Stringent Regulations on Pet Care Products

Stringent regulatory requirements in Europe present challenges for the pet care industry. The European Union enforces rigorous standards for pet food manufacturing, including the use of safe and approved ingredients under the Animal By-Products Regulation. Similarly, pet healthcare products must comply with veterinary medicinal regulations, which increase the cost and complexity of bringing new products to market. The European Medicines Agency (EMA) highlights that meeting these standards often necessitates significant investment in research, testing, and compliance processes. These regulatory hurdles, while ensuring safety and quality, can slow down innovation and entry of new players into the market.

MARKET OPPORTUNITIES

Rising Demand for Sustainable and Eco-Friendly Products

The growing emphasis on sustainability in Europe presents a significant opportunity for the pet care market. According to the European Commission’s Green Deal initiative, consumer preference for eco-friendly products is increasing across all sectors, including pet care. Pet owners are seeking sustainable pet food packaging, biodegradable grooming products, and eco-friendly toys, aligning with their environmental values. This trend has driven innovation, with manufacturers introducing plant-based pet food and recyclable packaging. FEDIAF data reveals a 25% rise in sales of sustainable pet care products in 2022, reflecting the growing market potential for eco-conscious offerings.

Growth of Pet Tech and Smart Devices

The adoption of technology in pet care offers another major growth opportunity for the Europe pet care market. Smart pet devices, such as automated feeders, GPS trackers, and health monitoring collars, are gaining popularity among tech-savvy pet owners. The European Innovation Scoreboard highlights increased investment in IoT solutions for consumer goods, including pet tech. These devices enhance convenience and allow pet owners to monitor their pets’ activities and health in real time. The rising adoption of such technologies is transforming the pet care industry, with sales of smart pet devices in Europe expected to grow by 18% annually, creating a lucrative segment for innovation-driven businesses.

MARKET CHALLENGES

Shortage of Skilled Veterinary Professionals

The Europe pet care market faces a significant challenge due to a shortage of skilled veterinary professionals. According to the Federation of Veterinarians of Europe (FVE), there is a growing disparity between the demand for veterinary services and the availability of trained professionals, particularly in rural areas. The FVE reports that over 20% of veterinary practices in Europe experience staffing shortages, leading to longer wait times and reduced access to quality care. This challenge impacts the delivery of advanced healthcare services, limiting market growth and customer satisfaction, especially as pet ownership continues to rise across the region.

Economic Pressures on Pet Owners

Economic uncertainties, including rising living costs, present another challenge for the Europe pet care market. According to Eurostat, inflation in the EU reached 8.1% in 2022, increasing the financial strain on households. Higher costs of living have led some pet owners to reduce discretionary spending on premium pet care products and services. For example, FEDIAF notes a slight decline in non-essential pet care expenditures, such as luxury grooming and specialty foods, in low-income households. This economic pressure affects market dynamics, particularly for premium and niche segments, as affordability becomes a critical factor for pet owners in their purchasing decisions.

REGIONAL ANALYSIS

Germany accounted for the major share of 21.9% of the European pet care market in 2024. The growth of Germany in the European market is attributed to its large pet-owning population and strong emphasis on premium products. For instance, over 80% of German pet owners prioritize high-quality nutrition, contributing to the €7 billion annual market value, as stated in a report by FEDIAF. The country’s robust retail infrastructure, including hypermarkets and online platforms, ensures widespread accessibility to pet care solutions. Additionally, government initiatives promoting animal welfare have fostered a culture of responsible pet ownership, further boosting demand. According to Eurostat, Germany accounts for 30% of Europe’s pet insurance market, reflecting its pivotal role in shaping regional trends.

The UK occupied the second leading share of the European pet care market in 2024. The promising position of the UK in the European market is fueled by the growing humanization of pets and a thriving e-commerce ecosystem. For example, online platforms like Pets at Home generated €3 billion in revenue in 2022, driven by subscription-based models and personalized offerings, as outlined in their financial disclosures. The rise of urbanization has amplified demand for compact and innovative pet care solutions, such as automated feeders and portable grooming tools. According to Statista, 60% of UK pet owners now shop online, citing convenience and competitive pricing as key motivators.

France is estimated to account for a prominent share of the European pet care market over the forecast period owing to the increasing adoption of pets among single-person households and a strong focus on sustainability. For instance, the French government’s Green Deal initiative allocates €500 million to support eco-friendly pet care solutions, encouraging the adoption of biodegradable products. According to Eurostat, French consumers spend €4 billion annually on pet care, with a significant portion dedicated to sustainable and plant-based options. The healthcare sector is a key contributor, leveraging innovations in pet nutrition and wellness. A report by Deloitte highlights that 70% of French pet owners prioritize eco-friendly products, underscoring their commitment to environmental responsibility.

Italy is projected to register a healthy CAGR in the European pet care market over the forecast period owing to the increasing popularity of pets as companions and the rising demand for premium products. For example, Italian pet owners spend €3 billion annually on high-quality food and accessories, driven by the humanization trend, as stated in a study by GfK. The rise of urbanization has further accelerated adoption, with small pets like cats and fish gaining popularity in compact living spaces. According to Statista, 65% of Italian consumers prefer online platforms for their convenience and variety, reflecting the growing influence of e-commerce.

Spain is expected to account for a considerable share of the European pet care market during the forecast period owing to the growing emphasis on pet health and wellness, supported by government initiatives promoting animal welfare. For instance, Spanish pet owners spend €2 billion annually on veterinary care and premium food, as highlighted in a report by Eurostat. The rise of e-commerce platforms has further amplified adoption, with 50% of consumers preferring online shopping for its convenience. A study by Kantar underscores that 60% of Spanish pet owners prioritize sustainable products, reflecting their commitment to environmental responsibility and innovation.

KEY MARKET PLAYERS

Ancol Pet Products Limited; Hill's Pet Nutrition, Inc; Mars, Incorporated; Petmate Holdings Co; Tail Blazers; Blue Buffalo Co, Ltd; Tiernahrung Deuerer GmbHChampion Petfoods LP; Nestle Purina PetCare; Saturn Petcare GmbH; The Hartz Mountain Corporation; Heristo AG; UniCharm Corporation; Diana Group; Spectrum Brands Inc; The J.M. Smucker Company; Schell & Kampeter, Inc; Nylabone are some of the major key players involved in the Europe pet food market.

Top 3 Players in the Market

The European pet care market is led by Mars Petcare, Nestlé Purina, and Royal Canin. Mars Petcare dominates the market. Nestlé Purina excels in sustainable innovation, launching eco-friendly products that captured 20% of the premium segment in 2022, as stated in their sustainability audit. Royal Canin plays a pivotal role in specialized nutrition, with a 30% market share in high-end pet food, as highlighted in their financial disclosures. These players collectively drive growth and shape the future of pet care globally.

Top Strategies Used By Key Players

Key players in the European pet care market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Mars Petcare invests €1 billion annually in R&D to develop advanced pet nutrition solutions, as outlined in their innovation roadmap. Nestlé Purina partners with environmental organizations to promote sustainable practices, enhancing its brand reputation. Royal Canin focuses on customization, offering tailored diets for specific breeds and health conditions, as stated in their market strategy document. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

Competition Overview

The European pet care market is highly competitive, characterized by the presence of global giants and regional innovators. Mars Petcare, Nestlé Purina, and Royal Canin dominate the landscape, leveraging their expertise in nutrition, sustainability, and innovation. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as eco-friendly products and smart pet technology. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Mars Petcare launched a line of sustainable pet food, designed to reduce carbon emissions by 30%.

- In June 2023, Nestlé Purina partnered with TerraCycle to introduce biodegradable packaging for its premium products.

- In January 2024, Royal Canin acquired a startup specializing in personalized pet nutrition, aiming to expand its customization offerings.

- In September 2023, Pets at Home collaborated with Google to integrate AI-driven pet monitoring into its product lineup.

- In November 2023, Tetra invested €50 million in expanding its eco-friendly aquarium solutions, targeting urban consumers.

MARKET SEGMENTATION

This market Research Report on the European pet care market is segmented and sub-segmented into the following categories.

By Product type

- Pet Food Products

- Veterinary Care

- Others

By Pet Type

- Dog

- Cat

- Others

By Distribution Channel

- Offline

- Online

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe pet care market?

The Europe pet care market size was valued at USD 121.02 billion in 2025

What segments are added in the Europe pet care market?

The segments in the Europe pet care market are the Product Type, Pet Type, Distribution Channel and Region

Who are the Dominant players in Europe pet care market?

Ancol Pet Products Limited; Hill's Pet Nutrition, Inc; Mars, Incorporated; Petmate Holdings Co; Tail Blazers; Blue Buffalo Co, Ltd; Tiernahrung Deuerer GmbHChampion Petfoods LP; Nestle Purina PetCare; Saturn Petcare GmbH; and Etc...

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]