Europe Pest Control Market Size, Share, Trends & Growth Forecast Report By Type, Application, Pest Type, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 To 2033

Europe Pest Control Market Size

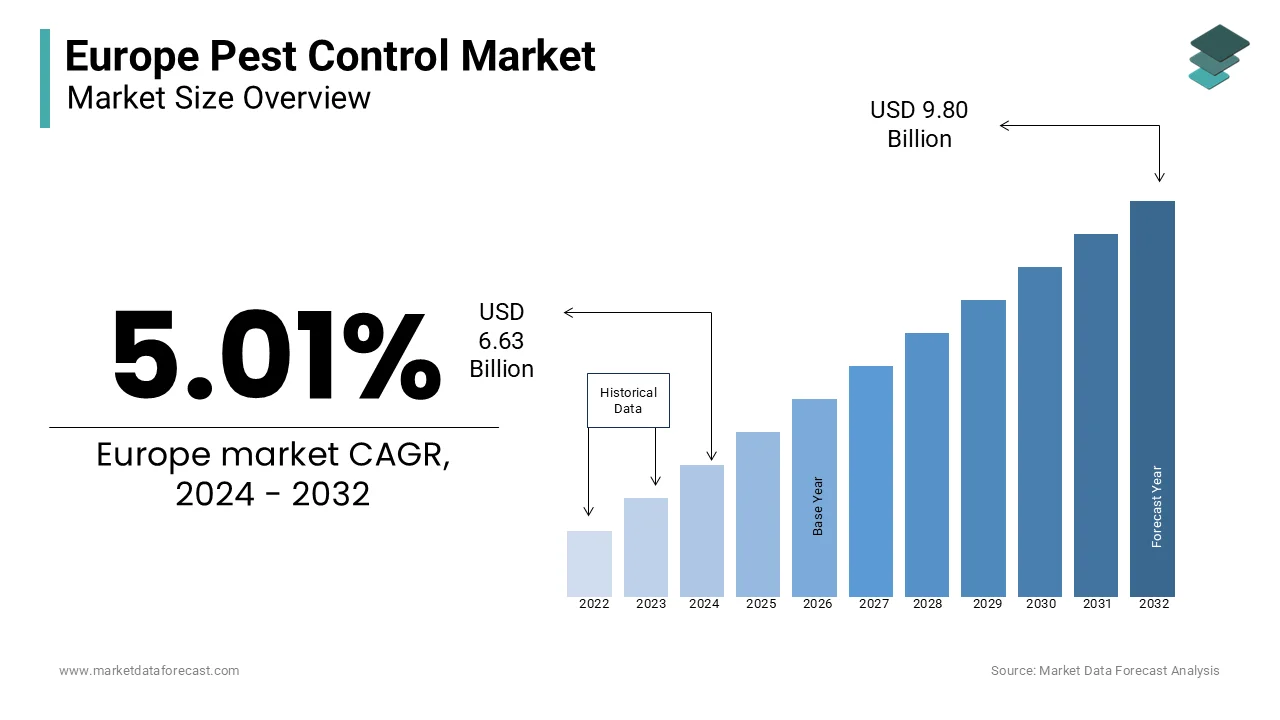

The pest control market size in Europe was valued at USD 6.63 billion in 2024 and is anticipated to reach USD 6.96 billion in 2025 from USD 10.29 billion by 2033, growing at a CAGR of 5.01% from 2025 to 2033.

Pest control caters to residential, commercial, and industrial sectors and employs methods such as chemical treatments, biological controls, and integrated pest management (IPM) systems to ensure effective pest mitigation. The rising prevalence of vector-borne diseases such as Lyme disease and West Nile virus has fuelled the demand for pest control services in Europe. According to the reports of the European Centre for Disease Prevention and Control, the number of tick-borne disease cases is growing in Central and Eastern Europe and resulting in the increasing need for effective pest management strategies.

MARKET DRIVERS

Increasing Urbanization and Infrastructure Development

The rapid growth of urban areas across Europe is a major driver of the European pest control market growth. According to Eurostat, approximately 75% of the European population resided in urban areas in 2022, and this figure is projected to rise further by 2050. Urbanization contributes to the proliferation of pests due to increased waste generation, construction activity, and dense housing and further creates ideal conditions for infestations. Rodent and insect control services are in high demand in cities, particularly in residential and commercial spaces. Infrastructure development also amplifies pest issues, and pest management solutions are needed to mitigate health and structural risks in urban settings.

Stringent Food Safety Regulations

The reliance of the food and beverage industry on pest control is driven by strict European Union regulations. The European Food Safety Authority enforces hygiene standards requiring the implementation of effective pest management systems to prevent contamination. This is especially critical in food processing and storage facilities, where pests can compromise product quality and consumer health. According to the European Commission, the food and beverage sector contributes over €1.1 trillion to the EU economy. The growth in the food and beverage sector in Europe is likely to result in the increasing demand for professional pest control services to ensure compliance and maintain operational standards.

MARKET RESTRAINTS

Stringent Regulations on Pesticides

The implementation of strict regulations governing pesticide usage in Europe significantly restrains the pest control market growth in this region. The Sustainable Use of Pesticides Directive and the European Green Deal of the European Commission aim to reduce pesticide use by 50% by 2030 by prioritizing environmental sustainability and public health. This regulatory framework restricts the availability of certain chemical pest control products and imposes high compliance costs on manufacturers and service providers. According to the European Chemicals Agency, the approval process for biocidal products can take several years, which limits the entry of new and innovative pest control solutions and slows the regional market expansion.

High Costs of Eco-Friendly Pest Control Solutions

The growing emphasis on environmentally friendly pest control methods increases operational costs for businesses. Eco-friendly solutions, such as biopesticides and integrated pest management (IPM) systems, often require advanced technology and skilled labor, making them more expensive than traditional chemical methods. As per the reports of the European Commission, biopesticides can cost 20% to 50% more than synthetic pesticides, which is limiting their adoption among small and medium-sized enterprises. Additionally, the initial investment in IPM systems and ongoing maintenance costs pose financial challenges, particularly in price-sensitive markets. This is further curbing the widespread adoption of sustainable pest control practices across Europe and limiting the expansion of the European market.

MARKET OPPORTUNITIES

Adoption of Digital Pest Monitoring Technologies

The integration of digital technologies in pest control presents a promising opportunity for market growth. Smart pest monitoring systems equipped with sensors and IoT-enabled devices provide real-time tracking and automated reporting of pest activity to enhance the efficiency of pest management. The European Commission emphasizes digital transformation in its agenda and encourages businesses to adopt smart solutions. These technologies are particularly valuable in the food and beverage sector to ensure compliance with stringent safety regulations while minimizing manual intervention. Digital pest monitoring is set to revolutionize pest control practices across Europe over the forecast period due to the increasing availability of affordable IoT devices.

Rising Demand for Biopesticides

The growing preference for environmentally sustainable pest control solutions creates significant opportunities for biopesticides. The commitment of the European Green Deal to reduce chemical pesticide use has accelerated the development and adoption of natural alternatives. According to the European Commission, the biopesticides market in Europe is projected to grow at a substantial rate and this growth is driven by increasing consumer demand for eco-friendly agricultural practices. Biopesticides are effective in controlling pests without harming non-target organisms, which makes them ideal for both agriculture and urban pest control.

MARKET CHALLENGES

Resistance Development in Pests

The increasing resistance of pests to conventional control methods poses a significant challenge to the market. According to the European Food Safety Authority, prolonged use of chemical pesticides has led to the development of resistance in common pests such as rodents and insects, which is reducing the effectiveness of these treatments. This resistance forces pest control companies to invest in research and development for alternative solutions and resulting in increasing costs and operational complexities. For instance, resistance in mosquito populations to pyrethroid-based insecticides has been documented across Europe by complicating efforts to control vector-borne diseases like West Nile virus.

Lack of Awareness and Adoption of Integrated Pest Management (IPM)

While Integrated Pest Management (IPM) systems are considered sustainable and effective, their adoption in Europe is hindered by a lack of awareness and technical expertise among end-users. As per the research of the European Commission, only a small percentage of farmers and businesses fully implement IPM practices, despite its promotion under the Sustainable Use of Pesticides Directive. The complexity and higher initial costs of IPM deter small-scale enterprises from adopting these methods. This gap in implementation slows the transition to sustainable pest control practices, which is limiting the ability of the European market to align with regulatory goals and consumer expectations for eco-friendly solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.01% |

|

Segments Covered |

By Types of Pest Control, Types of Pests, Application and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

BASF SE (Germany), Rentokil (U.K) and Syngenta (Switzerland). In addition to this, US-based companies such as Bell, Terminix, Ecolab, and Dow also operate in the region. |

REGIONAL ANALYSIS

Germany was the largest market for pest control in Europe in 2023. The stringent regulatory environment and robust industrial sector of Germany are majorly driving the growth of Germany's pest control market. As per the statistics of the Federal Statistical Office of Germany, The German food and beverage industry is valued at over €200 billion annually and heavily relies on pest control services to comply with EU hygiene regulations. Additionally, the urbanization rate in Germany is more than 77%, which fosters demand for pest control in residential and commercial spaces. The commitment of Germany to sustainability has further spurred the adoption of eco-friendly solutions and resulted in increasing investments in biopesticides and integrated pest management systems to reduce environmental impact while maintaining efficacy.

France is a prominent player in the European pest control market and is predicted to account for a substantial share of the European market over the forecast period due to its strong agricultural base and urban pest challenges. According to Eurostat, France is the largest agricultural producer in the European Union and requires extensive pest control to protect crops and livestock. The French government's emphasis on reducing chemical pesticide use under the Ecophyto Plan accelerates the adoption of biopesticides and IPM strategies. Together, these factors boost the pest control market in France.

The United Kingdom ranks among the top pest control markets in Europe. The growth of the UK pest control market is majorly driven by its diverse commercial sectors and growing pest-related health concerns. As per the data of the Food and Drink Federation, the UK food and drink industry is worth more than £100 billion annually and relies on rigorous pest management to meet regulatory standards. Additionally, the temperate climate of the UK supports a wide range of pests and requires advanced pest control solutions.

KEY MARKET PLAYERS

Some of the major companies dominating the market with their products and services include BASF SE (Germany), Rentokil (UK), and Syngenta (Switzerland). In addition to this, US-based companies such as Bell, Terminix, Ecolab, and Dow also operate in the region.

MARKET SEGMENTATION

This research report on the European pest control market is segmented and sub-segmented into the following categories.

By Types of Pest Control

- Chemical

- Mechanical

- Biological Control

By Application

- Commercial

- Industrial

- Agricultural

- Residential Control

By Type of Pest

- Termites

- Insects

- Rodents

- Wildlife

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe pest control market?

The current pest control market size in Europe was valued at USD 6.69 billion in 2025

What are the major drivers driving the Europe pest control market?

The Increasing Urbanization and Infrastructure Development and Stringent Food Safety Regulations are the major maket drivers that are driving the Europe pest control market.

What are the market opportunities in the Europe pest control market?

The Adoption of Digital Pest Monitoring Technologies and Rising Demand for Biopesticides are the major oppurtunities in this market.

Who are the market players that are dominating the Europe pest control market?

BASF SE (Germany), Rentokil (UK), and Syngenta (Switzerland). In addition to this, US-based companies such as Bell, Terminix, Ecolab, and Dow also operate in the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]