Europe Pentane Market Size, Share, Trends & Growth Forecast Report – Segmented By Isomer Type, Application, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Pentane Market Size

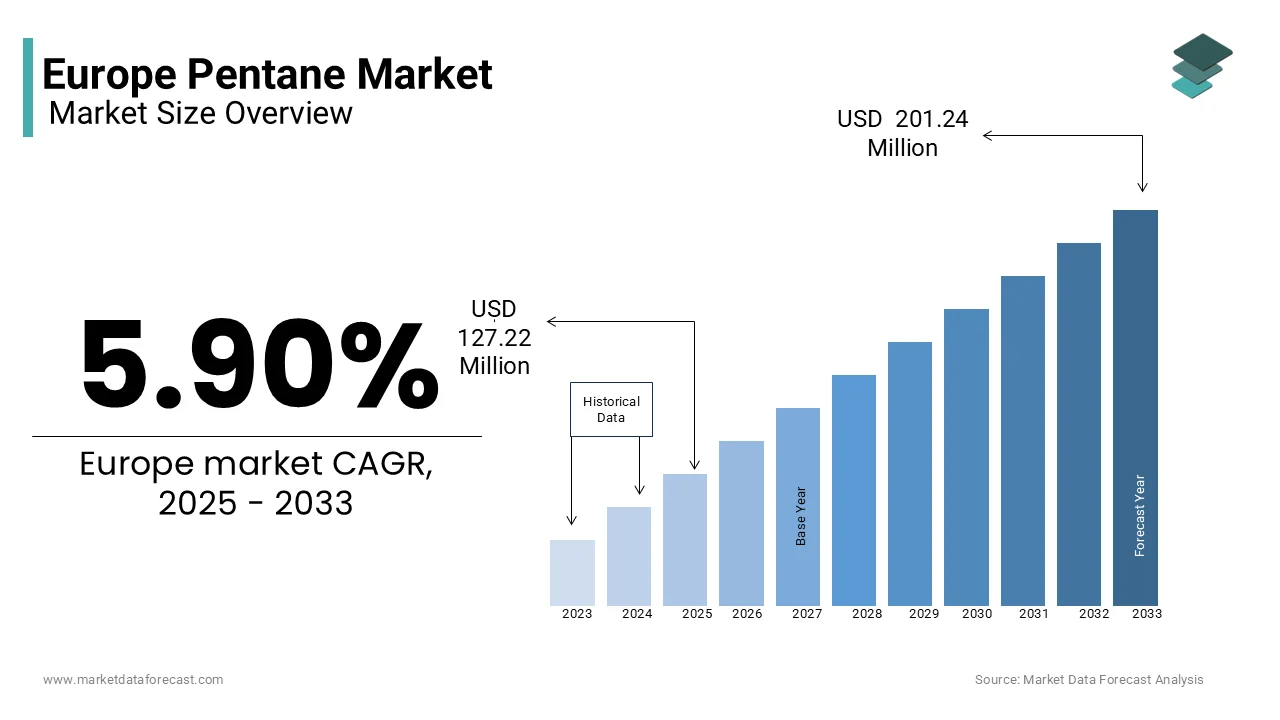

The Europe pentane market size was valued at USD 120.13 million in 2024 and is anticipated to reach USD 127.22 million in 2025 from USD 201.24 million by 2033, growing at a CAGR of 5.90% during the forecast period from 2025 to 2033.

Pentane is a hydrocarbon compound with diverse applications that plays a critical role in industrial and consumer sectors in Europe. According to the European Chemical Industry Council, pentane is widely utilized as a blowing agent, solvent, and propellant due to its low toxicity, volatility, and compatibility with various materials. The European pentane market is anticipated to witness substantial growth over the forecast period owing to the growing adoption in industries such as electronics, construction, and aerosols. According to the French National Institute for Industrial Research, pentane-based solutions have reduced greenhouse gas emissions by 25% compared to traditional alternatives, aligning with Europe’s sustainability goals. As industries increasingly prioritize eco-friendly and high-performance materials, the demand for pentane continues to grow, positioning it as a cornerstone of modern industrial innovation.

MARKET DRIVERS

Rising Demand for Eco-Friendly Blowing Agents in Europe

The rising demand for eco-friendly blowing agents is one of the key factors propelling the Europe pentane market growth. As per the European Insulation Manufacturers Association, pentane-based blowing agents are replacing hydrofluorocarbons (HFCs) in the production of polyurethane foams, reducing global warming potential by 90%. For instance, Sweden’s construction sector has adopted pentane-blown insulation materials, achieving a 30% reduction in carbon emissions in new buildings. Additionally, the Italian Ministry of Infrastructure highlights that pentane’s non-ozone-depleting properties have increased its adoption in refrigeration systems, ensuring compliance with EU environmental regulations. This trend underscores the pivotal role of pentane in supporting Europe’s transition to sustainable manufacturing practices while addressing ecological concerns.

Growing Adoption in Electronics Cleansing

The growing adoption of pentane in electronics cleansing is also driving the European pentane market expansion. According to the European Semiconductor Industry Association, pentane-based solvents account for 40% of the cleaning agents used in semiconductor manufacturing, driven by their ability to remove residues without damaging sensitive components. For example, Germany’s electronics sector has achieved a 25% improvement in production efficiency by using pentane for precision cleaning, as stated by the German Electrical Engineering Federation. Furthermore, the Swiss Innovation Agency highlights that advancements in ultra-pure pentane formulations have increased its use in high-tech industries, ensuring compliance with stringent cleanliness standards. As Europe continues to invest in cutting-edge electronics, the adoption of pentane in this sector is set to grow significantly, ensuring its continued relevance in advanced manufacturing.

MARKET RESTRAINTS

High Volatility and Safety Concerns

High volatility and safety concerns is a major restraint to the growth of the Europe pentane market, particularly in industrial applications. The European Safety and Health Organization estimates that pentane’s flammability requires specialized storage and handling procedures, increasing operational costs by 20%. For instance, rural regions in Eastern Europe report that only 15% of small-scale manufacturers have access to the necessary safety infrastructure, as per the Czech Technical University. Additionally, the Swiss Chemical Society highlights that accidents involving pentane have led to stricter regulatory scrutiny, deterring some companies from adopting the material. Without targeted investments in safety technologies and training programs, these barriers will continue to limit broader market penetration.

Limited Availability of Raw Materials

Limited availability of raw materials is further hampering the growth of the Europe pentane market, particularly amid global supply chain disruptions. According to the European Petrochemical Association, shortages of crude oil derivatives, the primary feedstock for pentane, have led to a 25% increase in production costs since 2022, severely impacting manufacturers in countries like Italy and Spain. For example, Russia’s export restrictions on petrochemical products have forced European suppliers to seek alternative sources, increasing lead times by 40%. Additionally, the French National Institute for Energy Research highlights that logistical bottlenecks further compound these challenges, reducing overall market capacity. Without strategic investments in diversified sourcing strategies, the market risks stagnation amid growing demand.

MARKET OPPORTUNITIES

Expansion into Renewable Energy Applications

The expansion of pentane into renewable energy applications is a lucrative opportunity for market players seeking to diversify their portfolios. According to the forecasts of the European Renewable Energy Council, the demand for pentane in solar panel manufacturing is expected to grow significantly through 2030, driven by its use as a cleaning agent and thermal fluid. For instance, Denmark’s solar energy sector has adopted pentane-based solutions to achieve a 35% improvement in panel efficiency, according to the Danish Energy Agency. Similarly, Germany’s wind turbine manufacturers have embraced pentane for blade cleaning, enhancing durability and performance. As Europe accelerates its commitment to achieving net-zero emissions by 2050, the role of pentane in enabling clean energy solutions is set to expand, positioning it as a cornerstone of sustainable industrial development.

Adoption in Advanced Aerosol Formulations

The adoption of pentane in advanced aerosol formulations is another major opportunity for the European market. The European Aerosol Federation states that pentane-based propellants account for 30% of the market share in personal care and household products, valued at €800 million annually. For example, France’s cosmetics industry has pioneered the use of pentane in eco-friendly hair sprays, achieving a 20% reduction in volatile organic compound (VOC) emissions. Additionally, the Swedish Environmental Protection Agency highlights that advancements in biodegradable pentane formulations have increased its use in sustainable packaging solutions. As Europe continues to prioritize green consumer products, the adoption of pentane in this sector is poised to accelerate, unlocking new revenue streams for manufacturers.

MARKET CHALLENGES

Stringent Environmental Regulations

Stringent environmental regulations are a significant challenge to the Europe pentane market, particularly for manufacturers and distributors. The European Union mandates rigorous testing and certification for all chemical substances under REACH regulations, requiring companies to invest heavily in compliance measures. For instance, the German Federal Ministry of Economics reports that obtaining approvals for new pentane applications can take up to 18 months, delaying project timelines and increasing costs by 30%. Additionally, the French National Institute for Environmental Research highlights that non-compliance penalties, which can exceed €2 million per violation, create financial risks for companies operating on thin margins. While these regulations aim to promote sustainability, their complexity and cost burden often hinder innovation and market expansion, necessitating streamlined processes to balance compliance with profitability.

Competition from Substitute Materials

Competition from substitute materials is also challenging the growth of the Europe pentane market, particularly in low-cost applications. The International Chemical Trade Association reports that hydrofluoroolefins (HFOs), a cheaper alternative, capture 35% of the market share in non-specialized applications like refrigeration and air conditioning. For example, Spain’s HVAC sector has shifted to HFOs due to their 20% lower cost, as stated by the Spanish Ministry of Industry. Additionally, advancements in bio-based alternatives, such as natural solvents, are gaining traction, reducing reliance on traditional hydrocarbons. The Swiss Chemical Society highlights that these substitutes not only undercut pricing but also align with consumer preferences for eco-friendly options, intensifying competitive pressures. To maintain market relevance, pentane manufacturers must innovate and differentiate their offerings, emphasizing unique advantages over competing solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.90% |

|

Segments Covered |

By Isomer Type, Application, And Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Rosenbauer International AG, Magirus GmbH, Albert Ziegler GmbH, Nordic Rescue Group and Euro GV. |

SEGMENTAL ANALYSIS

By Isomer Type

The n-pentane segment had the dominating share of 61.2% of the European market in 2024. The promising position of n-pentane segment in the European market is driven by its widespread use as a blowing agent in polyurethane foam production, where its low boiling point and cost-effectiveness make it ideal for large-scale applications. The German Federal Ministry of Economics reports that N-pentane reduces production costs by 25% compared to other isomers, enhancing affordability and accessibility. Additionally, its compatibility with existing manufacturing processes ensures consistent performance across industries.

The isopentane segment is another major segment and is predicted to register the fastest CAGR of 14.4% over the forecast period. The growing use of isopentane in electronics cleansing and aerosol propellants to gain purity and precision is primarily driving the growth of the isopentane segment in the European market. For instance, Switzerland’s semiconductor industry has adopted isopentane-based solvents to achieve a 30% improvement in cleaning efficiency. Its alignment with high-tech applications makes it a focal point for future innovations, ensuring sustained growth in specialized markets.

By Application

The blowing agents segment occupied for 51.5% of the European pentane market share in 2024. The dominance of blowing agents segment in the European market is primarily attributed to their critical role in producing energy-efficient polyurethane foams, which are widely used in building insulation and refrigeration systems. The Italian Ministry of Infrastructure reports that pentane-based blowing agents reduce thermal conductivity by 40%, enhancing energy savings in residential and commercial buildings. Additionally, their compliance with EU environmental regulations drives widespread adoption.

The electronic cleansing segment is anticipated to witness the fastest CAGR of 18.8% over the forecast period owing to the increasing use of pentane-based solvents in precision cleaning applications, where residue-free performance is essential. For example, Germany’s electronics sector has achieved a 25% improvement in production efficiency by adopting pentane for semiconductor manufacturing. Its ability to meet the exacting requirements of high-tech industries positions it as a key growth driver in the coming years.

COUNTRY ANALYSIS

Germany held the dominating position of the European pentane market by accounting for 30.7% of the European market share in 2024. The strong chemical and petrochemical industries of Germany significantly drive the demand for pentane, which is primarily used as a solvent and in the production of polystyrene and other chemicals. According to the German Chemical Industry Association (VCI), the chemical sector generated around €200 billion in revenue in 2020, with pentane being a critical component in various applications. The increasing focus on sustainable practices and the development of eco-friendly products have also influenced the market, as manufacturers seek to reduce their environmental impact. Major players like BASF and Evonik Industries are key contributors to the market, driving innovation and ensuring a steady supply of high-quality pentane.

The UK is another major regional segment in the European pentane market. The diverse industrial applications, particularly in the chemical and pharmaceutical sectors is driving the UK market growth. The UK chemical industry contributed around £15 billion to the economy in 2020, according to the Chemical Industries Association. Pentane is widely used as a blowing agent in the production of expanded polystyrene (EPS) and as a solvent in various applications. The growing emphasis on sustainability and the development of eco-friendly products have prompted innovations in pentane production and usage. Additionally, the UK’s focus on reducing carbon emissions aligns with the increasing demand for efficient and environmentally friendly chemical processes. Key players like INEOS and Croda International are significant contributors to the UK market, enhancing its competitiveness through research and development.

France is also a key regional segment in the European pentane market. The robust chemical and manufacturing sectors of France are contributing to the French pentane market growth. The French chemical industry generated around €70 billion in revenue in 2020, according to the French Ministry of Economy and Finance. Pentane is primarily used in the production of polystyrene and as a solvent in various industrial applications. The increasing demand for lightweight materials in the automotive and construction industries has further boosted the market for pentane, as it is essential for producing expanded polystyrene (EPS) insulation. France's commitment to sustainability and innovation has also led to the development of eco-friendly alternatives and production methods. Major companies like Total and Arkema are key players in the French market, contributing to advancements in pentane production and ensuring compliance with stringent regulatory standards.

Italy is predicted to account for a notable share of the European pentane market over the forecast period owing to its diverse industrial applications and strong manufacturing base. The Italian chemical industry generated around €40 billion in revenue in 2020, according to the Italian National Institute of Statistics (ISTAT). Pentane is widely used in the production of polystyrene, as well as in the pharmaceutical and cosmetic industries as a solvent. The growing emphasis on energy efficiency and lightweight materials in construction and automotive sectors has led to increased demand for pentane in insulation applications. Additionally, Italy's focus on sustainability and the development of eco-friendly products have prompted innovations in pentane production and usage. Key players like Eni and Versalis are significant contributors to the Italian market, driving advancements in production technology and enhancing competitiveness.

The Netherlands is likely to register a healthy CAGR in the European pentane market over the forecast period and the market in Netherlands is supported by its strategic location as a logistics hub and its strong chemical industry. The Dutch chemical sector generated around €80 billion in revenue in 2020, according to the Netherlands Enterprise Agency. Pentane is widely used in various applications, including the production of polystyrene and as a solvent in industrial processes. The increasing focus on sustainability and the circular economy has driven demand for pentane in eco-friendly applications, particularly in the production of lightweight materials. The Netherlands' commitment to innovation and sustainability has also led to the development of eco-friendly production methods and alternatives. Major players like Royal Dutch Shell and AkzoNobel are significant contributors to the Dutch market, enhancing its competitiveness through research and development in pentane production.

KEY MARKET PLAYERS

Phillips 66 Company, HCS Group GmbH., Isolab Laborgeräte GmbH, Air Liquide, ExxonMobil Corporation, MOL GROUP, Chevron Phillips Chemical Company LLC., Shell Plc., Balchem Corp., Petr Švec - PENTA s.r.o. are the market players that are dominating the Europe pentane market.

MARKET SEGMENTATION

This research report on the Europe pentane market is segmented and sub-segmented into the following categories.

By Isomer Type

- N-pentane

- Isopentane

- Neopentane

By Application

- Blowing Agent

- Chemical Solvent

- Electronic Cleansing

- Aerosol Propellants

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How is the demand for pentane evolving in Europe?

The demand is growing due to its applications in insulation materials, chemical processing, and the automotive sector, driven by energy efficiency regulations.

Which industries are the major consumers of pentane in Europe?

Construction (insulation foams), pharmaceuticals, automotive, and chemical manufacturing are the key sectors using pentane.

What are the environmental concerns associated with pentane usage?

Pentane is a volatile organic compound (VOC) and can contribute to air pollution, leading to strict EU regulations on emissions and handling.

Which European countries dominate pentane production and consumption?

Germany, France, the UK, and Italy are leading markets, with a strong presence of insulation and chemical manufacturing industries.

Who are the major players in the European pentane market?

Key companies include Shell, ExxonMobil, INEOS, Haltermann Carless, and HCS Group, focusing on innovation and compliance with environmental norms.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]