Europe Payment Gateways Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Hosted, and Non-Hosted), Enterprise (Small and Medium Enterprise (SME) and Large Enterprise), End-User (Travel, Retail, BFSI, Media and Entertainment, and Other End-users), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Payment Gateways Market Size

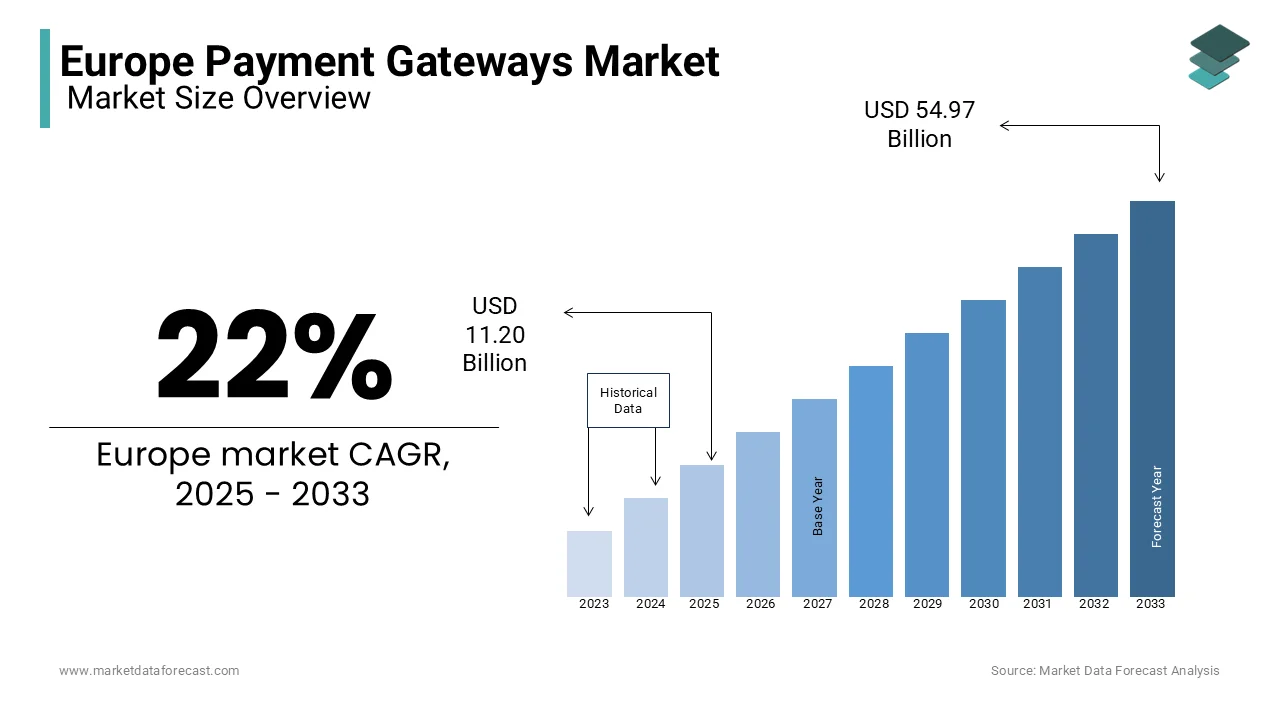

The Europe payment gateways market was valued at USD 9.18 billion in 2024. The European market is estimated to reach USD 54.97 billion by 2033 from USD 11.20 billion in 2025, growing at a CAGR of 22% from 2025 to 2033.

Payment gateways refer to the digital platforms that facilitate secure, seamless, and efficient online payment transactions between customers and merchants. Payment gateways act as intermediaries, encrypting sensitive financial data, validating payment details, and ensuring successful fund transfers across various payment methods, including credit/debit cards, digital wallets, and bank transfers. The European payment gateways market has experienced significant growth due to the rapid expansion of e-commerce, increasing adoption of contactless payments, and advancements in mobile banking technologies. According to Eurostat, online retail sales in Europe grew by over 13% in 2022. This is increasing demand for robust payment gateway solutions to handle growing transaction volumes. Additionally, as per the reports of the European Central Bank, that digital wallet usage rose by 25% in the same period. This indicates the changing consumer preferences towards faster and more convenient payment options.

MARKET DRIVERS

Rapid Growth of E-Commerce

The significant expansion of e-commerce in Europe is a major driver of the payment gateways market. Online retail sales have surged across the region, with Eurostat reporting a 13% growth in 2022, driven by increased digital adoption and consumer preferences for online shopping. Countries like Germany, France, and the United Kingdom contribute significantly, accounting for a substantial share of the e-commerce market. Payment gateways enable secure and seamless transactions for these platforms, catering to the high transaction volumes associated with e-commerce growth. Their role in supporting cross-border transactions further amplifies demand, as approximately 30% of European e-commerce sales are international.

Increased Adoption of Digital and Contactless Payments

The growing shift toward digital and contactless payments is another key driver of the Europe payment gateways market. The European Central Bank highlights that digital wallet usage increased by 25% in 2022, reflecting a consumer preference for convenient, fast, and secure payment methods. This trend was accelerated by the COVID-19 pandemic, which encouraged a reduction in cash transactions. Payment gateways are integral to processing these digital payments, ensuring compatibility with various devices and platforms. Additionally, initiatives promoting financial inclusion and cashless economies across Europe have further boosted the demand for advanced payment gateway solutions.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Europe's complex regulatory landscape acts as a significant restraint on the payment gateways market. The Revised Payment Services Directive (PSD2) mandates strong customer authentication (SCA) and other stringent compliance measures to enhance transaction security. While these regulations promote trust and transparency, they increase operational costs for payment gateway providers. The European Banking Authority reported that over 75% of merchants in the EU had to upgrade their payment systems to comply with PSD2 requirements, which posed challenges for small businesses with limited resources. This complexity can deter new entrants and slow market expansion, especially for smaller providers.

High Risk of Fraud and Cybersecurity Threats

The increasing prevalence of fraud and cybersecurity threats presents another major restraint for the Europe payment gateways market. The European Union Agency for Cybersecurity (ENISA) noted a 60% rise in online fraud attempts in 2022, including phishing and payment card fraud. These risks undermine consumer trust and impose additional costs on payment gateway providers, who must invest in advanced fraud detection and prevention systems. Smaller providers may struggle to implement such measures effectively, leading to operational challenges and potential reputational damage. The ongoing need to combat evolving cyber threats adds complexity to market operations and hampers growth.

MARKET OPPORTUNITIES

Expansion of Cross-Border E-Commerce

The rapid growth of cross-border e-commerce offers a significant opportunity for the Europe payment gateways market. Eurostat reports that nearly 30% of European e-commerce sales in 2022 were cross-border, reflecting a growing consumer preference for international online shopping. Payment gateways that support multiple currencies and localized payment methods are critical in facilitating these transactions. The European Union’s Single Digital Market strategy, aimed at reducing barriers to cross-border trade, further amplifies this opportunity. As more merchants and consumers engage in cross-border e-commerce, payment gateway providers can expand their offerings to meet the rising demand for seamless international payment processing.

Integration of Open Banking Solutions

The adoption of open banking presents a lucrative opportunity for payment gateway providers in Europe. Enabled by the Revised Payment Services Directive (PSD2), open banking allows third-party providers to access consumer financial data securely to facilitate transactions. The European Commission highlights that open banking has enhanced competition and innovation, with over 6,000 third-party providers registered across the EU by 2022. Payment gateways can leverage open banking to offer faster and more cost-effective payment solutions, such as direct bank transfers. This approach not only enhances user experience but also reduces reliance on traditional card-based systems, broadening the scope for growth and innovation.

MARKET CHALLENGES

Fragmented Regulatory Landscape

The fragmented regulatory environment across Europe presents a significant challenge for the payment gateways market. While the Revised Payment Services Directive (PSD2) has introduced a unified framework, individual member states often implement additional local regulations, creating inconsistencies. The European Central Bank has emphasized that navigating these variations increases compliance costs and operational complexities for payment gateway providers, particularly those operating in multiple countries. This regulatory fragmentation hinders the seamless scaling of services and requires providers to allocate significant resources for compliance management, limiting market growth.

High Costs of Technological Upgrades

The need for constant technological advancements to address evolving security requirements and consumer expectations is another major challenge. The European Union Agency for Cybersecurity (ENISA) reports that cyber threats targeting financial transactions increased by 50% in 2022, prompting payment gateways to invest heavily in robust fraud detection and cybersecurity systems. These upgrades, while necessary, impose significant costs on providers, especially small and medium-sized enterprises (SMEs). Additionally, the integration of emerging technologies such as artificial intelligence and blockchain adds to financial pressures. This ongoing need for innovation to remain competitive often results in higher operational expenses, affecting profitability and market sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22% |

|

Segments Covered |

By Type, Enterprise, End-User and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

VERIFONE, INC., Amazon Payments, Inc., PayPal Holdings, Inc., WorldPay, and Stripe are some of the key participants in the European payment gateways market. |

REGIONAL ANALYSIS

The UK outperformed other countries in the Europe payment gateways market in 2024. The domination of the UK is likely to continue in the European throughout the forecast period owing its advanced financial infrastructure and high adoption of digital payment methods. The UK Finance report highlights that over 57% of payments in 2022 were made through digital methods, including mobile wallets and contactless cards. The country’s strong e-commerce sector and widespread use of open banking further bolster its position. Additionally, the UK’s proactive approach to fintech innovation, supported by regulatory frameworks like the Financial Conduct Authority’s sandbox program, has created a favorable environment for payment gateway providers.

Germany is another leading market for payment gateways in Europe. The robust e-commerce ecosystem of Germany and rising preference for secure, bank-based payment methods are propelling the German payment gateways market. According to the Federal Statistical Office of Germany, online retail sales grew by 12% in 2022, with payment methods like PayPal and direct bank transfers dominating. Germany’s focus on data privacy, supported by strict adherence to the General Data Protection Regulation (GDPR), ensures consumer trust in digital transactions, making it a key player in the market.

France is anticipated to account for a substantial share of the European market over the forecast period. The dynamic e-commerce sector of France and rising use of mobile payments are contributing to the payment gateways market expansion in France. The French Ministry for the Economy and Finance reports that mobile payment usage increased by 20% in 2022, supported by widespread smartphone adoption. France’s strong regulatory framework and government initiatives to promote digital transactions have further accelerated the growth of payment gateways, solidifying its position among the top performers in Europe.

KEY MARKET PLAYERS

VERIFONE, INC., Amazon Payments, Inc., PayPal Holdings, Inc., WorldPay, and Stripe are some of the key participants in the European payment gateways market.

MARKET SEGMENTATION

This research report on the European payment gateways market is segmented and sub-segmented into the following categories.

By Type

- Hosted

- Non-Hosted

By Enterprise

- Small and Medium Enterprise (SME)

- Large Enterprise

By End-User

- Travel

- Retail

- BFSI

- Media and Entertainment

- Other End-users

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe payment gateways market?

The increasing adoption of e-commerce, digital wallets, and contactless payments, along with regulatory initiatives like PSD2 and open banking, are major drivers of market growth.

Which industries are the largest users of payment gateways in Europe?

E-commerce, travel and hospitality, retail, fintech, and subscription-based services are the top industries relying on payment gateways for secure and seamless transactions.

How do European payment gateways ensure security and fraud prevention?

They use encryption, tokenization, AI-based fraud detection, 3D Secure authentication, and compliance with GDPR and PCI DSS to protect transactions.

What is the future outlook for the Europe payment gateways market?

The market is expected to expand with advancements in AI-driven fraud prevention, real-time payments, increased open banking adoption, and seamless cross-border solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]