Europe Patient Monitoring Market Research Report - By Application ( Neuromonitoring Devices, Hemodynamic Monitoring Devices, Cardiac Monitoring Devices, Fetal and Neonatal Monitoring Devices, Respiratory Monitoring Devices, Multi-Parameter Monitoring Devices, Temperature Monitoring Devices, Weight Monitoring Devices, Remote Patient Monitoring Devices) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

Europe Patient Monitoring Market Size

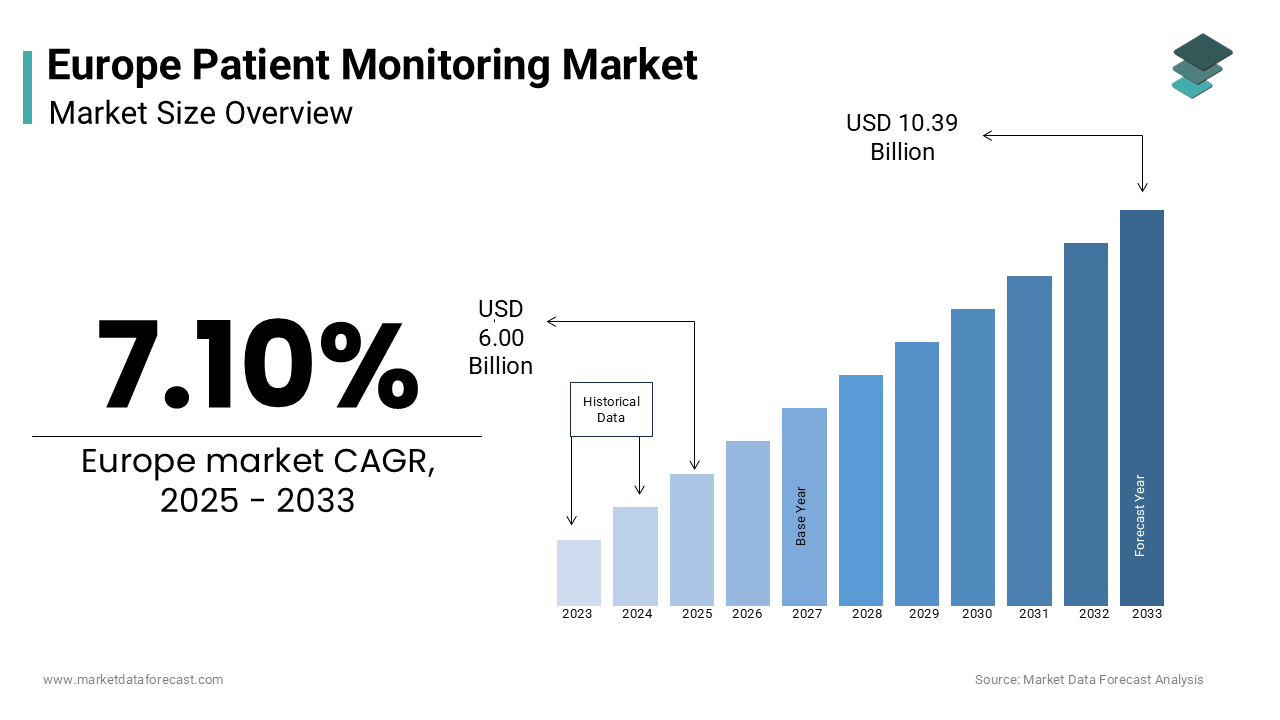

The European patient monitoring market size was valued at USD 5.60 billion in 2024 and is estimated to reach USD 10.39 billion by 2033 from USD 6.00 billion in 2025, registering a CAGR of 7.10% from 2025 to 2033.

The patient monitoring market in Europe plays a vital role in modern healthcare, driven by the region’s commitment to technological progress and proactive medical care. The European Society of Cardiology reports that cardiovascular diseases cause over 4 million deaths each year, highlighting the urgent demand for advanced monitoring solutions. These systems provide continuous tracking of vital signs, enabling healthcare professionals to respond swiftly and enhance treatment effectiveness.

The use of wearable health devices, such as biosensors and smartwatches, has seen significant growth. According to the European Telemedicine Conference, nearly 30% of remote monitoring procedures in 2022 relied on these technologies. This surge is largely due to Europe’s aging population, with Eurostat data showing that about 20% of residents are 65 or older, reinforcing the need for long-term health monitoring.

Additionally, AI-powered analytics platforms have transformed patient tracking by improving diagnostic accuracy by up to 40%, as reported in Healthcare Technology Letters. However, hurdles such as strict regulations and the high costs of advanced equipment remain. Even so, rising investments in telemedicine and supportive government policies continue to strengthen the market, ensuring its essential role in shaping the future of European healthcare.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The rising number of chronic diseases is a key factor driving the growth of the patient monitoring market in Europe. Conditions like heart disease, diabetes, and respiratory illnesses are among the leading causes of death, increasing the need for continuous health tracking solutions. According to the European Society of Cardiology, over 4 million people in the region die from cardiovascular diseases each year, highlighting the urgency for accurate diagnostic tools. This has led to a greater demand for cardiac monitoring devices, such as wearable ECG monitors, which help detect irregular heart rhythms early. Similarly, the European Diabetes Federation reports that more than 61 million people in Europe have diabetes, reinforcing the need for advanced glucose monitoring systems. These devices allow individuals to track their blood sugar levels effectively, leading to better disease management. Ongoing investments in research and development, along with supportive government policies, continue to drive innovation in patient monitoring technologies. These efforts further highlight how the growing prevalence of chronic diseases is shaping the future of healthcare in Europe.

Technological Advancements in Monitoring Devices

Advancements in patient monitoring technology are playing a major role in transforming healthcare. The introduction of wearable and wireless monitoring devices has made it easier to collect real-time health data and manage patients remotely. According to the European Telemedicine Conference, wearable health devices were used in nearly 30% of all remote monitoring procedures in 2022, showing their increasing adoption. These systems often use multi-parameter monitoring devices, which can track multiple vital signs at once, including heart rate, oxygen levels, and body temperature. Additionally, AI-powered analytics have brought new possibilities for predictive healthcare, helping doctors detect critical conditions early. Research in Healthcare Technology Letters shows that AI-based monitoring can boost diagnostic accuracy by up to 40%, leading to better patient outcomes. Ongoing research and development, supported by government initiatives, continue to drive innovation in medical technology. Together, these advancements are redefining patient monitoring and improving healthcare systems across Europe.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

A major challenge in the European patient monitoring market is the strict approval process for new devices. The European Medicines Agency (EMA) has stringent regulations, requiring thorough clinical trials and safety evaluations before a product can be sold. According to the European Federation of Pharmaceutical Industries and Associations, it takes over five years on average to receive regulatory approval, delaying the introduction of new technologies. This lengthy process raises development costs and slows the availability of advanced monitoring solutions. Research by the European Health Management Association shows that about 20% of monitoring devices do not pass EMA’s initial evaluation, highlighting the complexity of compliance. These strict regulations make it harder for smaller companies to enter the market, limiting innovation and slowing industry growth.

High Costs Associated with Advanced Monitoring Systems

A key challenge in the European patient monitoring market is the high cost of advanced systems, which makes them less affordable for both patients and healthcare providers. Modern multi-parameter monitoring devices are much more expensive than traditional models, making them difficult to obtain in low-budget healthcare settings. Limited insurance coverage in some countries further adds to the financial strain, discouraging many from using advanced diagnostic tools. A survey by the European Alliance for Personalised Medicine found that nearly 30% of patients skip recommended monitoring due to cost concerns. Hospitals and diagnostic centers also struggle to afford high-tech equipment, as purchasing and maintaining these systems require large investments. These financial obstacles slow down the adoption of patient monitoring technology, limiting market growth.

MARKET OPPORTUNITIES

Growing Demand for Remote Patient Monitoring

The increasing preference for remote patient monitoring presents a significant opportunity for the Europe patient monitoring market. Patients and healthcare providers alike are gravitating toward telehealth solutions, driven by convenience and the ability to track health metrics in real-time. According to a study by the European Telemedicine Conference, remote patient monitoring devices grew by 25% annually over the past three years, fueled by the integration of IoT and cloud-based platforms. Wearable devices, such as smartwatches and biosensors, enable continuous tracking of vital signs, facilitating early intervention in critical conditions. A report in the journal Telemedicine and e-Health notes that remote monitoring reduces hospital readmission rates by 30%, underscoring its clinical significance. Additionally, partnerships between device manufacturers and digital health platforms ensure seamless data integration, enhancing patient outcomes. By aligning with telemedicine trends, companies can tap into this burgeoning market, ensuring sustained growth and innovation.

Expansion of Home Healthcare Solutions

The growing popularity of home healthcare solutions is creating new opportunities for market expansion. As Europe's population ages and medical expenses continue to rise, more people are turning to home-based monitoring devices. According to Eurostat, around 20% of Europeans are aged 65 or older, and this number is expected to reach 30% by 2050. This trend is increasing the need for easy-to-use, portable monitoring tools that help individuals manage chronic illnesses without frequent hospital visits. Research from the European HealthTech Institute shows that home healthcare systems can lower overall medical costs by 20%, making them beneficial for both patients and healthcare providers. Improvements in battery efficiency and wireless connectivity have enhanced the reliability of these devices, overcoming past challenges. Manufacturers continue to invest in research and development, ensuring that new technologies are designed to meet the needs of aging populations. These advancements are driving growth in the patient monitoring market and improving healthcare accessibility.

MARKET CHALLENGES

Limited Accessibility in Rural and Underserved Regions

Limited access to patient monitoring technology remains a major concern, especially in rural and remote areas of Europe. While advanced monitoring tools like wearable devices and remote systems are widely available in cities, many outlying regions lack these essential services. The European Rural Health Alliance reports that about 25% of Europeans live in rural areas, where specialized healthcare facilities are scarce. A shortage of trained medical staff further reduces the availability of monitoring services in these regions. According to the European Society of Radiology, rural hospitals conduct 40% fewer monitoring procedures than urban hospitals, emphasizing the gap in healthcare access. High costs and logistical difficulties make it even harder to set up monitoring centers in remote locations. To bridge this divide, investments in mobile health units and telemedicine are essential. Without such efforts, healthcare inequalities will continue to grow, limiting access to vital diagnostic services for underserved populations.

Environmental Concerns Related to Device Disposal

Environmental sustainability is a growing concern in the patient monitoring industry, particularly regarding the disposal of medical devices and accessories. Many monitoring tools, including wearable biosensors and multi-parameter systems, contain materials that do not break down naturally, adding to electronic waste. The European Environment Agency states that medical devices contribute around 10% of the total e-waste produced each year, raising serious environmental issues. While biodegradable options exist, they often lack the durability and reliability needed for medical use. Research published in the Journal of Cleaner Production reveals that switching to eco-friendly materials increases manufacturing expenses by 25%, making it financially challenging for companies. At the same time, consumer interest in sustainable products is rising, pushing manufacturers to adopt greener alternatives. Ignoring these concerns could drive environmentally conscious customers away, affecting brand reputation and market competitiveness. To stay ahead, companies must find a balance between sustainability and product performance.

SEGMENTAL ANALYSIS

By Application Insights

The cardiac monitoring devices segment led the European patient monitoring market by holding 28.2% of the total share in 2024. This dominance is driven by the increasing number of heart-related illnesses, which cause over 4 million deaths annually across Europe. The European Heart Network reports that wearable ECG monitors and Holter devices are widely used due to their ability to continuously track heart activity. These tools help detect irregular heartbeats and other serious conditions at an early stage, improving patient outcomes. Research in the European Journal of Preventive Cardiology indicates that early diagnosis using cardiac monitoring lowers hospitalization rates by 25%, showcasing their role in preventive healthcare. Furthermore, advancements in AI-powered diagnostic systems have improved accuracy, making these devices even more essential in modern medical care.

The remote patient monitoring devices segment is the fastest-expanding segment in the European market and growing at a CAGR of 15. Their increasing demand is driven by the ability to track health conditions in real time and provide remote care, especially in areas with limited medical facilities. According to the European HealthTech Institute, these devices help lower hospital readmission rates by 30%, making them essential for managing long-term illnesses like diabetes and high blood pressure. The adoption of IoT and cloud-based systems has further improved their functionality, allowing seamless data exchange between patients and doctors. Research published in Telemedicine and e-Health reveals that remote monitoring boosts treatment adherence by 40%, leading to better health outcomes. Ongoing collaborations between tech firms and healthcare providers continue to drive innovation, establishing remote monitoring as a crucial factor in the region's medical advancements.

REGIONAL ANALYSIS

Germany has established itself as a leader in the European patient monitoring market and accounted for over 30% of all remote patient monitoring procedures in region. The country's dominance is fueled by its robust healthcare infrastructure and high prevalence of chronic diseases, including cardiovascular disorders and diabetes. As noted by the Robert Koch Institute, heart-related conditions make up more than 40% of all medical monitoring cases in the country. The increasing use of smart health technologies, including wearable ECG monitors and multi-parameter tracking devices, continues to push demand higher. A study in the German Journal of Cardiology found that wearable monitoring devices enhance diagnostic accuracy by 35%, proving their value in patient care. Additionally, government-backed health programs and favorable insurance policies supporting early disease detection have further strengthened the market’s expansion. The UK represents a substantial segment of the European market. It is driven by its focus on data-driven healthcare and technological innovation. With cardiovascular and respiratory illnesses being major health concerns, there is a growing need for advanced monitoring solutions. According to the NHS, chronic diseases account for more than 70% of healthcare expenses, highlighting the necessity for improved patient tracking systems. Research from the British Journal of Healthcare Technology indicates that remote monitoring devices help lower hospital readmissions by 30%, making them highly valuable to medical professionals. Additionally, nationwide initiatives promoting preventive healthcare have increased adoption, reinforcing the UK’s role as a leading contributor to the European market.

France holds a notable share of the European patient monitoring market, with a particular emphasis on neurological monitoring procedures and AI-driven predictive analytics. The country's dedication to early disease detection and the growing number of chronic illness cases have increased the need for advanced monitoring tools. Reports from Santé Publique France indicate that over 20 million people suffer from heart and lung diseases, emphasizing the demand for precise diagnostic solutions. Hospitals frequently use multi-parameter monitoring systems to help manage these conditions effectively. Research in the French Journal of Medicine shows that modern monitoring equipment boosts treatment success by 25%, proving its effectiveness in healthcare. Additionally, government programs promoting telemedicine have contributed to the widespread use of these technologies, further cementing France’s influence in the European market.

Italy plays a significant role in the European patient monitoring market. The country's aging population and rising prevalence of chronic conditions, including cardiovascular and respiratory disorders, drive demand for patient monitoring technologies. Reports from the Italian National Institute of Health indicate that over 30% of adults live with long-term health conditions, highlighting the need for advanced monitoring tools. Wearable health devices, valued for their real-time tracking capabilities, are becoming increasingly popular due to their ease of use and effectiveness. Research published in the Italian Journal of Healthcare Technology reveals that these monitors enhance patient compliance by 40%, making them especially beneficial for older individuals. Ongoing partnerships between technology developers and research institutions continue to drive innovation, strengthening Italy’s presence in the European healthcare market.

Spain is a key player in the European patient monitoring market, particularly in fetal and neonatal monitoring procedures with an emphasis on AI-driven predictive analytics. The country's growing emphasis on preventive healthcare and increasing healthcare expenditure have fueled the adoption of patient monitoring devices. According to the Spanish Ministry of Health, chronic illnesses make up over 80% of healthcare expenses, highlighting the need for efficient solutions. Remote monitoring systems, valued for their real-time tracking capabilities, are becoming increasingly popular among proactive healthcare consumers. Research published in the Spanish Journal of Healthcare Innovation indicates that these technologies help lower hospital readmission rates by 25%, encouraging widespread adoption.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few of the most promising companies operating in the Europe Patient Monitoring Market profiled in this report are Abbott Laboratories, Masimo Corporation, Covidien, Drager Medical GmbH, GE Healthcare, Johnson & Johnson Inc., Mindray Medical, Mortara Instrument Inc., Natus, Nihon Kohden, Nonin Medical, Omron Healthcare, Philips Healthcare, Roche Diagnostics Limited & Welch Allyn.

The Europe patient monitoring market is characterized by intense competition, driven by the presence of established multinational corporations and niche players. Companies vie for market leadership by leveraging their expertise in product innovation, technological advancements, and strategic collaborations. Regulatory compliance plays a pivotal role, as stringent guidelines set by the European Medicines Agency necessitate rigorous clinical validation and safety assessments. This has led to a heightened focus on developing eco-friendly and scientifically validated devices, aligning with sustainability goals. The market is also witnessing increased consolidation, with mergers and acquisitions enabling companies to expand their product portfolios and geographic reach. For instance, Philips Healthcare and GE Healthcare dominate the market through their extensive R&D investments and cutting-edge solutions. Meanwhile, smaller players differentiate themselves by targeting underserved segments and introducing cost-effective alternatives. Competitive pricing strategies, coupled with public health initiatives promoting preventive healthcare, further intensify rivalry. As a result, companies are compelled to adopt agile approaches, focusing on personalized medicine and digital integration to stay ahead in this dynamic landscape.

Top 3 Players in the Europe Patient Monitoring Market

Philips Healthcare

Philips Healthcare is a global leader in the patient monitoring market, offering a diverse portfolio of innovative solutions tailored for various healthcare settings. The company's IntelliVue and MX series are widely adopted in Europe for their ability to provide real-time tracking of vital signs, enabling early intervention in critical conditions. Philips leverages its expertise in AI-driven analytics to enhance diagnostic accuracy, ensuring superior patient outcomes. Its commitment to sustainability is evident through initiatives aimed at reducing environmental impact, aligning with European regulatory standards. By fostering collaborations with academic institutions and healthcare providers, Philips continues to drive innovation, reinforcing its position as a trailblazer in the global patient monitoring landscape.

GE Healthcare

GE Healthcare excels in the development of advanced patient monitoring systems, with flagship products such as the CARESCAPE series, designed for intensive care and surgical environments. The company's focus on precision medicine has enabled the development of targeted monitoring solutions, addressing unmet clinical needs. GE Healthcare invests heavily in R&D, exploring novel technologies and applications to expand its product offerings. Its strategic partnerships with hospitals and academic institutions facilitate the integration of monitoring devices with emerging technologies like AI. By prioritizing patient-centric solutions and adhering to stringent quality standards, GE Healthcare maintains its reputation as a trusted contributor to the global patient monitoring market.

Medtronic plc

Medtronic specializes in the development of clinically validated patient monitoring devices, with a focus on cardiac and respiratory applications. The company's Nellcor and Puritan Bennett platforms are widely recognized for their efficacy in tracking oxygen saturation and respiratory metrics. Medtronic emphasizes sustainability, investing in eco-friendly formulations to meet European regulatory requirements. Its collaborative approach, involving partnerships with healthcare providers and academic institutions, accelerates the adoption of advanced monitoring solutions. By leveraging digital innovations and focusing on personalized care, Medtronic strengthens its foothold in the global market, delivering impactful contributions to preventive healthcare.

Top Strategies Used by Key Players in the Europe Patient Monitoring Market

Product Innovation

Key players in the patient monitoring market prioritize product innovation to maintain a competitive edge. Companies invest in R&D to develop novel devices, such as AI-driven analytics platforms and wearable biosensors, addressing emerging clinical needs. For instance, Philips Healthcare introduced wearable ECG monitors to enhance patient mobility while ensuring continuous tracking. These innovations not only expand the scope of monitoring applications but also align with regulatory requirements, ensuring compliance and market acceptance. By continuously refining their product portfolios, companies strengthen their market position and cater to evolving healthcare demands.

Strategic Collaborations

Strategic collaborations are a cornerstone of growth strategies in the patient monitoring market. Industry leaders partner with academic institutions, research organizations, and healthcare providers to accelerate innovation and expand clinical applications. For example, GE Healthcare collaborated with leading hospitals to integrate AI-driven analytics into its monitoring systems, enhancing precision and outcomes. These partnerships enable knowledge exchange and facilitate the development of cutting-edge solutions. By leveraging external expertise and resources, companies enhance their capabilities and reinforce their leadership in the competitive European market.

Geographic Expansion

Geographic expansion is another critical strategy employed by key players to tap into untapped markets. Companies establish distribution networks and training programs in emerging economies within Europe, such as Turkey and the Czech Republic. This approach ensures broader accessibility and affordability of monitoring devices, particularly in underserved regions. For instance, Medtronic invested in localized manufacturing units to meet regional demand while adhering to local regulatory frameworks. By expanding their geographic footprint, companies not only increase market penetration but also mitigate risks associated with economic fluctuations in specific regions.

RECENT MARKET DEVELOPMENTS

- In April 2024, Philips Healthcare launched the IntelliVue MX750 patient monitoring system, integrating AI-driven analytics to enhance diagnostic accuracy and streamline workflows in intensive care units.

- In June 2023, GE Healthcare partnered with a leading European hospital network to conduct a multi-center trial evaluating the efficacy of its CARESCAPE monitoring platform, enhancing its credibility and adoption rates.

- In September 2022, Medtronic acquired a Czech-based biotech firm specializing in wearable biosensors, expanding its manufacturing capabilities and distribution network in Central Europe to meet rising regional demand.

- In November 2021, Philips Healthcare collaborated with a prominent AI startup to integrate its monitoring devices with machine learning algorithms, improving treatment personalization and operational efficiency in healthcare settings.

- In February 2020, GE Healthcare invested €150 million in a state-of-the-art R&D facility in Germany, focusing on the development of next-generation monitoring technologies tailored for neonatal and pediatric applications.

MARKET SEGMENTATION

This research report on the European Patient Monitoring Market has been segmented and sub-segmented into the following categories

By Application

- Neuromonitoring Devices

- Electroencephalograph (EEG)

- Transcranial Doppler (TCD)

- Magnetoencephalography (MEG)

- Cerebral Oximeters

- Intracranial Pressure Monitors (ICP)

- Hemodynamic Monitoring Devices

- Blood Pressure Monitors

- Blood Glucose Monitors

- Blood Gas and Electrolyte Analyzers

- Cholesterol Analyzers

- Cardiac Monitoring Devices

- Electrocardiogram (ECG)

- Event Monitors

- Implantable Loop Recorder (ILR)

- Cardiac Output Monitoring Devices

- Fetal and Neonatal Monitoring Devices

- Ultrasound Fetal Dopplers

- Internal Fetal Monitors

- Respiratory Monitoring Devices

- Capnography

- Spirometers

- Anesthesia Monitors

- Sleep Apnea Monitoring Devices

- Pulse Oximeters

- Multi-Parameter Monitoring Devices

- High-Acuity Monitors

- Mid-Acuity Monitors

- Low-Acuity Monitors

- Temperature Monitoring Devices

- Weight Monitoring Devices

- Remote Patient Monitoring Devices

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]