Europe Pasta Sauce Market Size, Share, Trends & Growth Forecast Report By Product Type (Tomato-Based Sauces, Cream-Based Sauces, Pesto Sauces, Other Specialty Sauces), Packaging Type, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Pasta Sauce Market Size

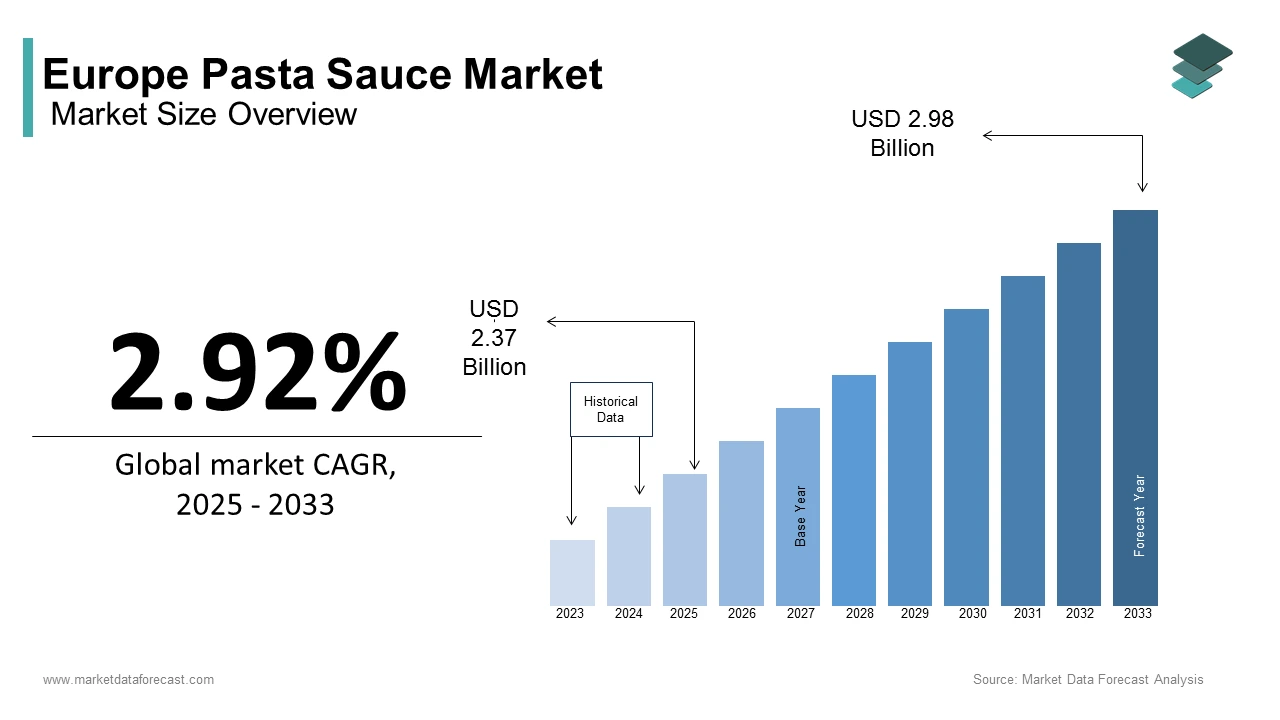

The Europe pasta sauce market size was calculated to be USD 2.30 billion in 2024 and is anticipated to be worth USD 2.98 billion by 2033 from USD 2.37 billion in 2025, growing at a CAGR of 2.92% during the forecast period.

Pasta sauces serve as essential accompaniments to one of most beloved staple foods of Europe, which is pasta that is consumed across all demographics. The changing dietary habits, the increasing demand for convenience foods, culinary traditions of Europe, the growing popularity of international cuisines, have expanded the variety of pasta sauces available, ranging from classic tomato-based options to gourmet pesto and creamy Alfredo varieties.

As per the European Food Safety Authority (EFSA), stringent food safety regulations ensure high-quality standards, fostering consumer trust and encouraging innovation in product development. Additionally, the rise of health-conscious consumers has spurred demand for organic, low-sodium, and plant-based sauces, as confirmed by Statista, which notes that sales of such products grew by 15% annually between 2018 and 2022. The proliferation of e-commerce platforms has further facilitated market expansion, enabling brands to reach a wider audience.

MARKET DRIVERS

Increasing Demand for Convenience Foods

The demand for convenience foods in Europe has surged significantly, with over 60% of households prioritizing time-saving meal solutions due to busy lifestyles. This trend is a primary driver of the pasta sauce market, as ready-to-use sauces offer a quick and effortless way to prepare flavorful meals. The European Commission reports that the working population spends an average of 40 hours per week on professional commitments, leaving limited time for elaborate cooking. Consequently, the adoption of pre-made sauces has increased, with Statista estimating a 12% annual growth in sales of pasta sauces between 2019 and 2022. Furthermore, the versatility of pasta sauces, which can be paired with a variety of ingredients, appeals to consumers seeking diverse yet convenient meal options. As urbanization continues to rise, particularly in metropolitan areas like London and Berlin, the reliance on convenience foods is expected to further propel market growth.

Growing Popularity of International Cuisines

The rising popularity of international cuisines has significantly influenced the pasta sauce market, with consumers eager to experiment with global flavors. The commission notes that over 70% of Europeans have tried dishes inspired by Italian, Mediterranean, or Asian cuisines, driving demand for authentic and exotic sauce varieties. For instance, the Italian Trade Agency reports that exports of traditional Italian pasta sauces to non-Italian markets increased by 18% in 2022, reflecting the widespread appeal of authentic recipes. Additionally, the European Food Information Council highlights that fusion sauces, such as spicy arrabbiata or creamy Thai-inspired variants, have gained traction among younger demographics, accounting for 25% of new product launches. This cultural exchange not only diversifies the market but also encourages innovation, positioning pasta sauces as a key player in the evolving culinary landscape.

MARKET RESTRAINTS

Stringent Health Regulations and Labeling Requirements

The European pasta sauce market faces significant challenges due to stringent health regulations and labeling requirements. EFSA mandates that all packaged foods, including pasta sauces, display detailed nutritional information, allergen warnings, and ingredient sourcing details. Non-compliance with these regulations can result in hefty fines and product recalls, as reported by the European Commission, which estimates that 5% of food products fail to meet labeling standards annually. These regulatory hurdles increase operational costs for manufacturers, particularly small and medium-sized enterprises, limiting their ability to innovate and expand. Additionally, the requirement to reduce sodium and sugar content, as emphasized by the World Health Organization (WHO), poses formulation challenges, as altering traditional recipes may compromise taste and consumer acceptance. Such constraints hinder market growth and create barriers for new entrants.

Economic Uncertainty and Price Sensitivity

Economic uncertainty in Europe has led to heightened price sensitivity among consumers, negatively impacting premium pasta sauce segments. Inflation rates exceeding 7% in several EU countries have forced households to prioritize essential expenditures, reducing discretionary spending on gourmet or organic sauces. The European Central Bank highlights that disposable income declined by an average of 3% in 2022, disproportionately affecting middle- and lower-income groups who constitute a significant portion of the market. Furthermore, Statista reports that 45% of consumers have switched to private-label or budget-friendly alternatives due to financial constraints. This trend is particularly pronounced in regions with higher unemployment rates, such as Southern Europe, where Spain and Italy recorded jobless rates of 12.8% and 7.8%, respectively. As economic pressures persist, maintaining affordability while ensuring product quality remains a critical challenge for industry players.

MARKET OPPORTUNITIES

Expansion of Organic and Plant-Based Offerings

The demand for organic and plant-based pasta sauces is surging, driven by increasing veganism and environmental consciousness. Over 10% of Europeans now identify as vegetarian or vegan, creating a niche yet rapidly expanding segment within the market. The European Commission highlights that organic food sales grew by 12% annually between 2019 and 2022, with Germany accounting for 30% of total revenue. Consumers are drawn to these products due to their perceived health benefits and sustainability credentials, as confirmed by a Nielsen study indicating that 65% of buyers are willing to pay a premium for eco-friendly options. Additionally, regulatory support for organic farming, such as the EU’s Common Agricultural Policy, incentivizes manufacturers to develop innovative formulations. This trend not only aligns with global sustainability goals but also positions organic and plant-based sauces as a key growth driver in the coming years.

Rising Adoption of E-Commerce Platforms

The rapid expansion of e-commerce platforms presents a lucrative opportunity for the European pasta sauce market. The convenience and accessibility offered by digital channels have transformed consumer purchasing behavior, particularly among younger demographics. For instance, a survey conducted by the European E-Commerce Association revealed that 70% of millennials prefer buying sauces online due to competitive pricing and extensive product information. Furthermore, the integration of artificial intelligence and personalized recommendations on platforms like Amazon and local European retailers has enhanced customer engagement, driving repeat purchases. Eurostat reports that countries such as Germany and the UK lead in online food product sales, contributing over 40% of total revenue. As internet penetration continues to rise, reaching 90% across Europe, the potential for market expansion through e-commerce remains immense.

MARKET CHALLENGES

Counterfeit and Substandard Products

Counterfeit and substandard pasta sauces pose a significant challenge to the European market, undermining consumer trust and brand reputation. OLAF estimates that 10% of sauces sold online are either counterfeit or fail to meet safety standards, often containing harmful substances or incorrect ingredient proportions. This issue is exacerbated by the anonymity of online sellers, making it difficult for authorities to enforce regulations effectively. The European Medicines Agency reports that adverse reactions linked to counterfeit products have increased by 20% since 2018, raising public health concerns. Furthermore, Eurostat data indicates that consumer complaints related to fraudulent sauces have surged by 25% in the past three years, highlighting the urgency of addressing this problem. Without robust measures to combat counterfeiting, the market risks losing credibility and facing stricter regulatory scrutiny.

Intense Market Competition and Price Wars

The pasta sauce market is highly competitive, with numerous players vying for market share through aggressive pricing strategies. This intense competition often leads to price wars, eroding profit margins and creating sustainability challenges for smaller brands. The commission notes that private-label products, which account for 35% of total sales, exert significant downward pressure on prices, forcing manufacturers to reduce costs without compromising quality. Additionally, Statista reports that promotional discounts and bulk-buying incentives have become commonplace, further intensifying price sensitivity among consumers. Such dynamics not only hinder profitability but also limit investment in research and development, stifling innovation. As the market becomes increasingly saturated, finding a balance between competitive pricing and product differentiation remains a critical challenge for industry participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.92% |

|

Segments Covered |

By Product Type, Packaging Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Barilla S.p.A., Ebro Foods S.A., Mizkan Holdings Co. Ltd., The Kraft Heinz Company, Mars Incorporated, Premier Foods plc, Conagra Brands Inc., Del Monte Foods Inc., and Saclà, Princes Group |

SEGMENTAL ANALYSIS

By Product Type Insights

The tomato-based sauces segment was the major segment in the European pasta sauce market in 2024 and this segment held 50.7% of the European market share in the same year. The domination of tomato-based sauces segment is attributed to their versatility, affordability, and alignment with traditional European culinary practices. As per the reports of the Eurostat, more than 80% of households regularly purchase tomato-based sauces, with Italy and Spain being the largest consumers. According to the Italian Trade Agency, those exports of authentic Italian tomato sauces exceeded €2 billion in 2022, underscoring their widespread appeal. Furthermore, the segment benefits from its compatibility with various pasta types and its role as a base for other sauce variants, such as arrabbiata or marinara. Its importance lies in its ability to cater to both everyday meals and gourmet preparations, making it indispensable for European consumers.

The pesto-based sauces is another leading segment in the European market and is estimated to witness the fastest CAGR of 18.8% over the forecast period owing to the rising popularity of Mediterranean diets, with the European Food Information Council reporting a 25% increase in pesto consumption over the past five years. Pesto’s unique flavor profile, derived from fresh basil, olive oil, and nuts, appeals to health-conscious consumers seeking nutrient-rich alternatives. A study by the Italian Ministry of Agriculture reveals that pesto sauce exports grew by 20% annually, driven by demand from Northern European countries. Additionally, innovations in packaging, such as single-serve sachets, have enhanced convenience, further boosting adoption. The segment’s prominence underscores its role in diversifying the market and meeting evolving consumer preferences.

By Packaging Type Insights

The glass bottles segment dominated the market by holding 40.9% of the European market share in 2024 due to their perceived premium quality and eco-friendly attributes. The European Environmental Agency highlights that glass is 100% recyclable and retains the freshness of sauces, making it a preferred choice for gourmet and organic variants. Additionally, consumer surveys conducted by Nielsen reveal that 60% of buyers associate glass packaging with higher product quality, driving its popularity. Countries like Italy and France, known for their artisanal pasta sauces, heavily rely on glass bottles to maintain authenticity and appeal to discerning consumers.

The pouches segment is anticipated to register the fastest CAGR of 21.8% over the forecast period due to their lightweight, flexible design and cost-effectiveness make them ideal for mass-market and budget-friendly sauces. The European Packaging Federation notes that pouches reduce material usage by 30% compared to traditional packaging, aligning with sustainability goals. Furthermore, innovations such as resealable and stand-up pouches have enhanced convenience, appealing to busy urban consumers.

KEY MARKET PLAYERS

Major Players of the Europe pasta sauce market include Barilla S.p.A., Ebro Foods S.A., Mizkan Holdings Co. Ltd., The Kraft Heinz Company, Mars Incorporated, Premier Foods plc, Conagra Brands Inc., Del Monte Foods Inc., and Saclà, Princes Group

REGIONAL ANALYSIS

Italy had 25.9% of the European market share in 2024 and held the leading position in the European market. The rich culinary heritage of Italy and high per capita consumption are boosting the pasta sauce market in Italy. The Italian Trade Agency reports that exports of traditional sauces exceeded €3 billion in 2022, driven by global demand for authentic Italian flavors.

Germany captured substantial share of the European market in 2024 and is expected to grow at a notable CAGR over the forecast period due to its robust retail infrastructure and growing preference for organic sauces. The Federal Ministry of Food and Agriculture highlights that organic sauce sales grew by 15% annually, reflecting consumer interest in sustainable options.

France is expected to account for a prominent share of the European market during the forecast period due to the increasing focus of France on gourmet and artisanal sauces. The French Ministry of Agriculture notes that premium sauces account for 40% of total sales, driven by the country’s emphasis on fine dining and culinary excellence.

The UK is a noteworthy regional segment for pasta sauces in Europe. The strong e-commerce ecosystem and widespread adoption of international cuisines are contributing to the pasta sauce market in the UK. As per the reports of Mintel, online sales of pasta sauces grew by 20% in 2022, underscoring the shift toward digital channels.

Spain contributes considerably to the European pasta sauce market. The focus of Spain on tomato-based sauces is one of the major factors driving the Spanish market growth. According to the Spanish Ministry of Agriculture, domestic production meets 80% of demand, ensuring affordability and accessibility for consumers.

DETAILED SEGMENTATION OF EUROPE PASTA SAUCE MARKET INCLUDED IN THIS REPORT

This research report on the Europe pasta sauce market has been segmented and sub-segmented based on Product type, packaging type & region.

By Product Type

- Tomato-Based Sauces

- Marinara

- Arrabbiata

- Bolognese

- Pomodoro

- Napoli

- Cream-Based Sauces

- Alfredo

- Carbonara

- Four Cheese

- Pesto Sauces

- Green Pesto (Basil-based)

- Red Pesto (Tomato & Pepper-based)

- White Pesto (Cheese & Nut-based)

- Other Specialty Sauces

- Wine-based sauces

- Truffle-infused sauces

- Vegan/Plant-based sauces

By Packaging Type

- Glass Bottles

- Plastic Jars

- Pouches

- Cans

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which distribution channels contribute most to pasta sauce sales in Europe?

Supermarkets and hypermarkets dominate, followed by online retail and specialty stores.

2. What factors are driving the growth of the pasta sauce market in Europe?

Increasing demand for convenience foods, the rise of plant-based diets, and the growing popularity of Italian cuisine are key drivers.

3. How is the demand for plant-based pasta sauces changing in Europe?

The demand is increasing due to the rising number of vegan and health-conscious consumers. Many brands are launching dairy-free and organic pasta sauces.

4. Who regulates the quality and safety of pasta sauces in Europe?

The European Food Safety Authority (EFSA) and national food safety agencies regulate quality, ingredients, and labeling requirements.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]