Europe Oxo Alcohols Market Size, Share, Trends & Growth Forecast Report By Product (N-Butanol, 2-Ethylhexanol, Iso-Butanol, Others), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Oxo Alcohols Market Size

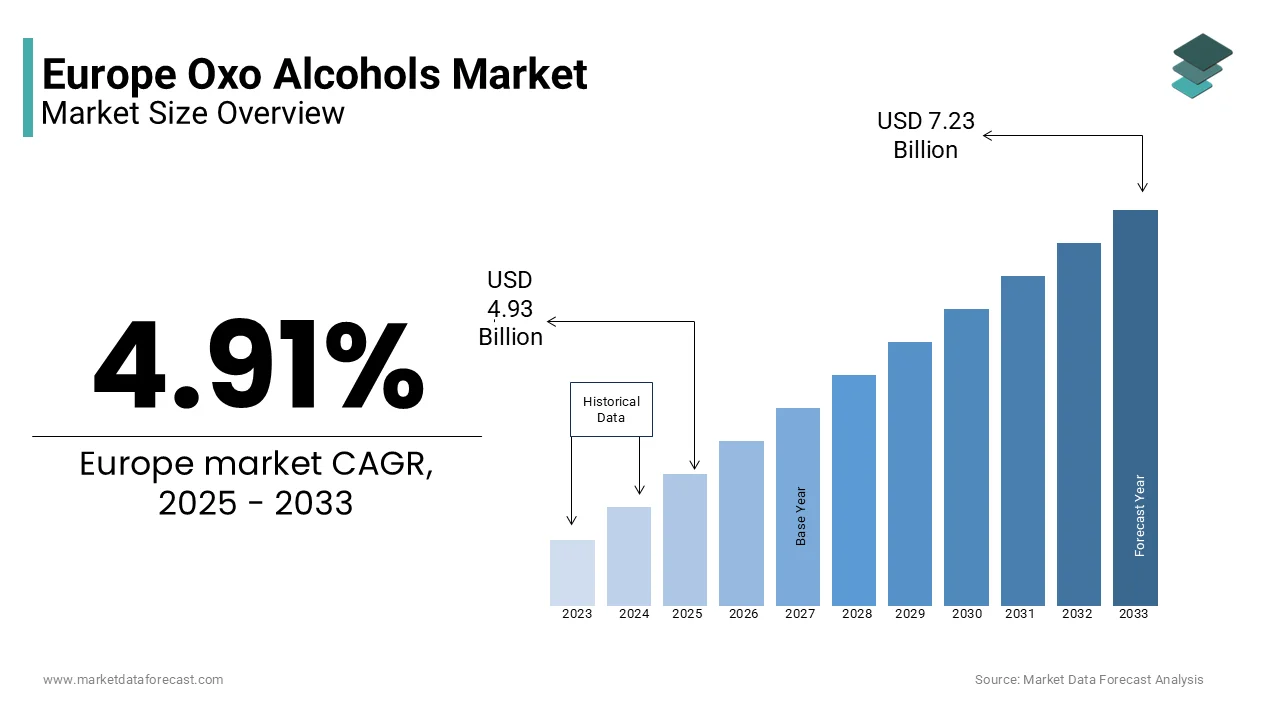

The Europe oxo alcohols market size was valued at USD 4.70 billion in 2024. The European market is estimated to be worth USD 7.23 billion by 2033 from USD 4.93 billion in 2025, growing at a CAGR of 4.91% from 2025 to 2033.

Oxo alcohols include a range of alcohols produced through the oxo process that involves the hydroformylation of olefins. These alcohols, including n-butanol, 2-ethylhexanol, and isobutanol, serve as essential intermediates in the production of various chemicals and materials, including plastics, solvents, and coatings. The European oxo alcohols market is driven by the increasing demand for oxo alcohols in diverse applications, such as plasticizers, adhesives, and automotive fluids. The rising consumption of oxo alcohols in the automotive and construction sectors, where they are used to enhance product performance and durability is further contributing to the expansion of the European market. Additionally, the shift towards sustainable and eco-friendly products is influencing the market dynamics, as manufacturers seek to develop bio-based alternatives to traditional oxo alcohols. As the industry evolves, the focus on innovation and sustainability will play a crucial role in shaping the future of the oxo alcohols market in Europe.

MARKET DRIVERS

Growing Demand from the Automotive Industry in Europe

The increasing demand from the automotive industry is one of the major factors propelling the Europe oxo alcohols market. As the automotive sector continues to evolve, there is a rising need for high-performance materials that enhance vehicle efficiency and sustainability. Oxo alcohols, particularly 2-ethylhexanol and isobutanol, are widely used in the production of automotive fluids, coatings, and plasticizers, which are essential for improving the performance and longevity of vehicles. According to the European Automobile Manufacturers Association, the production of vehicles in Europe is expected to reach 20 million units by 2025, reflecting a steady growth trajectory. This growth in vehicle production is driving the demand for oxo alcohols, as manufacturers seek to develop innovative solutions that meet stringent regulatory requirements and consumer expectations for fuel efficiency and reduced emissions. Furthermore, the automotive industry's focus on lightweight materials and advanced coatings is further propelling the demand for oxo alcohols, positioning this segment for robust growth in the coming years. As the automotive sector continues to prioritize performance and sustainability, the oxo alcohols market is expected to benefit significantly from these trends.

Expansion of the Construction Sector

The expansion of the construction sector is further boosting the expansion of the Europe oxo alcohols market. As urbanization and infrastructure development continue to accelerate across Europe, the demand for construction materials and chemicals is on the rise. Oxo alcohols play a crucial role in the production of various construction materials, including adhesives, sealants, and coatings, which are essential for ensuring the durability and performance of structures. According to the European Construction Industry Federation, the construction sector in Europe is projected to grow at a rate of 4% annually, further boosting the demand for oxo alcohols. The increasing focus on sustainable building practices and the use of eco-friendly materials are also driving the adoption of oxo alcohols, as manufacturers seek to develop innovative solutions that align with environmental regulations. As the construction industry continues to evolve and expand, the demand for oxo alcohols is expected to grow significantly, reinforcing their importance in the overall market landscape.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Issues

Regulatory challenges and compliance issues is a significant restraint on the Europe oxo alcohols market. The production and use of oxo alcohols are subject to stringent regulations regarding environmental and health safety standards. The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes rigorous requirements on the registration and assessment of chemical substances, which can complicate the formulation and approval processes for new products. According to industry estimates, approximately 30% of chemical manufacturers face delays in product approvals due to regulatory hurdles, impacting their ability to bring innovative oxo alcohols to market. Additionally, the evolving regulatory landscape, including potential changes in safety standards and labeling requirements, adds further complexity for manufacturers. As companies navigate these regulatory challenges, the potential for increased operational costs and delays in product launches may hinder growth in the oxo alcohols market.

Market Volatility and Price Fluctuations

Market volatility and price fluctuations is hampering the growth of the Europe oxo alcohols market. The prices of raw materials used in the production of oxo alcohols, such as propylene and butylene, are influenced by various factors, including geopolitical tensions, supply chain disruptions, and changes in global demand. According to market analyses, the price of n-butanol has experienced fluctuations of up to 20% over the past two years due to these factors. This volatility can create uncertainty for manufacturers, making it difficult to budget and plan production effectively. Additionally, rising costs of energy and transportation can further exacerbate price fluctuations, impacting the overall profitability of oxo alcohol producers. As the market grapples with these challenges, stakeholders must develop strategies to mitigate risks associated with price volatility, such as long-term contracts and diversified sourcing strategies, to ensure stability and sustainability in their operations.

MARKET OPPORTUNITIES

Rising Demand for Bio-Based Oxo Alcohols

The rising demand for bio-based oxo alcohols is a major opportunity for the Europe oxo alcohols market. As consumers and industries increasingly prioritize sustainability and environmental responsibility, there is a growing interest in bio-based alternatives to traditional petrochemical-derived oxo alcohols. The demand for bio-based chemicals is expected to grow significantly owing to the regulatory incentives and consumer preferences for sustainable products. Bio-based oxo alcohols, derived from renewable resources such as plant oils and sugars, offer a more sustainable option for manufacturers seeking to reduce their carbon footprint. As companies invest in research and development to create innovative bio-based formulations, the oxo alcohols market is well-positioned to capitalize on this growth. This shift towards sustainability not only aligns with environmental goals but also presents lucrative opportunities for businesses to innovate and capture market share in the evolving chemical landscape.

Technological Advancements in Production Processes

Technological advancements in production processes are another promising opportunity for the Europe oxo alcohols market. Innovations in manufacturing technologies, such as improved catalytic processes and more efficient separation techniques, are enabling producers to enhance the yield and quality of oxo alcohols while reducing production costs. According to industry forecasts, the implementation of advanced production technologies can lead to efficiency gains of up to 15% in oxo alcohol manufacturing. Furthermore, the integration of digital technologies and automation in production facilities is streamlining operations and improving overall productivity. As companies continue to invest in technology to optimize their production processes, the oxo alcohols market is poised for significant growth. Embracing these technological advancements not only enhances competitiveness but also aligns with the industry's broader goals of sustainability and efficiency.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the Europe oxo alcohols market, particularly in the wake of the COVID-19 pandemic. The pandemic has exposed vulnerabilities in global supply chains, leading to delays in the delivery of essential raw materials and increased costs. According to a survey conducted by the European Chemical Industry Council, approximately 70% of chemical manufacturers reported experiencing supply chain issues in 2021, with many citing difficulties in sourcing key materials for oxo alcohol production. These disruptions can hinder production schedules, increase operational costs, and ultimately impact the overall growth of the oxo alcohols market. Furthermore, geopolitical tensions and trade restrictions can exacerbate supply chain challenges, leading to further uncertainty in the availability of essential materials. As the industry grapples with these supply chain issues, stakeholders must develop strategies to mitigate risks and ensure a stable supply of materials to support ongoing and future projects.

Consumer Awareness and Education

Consumer awareness and education is another notable challenge for the Europe oxo alcohols market. As consumers become more informed about chemical products and their potential impacts on health and the environment, there is an increasing demand for transparency regarding the ingredients used in various applications. According to a survey by the European Consumer Organisation, approximately 65% of consumers express concern about the chemicals used in everyday products, including those derived from oxo alcohols. This heightened scrutiny can lead to scepticism regarding the safety and efficacy of certain oxo alcohols, particularly those that are synthetic. As a result, manufacturers must invest in consumer education and transparency initiatives to build trust and demonstrate the safety and benefits of their products. Additionally, the growing trend towards natural and organic products may further challenge the acceptance of certain oxo alcohols, necessitating a shift towards more sustainable formulations. As the market navigates these challenges, companies must prioritize consumer education and transparency to ensure the continued growth and acceptance of oxo alcohols.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.91% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

BASF SE, Eastman Chemical Company, Exxon Mobil Corporation, Dow Chemical Company, Evonik Industries, Sasol, LG Chem, Arkema, BAX Chemicals, and Andhra Petrochemicals, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The n-butanol segment had 41.4% of the Europe oxo alcohols market share in 2024. N-butanol is widely utilized in various applications, including the production of solvents, plasticizers, and coatings, due to its excellent solvent properties and versatility. The demand for n-butanol is driven by its extensive use in the manufacturing of butyl acrylate, which is a key component in the production of paints and adhesives. The rising demand for high-performance materials in various industries is further aiding the expansion of n-butanol segment in the European market. The ability of n-butanol to provide essential solutions for a wide range of applications, ensuring the continued growth of the oxo alcohols market, is also contributing to the segmental expansion. As industries increasingly prioritize efficiency and performance, the n-butanol segment is expected to maintain its leading position, supporting the overall development of the market.

The 2-ethylhexanol segment is projected to exhibit a CAGR of 6.21% over the forecast period. 2-Ethylhexanol is primarily used in the production of plasticizers, particularly dioctyl phthalate (DOP), which is widely utilized in the manufacturing of flexible PVC products. The increasing demand for flexible and durable materials in various applications, including construction, automotive, and consumer goods, is driving the growth of this segment. According to market analyses, the 2-ethylhexanol market is expected to capture a larger share of the overall oxo alcohols market as manufacturers recognize the benefits of incorporating this versatile alcohol into their formulations. As the industry continues to innovate and develop specialized solutions, the 2-ethylhexanol segment is well-positioned for significant growth in the coming years.

By Application Insights

The plasticizers segment led the market by holding 36.3% of the European market share in 2024. Plasticizers are essential additives used to enhance the flexibility, workability, and durability of plastic materials, particularly polyvinyl chloride (PVC). The demand for plasticizers is primarily driven by their extensive use in various industries, including construction, automotive, and consumer goods. As industries continue to prioritize high-quality and sustainable materials, the demand for oxo alcohols used in plasticizers is expected to rise, reinforcing this segment's leading position in the overall oxo alcohols market.

The solvents segment is anticipated to grow at a CAGR of 7.14% over the forecast period. Solvents derived from oxo alcohols, such as n-butanol and isobutanol, are widely used in the formulation of paints, coatings, and cleaning products due to their excellent solvency properties and low volatility. The increasing demand for high-performance solvents in the coatings and adhesives industries is driving the growth of this segment. According to sources, the solvents market in Europe is expected to expand significantly as manufacturers seek to develop eco-friendly and efficient formulations that comply with stringent environmental regulations. The importance of this segment lies in its ability to provide effective solutions for various applications while meeting the growing consumer demand for sustainable products. As the industry continues to innovate and adapt to changing market dynamics, the solvents segment is well-positioned for substantial growth in the coming years.

REGIONAL ANALYSIS

Germany had the major share of the Europe oxo alcohols market in 2024. The robust chemical industry in Germany, particularly in the production of automotive and construction materials, significantly contributes to this dominance. According to the German Chemical Industry Association, the country produced over 3 million tons of oxo alcohols in 2021, underscoring the critical role of these chemicals in various applications. Additionally, Germany's commitment to sustainability and innovation is driving the adoption of high-performance oxo alcohols that meet the evolving needs of industries. The increasing demand for eco-friendly products and the focus on reducing carbon emissions are prompting manufacturers to invest in advanced production technologies. As the demand for high-quality oxo alcohols continues to grow, Germany's position as a market leader is expected to remain strong, reinforcing its influence in the European oxo alcohols market.

France is another promising regional segment for oxo alcohols in Europe. The French chemical industry is characterized by significant investments in the production of solvents and plasticizers, driven by the growing demand for high-quality materials in various sectors. According to the French Ministry of Economy and Finance, the production of oxo alcohols in France reached around 1.5 million tons in 2021, reflecting a robust market for these chemicals. The emphasis on sustainability and regulatory compliance is also shaping the market landscape in France, as manufacturers seek to develop eco-friendly alternatives to traditional oxo alcohols. As the country continues to prioritize innovation and sustainability in its chemical industry, the demand for oxo alcohols is expected to grow, reinforcing France's position as a key player in the European market.

Italy is estimated to account for a notable share of the European market over the forecast period. The Italian chemical industry is diverse, with significant production in the automotive, construction, and consumer goods sectors. According to the Italian National Institute of Statistics, the production of oxo alcohols in Italy reached over 1 million tons in 2021, highlighting the importance of these chemicals in various applications. The increasing focus on high-quality materials and sustainable practices is driving the demand for oxo alcohols in Italy. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the oxo alcohols market. As the country continues to invest in modernization and innovation, the demand for oxo alcohols is expected to rise, contributing to the overall growth of the market.

The United Kingdom is predicted to register a steady CAGR in the European oxo alcohols market over the forecast period. The UK chemical industry is characterized by a diverse range of applications, including automotive, construction, and consumer products. According to the UK Chemical Industries Association, the production of oxo alcohols in the UK reached around 800,000 tons in 2021, reflecting a strong demand for these chemicals. The emphasis on improving product performance and sustainability is driving UK manufacturers to invest in high-quality oxo alcohols that meet regulatory requirements. Furthermore, the UK's commitment to innovation and research in the chemical sector is influencing the development of advanced oxo alcohol formulations. As the UK navigates post-Brexit challenges, the oxo alcohols market is expected to adapt and evolve, presenting opportunities for growth.

Spain is anticipated to account for a noteworthy share of the European market over the forecast period. The Spanish chemical industry is experiencing significant growth, driven by a resurgence in the production of automotive and construction materials. According to the Spanish Ministry of Industry, Trade and Tourism, the production of oxo alcohols in Spain reached over 600,000 tons in 2021, highlighting the importance of these chemicals in various applications. The increasing focus on sustainable practices and the demand for high-quality materials are propelling the growth of the oxo alcohols market in Spain. Additionally, Spain's growing e-commerce sector is driving the need for innovative chemical solutions that enhance product performance. As the country continues to develop its industrial capabilities and invest in sustainable practices, the demand for oxo alcohols is anticipated to rise, reinforcing its position in the European market.

KEY MARKET PLAYERS

The major key players in Europe oxo alcohols market are BASF SE, Eastman Chemical Company, Exxon Mobil Corporation, Dow Chemical Company, Evonik Industries, Sasol, LG Chem, Arkema, BAX Chemicals, and Andhra Petrochemicals.

MARKET SEGMENTATION

This research report on the Europe oxo alcohols market is segmented and sub-segmented into the following categories.

By Product

- N-Butanol

- 2-Ethylhexanol

- Iso-Butanol

- Others

By Application

- Plasticizers

- AcrylateAcetate

- Glycol Ether

- Solvents

- Adhesives

- Lube Oil Additive

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate for the European Oxo Alcohols market from 2025 to 2033?

The market is expected to grow at a compound annual growth rate (CAGR) of 4.91% during this period.

2. What factors are driving the growth of the Oxo Alcohols market in Europe?

Key factors include increasing demand from various industries such as automotive, construction, and consumer goods, as well as the rising use of oxo alcohols in manufacturing plasticizers and solvents.

3. How does the European Oxo Alcohols market compare to other regions?

While Europe is experiencing steady growth, other regions such as North America and Asia Pacific are also seeing significant demand for oxo alcohols, contributing to a competitive global market landscape.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]